Hey, folks.

Let’s have a frank talk about the new Aeroplan program. There’s been a lot of excitement, but then again, there’s also been more than a little bit of outrage. There are those who are ecstatic at the new program – hell, it’s hard not to be stoked about the painful heat death of the fuel surcharge – but some resentment has been real and present, too.

I feel that the cause of this backlash is because on the whole, the new Aeroplan is a net devaluation. Let’s call a spade a spade and a devaluation a devaluation. Flights, on average, will cost more points. Moreover, until we get an idea of the welcome offers on the new Aeroplan line of credit cards are, we have no idea if the average mileage hike will be compensated for with appropriate hikes in the credit card bonuses.

I’m sure any Americans or snowbirds in the audience who’ve been through much harder core devaluations are now asking the following question:

Let’s be honest: this devaluation is relatively velvet-glove; not half as bad as the Delta or United program changes suffered by our neighbours to the South. Moreover, there’s actual upsides, such as the introduction of household points pooling.

Still, as the budget travel writer here at Prince of Travel, I must say I’m feeling less ecstatic about the changes because Air Canada has done some alchemy: they’ve transformed the fees we had to pay into a points price hike on redemption.

So what do we, as a community, do? Let’s make an honest assessment of the positives as well as the negatives of the new program. There are many positives to the new Aeroplan, both for travellers who want to use the new “sweet spots” and for the public – but that doesn’t take away from the fact that our points are worth less now, and that sucks.

Why the “public”, by the way? Well, one of the largest owners of Air Canada, and by extension Aeroplan, is the Canada Pension Plan (CPP). If this new program helps Air Canada succeed, which hopefully it does, then many of the elderly in our nation do actually benefit. So there’s a lot of incentive for them to try and raise profitability – and we shouldn’t be blind to the fact that our flag carrier should try and represent all Canadians, not just Miles & Points fans.

The Bad

When anyone brings me good news and bad news, I always tear off the proverbial band-aid and eat the less pleasant information first. And frankly, for my money, there’s quite a bit with the new program that I’m not thrilled about.

Gripe the first: almost everything is more expensive. The price in terms of raw mileage has, on the whole, gone up – and that’s before even getting into the dynamic pricing model.

I’m not smart enough to code algorithms that can change points redemptions based on demand, but something tells me unless you’re travelling at 1am on the most boring Tuesday in November, it’s probably not going to be in your favour.

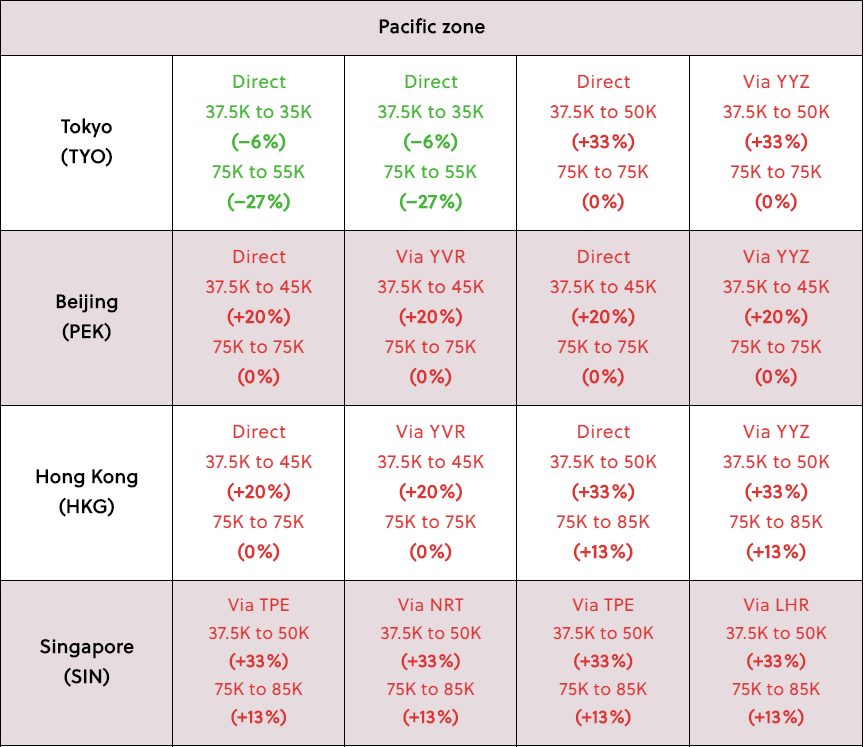

I’d like to use the comparison chart from North America to the Pacific zone that Ricky whipped up in his inaugural post for the new flight rewards to demonstrate what I’m talking about:

Let’s face it, things have gotten more expensive, especially for the big international flights so many of us are fond of. The slight improvements for certain combinations, like those to Tokyo from Vancouver or Calgary, do provide some encouragement – but it doesn’t undo the fact that this is a net devaluation.

Flights to places every class of traveller can care about – in this case, literal hub cities that double as vital cultural, political, and economic centres such as Singapore – have seen a universal price hike from almost every point of origin.

And that’s what this is, a price hike, and one I as a budgeteer am not pleased with because it now means that earning enough points for an award through our flying activity, credit cards, and other methods we treat like Fight Club now takes that much more time and pain. Not a fan, not one bit.

Gripe the second: the “greater value” of some of the new redemption spots, such as one-way flights in Europe, are in my opinion a bit of a waste of points. If you’re going to fly around the Schengen Area, why bother burning the increasingly valuable Aeroplan points as a budget-minded traveller, when you can just fly Ryanair?

Look at this, which details the prices in October of one-way flights from most places in the United Kingdom to the historic city of Milan, heart of the Lombard League:

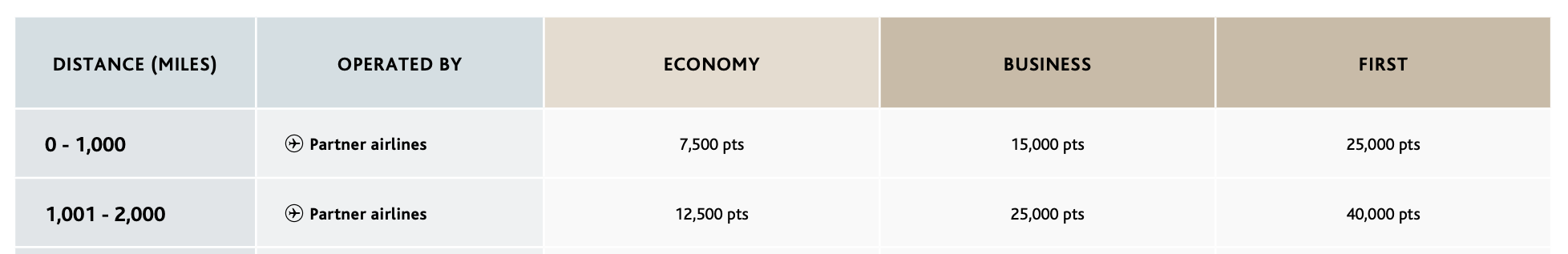

The price here is a low of 8 GBP – around $13 at the time of writing this article. The highest is about $49. The flight isn’t going to be comfortable or long, but as a budget traveller, I’m not against spending this small amount of money in order to save on points, if I think they may be needed later. Let’s look at the new Aeroplan chart now:

After perusing this, I’ll definitely be booking with a budget carrier. I can tough it out for a few hours for a $40 flight. If I did book with points, I’d be out 7,500+ points and paying a partner airline a $39 fee for the honour as well!

In defence of that fee, it is a decent price… if you’re travelling on a big international itinerary. But for short excursions when you’re in your chosen “play zone,” I think you’d do well to assess your cash options and forgo booking through Aeroplan.

Gripe the third: the new credit card offers are trying to be something they aren’t. To illustrate this point, let’s just look – as in, identify the physical design – of the new Aeroplan co-branded credit cards:

To me, the redesign emphasizes an attempt at modernity, to try and be a cool “in” card. The problem is that I think it’s all form, and no function.

Fact of the matter is, from a budget standpoint, the Visa Infinite cards are getting $19 annual fee price hikes for minimal discernible benefits. Maybe the free checked bag is nice for some cardholders, but overall, the rest of the card is unchanged. Short of there being a better welcome bonus, I’d take a pass.

But what I find really annoying are the Visa Infinite Privilege and the new American Express Aeroplan Reserve and Aeroplan Business cards. So they’re going to have fancy metal construction that you can use to flex on the lounge staff – big whoop.

The $599 fee, which is $100 more than the American Express Platinum Card once you take into account the latter’s $200 annual travel credit, doesn’t even offer hotel statuses.

Then, we get into the actual benefits. The Maple Leaf Lounge exists almost only in Canada and, for my money, is “OK” – the Centurion Lounge it ain’t. Heck, Priority Pass isn’t height of luxury, but I’ve had hot breakfast at the shoebox-sized Edmonton lounge that put the offerings in the Maple Leaf Lounge across the hallway to shame.

As someone who does not fall into the “nemesis of the CRA” tax bracket, the minimum household income needed to acquire the Visa Infinite Privilege family cards is comically high. Unfortunately, as we saw in Ricky’s recent three-way comparison post, the American Express cards don’t offer much to set them above the CIBC and TD offerings, either.

Between both families, the benefits of some free luggage or some Altitude Qualifying Segments upon spending above thousands of dollars seems niche at best. The express security lane would be nice, but it’s only available at a tiny number of airports, and the supplementary card cost (so your kid, wacky uncle, mistress, etc.) can enjoy any of the above bonuses is a steep $199!

And that’s before we get into the earn rates. Yeesh, they aren’t very good – no card matches the 3x on dining offered by the Platinum Card, and not a single one of the new cards has even 2x on groceries, something the American Express Gold Rewards Card beats for a much lower annual fee! And even on the highest earning tiers, the new cards only reward you for booking with Air Canada, not on travel as a category or within the big tent of the Star Alliance.

I’d be a bit more enthusiastic if the new credit cards come out with strong bonuses to compensate, but until then, the only parts of these cards that I feel offer something innovative are their insurance package. These do provide decent mobile and travel insurance.

Also, their travel loss insurance policies are not cancelled in the event of nuclear war the way the Platinum Card’s policy is.

The Good

Now I’ve gotten my complaints out of the way, I want to give credit where credit is due. The new program does cost more – and it is, in my mind, still a devaluation – but every cloud has its silver lining, and our current cumulus is surrounded by pure sterling.

My first silver lining: NO FUEL SURCHARGES. I’d say “rest in peace”, but my mom told me to never lie to my friends.

For me personally, this adds a huge factor of convenience in regards to Lufthansa. Their network is second to none, but the fuel surcharges just made them unbookable. Now, though, a pile of routes will be that much easier to book because you don’t have to redo your itinerary to avoid being whacked by a hefty surcharge. Now you can just pay the $39 fee and fly from Frankfurt or Munich to wherever you want (preferably gorging on gourmet pretzels in the lauded Lufthansa First Class).

My second silver lining: there are still sweet spots that provide excellent value.

A couple come to mind, such as that Hawaii has gone down to 75,000 points (with no fuel surcharge, to boot), and as Amy demonstrated in her article on the family traveller’s perspective, the Sun locations are a great value, especially for those in Eastern Canada.

Personally, my favourite by far is the simplicity of the Within South America chart:

This right here is a thing of beauty, because South America is notorious for being enormous, with rugged terrain that’s difficult to cross by land. Indeed, the dreams of great uniters like Simon Bolivar were smashed in large part due to the geography. At the same time, Latin America is home to incredible florae and faunae, a rich history, and dozens of fascinating countries and cultures.

I feel very bullish about the fact that there is one set redemption rate within South America, and definitely recommend it as having amazing value for budget travellers. Why? Because here in Canada, a cappuccino will set you back $5. In much of Latin America, $5 can buy you an incredible local meal, and the openness of the local culture means you probably won’t be dining lonely.

This comes with a caveat: Star Alliance, and thus Aeroplan by extension, do not possess a large number of Latin American airlines, though many alliance members do some flying to and from the continent.

This benefit will increase if more airlines join; until then, I think it’s a sweet spot that can be used if you’re willing to research what flights have award availability. Also, a different Brazilian airline seems to come and go every few years like clockwork, so watch out for that.

My third silver lining: family sharing. A lot of words have been typed about this subject, but I think that the new pooling rules are fantastic.

The value that you can get from sharing quantities inside a household means that everyone can contribute to the family vacation. Another thing it lets me do is allow me to directly help people I love and care about like my dad (who collects Aeroplan but doesn’t care to learn the “inside tricks”) from getting fleeced when it is time to go on a big travel bash by becoming an administrator on his household plan.

I’d also like to throw in a my two cents as a young bachelor. What qualifies as “family” to me aren’t just my beloved and long-suffering mom, dad, and sister (all of whom I love and value dearly).

For me, my family would also my inner circle and community of close friends. Some of the people I’d consider to be as close as blood are those whom I met as a direct result of attending Miles & Pints meetings – and I hope the new family pooling system allows us to reflect that.

There’s nothing I’d like more than to be able to use my family pooling resources to reflect this reality; to allow me to share my Miles & Points dreams with my closest confidantes. I therefore find it very promising that the new system isn’t tied to household address, like it is with British Airways Avios, for example.

The Ugly Truth

I’ve beaten it to death, but the changes at Aeroplan are causing trips to cost more in points, even if they’ve gotten rid of the hated surcharges. Whatever points you’re holding right now will be worth slightly less post November 8.

This is anathema to the budget traveller, until you realize two fundamental facts:

- Air Canada may have hiked the prices across the board, but they’ve created sweet spots – both those that cost fewer points, and those where the waived fuel surcharge makes it worth travelling for convenience

- Milk fact #1 to your advantage, but don’t chase “cheap flights” without considering ancillary costs (i.e., the cost of entertainment at your destination)

So go ahead and book the heck out of Calgary–Tokyo, it’s an amazing deal. Just make sure you have the spending money and hotel points for a more expensive place such as Tokyo on the other end.

On the other hand, you could burn a lot more to go from Vancouver to Beijing, and onto Ho Chi Minh City or Phnom Penh – but I suspect that that if you’re like me and on a budget, the latter will keep your ledgers happier.

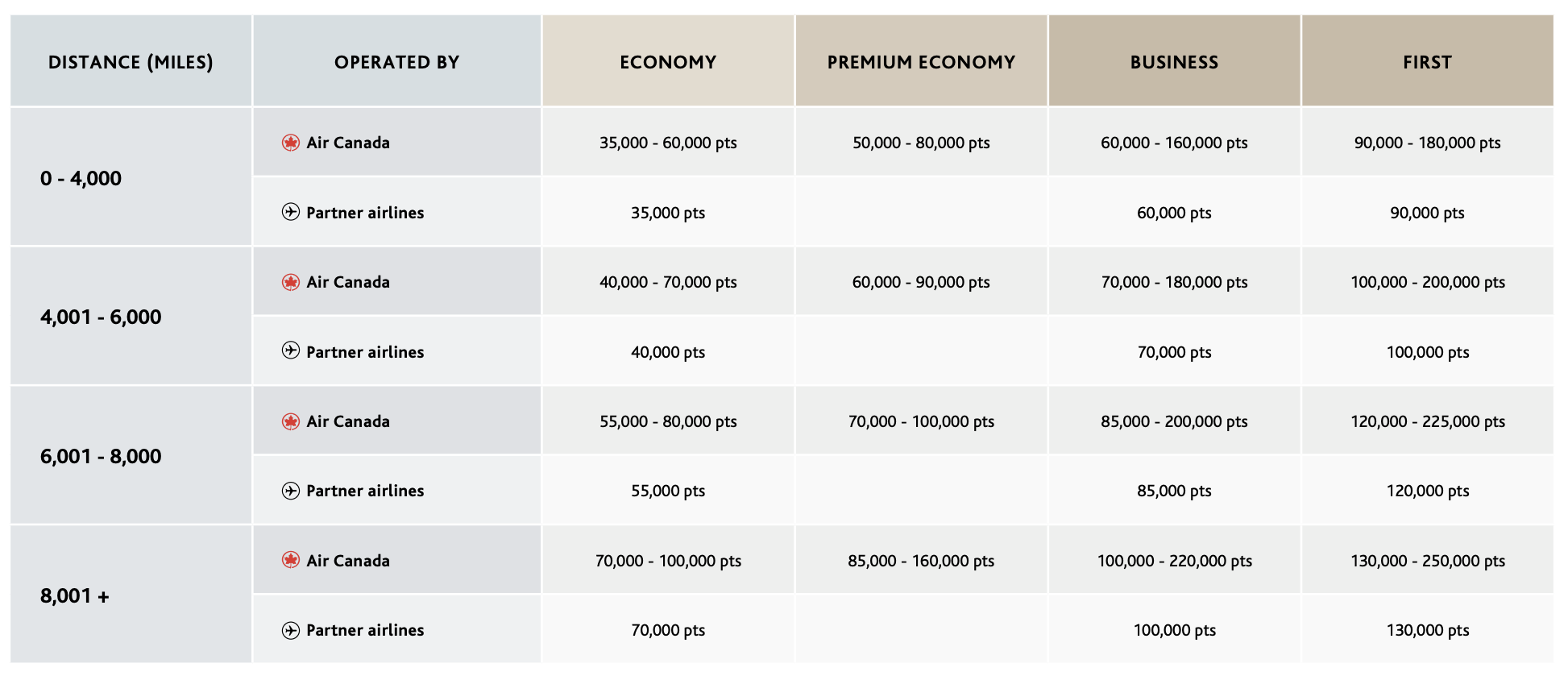

Let’s look at a real-world example with the new Aeroplan award chart that gives us the type of trip where we redeem a bit more in points but get a lot more “value” (in my opinion) for our dollar. Remember: we are doing these trips on the understanding we are not the monetary reincarnations of the Carnegie family, and if we can avoid spending too many points, that’s a bonus as well:

Let’s imagine we fly from Toronto to London Heathrow. I think most people have wanted to travel to the land of double-decker buses, King Arthur, and fish and chips at least once in their lifetime, and now that Air Canada has waived the fuel surcharges, all you have to pay are the ridiculous landing fees – and put up with the baggage retrieval system Monty Python lamented so loudly.

A one-way flight takes us to 3,540 miles. This puts us in the first distance zone, and the only direct flight from Toronto is operated by Air Canada. According to the chart, we owe them as low as 35,000 miles in economy. Business takes us to 60,000.

On a relatively short transatlantic flight, I’d probably still prefer economy. With the fees being what they are, we are looking at as low as 35,000 Aeroplan points plus about $200 in fees. Not too shabby, guv’nah.

On the other hand, let’s look at a different airline that benefits from the elimination of fuel surcharges: Toronto to Warsaw, Poland, operated by LOT Polish Airlines. The flight is 4,310 miles, which puts us into the second distance zone. This gives us the choice of economy for 40,000 points or Business for 70,000 points, plus the $39 partner airline booking fees and any landing fees.

So overall, 40,000 Aeroplan points plus about $60 in fees. Poland is not yet lost – and who wouldn’t want to sip generous lagers while touring the homeland of King Jan Sobieski and his famous winged lancers for less? Twoje zdrowie!

Which one should I go to? Well, one is cheaper in miles, but the other is way cheaper in cash. Lunch in London is around $21 (CAD) on average. In Warsaw, it’s $10. You’ll be paying more in points, but if you want a neat experience that isn’t as hard on the wallet, Warsaw is a great option.

Also ask yourself: when LOT was charging their namesake on fuel surcharges, would one have considered flying to Warsaw? I know I wouldn’t have – I didn’t want to pay any surcharges for my flight.

But now, I think budget-minded travellers are able to be a bit more generous with their points than before, because you can spend more points to pay a lot less in cash if you’re willing to go a little off the beaten path.

Conclusion

We cannot undo the fact that our miles have been devalued, and that is what they have been. I’m also not a huge fan of the new credit card offerings either, feeling they bring lower value than American Express Membership Rewards products, but that doesn’t mean these cards are useless, or that there won’t be some utility if they provide strong welcome bonuses from the outset.

With that being said, the demise of the infamous fuel surcharge is likely to be lamented by nobody, and the flat availability offered on untapped markets such as South America are ripe with possibilities. I think we are swallowing a bitter pill now, but many opportunities will soon arise, especially as Star Alliance grows larger.

I hope everyone gets a chance to use the new Aeroplan, warts and all, to explore the world and make their Miles & Points dreams a reality – on the cheap!