American Express’s twin top-of-the-line travel credit cards, the American Express Platinum Card and the Business Platinum Card from American Express, are among the most powerful points-earning cards in the Canadian marketplace; however, they can also appear quite intimidating from a newcomer’s perspective due to their high annual fees.

One common approach is to start by choosing between either the personal or the business version of this card to test drive the many significant benefits on these cards and build your comfort with those $799 annual fees. If you’re in this position, which card should you choose?

In this edition of the Head-to-Head series, we compare the personal and business Platinum cards in all the ways that matter to help you figure out which one is the better fit for you.

Card Basics

We’ll start with the most basic criteria that should be considered when applying for any credit card: welcome bonuses, referral bonuses, the annual fee, and the rate at which you earn points on your daily purchases.

1. Welcome Bonus

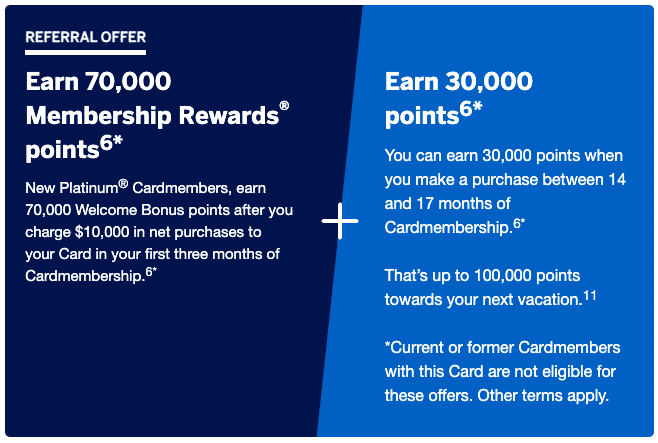

On the personal version of the Platinum card, you can earn up to 100,000 Membership Rewards (MR) points upon meeting the following criteria:

- 70,000 MR points upon spending $10,000 (all figures in CAD) in the first three months

- 30,000 MR points upon making a purchase in months 14–17 as a cardholder

For the first allotment of points, that works out to be an average of $3,333 per month to unlock 70,000 points. Then, you’ll just need to make a purchase in months 14–17 as a cardholder – after you’ve paid the second year’s annual fee – to garner a further 30,000 points.

The business version of the Platinum card currently comes with a welcome bonus of up to 120,000 Membership Rewards points upon meeting the following criteria:

- 80,000 MR points upon spending $15,000 in the first three months

- 40,000 MR points upon making a purchase in months 14–17 as a cardholder

For the first allotment of points, that works out to be an average of $5,000 per month to unlock 80,000 points. Then, you’ll just need to make a purchase in months 14–17 as a cardholder – again, after you’ve paid the second year’s annual fee– to earn a further 40,000 points.

Both welcome bonuses are very much worth pursuing, since it’s an effective way to boost your balance significantly in a very short amount of time. However, the amount of spending required for each is relatively steep, although not unattainable by any means.

Keep in mind that you’ll also earn points for each dollar you spend as you work towards the welcome bonus.

Since the Business Platinum Card from American Express has a flat earning rate of 1.25 points per dollar spent, you’ll wind up with a total of 98,750 points after meeting the minimum spending requirement: 80,000 points from the welcome bonus, and 18,750 points for spending $15,000.

On the other hand, if you’re able to take advantage of the category multipliers on the American Express Platinum Card, you could wind up approaching the first part of the welcome bonus on the Business Platinum Card, since you’d earn 2 points per dollar spent on travel and dining purchases, and 1 point per dollar spent elsewhere.

However, even if you earn 2 points per dollar spent on the full $10,000 minimum spending requirement with the personal Platinum card, you’ll still come out ahead with the Business Platinum card.

Verdict: Both cards currently offer a solid welcome bonus, which can go a long way towards helping you reach an aspirational travel goal.

However, if you’re able to meet the higher minimum spending requirement over the course of three months, the Business Platinum Card from American Express comes out ahead here, simply due to its larger bonus.

2. Referral Bonuses

One of the often-overlooked ways to earn points every year is with referral bonuses.

As a reminder, if you send a referral link for an American Express card to a friend or family member who’s eventually approved for the card, you’ll receive some points as a referral bonus, and they’ll typically receive a better offer than what’s available to the public.

After you’ve posted pictures of yourself travelling in the throes of luxury to your social media accounts, you may receive questions from your network asking if you’ve won the lottery or received a nice promotion.

Once you’ve explained that you simply learned how to maximize credit cards and loyalty programs, they may ask you for advice, and this is a great time to earn points through referral bonuses.

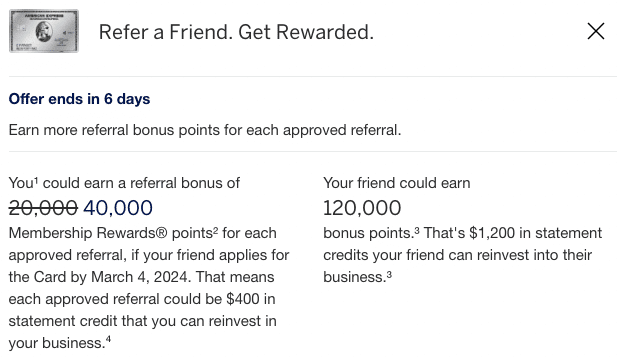

With the Business Platinum Card from American Express, you’ll receive an extra 20,000 Membership Rewards points for each approved referral to either the personal or business version of the Platinum card, or the American Express Business Gold Rewards Card.

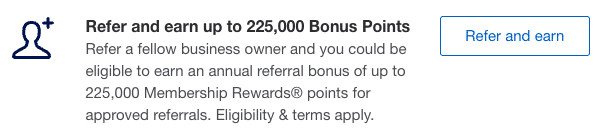

By this method, you can earn up to 225,000 points each year, as long as you’re able to refer 12 friends or family members.

With the American Express Platinum Card, you’ll earn an extra 10,000 Membership Rewards points for each approved referral to either the personal or business version of the Platinum card.

You can also earn up to 225,000 points each year this way; however, you’d need to refer 23 friends or family members to fully maximize the bonus.

However, until March 4, 2024, you’ll earn double referral points on the Business Platinum (40,000 points per referral), and triple referral points on the personal Platinum (30,000 points per referral).

This means that it would take only six referrals to max out your Business Platinum, and only eight referrals to max out your personal Platinum.

If you choose to hold on to either of these cards year-after-year for their benefits, it’s certainly worth your while to pursue referrals, especially during any double or triple referral promotions. This way, you’re making full use of the card, and padding your balance as you do so.

Verdict: With 20,000 points per approved referral, and with the bonus awarded when referring to a total of three cards instead of just two, the Business Platinum Card from American Express comes out ahead in this metric.

3. Annual Fee

In September 2023, both the American Express Platinum Card and the Business Platinum Card from American Express had their annual fees bumped to $799.

Previously, the personal Platinum card’s annual fee was $699, and the Business Platinum’s annual fee was $499.

On the surface, the cards have identical annual fees; however, each offers a number of credits, which can effectively reduce the annual fee each year.

Both cards now offer a $200 annual travel credit, which can be used on bookings made through Amex Travel.

In addition, there’s a $200 annual dining credit on the personal Platinum card, as well as the following credits on the Business Platinum:

- Up to $120 annual wireless statement credit ($10 per month) from eligible wireless providers

- Up to $200 in annual statement credits from Dell (enrolment required)

- Up to $300 in annual statement credits from Indeed (enrolment required)

For the personal Platinum card, the combination of the $200 travel and dining credits effectively brings the annual fee down to $499.

On the Business Platinum, you can get up to $720 in annual credits; however, the annual travel credit and the wireless credits are arguably easier to use than the Dell and Indeed credits.

As a minor point, the $799 annual fee on the Business Platinum may also be tax deductible if you’re using it for your small business purchases.

Verdict: The two Platinum cards are fairly equal in this regard, with the caveat that you may need to put in a bit of extra effort to take full advantage of the Business Platinum Card’s array of credits to bring the effective annual fee down.

Since the personal Platinum’s credits are easier to use, we’ll give it the advantage this time, while acknowledging that some business owners may get more value with the full array of credits on the Business Platinum.

4. Earning Rates

The differences between the two versions of the Platinum card start to show their colours when we look at a breakdown of the earning rates.

The personal Platinum will reward you with 2 MR points per dollar spent on travel purchases (excluding local transit) and on dining purchases (including restaurants, food delivery, coffee shops, and drinking establishments) in Canada, and 1 MR point per dollar spent on all other purchases.

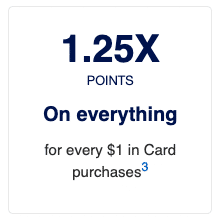

Meanwhile, the Business Platinum continues to offer 1.25 MR points per dollar spent across the board.

Which of these earning rates is more favourable will depend on your regular spending patterns. If you’re a city-dweller who goes out to eat and drink a fair bit, then the 2x earning rate on dining on the personal Platinum can add up especially quickly.

Meanwhile, if most of your spending falls into non-bonused categories, then you’d definitely prefer the Business Platinum’s 1.25x earning rate to the Platinum’s 1x return on general purchases. Indeed, given how valuable MR points are, the Business Platinum is one of the strongest Canadian credit cards for general non-bonused spending.

It’s also worth noting that you might not ultimately choose to get the Platinum Card for its earning structure alone, because similarly high returns can also be achieved by holding a different portfolio of cards: the Cobalt Card offers 5 MR points per dollar spent on dining and groceries, while the American Express Gold Rewards Card also offers 2 MR points per dollar spent on travel as well.

Verdict: This will depend on the spending patterns of the specific individual.

If you’re someone who travels and goes out to eat and drink a fair bit, you may place a greater value on the Platinum Card’s earning structure; however, you could just as easily see a justification for choosing the Business Platinum’s flat 1.25x earning rate as well, especially when paired with other Amex cards in your portfolio.

Perks & Benefits

Aside from the card basics, it’s important to consider the other perks and benefits that come with each card when considering which one is right for you.

1. Hotel Elite Status

Both versions of the Platinum card reward you with an instant status bump to Gold Elite within the Marriott Bonvoy hotel loyalty program. You may enroll online under the “Benefits” section of your Amex dashboard upon receiving your card, or you may enroll via the contact centre as well.

Note that this perk is simply an automatic status bump up to Gold Elite, and doesn’t actually come with the 25 elite qualifying nights required to qualify for Gold Elite. Therefore, it won’t be too beneficial if you’re pursuing Platinum Elite status the next level above.

Furthermore, both cards offer Hilton Honors Gold status to cardholders, which entitles you to room upgrades and free breakfast at Hilton hotel stays. However, it’s worth noting that the status is more meaningful outside of North America.

Verdict: Ever since Hilton Gold status became a perk on the Business Platinum Card from American Express, the two cards are essentially equal in this regard. This one’s a draw.

2. Lounge Access & Other Travel Perks

In the past, the lounge access benefits on the two Platinum cards had slightly different policies, but a few years ago Amex updated the terms so that both the Platinum and the Business Platinum now have virtually identical lounge access benefits.

In particular, you’ll get access to the entire Amex Global Lounge Collection, which includes a variety of different lounge providers (such as Priority Pass, Plaza Premium, Centurion Lounges, International Amex lounges, Delta Sky Clubs, etc.), each with their own slightly different access rules.

You can refer to this guide for the full breakdown of which lounges you may access and with how many guests in tow, although the relevant point here is that both the Platinum and the Business Platinum entitle you to the same level of access.

In terms of other travel benefits, both products also provide you with access to the Amex Fine Hotels & Resorts booking platform for luxury hotels, as well as its sister platform, the Hotel Collection, for mid-range hotels in major cities. There’s also the additional benefits when flying out of Toronto Pearson as well.

Verdict: Honours even.

Other Factors

Finally, we’ll take a look at the cards’ ancillary benefits and any other considerations that might sway your choice in favour of either the personal or the business versions of the Platinum Card.

1. Redeeming Points

Both cards earn Membership Rewards points under their respective earning structures outlined above (2-1 for the Platinum vs. a flat 1.25x for the Business Platinum).

These points can then be transferred to a variety of airline and hotel partners (the most common options being Aeroplan and British Airways Executive Club at a 1:1 ratio, Cathay Pacific Asia Miles and Air France KLM Flying Blue at a 1:0.75 ratio, and Marriott Bonvoy at a 1:1.2 ratio).

You also have the option of booking round-trip flights via the Amex Fixed Points Travel redemption chart, which can provide decent but not outstanding value based on the cash fare of a flight that you’d otherwise pay for.

Plus, both cards offer access to the Amex Platinum International Airlines Program, which offers discounted fares on airlines booked through Amex Travel.

Lastly, there’s always the option of redeeming points against statement purchases at a baseline value of 1 cent per point (cpp). Either card allows you to redeem points against all eligible expenses at 1cpp.

Verdict: With the same transfer partners, the same value through Amex Fixed Points Travel, and the same flat rate of 1cpp through Use Points for Purchases, we have ourselves another draw.

2. Travel Insurance

Both the person and business versions of the Platinum cards have very comprehensive travel insurance coverage.

Most notably, both offer emergency medical insurance of up to $5,000,000 on the first 15 days of your out-of-province trip (for those aged 65 and under), $500,000 Travel Accident Insurance in the event of death or dismemberment, and full coverage for car rental theft and damage, hotel/motel burglary, flight delay, baggage delay, and lost or stolen baggage.

There are only a few small differences between the insurance terms across the two cards:

-

Trip Cancellation Insurance: The Platinum Card covers up to $2,500 per insured person, per trip, up to a maximum of $5,000 for all insured persons combined; meanwhile, the Business Platinum Card only covers up to $1,500 per insured person up to a maximum of $3,000.

-

Trip Interruption Insurance: The Platinum Card covers up to $2,500 per insured person, per trip, up to a maximum of $6,000 for all insured persons combined; meanwhile, the Business Platinum Card only covers up to $1,500 per insured person up to a maximum of $6,000.

-

Purchase Protection Plan: While not strictly a travel insurance item, both cards also automatically insure your eligible purchases against accidental physical damage and theft, up to a limit of $1,000 per occurrence. The Platinum Card covers you for up to 120 days after purchase, while the Business Platinum only covers you for up to 90 days after purchase.

- Mobile Device Insurance: The Business Platinum offers up to $1,500 in the event of theft, loss, or accidental damage to a mobile device charged to your card. This benefit isn’t currently offered on the personal Platinum.

Verdict: While both cards’ travel insurance and purchase protection benefits are excellent, the Platinum Card offers slightly better terms on a few of those provisions, while the Business Card is unique with its Mobile Device Insurance.

3. Supplementary Cards

Adding supplementary cards on both the Platinum and the Business Platinum can come at a rather significant expense, as the two cards charge $250 for supplementary cards.

However, it’s worth noting that supplementary cardholders also receive their own Priority Pass memberships and other types of lounge access as well, which can definitely justify these expenses if your supplementary cardholders are frequent travellers themselves.

Both cards also allow you to give an authorized user the respective “Gold” equivalents as well (the American Express Gold Rewards Card and the American Express Business Gold Rewards Card) for free. However, the personal Platinum is capped at two free Gold cards ($50 thereafter), while the Business Platinum is capped at 99.

Verdict: If you’d like to extend the lounge access benefits on your Platinum or Business Platinum to a supplementary cardholder, then the $250 fee may well be justified. Since the cost is the same, we have ourselves another draw.

4. NEXUS Credit

Many credit cards have added a recurring NEXUS application credit as one of the benefits for cardholders.

When it comes to the pair of Platinum cards, both offer a $100 (CAD) statement credit every four years, which can be used to cover the cost of application or renewal fees.

Verdict: With the same benefit available on both cards, it’s another tie.

5. Visual Appearance

Both cards are about as visually appealing as a credit card can be, since both take the form of a stylish metal card (or as Amex calls it, a precision-cut and personally engraved metal card), and both make quite the satisfying clang-clang-clang noise when you drop it on the table to pay your bill.

Verdict: There’s a bit of a fascination with metal cards in the credit card community, and the Platinum and Business Platinum both rock that slick metal look very well.

Conclusion

With a higher 2x earning rate on travel purchases, a $200 annual dining credit, and a more comprehensive travel insurance package, the American Express Platinum Card’s travel perks are arguably a cut above those of its business-oriented counterpart.

On the other hand, the Business Platinum Card by American Express has a higher welcome bonus, an elevated 1.25x base earning rate, better potential through referrals, and a larger potential to benefit from credits every year.

If you’re just starting out and are deciding between one of these two cards to try stomaching its annual fee, then you’ll want to consider which of the above strengths are a better fit for your own needs.

However, once you move beyond that initial phase, the optimal strategy would likely involve pairing either with other cards in the Amex ecosystem to ensure your Membership Rewards balance is getting boosted on all fronts.

Do you benefit from the Avis/Hertz enhanced loyalty tier categories with the personal card?

Unfortunately it does not

I would love a AMEX card except I find that in Vancouver, a lot of the businesses don’t actually accept AMEX. Not sure if anyone has any good suggestions regarding workarounds for this?

As far as tax deductibility of credit cards, it really does not matter if it is a business or personal card. What matters is the purpose it is used for. A personal card used for business transactions will have a deductible annual fee. If you use a business card for purely personal transactions, then the CRA will disallow any fees associated with that card.