As of 2019, Canada was home to 642,000 international students.

Like most of us, after I landed at Montreal International Airport and got my study permit, I was aspiring to discover the country, enjoy the scenery, and connect with new people.

Soon after, reality flew into my face at the speed of a rotating Boeing 777 and made traveling an afterthought at best – hefty tuition fees and the cost of living in a big city left no room in an already tight budget.

Almost three years later, I have been to twelve cities across Canada and North America. I have boarded over thirty flights and flown tens of thousands of kilometres, most of them in business class. Hotel suites and elite treatment have become a regularity rather than a once-in-a-lifetime luxury.

This is the freedom that Miles & Points brought me – with nothing more than a student visa and a modest income in my hands.

Getting a First Credit Card

The first step to getting a Canadian credit card is obtaining a Social Insurance Number from Service Canada. They will only issue one if you are authorized to work while studying.

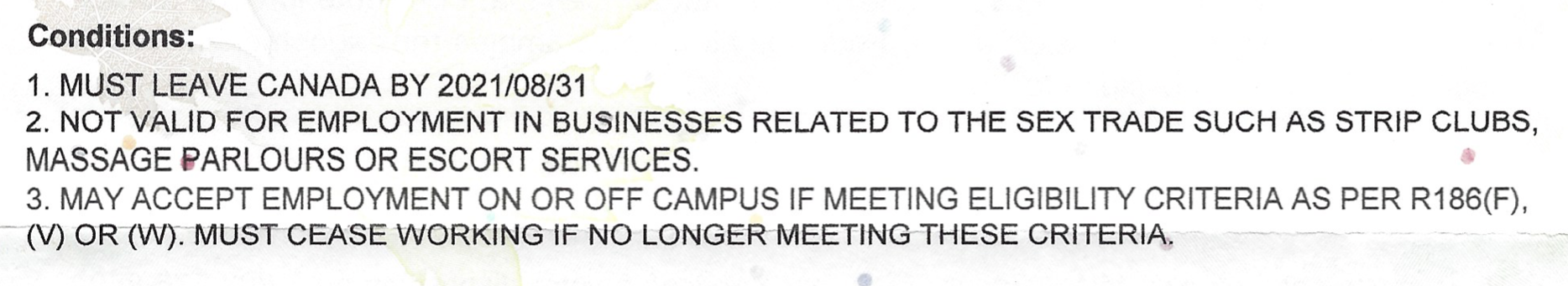

The border officer that delivers the study permit to you will usually tell if you can get a job. They will also include the employment conditions in the corresponding section of your study permit.

Within the first few weeks of settling in Canada, make an appointment with one of the big banks to open a student chequing account. These accounts are usually free, and you can get a bonus of up to $100 for things like enrolling in online banking or making a first debit card transaction.

During the meeting with the advisor, ask if you could apply for a credit card. Here are some of the policies that Canadian banks advertise:

- Scotiabank, HSBC, CIBC, RBC, and BMO extend up to $1,000 worth of credit to international students who have just arrived in Canada.

- TD will only approve a secured card application from a freshly arrived foreign student. They may, however, let you get an unsecured card once you have built up your credit history.

- MBNA and Tangerine will only let you sign up if you have a Canadian ID, such as a driving license.

The CIBC Aeroplan Visa Card for Students and RBC Avion Visa Platinum are good cards to start with. Like with other entry-level products, virtually anyone is eligible to apply, but you earn valuable travel rewards instead of cash back.

As of May 2021, the welcome offer on the CIBC card is 10,000 points on first purchase with no annual fee. Meanwhile, RBC offers a historic high of 35,000 Avion just for getting the card and paying the $120 first year fee.

When I was starting out, I did not yet know about collecting points. My first card was a secured TD Cash Back Visa Card, which I closed in about half a year to retrieve the $500 security deposit so that I could afford to pay my tuition fee.

RBC was initially unwilling to extend me credit, citing some changes in internal policies. I quickly got around that by making an appointment with another advisor a few months later, who instantly approved me for a RBC Cash Back Mastercard with a $1,000 limit.

As a rule, RBC will not issue a credit card that’s valid past your study permit expiration date; neither will they increase the credit limit, regardless of your income, while you are still an international student.

Starting with American Express

American Express usually asks for about a year of credit history before approving a first card.

The American Express Cobalt Card, American Express Gold Rewards Card, and American Express Aeroplan Card are three of the more approachable options with effective welcome bonuses in the 25,000-to-50,000 points range and annual fees between $120 and $150.

The spend multipliers on those cards suit a student lifestyle, including gas, groceries, dining, and drugstores. Usually, Amex refer-a-friend offers are significantly more competitive than the public ones, so make sure to use a friend’s referral link to get the best deal.

Three to six months after your first Amex, you can start applying for more cards, including their business and premium travel lineups.

If you can afford the annual fees and the minimum spending requirements, both the personal and business Platinum cards yield lots of points within a few months’ time. On the hotel side, the two Marriott cards are worth signing up for the long term because of the Free Night Awards worth 35,000 Bonvoy points after the first year anniversary.

If you already have an American Express card in your country of origin, such as the US, France, Italy, or Singapore, apply for a Global Transfer (GT) instead of waiting to build up a credit history.

Given how lucrative Amex cards are for earning points, it makes sense to purposefully sign up for a card back in your home country a few months before coming here, if possible. That would significantly fast-track the Miles & Points journey once you arrive and get settled in Canada.

My first try with Amex was at about six months of credit history in February 2019. They asked for a T4, which I didn’t have yet, so I cancelled the application. My credit score at that time was questionable at best, because I used to think that having high statement balances is actually good to show the bank that I’m using the card.

I waited a few more months until finally, in June 2019, they let me get an Amex Cobalt Card with a no-questions-asked $1,000 credit limit. I figured out that optimizing the grocery and spend multipliers and pursuing the monthly welcome bonus was a quick way to maximize my return on spend. However, I was still largely unaware that these points could easily subsidize my travel plans.

Three months later, I got an Amex Gold with a First Year Free offer and a welcome bonus of 25,000 MR points. Around the same time, I discovered the Prince of Travel YouTube channel and binge-watched hours of videos on maximizing credit card rewards and luxury travel.

I planned to fly business class to New York for my birthday, but I discovered the hard way that MR Select points are not transferrable to Aeroplan. I settled for a reasonably nice Delta premium economy flight, which was the last flight that I booked with cash.

Pursuing US Credit Cards

The process of getting a first US credit card is the same for all individuals who live in Canada and are also interested in being residents of the United States for the purposes of credit card bonuses, regardless of whether or not you’re an international student.

Our in-depth guide summarizes the procedure, including how to set up a mail forwarder, get an individual taxpayer identification number (ITIN), and maximize points-earning opportunities with both Amex US and other issuers.

If you need a visitor visa to cross the American border, make sure to apply for one early on with a US embassy or consulate in advance of your travel.

After all, walking into a US branch may yield a faster approval with Chase, and it’s required for Bank of America. Furthermore, if you plan on taking an international trip, US routes may have better business class and First Class availability with Asian, European, and Middle Eastern airlines.

I got my first Amex US card using Nova Credit in October 2019, when my Canadian credit history was about 14 months old. The card I chose was the Hilton Honors Card with a $0 annual fee, and I have it open to this day to build my average age of accounts. Because of limited earning opportunities in Canada as an international student, I went full force into the US credit card market, which is more accommodating to non-residents.

I obtained a long-yearned US visa for a trip to Orlando in May 2019, and I also used it to open a Chase Freedom Student credit card while visiting Chicago right before the pandemic started.

I had an ITIN already by this point (having followed the same steps as Canadians, except I visited my country’s consulate to get a certified copy of my foreign passport), so they approved me for a US$1,000 credit line, even though they appeared to be unable to pull my US credit file.

Along with continuing to get new Amex US cards, I was also eagerly waiting for my one-year mark in the US Miles & Points journey in October 2020. A few days after that date, I got approved for the Chase Sapphire Preferred with an all-time-high welcome bonus of 80,000 Ultimate Rewards points.

Conclusion

International students who come to Canada have a lot of opportunities to get into the Miles & Points game.

Most of the big banks will approve an entry-level secured credit card without any prior credit history. After only one year, you can start with American Express and collect a sizeable amount of points, which can take you on aspirational trips throughout North America and beyond.

Once you get comfortable on our side of the border, expanding the game to the US is the same as for anyone else living in Canada. You may want to get an American visa if you need it to cross the border, so that getting non-Amex cards and optimizing travel itineraries becomes easier.

Finally, make sure that you can afford to sign up for those premium travel credit cards before you apply – and remember that the pursuit of Miles & Points is a marathon, not a sprint.

Redeeming points was an afterthought to earning when I was starting out, but I’ve now realized that it’s just as important, and I’m looking forward to putting my points to good use on some post-pandemic trips.

Easy and informative guide for newbies. I have a couple questions for you.

1. You actually need to withdraw the 500 security deposit to pay for tuition? That’s unbelievable.

2. Why do you need a business class from Montreal to New York? One hours or so flight? What’s the point? There ain’t even lie flat seat. SMH

I’m glad you liked the post!

1) Yes, my financial situation was not amazing at the time so I could not afford to have $500 frozen up.

2) Business class may be pointless except for the premium service, but PY actually makes sense because of the extra space.

No need to have a SIN, when I was on student visa, I have held multiple credit cards without having a SIN.

In fact, as someone above suggested, it might actually be a disadvantage to provide a temporary (starting with a 9 SIN.

RBC and TD have asked me for a study permit and a SIN at the time of opening the account. I think they’d know you’re a student either way from your study permit, but I’m glad it worked out for you!

Gary, see TD and open a US Based account from here in Canada. Once you have a USA mailing address they will use your Canadian credit report to grant you credit cards. Very good cards to have!

Hi Ricky

Hope you are doing well and staying safe during your visit to home country.

Can you please which US credit card should I apply for as I am in Canada from 2 years and recently I got my Permanent residency. I have Amex preferred card and TD visa infinite already in Canada.Main focus is to Earn airmiles and annual fees should be fine around 100$.

Wish I saw this 10 years ago. The key of getting approved automatically online is to never provide your SIN. Some lenders will automatically reject SIN starting with 9 or require a security deposit, eg. TD. Some will limit your line of credit, eg. RBC, BMO. If you have some assets with the bank, it is always better to apply in-person and build a relationship with the banker.

I have been waiting for this post for a long time, even though I went through most of this already haha 😀 Another thing to consider other than sign-up bonus is insurance, especially car insurance as international students often rent a car. That was the reason I opened CIBC Aventura Student card as my first card because it was a rare no annual fee card but with car insurance. Now we have the new CIBC Aeroplan, also with car insurance.

My suggestion if someone wants to focus on Aeroplan points and easy approval:

First card: CIBC Aeroplan

Second card: American Express Personal Gold

Optional 2.5 card: American Express Cobalt, transfer to Marriott then to Aeroplan

Third card: American Express Personal Platinum (cancel after the first year)

Fourth card: American Express Business Platinum (after canceling the Personal Plat)

This will be enough to flying back home in style 😉

Plus American Express’s Aeroplan cards as well!