As the seasons turn, the Summer of American Express is carrying on into the fall. Although the best-ever welcome bonuses have come and gone, Amex keeps putting out creative ways to earn more rewards than ever before.

Now, they’ve announced a new series of refer-a-friend bonuses across many card products, in which the referrer can earn 3 bonus points per dollar spent after making a single successful referral.

Normally, Amex referral bonuses simply award the referrer with a lump sum of points when the applicant is approved. With these bonuses, you’ll get the same lump sum up front, plus extra points with each purchase you make.

Let’s take a look at how much you can earn, and how you can maximize this opportunity.

Premium Credit Cards: Up to 75,000 Bonus Points!

Naturally, the premium credit cards get the premium offers. Once again, you can earn the most points with Amex’s top-tier products.

On premium cards, after you make one referral, you’ll start earning 3 bonus points per dollar spent, up to a maximum of 75,000 bonus points! That’s in addition to the standard referral bonus for the card.

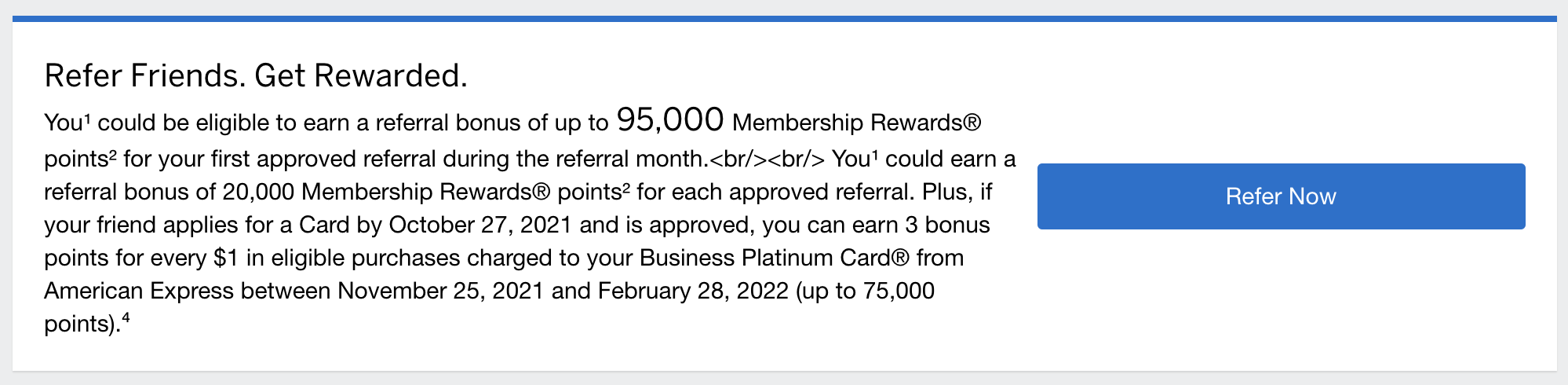

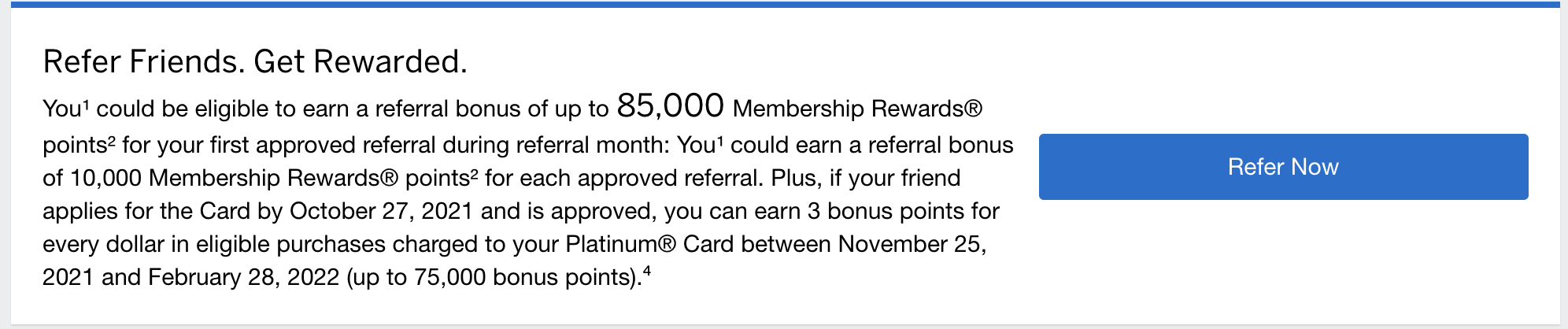

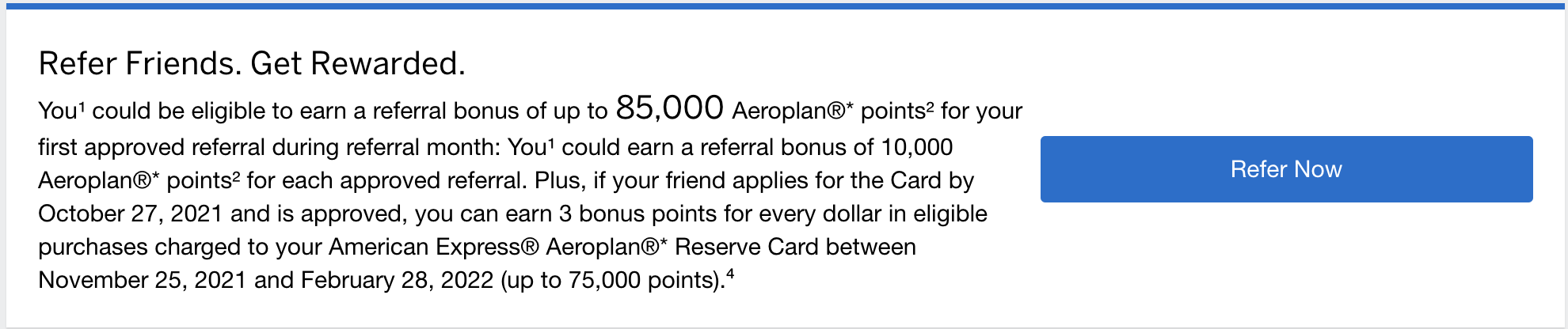

This offer is available on the Business Platinum Card, Platinum Card, Aeroplan Business Reserve Card, and Aeroplan Reserve Card:

- Business Platinum Card: 20,000 MR points + up to 75,000 MR points for spending, for a total of 95,000 MR points

- Platinum Card: 10,000 MR points + up to 75,000 MR points for spending, for a total of 85,000 MR points

- Aeroplan Business Reserve Card: 20,000 Aeroplan points + up to 75,000 Aeroplan points for spending, for a total of 95,000 Aeroplan points

- Aeroplan Reserve Card: 10,000 Aeroplan points + up to 75,000 Aeroplan points for spending, for a total of 85,000 Aeroplan points

All for the trouble of convincing one family member or friend to apply for a fantastic credit card? It almost sounds too easy!

These offers are spend-based, which is a double-edged sword. You’ll need to spend $25,000 in three months to earn the maximum number of points, but it’s also not all-or-nothing in case you fall short.

If you’re not counting on achieving the full bonus, you could instead view the bonus component as a boosted earn rate:

- Business Platinum Card: 4.25 MR points per dollar spent on all purchases

- Platinum Card:

- 6 MR points per dollar spent on dining

- 5 MR points per dollar spent on travel

- 4 MR points per dollar spent on all other purchases

- Aeroplan Business Reserve Card:

- 6 Aeroplan points per dollar spent on Air Canada and Air Canada Vacations

- 5 Aeroplan points per dollar spent on hotels and car rentals

- 4.25 Aeroplan points per dollar spent on all other purchases

- Aeroplan Reserve Card:

- 6 Aeroplan points per dollar spent on Air Canada and Air Canada Vacations

- 5 Aeroplan points per dollar spent on dining

- 4.25 Aeroplan points per dollar spent on all other purchases

Also, if you recently opened the Platinum or Aeroplan Reserve cards during the outrageous Summer 2021 offers, you might still be in the six-month window to earn 10 points per dollar spent on eats and drinks, up to 50,000 bonus points in total.

The offers should stack, so if you can line everything up properly, you’ll be earning 13 MR or Aeroplan points per dollar spent on eats and drinks! Needless to say, that’s impossible to pass up.

| Credit Card | Best Offer | Value | |

|---|---|---|---|

|

200,000 MR points!

$799 annual fee

|

200,000 MR points! | $5,616 | Apply Now |

| 180,000 MR points! | $4,001 | Apply Now | |

|

Up to 140,000 Aeroplan points

$599 annual fee

|

Up to 140,000 Aeroplan points | $3,680 | Apply Now |

|

130,000 Aeroplan points

$599 annual fee

|

130,000 Aeroplan points | $2,682 | Apply Now |

Core Credit Cards: Up to 30,000 Bonus Points

If the required spending on premium cards is too much to handle, luckily there are lesser options available that can still be quite lucrative.

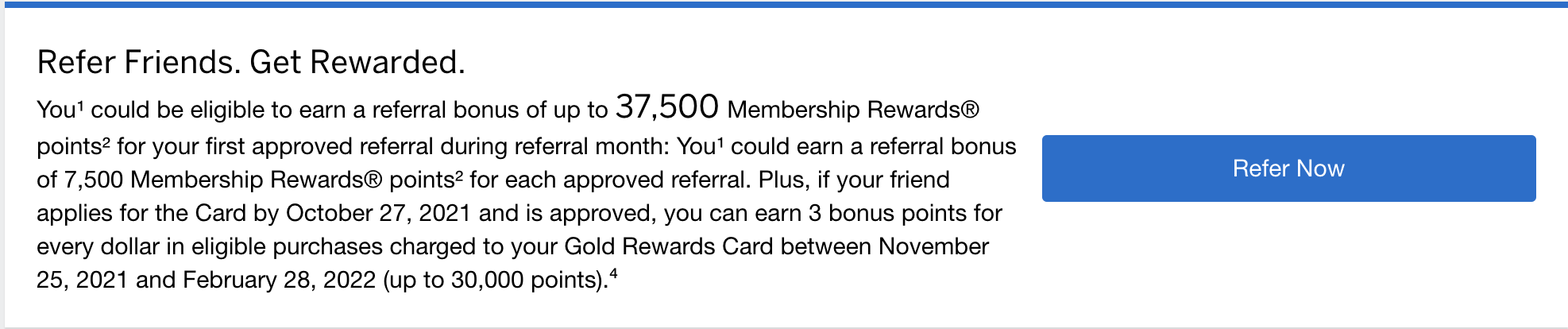

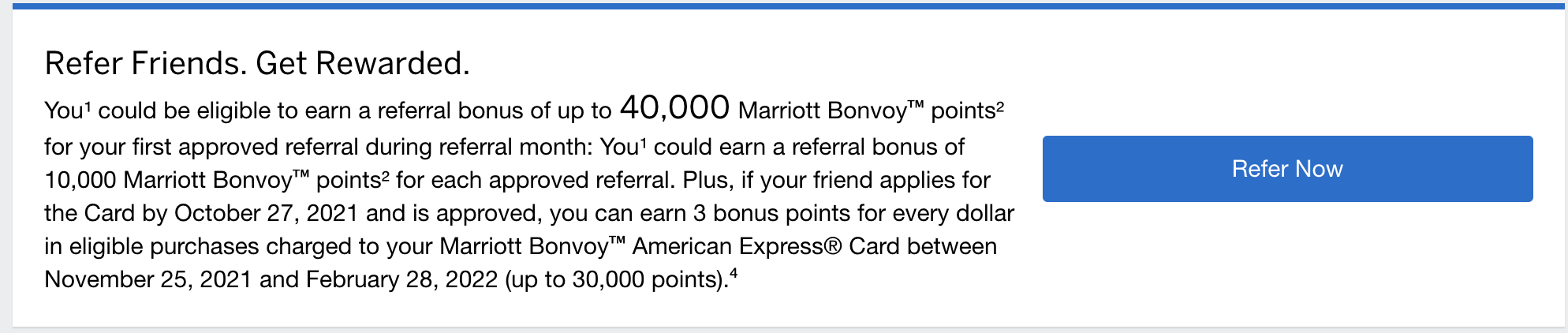

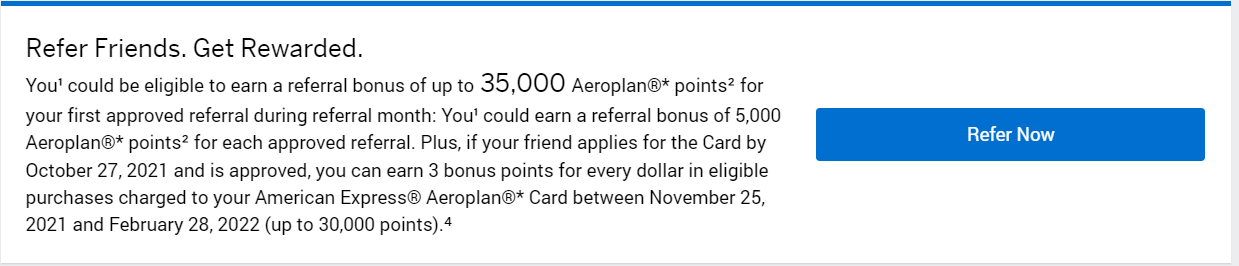

On the “core”-level cards, after you make one referral, you’ll start earning 3 bonus points per dollar spent, up to a maximum of 30,000 bonus points, in addition to the standard referral bonuses:

- Gold Rewards Card: 7,500 MR points + up to 30,000 MR points for spending, for a total of 37,500 MR points

- Cobalt Card: 5,000 MR points + up to 30,000 MR points for spending, for a total of 35,000 MR points

- Green Card: 2,500 MR points + up to 30,000 MR points for spending, for a total of 32,500 MR points

- Business Edge Card: 5,000 MR points + up to 30,000 MR points for spending, for a total of 40,000 MR points

- Marriott Bonvoy Card: 10,000 Bonvoy points + up to 30,000 Bonvoy points for spending, for a total of 40,000 Bonvoy points

- Marriott Bonvoy Business Card: 15,000 Bonvoy points + up to 30,000 Bonvoy points for spending, for a total of 45,000 Bonvoy points

- Aeroplan Card: 5,000 Aeroplan points + up to 30,000 Aeroplan points for spending, for a total of 35,000 Aeroplan points

All of these offers top out at 30,000 bonus points, which only requires $10,000 of spending to achieve.

Fortunately, you’ll still earn at the same rate as the premium cards of 3 bonus points per dollar spent. Therefore, if you don’t expect to be able to maximize the bonus on a premium card, you’ll actually do just as well by using a core credit card.

Similarly, if top-dollar annual fees deter you from keeping premium cards, you can still refer from any of the core cards with net annual fees in the $150-and-under range, again for the same benefit.

Even the cash back cards are getting in on the action:

- SimplyCash Preferred Card: $100 + 3% bonus cash back up to $300, for a total of $400 upon spending $10,000

- SimplyCash Card: $50 + 3% bonus cash back up to $150, for a total of $200 upon spending $5,000

Since these offers are likely more appealing to anyone who doesn’t think they can maintain high spend, it might be useful to view them as elevated earn rates (up to $10,000 spent), rather than maximum totals:

- Gold Rewards Card:

- 5 MR points per dollar spent on groceries, gas, drugstores, and travel

- 4 MR points per dollar spent on all other purchases

- Cobalt Card:

- 8 MR points per dollar spent on groceries and dining

- 6 MR points per dollar spent on streaming services

- 5 MR points per dollar spent on gas, transit, and travel

- 4 MR points per dollar spent on all other purchases

- Green Card: 4 MR points per dollar spent on all purchases

- Business Edge Card:

- 6 MR points per dollar spent on restaurants and office supplies

- 4 MR points per dollar spent on all other purchases

- Bonvoy Card:

- 8 Bonvoy points per dollar spent at Marriott properties

- 5 Bonvoy points per dollar spent on all other purchases

- Bonvoy Business Card:

- 8 Bonvoy points per dollar spent at Marriott properties

- 6 Bonvoy points per dollar spent on gas, dining, and travel

- 5 Bonvoy points per dollar spent on all other purchases

- Aeroplan Card:

- 5 Aeroplan points per dollar spent on Air Canada and Air Canada Vacations

- 4.5 Aeroplan points per dollar spent on dining

- 4 Aeroplan points per dollar spent on all other purchases

- SimplyCash Preferred: 5% cash back on all purchases

- SimplyCash: 4.25% cash back on all purchases (up to $5,000 spent)

| Credit Card | Best Offer | Value | |

|---|---|---|---|

|

110,000 MR points!

$250 annual fee

|

110,000 MR points! | $2,270 | Apply Now |

|

130,000 Bonvoy points

$150 annual fee

|

130,000 Bonvoy points | $1,250 | Apply Now |

|

110,000 Bonvoy points

$120 annual fee

|

110,000 Bonvoy points | $960 | Apply Now |

|

40,000 Aeroplan points

$120 annual fee

|

40,000 Aeroplan points | $573 | Apply Now |

| 15,000 MR points | $372 | Apply Now | |

| 10,000 MR points | $242 | Apply Now | |

|

$100 cash back

$0 annual fee

|

$100 cash back | $138 | Apply Now |

|

10% cash back

$120 annual fee

|

10% cash back | $80 | Apply Now |

|

$99 annual fee

$99 annual fee

|

$99 annual fee | $0 | Apply Now |

The Fine Print

To activate these offers, the person you are referring must be approved for their new card before October 27, 2021.

However, the bonus earn rate doesn’t kick in until November 25, 2021. Once it begins, you’ll have until February 28, 2022 to earn as many bonus points as you can.

So while immediate spending won’t count, you’ll have a three-month window to spend up to $10,000 on core cards, or $25,000 on premium cards.

You can only earn the 3x bonus points once per card. For example, if you referred two friends from your Aeroplan Reserve Card, you’d only earn 3 bonus points per dollar spent, not 6. (You’d still earn the usual 10,000 points up front for the second referral, up to the annual maximum.)

However, you can activate the offer on different products. If you successfully refer a new applicant from, say, your Aeroplan and Bonvoy cards, you’d trigger the bonus on both.

Finally, be careful not to have any returns during the bonus period. If you made a purchase before the bonus period, and return it during, your points will be deducted at the bonus rate – for a net loss!

On the other hand, purchases during the bonus period won’t have the bonus points deducted if you make a return after the window ends. This could work in your favour if you have some heavy holiday shopping at stores with generous return policies.

What’s the Best Referral Strategy?

Hold the “Amex Train” at the station this month – we’ve got to rearrange the train cars a bit.

As always, it’s best to start with the Business Platinum Card. You’ll get the usual 20,000 MR points up front, the highest referral bonus available, plus up to 75,000 MR points for spending.

But after that, assuming you can hit the spending requirements, it would be better to do a single referral from each of your other cards. By doing so, you’ll activate offers for 35,000–85,000 points, rather than just a maximum of 20,000.

Only then, or only if you can’t maximize the spending, should you go back to initiating referrals from the Business Platinum Card.

For example, if you and your partner are both opening Platinum and Business Platinum cards, normally you’d want to always refer each other from your Business Platinum cards for 20,000 MR points each time.

Specifically, the normal strategy looks as follows:

- First, you’d refer from your Business Platinum Card to your partner’s Business Platinum application.

- Then, your partner would refer from their Business Platinum Card to your Platinum application.

- Finally, you’d refer from your Business Platinum Card to your partner’s Platinum application.

However, in this scenario, it would be best to do the final step from your own Platinum Card instead.

You’ll have already activated the bonus offer by doing the first Business Platinum referral, and this way you’d also activate it on your Platinum Card. That way, you’d be able to earn up to 85,000 points for doing the referral, rather than just 20,000.

Conclusion

American Express continues to impress, with an incredible offer that all cardholders will be able to benefit from. Even if you’re unable to maximize the required spending on all of your cards, all it takes is one referral to get started.

Once again, American Express Canada is taking cues from south of the border. Amex US has occasionally put on similar offers in the past, in which a +3x MR spending bonus was triggered by a referral.

I had this offer on my US Gold Card last year, and with uncapped bonus rewards, I was able to amass an absolutely silly amount of points. Even with a 75,000-point limit on this one, it’s still a great opportunity to accelerate your points earnings.

So what are you waiting for? Go get your friends an Amex card – there’s never been a better time to evangelize the flock!

Hi, thanks for the site. Situation – have a BUS PLAT already. Looking to maximize 2P benefits. Was interested in Cobalt for Groceries prior. Referral to spouse BUS PLAT seemed like usual straightforward choice, but I think 2 new Cobalts are better even though already have the Bus Plat. Consider at $10k referral spend only, included the bonuses and assuming held one year and spend is met in all cases for comparison:

Option 1: Bus Plat – refer to Spouse. 20K MR bonus + 30k MR bonus on spend = 50k points. Spouse gets 105k points. Total is 155k MR. Fees = $499, so 0.32 cpp cost.

Option 2: New cobalt and then refer to spouse for new cobalt. 50k MR signup bonus + 5kMR referral + 30k MR bonus on spend = 85kMR. Spouse 50k MR signup bonus. Total is 135kMR. Fees = $312 for 2 cards so 0.23 cpp cost.

I know many ways to look at total points, CPP , etc. but the surprising thing here is how close the total points is between two options, for much lower cost just getting brand new Cobalts. Something to consider for anyone without a Bus Plat already, as I have one and Surprisingly I will probably not use it for referral but instead get new Cobalts. Even better if used for groceries. Different if you could/wanted to crank out the $25k spend on BUS PLAT. I bet you’re working on a blog post with some of these permutations anyway!

Not sure what was different, but I got 30,000 plus 3 points per $ spend for my platinum business instead of 20,000 plus 3

Did this post or does it say that in your account?

It says it on my account:

“You¹ could be eligible to earn a referral bonus of up to 105,000 Membership Rewards® points² for your first approved referral during the referral month. You¹ could earn a referral bonus of 30,000 Membership Rewards® points² for each approved referral.”

Some members have been targeted for a 30,000-point base bonus per referral, rather than the usual 20,000-point bonus (this was happening before too). The +3 points up to 75,000 extra points is separate and applies to everyone regardless of their base referral bonus. Lucky you!

Referred my wife today and the 30,000 points have already posted to my account!

And now she has referred back to me and I have picked up the gold rewards card, so now, if I spend $25K on her platinum, 25K on my platinum and 5K on my gold, we should receive 105K MR for my referral to her, 95K for her referral to me, 65K for my gold bonus, 100K for her gold bonus, 62.5K for our platinum spend and 5K for my gold spend. 432,500 MR points in all, not a bad chunk of points.

For the 10x points on dining&grocery on my platinum and aeroplan reserve card from the sign up offer in the summer, will the 3x offer from the referral work as well, will I get 13x points on dining&grocery?

That is an insane amount of spending if one doesn’t have methods to MS…

Thanks Ricky great article. Just to clarify, is the referral bonus based on the card you refer from, or the card you refer to? For example, if I hold Cobalt and the person I refer to chooses Gold instead, is my referral bonus 5k or 7.5k? Thanks in advance.

Hi Justin, glad you enjoyed it. The bonus for the referrer (whose link is being used) is always based on the card you refer from.

Hi Josh,

Just confirming based on your reply that if I refer my partner from my Aeroplan Reserve to the Aeroplan core card I’ll still get the 10,000 points and 3x spend bonus for the 3 month period mentioned?

I guess referring down from Aeroplan Reserve to regular Aeroplan card is not an option.

Correct, not an option.

Not sure if the offers are different, but my business edge referral bonus is showing as 5k MR + up to 30k as opposed to 10k+ up to 30k as noted above

Typo – you are correct, thanks!

So if we wanted to hit the 100k EDQ for Aeroplan 25k status, we have 5 days to use the 13x grocery + referral multiplier? Since the deadline for the 25k status is Nov 30th while the spending multiplier kicks in on Nov 25th?

I wouldn’t count on this method for 25K, as the points earned by spending likely won’t count for EDQ until your statement has posted. Highly recommend not cutting it so close to the deadline if you can avoid it.

Thanks Josh!