Review: RBC Avion® Visa Infinite Privilege†

The RBC® Avion Visa Infinite Privilege† is the premium card offering in RBC’s Avion line-up, and it comes with a solid welcome bonus, flexible points currency, and strong travel insurance.

In this review, we’ll look at what this card has to offer, and help you decide if it’s worth paying the higher annual fee to make this the next card you add to your portfolio.

At a Glance

Annual Fee: $399

- Supplementary cardholders: $99

- Minimum annual income: $200,000 (personal or household)

- Estimated credit score: Good to Excellent

- Rating: 3.5

What we love: flexible points, solid welcome bonus, strong travel insurance

What we’d change: increase earning rate and add tiered structure and remove foreign transaction fees

Improved Welcome Bonus

In the past, the RBC® Avion Visa Infinite Privilege† has offered a welcome bonus that is often around the same level as the bonuses offered with lower-tier Avion cards; however, the card’s welcome bonus offers have recently been given a boost to levels more suitable for a premium credit card.

The card’s welcome bonus has historically ranged from 35,000–70,000 Avion (Elite) points in the past few years, and it’s typically earned in two or three portions. Generally, you earn the first portion after you’ve made your first purchase on the card, and your second portion after meeting a (usually reasonable) spending requirement.

As part of the welcome bonus, there is also occasionally a third portion, which is earned after passing your first-year anniversary as a cardholder.

We value RBC Avion (Elite) points at 2 cents per point, and using this valuation, we estimate that a welcome bonus of 35,000 points would be worth around $700, and a welcome bonus of 70,000 points would be worth around $1,400.

Now, depending on how you choose to redeem your points, they could be worth more or less than these estimates, and we’ll go over some of your different redemption options below.

First-year value

$826

Annual fee: $399

• Earn 35,000 points on approval

• Earn 20,000 points upon spending $5,000 in the first 6 months

• Earn 15,000 points on card anniversary in the first 12 months

Earning rates

Key perks

- 6 Visa Airport Companion lounge visits per year

- Priority security at Toronto Billy Bishop, Montreal, Ottawa

- Visa RSVP Diamond at 60+ Sandman/Sutton hotels

- Troon Rewards Platinum (20% off at 150+ golf courses)

- Transfer to British Airways Avios, Cathay Asia Miles, WestJet, American Airlines

- DoorDash DashPass for 12 months

Annual fee: $399

• Earn 35,000 points on approval

• Earn 20,000 points upon spending $5,000 in the first 6 months

• Earn 15,000 points on card anniversary in the first 12 months

Earning rates

Key perks

- 6 Visa Airport Companion lounge visits per year

- Priority security at Toronto Billy Bishop, Montreal, Ottawa

- Visa RSVP Diamond at 60+ Sandman/Sutton hotels

- Troon Rewards Platinum (20% off at 150+ golf courses)

- Transfer to British Airways Avios, Cathay Asia Miles, WestJet, American Airlines

- DoorDash DashPass for 12 months

Uninspired Earning Rates

The RBC® Avion Visa Infinite Privilege† earns Avion (Elite) points at a flat rate of 1.25 points per dollar (all figures in CAD) spent across the board on all purchases.

This rate is 0.25 points higher than the lower-tiered RBC® Avion Visa Infinite† baseline earning rate of 1 Avion (Elite) points per dollar spent (though the RBC® Avion Visa Infinite† also earns 1.25 Avion points per dollar spent on travel purchases).

We feel this earning rate is low for a premium card, especially since you can earn almost the same number of points for a considerably lower annual fee with the RBC® Avion Visa Infinite†, not to mention RBC’s other Avion-earning card options.

It’s a shame not to see some elevated earning rates on a premium, travel-focused card, like those offered by the similar TD® Aeroplan® Visa Infinite Privilege* Card, with which cardholders can earn 2 Aeroplan points per dollar spent on Air Canada and Air Canada Vacations, 1.5 Aeroplan points per dollar spent on groceries, gas, travel, and dining, and 1.25 Aeroplan points on all other eligible purchases.

Given that RBC’s Avion (Elite) points and Aeroplan points have a nearly identical value, we’d love to see RBC provide some better earning rates on this premium card in the future.

The Essential Guide to RBC Avion Rewards

Read moreFlexible RBC Avion (Elite) Points

The RBC® Avion Visa Infinite Privilege† earns the valuable and transferrable Avion (Elite) points, which can be redeemed for travel, merchandise, statement credits, and more.

Avion (Elite) points are one of only two rewards currencies in Canada that can be transferred to external partners (the other being American Express Membership Rewards points).

With the RBC® Avion Visa Infinite Privilege†, you can transfer the Avion (Elite) points that you’ve earned from the welcome bonus and from your daily spending to the following loyalty programs:

- British Airways Executive Club at a 1:1 ratio

- Cathay Pacific Asia Miles at a 1:1 ratio

- American Airlines AAdvantage at a 1:0.7 ratio

- WestJet Rewards at a 100:1 ratio

By transferring your points to an airline loyalty program, you can access additional travel opportunities, including some of the most sought-after redemptions in the Miles & Points game, like Qatar Airways’ Qsuites.

Additionally, throughout the year, RBC will often run transfer bonus events that let you transfer your Avion (Elite) points to an airline loyalty program for 10–50% more points.

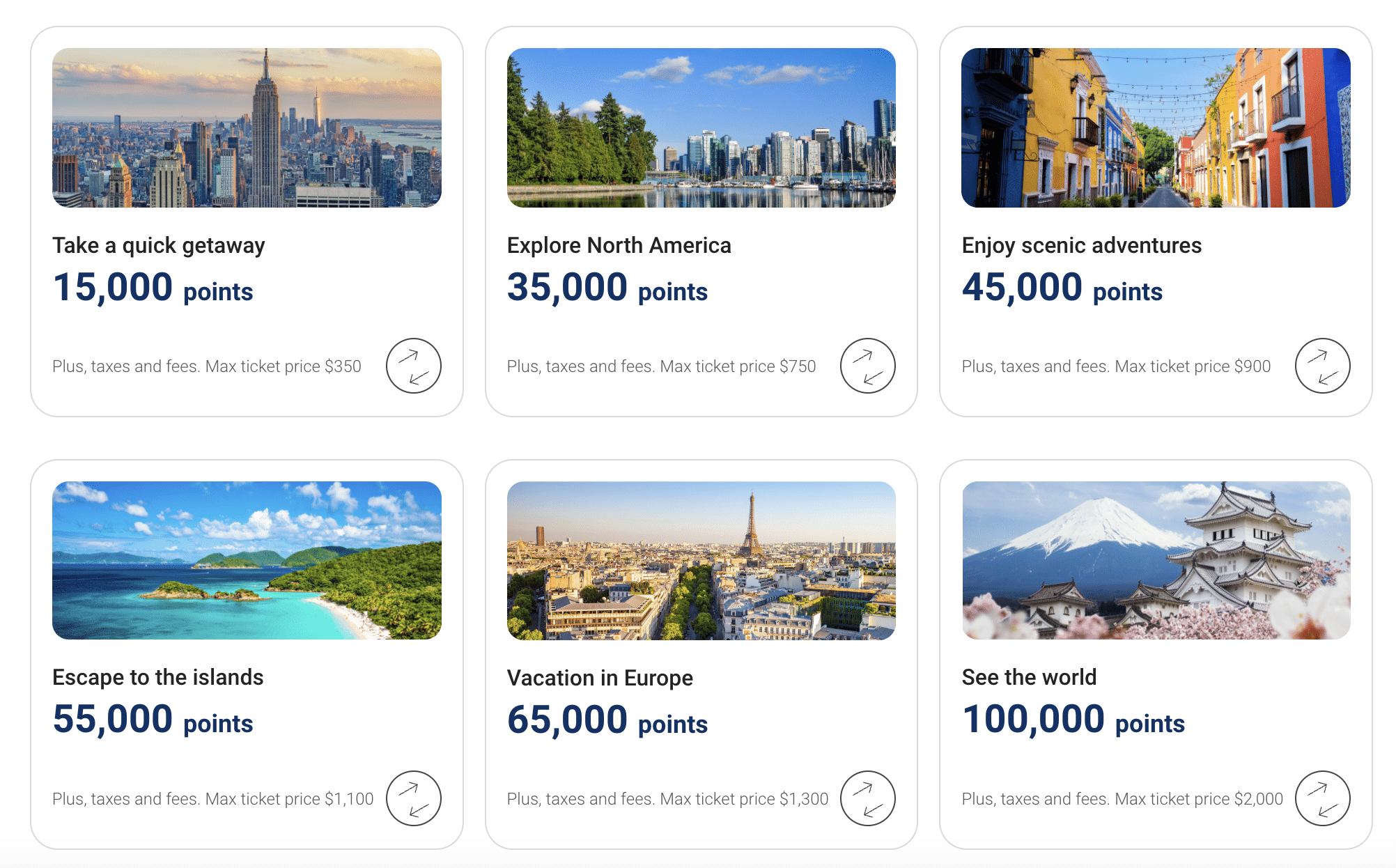

If you’d prefer to use your points for flights without having to transfer them to airline loyalty programs, you can also redeem your points through RBC’s in-house option called the RBC Air Travel Redemption Schedule, which also provides a great return for your points.

With the RBC Air Travel Redemption Schedule, you can redeem Avion (Elite) points for economy flights close to home or around the world and get an elevated value of up to 2.3 cents per point, depending on the route.

Alternatively, you can also redeem Avion (Elite) points at a rate of 1 cent per point against any eligible travel expenses charged to your RBC® Avion Visa Infinite Privilege†, giving you an incredibly straightforward way to use your points for a flight, hotel, car rental, and more, of your choosing.

Additionally, if you’re planning to book a premium cabin flight, you can also redeem your points for 2 cents per point when you book business class or First Class flights using RBC’s Avion Rewards booking portal.

Redeeming RBC Avion Points for Premium Flights

Read moreAs a final note, you can also redeem your Avion (Elite) points for merchandise, gift cards, and statement credits, though these options will not provide the same amount of value from your points that you can get when booking travel, so we don’t particularly recommend these options.

Perks & Benefits

As a premium travel-focused card, the RBC® Avion Visa Infinite Privilege† falls a bit short in terms of its perks and benefits package.

The card’s benefits include the Visa Infinite Privilege suite of offerings, which give you access to some exclusive dining events, wine tastings, hotel benefits, and more.

The card also provides you with six complimentary passes to airport lounges through the Visa Airport Companion Program, and some priority services at eligible airports in Toronto, Vancouver, Montreal, and Ottawa.†

Additionally, the RBC® Avion Visa Infinite Privilege.† comes with strong travel insurance, including trip cancellation and trip interruption insurance and emergency medical.†

The card also provides solid mobile device insurance, covering up to $1,500 if your new device gets lost, stolen, or damaged.†

Given that this is a premium card, we’d love to see some additional travel-focused benefits added to this card, such as unlimited lounge access, or perhaps an annual travel credit.

What Else Does the Card Offer?

In addition to the benefits mentioned above, the RBC® Avion Visa Infinite Privilege† comes with a few other perks of note.

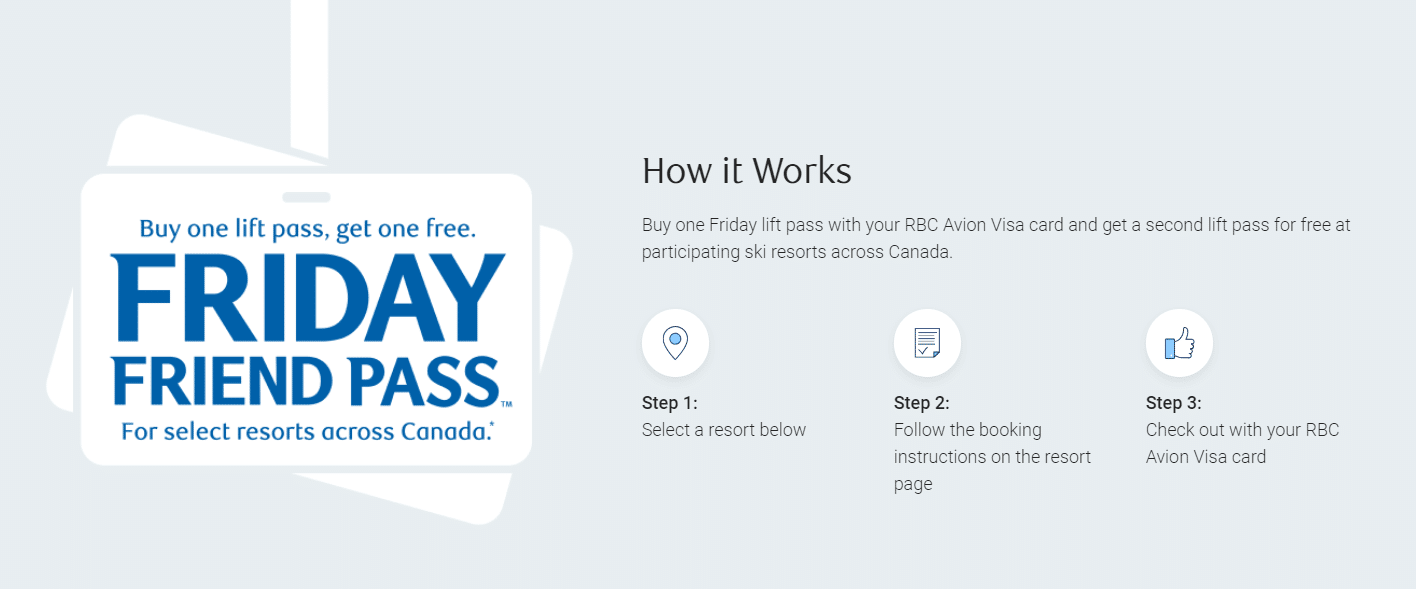

One of our favourite perks offered by this card is the opportunity to enjoy a free second lift pass when purchasing a full-price lift pass at many major ski resorts in Canada through the Friday Friend Pass program.†

This feature can help you save a nice chunk of money when you hit the slopes with a friend or family member.

Additionally, as a cardholder, you can save money every time you fill up your tank by linking your RBC® Avion Visa Infinite Privilege† to a Petro-Points card. Through this partnership, you’ll save 3 cents per litre on gas at Petro-Canada, and you’ll also earn more Petro-Points.†

50,000+ travellers get this email

Weekly deals, credit card insights, and points strategies – free forever.

Top 3 Credit Cards for Gas Stations

Read moreYou can also link your card with your Rexall loyalty Be Well card and earn 50 Be Well points per dollar spent.†

The RBC® Avion Visa Infinite Privilege† also lets you enjoy 20% off your car rental at Hertz, plus you’ll earn 3x the Avion (Elite) points on your associated spending and get upgraded to Five Star status in the Hertz Gold Plus Rewards Program.†

As a final perk, when you add your card to your DoorDash account, you’ll get a 12-month complimentary DashPass subscription, which lets you enjoy unlimited deliveries with $0 delivery fees on orders of $15 or more when you pay with your eligible RBC credit card.†

First-year value

$826

Annual fee: $399

• Earn 35,000 points on approval

• Earn 20,000 points upon spending $5,000 in the first 6 months

• Earn 15,000 points on card anniversary in the first 12 months

Earning rates

Key perks

- 6 Visa Airport Companion lounge visits per year

- Priority security at Toronto Billy Bishop, Montreal, Ottawa

- Visa RSVP Diamond at 60+ Sandman/Sutton hotels

- Troon Rewards Platinum (20% off at 150+ golf courses)

- Transfer to British Airways Avios, Cathay Asia Miles, WestJet, American Airlines

- DoorDash DashPass for 12 months

Annual fee: $399

• Earn 35,000 points on approval

• Earn 20,000 points upon spending $5,000 in the first 6 months

• Earn 15,000 points on card anniversary in the first 12 months

Earning rates

Key perks

- 6 Visa Airport Companion lounge visits per year

- Priority security at Toronto Billy Bishop, Montreal, Ottawa

- Visa RSVP Diamond at 60+ Sandman/Sutton hotels

- Troon Rewards Platinum (20% off at 150+ golf courses)

- Transfer to British Airways Avios, Cathay Asia Miles, WestJet, American Airlines

- DoorDash DashPass for 12 months

Other Cards

While there are many reasons to hold the RBC® Avion Visa Infinite Privilege†, if you’re looking for a similar alternative, here are two other cards worth considering.

American Express Platinum Card

If you’re looking for a premium card that still earns a flexible rewards currency, and that also comes with some stronger travel benefits, take a look at the American Express Platinum Card.

This card earns American Express’ valuable and flexible Membership Rewards (MR) points, which can be transferred to airline loyalty programs, used for travel expenses through the Amex Fixed Points Travel rewards chart, and redeemed for statement credits against travel purchases made on the card (among other redemption options).

In terms of travel perks, the card also comes with Priority Pass airport lounge access, automatic Marriott Bonvoy Gold Elite status and Hilton Honors Gold status, access to American Express’ Fine Hotels & Resorts program, and solid travel insurance coverage.

Although the American Express Platinum Card does carry a hefty annual fee of $799, this is partially offset by a $200 annual travel credit and a $200 annual dining credit, ostensibly bringing the annual fee down to $399.

First-year value

$1,581

Annual fee: $799

• Earn 80,000 points upon spending $10,000 in the first 3 months

• Plus, earn 30,000 points upon spending in month 13

Earning rates

Key perks

- $200 annual travel credit

- $200 annual dining credit

- $100 NEXUS credit

- Unlimited Priority Pass lounge access

- Marriott Bonvoy Gold Elite status

- Platinum Concierge

Annual fee: $799

• Earn 80,000 points upon spending $10,000 in the first 3 months

• Plus, earn 30,000 points upon spending in month 13

Earning rates

Key perks

- $200 annual travel credit

- $200 annual dining credit

- $100 NEXUS credit

- Unlimited Priority Pass lounge access

- Marriott Bonvoy Gold Elite status

- Platinum Concierge

American Express Cobalt Card

The American Express Cobalt® Card is a card that we recommend across the board, in no small part due to its great earning rates that help you quickly accumulate the flexible and transferrable American Express Membership Rewards (MR) points.

Earning 5 MR points per dollar spent on groceries, restaurants, and bars, the Cobalt Card is an incredibly valuable addition to any Miles & Points strategy.

The MR points earned by the card can be transferred to many hotel and airline loyalty programs, such as Aeroplan, Air France KLM Flying Blue, Marriott Bonvoy, and more.

Plus, the card comes with a handful of perks and benefits, like access to Amex Offers, travel insurance, mobile device coverage, and more, helping to round out the card’s offerings.

First-year value

$336

Monthly fee: $15.99

• Earn 1,250 points per month upon spending $750 per month for 12 months

Earning rates

Key perks

- Transfer to airline and hotel partners

Monthly fee: $15.99

• Earn 1,250 points per month upon spending $750 per month for 12 months

Earning rates

Key perks

- Transfer to airline and hotel partners

Conclusion

The RBC® Avion Visa Infinite Privilege† is a decent card for earning the valuable Avion (Elite) points, which you can transfer to partnered loyalty programs to enjoy a wide range of travel opportunities.

Although we feel the card falls a bit short in terms of earning rates and travel perks, it still provides a solid way to earn Avion (Elite) points through the welcome bonus and daily spending, and it comes with a handful of helpful perks and benefits, like the notable buy-one-get-one ski lift tickets available through the Friday Friends Pass promotion.

† Terms and conditions apply. Please refer to the RBC website for the most up-to-date product information.

First-year value

$1,080

Annual fee: $120

• Earn 35,000 points on approval

• Earn 20,000 points upon spending $5,000 in the first 6 months

Earning rates

Key perks

- Transfer to British Airways Avios, Cathay Asia Miles, WestJet, American Airlines

- DoorDash DashPass for 12 months

- Petro-Canada 3c/L savings + 20% bonus Petro-Points

Annual fee: $120

• Earn 35,000 points on approval

• Earn 20,000 points upon spending $5,000 in the first 6 months

Earning rates

Key perks

- Transfer to British Airways Avios, Cathay Asia Miles, WestJet, American Airlines

- DoorDash DashPass for 12 months

- Petro-Canada 3c/L savings + 20% bonus Petro-Points

Comments

Create a free account or become a member to comment.