The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

While a single good credit card can provide you with loads of benefits and points, you may have noticed that we often discuss how building up a portfolio of cards is ultimately the best strategy for you to get the most points possible.

With countless credit cards available, choosing the right ones to stack together can be daunting. Annual fees keep rising, spending bonuses change frequently, and loyalty programs face devaluations.

This guide aims to simplify your decision-making process by focusing on three US-issued cards that can significantly enhance your travel experiences without the hassle of managing a vast number of cards.

In This Post

- The Ultimate Travel Credit Card Trio

- American Express® Gold Card: The Everyday Spend Card

- Capital One Venture X Rewards Card: The Travel Perks Card

- Marriott Bonvoy Brilliant® American Express® Card: The Hotel Loyalty Card

- Conclusion

The Ultimate Travel Credit Card Trio

In this article, we’ll explore why the American Express® Gold Card, the Capital One Venture X Rewards Credit Card, and the Marriott Bonvoy Brilliant® American Express® Card make up the best credit card combination for a savvy traveler.

Each of these cards offers unique benefits that, when combined, provide comprehensive coverage for all your travel needs.

American Express® Gold Card: The Everyday Spend Card

The American Express® Gold Card is a powerhouse for earning points on everyday expenses.

The card earns American Express Membership Rewards® points (MR points) at the following rates:

- Earn 4 MR points per dollar spent at restaurants worldwide (on up to $50,000 USD per year, then 1x) and at U.S. supermarkets (on up to $25,000 USD per year, then 1x)‡

- Earn 3 MR points per dollar spent on flights booked directly with airlines or on AmexTravel.com‡

- Earn 2 MR points per dollar spent on prepaid hotels and other travel purchases booked through AmexTravel.com‡

- Earn 1 MR point per dollar spent on all other eligible expenses‡

The great thing about earning MR points is that you’re unlocking a lot more opportunities compared to when you earn other types of credit card rewards currencies.

Amex MR points are a highly versatile currency and are transferable to over 15 airline loyalty programs and three hotel programs. This flexibility allows you to use your points in whatever way suits you, including booking business class flights and luxury hotel stays.

To illustrate the power of Amex MR points, let’s say that each month you spend $1,000 (all figures in USD) on groceries and $500 on dining out. By using your American Express® Gold Card for these purchases, you’ll earn 72,000 MR points annually.†

By transferring these MR points to a program like Aeroplan at a 1:1 ratio, you can redeem them for a one-way business class flight from North America to Europe, with points to spare.

With the American Express® Gold Card, in addition to the high earning rates, you’ll also enjoy up to $120 in Uber Cash each year ($10 per month)‡, up to $120 dining credit for select restaurants ($10 per month)‡, $50 semi-annual statement credits for eligible expenses with Resy‡, and $84 in credits when spending at Dunkin’ ($7 per month)‡.

Additionally, when you apply for the American Express® Gold Card, you can also expect a generous welcome bonus that will more than make up for the card’s $325 annual fee. See rates and fees.

As you can see, the American Express® Gold Card is great for earning points on your spending and helping you to get closer to a dream redemption; however, the card does have some shortfalls – for example, it doesn’t provide much in terms of travel benefits (e.g., airport lounge access).

Luckily, where the American Express® Gold Card falls short is exactly where the next recommended card for the trio shines.

Capital One Venture X Rewards Card: The Travel Perks Card

The Capital One Venture X Rewards Card is a standout in the travel credit card space, offering a range of benefits that make it an exceptional addition to your wallet.

To start, the earning rates complement the American Express® Gold Card perfectly.

Where the American Express® Gold Card earns high rates on restaurants and grocery purchases, the Capital One Venture X Rewards Card will earn you the most points on travel expenses.

The Capital One Venture X Rewards Card earns Capital One Miles at the following rates:

- Earn 10 Capital One Miles per dollar spent on hotels and rental cars booked through Capital One Travel†

- Earn 5 Capital One Miles per dollar spent on flights and vacation rentals booked through Capital One Travel†

- Earn 2 Capital One Miles per dollar spent on all other purchases†

Similarly to Amex MR points, Capital One Miles can be transferred to 15+ travel loyalty partners.

Additionally, if you book travel and pay for it with your Capital One Venture X Rewards Card, you can also redeem your Capital One Miles at a rate of 1 cent per mile against your travel expenses.†

However, keep in mind that you’ll generally get more value out of your Capital One Miles by transferring them to partner programs rather than redeeming for the statement credits against travel purchases.

As we mentioned, our biggest reason for choosing this card as part of the trio is the card’s excellent travel benefits.

As part of the card’s perks and benefits package, every year you’ll receive a $300 travel credit for bookings through Capital One Travel and an anniversary bonus of 10,000 Capital One Miles, starting on your first cardholder anniversary.† These two annual perks combined are worth more than the card’s $395 annual fee, so these two features alone effectively offset the card’s cost.

The Capital One Venture X Rewards Card also gives you unlimited complimentary access to Capital One Lounges for you and two guests, and access to Priority Pass airport lounges for you and two guests – plus you can add up to four authorized users for free, allowing each one of them to receive Priority Pass airport lounge access as well.†

With the card, you’ll also enjoy Global Entry and TSA PreCheck credits every four years, access to Capital One’s Premier Hotel Collection (which includes a $100 credit, daily breakfast for two, and room upgrades), and Hertz President’s Circle Status.†

Another strong reason the Capital One Venture X Rewards Card is part of this trio is that when you apply for the card and reach the minimum spending requirement, you’ll receive a welcome bonus that is typically around 75,000 Capital One Miles.†

As you can see, the Capital One Venture X Rewards Card is an excellent credit card for travel benefits, offering an array of travel credits and free airport lounge access for you and up to four authorized users, year after year.

The final card in our recommended trio rounds out your travel experience by making sure you’re covered for all your hotel needs.

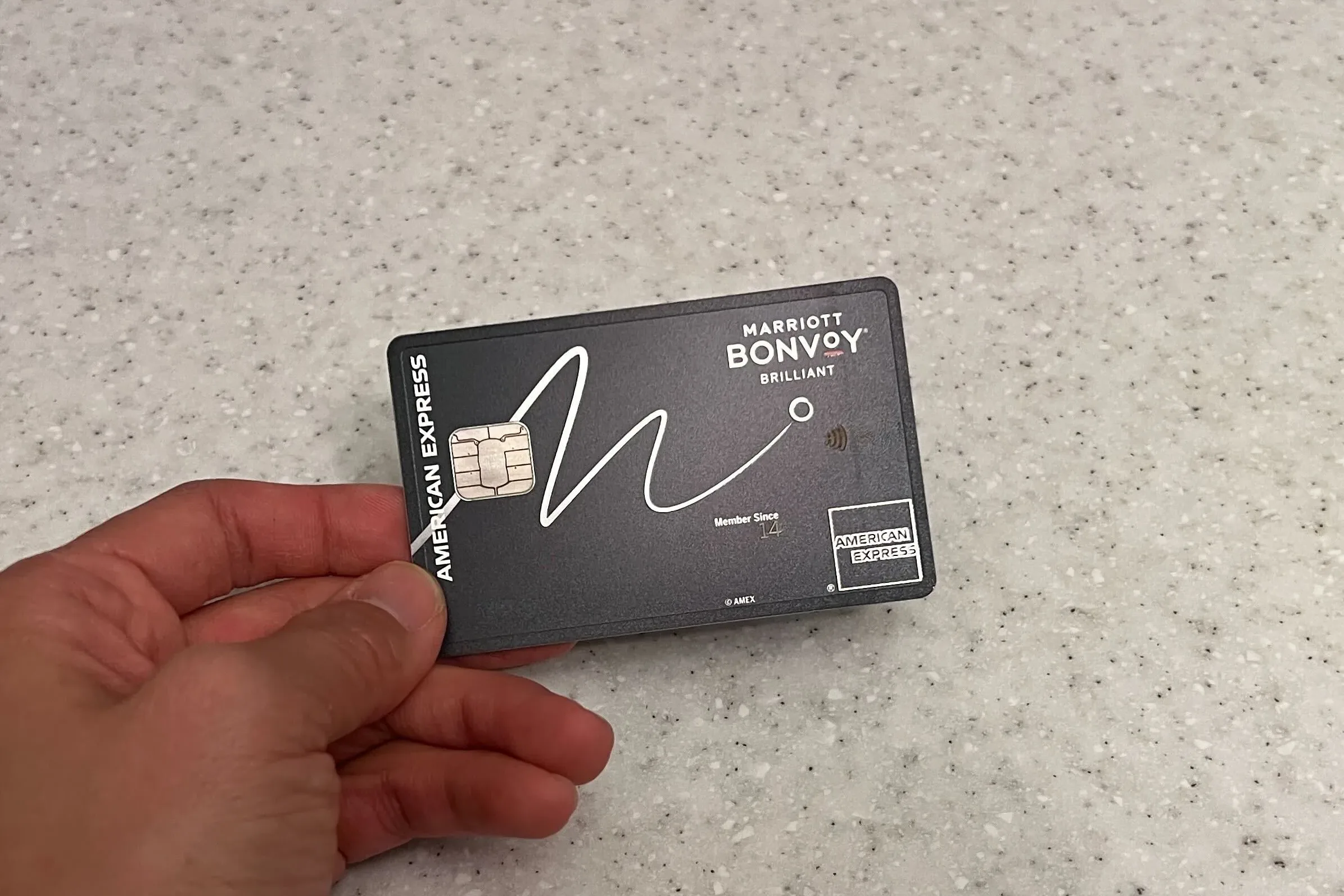

Marriott Bonvoy Brilliant® American Express® Card: The Hotel Loyalty Card

The Marriott Bonvoy Brilliant® American Express® Card rounds off our list of the three best cards to have when you’re trying to elevate your travel experience and your Miles & Points game.

This card does come with a relatively high annual fee of $650; (see rates and fees)† however, the attached hotel benefits more than justify this high cost.

To start, by simply being a cardholder of the Marriott Bonvoy Brilliant® American Express® Card, you’ll receive Marriott Bonvoy Platinum Elite Status.†

This is an incredibly valuable perk as Marriott Bonvoy Platinum Elite status comes with executive lounge access, free breakfast for two, suite upgrades, and more.

To earn this status organically, you would normally have to earn 50 elite qualifying nights within the year, so having the status provided for doing nothing more than holding the card is pretty fantastic.

The free breakfasts alone could be worth hundreds if not thousands of dollars each year depending on how often you travel.

Another notable perk of the Marriott Bonvoy Brilliant® American Express® Card is that each year you also receive a Free Night Award worth 85,000 points.†

This is the most valuable Free Night Award you can earn with Marriott Bonvoy, and it can be redeemed for a night in some of Marriott’s best hotels worldwide.

Although the Marriott Bonvoy Platinum Elite status and the Free Night Award can easily make up for the annual fee, the Marriott Bonvoy Brilliant® American Express® Card actually comes with even more benefits.

You’ll enjoy an annual $300 dining statement credit (up to $25 monthly), 25 elite night credits that go towards you earning Lifetime Platinum Elite status, Priority Pass membership for airport lounge access, and Hertz President’s Circle Status.†

With the card, you’ll also earn Marriott Bonvoy points on your everyday expenses at the following rates:

- Earn 6 Bonvoy points per dollar spent at Marriott hotels‡

- Earn 3 Bonvoy points per dollar spent at restaurants worldwide and on flights booked directly with airlines‡

- Earn 2 Bonvoy points per dollar spent on all other eligible purchases‡

For frequent Marriott travelers, this card offers significant value. The combination of the card’s welcome bonus and the high earning rate on spending at Marriott hotels easily sets you up with enough points for several nights at luxury hotels.

Conclusion

The American Express® Gold Card, Capital One Venture X Rewards Card, and Marriott Bonvoy Brilliant® American Express® Card complement each other perfectly.

The American Express® Gold Card excels in earning points on everyday purchases, while the Capital One Venture X Rewards Card provides unbeatable travel perks, and the Marriott Bonvoy Brilliant® American Express® Card offers luxurious hotel benefits.

With just these three cards, you’ll earn enough points each year for free trips without the hassle of negotiating a vast multitude of different credit cards and welcome bonuses.

†Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.