New Aeroplan: A Closer Look at Dynamic and Preferred Pricing

One of the heavily advertised core features of Air Canada’s new Aeroplan is the Preferred Pricing benefit on Air Canada flights.

Under the new dynamic pricing model for Air Canada flights, Aeroplan award redemptions will be integrated much more closely with Air Canada revenue flights. Members who show engagement with the program via Aeroplan Elite Status or holding a co-branded credit card are meant to be rewarded with discounted redemptions compared to regular members with no status and no credit card.

It’s a creative idea in theory, but the question we’re all wondering is: just how much of an effect does Preferred Pricing have? How exactly does the Aeroplan points pricing vary based on which status level and credit card you hold?

In this post, we’ll set out to answer this question by putting together a volume of search results that we’ve collected here at Prince of Travel and seeing if we can find any patterns.

In This Post

- A Comparison by Route, Date, and Elite Status & Credit Card

- 1. Toronto (YYZ) – Montreal (YUL)

- 2. Toronto (YYZ) – Vancouver (YVR)

- 3. Toronto (YYZ) – Punta Cana (PUJ)

- 4. Vancouver (YVR) – Tokyo (TYO)

- 5. Montreal (YUL) – Paris (CDG)

- 6. Calgary (YYC) – London (LHR)

- 7. Toronto (YYZ) – Hong Kong (HKG)

- 8. Toronto (YYZ) – São Paulo (GRU)

- 9. Vancouver (YVR) – Sydney (SYD)

- So, How Does the Preferred Pricing Work?

- Conclusion

A Comparison by Route, Date, and Elite Status & Credit Card

Members of the Prince of Travel Club Lounge chipped in to work on this project together.

Across all the contributors so far, we’ve used Aeroplan accounts with the following combinations of status level and credit card ownership:

- No status + No credit card

- No status + Core credit card

- Aeroplan 25K + No credit card

- Aeroplan 25K + Core credit card (e.g., TD Aeroplan Visa Infinite)

- Aeroplan 25K + Premium credit card (e.g., American Express Aeroplan Reserve Card)

- Aeroplan 50K + No credit card

- Aeroplan 50K + Core credit card

- Aeroplan Super Elite + Premium credit card (i.e., in theory the most powerful combination)

Using each one of our accounts, we searched for a range of different Air Canada routes to various parts of the world, each on four separate dates throughout the calendar: the 21st of December, March, June, and September.

The idea was to glean insights into both the nature of both the Preferred Pricing benefit across different accounts, as well as the nature of Air Canada’s dynamic pricing throughout the calendar.

The data is presented below, one route at a time, with some analysis of the pricing to follow each route, and more discussion of the overall patterns at the end of the article.

Note the following criteria that were used when searching:

- Only direct Air Canada flights on the route were examined; if a direct flight wasn’t available on the specified date, then the cell is left blank.

- If there were multiple direct Air Canada flights on a given date (such as Toronto–Vancouver), then the cheapest available option was chosen.

1. Toronto (YYZ) – Montreal (YUL)

According to the published ranges on the Flight Reward Chart, Toronto–Montreal should cost the following most of the time:

- 6,000–10,000 Aeroplan points in economy class

- 10,000–20,000 Aeroplan points in premium economy

- 15,000–25,000 Aeroplan points in business class

However, we can see from the searches that the vast majority of results (even for a user with no status and no credit card) falls below the published range at the moment.

Indeed, that’s reflective of a larger trend we’ve observed in the search engine, wherein a far higher than expected percentage of dynamic search results are pricing below the published range. The consensus seems to be that this may be reflective of low demand across the board due to the current pandemic, and that these prices are expected to rise over time.

2. Toronto (YYZ) – Vancouver (YVR)

December 21, | March 21, | June 21, | September 21, | |

No status | 15.7K | 17.6K | 17.6K | 17.6K |

No status | 12.6K | 13.9K | 13.3K | 13.3K |

Aeroplan 25K | 12.6K | 13.9K | 13.3K | 13.3K |

Aeroplan 25K | 12.3K | 13.7K | 13K | 13K |

Aeroplan 25K | 12.3K | 13.7K | 13K | 13K |

Aeroplan 50K | 12.1K | 13.4K | 12.8K | 12.8K |

Aeroplan 50K | 12.1K | 13.4K | 12.8K | 12.8K |

Aeroplan SE | 12.1K | 13.4K | 12.8K | 12.8K |

According to the published ranges on the Flight Reward Chart, Toronto–Vancouver should cost the following most of the time:

- 12,500–17,500 Aeroplan points in economy class

- 20,000–35,000 Aeroplan points in premium economy

- 25,000–60,000 Aeroplan points in business class

On this transcontinental journey, the actual search results tend to fall pretty accurately within the published ranges. This perhaps reflects the fact that Toronto–Vancouver is probably one of the most popular routes within the Air Canada network at this time, when the vast majority of Canadians who are travelling are doing so domestically.

It’s worth noting that the December 21 prices shown mostly reflect only one or two of about 10 daily flights – the remaining flights are all priced much higher, due to the peak demand on this date.

Note that there were some notable anomalies when searching Toronto–Vancouver: often times, only a subset of the 10 daily flights would show up in the search results.

It would often require refreshing the page for all 10 direct flights (including the one or two lowest-priced ones) to actually show up.

It’s perhaps a case of the dynamic pricing model being too dynamic. As the new system first launches, there will surely still be kinks that need to be ironed out, so perhaps try running your searches a few different times if you don’t see the results you want at first.

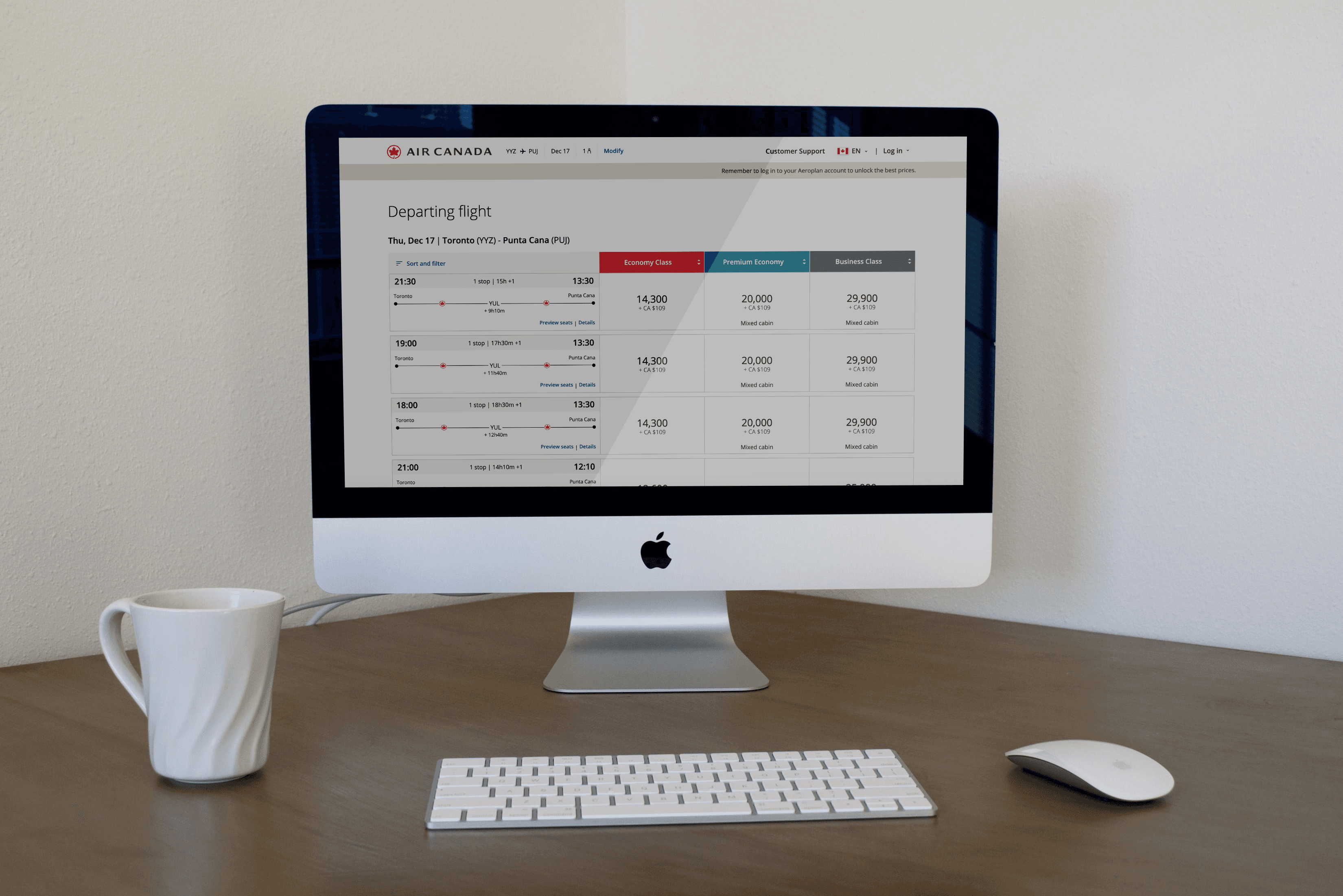

3. Toronto (YYZ) – Punta Cana (PUJ)

According to the published ranges on the Flight Reward Chart, Toronto–Punta Cana should cost the following most of the time:

- 12,500–17,500 Aeroplan points in economy class

- 20,000–35,000 Aeroplan points in premium economy

- 25,000–60,000 Aeroplan points in business class

Here, we’re seeing prices fall relatively squarely at the lower bound of the published range. Note that the Punta Cana route is served by a mainline aircraft in December and March, but an economy-only Air Canada Rouge A321 in June and September.

4. Vancouver (YVR) – Tokyo (TYO)

December 21, | March 21, | June 21, | September 21, | |

No status | 38.5K | 50.6K | 30.8K | 30.4K |

No status | 32.9K | 38K | 28.3K | 27.9K |

Aeroplan 25K | 32.9K | 38K | 28.3K | 27.9K |

Aeroplan 25K | 32.7K | 37.8K | 28K | 27.7K |

Aeroplan 25K | 32.7K | 37.8K | 28K | 27.7K |

Aeroplan 50K | 32.4K | 37.5K | 27.8K | 27.4K |

Aeroplan 50K | 32.4K | 37.5K | 27.8K | 27.4K |

Aeroplan SE | 32.4K | 37.5K | 27.8K | 27.4K |

According to the published ranges on the Flight Reward Chart, Vancouver–Tokyo should cost the following most of the time:

- 35,000–65,000 Aeroplan points in economy class

- 45,000–120,000 Aeroplan points in premium economy

- 55,000–150,000 Aeroplan points in business class

On this route, the broad pattern continues to fall either at the lower bound of the published range or even lower than that, but with a few major spikes throughout the schedule.

The spike in December isn’t surprising due to the peak travel season, but the spike in September is pretty surprising to me. Moreover, the discounts given to a status member during these spikes – even if it’s a “lowly” Aeroplan 25K member – are very significant.

5. Montreal (YUL) – Paris (CDG)

According to the published ranges on the Flight Reward Chart, Montreal–Paris should cost the following most of the time:

- 35,000–65,000 Aeroplan points in economy class

- 45,000–120,000 Aeroplan points in premium economy

- 55,000–150,000 Aeroplan points in business class

A broad pattern that we’ve observed since the launch is that North America–Europe flights are largely pricing below their published ranges, and that’s the case here as well, even for a no-status, no-card member.

6. Calgary (YYC) – London (LHR)

December 21, | March 21, | June 21, | September 21, | |

No status | - | 32.2K | 36K | 33K |

No status | - | 29.3K | 32.3K | 30K |

Aeroplan 25K | - | 29.3K | 32.3K | 30K |

Aeroplan 25K | - | 29K | 32.1K | 29.7K |

Aeroplan 25K | - | 29K | 32.1K | 29.7K |

Aeroplan 50K | - | 28.8K | 31.8K | 29.5K |

Aeroplan 50K | - | 28.8K | 31.8K | 29.5K |

Aeroplan SE | - | 28.8K | 31.8K | 29.5K |

According to the published ranges on the Flight Reward Chart, Calgary–London should cost the following most of the time:

- 40,000–70,000 Aeroplan points in economy class

- 60,000–90,000 Aeroplan points in premium economy

- 70,000–180,000 Aeroplan points in business class

As above, the default prices are coming in below the published ranges for now – with the exception of the premium economy cabin on this route, which seems to be suffering from the well-documented anomaly of consistently pricing higher than business class.

Having status or a credit card helps lower this amount, but it’ll still be more expensive than business class, so a lie-flat pod seems to be the way to go on this route.

7. Toronto (YYZ) – Hong Kong (HKG)

According to the published ranges on the Flight Reward Chart, Toronto–Hong Kong should cost the following most of the time:

- 50,000–90,000 Aeroplan points in economy class

- 70,000–160,000 Aeroplan points in premium economy

- 85,000–200,000 Aeroplan points in business class

Just like before, perhaps due to the depressed demand across the board at the moment, prices are showing up lower than what the published ranges would suggest. The prices on this route also show a pretty clear pattern in terms of the benefit of Preferred Pricing, which we’ll summarize in full below.

8. Toronto (YYZ) – São Paulo (GRU)

December 21, | March 21, | June 21, | September 21, | |

No status | - | 34.7K | 36.4K | 38.7K |

No status | - | 31.9K | 33.5K | 35.4K |

Aeroplan 25K | - | 31.9K | 33.5K | 35.4K |

Aeroplan 25K | - | 31.7K | 33.2K | 35.2K |

Aeroplan 25K | - | 31.7K | 33.2K | 35.2K |

Aeroplan 50K | - | 31.4K | 33K | 34.9K |

Aeroplan 50K | - | 31.4K | 33K | 34.9K |

Aeroplan SE | - | 31.4K | 33K | 34.9K |

According to the published ranges on the Flight Reward Chart, Toronto–São Paulo should cost the following most of the time:

- 40,000–70,000 Aeroplan points in economy class

- 55,000–150,000 Aeroplan points in premium economy

- 60,000–200,000 Aeroplan points in business class

In this case, the baseline pricing appears to be lower than the published ranges, but there are a few spikes in the premium economy pricing on March 21, as well as the business class pricing in both March and June.

As you can see, whenever the dynamic model throws up significant spikes, then having Elite Status and/or a credit card helps to soften the blow by a significant amount.

9. Vancouver (YVR) – Sydney (SYD)

According to the published ranges on the Flight Reward Chart, Vancouver–Sydney should cost the following most of the time:

- 50,000–90,000 Aeroplan points in economy class

- 70,000–160,000 Aeroplan points in premium economy

- 85,000–200,000 Aeroplan points in business class

As you can see, the Vancouver–Sydney route is currently a major anomaly in several ways.

The new Aeroplan is supposed to be able to book every last seat on Air Canada flights, so it’s a mystery why there are no results showing up in economy class on this route during June and September.

Furthermore, the price for premium economy and business class are appearing far above the published ranges on a consistent basis throughout the schedule.

This does not line up with our initial expectation: while we knew that some routes would trend towards the higher end of the published ranges, the occasions that prices exceeded the published range were meant to be limited to only the most popular peak dates, not consistently throughout the schedule.

It’s worth noting that there are a very limited number of dates at the very end of the schedule, where two awards per day show up at more reasonable prices:

This may align with the reality under the old program that the award seats on Vancouver–Sydney were very hotly contested, and would be booked up very quickly as soon as they were released at the end of the schedule.

However, that doesn’t explain or excuse the fact that the rest of the flights throughout the year are pricing far higher than the published ranges, rather than merely at the top end of the published ranges.

So, How Does the Preferred Pricing Work?

Looking at the tables, we can arrive at the following preliminary conclusions about how Preferred Pricing works at the moment.

- The greatest “jump” in pricing occurs between a regular “no status + no credit card” Aeroplan member and a member who shows even a minimal level of engagement with either Aeroplan 25K status or an entry-level or core credit card.

- Anecdotal data points indicate that even a “no status + entry-level credit card” member will still benefit from the jump in pricing compared to a “no status + no credit card” member.

- In the majority of cases, this discount is pretty consistently around 8–15% of the original price that regular members see. Some exceptions include:

- When a flight is dynamically priced higher than the published range, the base-level discount can be up to 40%, as in the case of Vancouver–Tokyo on September 21 or Toronto–São Paulo on March 21. Essentially, members who engage with the program seem to be rewarded here by being quasi-exempt from the elevated dynamic pricing for ordinary members.

- However, this does not hold true across the board: in the Vancouver–Sydney examples, the base-level discount is only around 8,000 points off a total of 583,200 points – a measly 1.4%. Having said that, the Vancouver–Sydney route seems to be pricing anomalously as a whole, so maybe we’ll wait and see if any kinks need to be ironed out here.

- Once you have either Elite Status or a co-branded credit card, the further discounts are less meaningful in terms of earning a higher level of Elite Status tiers or signing up for a higher-tier credit card.

- Members who have either Aeroplan 25K status or a core credit card see the same pricing.

- A member who has both Aeroplan 25K status and a core credit card (or a premium card) sees a further discount of about 200–300 Aeroplan points on each award.

- A member who has Aeroplan 50K status (regardless of what card they hold) sees another further discount of about 200–300 Aeroplan points on each award.

- That’s it. I was surprised to see that there was no difference between an Aeroplan 50K member with no credit card… and a Super Elite member with a premium credit card.

Essentially, as things stand, there are four separate tiers of award pricing:

- The regular pricing for members who have no status and no credit card, which is displayed to everyone if you aren’t logged in.

- The first discount tier of 8–15% (with some exceptions), available to members who engage with the program by earning Elite Status or holding a co-branded credit card.

- The second discount tier of a further 200–300 points, available to members who engage further with the program through both Elite Status and a co-branded credit card.

- The third discount tier of a further 200–300 points, available to members who engage further with the program primarily by earning Elite Status – after all, an Aeroplan 25K member with a premium credit card did not reach this tier, whereas an Aeroplan 50K member with no credit card did.

With this structure in place for Preferred Pricing, it’s clear that reaching the first discount tier will be the most meaningful step you can take to save points on your future Aeroplan redemptions.

If we go by the anecdotal evidence of a “no status + entry-level credit card” member unlocking this discount (Preferred Pricing is a published benefit on these cards, after all), then this means the no-annual-fee CIBC Aeroplan Visa Card could have a key role to play.

Just by holding this no-fee card in perpetuity and using it to bolster your credit history, you’ll continuously unlock a discount of 8–15% compared to the prices that regular Aeroplan members pay.

Beyond the first discount tier, the savings of up to 500 points on each award redemption really isn’t the most meaningful, and I personally think Aeroplan Super Elite members may even feel a little hard done by with being offered such a measly discount.

It’s nice to save up to 500 points on a redemption if you’re already a high-level elite member or if you were already going to get the premium credit cards, but I wouldn’t say the Preferred Pricing benefit is a reason to go out of your way to do either of these.

Remember that the patterns we’re seeing here are correct as of now, but can always change over time – that’s the nature of dynamic pricing, after all.

I’ll be keeping a close eye on the Preferred Pricing patterns and will let you know if it changes, and I certainly wouldn’t rule out Air Canada using this benefit to offer surprise discounts for members who hold certain status and credit card combinations on a whim.

Conclusion

The nature of the dynamic pricing model and the Preferred Pricing benefit was always a big mystery coming into the launch of the new Aeroplan program, so I hope that our efforts at data collection and analysis have been helpful in understanding how they work.

For the most part, the dynamic pricing model seems to be pricing Air Canada’s international flights below the published ranges on the Flight Reward Chart at the moment, most likely as a reflection of the depressed demand for global travel during the current pandemic.

There are also some exceptions, like Vancouver–Sydney, which seem to be priced consistently far above the published range, and may represent kinks that still need to be ironed out in the new system.

Meanwhile, the Preferred Pricing benefit seems to be stratified into four separate pricing tiers, with the greatest jump occurring between the “average Aeroplan member” and a member who engages with the program through either Elite Status or a credit card. That’ll be key to unlocking the greatest value on Air Canada flights in the new program going forward!

Have you played around with the new program extensively yourself? Do your search results correspond to the above findings, or are there further granularities that I’ve missed? Let me know in the comments below.

First-year value

$588

Annual fee: $139First Year Free

• Earn 10,000 points on first purchase

• Earn 15,000 points upon spending $3,000

• Earn 20,000 points on card anniversary upon spending $12,000 in the first 12 months

Earning rates

Key perks

- Free first checked bag for cardholder + up to 8 companions

- 1,000 SQC per $20,000 spend toward Aeroplan Elite Status (up to 25,000 SQC/year)

- $100 NEXUS rebate every 48 months

- 4th night free on Aeroplan hotel redemptions

- Troon Rewards Silver (10% off at 95+ golf courses)

- Avis Preferred Plus (1 car-class upgrade)

Annual fee: $139First Year Free

• Earn 10,000 points on first purchase

• Earn 15,000 points upon spending $3,000

• Earn 20,000 points on card anniversary upon spending $12,000 in the first 12 months

Earning rates

Key perks

- Free first checked bag for cardholder + up to 8 companions

- 1,000 SQC per $20,000 spend toward Aeroplan Elite Status (up to 25,000 SQC/year)

- $100 NEXUS rebate every 48 months

- 4th night free on Aeroplan hotel redemptions

- Troon Rewards Silver (10% off at 95+ golf courses)

- Avis Preferred Plus (1 car-class upgrade)