As we continue our Miles & Points for Beginners series, we look at what makes for a good deal when it comes time to redeem your points.

After all, choosing the right credit card and earning the points is actually the easiest part of the whole Miles & Points process.

When you’re ready to redeem your points, you may find that navigating and understanding the complex world of loyalty programs can be difficult, especially as a beginner.

For many people, it’s easy to get frustrated and give up at this stage, choosing to redeem your accumulated points for merchandise instead of travel because it’s simpler to understand.

However, if you invest some time in learning the ins and outs of loyalty programs, you’ll get significantly greater value from your points and incredible travel experiences to boot.

In This Post

- What’s a Good Deal?

- Calculating Value in Cents Per Point

- The Pros and Cons of Fixed Pricing and Dynamic Pricing

- What About Redeeming Points for Merchandise and Gift Cards?

- Conclusion

What’s a Good Deal?

Figuring out whether a flight redemption is a “good deal” or not can seem complicated, given the sheer number of different loyalty programs and points currencies out there.

The meaning of a “good deal” can also shift based on your personal needs and desires.

Some Miles & Points enthusiasts are very focused on experiencing specific airline cabins and indulging in luxury, and for these people, a good deal will only exist within this context.

However, for a large number of travellers, a good deal has a lot more to do with balancing value, availability, and convenience.

The average traveller may not be looking to get outsized value every time they redeem their points; instead, they may just be looking to save money on travel and be knowledgeable enough to make smart redemption choices.

After all, the best redemption is the one that you can actually make and enjoy. Unlike cash, miles and points don’t tend to appreciate over time, and in fact, they’re likely to be less valuable if you save them for years, rather than “earning and burning” more frequently.

One important (and frustrating) aspect of loyalty programs is that they often change, and usually for the worse.

If you’re saving all of your points for retirement, a redemption that might cost 50,000 points now could cost much more then.

You’re only ever guaranteed to get the same value out of your points as what’s available today, and that’s why we encourage you to set a goal, earn the points needed to reach that goal, and then enjoy the experience.

With this in mind, we’ll explore a few different ways to determine whether or not you’re getting a good deal with your miles and points.

Calculating Value in Cents Per Point

You may notice that many people in the Miles & Points community often refer to “cents per point” when they talk about value.

Using this metric, two key factors in sorting out whether you’re getting good value for your miles and points on a particular redemption are the cash cost of the flight and the subjective valuation of the points currency you intend to use.

Basically, a redemption is considered a good deal if the total valuation of the cost in points is less than the total cash fare value (don’t worry, we’ll show this equation in practice below).

Prince of Travel provides regularly updated valuations of points currencies on our website, so you can explore approximately how much each of your points is worth using our values.

Of course, you may value points higher or lower than this – these are meant to be used as a guideline.

To illustrate how to use points valuations to determine a good deal using cents per point, let’s look at a couple examples.

Let’s assume you’re hoping to book a flight with your accumulated Aeroplan points, and you’d like to make sure you’re getting an okay deal versus paying cash.

You’ve looked up our value assessment for Aeroplan points, so you know that we value Aeroplan points at around 2.1 cents (CAD) each.

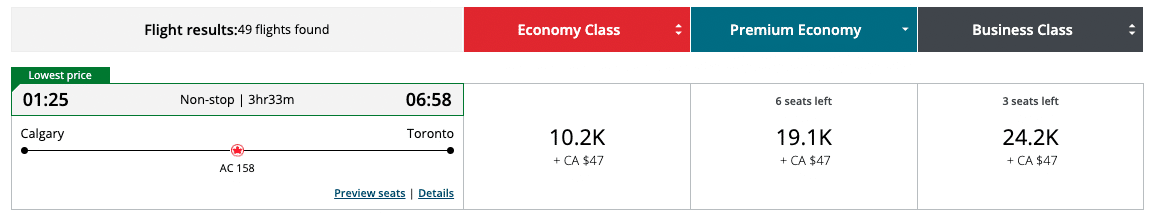

Using the Aeroplan portal, you search for a flight from Calgary to Toronto and bring up the following results:

- Economy (Standard): 10,200 points + $47 (taxes and fees)

- Premium Economy (Lowest): 19,100 points + $47 (taxes and fees)

- Business Class (Lowest): 24,200 points + $47 (taxes and fees)

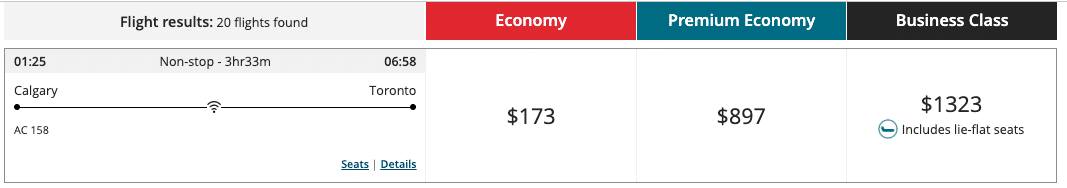

Then, you look up the cash prices for the same flights, which are as follows:

- Economy (Standard): $173

- Premium Economy (Lowest): $897

- Business Class (Lowest): $1,323

In each of the three classes, we can estimate the value of the redemption in cents per point, using the following equation:

((cash price in cents) − (taxes and fees on award booking in cents)) / (flight cost in points)

In practice, the equation for the Economy (Standard) fare looks like this:

(17,300 − 4,700) / 10,200 = 1.24

So, with the above flight examples, we’d wind up with the following estimations of value for each class of service:

- Economy (Standard): 1.24 cents per point

- Premium Economy (Lowest): 4.45 cents per point

- Business Class (Lowest): 5.27 cents per point

From this, we see that an economy booking comes in below our target valuation, while premium economy and business class both come in well above.

Here, you might opt to pay cash for the low economy fare and save your points for a higher-value redemption, or you might choose to redeem your points for a higher class of service, satisfied that you’re getting a great deal.

It’s important to always take into account the taxes and fees on your award redemption, since it can eat into the value you can get from your points.

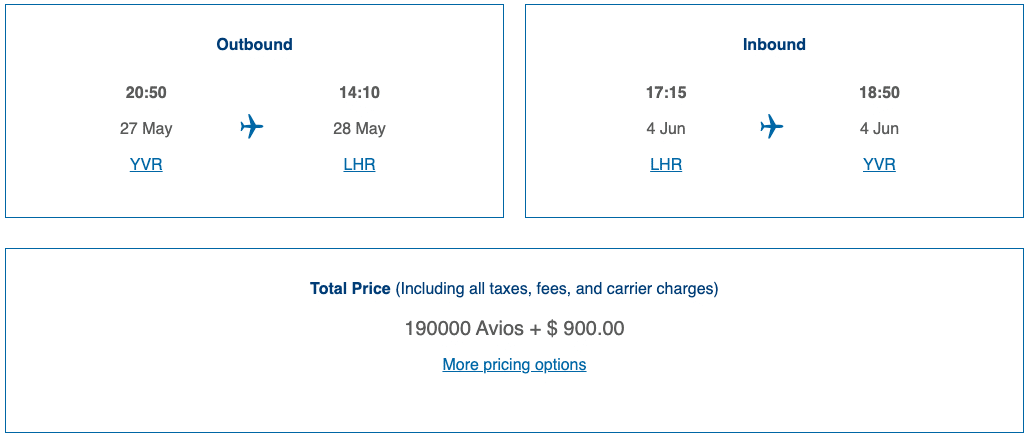

For example, let’s look at the cost breakdown of round-trip flights between Vancouver and London, booked with British Airways Avios:

- Economy: 65,000 Avios + $300 (taxes and fees)

- Premium economy: 115,000 Avios + $600 (taxes and fees)

- Business class: 190,000 + $900 (taxes and fees)

(Note that the amount of taxes and fees you pay increases as you travel in a higher class of service.)

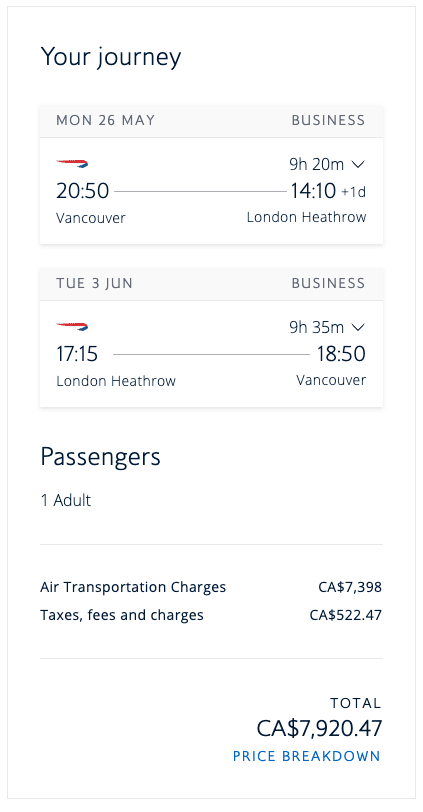

And here are the prices of the same flights booked with cash:

- Economy: $1,258.77

- Premium economy: $2,510.47

- Business class: $7,920.47

Once we crunch the numbers, we wind up with the following values:

- Economy: 1.48 cents per Avios

- Premium economy: 1.66 cents per Avios

- Business class: 3.69 cents per Avios

We value British Airways Avios at 2 cents per Avios (CAD), so using this metric, we see that both economy and premium economy come in below, while business class comes in at nearly twice the value.

However, the number of points required for a business class redemption is nearly triple the amount needed for economy.

Therefore, while you may not be thrilled with the dollar value for your Avios if you book economy, you may be happy to choose this option to pay less out of pocket, and to ration your points to enjoy nearly three trips instead of just one.

As you can see from the above examples, economy flights can often be a decent deal; however, you do want to always compare the value in points to the cash fare value since specific routes, travel seasons, and dynamic pricing can make it so that cash fares are sometimes the better option.

For travellers seeking a more luxurious experience, business class and First Class redemptions are where you’ll find the particularly great deals, in terms of getting outsized value for your points.

Calculating the value of a redemption isn’t the only way to determine whether or not a flight is a good deal. If you’re looking for an easier way, you’ll just need to understand the differences between fixed pricing and dynamic pricing systems.

The Pros and Cons of Fixed Pricing and Dynamic Pricing

Once you earn enough points and you’re ready to start looking up award flights, you may be shocked to see just how many points are required for certain flights.

To understand why some short-haul flights in economy might cost more than a business class flight to Europe, and to help you use your points wisely, you need to understand the differences between fixed pricing and dynamic pricing.

For the most part, airline loyalty programs price redemption flights using fixed pricing systems, dynamic pricing systems, or a combination of the two.

Fixed Pricing

Fixed pricing is when an airline loyalty program keeps the cost the same for all available award flights regardless of market demand or the date flown.

With fixed pricing programs, there’s a limited amount of seats that are available to be booked with points. Once they’re booked, you won’t be able to book a spot on the flight unless the program releases more award seats, which is never guaranteed.

Some programs have a single level of fixed pricing, such as Avianca LifeMiles, while other programs have multiple levels of fixed pricing, such as Singapore Airlines Krisflyer with Saver awards and Advantage awards.

With programs that use fixed pricing, you’ll know you’re likely getting a great deal if you can find award availability at the lowest fixed rate. This is often referred to as “Saver” pricing on Miles & Points websites.

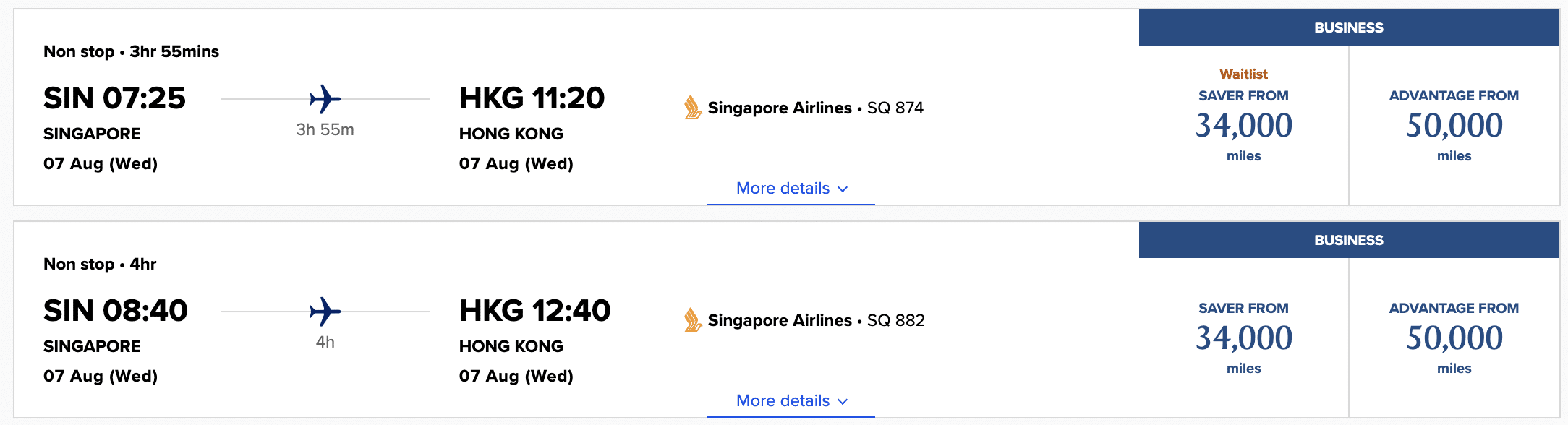

Using Singapore Airlines KrisFlyer as an example, we can look at its two different levels of fixed pricing, Saver and Advantage.

Saver pricing is lower than Advantage pricing, but there are more award seats available at the Advantage pricing level than there are at the Saver pricing level. Advantage fares also have more inclusions than Saver fares.

Under this fixed pricing structure, a one-way flight in business class on Singapore Airlines from Singapore to Hong Kong costs 34,000 KrisFlyer miles at the Saver level or 50,000 KrisFlyer miles at the Advantage level.

Naturally, looking at these prices, you’ll be getting a better deal with the Saver award since it costs less than the Advantage award; however, Saver awards tend to get booked up, so you’ll often be subject to the Advantage award pricing (or looking elsewhere for another redemption option).

Airlines that have a fixed pricing loyalty program will usually publish award charts that show you how many points you’ll need for a redemption. Often, there will be multiple charts that provide prices for travel between various regions of the world or for different distances flown.

With fixed pricing programs, as long as there is award availability, you can expect prices to be consistent. You’ll know you’re getting a good deal if you can find award availability in the first place, or at the “Saver” level if there are multiple tiers.

Dynamic Pricing

While fixed pricing programs provide consistent and predictable award prices, with a dynamic pricing structure, award prices can fluctuate drastically.

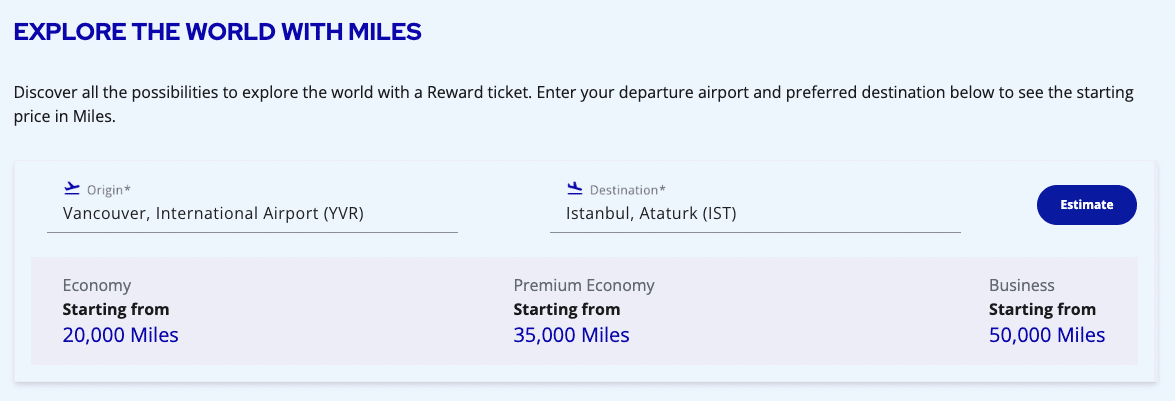

Typically, award programs with dynamic pricing will use “starting at” prices, or show a range of prices that you might expect to pay. You’ll also find that these programs don’t publish award charts, but they’ll often have a calculator that you can use to estimate the lowest cost for a booking.

With dynamic pricing, you’ll know you’re getting a good deal if you find awards at the lower end of the range of prices, or if you can find them at the “starting at” prices.

A major benefit of airline programs that use dynamic pricing is that you can book any seat on a plane with miles and points. With this structure, you don’t have to worry about searching in vain or waiting for an award seat to show up at a later date; rather, as long as you can purchase the seat with cash, you can also book it with points.

For example, Air France KLM Flying Blue has the following “starting at” prices for flights between North America and Europe:

- Economy: 20,000 miles

- Premium economy: 35,000 miles

- Business class: 50,000 miles

Based on this, if you can find a business class seat for 50,000 miles, you’ll know that it doesn’t get any better than that, and it’s going to be a great deal.

However, you may also find that on a different date, that same flight costs two, three, or four times as much as it “should” given the “starting at” prices.

If you encounter a cost that’s much higher than the “starting at” price, consider looking at different dates for better prices, or consider looking at different loyalty programs altogether.

(Again, this is where the importance of having flexible points comes into play, since you aren’t shoehorned into a single program).

Hybrid Programs

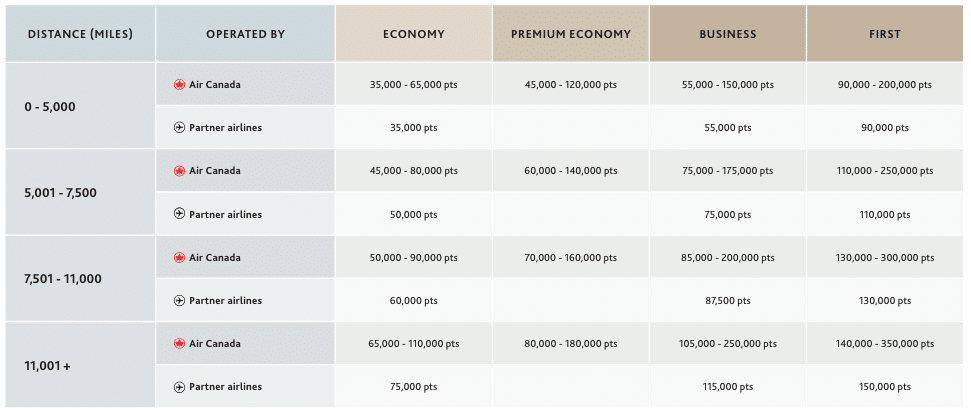

Some airlines use a hybrid model of both fixed pricing and dynamic pricing. Some examples of these include Air Canada Aeroplan and American Airlines AAdvantage.

With Aeroplan, you’ll find dynamic pricing for Air Canada flights and fixed pricing for flights with partner airlines.

In the Aeroplan Flight Reward Chart, you’ll see a range of prices that you can expect to find for Air Canada flights on one line, and on a different line, you’ll see a fixed number of points that you can expect to pay for flights with partner airlines.

With Aeroplan, you’ll know you’re getting a great deal if you can find award flights at the fixed partner rate or at the lower end of the dynamic range for Air Canada flights.

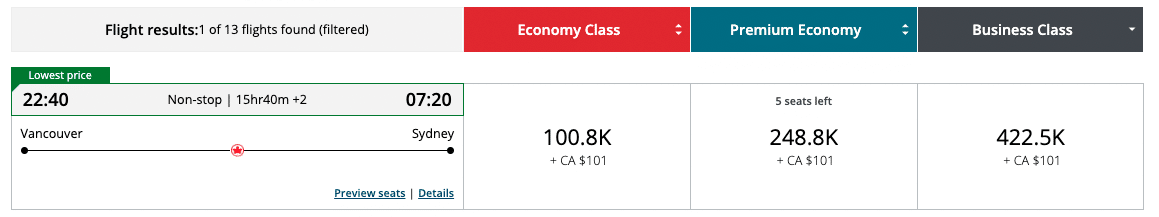

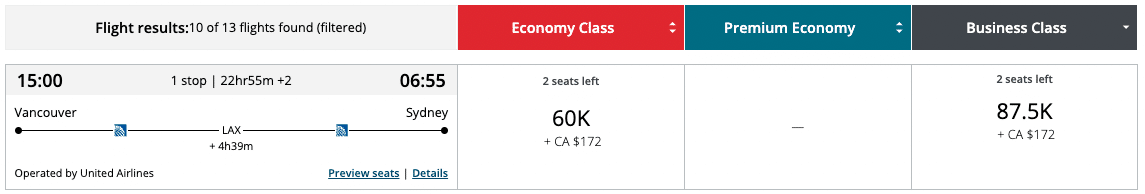

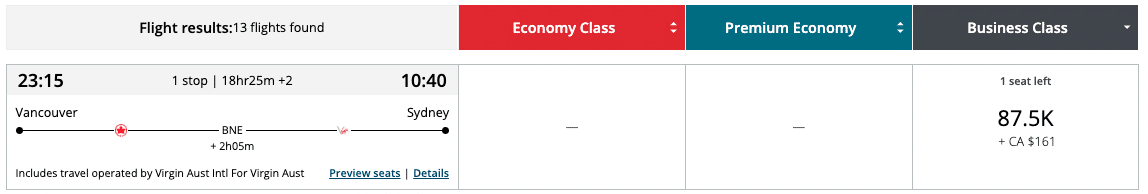

As an example, let’s say you want to fly to Australia from Vancouver using Aeroplan points.

In your search for an award flight, you find that the cost to fly Air Canada business class direct from Vancouver to Sydney is very high (or even pricing well above the upper end of the dynamic range)…

However, you also find that there is a fixed price option available if you were to willing to fly via Los Angeles with United Airlines (an Air Canada partner airline) instead…

And you may even find the same price with Air Canada if you fly to Brisbane and then connect on Virgin Australia (an Aeroplan partner) to Sydney…

So, by understanding what a good deal is and by being a bit flexible, you’d wind up at your destination having paid a fixed price that is significantly less than the price you may have paid for the dynamically priced non-stop flight with Air Canada.

Pros and Cons

As always, there are pros and cons to both the fixed pricing and dynamic pricing models.

With fixed pricing, you know what the price of the flight should be before you even start your search. This can simplify your points earning strategy, as you know exactly how many points you need to earn.

However, with fixed pricing you may run into problems around being able to actually find award availability in the first place.

A business class flight to Europe for 50,000 points sounds great on paper, but if there is no award availability at all, then it doesn’t matter how good of a deal it is.

With the dynamic pricing model, you might not know what the price will be when you go to search for your award flight, but you do know that there will always be a seat available to book with points (unless the flight is completely sold out).

The downside here is that the cost might be significantly more than a similar flight with a fixed price.

What About Redeeming Points for Merchandise and Gift Cards?

Depending on the type of points you have, you may also have the option to redeem them for other things, like car rentals, hotel stays, gift cards, merchandise, and more.

While having more options for using your points is always ideal, it’s important to note that you’ll often get much lower value by redeeming your points for anything other than travel.

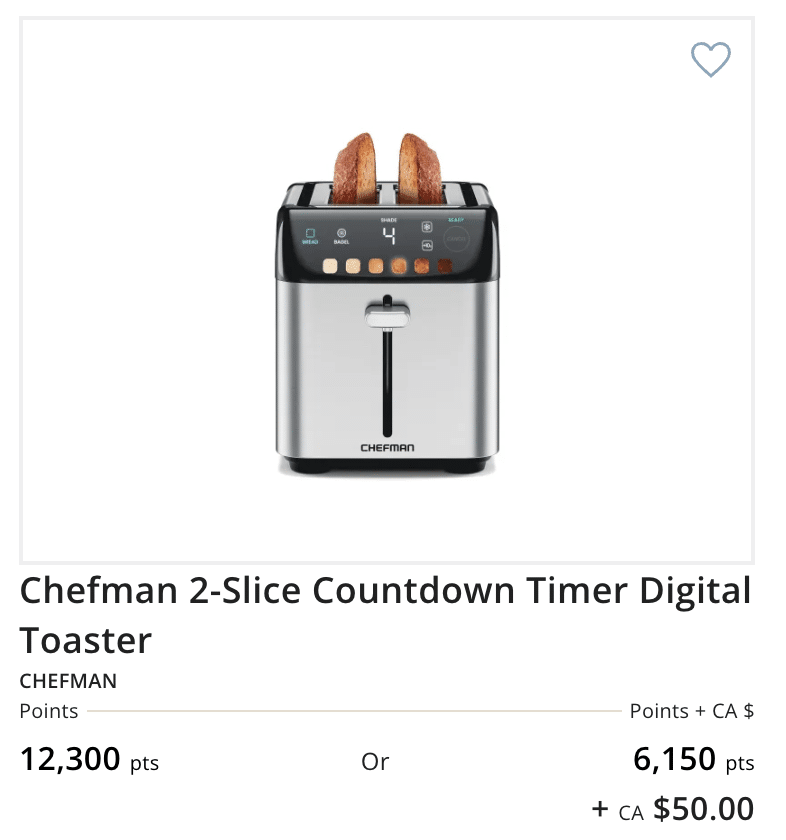

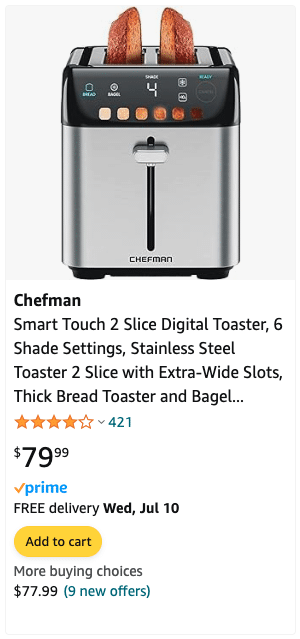

For example, you might see an option to redeem 12,300 Aeroplan points for a toaster. You also have the option of redeeming 6,150 points and paying $50 out of pocket.

A quick search online shows the same toaster available for $80.

Redeeming your points this way would result in a value of 0.65 cents per point ($80 / 12,300 points) with the first option and 0.48 cents per point ($80 − $50 / 6,250 points) for the second option, both of which are far below the value available when using the same points for flights (as shown in the earlier examples).

No matter how you choose to redeem your points, it’s worth considering the many options at your disposal, especially if you’d like to make the most of what you’ve earned.

Prior to redeeming your points for merchandise or gift cards, just be sure to think about the value you can get from your miles and points by using them for travel instead.

Conclusion

Navigating the world of Miles & Points can be overwhelming, but with the right knowledge and strategy, you can unlock incredible value and unforgettable travel experiences.

While the definition of a good deal ultimately comes down to your personal opinions and priorities, by building up your knowledge, you’ll be in a better position to evaluate what constitutes a good deal on your own terms.

Next up, we’ll explore how to leverage sweet spots when making a dream redemption.