In this edition of Head-To-Head, we have a heavyweight cross-border showdown between two American Express behemoths: the Canadian-issued American Express Platinum Card vs the US-issued American Express Platinum Card.

These two cards have long been major players when it comes to premium travel credit cards on both sides of the border. Both offer best-in-class travel perks, complimentary hotel status, and powerful boosts to your Membership Rewards coffers.

While holding onto both Platinum Cards can unlock a world of rewards, the hefty annual fees may warrant only keeping one. Let’s pit these two gladiators against each other and see which one emerges as victorious.

Card Basics

1. Welcome Bonus

First and foremost, let’s compare the welcome bonuses, which is always one of the most compelling factors when deciding between two cards.

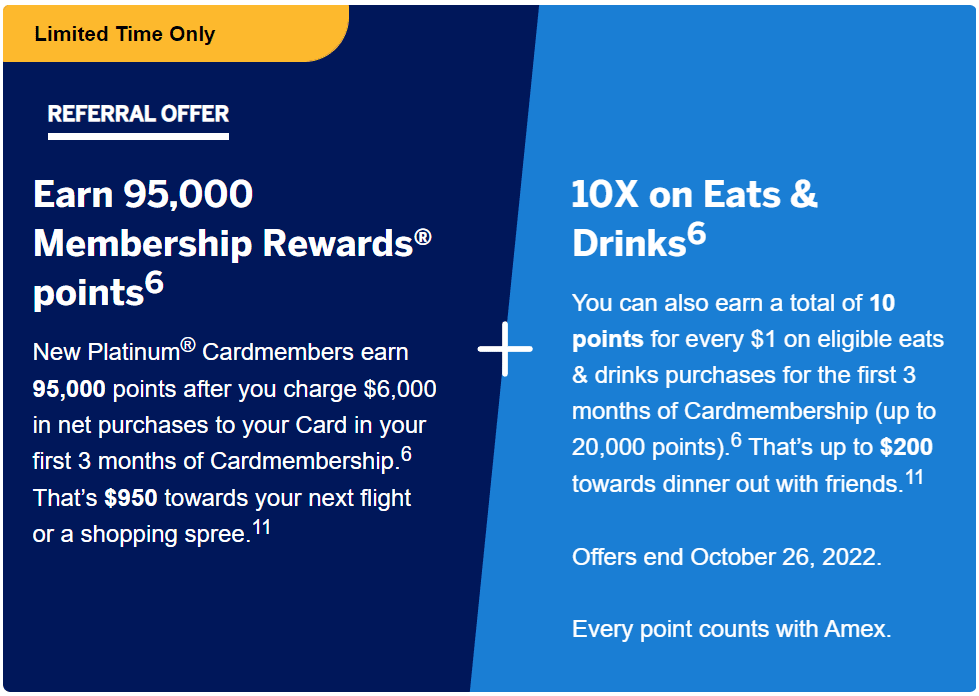

The Canadian-issued Amex Platinum Card currently offers 115,000 Membership Rewards (MR) points, broken down as follows:

- 95,000 MR points upon spending $6,000 in the first three months

- 10x MR points on up to $2,000 of food and drink purchases in the first three months, up to a maximum of 20,000 MR points

Meanwhile, the base offer for the US-issued Amex Platinum Card is 100,000 US MR points upon spending US$6,000 in the first six months.

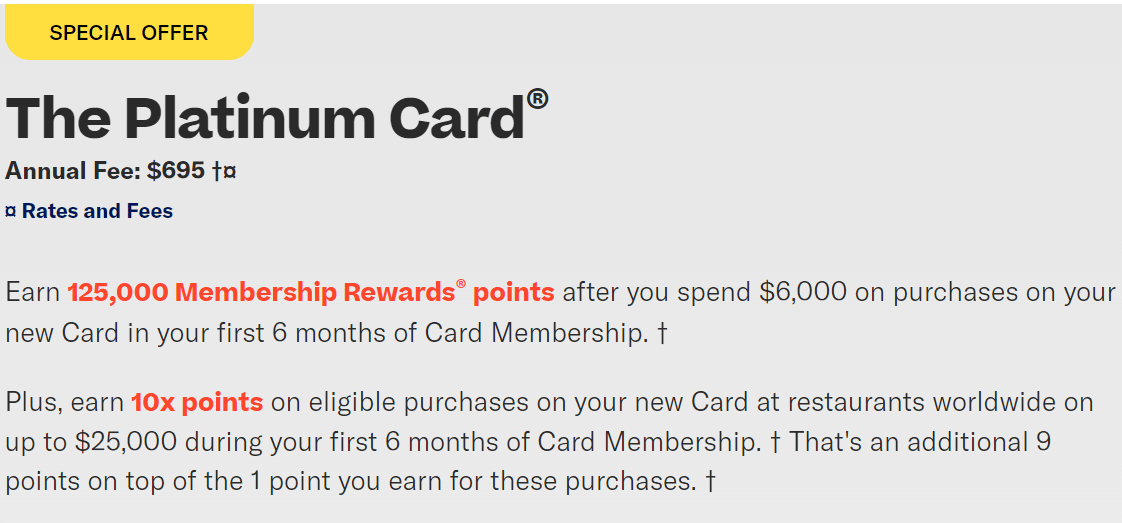

However, the US Platinum Card also has an even higher value welcome offer via Resy, the restaurant booking platform owned by American Express.

Taking a look at the current welcome offer with Resy, you’ll earn 125,000 US MR points upon spending $6,000 (USD) in the first six months, as well as 10x US MR points on up to $25,000 (USD) spent at restaurants worldwide in the first six months.

This is a truly incredible welcome offer, especially if you’re a big spender at restaurants or small businesses. Indeed, the earning potential with the 10x multiplier for purchases up to $25,000 is vastly superior to the $2,000 cap with the Canadian card.

Looking at historical records, the welcome offer of the Canadian-issued card ranges between 60,000–100,000 points, reaching a singular high of 150,000 points last summer.

On the other hand, the US-issued card tends to be more generous, with an average base welcome offer of 75,000–100,000 points, often reaching 150,000 points or more with extra multipliers.

Verdict: The US-issued Amex Platinum Card takes the lead with a superior welcome offer both currently and historically.

The gap widens even further if you can maximize the incredible 10x points on dining as part of the US Platinum Card’s Resy welcome bonus.

2. Points Currencies

We value US-issued Amex MR points at 1.8 cents per point (USD) and 2.3 cents per point (CAD), while we value Canadian-issued Amex MR points slightly lower at 2.2 cents per point (CAD).

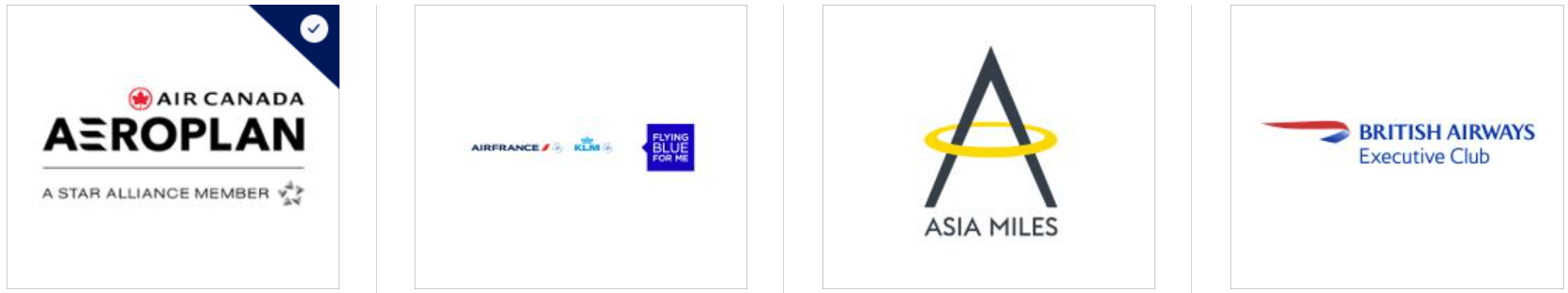

When it comes to transfer partners, Canadian MR points can be transferred at a 1:1 ratio to Aeroplan, British Airways Avios, and Hilton Honors, as well as Marriott Bonvoy at a 1:1.2 ratio.

Meanwhile, points can also be transferred to Cathay Pacific Asia Miles, Air France/KLM Flying Blue, Etihad Guest, and Delta SkyMiles at a ratio of 1:0.75.

Meanwhile, US MR points have a much wider range of transfer partners, including 17 eligible partner airlines, and almost all are at a 1:1 ratio.

In addition to the same transfer partners of Canadian MR points, other notable programs include Virgin Atlantic Flying Club, Emirates Skywards, Singapore Airlines KrisFlyer, and ANA Mileage Club.

The transfer partners for US MR points are much more versatile, and can unlock direct access to some of the best flight rewards in the game, including Emirates First Class, ANA First Class, and Singapore Airlines Suites Class.

Furthermore, in addition to Hilton and Marriott, US MR points also has a third hotel rewards program transfer partner: Choice Privileges.

Verdict: US MR points have a much wider set of transfer partners, making it the clear winner in this category.

3. Annual Fee

When it comes to annual fees, the US-issued Platinum Card has an annual fee of $695 (USD), which equates to ~$891 (CAD).

The Canadian-issued Platinum Card comes in lower with a $699 (CAD) annual fee.

It’s worth noting that the Canadian-issued Platinum Card has an annual $2oo (CAD) travel credit that we usually take into consideration. Netted against the annual fee, we can think of the Canadian card as having an “effective annual fee” of $499 (CAD).

At the same time, the US-issued Platinum Card also has a $200 (USD) annual hotel credit, equivalent to ~$256 (CAD). However, this credit is limited to select prepaid hotel bookings only, and could be viewed as less flexible than the Canadian card’s $200 (CAD) travel credit.

Even if we valued these travel credits equally, this would effectively reduce the US-issued card’s annual fee to $635 (CAD) – which would still be less favourable than the net cost of the Canadian-issued card.

Verdict: The Canadian-issued Platinum Card has the edge, with a lower net annual cost than the US-issued Platinum Card.

4. Credits & Offers

Taking a closer look at annual credits offered by the two cards, in addition to the $200 (USD) annual hotel credit, the US-issued Platinum Card has a handful of other credits which may or may not make a noticeable difference.

The US-issued Amex Platinum Card offers the following credits:

- $240 (USD) Digital entertainment credit

- $155 (USD) Walmart+ membership: $12.95 per month

- $200 (USD) Monthly Uber credits: $15 per month, with an extra $20 in December

- $300 (USD) Equinox gym credit

- $100 (USD) Saks Fifth Avenue credit of two annual $50 statement credits

- $300 (USD) SoulCycle At-Home Bike credit

- $200 (USD) Airline incidental credit

- $189 (USD) CLEAR membership credit

- $85–100 (USD) TSA PreCheck or Global Entry credit

These credits are often compared to a coupon book. Since they’re limited to specific retailers, they’re only useful to you if you would have otherwise spent money there anyway.

If you don’t otherwise frequent these businesses, you’d essentially have to spend more money just to make use of them.

Most of these credits may already be difficult to fully use up for those based in the US, and are generally even more difficult for Canadians.

The exception may be the $200 (USD) airline incidental credit, which can typically be used to load up a united travel bank for future trips with one of the major US airlines.

On the Canadian side, in addition to the $200 (CAD) annual travel credit offered on the Canadian-issued card, you’ll also receive a $100 (CAD) NEXUS credit once every four years to cover the cost of a NEXUS application or renewal.

Verdict: This category is a bit of a toss up. Some of the US-issued card’s credits can be valuable, but they’re difficult for many US-based cardholders to maximize, let alone for Canadians. On the other hand, the Canadian-issued card doesn’t have quite as many credits available.

Assuming you can make use of a portion of the credits, I’d say that the US-issued Platinum Card just about has the edge here.

5. Earning Rates

Of course, earning rates are always an important factor to consider, especially when deciding on a card to hold long-term.

The Canadian-issued Platinum Card has the following earning structure:

- 3 MR points per dollar spent on dining & food delivery in Canada

- 2 MR points per dollar spent on travel purchases

- 1 MR point per dollar spent on everything else

The 3x return on dining and 2x return on travel are fairly strong at first glance. But let’s take a look at the US-issued Platinum Card’s earning structure for a side-by-side comparison:

- 5 US MR points per dollar spent on airfare

- 5 US MR points per dollar spent on prepaid hotels booked with Amex Travel

- 1 US MR point per dollar spent on everything else

The 5x return on airfare is actually the highest return on airfare spending among all credit cards in the US and Canada.

The value of the earning rates will depend on which categories you tend to spend your money. If you travel a lot and frequently spend on airfare, the 5x return alone far outweighs the Canadian card’s earning rates.

Verdict: For those with a high spending threshold in the travel category, the Amex US Platinum Card certainly has a standout earning structure.

On the other hand, the Canadian-issued Platinum Card may be compelling if you tend to spend more on dining – but keep in mind, it’s still outshone by a lower-tier product in the same market, the Cobalt Card.

For that reason, the US-issued Platinum Card’s best-in-class earning rates wins this category.

Perks & Benefits

1. Lounge Access

Both the Canadian- and US-issued Platinum Cards offer a comprehensive suite of lounge benefits, including access to the Global Lounge Collection.

These travel benefits are considered some of the most powerful, as they encompass the exclusive Centurion Lounges and access to select Priority Pass lounges.

At the moment, both the US- and Canadian-issued Platinum Cards allow you to bring in two guests to the Centurion Lounge free of charge.

As of February 2023, however, this will be changing. To address overcrowding issues, the US-issued Platinum Card will have a guest access fee of $50 (USD) per guest, and must “earn” the guest allowance of two free guests by spending $75,000 (USD) on the card within a calendar year.

However, this change doesn’t appear to affect Canadian-issued Platinum Cards, so by February 2023 the Canadian card will hold the advantage of continuing to offer a two-guest allowance for Centurion Lounges without having to reach a very high spending threshold.

Verdict: Although lounge access is almost identical for both cards, the Canadian-issued Amex Platinum Card is set to hold the edge as of February 2023 with a more generous Centurion Lounge guest access policy.

2. Other Travel Benefits

As a cardholder of the Canadian-issued Platinum Card, you’ll automatically receive Marriott Gold Elite status, Hilton Gold status, and Radisson Gold status. On the US side, you’ll only receive Marriott Gold Elite and Hilton Gold status.

Furthermore, both cards can access American Express’s Fine Hotels & Resorts (FHR) program, which lets you can book special rates at select luxury hotels around the world with perks like suite upgrades, daily breakfast for two, and benefits unique to each property.

The two premium cards also offer a mix of airport priority services.

On the Canadian-issued card, benefits include car rental discounts and priority security lanes at Toronto Pearson International Airport. On the US-issued card, you’ll also receive premium car rental status for upgrades and discounts.

Verdict: On one hand, you’ll receive one additional hotel elite status with the Canadian-issued Platinum Card. Radisson Gold isn’t exactly the most sought-after status level, but you never know when it might come in handy.

On the other hand, anecdotally speaking, the Fine Hotels & Resorts rates can at times be more favourable on the US-issued Platinum Card, with a smaller difference to the publicly available rate compared to the Canadian FHR program.

Overall, these travel benefits are essentially on par with each other, and we can call this round a tie.

Other Factors

1. Travel Insurance

As top-of-the-line travel credit cards, both countries’ Platinum Cards offer very strong insurance coverage, including flight delay, trip cancellation, car rental insurance, and baggage delay insurance. Furthermore, both offer a similar version of purchase protection benefits.

While the maximum coverage amounts on the above insurance types are more favourable on the US side, the Canadian-issued Platinum Card naturally offers something that Canadians enjoy but Americans lack: medical insurance.

Indeed, the Canadian Platinum Card comes with emergency travel medical insurance of up to $5,000,000 and travel accident insurance of up to $500,000.

Verdict: While both cards offer fairly comprehensive travel insurance and purchase protection, the Canadian issued card’s emergency medical and travel accident insurance moves the needle substantially in its favour.

2. Visual Appearance

The two cards look virtually identical. Both are made of sleek metal and have a classic American Express design.

Despite their identical appearance, the US-issued card recently unveiled a few colourful reimagined designs, which could be considered more visually enticing if that’s your thing.

Verdict: While the metal credit cards will make the same clang-clang-clang noise when tossed on the table on both sides of the border, we’ll give this one to the US-issued Amex Platinum Card for the extra design optionality.

Conclusion

After comparing the value proposition of both the Canadian- and US-issued Amex Platinum Cards, I’d say it’s a very close call as to which product offers better value.

The Amex US Platinum Card is certainly worth picking up when it’s putting on a strong welcome bonus, which tends to be higher than what we see on the Canadian side.

However, I don’t think it’d be too compelling to keep year after year unless you spend a very high amount on airfare and can maximize its superior 5x earning rate in that category.

While it’s true that the Amex US MR program does offer a superior set of transfer partners, but you can always pool the points from your Platinum Card with another US-issued Amex product if you decide to part ways with the card.

Ultimately, most Canadians will likely benefit more from our homegrown Platinum Card. It comes with a lower net annual fee, a solid range of transfer partners, strong travel benefits, a superior Centurion Lounge guest policy as of 2023, and – in a truly Canadian advantage – up to $5,000,000 in emergency medical coverage.

Hey guys, could you pls offer an updated head-to-head comparison (2024) between the US and Canadian Platinum AmEx cards? With our increased annual fee, I’m considering considering switching to the US counterpart, and wondering if it’s a good or bad idea. Thank you!

My understanding is USA card has no fx transaction fee. That’s a huge travel benefit for I wish we had on the Canadian card.