If you want to collect large volumes of Membership Rewards points in either Canada or the US, you’ll inevitably have to talk to American Express customer service every now and then.

Rather than picking up the phone to speak with another human, one of the easiest ways to get most of your Amex-related requests dealt with is by using the Live Chat feature online.

While you aren’t able to address every issue this way, the vast majority of your needs can met with a few clicks on your keyboard.

In this article, we’ll take a closer look at the various ways Amex’s Live Chat feature can make your Miles & Points life much easier.

In This Post

How to Access Live Chat

For Canadian cardholders, the Live Chat feature is only accessible during regular business hours: Monday to Friday, 9am to 5pm Eastern Time.

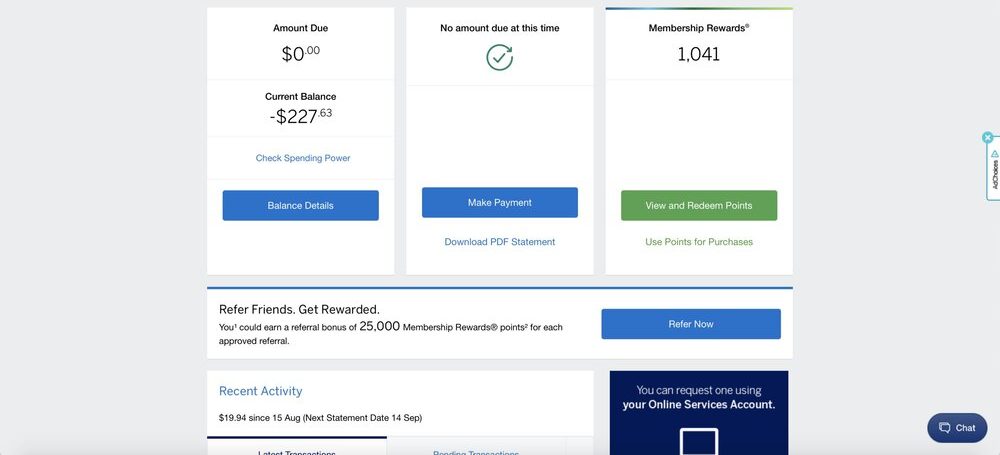

During these times, you should see a “Chat” button show up on the bottom-right corner of your Amex dashboard upon logging in.

If you don’t see the Chat feature, make sure your ad blocker is turned off, since that’s been known to disable the Chat button for certain users. If it still doesn’t show, trying using incognito mode or a different browser.

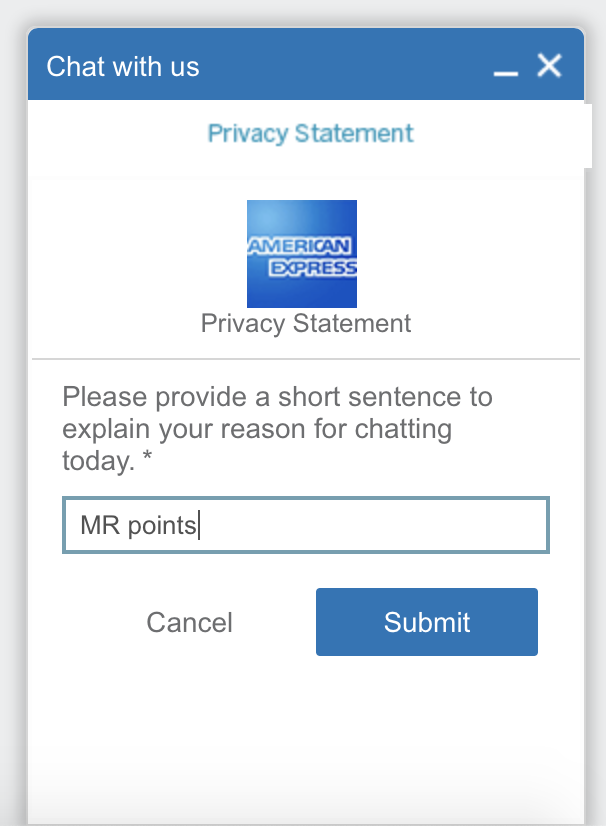

Click the button to pull up the chat window, and you’re prompted to enter a topic of conversation. Usually a generic phrase will do.

For example, if what you’re asking about is remotely related to my MR points in any way, you can just say “MR account”.

Then just click Submit and you’ll be put through to a chat representative.

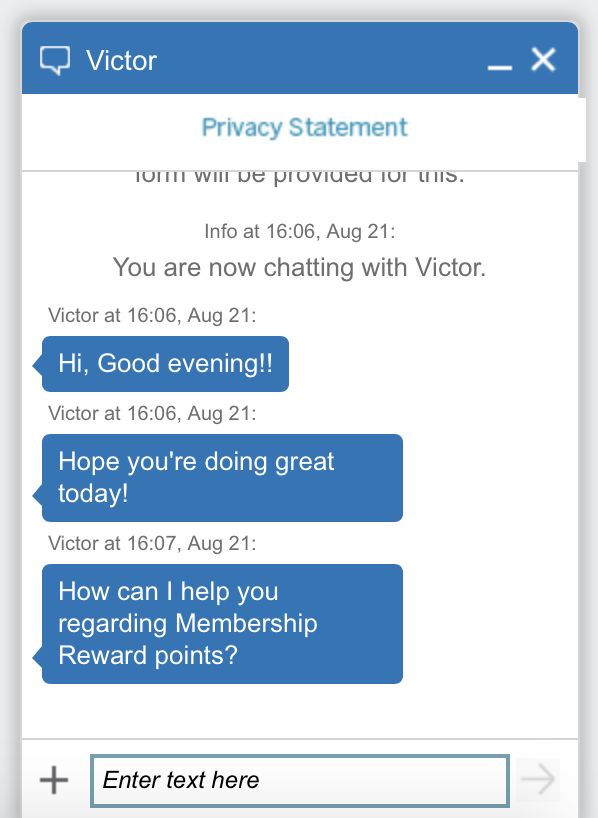

Most chats will begin with a quick identity verification before the agent can do anything. The initial verification usually only involves the question “Am I chatting with <insert your name here>?”

Any further inquiries into your account require some more security questions. You’ll usually be sent a secure form that asks you to enter some personal information and some numbers from your credit card.

You’ll want to have your credit cards handy so you can input whatever information Amex asks for, assuming you haven’t memorized those already.

The process is largely similar when accessing Live Chat from a US American Express account.

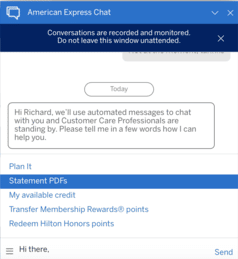

In contrast to Canada, where the Live Chat is only available during business hours, Amex US has Live Chat on a 24/7 basis. Moreover, their Live Chat interface is a lot more powerful.

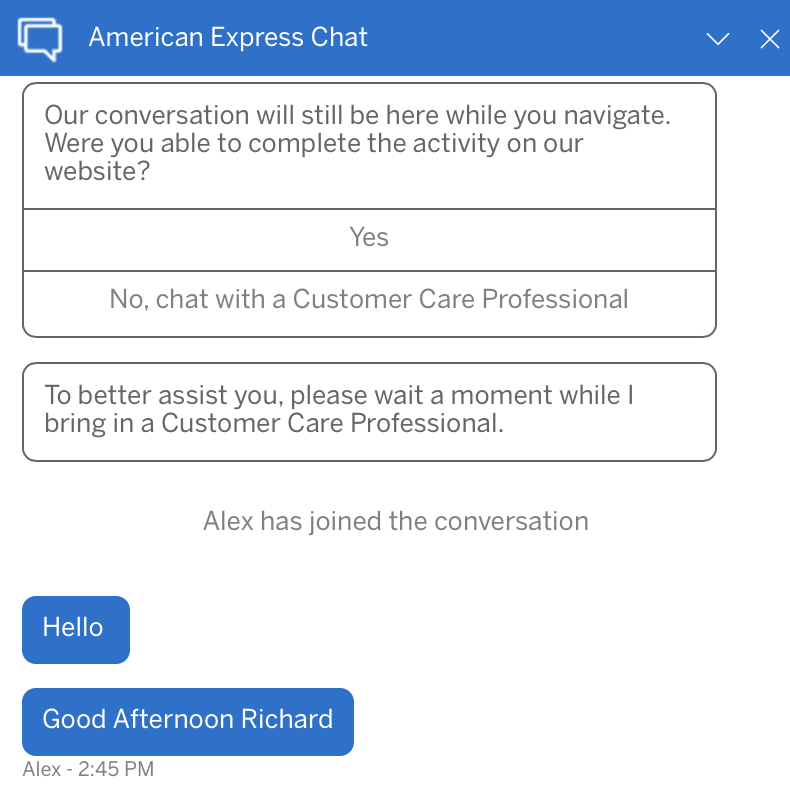

The chat app first consists of an automated menu with a few quick solutions to common questions, after which you may ask to speak to a live representative if your concerns haven’t been resolved.

The chat app first consists of an automated menu with a few quick solutions to common questions, after which you may ask to speak to a live representative if your concerns haven’t been resolved.

What You Can Do Through Live Chat

A great deal of tasks that you can accomplish via a phone call can be handled through Live Chat.

Linking MR Accounts

If you want to cancel an Amex credit card, but you also want to keep your MR points around, you’ll want to be sure to link your MR account to another MR-earning credit card that you currently hold. You can easily get this done over Live Chat:

“Can you please help me link the MR account on my American Express Platinum Card ending in 1234 with my American Express Business Platinum Card ending in 1234?”

Adding Frequent Flyer Accounts

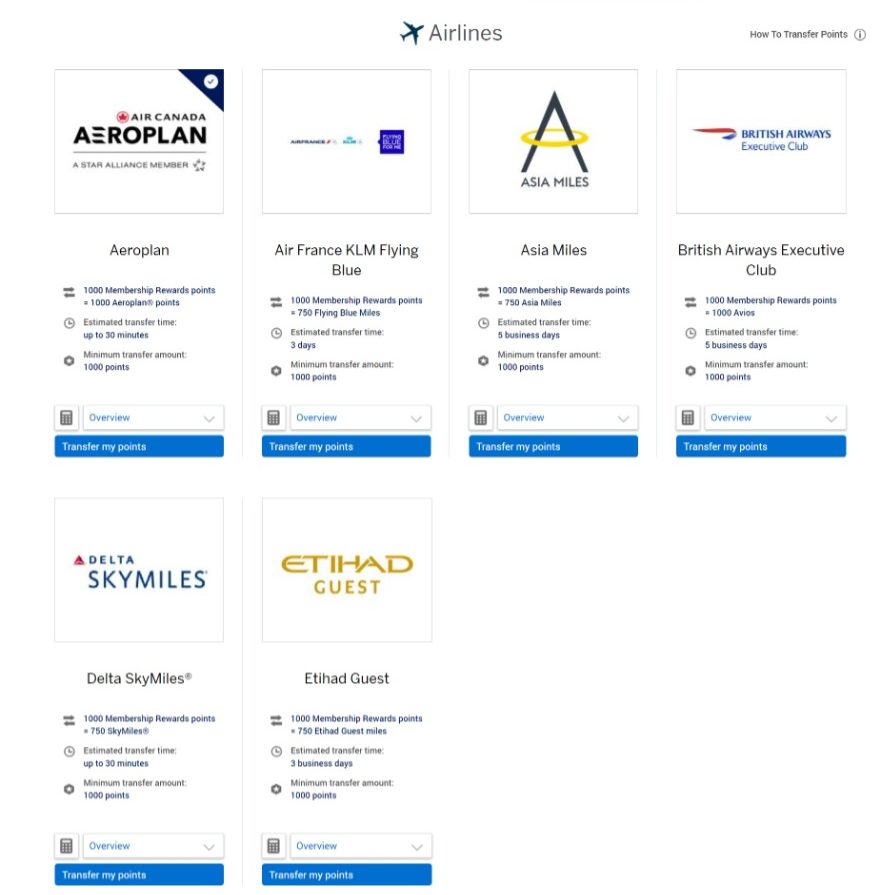

You can add frequent flyer accounts like Aeroplan and Avios to your MR account quite easily on your own, but you can also get it done through Live Chat.

Sometimes, errors occur when manually adding accounts through the MR portal, so this may be a useful backup option.

“Can you please help me add my Etihad Guest account to my MR account? My membership number is 1234567890.”

Transferring Points

Live Chat agents can help you transfer points to your associated frequent flyer accounts, as well.

Again, while this is something you could do on your own, you’ll occasionally encounter random errors along the process, so it can be useful to get the chat agents to help:

“Can you please help me transfer 38,000 points to the Aeroplan account associated with my account?”

Transferring Credit Balances Between Cards

Say you’ve made a large purchase, paid it off, but then you received a refund on that purchase, leaving your credit card with a negative balance (i.e., a credit in your favour).

You can get the Live Chat agent’s help to transfer these balances to another one of your credit cards, offsetting against the purchases you’ve made on that card:

“Can you please help me transfer my credit balance of $5,990.77 from my Business Gold Card ending in 1234 to my Cobalt Card ending in 5678?”

The balance transfer will show up on both cards in 24–48 hours.

Getting Refunds on Credit Balances

If you’d rather receive a refund of that large credit balance in the form of a cheque, the Live Chat team can handle that as well.

They do require some verification that the credit balance was the result of a purchase refund, though, so they’ll send you a secured link to upload the refund receipt that corresponds to your credit balance.

Once you’ve sent that over, they’ll be able to issue the refund cheque to your home address within 24–48 hours.

“Can you please help me process a refund cheque of the $4,340 credit balance on my Bonvoy Card ending in 1234?”

Checking for Outstanding Balances on Closed Cards

When you close a credit card, it doesn’t actually mean that purchases can no longer be made on that card. Indeed, things like pre-authorized payments can continue to be charged on your cancelled account.

The card may get removed from your online dashboard, which makes it particularly difficult to notice. This might result in a nasty surprise when you open up an unexpected credit card statement for a card you’ve already closed, showing that your payments are now well past due.

If you are suspicious that you still have charges going through, use Live Chat to have an agent check for balances on any closed accounts:

“Can you please help me check if there is still an outstanding balance on my Cobalt Card ending in 1234, which I cancelled recently?”

It’s easy to be reassured that you don’t have any outstanding balances that could be negatively affecting your credit score.

Moving Credit Limits

You can also transfer a credit limit through Live Chat. For example, if you have a $5,000 limit on one card and a $500 limit on another, you can ask for some of your credit to be transferred to the other card.

Can you please help me transfer $1,000 of the credit limit from my Marriott Bonvoy American Express Card to my Cobalt Card?

This can come in handy if you’re looking to make a very large purchase on a specific card, but need a higher limit to do it all on one transaction.

The above are just a handful of examples in the ways that that Amex Live Chat can assist. It’s so much easier than picking up the phone to call, and it’s so easy to engage with Live Chat to get any requests quickly addressed.

What You Can’t Do Through Live Chat

Some of the more “serious” stuff tends not to be handled by the Live Chat team, and instead, you’ll be directed to either taking care of it on your own or calling the Customer Service team at the usual phone numbers. These might include:

-

Making a new credit card application

- Cancelling a credit card

-

Changing your address, phone number, 4-digit online verification code, or other personal details

-

Asking for changes in credit limits

-

Asking for credit card retention offers

-

Dealing with a Financial Review

If you aren’t able to have your request serviced with Live Chat, the phone agents with American Express are known for being very friendly and helpful. It’s also nice to chat with real humans, so it’s not the end of the world if you have to pick up the phone.

Conclusion

The Amex Live Chat features offered on both sides of the border are a huge time saver. What would otherwise require at least 15 minutes on the phone can be done by merely typing away on your laptop.

Whether it’s linking your MR accounts, transferring points, or looking for some details about your account, Amex Live Chat is the most convenient solution to get things done quickly.

Just make sure your volume is on so you can hear the reminder blips when the agents send you a message. Nobody likes to be left hanging.

Was just on live chat with Amex trying to cancel a card. It seems like “due to recent policy changes” the only way to cancel a card now is by calling in.

I haven’t seen the chat button show up during those hours (even with ad-blocker off and using incognito mode). Maybe they disabled it during COVID.

Hey Ricky, just wanted to clarify a point that you made above

" The agent typically replies by double-checking that you want to cancel, gives you a warning that your MR points will be forfeited (which is a moot point if you’ve transferred them out to a different program or combined them with another card)…"

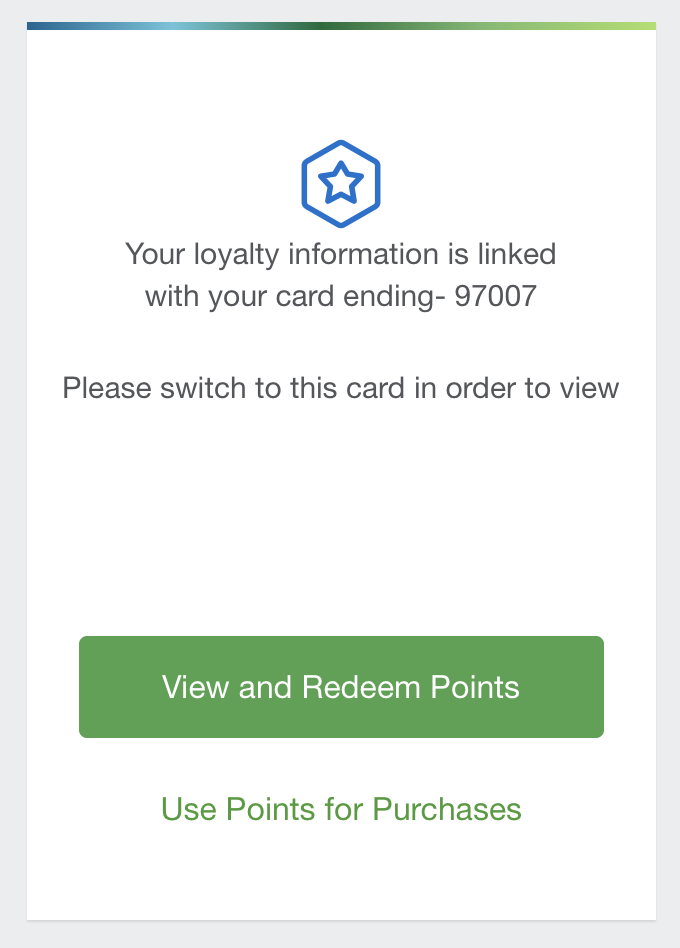

Whenever I’ve combined MR card accounts, there’s always a "primary" card where the MR points balance is under and secondary cards which tell you to view your MR balance under the primary card that it’s linked to

In my case, I have a Gold card and a Gold Business card. I had emailed Amex to combine my Gold card and Gold Business card MR balances with the intention of canceling the Gold card and keeping the Gold Business card. However, when they combined it, they made the Gold card to be the primary card and the Business card to be the secondary card. I’ve emailed Amex to see if they can change the primary card and they keep saying they will but I still don’t see that it’s been done

So my question is, if I cancel the Gold card (which is the primary card), would the MR points automatically be transferred under the Gold business card?

Thanks!

Hello Ricky,

"“Can you please help me remove the Aeroplan account on my MR account for my Gold Rewards Card ending in XXXXX?”"

If they ask you why, what do you answer? Thanks

I’ve never been asked why. But I imagine something like "I’d like to attach a different Aeroplan account"

HI Ricky, Can you confirm if Amex Canada allows transfer of MR to a spouses Aeroplan account if she is an authorized user on the Amex Gold? I got a chat agent who insisted that only the Primary Account holder earns the MR’s and so can only transfer them to his own Aeroplan in his same name. When I pointed out this was not the case in the US (Where I have transferred MR’s to multiple Avios or Aeroplan simultaneously) we said this was a "Canadian" rule and sent me to an Amex link that said this "3. Can I transfer points into someone else’s frequent flyer or loyalty program account?

No, Membership Rewards points can only be transferred by you into an account in your name.

That’s the policy on paper. But in practice, any MR points can be transferred to anyone’s Aeroplan account (not even just an authorized user) – you just need to enter the Aeroplan # and transfer.

Are retention offers really a thing with Amex in Canada? I’ve never had any luck despite putting >$20k/year of legit spend on my Gold or Platinum cards.

AMEX offered me 10k MR for biz gold. Turned it down, but would have taken 15k.

@David Yes, you will just lose the MR Firstness of them as they all essentially become Gold points.

Hey Ricky, slightly unrelated but am I able to ask them to link an Amex Platinum Business MR to an Amex Platinum Gold MR before I cancel Platinum MR? I know the MRs are slightly different, but not as different as MR to MR-S.

-David