On the final day of 2019, and indeed of this decade, I thought it would be fun to delve into the history books and pick out the 10 most amazing Miles & Points deals and opportunities that occurred this decade from a Canadian perspective.

Some of these opportunities allowed you to earn staggering amounts of points for very little effort; others allowed you to redeem miles for travel at an extremely outsized value, even compared to other award chart sweet spots. Some were public knowledge; others were kept under tight wraps by those in the know, until they eventually met their end.

I myself managed to benefit from some of these, while I didn’t hear about the others through the grapevine until it was too late. So what did these smoking-hot deals look like? And what lessons might we be able to learn from them to find similar deals going forward?

1. Aeroplan, Many Devaluations Ago

Devaluations are a fact of life in Miles & Points, although it can be fun to look back on the past editions of points programs and imagine the sheer value they would’ve delivered.

Aeroplan is among the best loyalty programs for Canadian travellers in the modern day, but at the start of the decade, the value in the program was insane.

Back in the day, a round-trip business class flight to South East Asia was only 100,000 Aeroplan miles in business class (compared to 155,000 miles today) or 125,000 Aeroplan miles in First Class (compared to 210,000 miles today). Better yet, there were no fuel surcharges on any airlines, and Lufthansa and Swiss First Class were both easily bookable throughout the schedule without any restrictions on availability.

The “good old days” of flying indeed!

Over the years, things tightened up significantly. The award chart was hit with several devaluations, fuel surcharges were introduced on select airlines, and Lufthansa and Swiss moved to tighten up their First Class partner availability to a 15-day window and an iron-fist policy of zero seats for partners, respectively.

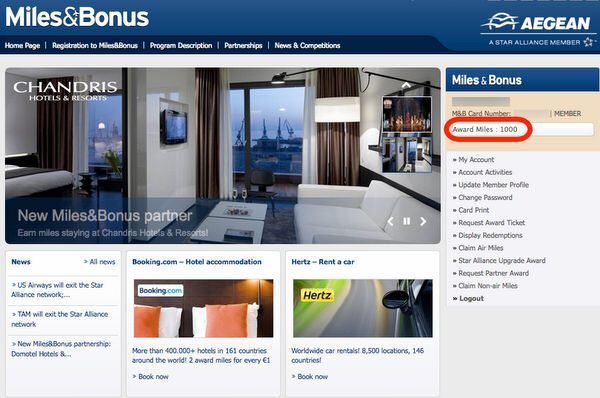

2. Star Alliance Gold via Aegean Miles & Bonus

This was the one that got me into the game.

In 2013, Aegean Airlines, the Greek flag carrier, had only recently joined Star Alliance. Their Miles & Bonus loyalty program had included a threshold of 20,000 qualifying miles to reach Gold status; however, when they joined Star Alliance, Miles & Bonus Gold translated into Star Alliance Gold as well – and the other Star Alliance airlines would usually require a much higher threshold, in the range of 50,000 qualifying miles, to qualify.

And best of all, Aegean would give you 1,000 bonus miles simply for opening an account, so in reality only 19,000 qualifying miles were needed.

As a student at the University of Toronto at the time, I was flying back-and-forth routinely between Canada and China, so I met the threshold with only a couple of round-trip flights. This allowed me to supplement my unceremonious economy class flights with some fine dining and champagne in the lounge (or, more accurately, machine-brewed cappuccinos and stale cookies, but hey, these were my small victories at the time!)

Eventually, too many “cheap elites” started popping up at Star Alliance lounges around the world, resulting in Aegean Miles & Bonus changing the qualifying threshold to include a few Aegean-operated flights every year for Gold members.

I continued segment-running on Aegean for a few years until eventually, in 2017, allowing my Star Alliance Gold – that coveted piece of plastic that had first gotten me interested in airlines and loyalty programs in the first place – to lapse.

3. Instant Fairmont Platinum Status

An oldie but goodie, as they say.

Before Fairmont was acquired by Accor, they had operated their own loyalty program, Fairmont President’s Club. Top-tier Platinum status was ordinarily granted after 30 nights, but there was a certain credit card – I can’t recall the specifics, maybe one of the higher-end Scotiabank cards – that would grant cardmembers instant Platinum status via a specific benefit code.

Free nights, night after night…

There was no further check against the cardholder’s name or anything; as long as you entered the code on a specific box in your Fairmont President’s Club profile, you were Platinum.

This code was listed somewhere on the Scotiabank website, and cardholders were redirected there via their online dashboard. But here’s the thing: the page was indexed by Google, so you could also identify the code simply by searching “site:scotiabank.com Fairmont platinum”!

Since Platinum status gave you an instant free night award and suite upgrade at any Fairmont hotel, many of those who were “in the know” began making Fairmont President’s Club accounts for their friends and family members and upgrading them all to Platinum status to rack up the free nights.

You’d also get a US$100 food or drink credit as part of your upgrade, so you know what that meant… Afternoon tea with fellow guests who were also “in the know”, every single day, at the local Empress, Pacific Rim, or Royal York. Amazing.

4. The Avianca LifeMiles “Tricks”

Until about 2014, Avianca LifeMiles had a number of glaring weaknesses that were being ruthlessly exploited by savvy travellers.

The folks who designed their loyalty program might not have done so well in geography class, since they had naively designated the island of Guam (a US territory) as within North America. As a result, anyone redeeming miles on a route like Los Angeles–Tokyo–Guam or Vancouver–Taipei–Guam would be charged a stupidly low amounts of miles, the equivalent of an intra-North America flight.

What’s more, their programmers seemed to have a bad habit of making mistakes when entering the airport codes into their system. For example, Istanbul’s Sabiha Gokcen Airport has an IATA code of “SAW”, but LifeMiles mistook this airport for Sawyer International Airport in Marquette County – also in North America. And so, any redemption from North America to Istanbul would be priced as an intra-North America flight.

Who’s in the mood for some iskender and döner kebab?

To make matters even worse, Avianca was (and still is) known for routinely selling miles at a huge discount, so you could book these “glitch” redemptions for a very paltry sum of money. Lufthansa First Class to Istanbul for around $200, anyone?

As I recall, Avianca was made aware of the many flaws in their system when someone tried to fly Los Angeles–Taipei–Guam on EVA Air, an act of cabotage (i.e., when a foreign carrier transports a passenger between two domestic points in the same country, since Guam is a US territory after all), and was denied boarding as a result.

That was the beginning of the end, as they fixed the Guam loophole, and the others soon followed.

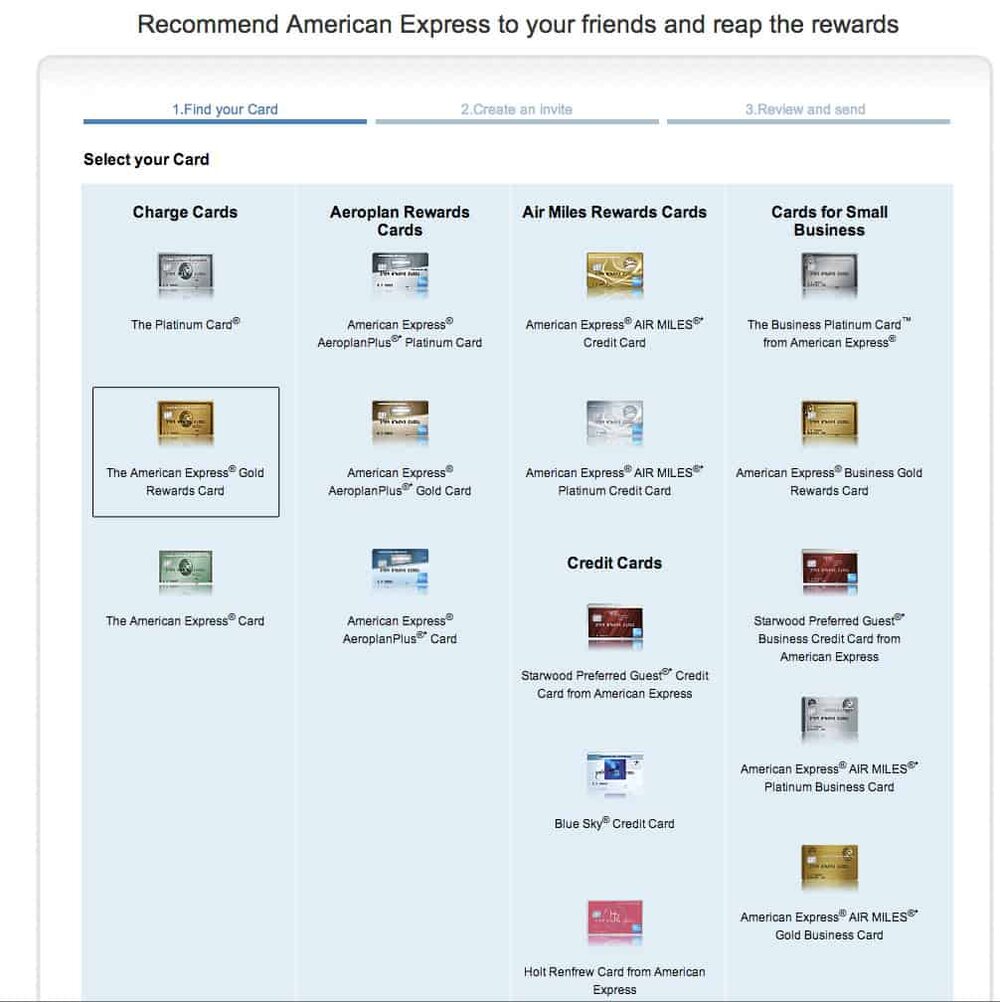

5. Amex Referrals, From Any Card to Any Card

These days, as you see in the Amex Flowchart, you can only earn referral bonuses by referring from a specific card to another card in the same family.

But it wasn’t always this way. Only a few years ago, when you went onto your Amex dashboard to generate a referral link, you’d be prompted to select the card you currently have as well as the card you’d like to refer to.

At one point, you’d be able to earn referral bonuses across entire product families – indeed, I distinctly remember earning 10,000 Aeroplan miles as a referral bonus on an Amex AeroplanPlus Gold Card (which earns Aeroplan miles) when opening an Amex Gold Rewards Card (which earns MR points).

You could also earn a higher referral bonus simply by being a little clever during the referral process. When asked which card you currently hold, you’d earn a higher referral bonus of 15,000 MR points if you chose the Platinum Card, even if you actually only held the Gold Rewards Card (and were therefore only entitled to a referral bonus of 10,000 MR points at the time).

Alas, Amex tightened up the referral rules over the years, and nowadays the Business Platinum’s referral bonus of 25,000 MR points when getting the Business Gold and Business Edge is where the bulk of the earnings lie.

6. Emirates First Class for 100k Alaska Miles

For me, this was the one that got away.

Between January 2013 and March 2016, one of the best sweet spots in the entire Miles & Points landscape was the ability to redeem a maximum of 100,000 Alaska miles for travel on Emirates First Class virtually anywhere in the world.

You could fly for 30+ hours in the world’s best First Class cabin, on routes such as Los Angeles–Dubai–Auckland, for that rate. Combine that with the wide-open availability and the fact that you could also hold multiple MBNA Alaska credit cards in quick succession at the time, and you were looking at a downright jaw-dropping award chart sweet spot – the kind that’s ripe for devaluation at a moment’s notice.

The one that got away (until I eventually booked it this year)…

Every blog out there was talking about it. Some guy even made the news for it. Eventually, it had to go… but the way it went was particularly unsavoury, since Alaska implemented an overnight devaluation of their Emirates award chart to virtually double the number of miles required for First Class.

And that’s how we ended up with the disproportionately expensive chart, in which Emirates First Class costs between 150,000 and 200,000 miles one-way, that we see today.

7. Marriott Travel Packages

Many of you will remember this one, I’m sure.

The world was a better place before the name Marriott Bonvoy ever entered our collective consciousness, especially since the legacy Starwood Preferred Guest and Marriott Rewards programs had created some insane opportunities back when they were linked by a 1:3 inter-program transfer ratio.

The old Travel Packages (also known as Flight & Hotel Packages) in the Marriott Rewards program were particularly lucrative. For 270,000 Marriott Rewards points, you’d earn 120,000 airline miles in the program of your choosing, plus a seven-night certificate at a Category 1–5 hotel. Alaska Mileage Plan was a particularly popular target for those 120,000 miles, especially since there were few other ways to quickly rack up Alaska miles.

270,000 Marriott Rewards points were equivalent to 90,000 Starpoints in SPG at the time, which were themselves equivalent to 180,000 Amex MR or MR Select points. Imagine redeeming 180,000 MR Select points for 120,000 Alaska miles plus seven hotel nights? Those were the days.

Indeed, in the weeks and months leading up to the August 2018 transition to the new Marriott program, there was a clear and singular strategy: cash out as many of your Amex, SPG, and Marriott points as possible for the Travel Packages, because we might never see as good a deal again.

I ended up with a huge stash of Alaska miles as a result, although I still have a handful of those seven-night hotel certificates (now converted to Category 1–4 in the new program) that I’m not really sure what I’ll be using for!

8. Cathay Pacific’s Insane First Class Fares

We’ll end with what has been widely touted the “deal of the decade”: the insanely low Cathay Pacific First Class fares that were available for a brief few hours over New Year’s Eve of 2018.

The best deals were the US$845 round-trip fares from Da Nang, Vietnam to New York JFK. To put this in perspective, if you credited the flights to Alaska Mileage Plan, you’d earn 56,504 Alaska miles – enough for yet another flight in Hainan Airlines business class, or (whisper it quietly) enough to offset your original ticket cost if you sold the miles through back-channels. You could basically get paid to fly Cathay Pacific First Class.

The most surprising part of this deal was that Cathay Pacific actually honoured the fares, even though they took up a huge chunk of their First Class inventory throughout 2019.

Happy 2019 all, and to those who bought our good – VERY good surprise ‘special’ on New Year’s Day, yes – we made a mistake but we look forward to welcoming you on board with your ticket issued. Hope this will make your 2019 ‘special’ too!

.#promisemadepromisekept #lessonlearnt— Cathay Pacific (@cathaypacific) January 2, 2019

Furthermore, since these were full-fare First Class tickets, you could make changes well into 2020 for a very low change fee. In fact, that’s exactly what I’ve done, having flown my outbound from Vietnam to Vancouver this past summer and changed the return portion for a different trip next March.

I imagine it’ll be quite some time before we see such a good deal on international First Class, with the airline choosing to honour it, in the future. But then again, who knows? The nature of these fares is that they’re entirely unpredictable, so don’t let your guard down and always keep your eyes peeled!

Conclusion

The above are my picks for the 10 Miles & Points deals of the decade, but the list is by no means exhaustive. Honourable mentions must also go out to the Royal Canadian Mint’s face value coins, the $700 ANA business class fares from Vancouver to Sydney, and the Amex business cards from Canada Post. 😉

While most of these deals are merely fun to think about and no longer work in practice, the important thing is to think about how each of the deals worked and what kind of similar deals might be floating around at the moment.

What other valuable yet poorly-concealed codes could you uncover with a targeted Google search? What other loyalty programs might have mis-coded cities like Avianca LifeMiles? What other opportunities for loading and withdrawing money at a profit might exist, similar to the AC Conversion Card?

Those who took advantage of these deals would’ve all been willing and eager to search for weaknesses, experiment with sweet spots, and network with other like-minded individuals, and those are the key traits you’ll need if you wish to jump onboard any of the deals on next decade’s list while they’re still around right now.

Hi Rick. Great post as always! Wow your closing paragraphs really got me thinking about possible avenues of MS. Ugh it frustrates me that similar possibilities probably do exist right now that rival these deals. I just don’t know about them..

like okay the new methods are all probably online since we don’t see all the bloggers spending all their time at Walmart doing MO’s. So my best guess is these avenues probably have nothing to do with the travel industry, but are a part of other sectors that people wouldn’t think would be ripe for MS. I also have a feeling it does involve a fee but the scale and ease is so good that the fee is worth it. Plastiq comes to mind. Am I getting colder or hotter? Haha

You did mention a shopping portal that didn’t refund the rewards when you returned an item, I’m thinking it might have to do with the timing of the return ie. credit card purchase protection outlasts or return policy outlast how long the portal tracks the item for a return. I’ve got to be getting closer..

Aloha!

Todd

A more recent deal to highlight: Iberia promotion in 2018 where you could book any flight and earn 10k Avios. People ended up booking flights between MAD-PMI for ~$15 USD each. Enjoyed a MEX-MAD return flight in Bus class for super cheap.

Yep, that was another crazy one. I think I ended up transferring the 90k to BA Avios and my Iberia account has been sitting in the negatives ever since.

How about the Mexican Hat Dance?

Thanks Ricky. Making us miss the good old days… I did not know there was a green card in Canada!

You forgot two significant deals:

1) Garuda Indonesia’s 90% discount for award tickets.

You could book GA’s Jakarta-London/Amsterdam first class flights for 19000 miles one-way.

GA’s first class soft product is the best in the world, so this was an insane way of experiencing it.

Shoe service anyone?

2) GOL Smiles’ mileage sale currency conversion error.

This is not a well-known one, but Brazil’s GOL Smiles program had a currency conversion error for the miles they were selling. (GOL Smiles’ is like Lifemiles where you buy miles and use them for award flights.)

Basically you could buy 1 mile for 0.001 USD or less, which meant you could fly international first class products like Etihad’s First Class Apartments on the AUH-SYD route for just a couple of hundred dollars.

I kicked myself for not buying literally millions of miles when this happened.

If I recall correctly, the Garuda promo was incredibly difficult to redeem since you had to go to a Garudaoffice location to get the ticket actually issued.

The Garuda one did indeed slip my mind, killer deal, that.

The currency one I considered including but I must say I felt it a bit esoteric even for this list. Let’s give it an honourable mention. Long live the Venezuelan bolivar 🙂