One of my goals for 2020 is to cover the US side of the game more comprehensively, as I view it as a key part of the advanced Miles & Points strategy for Canadians.

All the necessary elements to participate in the US game are quite readily accessible from this side of the border, so it’s a natural next step for those who feel they’re largely comfortable with the Canadian offers.

In this article, we’ll evaluate one of the recent major news items from the US side – the impending US$100 annual fee increase on the Chase Sapphire Reserve – and also assess the overall Chase strategy for Canadians as a whole.

How to Apply for Chase Cards as a Canadians

As a reminder, the general process for getting into US credit cards as a Canadian typically involves using an Amex Global Transfer to get set up with an Amex US cards as your first US credit card.

The Chase cards tend to come later on during the process, since Chase typically likes to see at least a year’s worth of credit history (if not more) before approving people for cards.

Since Chase also has the notorious 5/24 rule, in which they won’t approve you for any cards if your credit report shows more than five newly-opened cards over the past 24 months, that means that your first one or two US cards are likely to remain within the Amex ecosystem, before you venture over to Chase for your third, fourth, and fifth cards.

Chase requires either a Social Security Number (SSN) or an Individual Taxpayer Identification Number (ITIN) to apply for their products, so if you don’t have an SSN, then that waiting period of building up roughly one year of credit history is the perfect time to get your ITIN.

It may also be helpful to visit a Chase branch in-person during this period to open a bank account and build your relationship with Chase, which may help to get you approved for their cards sooner.

I myself got approved for the Chase Sapphire Preferred as my first Chase card after about one and a half years of US credit history; since then, I’ve also obtained the Chase Ink Preferred and the Chase IHG MasterCard as well.

Chase Sapphire Reserve Card Highlights

One of the most popular starting points within the Chase ecosystem is the Sapphire family: either the Chase Sapphire Preferred or the Chase Sapphire Reserve.

Chase limits individuals from holding both of these cards simultaneously, so you can only apply for one or the other.

The Sapphire Reserve is the higher-end product, having historically had a US$450 annual fee and a host of strong earning categories and premium travel perks. In particular, the card offers:

-

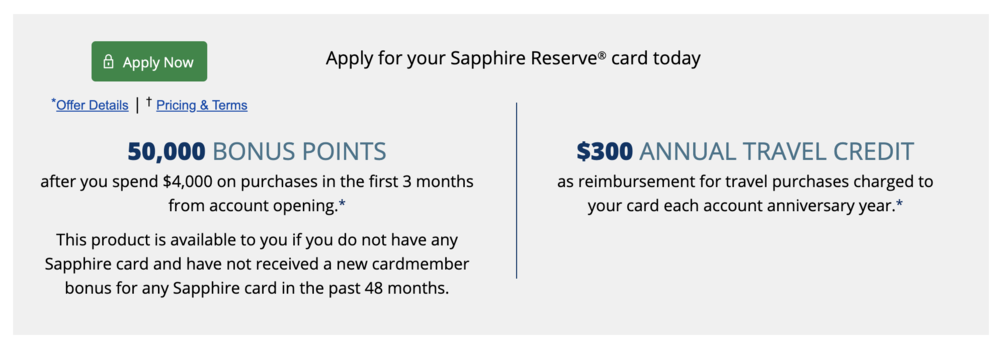

A welcome bonus of 50,000 Ultimate Rewards points upon spending US$4,000 in the first three months

-

This is worth at least US$750 in travel booked directly through the Chase Ultimate Rewards portal, since Reserve cardholders are able to redeem points towards travel at 1.5 US cents per point

-

These points can also be transferred to one of Chase’s many airline or hotel partners for redemption at even better value

-

-

A US$300 travel credit per card membership year, which effectively offsets against the annual fee

-

The annual fee on the Chase Sapphire Reserve should therefore be thought of as a US$150 “effective annual fee”

-

-

An earning rate of 3 UR points per US dollar spent on dining and travel purchases, globally

-

No foreign transaction fees

-

The above two perks mean that Canadians can use this card to earn around 2.3 UR points per Canadian dollar spent on dining and travel, globally (subject to change based on FX rates), which is mildly competitive against some of our Canadian offerings in dining (like the Amex Platinum Card’s 3 MR points per dollar spent) and much stronger in travel

-

-

An unlimited-access Priority Pass membership that allows you to bring up to two accompany guests for free

-

Crucially, while Amex-issued Priority Pass memberships no longer allow access to Priority Pass-affiliated airport restaurants, Chase-issued memberships do

-

Priority Pass typically covers US$28 in food and drinks per person, so with the allotment of two guests, you could potentially get US$84 in free food and drinks every time you visit a Priority Pass-affiliated airport restaurant

-

As you can see, there are a wealth of benefits that justify the US$450 effective annual fee, and if you were to apply for the Chase Sapphire Reserve before January 12, 2020, then you’d be entitled to the above benefits.

Chase Sapphire Reserve Annual Fee to Increase by US$100

As of January 12, however, the annual fee on the Chase Sapphire Reserve will be increasing from US$450 to US$550. Accompanying this annual fee increase are a few additional benefits on the card:

-

10 points per US dollar spent on Lyft rides

-

A one-year Lyft Pink membership, which usually costs US$19.99 per month, and includes perks such as 15% off Lyft rides, priority airport pickups, waived cancellation fees on three rides per month

-

US$60 credit to DoorDash (a food delivery service) in both 2020 and 2021

To me, these additional benefits barely justify a US$100 annual fee increase for US consumers, and certainly don’t justify it for Canadian ones.

For one, the Lyft benefits are only available on US rides, and while DoorDash is active in many Canadian cities, I can’t say I’ve ever used them for my food delivery services.

Even among US cardholders, many will likely need to change their consumer behaviour quite significantly and go out of their way to avail of these benefits, since Lyft’s coverage and popularity pales in comparison to Uber’s, and DoorDash faces heavy competition from many other companies in the food-delivery space.

Moreover, many of these perks are only temporary – the Lyft Pink membership is only granted for one year, while the DoorDash credits are valid in 2020 and 2021 only.

On one hand, I see Chase’s logic in this, since it’s anyone’s guess whether these startup companies, which come and go by nature, will still be viable partners a few years’ from now. And yet, it’s hard to see how these transient perks can possibly justify an ostensibly permanent increase in the annual fee.

It’s a shame that Chase seemed to focus exclusively on competing with Amex US on their Uber and UberEats partnerships (and in particular the Amex US Platinum Card, which recently underwent a similar fee hike from US$450 to US$550), when there are so many other ways they could’ve improved the Sapphire Reserve.

For example, potential 5x earning categories, or status perks with their hotel partners like IHG and Hyatt, would’ve gone a much longer way towards justifying the annual fee increase in my view.

I personally had considered upgrading my Chase Sapphire Preferred to the Chase Sapphire Reserve sometime soon (as Chase allows you to product-switch cards within the same family after holding them for one year), but now that there’s been an increase to a US$550 annual fee without a corresponding increase in the benefits, I’m much less likely to do so.

If you are interested in the Chase Sapphire Reserve and are in a position to apply now, it would be ideal to apply prior to January 12. This way, you get to try out the new benefits for a year while still paying the old annual fee of US$450, allowing you to decide whether those benefits justify keeping the card for US$550 per year when your annual renewal date comes around.

Sapphire Reserve vs. Sapphire Preferred: Which Is Better for Canadians?

Since you’re only allowed to apply for either the Chase Sapphire Preferred or the Chase Sapphire Reserve, which card is best-suited for Canadians looking to get started with Chase?

It’s my view that the Chase Sapphire Preferred is more than sufficient for Canadians. The Preferred’s annual fee of US$95 is lower than the Reserve’s US$250 effective annual fee (after the January 12 changes), while the signup bonus is higher at 60,000 UR points vs. 50,000 UR points. Those two factors alone swing clearly in favour of the Preferred.

Now, US consumers might well choose the Reserve over the Preferred due to the 3x earning power on global dining and travel, compared to the Preferred’s 2x earnings.

But Canadian cardholders are likely to be more interested in the signup bonus than the ongoing ability to earn points, since we already have many cards in Canada with a decent return on dining and travel. Furthermore, even though the major US credit cards have no FX fees, there may still be an FX impact in converting Canadian funds into US funds to pay off the purchases on your US credit card bills.

The other major benefits of the Reserve include the ability to redeem UR points for 1.5 US cents per point directly towards travel (whereas the Preferred only lets you redeem at 1.25 US cents per point), as well as the unlimited Priority Pass membership (which the Preferred lacks).

But on the former point, as a savvy traveller, you’re likely going to be transferring your UR points to airline and hotel partners to get higher value than 1.5cpp anyway. And as for the Priority Pass membership, there are so many Canadian and US Amex products offering a similar unlimited-access membership, so the only perk left might be the ability to access airport restaurants as a non-Amex-issued Priority Pass membership, which is a pretty minor benefit in the grand scheme of things.

While the Sapphire Reserve is definitely a more upmarket product than the Sapphire Preferred, I’d say the latter product is ideal for Canadians looking to get started on their Chase portfolio, especially in light of the former’s increase in annual fee without a corresponding change in benefits.

Conclusion

As someone who was considering upgrading to the Chase Sapphire Reserve from my current Chase Sapphire Preferred, I find the card’s addition of Lyft and DoorDash benefits quite uninspiring in the face of the upcoming US$100 increase in annual fee, and can’t see myself changing to the Reserve for the foreseeable future unless more accompanying benefits were introduced.

I continue to view the Chase Sapphire Preferred as the ideal starting point for Canadians who’ve established sufficient US credit history, ideally as your third US card overall after a couple of Amex US cards, so that you may obtain two more Chase products as your fourth and fifth cards to round out your 5/24 allowance.

Do you just keep holding the CSP and paying the $95 AF after first year?

Yep. I find a lot of value in the CSP in using it to pay for stuff along my travels, because I can earn competitive rewards while paying No FX Fees (and Amex isn’t always accepted worldwide).

Was planning on cancelling my CSP in Sep and applying for the CSR since that’s when I would have qualified for the sign up bonus (48 months rule). With these upcoming changes to CSR, I will definitely keep the CSP and my CIP. I have zero use for Doordash, primarily use Uber, and have PP via another card.

Echoes my thoughts exactly. CSP + CIP is all I need here. Now I’m just waiting to be under 5/24 so I can get the Hyatt card.

Do you have the Hilton Aspire card? Trying to decide between it and the Hyatt card. Both offer a lot of value but the Aspire’s travel credit is so difficult to use now.