When American Express first announced the stunning Double Rewards promotion on the Platinum Card, the end-date of July 20 seemed so far away. But here we are, with only one more week to go until one of the most generous promotions in the history of the Canadian credit card landscape comes to an end.

It speaks volumes that American Express quietly moved to neutralize the many creative ways to maximize Double Rewards in the time since it was first introduced, with the lowering of the Platinum and Business Platinum signup bonuses and the temporary suspension of the ability to link MR accounts.

That tells me that the Double Rewards promotion ended up being far more generous than intended, and since it was only introduced because of the pandemic in the first place, it’s quite likely we’ll never see anything like it again.

In this article, let’s look at how you should be maximizing the value of your Platinum Card in the final days of Double Rewards – and beyond.

Load Up on the Double Earning Rate

As you’ll recall, the Platinum Card is essentially offering a flat 4% cash back on all purchases under Double Rewards, thanks to the doubled earning rate of 2 MR points per dollar spent on general purchases combined with the doubled redemption rate of 1,000 MR points = $2 against statement purchases.

Similarly, the card is effectively also offering bonus categories of 8% in travel (4 MR points per dollar spent) and 12% in dining (6 MR points per dollar spent) as well.

With a good chance that we’ll never see anything like 4% uncapped cash back on any credit card in Canada ever again, now may be a good time to front-load any spending you have planned over the upcoming weeks and months. Load up on gift cards for stores you know you’ll be shopping at (including restaurant gift cards bought directly from restaurants for that 12% return), pay off any outstanding bills via Plastiq or PaySimply, and complete any large purchases you might’ve been contemplating for the rest of the year.

(If you’re contemplating a potential purchase over the next few months but aren’t 100% sure you’ll need it, you may as well go ahead and purchase it for now anyway – you can always return the purchase if you change your mind later.)

Don’t forget that the Platinum Card is simultaneously offering $250 in statement credits on everyday essentials, so if you haven’t used up that offer yet, make sure to do so by July 20 in order to benefit from the elevated earnings – especially if you use it on Uber Eats, which in most cases is being treated as a dining purchase.

Similarly, the Amex Shop Small offers are valid across all American Express products, but if you’re a Platinum cardholder, then that’s the card you should be prioritizing for the 10 sets of “Spent $10, Get $5” offers before the Double Rewards event ends next week.

In all cases, as long as the purchases are made on your card as of July 20, they should be subject to the doubled earning rate even if they only post to your account a few days later.

However, if you intend to then redeem those points at 2 cents per point (cpp) against statement purchases (as we’ll explore below), then you want to make sure that the purchases post by July 20. It’d therefore be safest to make the purchases by this Friday at the latest.

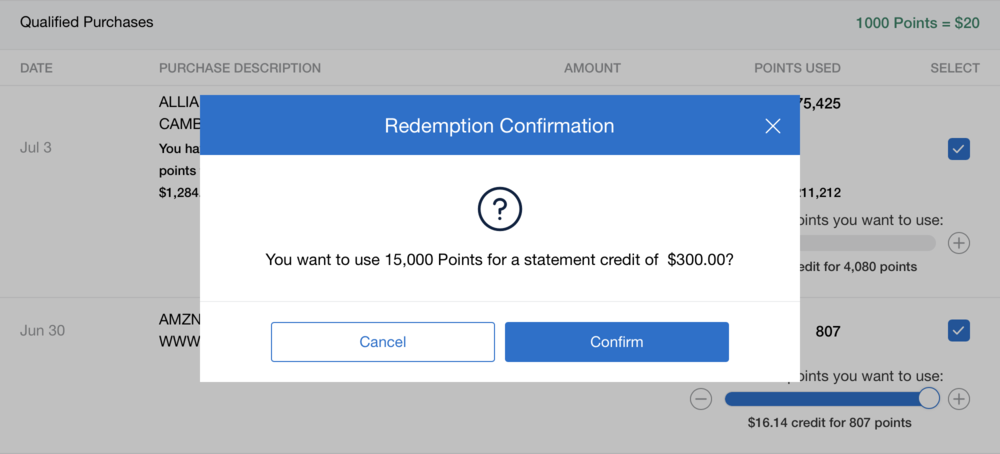

Redeem MR Points at 2cpp vs. Future Flights & Hotels

As generous as it is, the ability to redeem MR points at 2cpp against statement purchases likely presents a major dilemma for many Platinum cardholders.

On one hand, transferring MR points to frequent flyer programs like Aeroplan or British Airways Avios and redeeming miles for high-value flights is probably the main motivation that many Platinum cardholders had signed up for the card in the first place.

On the other hand, there is great uncertainty in the future of global travel at the moment, and the baseline cash-out rate of 2cpp can be very tempting indeed – even if you don’t absolutely need the cash right now, it can still be put towards valuable uses that may outweigh the prospect of travelling in the near term.

Everyone will have to decide for themselves exactly what to do with the MR points sitting in their Platinum Card accounts. Here are a few questions to ask yourself as you make that decision:

-

How confident are you of getting more than 2cpp in value from airline transfers? Was your initial goal with earning MR points to redeem for premium flights at a high value? If so, is your belief in the Aeroplan program holding strong despite the uncertainty of the new program coming in Quarter 4 of 2020? If you answered “no” to either question, then 2cpp in cash may be difficult to turn down.

-

How willing are you to travel over the next year or so? In my view, consideration of the prospect of redeeming Aeroplan miles or British Airways Avios for high-value travel should be restricted to the upcoming one-year period, because you can always earn more points in the future to fund your travels two or three years from now. So, do you envision yourself travelling using these programs’ sweet spots over the course of 2020 and 2021, keeping in mind that the “style” of travel may be greatly affected by the pandemic (both in terms of the onboard service in premium flights, and the challenges of scheduling multiple stopovers and layovers on a single international redemption)?

-

How large are your existing points balances? If you already have a six-figure balance in a program like Aeroplan, Avios, or Marriott Bonvoy, then adding more to that balance may not be as useful given the uncertainty around travel. Cash in your pocket or put towards a valuable use could be the better play in both the short term and the long term.

-

How badly do you need the cash? If an extra dose of cash could really help you get through a slow period at the moment, then that could very well be the right move.

-

What are your long-term goals with earning and redeeming points? If you’re in this game with the general mindset of travelling more for less, then 2cpp in cash could help you towards that goal just as much as an Aeroplan or Avios transfer, considering the ever-blurring line between points and cash on the redemption side. But if you’re in this game with the singular focus on sampling unique experiences that money can’t buy, then saving your miles for premium flights and hotels is clearly the answer.

Your thoughts on the above questions will help you decide what to do with your MR points under Double Rewards.

Remember, you don’t have to go all-in either way; indeed, I believe that a hedged strategy, in which you cash out some MR points at 2cpp and leave the rest for future redemptions, will serve most Platinum cardholders very well. I myself went with a hedged strategy as well, with a slight majority in the direction of cashing-out largely because of point #3 above.

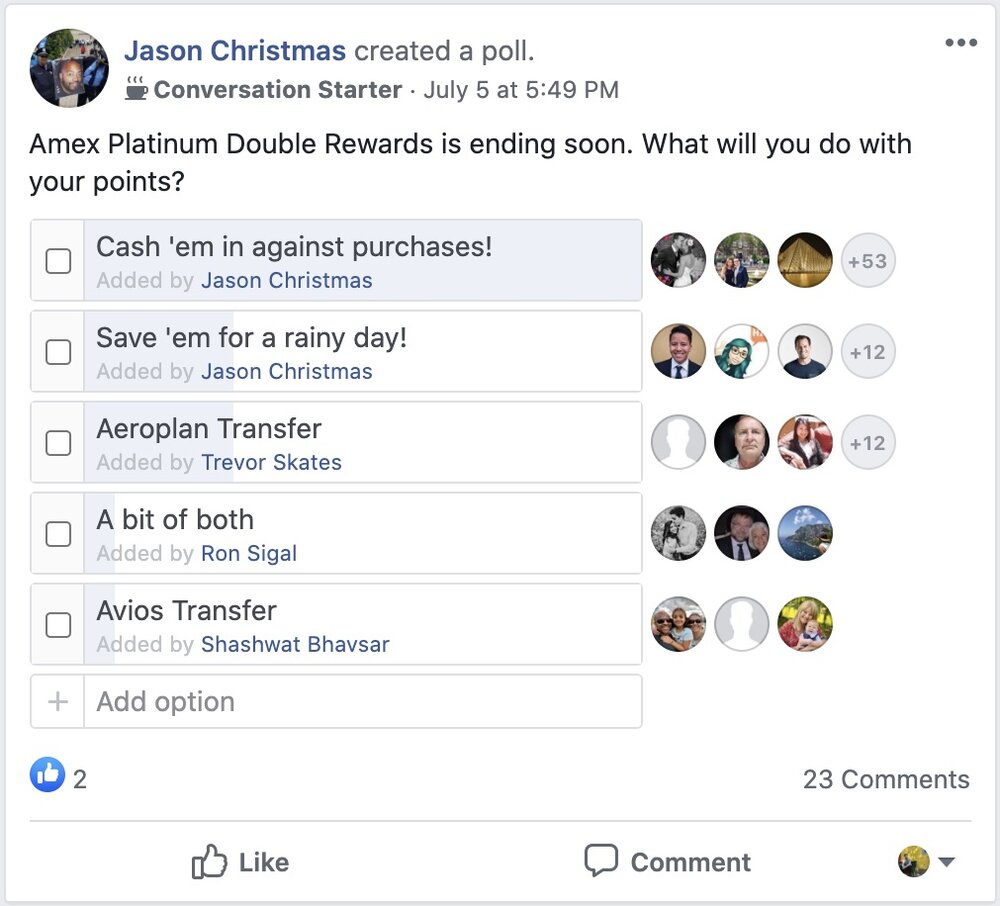

A recent poll on the Prince of Travel Elites Facebook group on this very topic showed that most Platinum cardholders generally favoured cashing in their points against purchases:

Don’t forget that, if you decide to transfer points out to Aeroplan, then taking advantage of the 65% bonus when converting Air Canada tickets into Aeroplan miles could represent a better than 1:1 transfer ratio, as long as you aren’t in a rush to use the miles (since they do take quite a long time to be deposited).

Is the Platinum Card Worth Keeping After Double Rewards?

The Double Rewards promotion was meant to entice Platinum cardholders to keep the card despite its $699 annual fee, even though its multitude of travel benefits are much less useful right now. When Double Rewards draws to a close, then, does it still make sense to keep the Platinum Card around?

Many cardholders may have only been tempted to open the Platinum Card during the early days of Double Rewards itself, so in this case, you won’t have to make a decision until early next year.

If you’re coming up to the annual renewal date of your card, though, you’ll want to ask yourself similar questions about the prospect of travelling over the next year or so and taking advantage of the benefits like Priority Pass lounge access and hotel elite status. While it seems likely that lounges will reopen and hotel elite privileges reinstated by the end of the year, how likely are you personally to travel enough and take advantage?

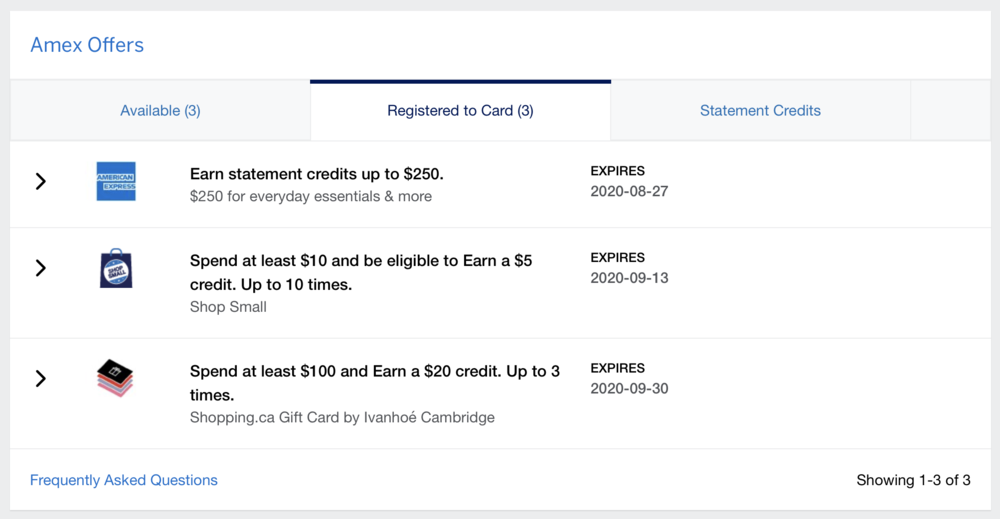

Another factor that could help offset the $499 net annual fee (taking into account the $200 annual travel credit) is the wealth of merchant offers that American Express has been offering recently, which points towards a larger trend that US-style Amex Offers could very well be here to stay in Canada.

In the past couple months alone, Platinum cardholders have received $250 towards everyday essentials, up to $50 in statement credits via Shop Small, and up to $60 in statement credits on Ivanhoé Cambridge shopping gift cards – offsetting over 70% of the net annual fee if you were to maximize them, and who knows what other offers will show up next.

If you plan to be using the Platinum Card a fair bit on your daily spending going forward – perhaps not a bad idea given Amex’s harsher stance on unprofitable behaviour during these economically challenging times – then I could easily see it remaining a valuable card even after Double Rewards is finished, as long as Amex continues to put out merchant offers and you have a somewhat optimistic view on the future of travel.

Conclusion

One week from now, the Double Rewards promotion on the American Express Platinum Card will be consigned to the history books as what was likely the most generous credit card promotion we ever did see in Canada, at least for a very long time.

For Platinum cardholders, this week is all about loading up on purchases to take advantage of the doubled earning rate and deciding whether to cash out their MR points at the very tempting rate of 2 cents per point; after that, the Platinum will be “just another American Express card”, and everyone will need to decide whether to keep it around for the long-term or make off with their gains.

So do you get the max points just using your amex to book on aircanada website and booking.com for hotel. Or do you need to use the amex website or app to book?

I booked on the ac website and cost was 575 but in the amex app i can book same flights for 410$ And the ticket class was full points value. Oh man so confusing __

Hi Ricky,

I wonder what your thoughts are on a “refundable hotel trick” to get the double points and then refund after the promo. Do you think they would claw back the points at regular rate or the doubled rate in which they were earned?

Thanks

Probably the regular rate, since that’s been happening to refunds even during the promotion. But I wouldn’t overdo it, because it’s a pretty easy behaviour to detect.

Great article. I find the cash out question an interesting psychological problem. Lots of people are hesitant to cash out their Amex points at 2cpp but at the same time very few people are interested in buying Avios or Aeroplan points at 2cpp. ( essential the same thing ).

Just goes to show how irrational we can be about our points, as much as we like to think otherwise.