If you’re a fan of maximizing your rewards, travelling for less, or getting a little extra from your investment strategy, this is a promotion worth noting.

From May 1 to July 31, 2025, TD Direct Investing is giving new and existing clients the chance to earn up to 1,000,000 Aeroplan points when you transfer external assets into a TD Direct Investing account.1

Whether you’re investing for retirement, a home, or your next trip, this offer is an exceptional opportunity to earn valuable points while consolidating your finances.

Let’s take a closer look at how this offer works, why TD Direct Investing is a top choice for self-directed investors, and how to take full advantage of the rewards.

In This Post

How the TD Direct Investing Aeroplan Take Flight Offer Works

The promotion rewards clients with tiered Aeroplan points based on the total value of external assets transferred into an eligible TD Direct Investing account.1

You must register for the offer using the promo code AEROPLAN2025 by July 31, 2025, and initiate a transfer of $10,000 or more within 30 days of registering for the offer.

The tiers start at $10,000 for 10,000 Aeroplan points and go all the way up to 1,000,000 points for transfers of $2 million or more.

Bonus points are paid out in three instalments as long as your balance is maintained:

- 25% by November 30, 2025

- 25% by April 30, 2026

- 50% by August 31, 2026

For example, If register for the promotion before July 31, 2025 and transfer $250,000 within 30 days, you’ll receive 37,500 Aeroplan points by November 30, 2025, another 37,500 points by April 30, 2026, and the remaining 75,000 by August 31, 2026.

You must maintain the full value of your qualifying assets in your account(s) throughout the entire holding period. If you withdraw more than 5% of your balance, you’ll forfeit any remaining points.

Qualifying assets must come from an external financial institution that’s not part of TD Bank Group. Transfers from TD Canada Trust, TD Wealth, or TD Direct Investing accounts are not eligible for this offer.

Also, assets that have previously received bonuses from other TD promotions are excluded.

Why Aeroplan Points Are So Valuable

Aeroplan is one of the most flexible and rewarding loyalty programs in Canada, with flight redemptions available on Air Canada and over 45 airline partners.

Whether you’re looking to fly short-haul in economy or enjoy lie-flat seats in international business class, Aeroplan offers tremendous value, especially when used strategically.

For example, a one-way business class flight on ANA from Vancouver to Tokyo can cost as little as 55,000 Aeroplan points. With the highest tier in this offer, that’s enough for over nine round trip business class flights to Japan, a dream trip for any Asia-bound traveller.

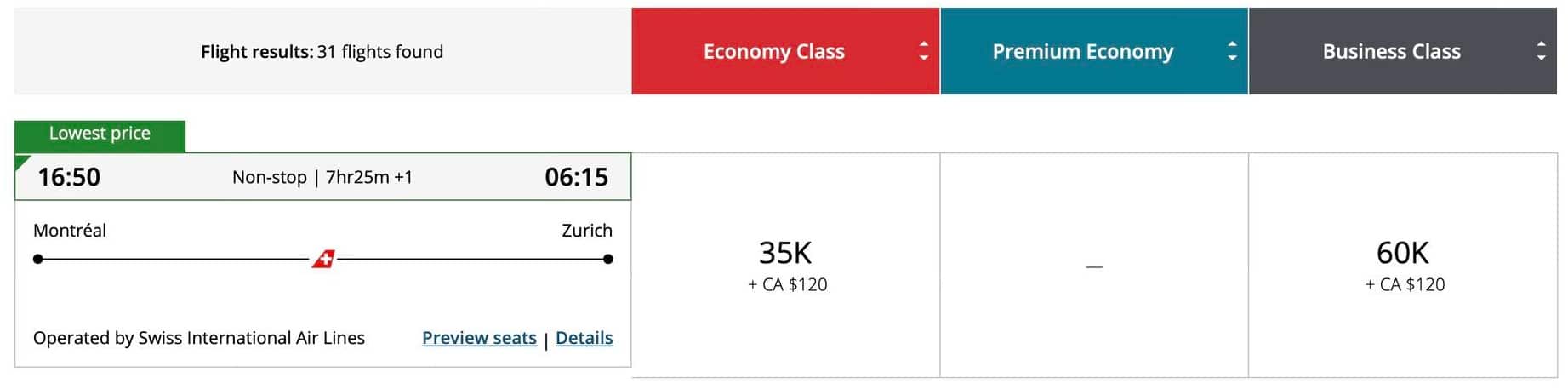

And it’s not just limited to ANA. If Europe is calling, a one-way business class flight from Montreal to Zurich on SWISS can go for as low as 60,000 Aeroplan points.

And with Aeroplan’s vast network of 45+ airline partners and stopovers for just 5,000 extra points, you can stretch your points further than almost any other program in Canada.

Whether you’re planning to fly in style or stretch your points on multiple economy redemptions, this offer could be your chance to boost your balance significantly—and start booking the kinds of trips you didn’t think were possible.

Eligible Accounts and Transfers

This offer applies to a broad selection of account types, including personal and corporate investment accounts:

- Cash (single or joint account holder)

- Margin (single or joint account holder)

- Tax-Free Savings Account (single account holder) (TFSA)1

- Registered Retirement Savings Plan (single account holder) (RRSP)1

- Registered Education Savings Plan (single account holder) (RESP)2

- Self-Directed Locked-In Retirement Accounts (LIRA)1

- Self-Directed Locked-In Retirement Savings Plan (LRSP)3

- Corporate Account

Account(s) not eligible for the offer include:

- Any non-personal accounts other than corporate

- Retirement Income Fund (RIF)1

- Life Income Fund (LIF)1

- Registered Disability Savings Plan (RDSP)1

- First Home Savings Account (FHSA)1

You’ll need to transfer net new assets from outside the TD ecosystem. That includes stocks, ETFs, GICs, mutual funds, and cash. Transfers from another TD account, such as TD Wealth or TD Direct Investing, aren’t eligible.

Credit Card Requirement: Which Cards Qualify

In order to participate, you’ll also need to hold an eligible TD Aeroplan credit card in good standing as of July 31, 2025, and keep it active until August 31, 2026.

The list of eligible TD Aeroplan credit cards includes the following:

- TD® Aeroplan® Visa Infinite Privilege* Card

- TD® Aeroplan® Visa Infinite* Card

- TD® Aeroplan® Visa Platinum* Card

- TD® Aeroplan® Visa* Business Card

But this isn’t just a technical requirement. It’s also a great way to accelerate your Aeroplan earning strategy.

TD Aeroplan cards are among the most rewarding co-branded cards in Canada, offering generous welcome bonuses, high earn rates on everyday purchases, and built-in travel benefits that enhance your Aeroplan membership.

| Credit Card | Best Offer | Value | |

|---|---|---|---|

|

Up to 85,000 Aeroplan points†

$599 annual fee

|

Up to 85,000 Aeroplan points† | $871 | Apply Now |

|

Up to 40,000 Aeroplan points†

First Year Free

|

Up to 40,000 Aeroplan points† | $683 | Apply Now |

|

Up to 15,000 Aeroplan points†

First Year Free

|

Up to 15,000 Aeroplan points† | $329 | Apply Now |

Depending on the card, you could earn up to 85,000 Aeroplan points as a welcome bonus, points that stack perfectly with the Direct Investing bonus.

You’ll also earn up to 1.5–2x Aeroplan points on eligible purchases like groceries, gas, and travel, allowing you to keep growing your balance even after the investment bonus pays out.

On top of that, TD Aeroplan cards unlock preferred pricing on Aeroplan redemptions for Air Canada flights, and some cards even come with free first checked bags, Maple Leaf Lounge access, or Priority Airport Benefits when flying with Air Canada.

In other words, holding a TD Aeroplan card isn’t just about ticking a box. It’s about unlocking even more value from the points you earn through this investing promotion. If you don’t already hold one, now’s the perfect time to apply and double-dip on rewards.

What Makes TD Direct Investing a Strong Platform?

For anyone looking to manage their own portfolio, TD Direct Investing is a self-directed investing brokerage platform operated by TD Waterhouse Canada Inc., a subsidiary of The Toronto-Dominion Bank.

Clients can access markets using WebBroker, TD’s desktop trading tool, or use the mobile app to manage their account on the go. There’s also an Advanced Dashboard for active traders, complete with real-time quotes, customizable layouts, and streaming news.

You’ll also have access to a broad range of investment options. TD Direct Investing supports trading in Canadian and U.S. stocks, ETFs, mutual funds, bonds, and GICs. IPO participation is available too, as are tools for managing registered and non-registered accounts.

Cost Considerations

While TD Direct Investing isn’t the cheapest platform on the market, it’s competitive—especially when you factor in the size of the Aeroplan bonus.

Stock trades cost $9.99 each for most users, and drop to $7.00 if you trade at least 150 times per quarter. Options contracts cost an additional $1.25 per contract.

Mutual fund purchases are commission-free, and account maintenance fees are waived if your household holds at least $15,000 in assets across eligible TD Direct Investing accounts.

One thing to keep in mind is the $150 transfer-out fee per account if you choose to move your assets elsewhere later on.

That said, with a potential 1,000,000 Aeroplan points on the table, the upfront value far outweighs that cost for most clients.

How to Qualify and Optimize the Offer

To make the most of the TD Direct Investing Aeroplan offer, timing and strategy matter.

Start by registering for the offer using the promo code AEROPLAN2025 by July 31, 2025. You’ll have 30 days from registration to initiate your transfer, and 60 days to complete it.

Additional contributions can be made up until August 31, 2025, and will count toward your qualifying total.

To receive your full bonus, maintain your Aeroplan-eligible credit card and keep your account balance intact until August 31, 2026. Avoid withdrawing more than 5% of your transferred assets or you’ll risk forfeiting remaining points.

If you’re just shy of a higher tier, consider topping up your account or consolidating across multiple TD accounts (including household-linked accounts) to reach a bigger bonus.

Conclusion

The TD Direct Investing 2025 Aeroplan Take Flight Offer is one of the most rewarding brokerage promotions we’ve seen in Canada.

With the chance to earn up to 1,000,000 Aeroplan points, it bridges the gap between financial strategy and travel rewards in a way that’s hard to ignore.

If you’ve been thinking about consolidating your investments or switching platforms, this offer makes it well worth doing so. Add in the ability to pair the promotion with a TD Aeroplan credit card, and you’re looking at an incredibly powerful combo for growing your points balance.

Whether you’re chasing a bucket-list trip or just want a smarter way to invest, this promotion gives you a unique way to achieve both goals at once.

Disclaimer

1Refers to the TD Waterhouse Self-Directed Retirement Savings Plan, TD Waterhouse Tax-Free Savings Account, TD Waterhouse Self-Directed Locked-In Retirement Account, TD Waterhouse Self-Directed Retirement Income Fund, TD Waterhouse Self-Directed Life Income Fund, TD Waterhouse Registered Disability Savings Plan, and the TD Waterhouse Self-Directed First Home Savings Account.

2Refers to the TD Securities Inc. Self-Directed Education Savings Plan (RESP)3Refers to the TD Waterhouse Self-Directed LRSP (Locked-in Retirement Savings Account) under Federal pension legislation.

All trademarks are the property of their respective owners.

®Aeroplan is a registered trademark of Aeroplan Inc., used under license.

®The Air Canada maple leaf logo is a registered trademark of Air Canada, used under license.

*Trademark of Visa International Service Association and used under license.

TD Direct Investing, TD Wealth Financial Planning and TD Wealth Private Investment Advice are divisions of TD Waterhouse Canada Inc., a subsidiary of The Toronto-Dominion Bank.

TD Easy Trade™ is a service of TD Direct Investing, a division of TD Waterhouse Canada Inc., a subsidiary of The Toronto-Dominion Bank.

TD Wealth Financial Planning Direct is a service offering from TD Wealth Financial Planning, a division of TD Waterhouse Canada Inc., a subsidiary of The Toronto-Dominion Bank.

TD Wealth Private Investment Counsel represents the products and services offered by TD Waterhouse Private Investment Counsel Inc., a subsidiary of The Toronto-Dominion Bank.

TD Wealth Private Banking services are offered by The Toronto-Dominion Bank.

TD Wealth Private Trust services are offered by The Canada Trust Company.

TD Bank Group means The Toronto-Dominion Bank and its affiliates, who provide deposit, investment, loan, securities, trust, insurance and other products or services.