American Express Membership Rewards (MR) points are by far the most powerful rewards currency in Canada.

Membership Rewards points excel in pretty much every metric: they are extremely easy to earn, they offer very good value on the redemption side, and as a transferable points currency, the flexibility they provide is unparalleled.

If you had to pick one rewards program in Canada to concentrate on, Amex Membership Rewards should be at the top of your list. Read this guide to find out the many reasons why this is the case.

Earning American Express Membership Rewards Points

American Express Membership Rewards points can be earned in a number of ways, including the following:

- Welcome bonuses, spending, and upgrades on credit cards that earn Membership Rewards points

- Referral bonuses through the Refer-a-Friend program

- Amex Offers

Credit Card Welcome Bonuses

Signing up for American Express credit cards that earn MR points is the best way to build up your points balance, as American Express is known for offering high welcome bonuses if you’re able to meet the minimum spending requirement.

In fact, there are six American Express credit cards that earn MR points to choose from – four personal cards and two business cards.

Looking closer, here’s the list of the available cards that you can use to earn American Express MR points:

Credit Card

Best Offer

Value

130,000 MR points

$1,794

Apply Now

70,000 MR points

$1,676

Apply Now

110,000 MR points

$1,581

Apply Now

40,000 MR points

$846

Apply Now

15,000 MR points

$372

Apply Now

10,000 MR points

$242

Apply Now

Within the personal card category, the flagship American Express Platinum Card tends to come with the highest welcome bonus, albeit paired with a hefty annual fee of $799 (all figures in CAD). This annual fee is offset by some strong benefits, including an annual $200 travel credit. as well as a $200 restaurant credit, effectively making the annual fee $399.

- Earn 80,000 MR points upon spending $10,000 in the first three months

- Plus, earn 30,000 MR points upon making a purchase in months 15–17 as a cardholder

- Earn 2x MR points on all dining and travel purchases

- Receive an annual $200 travel credit

- Receive an annual $200 dining credit

- Transfer MR points to Aeroplan, The British Airways Club, Flying Blue, and other frequent flyer programs for premium flights

- Unlimited airport lounge access for you and one guest at Priority Pass, Plaza Premium, Centurion, and other lounges

- Credits and rebates for daily expenses throughout the year with Amex Offers

- Bonus MR points for referring family and friends

- Annual fee: $799

The American Express Gold Rewards Card has a lower annual fee of $250, and with it, a lower welcome bonus. You’ll also get four complimentary visits to Plaza Premium Lounges and a $100 travel credit.

- Earn 5,000 MR points upon spending $1,000 in each of the first 12 months, up to 60,000 MR points

- And, earn 10,000 MR points upon spending $4,000 in the first three months as a cardholder

- Also, receive an annual $100 travel credit and a $50 NEXUS credit

- Transfer MR points to Aeroplan, The British Airways Club, Flying Blue, and other frequent flyer programs for premium flights

- Plaza Premium membership with four annual lounge passes

- Credits and rebates for daily expenses throughout the year with Amex Offers

- Bonus MR points for referring family and friends

- Annual fee: $250

The American Express Cobalt Card offers a much lower welcome bonus than the Platinum Card and the Gold Card, but it has the best earning rates for daily spending in the country. The annual fee comes in the form of $12.99 monthly fee.

- Earn up to a total of 15,000 MR points upon spending $750 in each of the first 12 months

- Earn 5x MR points on groceries, restaurants, bars, and food delivery

- Earn 3x MR points on eligible streaming services

- Earn 2x MR points on gas and transit purchases

- Transfer MR points to Aeroplan, The British Airways Club, Air France KLM Flying Blue, Marriott Bonvoy, and more

- Enjoy the exclusive benefits of being an American Express cardholder

- Bonus MR points for referring family and friends

- Monthly fee: $12.99

Lastly, the American Express Green Card is the only card in the lineup that earns MR points and has no annual fee.

- Earn 10,000 MR points upon spending $1,000 in the first three months

- Plus, earn 1x MR points on all purchases

- Transfer points to airlines or hotels

- Amex Offers and cardholder benefits

- Annual fee: $0

Looking at the American Express business credit cards, the Business Platinum Card from American Express is the best in terms of earning MR points from a consistently strong welcome bonus. Like its personal counterpart, the annual fee is $799, and it comes with a $200 annual travel credit and excellent lounge access.

- Earn 90,000 MR points upon spending $15,000 in the first three months

- Plus, earn 40,000 MR points upon making a purchase in months 15–17 as a cardholder

- And, earn 1.25x MR points on all purchases

- Also, receive a $200 annual travel credit

- Transfer Membership Rewards points to Aeroplan, The British Airways Club, Flying Blue, and other frequent flyer programs for premium flights

- Unlimited airport lounge access for you and one guest at Priority Pass, Plaza Premium, Centurion, and other lounges

- Credits and rebates for business expenses throughout the year with Amex Offers

- Bonus MR points for referring family and friends

- Qualify for the card as a sole proprietor

- Annual fee: $799

Another option to consider is the American Express Business Gold Rewards Card, which has an annual fee of $199.

- Earn 40,000 MR points upon spending $7,500 in the first three months

- Also, earn 10,000 MR points in each calendar quarter you spend $20,000

- Transfer MR points to Aeroplan, The British Airways Club, Flying Blue, and other frequent flyer programs for premium flights

- Credits and rebates for daily expenses throughout the year with Amex Offers

- Bonus MR points for referring family and friends

- Enjoy the exclusive benefits of being an American Express cardholder

- Annual fee: $199

Credit Card Spending

Beyond the chunk of points you’ll earn through the welcome bonus, you’re also able to continue earning MR points through day-to-day spending on each of the cards. Fortunately, American Express cards have some of the best earning rates in Canada, so it shouldn’t take long to rack up a tidy amount of points.

The number of MR points earned will depend on the card you are using, what category your spending falls within, and in some cases, how much you are spending.

Here are the rates at which each of the cards earns MR points:

American Express Platinum Card

- 2 MR points per dollar spent on dining and food delivery purchases in Canada

- 2 MR points per dollar spent on eligible travel purchases

- 1 MR point per dollar spent on all other eligible purchases

American Express Gold Rewards Card

- 2 MR points per dollar spent on gas, grocery, and drugstore purchases

- 2 MR points per dollar spent on eligible travel purchases

- 1 MR point per dollar spent on all other eligible purchases

- 5 MR points per dollar spent on restaurant, food delivery, and grocery purchases (up to a maximum of $2,500 per month)

- 3 MR points per dollar spent on streaming services

- 2 MR points per dollar spent on gas, public transit, and eligible rideshare purchases in Canada

- 1 MR point per dollar spent point on all other eligible purchases

- 1 MR point per dollar spent on all eligible purchases

Business Platinum Card from American Express

- 1.25 MR points per dollar spent on all eligible purchases

American Express Business Gold Card

- 1 MR point per dollar spent on all eligible purchases

American Express Business Edge Card (no longer open for applications)

- 3 MR points per dollar spent on office supplies, electronics, rideshare services, gas, and eats and drinks (including food delivery services, but excluding groceries)

- 1 MR point per dollar spent on all other eligible purchases

Credit Card Upgrades

In addition to earning points through welcome bonuses and everyday spend, American Express also has targeted upgrade offers on some of their cards that earn MR points.

You’ll notice upgrade offers on your Amex Offers dashboard, and you’ll likely also receive an email about them, too.

If you get an upgrade offer, you’ll be responsible for paying the annual fee on the new card, but you’ll also receive bonus MR points as an incentive to upgrade.

It’s worth noting that you’re always able to call American Express to see if you are eligible for an upgrade offer. That being said, you’re also able to wait and see if you get a promotional email inviting you to upgrade.

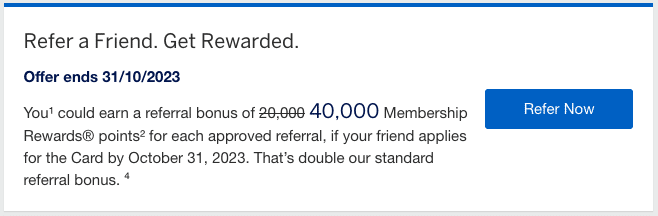

Refer-a-Friend

Another great way to collect American Express MR points is through the American Express Refer-a-Friend program.

With this program, if you have an American Express card, you can send a friend or family member a unique link through which they can apply for the same card or another eligible card. Once your friend’s application is approved, you’ll receive the corresponding number of points as set out by the program.

The number of MR points that you’ll earn will depend on the card you’re referring from and whether or not American Express is currently running a referral promotion.

It’s important to keep in mind that points will only be awarded if your friend’s application is approved, and that the points can take a few weeks to post to your account.

When there is no promotion running, you can expect to earn the following point quantities for successful referrals:

Personal Cards

- American Express Platinum Card: 15,000 MR points per referral, to a maximum of 225,000 points per calendar year

- American Express Gold Rewards Card: 7,500 MR points per referral, to a maximum of 112,500 points per calendar year

- American Express Cobalt Card: 5,000 MR points per referral, to a maximum of 75,000 points per calendar year

- American Express Green Card: 2,500 MR points per referral, to a maximum of 37,500 points per calendar year

Business Cards

- American Express Business Platinum Card: 20,000 MR points per referral, to a maximum of 225,000 points per calendar year

- American Express Business Gold Card: 15,000 MR points per referral, to a maximum of 75,000 points per calendar year

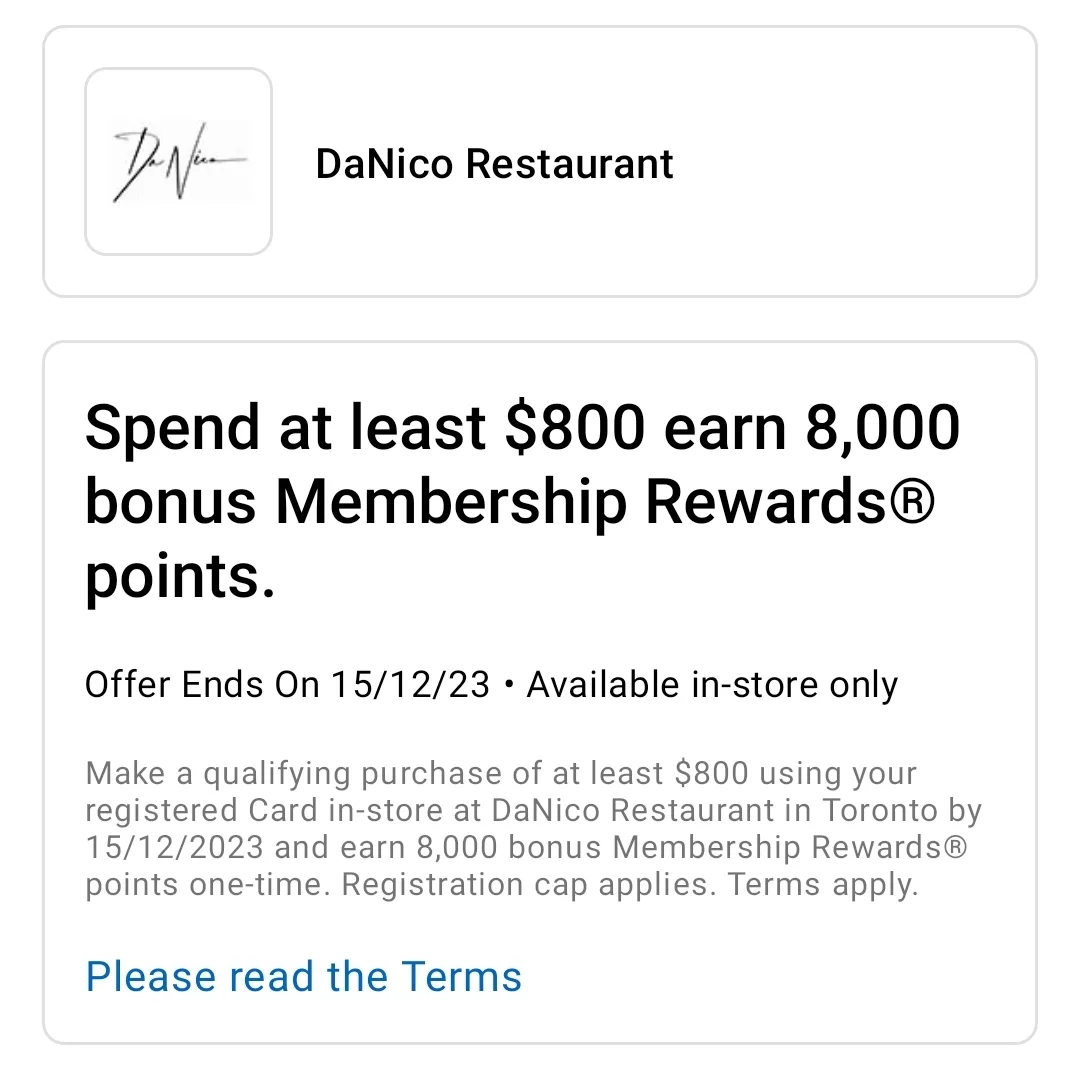

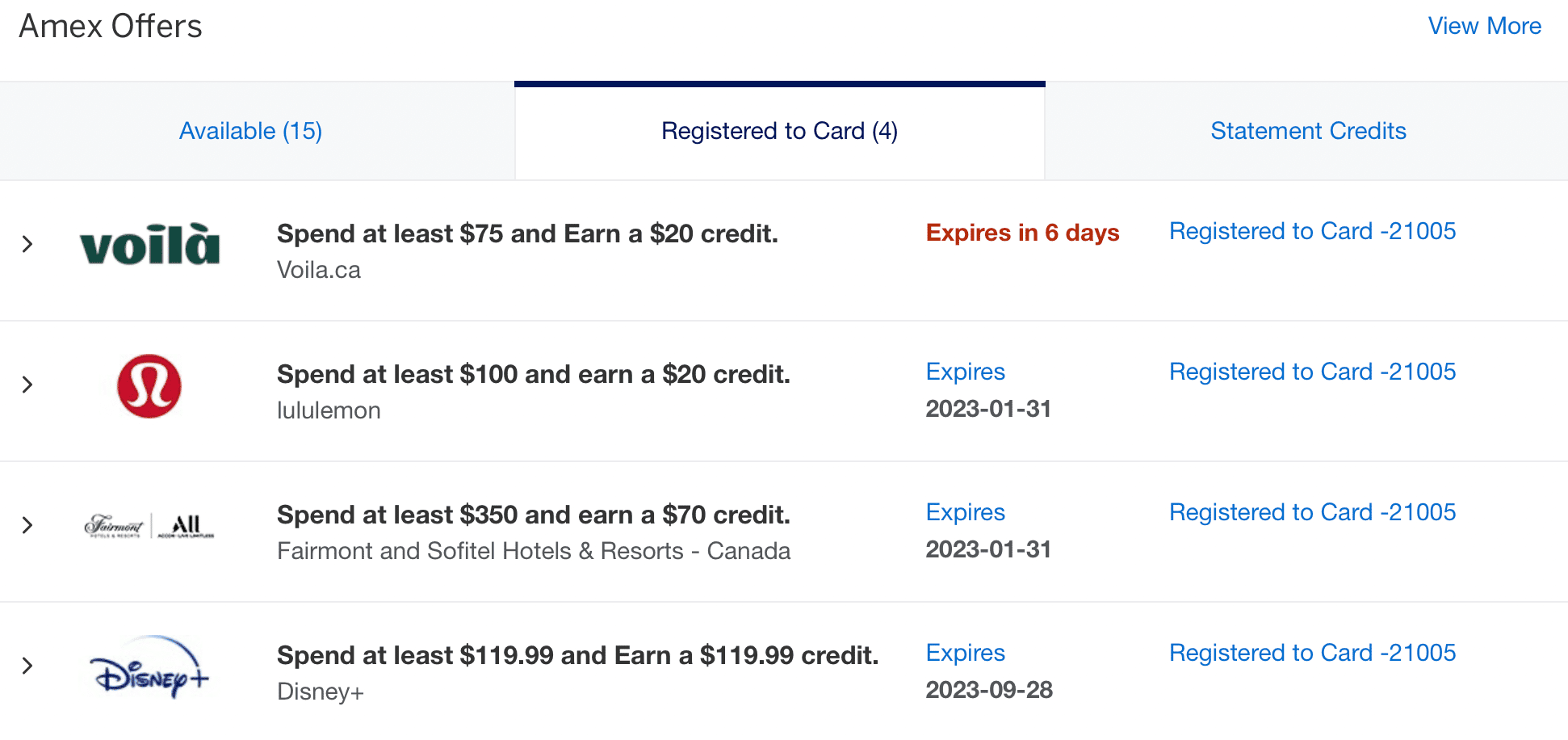

Amex Offers

Every American Express card comes with a series of rotating promotions called Amex Offers. A majority of Amex Offers provide statement credits; however, you can usually find a few that offer MR points.

Some of these Amex Offers will earn you extra MR points per $1 spent, while others will hand out a pre-determined quantity of points in a single go after you hit a spending threshold at specific stores or with specific businesses.

In order to be eligible for Amex Offers, you’ll need to register for each offer individually through your American Express account. You’ll then need to meet the necessary requirements set out by that offer before the offer’s expiration date.

Keep in mind that each card has its own unique offers, so if you have more than one American Express card, you’ll want to make sure you check all the offers through your online profile or the mobile app.

Redeeming American Express Membership Rewards Points

In the same way that there are many ways to earn American Express Membership Rewards points, there are also lots of options when it comes to redeeming your hard-earned points.

When debating your MR redemption choices, you’ll want to consider which redemption route offers the best opportunity to maximize the value of your points.

In general, transferring MR points to airline and hotel partner programs is often the best way to get the most value out of the American Express Membership Rewards program.

However, there’s also a variety of other ways to redeem MR points that still provide great value, and we’ll go over these options below.

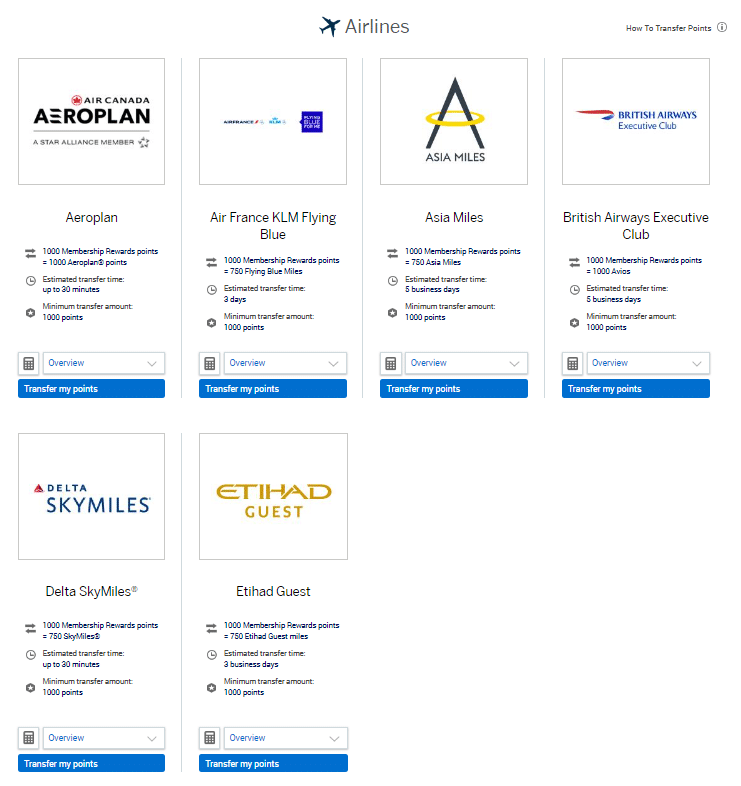

Transferring to Partner Programs

Generally speaking, the best choice for redeeming MR points is by transferring them to airline and hotel loyalty programs.

The American Express Membership Rewards program is partnered with six airlines and two hotel loyalty programs to which you can transfer your MR points.

The airline loyalty partner programs and the corresponding transfer ratios are as follows:

- Air Canada Aeroplan: 1:1

- Air France KLM Flying Blue: 1:1

- The British Airways Club (Avios): 1:1

- Cathay Pacific Asia Miles: 1:0.75

- Delta SkyMiles: 1:0.75

- Etihad Guest: 1:0.75

In this category, transferring MR points to the Aeroplan or The British Airways Club programs offer the best transfer rate of 1:1, but you must transfer a minimum of 1,000 MR points, and points transfers must be in increments of 100.

Comparatively, the other four airline programs have a less favourable transfer rate of 1:0.75 and follow the same rules for transfer amounts.

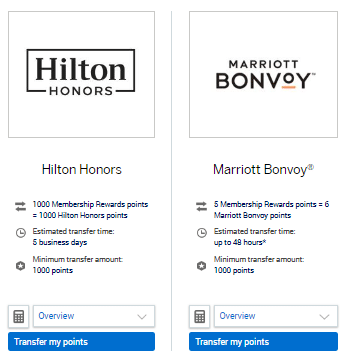

If you’re hoping to use your MR points to book a free hotel stay, you’re able to transfer points to the following hotel loyalty programs:

In this case, MR points can be transferred to Marriott Bonvoy at a rate of 5:6, and to Hilton Honors at a rate of 1:1, following the same rules for transfer quantities as above.

In some cases, transfers are instant, while in others, you’ll have to wait a few days.

One of the main reasons why Amex MR points are so powerful is that by earning a single points currency, you can transfer them to airline loyalty programs in all three major airline alliances: Air Canada Aeroplan (Star Alliance), The British Airways Club (oneworld), and Air France KLM Flying Blue (SkyTeam).

Within each of the programs, not only can you redeem points for flights with the member airline, but you can also redeem them for flights with other alliance members, as well as external partner airlines.

In other words, earning MR points gives you access to dozens of airlines for redemptions, which are accessible through the transfer partners.

The best program to transfer your MR points to will largely depend on your own travel goals, but you’ll generally get the most value by transferring to Aeroplan, Air France KLM Flying Blue, or The British Airways Club.

Air Canada’s Aeroplan program is great for unlocking Star Alliance partner flights at solid redemption rates. Some of the most aspirational products you can book using the program include ANA First Class, Lufthansa First Class, Singapore Airlines business class, and much more.

We have a comprehensive guide to Aeroplan redemptions, which you can find by clicking through below.

Air France KLM Flying Blue is arguably the best program for booking transatlantic flights with Air France or KLM in economy, premium economy, or business class, due to the very attractive award pricing.

You can also book flights with other SkyTeam airlines, such as China Airlines, as well as external partners, such as Etihad Airways.

British Airways Club Avios are an esxcellent option for short-haul flights in parts of Europe, Asia, and Australia, and can also be used to book Qatar Airways Qsuites – widely considered the best business class in the world.

Plus, you can instantly transfer your British Airways Avios into different “flavours” of Avios, since other airline loyalty programs (Aer Lingus AerClub, Finnair Plus, Iberia Plus, and Qatar Airways Privilege Club) also use it as a points currency.

When transferring to hotel programs instead airline programs, it’s harder to get the same level of outsized value; however, there’s still situations where it could make sense.

Generally speaking, transferring to Marriott Bonvoy will get your more value than transferring to Hilton Honors due to the value of Bonvoy points and the more favourable transfer rate.

It’s important to note that once you transfer MR points to another program, you won’t be able to transfer them back, so it’s always best to have a specific redemption in mind before initiating your transfer to avoid any post-transfer regret.

Plus, if you can time your redemption during a transfer bonus event, you can unlock even more value. Be sure to sign up for our newsletter to be the first to know about transfer bonus events!

Fixed Points Travel Program

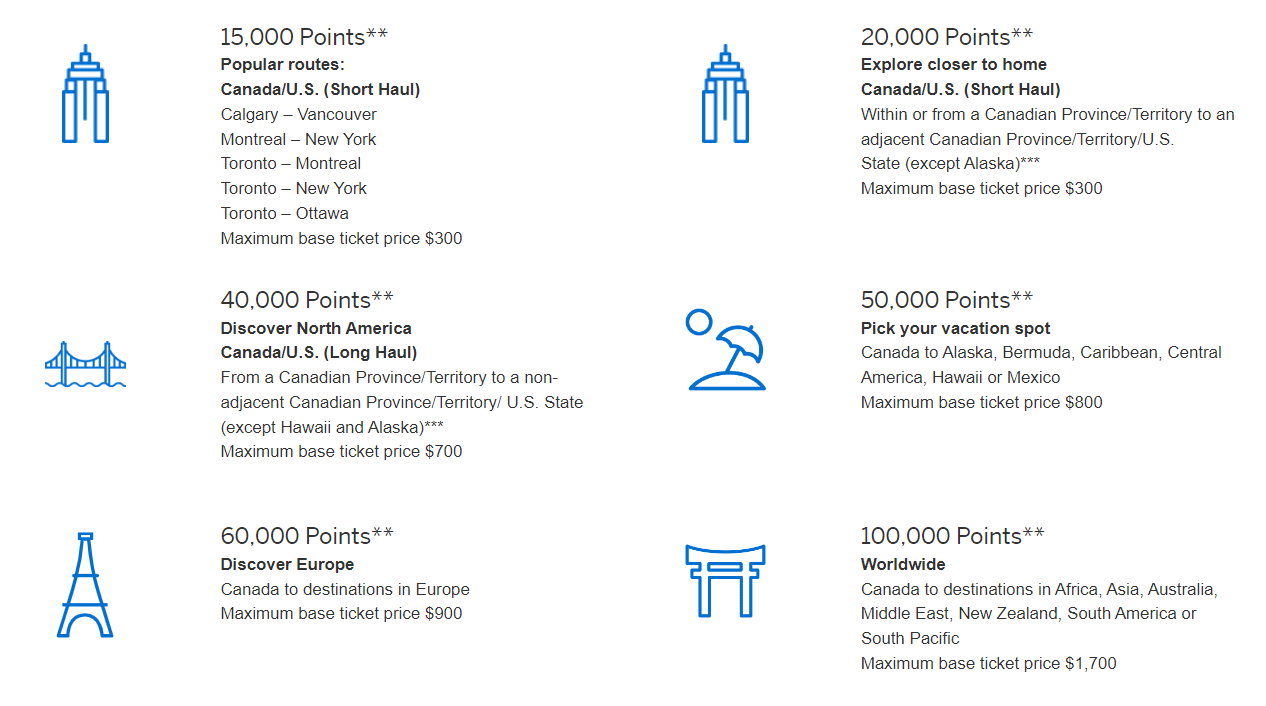

Another option for redeeming your MR points for good value is by booking flights through the American Express Fixed Points Travel program.

When booking flights through the Amex travel portal, you can use a specific number of MR points to cover the base ticket price of your fare, up to a certain amount (based on your chosen route).

To determine the number of MR points needed for each flight redemption, you’ll need to find out which the program’s six categories your flight falls within, with the categories being based primarily on the distance flown.

The categories are as follows:

Canada/US Popular Short-Haul Flights

This category offers redemptions for popular short-haul routes at a rate that is incrementally lower than the regular short-haul category below. The eligible routes include Calgary–Vancouver; Montreal–New York; Toronto–Montreal; Toronto–New York; and Toronto–Ottawa.

For a round-trip economy flight within this category, you’ll need to redeem 15,000 MR points, with a maximum base ticket price of $300. This redemption offers a value of 2 cents per MR point.

Canada/US Other Short-Haul Flights

This category allows you to redeem MR points for flights from a Canadian province or territory to a destination within the same province or in an adjacent Canadian province, Canadian territory, or US state (excluding Alaska).

For a round-trip economy flight within this category, you’ll need to redeem 20,000 MR points, with a maximum base fare price of $300, giving you a value of 1.5 cents per MR point.

Another option is to redeem 50,000 MR points for a maximum base fare of $800 in business class, offering a value of 1.6 cents per MR point.

Canada/US Long-Haul Flights

This category offers redemptions on flights travelling from a Canadian province or territory to a non-adjacent Canadian province, Canadian territory, or US state (excluding Alaska and Hawaii).

For a round-trip economy flight within this category, you’ll need to redeem 40,000 MR points for a maximum base ticket fare of $700. This provides a 1.75 cents per MR point value.

For a round-trip business class ticket, you’ll need to redeem 100,000 MR points for a maximum base fare of $1,800, giving you a value of 1.8 cents per MR point.

Canada to Specific Destinations

The last three categories offer flights to destinations outside of Canada and the US (plus Hawaii and Alaska).

North America and Central America

For round-trip economy flights from anywhere in Canada to Alaska, Bermuda, the Caribbean, Central America, Hawaii, or Mexico, you’ll need to redeem 50,000 MR points. With a maximum ticket price of $800, this redemption offers a value of 1.6 cents per MR point.

Round-trip business tickets within the same category require 120,000 MR points for a maximum base fare price of $2,100, offering a value of 1.75 cents per MR point.

Europe

For round-trip economy flights from anywhere in Canada to any destination in Europe, you’ll need to redeem 60,000 MR points for a maximum base fare price of $900. This exchange offers a redemption value of 1.5 cents per MR point.

If you’d prefer to travel business class, you can get a round-trip ticket for 140,000 MR points. This covers a maximum base fare of $2,500 and offers a redemption value of 1.79 cents per MR point.

Worldwide

The final redemption category is for flights from anywhere in Canada to destinations in Africa, Asia, Australia, Middle East, New Zealand, South America, or the South Pacific.

In this category, you’re able to redeem 100,000 MR points for a round-trip ticket in economy class. This redemption can have a maximum base fare of $1,700 and is valued at 1.7 cents per MR point.

You’re also able to book a round-trip business class ticket for 250,000 MR points, with a maximum base fare of $4,500. This offers a value of 1.8 cents per MR point.

Comparing all the redemption categories, the best value can be found in redeeming your MR points at 2 cents per point for a round-trip economy flight on one of the popular short-haul routes found in the first category.

To achieve this value, you’ll need to redeem the fixed amount of MR points (15,000 points) for the maximum base ticket price ($300).

That being said, you’ll want to compare all of your options when it comes to booking your flight, as you can still get better value from transferring your MR points to Aeroplan or The British Airways Club.

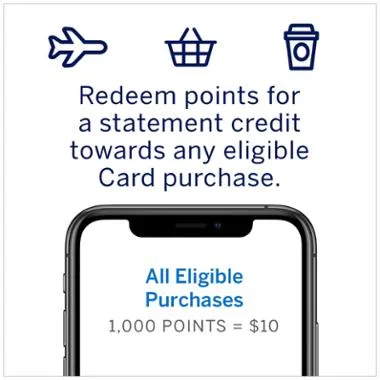

Statement Credits

Membership Rewards points can also be redeemed for statement credits. This is probably the quickest and easiest way to redeem your MR points; however, you’ll likely get better value by transferring to a partnered loyalty program instead.

When redeeming your points for statement credits, you’ll get a fixed rate of 1 cent per MR point. To access this option, you’ll also need to redeem a minimum of 1,000 MR points.

As stated above, when compared to loyalty program transfers or redemptions for a flight through the fixed-points travel program, redeeming MR points for statement credits provides significantly worse value.

That being said, there have been promotions, which raise the statement credit from 1 cent per point to 1.2 or 1.5 cents per point.

While you still won’t get quite the same value as transferring your MR points out or redeeming them for a flight, you’re definitely getting a lot closer at 1.5 cents per point.

What’s more, given that statement credit redemption s are by far the quickest way of redeeming your MR points, this can be of value if you find you need to offload your points in a hurry.

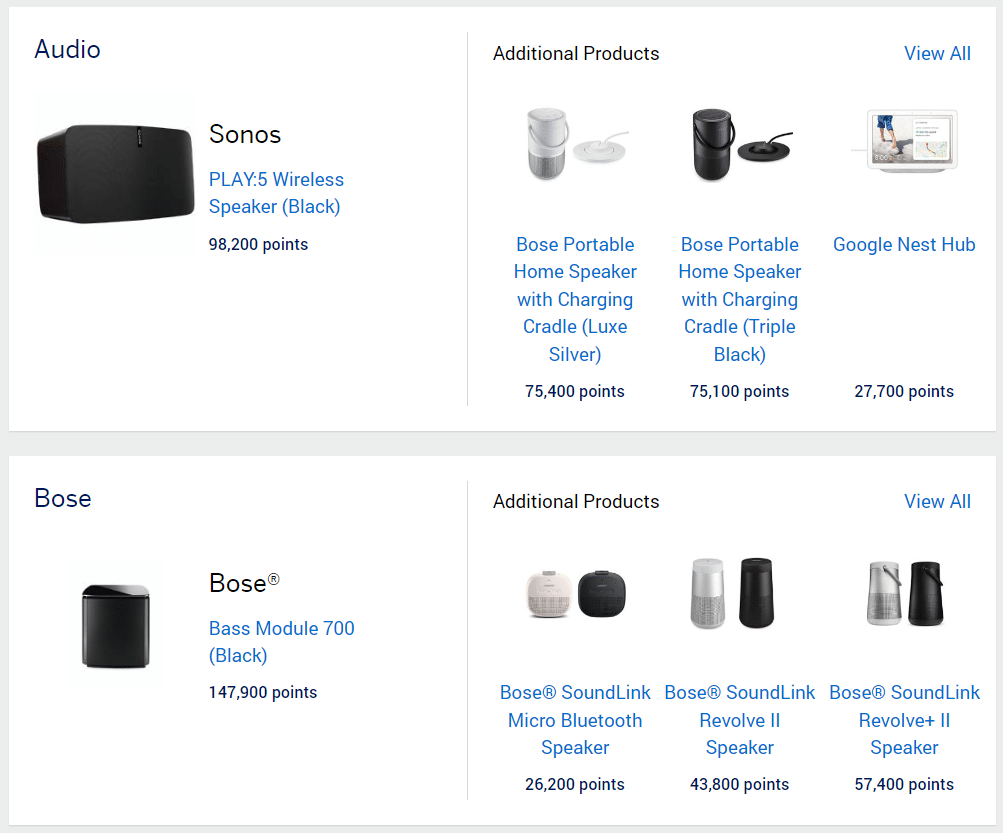

Other Options for Redeeming MR Points

Although additional redemption options for MR points do exist, they should all be avoided. This includes the options to redeem your points for gift cards, for purchases made on Amazon or with PayPal, or for overpriced items in the Amex online store.

Each of these options provides a redemption rate of less than 1 cent per point. This means that you will always be better off simply redeeming your points for a statement credit against your purchases, rather than buying a gift card or an overpriced item.

Transferring Points to Another Country

The final option for redeeming your MR points is by transferring them to an Amex Membership Rewards program in another country. In this case, if you hold an American Express card within a second (or third) country, you can transfer your MR points to that account.

For example, if you have an American Express US card that earns Amex US Membership Rewards points, you can transfer your Canadian MR points to your US Membership Rewards account.

MR points will be transferred based on the exchange rate, so you’ll end up with less US MR points than the number of Canadian MR points you started with. However, you’ll have access to more transfer partners in the US program, which may help you unlock flights that you don’t have access to through the Canadian MR transfer partners.

Conclusion

American Express’s Membership Rewards program is the strongest rewards program in Canada. There are lots of ways to earn MR points, including with generous welcome bonuses and referral bonuses, as well as some of the best category earning rates in the country.

The program also offers a wide array of transfer partners, allowing you to piece together your travel plans through several airline and hotel loyalty programs, or to redeem your points for fixed-rate flights at a decent value.

With so many redemption choices, make sure you take some time to get to know all of the options in order to make the best decision for your needs.

Amazing website full of good información

People like you give us happiness in this World full of negatives

I am Canadian and my brother is American

My question is

What is the best travel card for me and for him ?

Hi Ricky – newbie here, thanks for the amazing resource – looking to signup. I have the Bus. Platinum and focused on meeting the spend there (used your link btw) – couple of questions:

1. IS the AMEX Cobalt seen as ‘equal’ from points perspective with the Plat / Gold cards? (ie. I read somewhere they’re actually MR Select?) I wanted to get the Cobalt too and maximize the 5x, etc. leverage and link the two accounts together to just pool all the points in one if thats the case – can you confirm please?

2. Would you recommend a self referral to get a Gold card? (even this i think Id have to sign up seperately instead of adding a ‘supplementary’ card on my existing ‘Business Platinum’ to get the bonus right?

Anyway we can transfer Bonvoy points to MR points? 1.2 to 1?

So now points earned from Business edge can be transferred to aeroplan at 1:1?

Yes exactly.

Yes, correct.

Hi Ricky,

You should update this article now that the MR Select can be transfered to airline partners!

Agreed! Would love to have a fresh comparison between MR and MR select points re transfer ability etc. especially for people who can only have one card for now.

Any idea how often AMEX MR has bonus transfer offers for partners (Aeroplan, Marriott, etc.). Sounds like there was one last September for Marriott, but wondering if I should hold off on transferring now.

On the Emirates website it states that MR rewards are transferable to Skyrewards at a rate of 1:1. Is this a US only offer?

Yes, US only.

Can you transfer MR Select to Bonvoy, and then transfer to British Airways Avios?

Yes!

Hi I would just like to update that the transfer ratio to Marriott Bonvoy has gone back down to 1:1.2. Since I just transferred mine in the last week of 2020.

Just to now cause any confusion for people who just read short in this page and just skimmed through the top of the page.

Thanks for the update here! Guide updated.

I’ve held all AMEX MR cards at some point in the past 2 years…

1P mode, just referring to myself each time.

Bit concerned about DP’s of some people being “shut down” by AMEX indefinitely and having their balance of points disappear. I have no MR points at present but with their versatility would like to continue earning. Suggestions?

Amex Gold (personal) was the one I held longest ago (closed September 2019). Safe to self-refer again?

Yeah it’s a tricky one. I’d say you’re good to start again but this time be more conservative if you want to cancel the cards eventually. Only cancel after Month 12 if you need to, while asking for a refund of the annual fee that has posted, similar to the best practices down in the USA.

Was searching if, historically, there were any transfer bonuses from MR-S to Marriott Bonvoy, and I came across this

“After all, it would be no good earning 2 MR per dollar spent if one MR point were worth, say, less than a dollar.” I think you meant “less than a cent.” It would be nice if 1 MR = 1 dollar 😛

Anyways, do you know if there has ever been a transfer bonus from MR (MR-S) to Bonvoy? It seems that AMEX US had one earlier this year but unsure if Canadians had it as well. If so, I’m thinking of holding the MR-S points until there is a transfer bonus, if not looking to cancel the biz edge as its AF is coming up soon! Thanks in advance!

Thanks Eric! And now we know. 🙂