Annual fees.

Paying them sucks.

Sooner or later in this game, you will do so anyways. It will not be fun. It will probably be necessary, as the best deals are always lurking behind the largest paywalls.

I know I’m not a fan of paying fees. I suspect you aren’t, either. And the one person who, I’m certain, hates them with a fiery passion that can’t be matched by you and me combined is your “Player 2”.

Today, let’s talk candidly about how to lessen the sting of paying for your points. I’ve come up with four main strategies: dodging annual fees, mitigating them, overriding them, and bundling fees with other offers.

For those of you with Player 2s whose attitudes range from “tolerant of your hobbies” to “borderline excommunicado”, I’ll also be rating my methods on a scale of 1–5 (1 being easiest, 5 hardest) for ease of explanation to your significant other/mom/best friend.

Strategy #1: Dodge

Let’s get the obvious out of the way first: the simplest way to avoid paying annual fees is to dodge them entirely. This is usually done by taking advantage of banks’ cyclical offers, which will often guarantee a First Year Free rebate.

This is one of the basic pillars of Miles & Points, and indeed it’s where many people (including yours truly) started in their journey.

We used to see First Year Free offers from American Express, but these days it’s quite unlikely for those offers to return. American Express’s bonuses are simply too high.

Meanwhile, an offer from another issuer of $200–300 in points wouldn’t merit the effort to hit the minimum spend if you were dinged the typical annual fee of about $120 for a premium credit card. With the fee waiver, the labour required to meet the spend becomes worth it.

Alas, this category of First Year Free offers are at the mercy of the banks’ desire to make profits. Certain cards that might be “loss leaders” may have First Year Free some quarters and charge the full fee the next.

A good example of this is the Scotiabank Gold American Express, whose No FX Fees, strong 5x earning rate on dining and groceries, and signup bonus of 25,000 Scotia Rewards points probably don’t make Scotiabank a lot of money.

It doesn’t surprise me, therefore, that we haven’t seen a First Year Free offer on it in a while. If you do see such an offer, be assured it won’t last long and strike while the iron’s hot by applying.

What this means when it comes to using the “dodge” strategy is to maximize your value. A lot of cards, such as those earning bank-issued “monopoly money” internal points (like CIBC Aventura, BMO Rewards, etc.) are pretty much always First Year Free. You can apply another day.

Meanwhile, cards like the HSBC World Elite, offering First Year Free and $500+ in points and credits, are not. You do the math on which you’d prefer.

This is the simplest and most ubiquitous of the strategies for Miles & Points enthusiasts. For that reason, it gets a 1/5 “difficulty of explanation” score for Player 2.

Let’s be real, selling your boyfriend on the American Express Aeroplan Reserve‘s jaw-dropping $599 price tag is going to be much harder than a First Year Free BMO Air Miles World Elite. At the same time, this category is a “comfort zone” that you (and your Player 2) will need to exit if you want to attain the highest level of rewards.

Strategy #2: Mitigate

Do you remember ever making the following complaint to a friend or loved one?

“Yes, the annual fee is unavoidable, but that bonus is so high. I have to have it!”

Usually, you’re saying this about an American Express card, but it’s also typical of products such as the MBNA Alaska. Either way, the perplexed onlooker probably feels much like your wallet: unamused.

Mitigation can help offset this issue by eating some of the costs. There’s two ways to go about this: using cash back websites, or networking for referrals.

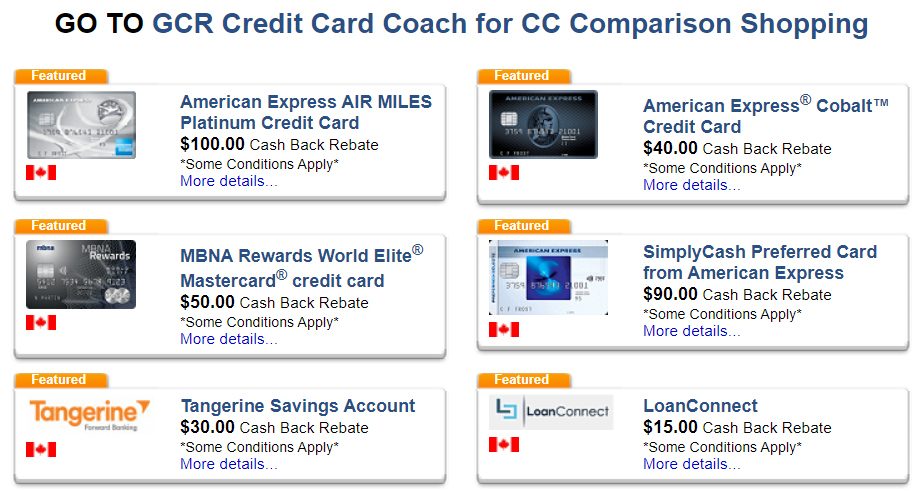

The first strategy requires the use of sites that offer cash-back rebates for applications. In Canada, 90% of the time when we allude to this, we are actually talking about Great Canadian Rebates, though there are other service providers as well.

The way this works, as you can see from above, is you’re offered a certain amount of cash back contingent upon you being approved for a credit card listed on their website. You’ll then be paid by your choice of cheque, Paypal, or Amazon.ca e-gift card within roughly two months.

The reason for this pause is for their backend IT to verify you’ve actually been approved for said card, and for the company paying you out to receive their promotional payment from the card’s issuer. If there’s a bit of a delay, don’t be afraid to reach out to customer service. Their website might be from 1999, but they’re really on the ball when it comes to assisting you.

A word of warning: sometimes, the rebate offer that offers cash back will not be as high as the best offer available for a credit card. This is particularly true when it comes to American Express business cards.

That brings us to the second part of mitigation: through networking.

Now, let me by crystal clear: it’s generally a violation of all issuers’ terms and conditions to use a stranger’s refer-a-friend link to apply for a credit card in exchange for monetary compensation.

On the other hand, if a close personal friend of yours who has access to such links were to, say, take you out for a night at the Kirov Ballet, and you felt such gratitude to them that when you wanted to apply for your next travel credit card via their link, then that would be using such programs as intended.

Whatever method is available to you, if you’re going to apply for a credit card, check if there’s a rebate available first, and weigh if the rebate is potentially worth fewer points!

In terms of difficulty for you to explain to a Player 2, I’d rate the cash back portals as 2/5 due the possibility of having to deal with customer service. Still, if your Player 2 is very frugal, they might encourage you to use them for more than just credit cards!

Strategy #3: Override

This probably sounds like something exciting where I give you a code that will hack the internet into giving you free credit cards. It’s nothing so exhilarating.

When I talk about “override,” it means looking into ways to get the fees waived entirely. The most common strategy, and one that you’ll hear about at all the internet carousing grounds of Miles & Points enthusiasts, is to get a promotional bank account from one of the Big 5 banks.

The offers are very similar. Each account will require you to maintain a minimum monthly balance of $5,000–6,000, depending on the bank, lest they charge you $30 in monthly fees. In return, you get a slew of banking benefits and an annual fee waiver up to $120–150 for one credit card issued by that bank.

This waiver can then be used on a “keeper” card, applied to a new signup, or used against a product with an unusually high annual fee, such as a product from the Visa Infinite Privilege line.

Here’s a list of the various accounts and their sign-up offers and features:

Patented caveat time: Your annual fee waiver only applies to a credit card from that bank. So don’t get a TD All-Inclusive if you have no interest in TD products.

Also, when the Big 5 banks say “maintain a minimum monthly balance”, they mean it. If you dip 4 cents under $6,000 at 4am on the 30th of the month, you’ll be assessed the monthly fee, though you might have luck getting this ignored by calling in. Might. If you’re out by more than that, you’re sorta toast.

The only exception to needing a minimum balance is Canadian Defence Community Banking from BMO, which is free for all current and former Canadian Armed Forces personnel and some members of their families. Its annual rebate is $30, but then again – no minimum balance requirement.

Which takes me organically to my next angle of attack: asking to have your annual fees waived.

You’d be amazed how, even during completely normal times, almost anyone can get an annual fee waiver. Usually it’s as simple as picking up the phone and just asking your bank to waive the fees.

You’re especially likely to succeed in this endeavour if you have a long history with the bank which issued the card, or hold a lot of assets or investments with them. Even more powerful is if you put a huge amount of spend on the card – banks love those interchange fees!

Still, even without these stipulations, you can often get your annual fee waived.

Maybe the card isn’t right for you and you need some more time to try it. Perhaps you can’t afford the annual fee this year because of some personal relationship difficulties.

Whatever the case may be, I’d like to tell you not to fabricate reasons to get a waiver, but if you soberly explain your case, you’d be surprised how often you can get rid of that pesky yearly charge.

I understand that calling can be long and tedious as a process, so I’ll share with you what happened when my friends and I called in for annual fee waivers to the Big 5. As always, your mileage will vary.

-

RBC: I was unable to get anything; a friend who has his mortgage with them got it waived on the WestJet World Elite.

- CIBC: Both I and multiple people have been able to request rebates with few issues. The Fredericton call centre particularly helpful.

- TD: I haven’t had a TD card in a while but know of one friend with no banks/investments/spend able to get an annual fee rebate on a cash back card.

- BMO: Very difficult to ask for a rebate; however, I and a friend have both gotten an annual fee rebate this year on different versions of their World Elite MasterCard (regular vs. cash back). Required a lot of arguing.

- Scotiabank: Anyone who knows me knows I have a lot of gripes with Scotia’s customer service. When it came to getting an annual fee waiver on the Scotia Gold Amex, it was surprisingly easy in my second year. I cancelled it later due to inactivity (I shop at a grocery store that’s Visa/MasterCard only).

The calling in method, though, is not for the faint of heart. I’d rate it a 5/5 in difficulty to sell to a Player 2, and quite daunting for anyone trying it the first time. Definitely gets easier with practice.

Strategy #4: Bundle

“Bundling” fees, as I put it, is for when you have a card you don’t want to cancel, and you tried to call in but couldn’t get an annual fee waiver (as is always the case with American Express cards). Alternatively, it’s for a card you just really, really want, you’re going to get, and want to get maximum value from.

The most common method to get a “bundle” is to try and get a retention offer: if the bank won’t write off the annual fee, maybe they will give you bonus points as a thank you for renewing your account, or at least give you a minimum spend to hit in return for the same.

You’ll have to call in to get such an offer manually applied to your account, but hey, apparently even Amex will sometimes begrudgingly proffer these.

As always, remain courteous when asking for your retention offer, but be firm. Explain that you may not be able to keep the card unless the bank makes it worth your while. Understand when you’re willing to cancel a card, and when maybe you’ll keep it even without an offer. Act on these instincts, and neither bully the customer service rep nor feel bullied into keeping a credit card.

Follow those rules and you’ll find that you will start getting a lot more retention offers, and feel less poorly about cancelling cards that maybe you didn’t really need any longer.

The other way to “bundle” and maximize the value of your credit cards is to get the most out of your supplementary cards.

We often overlook supplementary cards in our community, and as a bachelor I know I’m not likely to be issuing one anytime soon. But that doesn’t mean they’re devoid of value; in fact, many banks want to incentivize you to get additional cards.

For example, the TD Aeroplan Visa Infinite offers a fee-free first-year supplementary card, as well as $100 in NEXUS credits for one or both of the cardholders. That’s not a bad way to justify a single hit to your Equifax report.

On the other hand, you can have promotions targeting supplementary cards such as the 2019 TravelZoo exclusive offer for the American Express Platinum Card. This promo offered a free supplementary card (which could be used by the holder to register for Priority Pass and hotel statuses), and 5,000 bonus Membership Rewards points to boot. Not shabby!

When it comes to bundling, it’s definitely in the intermediate range of complexity for a Miles & Points enthusiast. I’d rate the retention offer method being about 4/5 in complexity to explain to a significant other, because you have to call in and make your case.

On the upside, supplementary card benefits are about 1.5/5 on a bad day – everyone can understand free cocktails at the lounge!

Conclusion

To wrap up, paying annual fees will never be fun. Does this mean there’s nothing you can do about that? Hell, no!

I hope that the strategies I’ve outlined here help all of you save some money on you Miles & Points journey, and that your Player 2 will be slightly less furious about how much you spend on credit card annual fees when you prove that you can spend less.

Until next time, happy collecting.

“override,”to get a promotional bank account from one of the Big 5 banks. THIS IS NOT TRUE FOR RBC, WHICH DOES NOT PROVIDE A MINIMAL FEE ACCOUNT TO WAIVE CREDIT CARD ANNUAL FEE. RATHER THEY REQUIRE THAT YOU HAVE A MULTI-PRODUCT REBATE BASED UPON HAVING 3 DIFFERENT PRODUCTS WITH THEM, INCLUDING AN INVESTMENT ACCOUNT AND ITS FEES AND WAIVERS IN ORDER TO WAIVE ANNUAL FEE FOR A CREDIT CARD.

The offers are very similar. Each account will require you to maintain a minimum monthly balance of $5,000–6,000, depending on the bank, lest they charge you $30 in monthly fees. In return, you get a slew of banking benefits and an annual fee waiver up to $120–150 for one credit card issued by that bank.

Top account from RBC offers $120 fee rebate towards c/c. Lower tier $39. But the bank accounts as you mention cost $30 or $16 a month, and there is no way to bring it to zero other then cancelling the checking account after receiving the c/c rebate.

Very interesting, it the first time I read something about that subject for the travel hacking. I do some strategy you mention. Year after year, we face those situation: keep or not to keep ?And right now with covid, it more about getting point then have advantage to travel. What is your feeling on this ? Thank for the perfect article !!!

In regards to dipping below the “maintain a minimum monthly balance” amount. You actually can dip below the required amount at 4am (assuming a business day). As long as you have the minimum monthly balance required in your account by end of the business day, you won’t be assessed the monthly fee.

You mentioned: “2019 TravelZoo exclusive offer for the American Express Platinum Card. This promo offered a free supplementary card (which could be used by the holder to register for Priority Pass and hotel statuses), and 5,000 bonus Membership Rewards points to boot.”

the 5k bonus MR … are you referring to the Annual Bonus of 5,000 MR when you charge $60k?

you know; funny thing happened .. amex put a (Credit limit) on one of my charge cards for the first time ever citing their concern about my spending and balances overall. (I do pay all balances in full each month however but my situation is unique). That said when it came time for the platinum annual fee renewal there wasn’t enough room on the strict limit (2,500) to put it through so it perhaps just wasn’t put through. Month 3 now and still hasn’t been charged.