Back in 2021, the Neo Card™ launched to much fanfare. A millennial- and Gen Z-focused cash back card, it features a slick app, even slicker marketing, and the promise of excellent rewards delivered just the way you want them.

Now, Neo Financial has launched a bevy of new products with a menu of multiple pre-made offerings, as well as the option to select “perks” à la carte. These perks are designed to live up to the promise of delivering customized rewards tailored to the consumer’s choice.

Let’s take a look at how much the Neo family has expanded, and what value there may be for you to extract from it.

Stack Perks that Reward Your Spending

Despite being one of the youngest members of the Canadian financial community, Neo has come out of the gate punching. Not only did it launch its signature no-fee cash back credit card in 2021, but it replaced Capital One as the credit card issuer for Hudson’s Bay Company co-branded cards shortly thereafter.

The stylistic choices of Neo certainly remind me of a would-be “disruptor” – though as the official partner of HBC, a company which has been in continuous operation since the time of King Charles II, it is hard to imagine an older business fogey.

Still, it’s clear Neo wants to shake up the Canadian credit card space, and with this launch of perks, they’re hoping to do just that by allowing customers to pick and choose from a menu of benefits at a defined monthly rate. The subscription model comes to another industry!

Neo perks allow consumers to order specific credit card benefits à la carte on a monthly subscription basis.

Perks can be purchased at a monthly rate and cancelled at any time. Interestingly, perks bundles will last to the end of any given month, but if cancelled mid-month, cardholders will be charged at a prorated fee dated back to the date of cancellation.

You can stack as many perks as you want, though there are no discounts for purchasing or maintaining more than one at a time.

The available perks are as follows:

- Premium Access includes a dedicated customer service line, extended warranty, and purchase protection for $0.99 per month.

- Travel has 2% cash back on transactions outside Canada and travel insurance for $4.99 per month.

- Everyday Essentials gives you a gas & grocery multiplier option for $8.99 per month.

- Mind & Body is for the fitness and wellness fanatics out there at $9.99 per month.

- Food & Drink gives a straightforward 1.25x multiplier on partner restaurants and delivery at $1.99 per month.

- Mobile & Personal Protection offers mobile device insurance, credit monitoring, and password management at $9.99 per month.

While you can choose to add perks to your Neo Card™ at any time you desire, the company has also taken steps to create a variety of pre-made products aimed at specific types of consumers.

Please note that you can add other perks to any of these cards, or even to your basic Neo Card™, but that these are being marketed as specific products for people who want a grab-and-go financial solution.

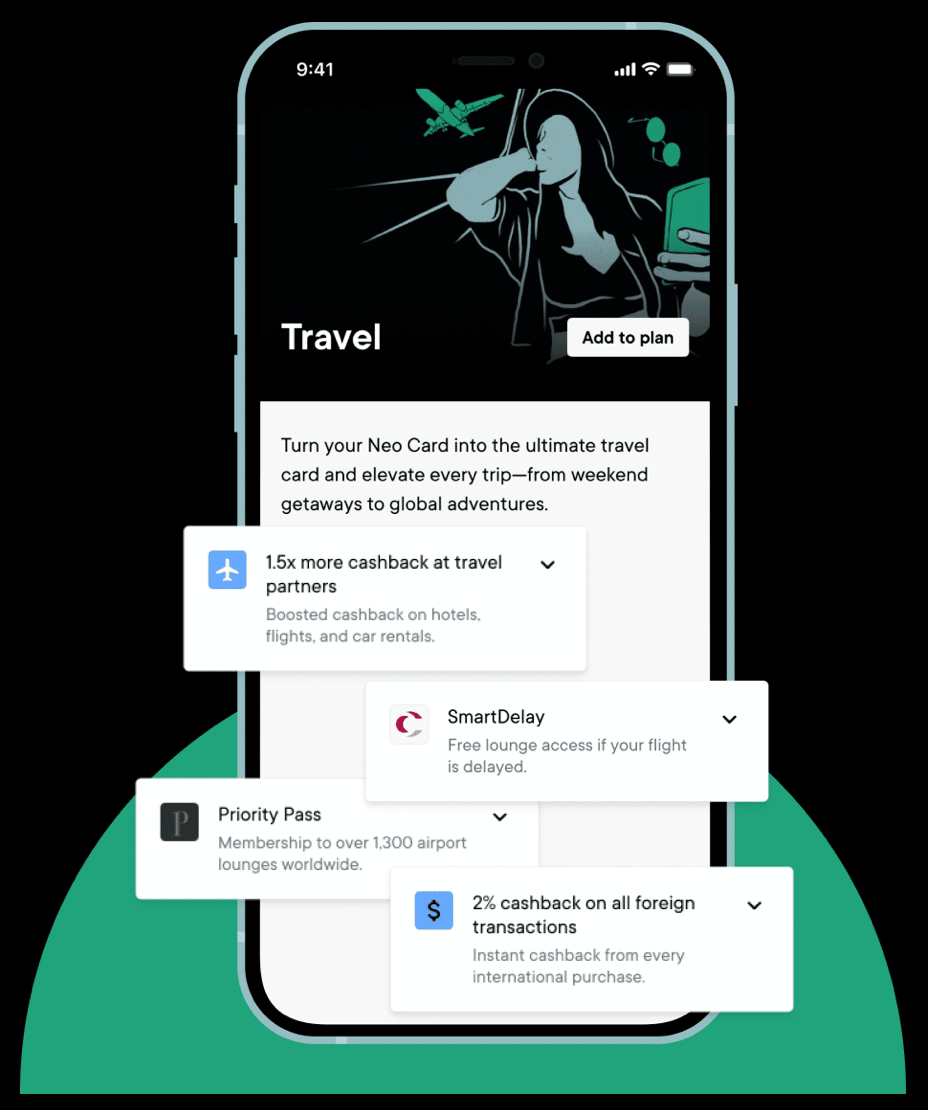

The Neo Card™ Plus Travel Perks

First up on our list of these new offerings is the Neo Card™ Plus Travel Perks, which is focused on, you guessed it, travel.

For $4.99 per month, you get a variety of benefits that are specifically related to travel:

- Travel insurance, which includes emergency medical insurance, car rental loss damage waiver, trip cancellation/interruption and flight delay coverage, baggage delay and loss protection, coverage for personal effects and hotel burglary, as well as accidental death and dismemberment coverage

- 1.5x increase to your cash back rate when purchasing with travel partners

- SmartDelay, which gives you free lounge access if your flight is delayed by more than an hour

- Priority Pass Standard membership ($32 (USD) on average per lounge visit)

- 2% cash back on transactions made outside of Canada

There’s a lot to unpack here. Assuming you keep this card for a year, its effective annual fee is $59.88.

The insurance may be worth that to many, because it appears to be somewhat strong, but my issue is that you cannot access what the coverage specifically entails unless you already have a Neo Card™.

The 2% cash back on foreign transactions reduces foreign spending to a net fee of 0.5%, which isn’t as good as a no foreign transaction fee card, but sure beats paying the full price.

The increase to cash back on travel spending is also useful; however, one cannot help but feel slightly confused about how the multiplier works.

Let’s say that a travel partner gave you 2% on your Neo Card™. If you buy this bundle, this would multiply 2% by 1.5, so you would get a total of 3% cash back. This is a nice boost, but doing arithmetic just to determine the rate of rewards can be a little confusing.

SmartDelay seems like an interesting perk, but it’s only available if you’re delayed by more than an hour. The terms and conditions aren’t available until you sign up, so unfortunately we’re unable to unpack this more.

And lastly, the Priority Pass membership is nice if you feel that you get $32 (USD) of value from each lounge visit.

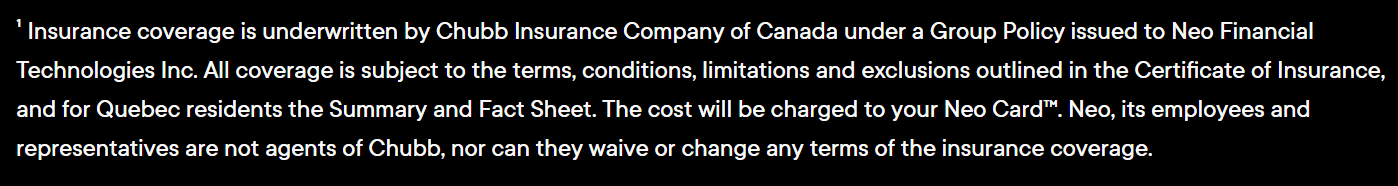

The Neo Card™ Plus Everyday Essentials Perks

The next pre-made item on our list is the Neo Card™ Plus Everyday Essentials Perks. As it name suggests, this product is designed to enhance daily spending on essential needs, which in Canada tend to be food, liquor, and petroleum.

Coincidentally, both petroleum and food are available in bulk and at a discount at Costco, a store most credit card issuers refuse to give a multiplier for. Not so for Neo.

The benefits of the Neo Gas & Grocery Card are as follows:

- 1.5% more cash back on groceries, 1.5% more cash back at liquor stores, and up to 6% cash back at partner butchers and bakers (candlestick makers presumably pending)

- 1.5% more cash back at gas stations

- A variety of exclusive offers with partner gas stations, such as Husky and Irving

- $2,500 in life insurance

- 24/7 free legal assistance hotline

I don’t advise anyone to engage in any nefarious activity, but a 24/7 legal hotline for $8.99 per month seems reasonable even if your worst offence in a decade has been driving 10 km/h over the speed limit.

As for the other benefits, they offer decent earning if you’re able to organically spend enough to make cash back exceeding the monthly fee, or make full use of the included services.

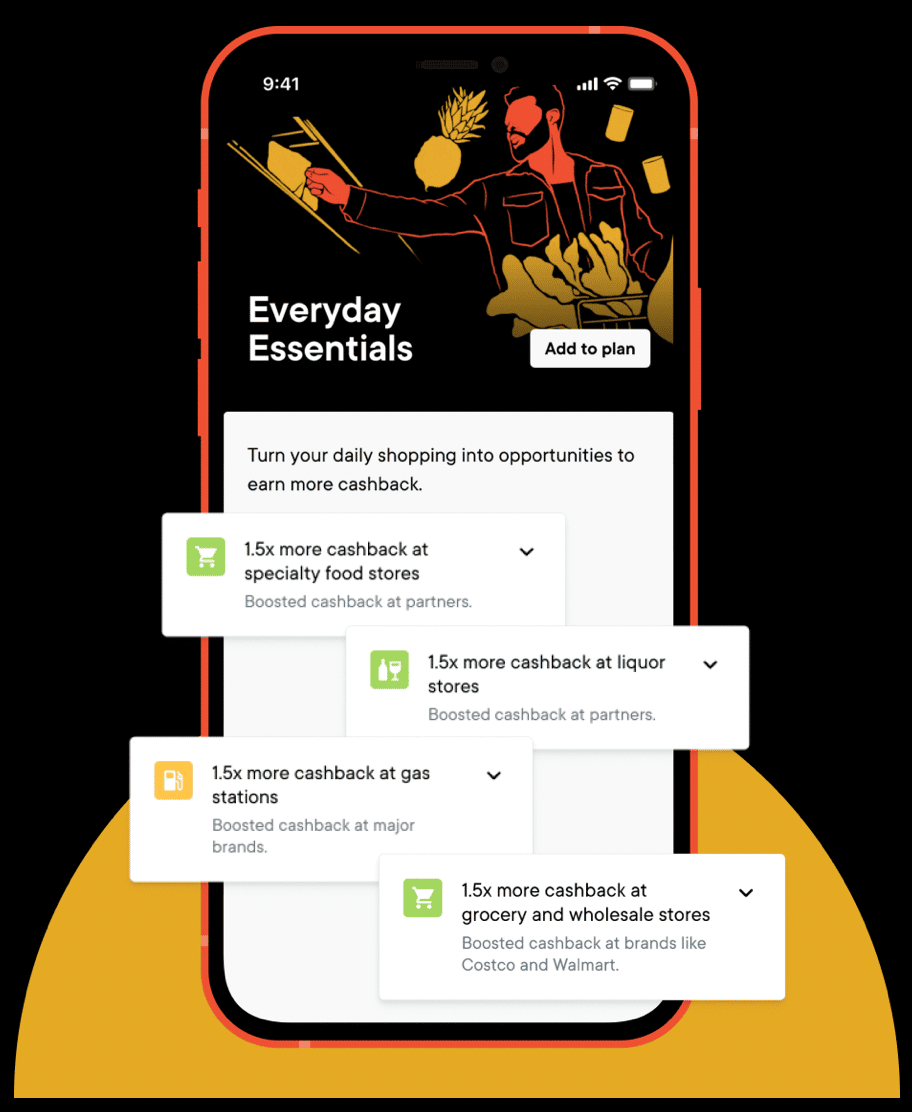

The Neo Card™ Plus Premium Access Perks

The Neo Card™ Plus Premium Access Perks seems unique due to the small size of the bundle’s added cost at only $0.99 a month, or $11.88 per annum. That’s less than one month of the American Express Cobalt Card!

Premium Access offers the following amenities:

- A dedicated priority phone line (right now, most customer service functionality is through the app’s live chat support)

- Early access to select features

- Monthly bonus offers

- 1.25x cash back boost on new partners, especially for first-time purchases

- Extended warranty that doubles the manufacturer’s warranty

- Purchase protection to protect from loss and theft

The small fee for this card seems to have the early access feature as one of its key sticking points, though the ability to stack cash back on first-time purchases probably helps it break through. A huge bonus on a large purchase could easily offset the $11.88 annually, for example, and leave you to comfortably use the phone line without having to really pay for it.

At the same time, the insurance offerings listed are once again not immediately available to peruse unless one begins the registration process, and such coverages are often standard on credit cards without any fees at all.

What About the Other Perks?

There are a few more packages to look at, which don’t come advertised as belonging to a specific card, though as always you can add these to your Neo product any time you wish.

The first and simplest package is the Food & Drink option. For $1.99 a month, you get a 1.25x boost to the cash back earned at bars and restaurants partnered with Neo, as well as on food delivery. It’s short and simple.

The second remaining package is one a little bit dearer to my heart, Health & Wellness, though it’s a little steeper at $9.99 monthly.

The Health & Wellness perks reward you with:

- 1.25x on cash back earned at gyms and fitness studios (useful if you pay your gym membership in full or buy services such as personal training)

- Complimentary access to FitOn Pro, with tailored workouts and meal plans

- Headspace Plus membership, which is a mindfulness and meditation app replete with exercises and mantras

Finally, there’s the Mobile & Personal Protection package, which costs $9.99 a month and provides:

- Mobile device insurance against breakdown, damage, or theft (up to $500 annually with a $49 deductible)

- A free Dashlane Premium subscription service, which manages access and passwords

- 24/7 anti-identity theft/fraud hotline, as well as credit monitoring

- Up to $1,000,000 in fraud, ransomware, and social engineering coverage

The amount of cellphone coverage seems small in the era of $1,500 flagship products, but most interesting is the idea of a credit card that comes with coverage against fraud and social engineering. Will this become a trend with financial products as issues like ransomware become more abundant?

Either way, there are plenty of options from Neo to suit any customer’s taste, and the most important thing will be ensuring you feel that you can extract value from every product you subscribe to.

Conclusion

With the introduction of Neo Financial’s newest suite of products, will the menu-style of ordering credit card benefits become the standard as time goes by? Nobody can say for certain, but what is sure is that Neo is launching a type of financial product that hasn’t been seen before in Canada.

The ability for the customer to select what benefits come, and to opt-in on a subscription basis, is something we’ve never experienced before. It will be interesting to see how it stacks up against its competitors, especially millennial-focused monthly fee cards like the Amex Cobalt

Until next time, make sure to not forget the benefits on your credit card.

So confusing, even for a math loving credit card geek….

Good luck to them.