Brex is a US-based financial services company with a mission to disrupt the traditional business banking model. Brex has recently launched a series of new banking and accounting products for business owners in the US.

Brex is currently promoting a special signup offer on their Brex Cash product in conjunction with the popular US-based points website One Mile at a Time, which rewards new Brex account holders with a staggering 110,000 Brex points upon signing up and completing a few easy tasks.

These 110,000 Brex points can be transferred at a 1:1 ratio to eight global major frequent flyer programs, or cashed out at 1 cent per point (USD) for a value of US$1,100.

Unfortunately, most Canadian-based readers probably won’t be eligible for Brex Cash, as you do need a registered business in the US to apply.

But if you or anyone you know does happen to own a US-registered business, you’ll definitely want to sign up for Brex Cash – or encourage your eligible friends to sign up and share some of the 110,000 points with you!

In my case, I had set up a US-based LLC for Prince of Travel and its related ventures a few years ago, so in this article, I wanted to share my experience opening a Brex Cash account and collecting a very straightforward 110,000 points.

Who Is Eligible for a Brex Cash Account?

Brex Cash is a no-fee cash management account geared towards small business owners. Unlike small business credit cards, however, individuals doing business as a sole proprietorship aren’t eligible to get a Brex Cash account.

Instead, you’ll need to have a registered business in the US (C-corp, S-corp, LLC, or LLP) with an associated Employer Identification Number (EIN) to qualify for Brex Cash.

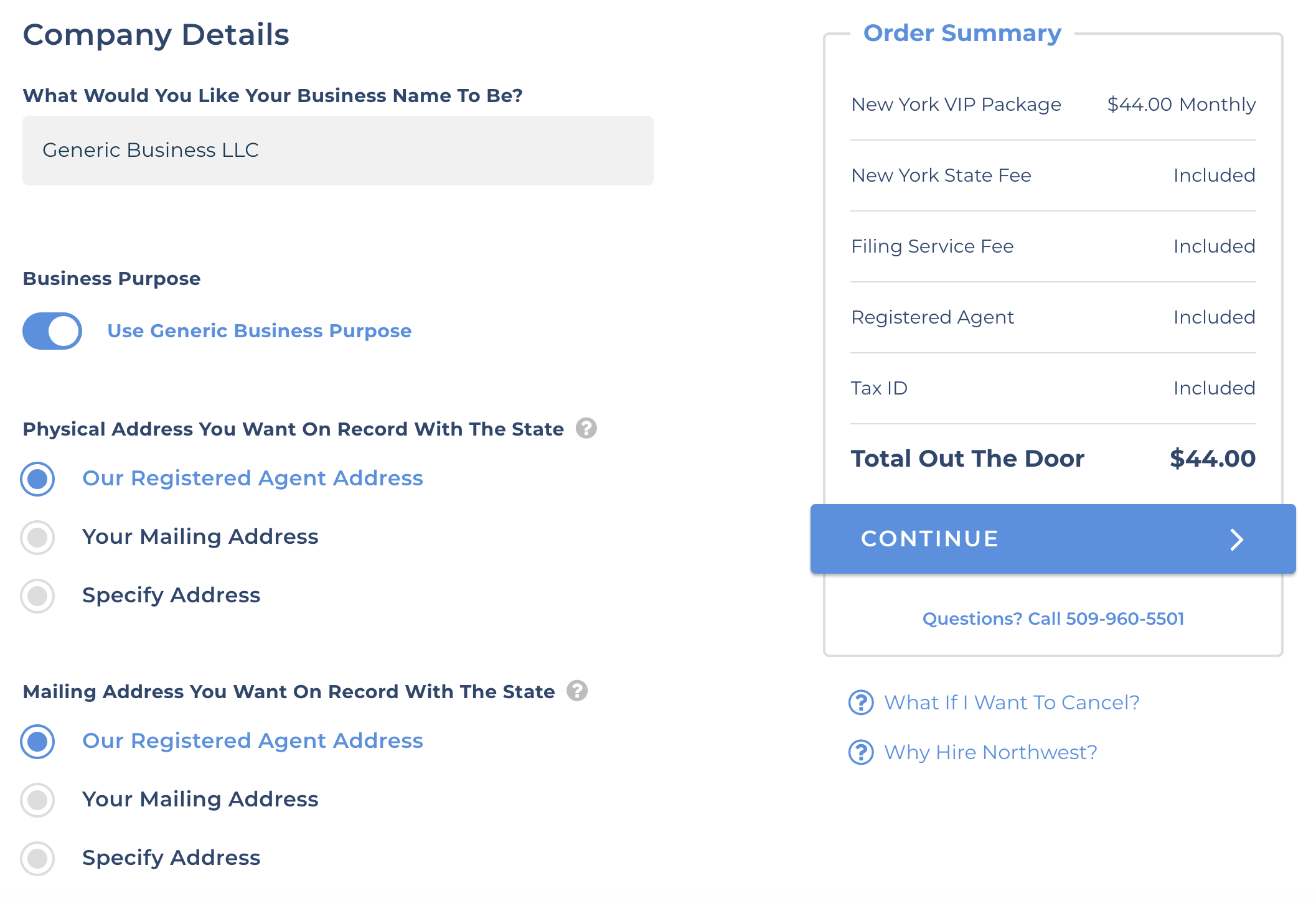

How straightforward is it to set up a registered business in the US? In my case, I had actually worked with an accountant to complete the process, but a cursory search shows that there are many services that will help you set up an LLC in a do-it-yourself fashion for a relatively low cost, similar to services like Ownr here in Canada.

If you don’t have actual business activities that require a registered business in the US, then it may or may not be worthwhile to go through the trouble of setting one up purely for the pursuit of rewards points.

Keep in mind that Ben from One Mile at a Time has warned that the special offer on Brex Cash may be ending soon, so it’s probably too late to set up a business for this particular offer – although you might have an easier time getting approved for US business credit card offers in the future (including potential future offers on Brex Cash).

Applying for the Brex Cash 110K Offer

The special Brex Cash offer of 110,000 Brex points (worth US$1,100+) is only available when applying through One Mile at a Time. You’ll earn:

- 80,000 Brex points upon spending US$1,000 in the first three months

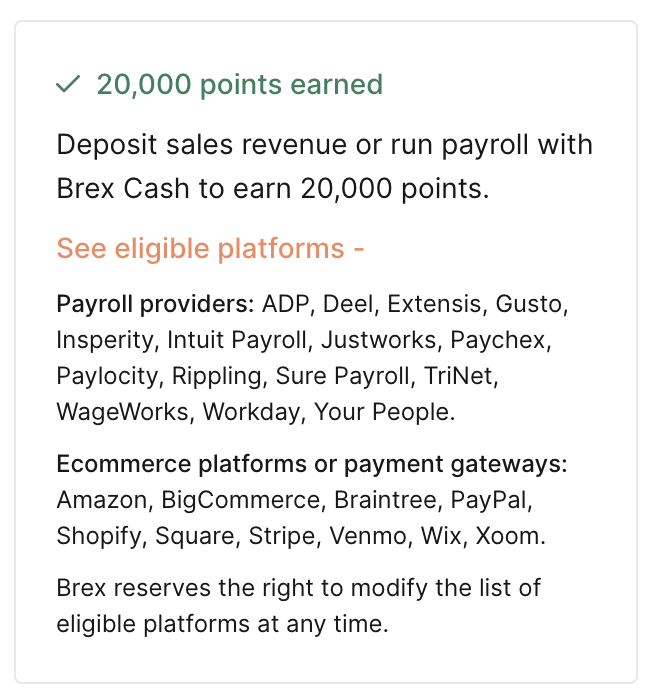

- 20,000 Brex points upon depositing sales revenue or linking payroll to your Brex Cash account

- 10,000 Brex points upon spending US$3,000 in the first three months

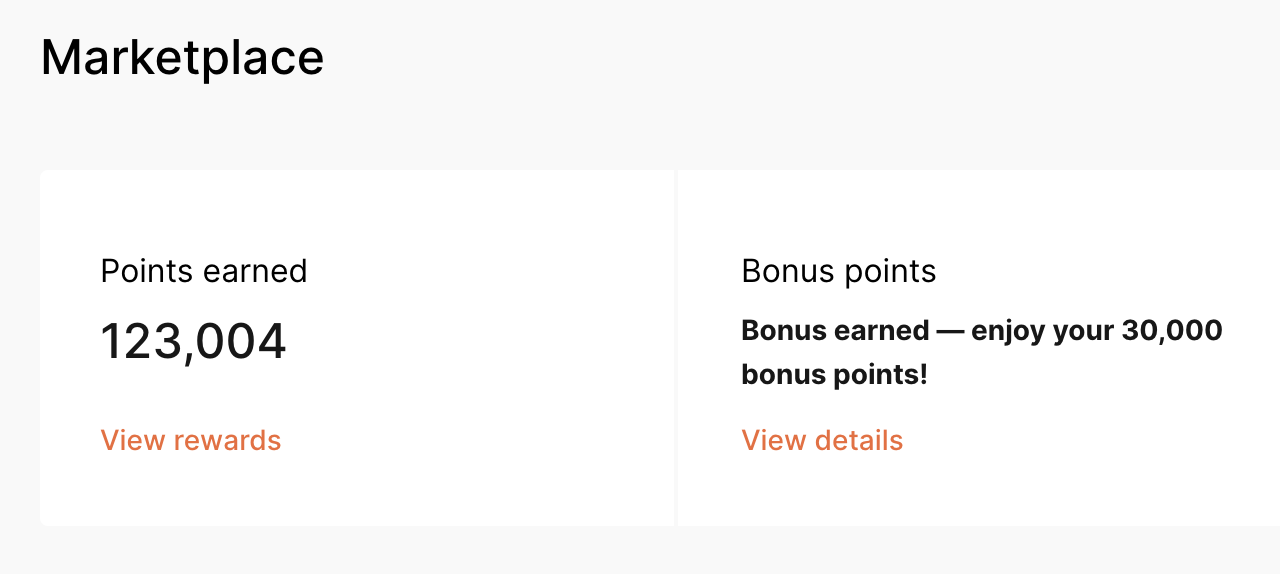

The standard offer on Brex Cash, outside of One Mile at a Time’s special offer, is only for the second and third chunks of the above bonus, comprising a total of 30,000 Brex points (worth US$300+).

Upon clicking through from One Mile at a Time’s link, you’ll be brought to the landing page to begin your Brex Cash application.

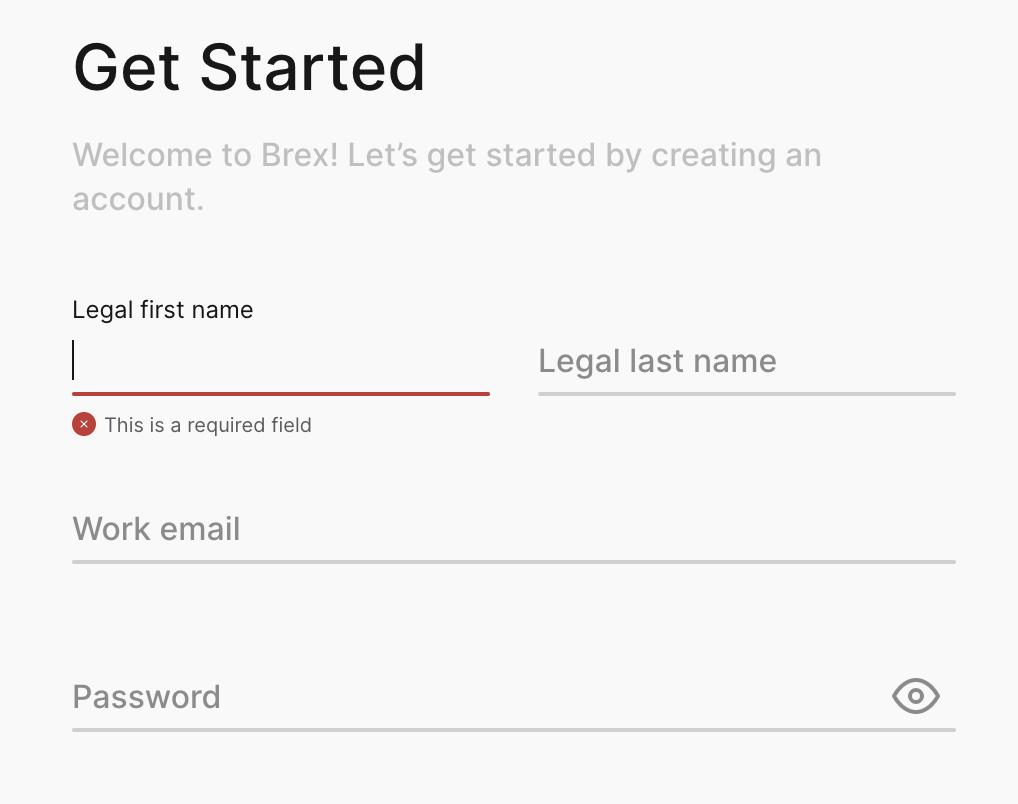

The application is relatively straightforward. At the start, you’re asked to enter your name and email, followed by details about your business.

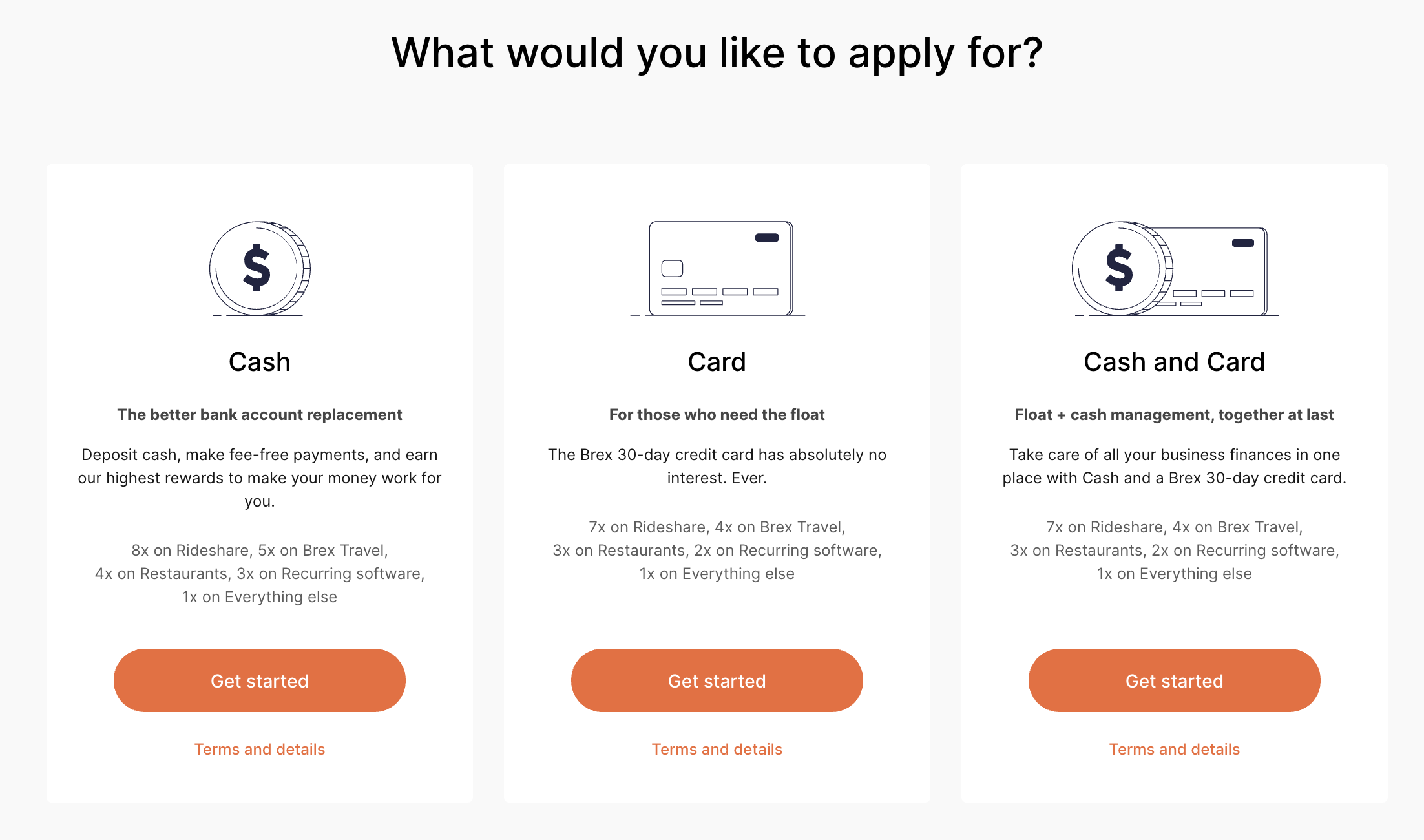

Then, you’re asked to select the Brex product you’d like to apply for.

Brex Cash is the cash management account that’s currently promoting the special offer of up to 110,000 Brex points. It has no minimum balances or funding requirements to qualify.

Meanwhile, the Brex Card is a credit card on the Mastercard network that requires at least a US$50,000 minimum balance in any US bank account. If you meet that criteria, it might be worth getting both the Brex Cash and the Brex Card together, but in my case I simply went ahead and chose Brex Cash.

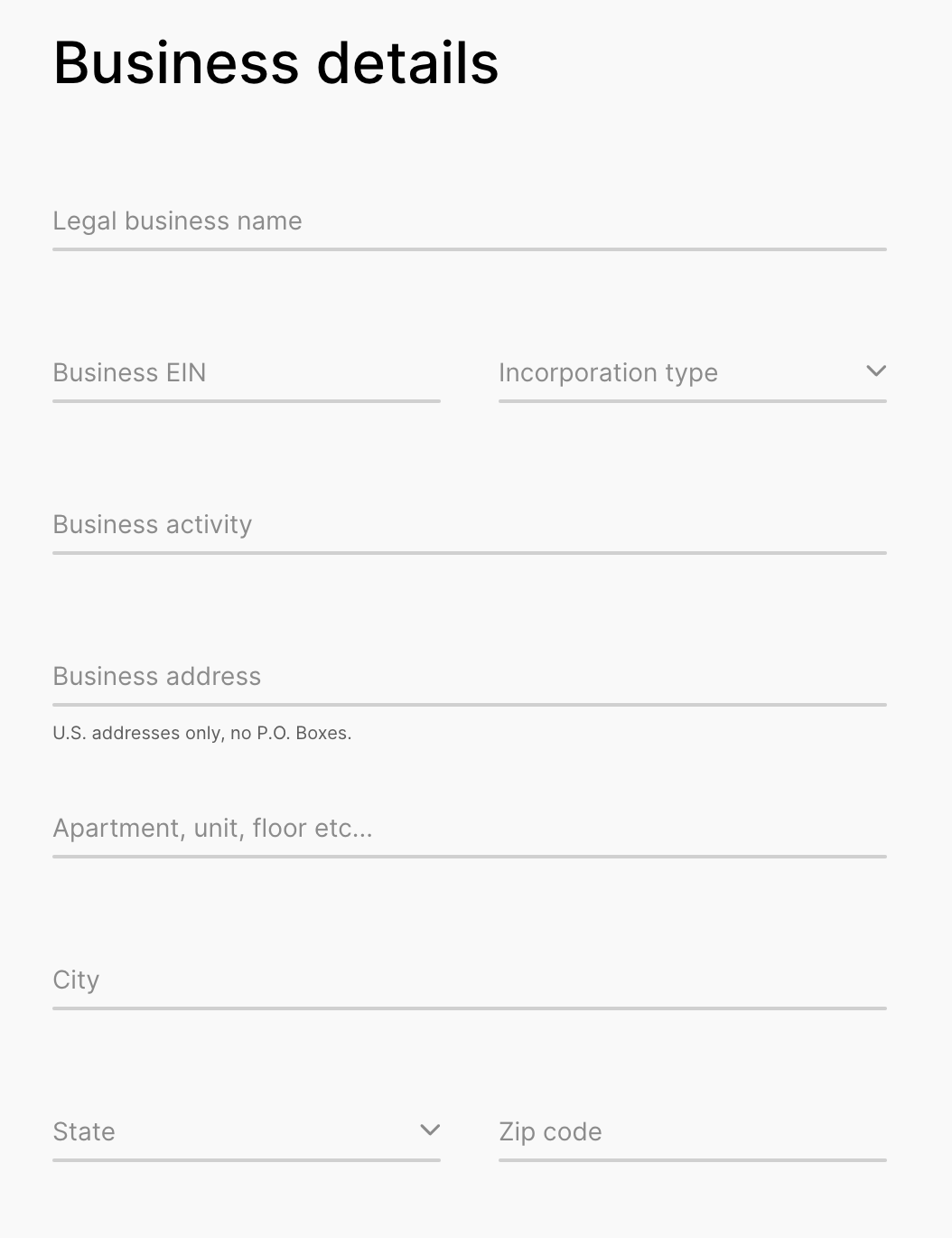

After that, you’re asked to fill in a few more details about your business, as well as the personal information of yourself or any other person who owns 25% or more of the company.

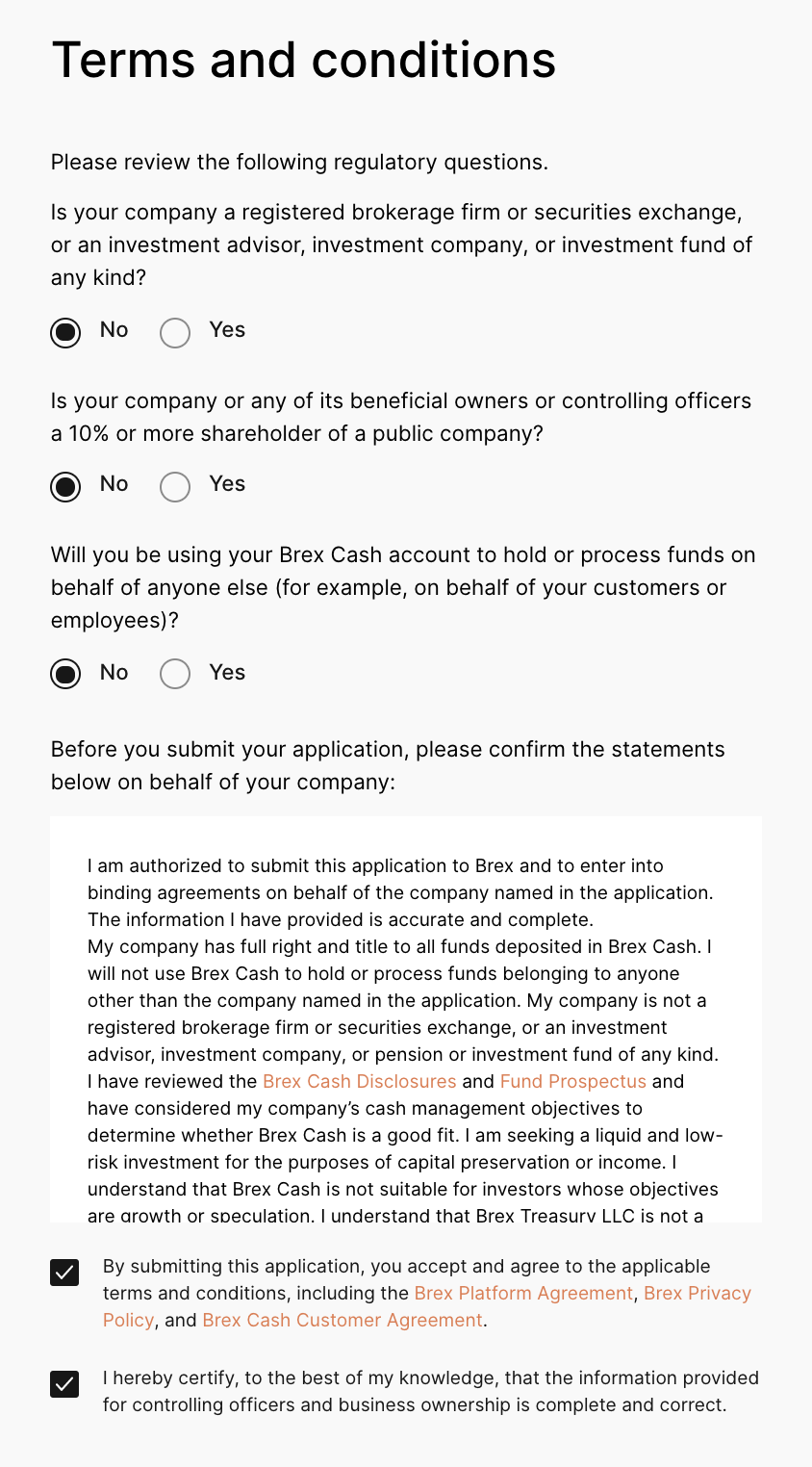

The last page contains some terms and conditions, and then you can submit your application.

Based on applicants’ experiences, it seems like there are two types of approval for Brex Cash: an instant approval and a conditional approval. It’s more likely that you’ll receive an instant approval if you have an online presence of some sort, whereas companies without a significant online presence may require a manual approval that takes a few days’ time.

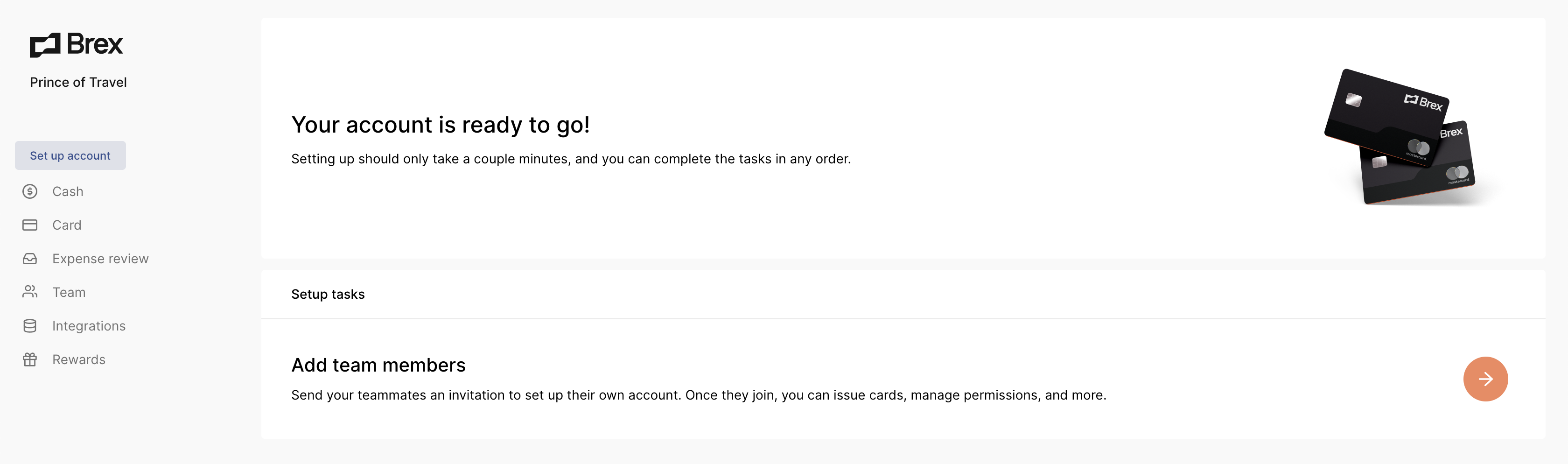

In my case, the Brex Cash account was approved instantly, and I was able to load funds and start using the account immediately.

Using Brex Cash for Payments

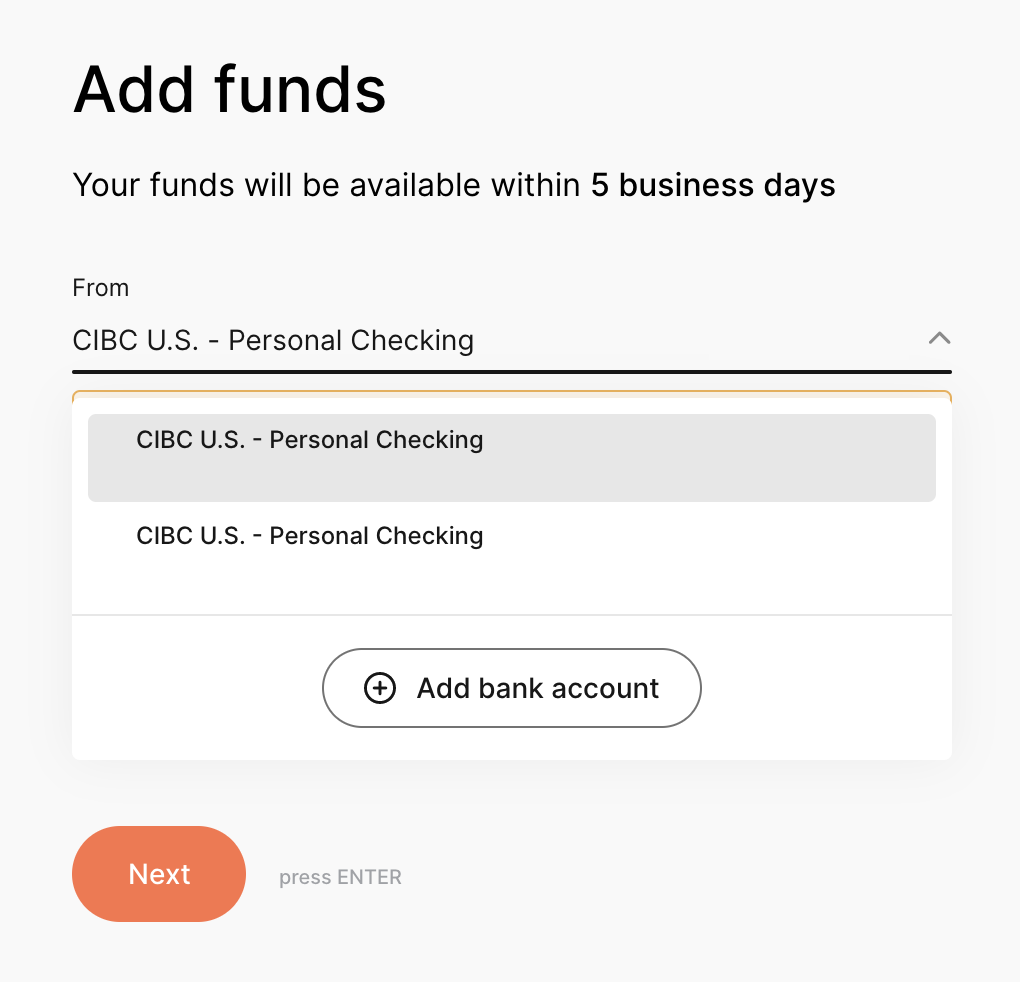

As a cash management account, Brex Cash needs to be loaded with funds before you’re able to spend funds out of the account. I connected my Brex Cash account to my CIBC US bank account, and transferred over some funds via ACH within two business days.

Rather confusingly, a Brex Cash account also comes with a Brex Card to facilitate spending out of the account, although this Brex Card isn’t the same as the Brex Card credit card that you’d otherwise need US$50,000 in a bank account to qualify for.

Instead, it functions like a prepaid debit card, allowing you to spend the funds that you’ve loaded into your Brex Cash account.

You’ll get a virtual Brex Card that you can use immediately, and you can also order a physical card to be delivered to your address, too. In my case, I had a rather large bill to pay through Plastiq immediately, so I went ahead and used the virtual Brex Card to process the payment and it went through without a hitch.

The 10,000 Brex points for completing US$3,000 in spending posted immediately after the charge was posted to my Brex Card, about two business days after I made the payment.

Meanwhile, the 80,000 Brex points for completing US$1,000 in spending (i.e., the special bonus offer from One Mile at a Time) took a while longer to post. Ben from One Mile at a Time notes that these 80,000-point bonuses generally get swept up on the Tuesday after the charge is made, and indeed, my 80,000 points showed up late in the day on Tuesday.

Finally, I still needed to deposit sales revenue or link a payroll service to my Brex Cash account to earn the final 20,000 Brex points. In relation to this portion of the bonus, Brex specifies the following:

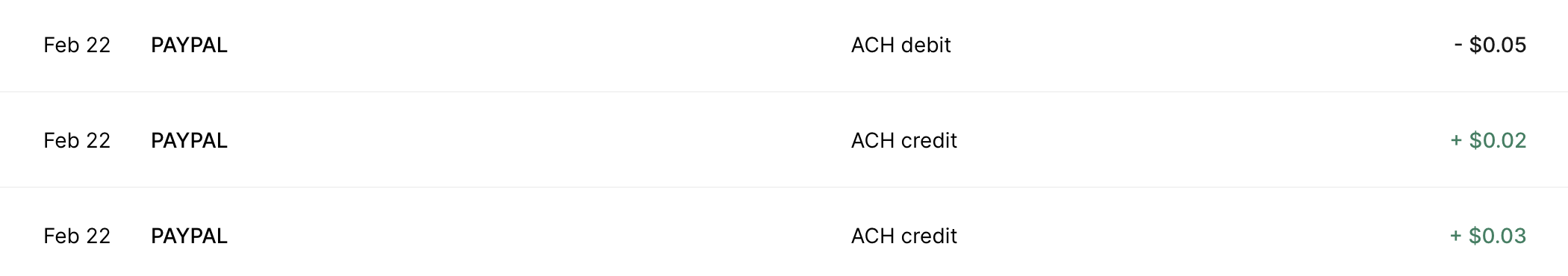

I didn’t really have any other option besides linking my Paypal US account to Brex, sending some money over from Paypal, and hoping that would count as sales revenue.

Well, it turns out I didn’t even need to move any money over, because the $0.02 and $0.03 micro-deposits from Paypal (which are used to verify that I was the owner of the Brex account) happened to count as sales revenue all on their own! What can I say, business is tough these days…

All told, I’ve earned about 123,000 Brex points including the points I earned from my spending, so now I have to decide what I want to do with the points.

How Do Brex Points Work?

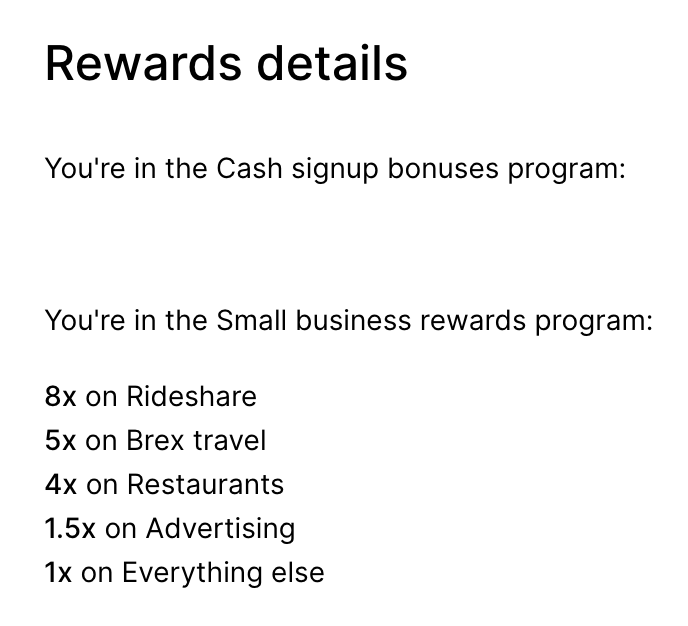

In addition to the gargantuan signup bonus, you’ll also earn points based on your spending with Brex Cash, according to the following earning rates:

I’ve gone ahead and linked my Brex Card to my Uber account, because it’s pretty awesome to be earning an 8%+ return on Uber rides, especially when Brex points can be transferred to a variety of useful frequent flyer programs.

(These earning rates are even more impressive when you consider that Brex Cash isn’t even a credit card in the traditional sense, but rather it’s more akin to a debit card with a very powerful rewards structure.)

Once you’ve earned Brex points, they can be redeemed in one of four ways:

- Redeem for cash into your Brex Cash account at 1 cent per point (cpp)

- Redeem for gift cards at major retailers at 1cpp

- Redeem for travel via the TravelBank online portal at 1cpp

- Transfer at a 1:1 ratio to one of eight global frequent flyer programs:

- Aeromexico Club Premier

- Air France/KLM Flying Blue

- Avianca LifeMiles

- Cathay Pacific Asia Miles

- JetBlue TrueBlue

- Emirates Skywards

- Qantas Frequent Flyer

- Singapore Airlines KrisFlyer

Redeeming for cash is strictly better than redeeming for gift cards or travel, since you could always cash out your points and then buy the gift cards or travel purchases separately, and earn extra rewards points on those purchases.

The best value, however, will likely be attained by transferring to one of the eight frequent flyer partners, since you can usually extract higher than 1cpp through redeeming miles in one of these programs.

I’ve yet to decide on exactly which airline partner to transfer my Brex points to. I’m considering any one of the following programs, in order of likelihood:

- Singapore Airlines KrisFlyer: I’ve already built up a balance of KrisFlyer miles under the 15% conversion bonus not too long ago, and I’d like to fly Singapore’s New A380 Suites at some point when travel resumes in the next few years. However, KrisFlyer miles also have a fixed expiry date three years after you’ve earned them, so I’m not sure if it’s wise to concentrate a large balance in the program if I’ll only be redeeming sporadically.

- Emirates Skywards: The program has a nice sweet spot of 135,000 Skywards miles for Emirates First Class round-trip to Europe. But I’ve already flown Emirates First Class a couple of times, so ideally I’d like to use these Brex points towards trying out something new.

- Cathay Pacific Asia Miles: Since I travel to Asia quite often, Asia Miles are always useful for flying in Cathay Pacific’s premium cabins. But I’ve already built up a stash of Asia Miles through my Canadian credit cards, so maybe it’d be better to save the Brex points for one of the more unique partners that aren’t accessible through Canadian credit cards.

- Avianca LifeMiles: LifeMiles can be useful for booking Star Alliance flights at a reasonable rate with no fuel surcharges, but then again, Aeroplan points can now be used to accomplish basically the same thing.

- Aeromexico Club Premier: Given that these points were earned through a rather unorthodox product in Brex Cash, perhaps it’s only fitting to attempt a highly unorthodox Aeromexico round-the-world redemption on a series of SkyTeam business class products?

As you can see, none of the transfer options strike me as a clear winner over the others, so I’ll probably keep my points in my Brex account until I have an imminent use for them.

My understanding is that Brex is also in the process of adding new airline partners, so I’ll be eager to see which partnerships they strike up and whether I can tailor them to some aspirational travel plans.

Now, most rewards programs only let you transfer points to a frequent flyer account with the same name as the cardholder themselves.

With Brex Cash, however, you can transfer points to any of your team members’ frequent flyer accounts – and since you can easily add team members for free, this means that you can easily transfer your Brex points to anyone else’s frequent flyer account with any of the above eight programs.

So even if you don’t own a US-registered business yourself, think about whether anyone in your circles might have a US business and would be eligible for a Brex Cash account. If you let them know of the Brex Cash promotion by the end of February, perhaps you’ll be able to split the points earnings for an easy US$550+ gain each!

Conclusion

Brex is a startup financial services company in the US, and for any eligible business owner, their current promotion on the Brex Cash account could very well represent the easiest and most painless 110,000 points you’ll ever earn.

These points can be cashed out for an instant gain of US$1,100, or transferred to one of eight global frequent flyer programs for even more valuable redemptions.

Ben from One Mile at a Time warns that the current offer is likely to end soon, and that eligible business owners are encouraged to submit their applications by the end of February.

Here’s hoping that Brex continues to add exciting airline partners, puts forth even more juicy offers, or even expands its operations to Canada at some point in the future.

24/7