The Chase Aeroplan Card launched in the US in late 2021, supplementing the 11 Aeroplan co-branded credit cards that we already have in Canada.

The US credit card has debuted with a series of interesting features that aren’t available up here in Canada. Meanwhile, the sheer number of co-branded cards in Canada makes it far easier to rack up the points through bonuses and spending up here.

Let’s take a look at some cross-border Aeroplan credit card strategies that you might consider to extract maximum value out of the Aeroplan credit card offerings in both countries.

Getting Approved for the Chase Aeroplan Card

If you haven’t gotten started with US credit cards just yet, know that it’ll take a fair bit of upfront legwork before you’re eligible to be approved for the Chase Aeroplan Card.

You’ll need to set up a US address and bank account, kickstart your US credit history with an American Express US card first, and only after about one year of solid US credit history will Chase deem you eligible for one of their credit cards.

Keep this timeframe in mind as you mull over the cross-border Aeroplan credit card strategies that we’ll discuss in this article.

Aeroplan 25K Status: Apply in a Few Years & Keep the Card Open

Arguably one of the most attractive features of the Chase Aeroplan Card is the fact that new applicants earn Aeroplan 25K status upon signing up, through the following calendar year.

Then, in subsequent years, they can retain Aeroplan 25K status simply by spending US$15,000 on the card, and they can earn a further one-tier Elite Status Level Up by spending US$50,000 on the card.

I imagine many Canadian-based Aeroplan members are already dabbling with 25K and higher status for 2022, thanks to the Everyday Status Qualification benefit, the status extensions from 2021 and 2020, plus last year’s “Spend Your Way to Elite Status” promotion.

But when the pandemic settles down in the upcoming years and the status bumps are no longer being offered quite as generously, then the Chase Aeroplan Card might well offer the easiest pathway to Aeroplan 25K status that you’ll find anywhere.

Let’s just imagine that Air Canada stops offering status extensions and promotions in 2022 due to the miraculous upturn in global travel prospects.

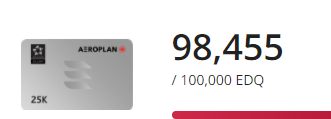

Come 2023, you can earn Aeroplan 25K status either by earning 100,000 eligible Aeroplan points through Everyday Status Qualification…

…or you could simply sign up for the Chase Aeroplan Card, thus instantly achieving 25K status through all of 2023 and 2024.

Then, come 2025, you could simply spend US$15,000 on the card and get 25K status through all of 2025 and 2026, and so on.

That US$15,000 of spending might be a lot more feasible than earning 100,000 points for Everyday Status Qualification – especially if the American Express Aeroplan Reserve Card stops offering 10x points on eats & drinks by then. 😉

Plus, even if you do achieve Everyday Status Qualification on the Canadian side – or indeed, if you qualify for status the “normal” way through flying activity – then a one-tier Elite Status Level Up is only available by spending US$50,000 on the Chase Aeroplan Card.

A regular Canadian-based Aeroplan 35K member can now count on earning 50K and Star Alliance Gold by spending US$50,000 on the US card. A regular 75K member can count on being a Super Elite by shifting their spend stateside, and so on.

The status advantage is one of the most significant reasons that Canadians might consider going through the effort of getting the Chase Aeroplan Card. And with Air Canada largely taking care of our status needs by default for now, the one-year waiting period for Chase approvals might just work in your favour if you get started now.

Welcome Bonus: Combine Flight Reward with Points

The Chase Aeroplan Card offers a welcome bonus of up to 100,000 Aeroplan points, delivered in the form of two Welcome Flight Reward Certificates worth 50,000 points each.

The way these Welcome Flight Rewards are designed makes them not the most useful on their own.

Long-haul partner flights in premium cabins departing from North America begin at 55,000 Aeroplan points one-way, and can also be found at the common price points of 60,000, 70,000, 85,000, or 100,000+ Aeroplan points one-way.

This means that you’ll ideally want to combine a Welcome Flight Reward Certificate with excess Aeroplan points in order to truly maximize their value.

And that would be quite easy to achieve for a cross-border cardholder, with all of the free-flowing points we have in Canada from the 11 Aeroplan co-branded credit cards and the Amex MR credit cards on top of that.

Overall, it should be quite feasible to combine the Chase Aeroplan Card’s welcome bonus with even more welcome bonuses from up here in Canada, in order to fully realize the potential of the “100,000 points” that’s advertised on paper.

Earning Rates: 3x Aeroplan Points on Groceries

The Chase Aeroplan Card earns 3x Aeroplan points on dining and groceries worldwide, as well as Air Canada and Air Canada Vacations purchases.

The 3x grocery multiplier in particular is fairly attractive compared to other airline co-branded credit cards in the US. However, when it comes to earning Aeroplan points specifically, we can do a lot better in Canada with 5x MR points on the American Express Cobalt Card, which can then transfer 1:1 to Aeroplan.

(Keep in mind that the Chase Aeroplan Card’s earning rates is based on USD purchases, so it’s really earning ~2.37x Aeroplan points compared to the Cobalt Card’s 5x points.)

Nevertheless, as a Mastercard product with greater acceptance, the Chase Aeroplan Card could be a worthy contender if you prefer to shop at grocery stores that don’t take American Express.

One example is the NoFrills supermarket, many of whose locations only accept Mastercard and not even Visa. Unfortunately, wholesale retail stores like Costco are generally excluded from the definition of “groceries”, and the Chase Aeroplan Card is no exception.

And if you’ve already reached the $30,000 limit of 5x purchases on your Cobalt Card with your high-volume grocery purchases, then you could also consider putting additional spend on the Chase Aeroplan Card as a means to further rack up the points.

If you do choose to put some grocery spending on the Chase Aeroplan Card, also consider the possibility of using the US-issued Citi Premier Card instead, which earns 3 ThankYou points per USD spent on groceries.

Which card is a better choice depends on whether you’d prefer to consolidate your earnings in Aeroplan or to explore the flexibility of Citi ThankYou points.

Threshold Bonuses: Earn Priority Rewards Without SQD

The Chase Aeroplan Card offers the only pathway to Priority Rewards without having to rack up Status Qualifying Dollars (SQD) with Air Canada.

If you’d like to earn 50% off Aeroplan points redemptions, but rarely spend money on paid Air Canada flights, the Chase Aeroplan Card could be your solution.

This strategy only makes sense for individuals with high spending volumes, organic or otherwise. That’s because Priority Rewards are earned at the spend thresholds of US$100,000, US$250,000, US$500,000, or US$750,000.

Meanwhile, spending US$1,000,000 on the card in a calendar year earns you a Global+1 voucher, which is a no-questions-asked companion pass for any Aeroplan redemption with any airline in any class of service.

With a Global+1 voucher, book any flights for yourself and your designated companion, and the points for your companion will be redeposited after travel takes place, through the following calendar year.

Let’s imagine you’re a Canadian-based small business owner or office procurement manager with that level of annual spending capacity.

If you put the spend on one of the best Canadian credit cards for general uncategorized spending – say, the Business Platinum Card by American Express – you could earn a return of 1.25x MR points.

Now, what if you moved that spending over to the Chase Aeroplan Card? On the surface, you’d only earn 1x Aeroplan points based on the USD amount, so effectively 0.8x Aeroplan points based on CAD.

But if your travel patterns are such that you frequently travel with one individual, then you could earn a Global+1 voucher for your troubles – which would effectively make your Aeroplan points go twice as far. You could think of it as doubling your effective earning rate, from 0.8x to 1.6x in the CAD-to-CAD comparison against the Business Platinum’s 1.25x.

And don’t forget, you’d also be earning four Priority Reward vouchers in the meantime, which could be used to slash the cost of two of your most expensive trips (for two passengers) by a further 50%!

Effectively, on the portion of spend that goes towards the points used for those trips, you’d be earning at an optimal rate of 3.2x Aeroplan points!

Of course, the number of individuals for whom this is applicable will ultimately be fairly limited.

But if you’re one of the lucky few with more spending than you feel you can optimize through credit cards, then the Chase Aeroplan Card is one of the only options on the market with threshold-based spending incentives that are truly worth pursuing.

Chase Pay Yourself Back: Liquidate Excess Aeroplan Points

Bringing it back to the realm of us mere mortals, the last cross-border strategy I wanted to highlight is tied to the innovative Pay Yourself Back feature on the Chase Aeroplan Card.

If you’ve been collecting points in Canada over the last few years, then you very well might find yourself sitting on more Aeroplan points than you know what to do with.

The travel landscape continues to be mired with uncertainty, and even if you’re able to take a few trips and burn some points in 2022, you’d probably still earn enough points to have a big balance left over.

“Earn and burn” has always been the mantra of the game, and there’s something to be said about redeeming points now for a decent but not outstanding value, compared to saving points for premium flights many years into the future and opening yourself up to the risk of devaluations.

That’s where the Chase Aeroplan Card’s Pay Yourself Back feature comes in. As a cardholder, you can redeem Aeroplan points at a fixed value of 1.25 cents per point (USD) – equivalent to 1.6 cents per point (CAD) – against any travel purchase charged to your card.

That includes hotels, car rentals, and even flights operated by airlines outside of Aeroplan’s existing partners! Ever wanted to redeem Aeroplan points towards a flight operated by Qatar Airways, China Eastern, or Yakutia Airlines? Now you can!

You can apply Pay Yourself Back to up to 50,000 Aeroplan points per calendar year, which equates to US$625 in excess travel spending that you can wipe from your statement using Aeroplan points.

With so many easy sources of earning Aeroplan points up here in Canada, I see the Chase Pay Yourself Back feature as an easy way to funnel some of the excess Aeroplan balances towards other travel costs that inevitably arise along our journeys.

Conclusion

The introduction of the Chase Aeroplan Card in the US has added another few layers of potential Aeroplan strategies for us to think through, and could serve as a major motivator for Canadians to kickstart their US credit history.

The Chase Aeroplan Card’s status advantages and threshold-based spending incentives are clearly superior to what we have on the Canadian side, and are well worth pursuing in their own right.

Meanwhile, the card’s earning rates and welcome bonus are less exciting from a Canadian member’s perspective, but can still supplement our strategies in a useful way, and the Pay Yourself Back feature offers a useful “drain” for the bloating Aeroplan balances that we find ourselves with up north.

In the article, it mentions that No Frills accepts only Mastercard and not Visa. That’s not true anymore. That’s not true. No Frills has been accepting Visa alongside Mastercard since last summer and I’ve actually been able to use my Visa cards there.

I think it varies by No Frills location.

The Chase Aeroplan MasterCard makes it easy to maintain 25k status. Is the priority boarding/priority check-in conveyed by 25k status any better/worse than what one gets from a TD Aeroplan Infinite Reserve Card/AmEx Aeroplan Reserve card?

Which way works NOW for ITIN applications?

In the past, it was either paid services or applying through the Amazon Kindle “publisher” letter (which they refuse to grant nowadays)…

The paid services still work.

I know they do – I was hoping to know of a diy approach that is currently working. Like the one you published about back in the day about Kindle letter..

Thanks

You can follow the same procedure that the paid services use, which is to generate a US tax return with $5 in earnings declared from, say, gambling in Las Vegas. Use this as your reason for needing an ITIN (to declare your US income as a foreign resident), and submit to the IRS along with a completed W-7 form. The paid services just help ensure that this procedure is completed correctly, as it may be prone to error.

Ricky – do I actually need to generate that US tax return with $5 in earnings declared – or just use it as an excuse when I submit the w7?

Do you think there’s any issue having both a US card (with US address) and a Canadian card (with a Canadian address) linked to the same Aeroplan account?

What’s the preferred pricing rate for Chase Aeroplan vs. any of the Canadian Aeroplan cards?

Will a year of us amex with no itin work, or do we really need the history with the itin attached?

Im currently going through the ropes to get the Chase Aeroplan card. I received a letter from Chase 2 weeks ago requesting more information and to call in. I called every day only to be waiting upwards of 2 hours each day finally giving up after several days of trying. FINALLY, I got through to an agent and they are now sending me an additional form that they want filled out. IN the end, I’ll be looking at another 2 to 3 weeks before I get that letter once it gets rerouted up to Canada. I think theres a definite upside to getting this card, so be very patient if you do have to phone to them.

I can’t find any details on Chase’s website for the Aeroplan card for the priority rewards on the high spend thresholds, where’s the source for that info?