RBC Avion points are versatile, since you can choose to redeem them in a variety of ways, such as transferring them to airline partners, using the RBC Air Travel Redemption Schedule, or redeeming them for flights booked on your own.

Some cardholders have the option to redeem Avion points for business class and First Class flights at a fixed rate of 2 cents per point (all figures in CAD), and in this guide, we’ll explore how this can be one of the best uses of your Avion points.

In This Post

- Redeeming RBC Avion Points for Business Class and First Class

- Tips and Tricks for Redeeming RBC Avion Points for Business Class and First Class

- Is Redeeming RBC Avion Points for Business Class Flights Worth It?

- Conclusion

Redeeming RBC Avion Points for Business Class and First Class

RBC Avion allows certain cardholders to redeem points for business class or First Class flights at a rate of 100 Avion points = $2.

Recall that this is twice the standard value of 100 Avion points = $1 for redeeming Avion points for a statement credit on travel purchases.

As a bonus, the points can be used to not only pay the base fare, but also to pay all taxes, fees, and surcharges, and fees.

To access this redemption option, you’ll need to have one of the following four credit cards:

- RBC® Avion Visa Infinite Privilege†

- RBC® Avion Visa Infinite Business

- RBC® Avion Visa Infinite Privilege† for Private Banking

- RBC® Commercial Avion Visa

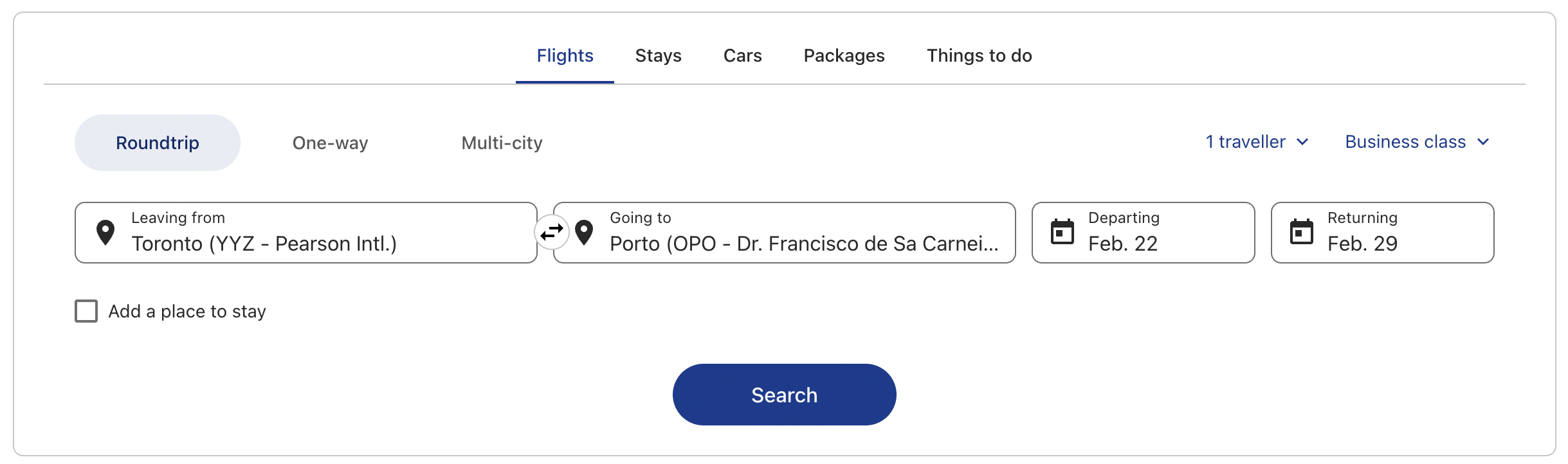

As long as you have one of the above credit cards, you can book a business class or First Class flight by logging on to your Avion Rewards account and searching for your desired flight. Be sure to select “business class” or “First Class” as your desired class of service.

In the search results, the option to book “Business Class Pricing (100 points = $2)” will appear. Look through the list of options in the search results, and choose the flight that best suits your needs.

As long as you have enough points in your account, and assuming that you have one of the four eligible credit cards, you’ll get a value of 2 cents per point for your booking.

Keep in mind that the RBC Avion Rewards booking platform is powered by Expedia, so any flight that you can book through Expedia can be booked through RBC Avion Rewards.

However, if you find an available business class or First Class flight that doesn’t appear through the RBC Avion Rewards booking platform, you can call RBC Avion Rewards and get authorization to book the flight on your own.

You’ll need to submit some information back to RBC, and you’ll then get a statement credit at a rate of 2 cents per point for your flights.

It’s always a good idea to cross-reference the flight cost you see in the RBC Avion Rewards portal with the price when booking directly with the airline, as you may find lower prices when booking direct.

Redeeming RBC Avion points for 2 cents each can offer a great redemption value, since you can book any business class or First Class flight you can find while using your points to cover the entire fare and the extra fees. In this sense, you’re truly getting a “free” ticket with your points.

While it’s certainly possible to get more value from your points by transferring them to partner programs and booking business class flights, finding award availability for specific flights can certainly be tricky.

Plus, if you don’t have flexibility, or if you don’t have time to search for available award space or learn about points programs, redeeming your points this way lets you get the flights you want without being subject to the many nuances associated with award redemptions.

You could also consider using the RBC Air Travel Redemption Schedule, with which you can get good value for your points. However, the points only cover the base fare up to a specified maximum, and you’ll still be on the hook for the taxes and fees.

Given this, redeeming Avion points at a rate of 2 cents per point for a business class or First Class seat can be an excellent option when you’re looking for a straightforward way to exchange your points for good value.

Tips and Tricks for Redeeming RBC Avion Points for Business Class and First Class

Here are a few tips and tricks that can help you navigate the RBC Avion landscape and access some valuable redemptions.

Combine Avion Points

Although you need to have one of the four specific Avion credit cards mentioned above in order to redeem Avion points for business class and First Class flights at 2 cents per point, keep in mind that RBC lets members move Avion points freely from one card to another.

This feature allows you to pool points from multiple credit cards to build up your balance.

This means that points earned on the RBC® Avion Visa Infinite†, RBC® Avion Visa Platinum†, RBC® ION Visa, and RBC® ION+ Visa can all be redeemed for business class or First Class flights at 2 cents per point as long as you also have an eligible card, such as the RBC® Avion Visa Infinite Privilege† or the RBC® Avion Visa Infinite Business.

| Credit Card | Best Offer | Value | |

|---|---|---|---|

|

Up to 70,000 RBC Avion points†

$399 annual fee

|

Up to 70,000 RBC Avion points† | $826 | Apply Now |

|

35,000 RBC Avion points

$175 annual fee

|

35,000 RBC Avion points | $700 | Apply Now |

| 35,000 RBC Avion points† | $580 | Apply Now | |

| 35,000 RBC Avion points | $580 | Apply Now | |

| 35,000 RBC Avion points† | $580 | Apply Now | |

| 14,000 Avion points† (worth up to $100 in gift cards†) | $125 | Apply Now | |

| 7,000 Avion points†(worth up to $50 in gift cards†) | $75 | Apply Now |

This becomes even more interesting when you look at the elevated earning rates on the RBC® ION+ Visa, which are as follows:

- 3 Avion Premium points† per dollar spent on qualifying grocery, dining, food delivery, gas, rideshare, daily public transit, electric vehicle charging, streaming, digital gaming, and digital subscriptions†

That’s because both the RBC® Avion Visa Infinite Privilege† and the RBC® Avion Visa Infinite Business have a baseline earning rate of 1.25 points per dollar spent on all purchases.

Therefore, if you have both the RBC® ION+ Visa and an RBC® Avion Visa Infinite Privilege† or RBC® Avion Visa Infinite Business, you can take advantage of the elevated earning rates on the RBC ION+ Visa, as well as the heightened redemption rates on the latter two cards by pooling them together.

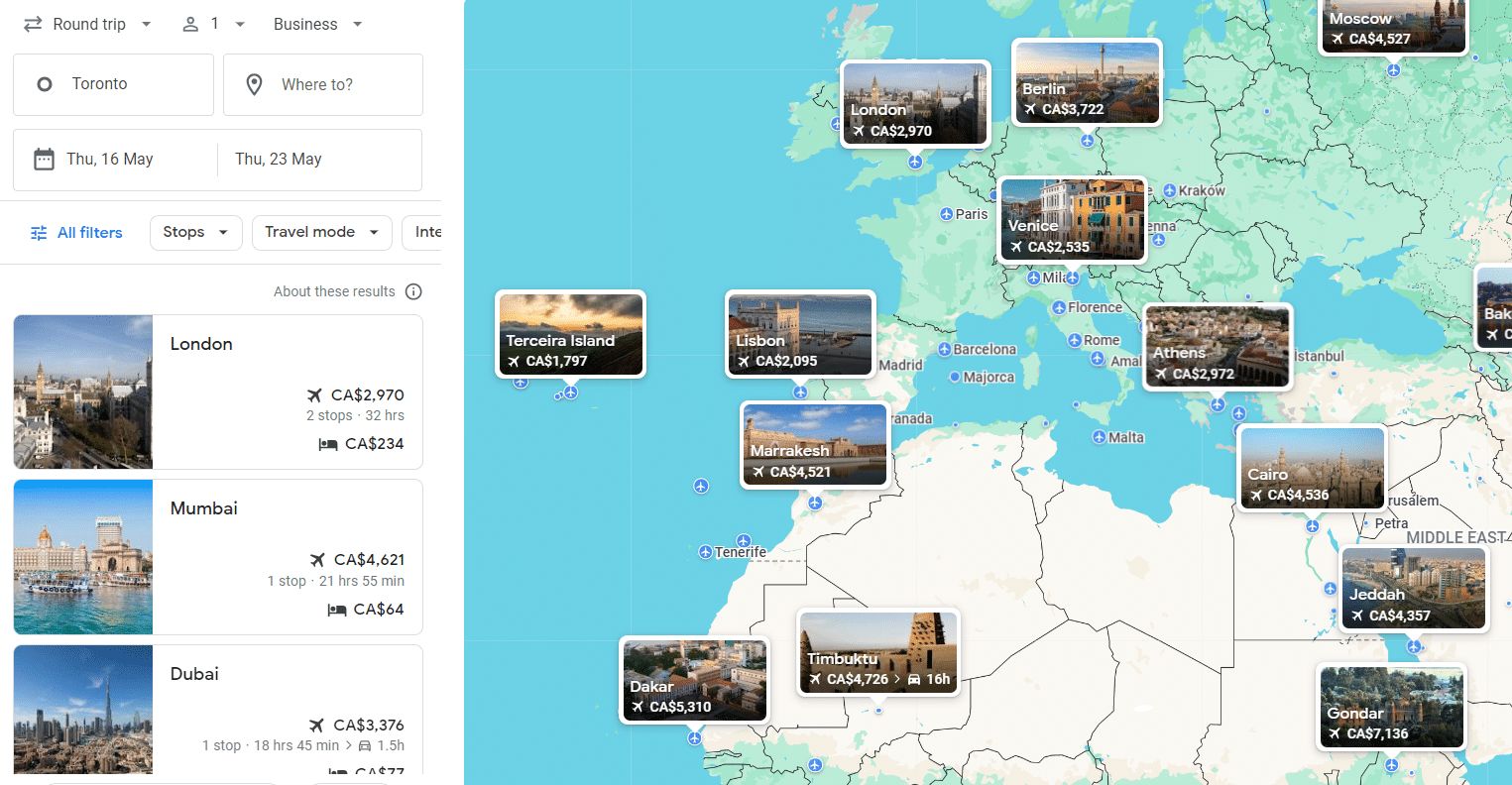

Use Google Flights

Perhaps the most convincing reason to book business class flights at 2 cents per point is the sheer flexibility available through this redemption option.

In fact, you can book any business class or First Class flight that you can find online, and redeem your RBC Avion points at a rate of 2 cents per point against the cost.

By and large, the best way to search for flights is through Google Flights.

With Google Flights, you can easily look for flights across multiple months at a time, helping you to pinpoint the cheapest fares for your desired route.

Additionally, if you have flexible travel dates, you can use the Google Flights Explore feature.

On the Explore page, enter the airport from which you want to depart, and select business class or First Class; you can now view all the business class flights within whatever timeframe you choose.

Notably, if the flight you find through Google Flights isn’t available through RBC Avion Rewards, you can simply call RBC directly and get authorization to book the flight on your own.

You’ll then apply your points as a statement credit afterwards at the same rate of 2 cents per point.

Booking Flights Directly with the Airline

Flights booked with points directly through RBC Avion Rewards usually don’t count towards earning status with the airline, and you won’t be able to earn any points when booking an award flight.

However, if your desired flight happens to only be bookable by calling RBC for authorization, you stand to benefit in a unique way.

If you find a flight that doesn’t appear through the RBC Avion Rewards search, and you get authorization to book it, you’ll gain the opportunity to earn qualifying status activity and miles or points from the airline.

Keep in mind that most flights will be bookable through RBC Avion Rewards, so this opportunity is less common. However, it’s still worth watching out for, as you can earn a decent number of miles/points when you fly business class, and the status-qualifying activity can also be quite significant.

Some cardholders have reported that they indeed earn points and status qualifying activity on flights booked through the RBC Avion Rewards portal. However, since there doesn’t appear to be any reliable pattern to this, it’s best not to count on it, and rather treat it as a bonus if it happens.

The Cheaper, the Better

Lastly, when it comes to redeeming RBC Avion points this way, the cheaper the flight, the better.

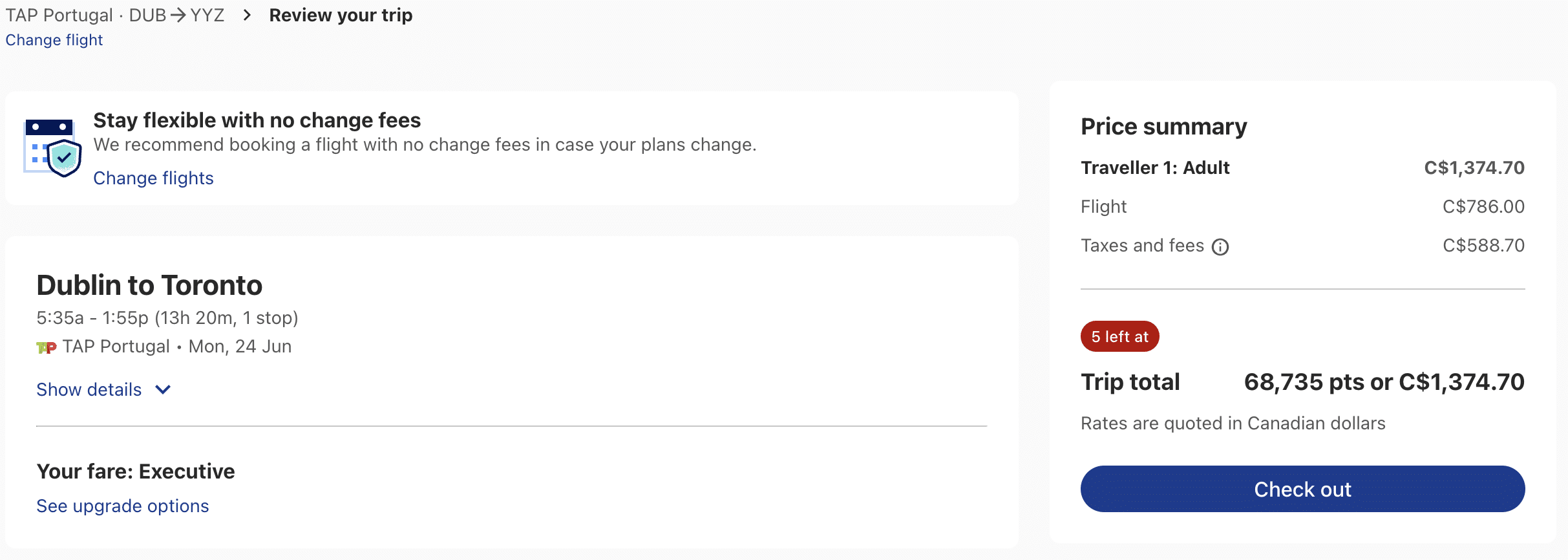

Throughout the year, some airlines may offer sales for business class flights, and in these situations, it may wind up being a much better deal than transferring points to a loyalty program.

For example, TAP Air Portugal is known to offer round-trip business class fares between Europe and North America for around $1,700 at least once per year.

During a sale like this, it’d only cost 85,000 RBC Avion points for round-trip business class flights to Europe, as you’d get 2 cents per point for a redemption.

To put this in perspective, booking the same flights with Aeroplan might cost at least 120,000 points, and you’d be on the hook for taxes and fees. Likewise, booking round-trip award flights to Europe with British Airways Executive Club might cost 160,000 Avios, plus $700 or more in taxes and fees.

Therefore, whenever a business class flight sale pops up, be sure to consider booking the flights and redeeming RBC Avion points for it, as it can wind up being an outstanding deal.

Just be sure to get an authorization prior to booking.

Is Redeeming RBC Avion Points for Business Class Flights Worth It?

Whether or not it’s worth it to redeem RBC Avion points for business class flights will depend on your individual preferences.

While it’s possible to get more value out of your Avion points by transferring them to loyalty programs and booking business class flights, there’s certainly more freedom and flexibility with the option to redeem Avion points for any available business class or First Class flight, regardless of airline.

With this option, you won’t have to wait for award availability to show up, and you can easily compare all of the cheapest flight options through Google Flights.

Likewise, if you’re able to find a flight that’s not bookable through RBC Avion Rewards, you’ll have the additional opportunity to earn qualifying airline status activity and miles/points, which can help make your business class redemption a whole lot more valuable.

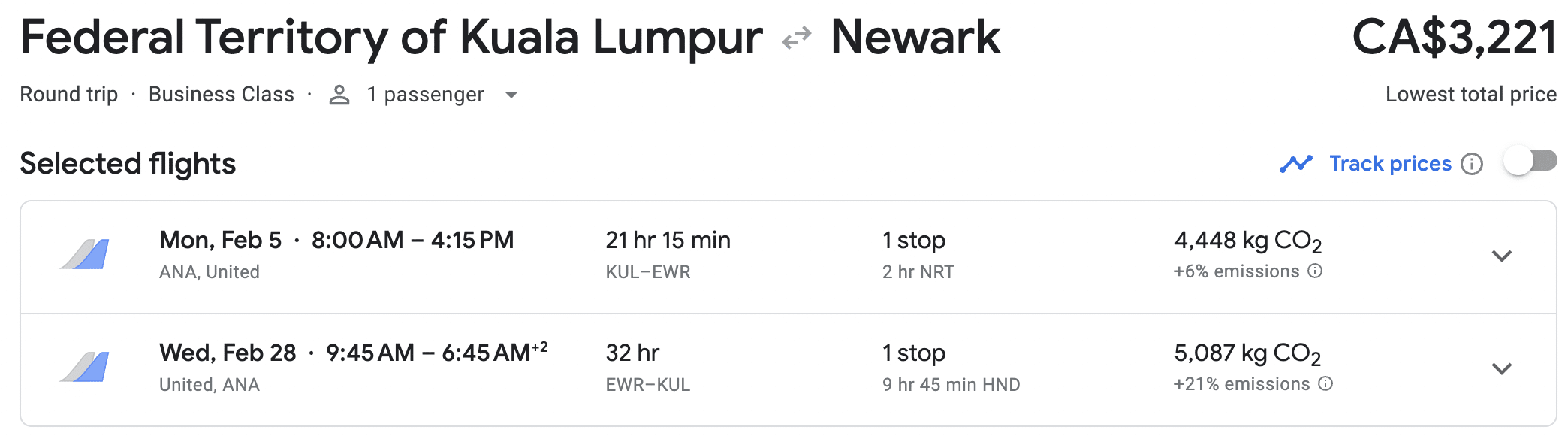

The caveat is that cash fares for business class and First Class tickets tend to be very expensive.

For example, round-trip flights to Europe might cost $4,000–5,000, which means you’d need to have 200,000–250,000 RBC Avion points to cover the total cost.

That’s certainly a lot of points to use for a single trip, and if cash prices are this high, you’re likely better off transferring them to airline programs instead.

However, if you can find a deal on business class flights, redeeming points this way can result in a better option than booking through loyalty programs.

Lastly, the standard earning rate on the cards eligible for redeeming Avion points for flights at 2 cents per point is 1.25 points per dollar spent. Without a category earning multiplier, it can take a long time to earn enough points for a business class flight booked this way.

In any event, having the ability to redeem Avion points for business class and First Class flights at 2 cents per point provides you with another option for getting good value, should you choose to make use of it.

Conclusion

RBC Avion points are a useful currency to collect, due in large part to the flexible nature of the program. You can transfer points to partner airline loyalty programs, or you can redeem points for your own travel, either through the RBC Air Travel Redemption Schedule or booking flights on your own.

One of the best ways to redeem Avion points is for business class and First Class flights, offered with select RBC Avion credit cards.

If you hold one of the four RBC credit cards that give you access to this redemption option, you’ll certainly want to consider taking advantage of it, especially during flight sales.

†Terms and conditions apply. Refer to the card issuer’s website for complete, up-to-date information.

What is the redemption rate for premium economy seats?

You would be subject to the normal RBC Air Travel Redemption Schedule: https://princeoftravel.com/guides/rbc-air-travel-redemption-schedule/

I’ve had the card for 2 years now and love it. My primary spending card and thus I earn a lot of Avion points for 2cpp redemptions (avion infinite privilege visa). Used it recently for flights between Tokyo to Seoul and Manila and also Toronto to Tunis Visa Frankfurt and Back.

Thanks TJ

I cancelled my RBC infinite privilege avion card 6 months ago.

When can I reapply for the same or different Avion card. PS Thanks for the previous Prince of Travel Consult. It was a great value.

While redeeming for business class flights at 2cpp with the Rbc VIP, is it possible to cover a part of the flight with redeeming the points at 2cpp and pay for the remaining or does the entire flight have to be covered with the Avion points at the rate of 2cpp