The American Express Cobalt Card has long ranked as the best Canadian credit card for everyday spending. This lifestyle-oriented card is one that every Canadian should have in their wallet for a multitude of reasons.

With outstanding earning rate multipliers, a low cost, and plenty of top notch transfer partners, it’s no wonder that the Cobalt Card has established itself as a top contender in the Canadian market since its debut in 2017.

If you’ve yet to sign up, let’s look at six reasons why the American Express Cobalt Card should be the next credit card in your portfolio.

In This Post

1. Earn 5x Points on Eats and Drinks

The American Express Cobalt Card offers an outstanding 5 Membership Rewards (MR) points for every dollar spent at restaurants, bars, cafés, food delivery services, and even grocery stores in Canada.

At the bare minimum, those points are worth 1 cent per point, which equates to a 5% return on eats and drinks. We value American Express Membership Rewards points at 2.2 cents per point, given how versatile they are.

Using this valuation, you could look at the rate of return at 11%, which is unparalleled in Canada. No other Canadian credit card with flexible points currencies has this kind of earn rate, and it’s very satisfying to get 5x points on daily essentials like groceries and dining out.

You’ll earn this 5x multiplier on up to $2,500 spent each month, which equates to $30,000 spent per year. Therefore, if you can max it out, that’s a whopping 150,000 MR points in your account, in addition to any other points you’d earn on the card.

Curious how many points you could earn with your monthly spending habits?

Use the calculator below to estimate how many American Express Membership Rewards points you could rack up with the Cobalt Card.

If your grocery and dining budget doesn’t quite add up to $2,500 each month, keep in mind that grocery stores also sell gift cards, which you can then use at other businesses where you’d otherwise earn less.

In addition to this generous 5x earn rate, you’ll earn 3x MR points per dollar spent on a plethora of streaming subscriptions in Canada, including Netflix, Disney+, Crave, Spotify, Apple Music, and more.

You’ll also earn 2x MR points per dollar spent on gas, travel, and public transit purchases in Canada.

Unfortunately, the earning rate for travel purchases is dropped to 1 point per dollar spent as of October 8, 2024. However, you can easily bypass this by having an optimized credit card portfolio, adding the American Express Gold Rewards Card or American Express Platinum Card, both of which offer 2x MR points on travel.

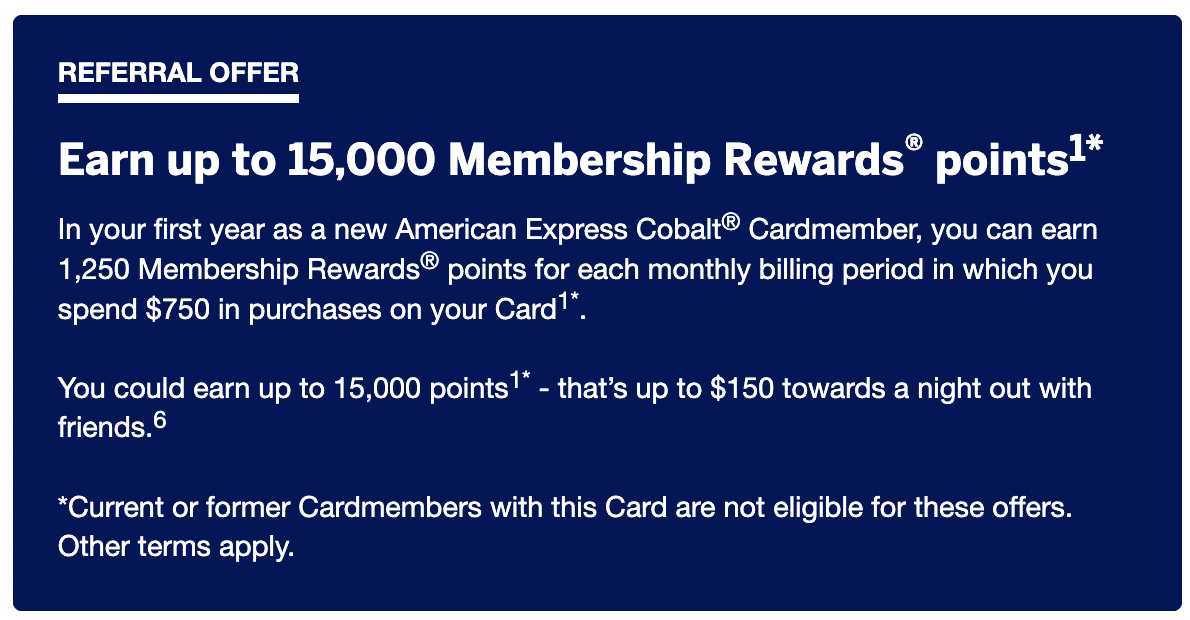

2. Modest Welcome Bonus

In addition to the 5x earning rate on food and drinks, there’s a welcome bonus to sweeten the deal for new cardholders, too, which comes with a unique structure that encourages monthly spending.

Instead of a one-time bonus, you’ll receive 1,250 MR points for each month in the first year as a cardholder in which you spend $750, netting you to a total of 15,000 MR points for the welcome bonus.

Membership Rewards points have a tonne of power, as they give you a lot of options for redemptions. You can choose to transfer them to airline or hotel loyalty programs, redeem them for flights with the Amex Fixed Points Travel Program, or apply them as a statement credit against any purchase.

While there are certainly other cards other there with higher welcome bonuses, those often come at a higher cost and with less competitive earning rates for everyday spending. Indeed, with the Cobalt Card, you’ll be sure to watch your points balance grow quickly with the monthly bonuses and your daily spending combined.

3. Earn Membership Rewards Points

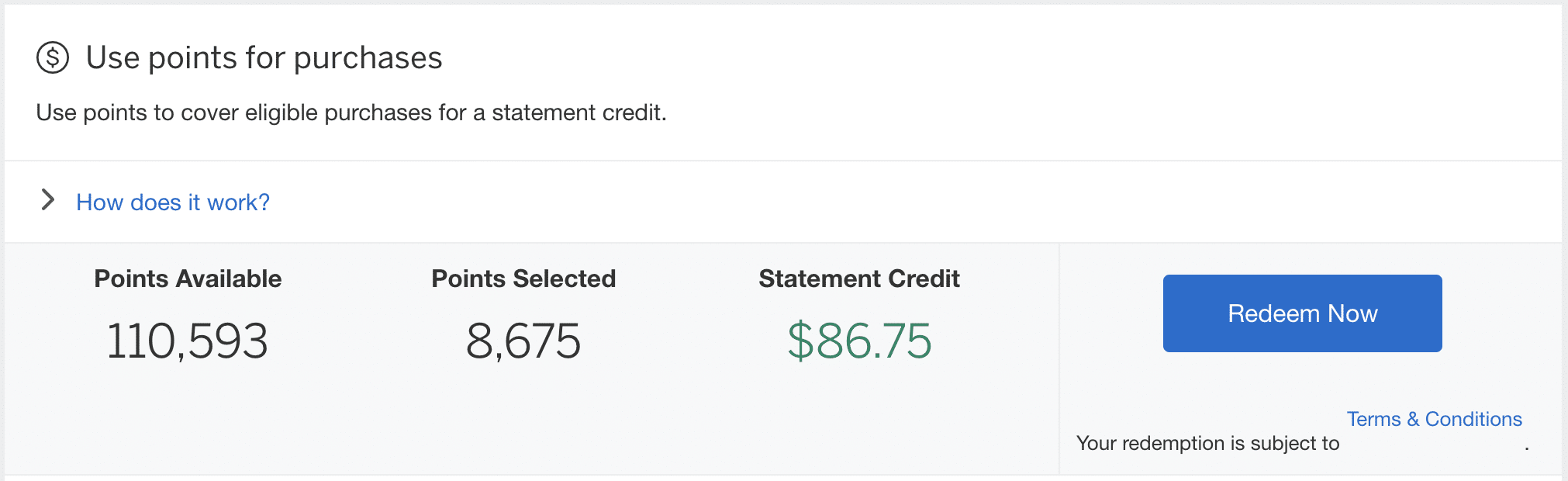

American Express Membership Rewards are the most flexible and versatile points currency in Canada. That’s because they can do everything that a cash back or fixed-value points currency can do, but they can also do much more.

For example, you can redeem your points against any purchase made to the card at a value of 1 cent per point through the “Use Points for Purchases” redemption option. While there are certainly other ways to get greater value out of your points, if you’re looking for a simple way to offset costs, Amex MR points offer a great option.

Keep in mind that the card earns 5x points on eats and drinks, and if you redeem points for a statement credit at a rate of 1 cent per point, you’re looking at a healthy 5% return on spending, which is great!

Other points programs in Canada offer the option to book flights at a higher value of around 2 cents per point. Fortunately, Amex MR points also offer this option through the Amex Fixed Points Travel Program.

However, if you’re looking for the most valuable way to redeem your points, look no further than the long list of airline and hotel loyalty program transfer partners available through Membership Rewards.

4. Airline & Hotel Transfer Partners

American Express allows you to transfer Membership Rewards points to six different airline loyalty programs and two hotel loyalty programs. Amongst them are some of the most popular frequent traveller programs out there, including top loyalty programs from each of the three major airline alliances.

Aeroplan

Membership Rewards points can be transferred to Aeroplan points at a 1:1 ratio in increments of 100 points, starting at 1,000 MR points.

Aeroplan points are the most valuable type of airline points for Canadians to earn, as they can easily unlock discounted travel in economy class, business class, and First Class to destinations all over the world.

As a member of Star Alliance, in addition to booking Air Canada flights, you can also use Aeroplan points to book flights with other Star Alliance members, such as United Airlines, Lufthansa, All Nippon Airways, Thai Airways, Singapore Airlines, and many more.

Plus, Aeroplan partners with other airlines that don’t belong to Star Alliance, which opens the door for unique redemptions all over the world.

Aeroplan remains one of the best loyalty programs in the the world, and having the option to earn MR points on the Cobalt Card and convert them to Aeroplan points is one of the best ways to leverage the many sweet spots in the program.

British Airways Avios

The British Airways Club is another great option for transferring American Express MR points, as there are quite a few sweet spots for short-haul flights across different places in the world, including Europe, Asia, and Australia with oneworld airlines.

Similar to Aeroplan, MR points can be transferred to British Airways Avios at a 1:1 ratio in increments of 100, and with a minimum of 1,000 MR points.

Plus, with the partnership between British Airways and Qatar Airways, you can also transfer your Avios between the two programs instantly, allowing you to book the world’s best business class – Qatar Airways Qsuites – starting at just 70,000 Avios one-way from North America to Doha.

Air France KLM Flying Blue

Representing the SkyTeam alliance, Air France KLM Flying Blue is one of the best programs for booking transatlantic flights in economy, premium economy, or business class.

That’s because flights with Air France and KLM have the following “Saver”-level prices for flights from anywhere in North America to anywhere in Europe:

- Economy: 25,000 miles

- Premium economy: 40,000 miles

- Business class: 60,000 miles

One thing to keep in mind is that the transfer ratio to Flying Blue is 1:0.75, so you’ll need to factor that in when you’re deciding which program to book flights with.

However, you’ll also want to pay attention to the program’s monthly Promo Rewards, which offer discounts on award travel of up to 50%. If you can snag a flight on an eligible route, the sub-par transfer rate becomes less burdensome.

Marriott Bonvoy

Marriott is the world’s largest hotel chain, with an impressive global footprint of over 7,500 hotels. Membership Rewards points can be converted into Marriott Bonvoy points at a rate of 5:6, meaning that you’ll get 1,200 Bonvoy points for every 1,000 MR points you transfer.

While it’s usually more advisable to transfer Membership Reward points to Air Canada Aeroplan, The British Airways Club, or Air France KLM Flying Blue, there’s still a lot of value to be found in the Marriott Bonvoy program.

This is especially the case if you’re travelling in places like Asia or the Middle East, where Marriott Bonvoy Elite status goes a long way towards elevating your travel experience.

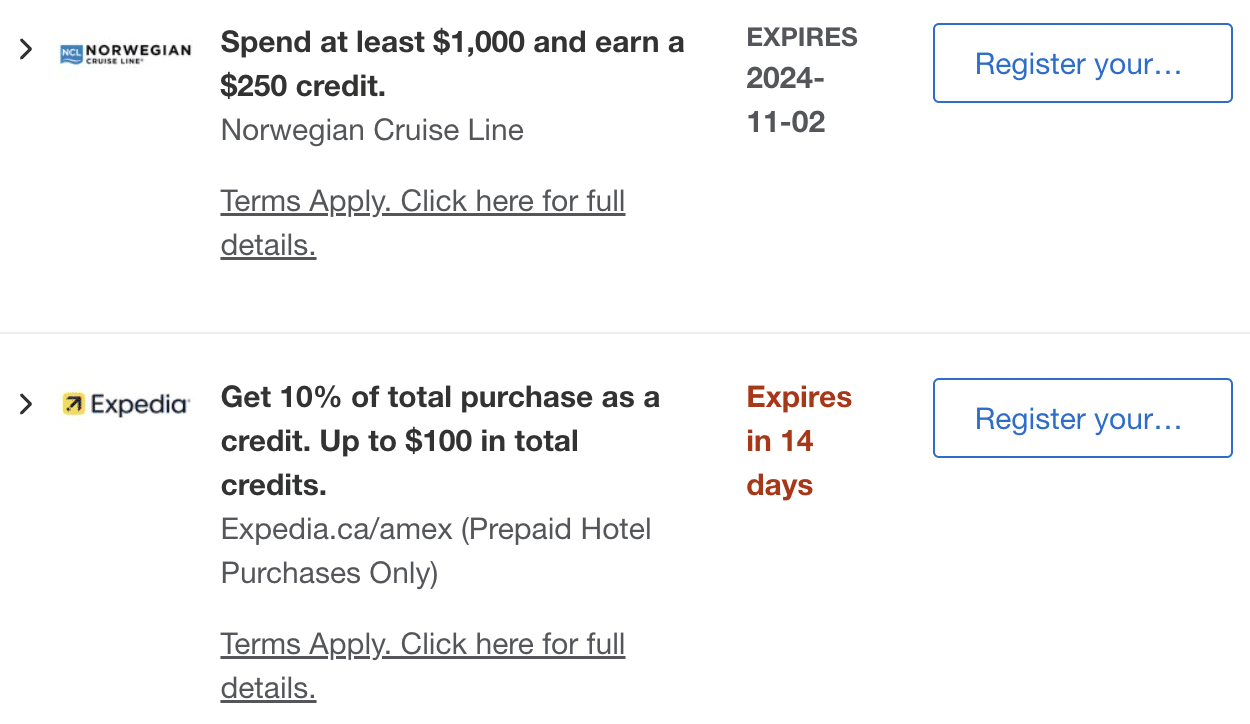

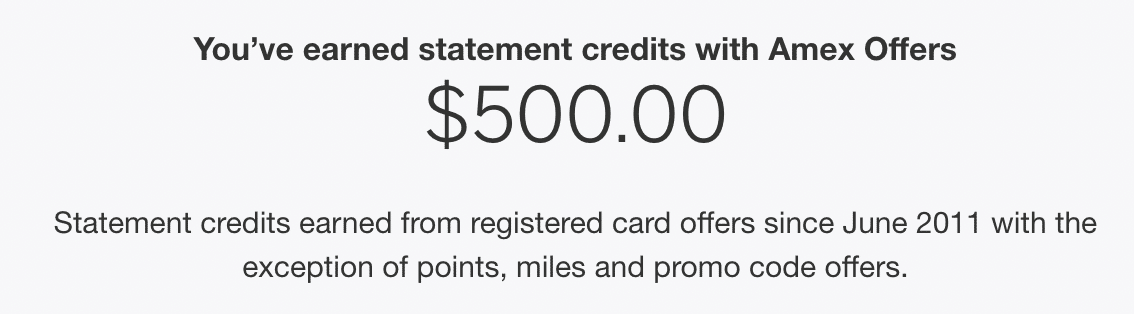

5. Access to Amex Offers

Holding an American Express card comes with many additional benefits, such as access to Amex Offers.

Some of the other more popular Amex Offers we’ve seen recently are the annual Shop Small promotion and the recurring Marriott offer.

In order to take advantage of these and other offers that pop up, you’ll have to navigate to the Amex Offers section online after logging in, or simply logging into your account.

The offers definitely add up over time, and can easily offset the monthly fee with a single purchase.

6. Insurance Coverage

The American Express Cobalt Card wraps things up with a solid list of insurance provisions for a card in its price range.

Simply by being a Cobalt cardholder, you’ll automatically receive emergency medical insurance for 15 days, up to a maximum of $5,000,000, if you’re under the age of 65.

Furthermore, if you use your Cobalt Card to pay for your travel expenses, you’ll be eligible to receive many more types of travel insurance coverage, which includes:

- Lost or stolen baggage insurance, up to a maximum of $500 per trip

- $250,000 travel accident insurance

- Flight and baggage delay insurance, up to a maximum of $500

- Hotel burglary insurance, up to a maximum of $500

- Car rental theft and damage insurance

Trip cancellation and interruption insurance is a noteworthy omission that you’d find on other credit cards in a similar fee range, so that’s something to weigh up if those types of travel insurance are meaningful to you.

Purchase protection, extended warranty, and mobile device insurance round out the coverage types.

Conclusion

The American Express Cobalt Card is the best all-around Canadian credit card when it comes to everyday spending.

The Membership Rewards points earned through its welcome bonus and generous category spending multipliers, when transferred to one of American Express’s airline or hotel partners, can go a long way towards fuelling your next trip.

Any Canadian household can reliably earn a handful of high-value travel redemptions year after year simply by using the Cobalt Card to pay for their grocery and dining expenses – and you can’t really ask for more from a credit card than that!