Cathay World Elite® Mastercard®: Earn Up to 60,000 Asia Miles!

The Cathay World Elite® Mastercard® – powered by Neo is currently offering a historical high welcome bonus, making it a compelling choice for Cathay Pacific loyalists and Asia Miles collectors.

With this offer, you can earn up to 60,000 Asia Miles and get 15% off Cathay Pacific flights when paying with the card and using a special promo code.

If you’re looking for a way to boost your Asia Miles balance while securing a discount on flights, now is the best time to apply.

Let’s take a closer look at what this card offers.

New Historical High Offer: Up to 60,000 Asia Miles + 15% Flight Discount

The current offer on the Cathay World Elite® Mastercard® – powered by Neo is the strongest we’ve seen on this card since its launch.

Here’s what you can earn:

- Earn 35,000 Asia Miles upon activating the card†

- Earn 25,000 Asia Miles upon spending $5,000 in the first three months†

- 15% discount on Cathay Pacific flights when using the promo code CXNEO15OFF (valid until December 31, 2025)

If you frequently book Cathay Pacific flights, this discount alone could lead to significant savings, and then you can use the Asia Miles for redemptions with Cathay Pacific and other Oneworld airline partners.

First-year value

$380

Annual fee: $180

• Earn 15,000 points on approval

• Earn 15,000 points upon spending $5,000 in the first 3 months

Earning rates

Key perks

- 15% discount on Cathay Pacific flights

- Bonus Asia Miles with Neo partners

Annual fee: $180

• Earn 15,000 points on approval

• Earn 15,000 points upon spending $5,000 in the first 3 months

Earning rates

Key perks

- 15% discount on Cathay Pacific flights

- Bonus Asia Miles with Neo partners

The welcome bonus of up to 60,000 Asia Miles is enough to cover a one-way economy ticket from Toronto to Hong Kong, which starts at 38,000 Asia Miles.

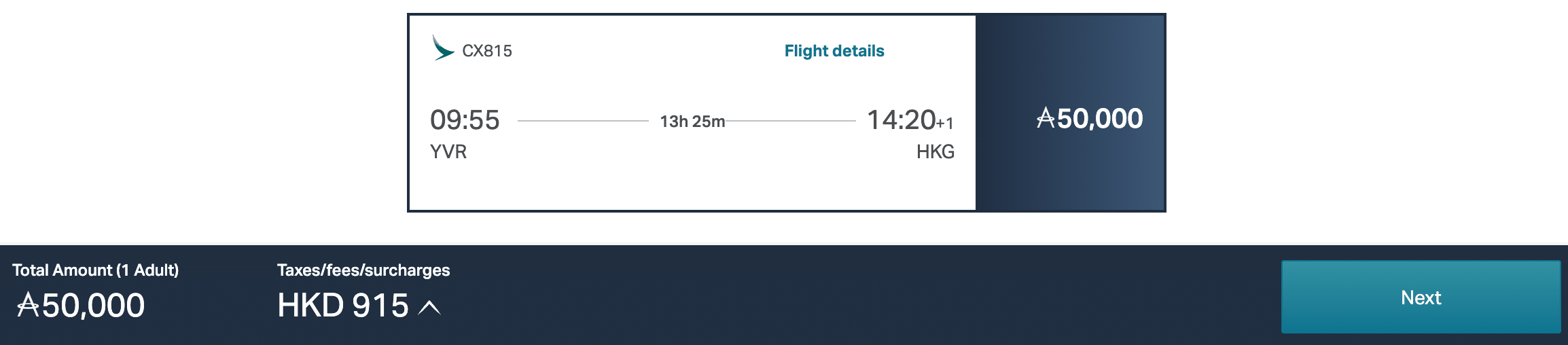

For Vancouver-based travellers, the welcome bonus is enough to cover a full round-trip economy ticket between Vancouver and Hong Kong, with redemptions starting at 27,000 Asia Miles each way. Alternatively, premium economy can be booked for just 50,000 Asia Miles one-way, making this a great sweet spot for West Coast flyers looking for extra comfort.

Asia Miles can also be redeemed for flights with Oneworld partners such as Japan Airlines, Qatar Airways, and American Airlines, providing additional flexibility.

If you’re planning to redeem Asia Miles for long-haul flights in premium cabins, this bonus could help offset a good chunk of the cost, too.

- Vancouver to Hong Kong: 88,000 Asia Miles in business class

- Toronto to Hong Kong: 115,000 Asia Miles in business class

While you’ll still need to top up your balance for business class awards, this welcome bonus gives you a strong head start. Plus, Asia Miles offers the only meaningful pathway to premium cabin redemptions with Cathay Pacific these days, as other programs don’t have access to the same award inventory.

Earning Rates & Everyday Spending

Beyond the welcome bonus, the Cathay World Elite® Mastercard® – powered by Neo offers the following earning structure:

- Earn 4 Asia Miles per dollar spent on Cathay Pacific flights†

- Earn 2 Asia Miles per dollar spent in foreign currencies†

- Earn 1 Asia Mile per dollar spent elsewhere†

- Bonus earning opportunities with Neo partners†

The 4x earn rate on Cathay Pacific flights is a significant boost and makes this card much more attractive for frequent flyers who pay cash for tickets. However, the 2.5% foreign transaction fee still cuts into the value of earning 2x on foreign purchases.

If you frequently spend in foreign currencies, an ideal strategy is to pair this card with a no foreign transaction fee credit card, such as the Scotiabank Passport® Visa Infinite Card*, to ensure you’re maximizing rewards while avoiding unnecessary fees.

Additionally, the Neo partner network provides elevated earning rates at select retailers, though the exact rates vary and are only visible to cardholders. If you shop regularly at Neo’s partner merchants, this feature could help boost your Asia Miles earnings.

Redeeming Your Asia Miles

Asia Miles is a distance-based rewards program, meaning the number of miles required for a flight depends on how far you’re flying.

For standard Cathay Pacific, partner, mixed-carrier, and oneworld multi-carrier awards, there’s no officially published award chart.

Instead, you’ll need to visit the Redeem Flight Awards page to look up mileage requirements manually for each route.

To help fill that gap, I’ve created an unofficial chart for Cathay Pacific flights based on personal research and live award searches.

While it’s not officially endorsed by Asia Miles, it should serve as a reliable reference point when planning your redemptions.

| Distance zone | Economy | Premium Economy | Business | First |

|---|---|---|---|---|

| Ultra-short1 - 750 miles | 7,000 | 11,000 | 16,000 | N/A |

| Short – Type 1751 - 2,750 miles | 9,000 | 20,000 | 28,000 | 43,000 |

| Short – Type 2751 - 2,750 miles | 13,000 | 23,000 | 32,000 | 50,000 |

| Medium2,751 - 5,000 miles | 20,000 | 38,000 | 58,000 | 90,000 |

| Long5,001 - 7,500 miles | 27,000 | 50,000 | 88,000 | 125,000 |

| Ultra-long7,501+ miles | 38,000 | 75,000 | 115,000 | 160,000 |

The best redemptions typically include:

- Cathay Pacific long-haul flights

- Short-haul flights within Asia

- Transatlantic flights on Oneworld partners

For travellers based in Canada, long-haul and ultra-long-haul Cathay Pacific flights from Toronto (YYZ) and Vancouver (YVR) are among the most valuable uses of Asia Miles.

Asia Miles can also be used for flight upgrades, hotel stays, and other travel perks, but the best value is typically found in flight redemptions.

If you’re new to Asia Miles, check out our guide to learn how to maximize your redemptions.

Additional Cardholder Benefits

In addition to earning Asia Miles, the Cathay World Elite® Mastercard® comes with a few travel perks:

- 15% off Cathay Pacific flights (valid until December 31, 2025)

- Virtual card upon approval for immediate use

- Mastercard Travel Pass (DragonPass) lounge access ($32 USD per visit)

Frankly, the perks are underwhelming given the $180 annual fee. Unlike other airline co-branded cards, this card does not offer free checked bags, priority boarding, or airport lounge passes—benefits that many travellers expect.

Another major downside is that the Mastercard Travel Pass does not come with any complimentary visits, which is disappointing for a card with a pretty substantial annual fee.

In contrast, credit cards with lower annual fees—such as the CIBC Aventura® Visa Infinite Card* and Scotiabank Passport® Visa Infinite Card*—offer four and six complimentary lounge visits per year, respectively.

DragonPass Lounge Access with Visa and Mastercard Products

Read more50,000+ travellers get this email

Weekly deals, credit card insights, and points strategies – free forever.

If you travel frequently and want to enjoy more airport benefits, supplementing this card with the Scotiabank Passport® Visa Infinite Card* could be a smart move.

Not only does it offer no foreign transaction fees, but it also provides six complimentary Visa Airport Companion Pass lounge visits per year, making your overall travel experience smoother and more rewarding.

Insurance Coverage

The Cathay World Elite® Mastercard® – powered by Neo provides moderate travel insurance benefits, including:

- Emergency medical insurance (up to $1 million for trips up to 14 days, for those 60 and younger)

- Trip cancellation & interruption insurance (up to $1,000 per person, up to $5,000 per trip)

- Flight delay insurance (up to $500)

- Lost/delayed baggage insurance (up to $1,000)

- Rental car collision/damage insurance (up to 48 consecutive days)

- Hotel/motel burglary insurance (up to $1,000)

One major drawback with regarding the insurance offered by this card is that the coverage does not apply to award bookings.

This is a surprising omission, as most other airline co-branded credit cards provide insurance coverage on award tickets, as long as the taxes and fees are charged to the card.

If you plan to book an award flight with Asia Miles, you may want to use a credit card that offers insurance on award travel, such as the National Bank® World Elite® Mastercard®, which provides full coverage on award redemptions.

Annual fee: $150

Earning rates

Key perks

- Airport lounge access

Annual fee: $150

Earning rates

Key perks

- Airport lounge access

Should You Get the Cathay World Elite® Mastercard®?

The new 60,000 Asia miles welcome bonus and enhanced 4x earn rate on Cathay Pacific flights make this the most competitive version of the card we’ve seen to date.

That said, the card still has some notable limitations. The foreign transaction fee, lack of complimentary lounge visits, and insurance coverage that excludes award bookings are areas where it falls short compared to other airline or premium travel cards.

Also, it has a relatively high annual fee of $180 when compared to other premium travel credit cards that offer more ongoing perks.

Is It Still Worth Getting?

Yes—this is the best offer we’ve seen on the Cathay World Elite® Mastercard® – powered by Neo, and it’s now one of the strongest Asia Miles welcome bonuses available in Canada.

As a reminder, RBC Avion points transfer to Asia Miles at a 1:1 ratio. With the current round of welcome offers on the Avion suite of cards, the offer on the Cathay World Elite® Mastercard® – powered by Neo is much more lucrative if you’re looking to pad your Asia Miles balance.

However, Avion points still offer more flexibility overall. They can be transferred to other airline programs like The British Airways Club or American Airlines Aadvantage, giving you more redemption options beyond Cathay Pacific flights.

So, if you’re looking to keep your options open or redeem across various programs, Avion is a better long-term points strategy. But if you’re laser-focused on flying Cathay Pacific, this is the card to prioritize right now.

Earn More Miles on Your Everyday Spending

Beyond welcome bonuses, the way you earn points from daily spending also matters.

A much stronger long-term earning strategy would be to pair with the RBC ION+™ Visa Card.

First-year value

$450

Monthly fee: $4First Year Free

• Earn 7,000 points on approval

• Earn 14,000 points upon spending $1,500 in the first 6 months

Earning rates

Key perks

- Transfer to BA Avios, Cathay, WestJet, AA

Monthly fee: $4First Year Free

• Earn 7,000 points on approval

• Earn 14,000 points upon spending $1,500 in the first 6 months

Earning rates

Key perks

- Transfer to BA Avios, Cathay, WestJet, AA

The RBC® ION+ Visa earns 3 Avion points per dollar on:

- Groceries

- Dining & food delivery

- Gas & EV charging

- Rideshare & public transit

- Streaming services

Since these categories make up the bulk of most people’s monthly spending, this means you’d effectively be earning 3 points per dollar on a majority of your everyday purchases.

However, the Avion points earned on the ION+ card don’t transfer directly to Asia Miles. To do that, you’ll need to either:

- Hold an eligible Avion card, or

- Upgrade your ION+ card to an Avion card in the future

Once the Avion points are held under the Elite membership tier, you’ll be able to transfer them to Asia Miles at a 1:1 ratio.

In other words, this setup effectively earns you 3 Asia Miles per dollar on most of your monthly essentials—far outperforming the Cathay World Elite® Mastercard® – powered by Neo’s flat 1 Asia Mile per dollar on everyday spending.

Conclusion

The Cathay World Elite® Mastercard® – powered by Neo currently has its best-ever public offer, with up to 60,000 Asia Miles and 15% off Cathay Pacific flights, and 4x earning on Cathay Pacific flight purchases.

For those who frequently fly with Cathay Pacific or have Asia Miles redemptions in mind, this card presents excellent upfront value and strong ongoing benefits for loyal customers.

However, if you want greater flexibility, no foreign transaction fees, or stronger travel perks, there are better alternatives to consider.

Still, if Asia Miles is your focus, this is the best offer on the market right now, and a great way to jump-start your next premium redemption.

Jason thrives on connecting with the heart of a destination, seeking out experiences that go beyond the guidebooks.

First-year value

$1,080

Annual fee: $120

• Earn 35,000 points on approval

• Earn 20,000 points upon spending $5,000 in the first 6 months

Earning rates

Key perks

- Transfer to BA Avios, Cathay, WestJet, AA

- DoorDash DashPass for 12 months

- Petro-Canada 3c/L savings + 20% bonus Petro-Points

Annual fee: $120

• Earn 35,000 points on approval

• Earn 20,000 points upon spending $5,000 in the first 6 months

Earning rates

Key perks

- Transfer to BA Avios, Cathay, WestJet, AA

- DoorDash DashPass for 12 months

- Petro-Canada 3c/L savings + 20% bonus Petro-Points