It may be Canada Day, but it’s down in the United States that we’re seeing massive action on the credit card front today.

Following in the footsteps of our very own Canadian-issued Platinum Card, the Amex US Platinum Card has also bumped up its signup offer to an unprecedented level, while also raising its annual fee in line with previously rumoured changes.

The US Platinum Card is now offering 100,000–125,000 US MR points as a base signup bonus, as well as a further 10–15x points on up to US$25,000 of restaurants worldwide and Shop Small in the first six months, up to 250,000–375,000 US MR points.

However, the card’s annual fee increases from US$550 to US$695 as of today for new applicants and upcoming renewals. Let’s digest these changes from a cross-border perspective.

125,000 US MR Points + 15x Points on Restaurants & Shop Small

The historical standard offer on the US Platinum Card has been in the range of 60,000 US MR points upon spending US$5,000 in the first three months, but the card has simply blown those standards out of the water in recent months.

Following a consistent period of offering 100,000 US MR points since the fall of 2020, the US Platinum Card has now raised the stakes even further to coincide with its increased annual fee.

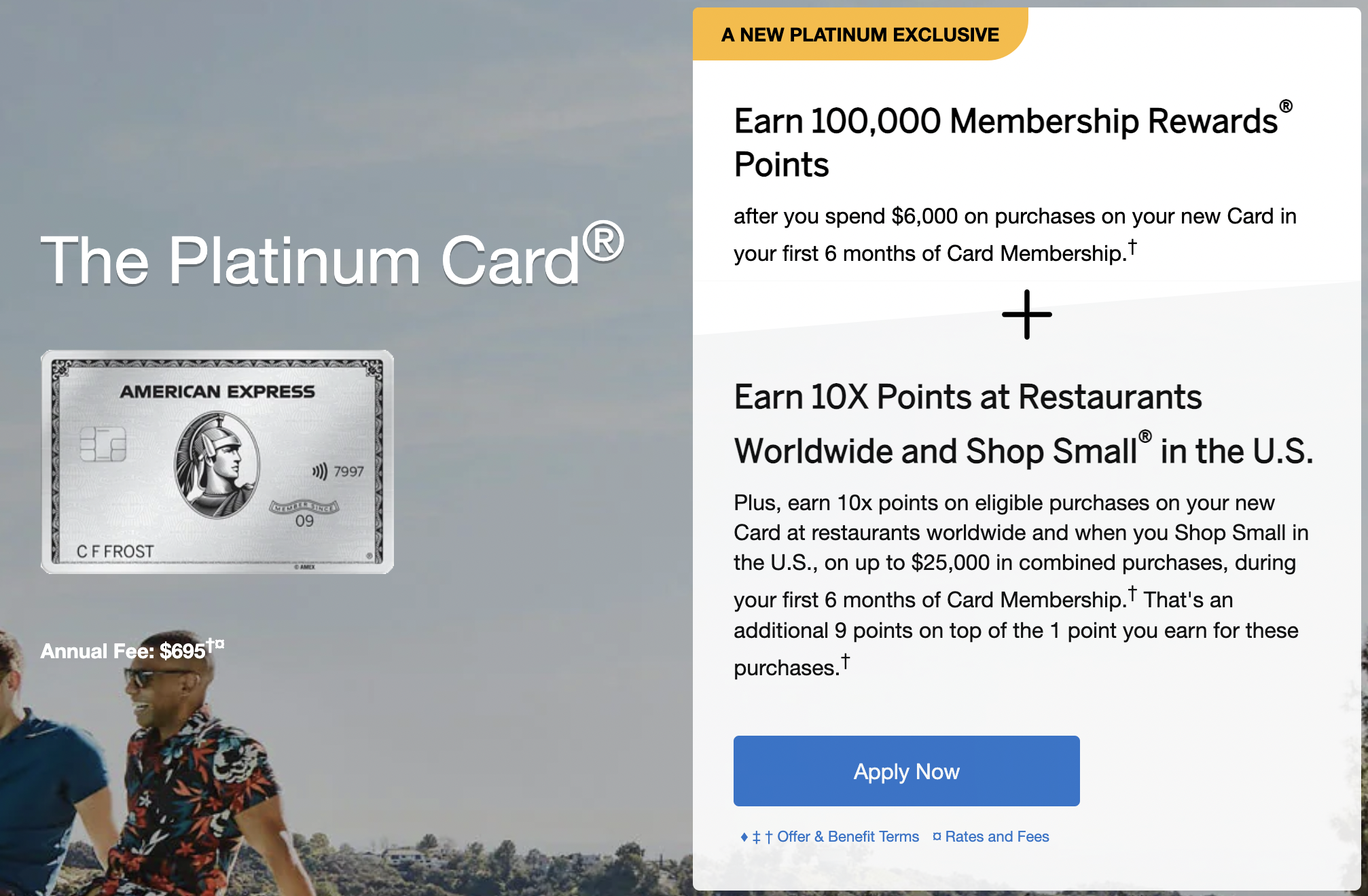

The standard welcome bonus looks as follows:

- 100,000 US MR points upon spending US$6,000 in the first six months

- 10x US MR points on up to US$25,000 spent at restaurants worldwide and Shop Small purchases in the US in the first six months, up to 250,000 US MR points

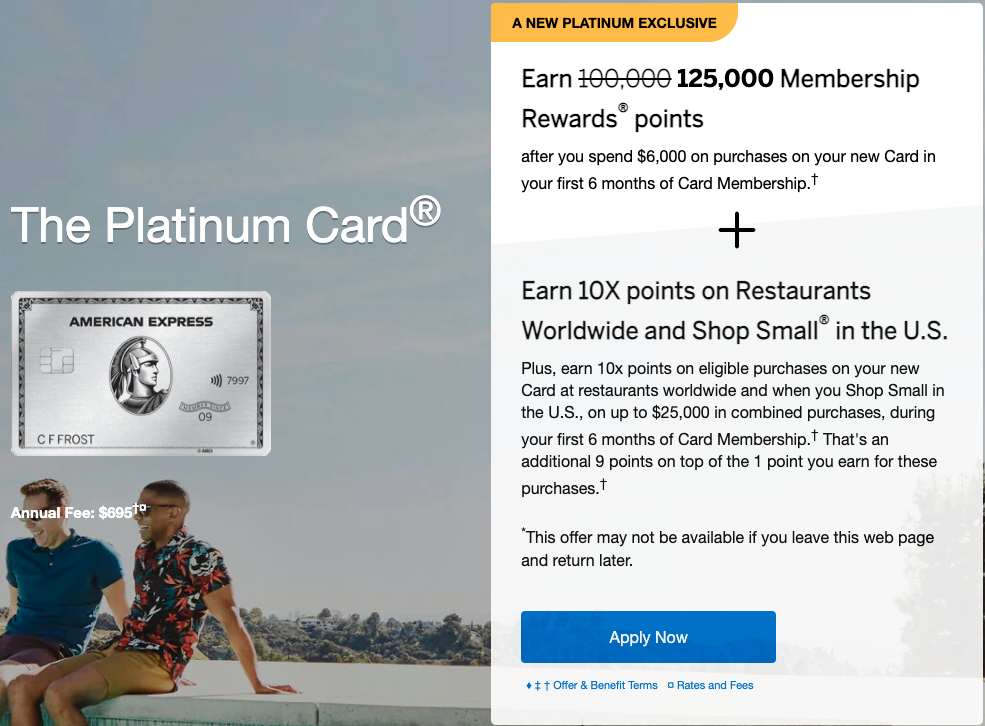

Furthermore, there are also “incognito offers” in which the base signup bonus is 125,000 US MR points. I haven’t been able to pull this up myself just yet, but several others have reported seeing it using various combinations of incognito mode, different browsers, and VPNs.

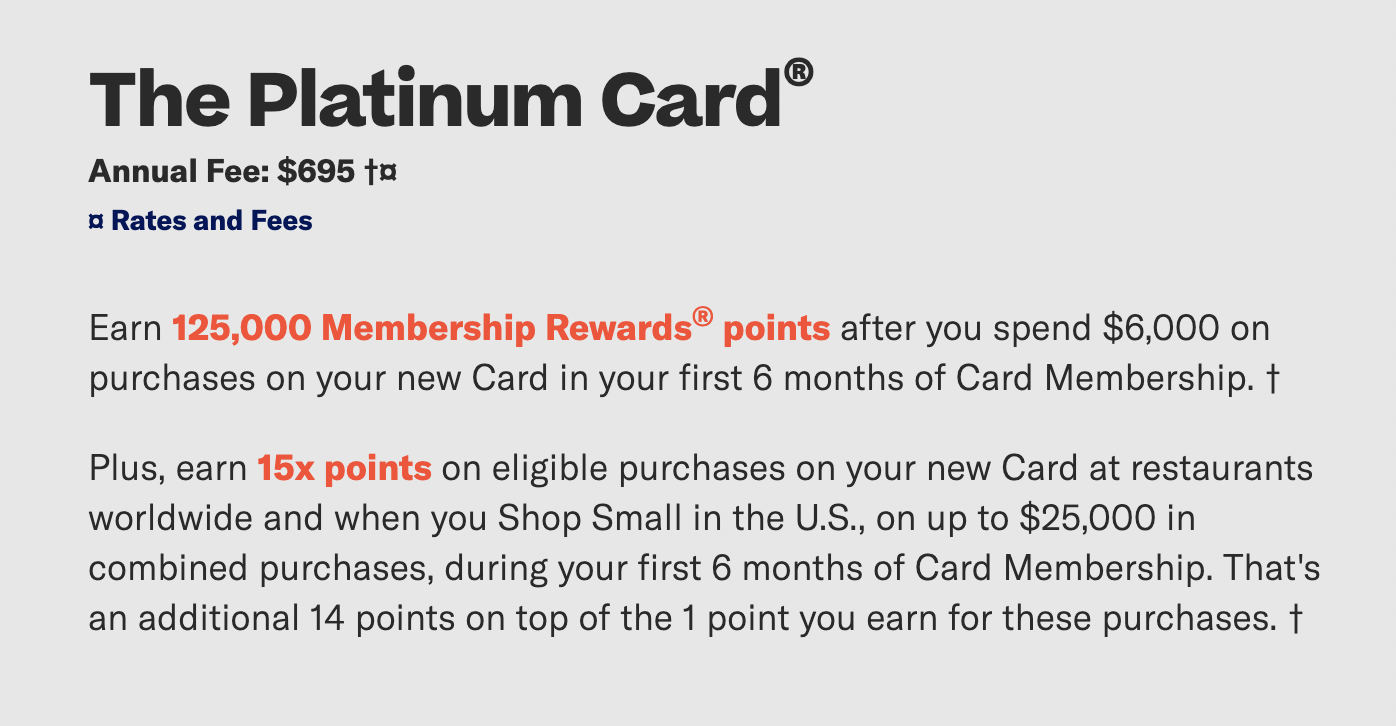

Then, there’s also a strictly superior welcome offer available via Resy, the restaurant booking platform owned by American Express. Here, you’ll earn:

- 125,000 US MR points upon spending US$6,000 in the first six months

- 15x US MR points on up to US$25,000 spent at restaurants worldwide and Shop Small purchases in the US in the first six months, up to 375,000 US MR points

Unless you’re applying via a referral link (in which case your partner’s referral bonus may move the needle), the Resy offer will be the best channel to apply through. You could potentially earn up to 500,000 US MR points from a single card, which is simply staggering beyond belief.

Let’s talk about the limited-time ability to earn 10x or 15x US MR points on up to US$25,000 of spending at restaurants worldwide and US Shop Small.

10x or 15x points on restaurants worldwide makes this very quite appealing even for Canadians, who are often excluded from the spend-based components of welcome offers in the US, especially as many of us are looking at a fair bit of dining and restaurant spend in the coming months both at home and abroad.

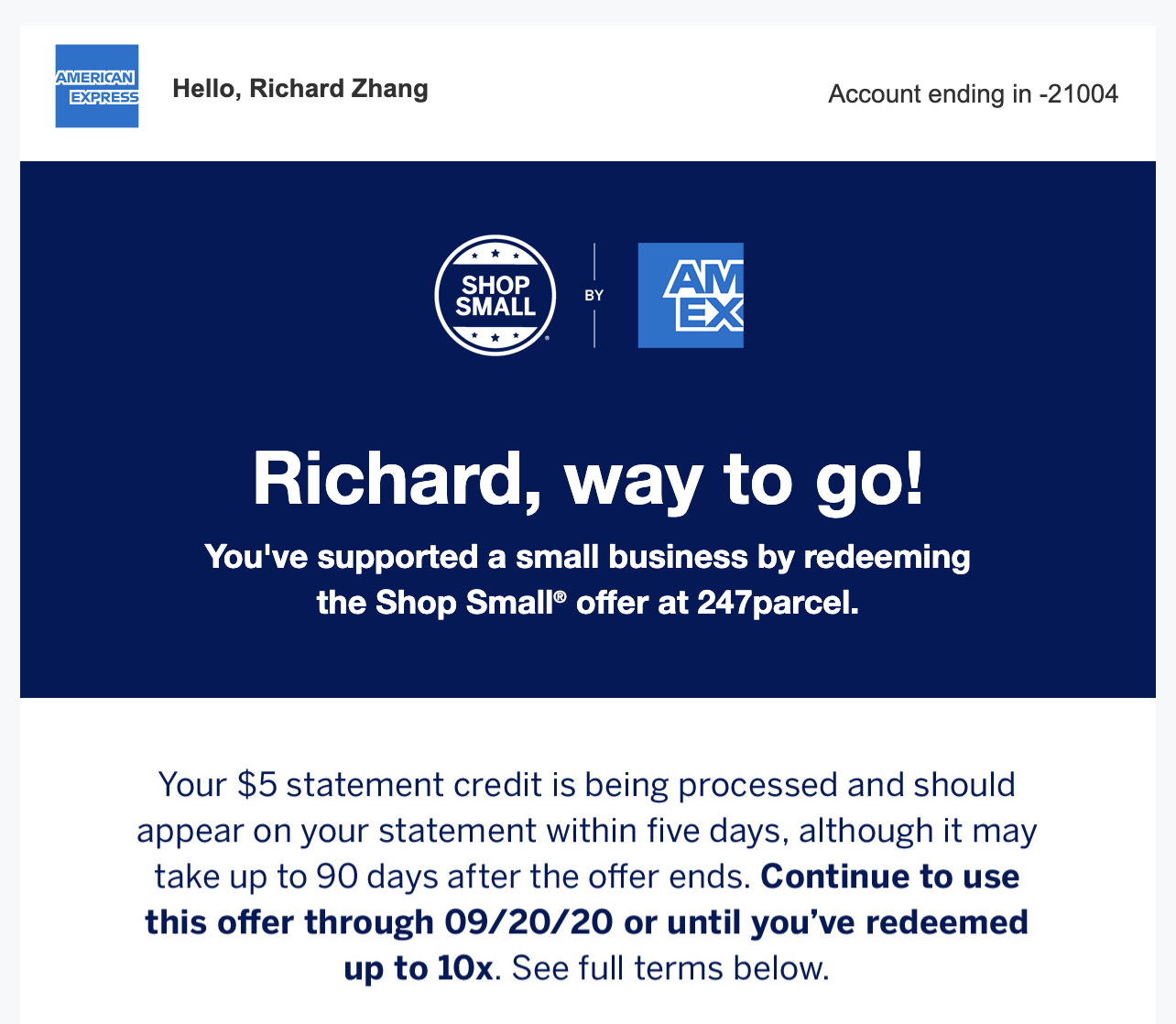

I’m also very intrigued by the inclusion of Shop Small bonuses as part of the signup offer, as we know that US-based gift card app Fluz, for example, counted as Shop Small during the last US Shop Small promotion. Buying a huge amount in gift cards will necessarily incur a slight loss in case you wanted to pawn them off, but that’s not a big deal when 15x US MR points are on the line, is it?

Remember, because Amex US enforces a strict once-in-a-lifetime rule on welcome bonuses, the prevailing strategy for all Amex US cards is to only apply when there are historically high offers on the table. In my opinion, these offers most certainly fit that bill, so if you’ve never held the Amex US Platinum Card before and are prepared to dive right in, now’s the time to do so.

All on its own, 125,000 US MR points would be enough for the following spectacular redemptions:

- Transferring to Virgin Atlantic Flying Club to book ANA First Class for 60,000 miles one-way or 120,000 miles round-trip

- Transferring to Emirates Skywards to book Emirates First Class to Europe for 85,000 miles one-way

- Transferring to ANA Mileage Club to book an ANA round-the-world award with eight stopovers and four open-jaws

- Transferring to Singapore Airlines KrisFlyer to book elusive Singapore Airlines business class, First Class, and Suites Class awards

- Transferring to Cathay Pacific Asia Miles to book Cathay Pacific flights with much greater award space

Another factor to consider here is that the 125,000 US MR points are associated with a minimum spending requirement of “only” US$6,000 in the first six months. That’s a pretty generous threshold considering the strong bonus: previous welcome bonuses in this range have typically seen spending thresholds of US$10,000 or US$15,000, often limited to the first three months as well.

If you’ve already gotten started with US credit cards, then you can simply go ahead and apply to add the Platinum Card to your portfolio.

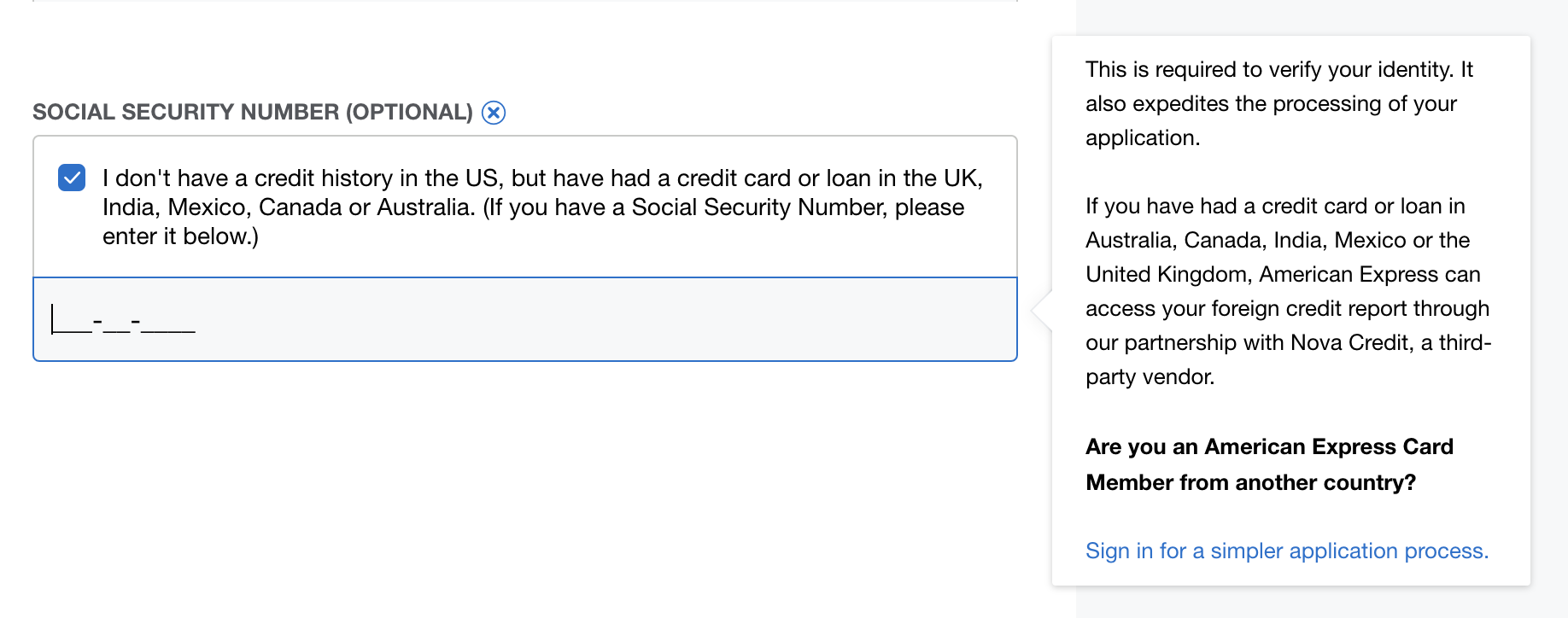

If not, you can quite easily apply for this card via the Nova Credit service, simply by checking the box that says “I don’t have a credit history in the US, but have had a credit card or loan in the UK, India, Mexico, Canada or Australia” on the application form, where it asks you for a Social Security Number.

Amex US Platinum Card: Higher Annual Fee of US$695

Just like its Canadian counterpart, the Amex US Platinum Card represents a high-stakes, high-rewards value proposition, especially now that the card has increased its annual fee from US$550 to US$695 as of July 1, 2021.

If you were to go ahead and apply for the US Platinum Card now, you’ll pay the higher annual fee of US$695 on the first statement.

Meanwhile, existing cardholders will be charged the higher annual fee on their next renewal, even though the card’s new benefits kick in as of today, giving them some time to evaluate the new benefits and decide whether they’re worth the higher fee.

The standout benefit on the US Platinum Card is the ability to earn 5x US MR points on airfare purchased directly with the airline or via the American Express US travel website.

This represents arguably the single best possible return on airfare spending among all credit cards in the US and Canada, and as a current US Platinum cardholder, it’s where I put all of my airfare spending whenever I do purchase revenue tickets (which inevitably happens from time to time, even if I prefer to redeem points for most of my flights).

(This 5x earning rate applies to the first US$500,000 of airfare purchases, which should still be more than enough for your needs.)

Then, directly offsetting against the US$695 annual fee are a variety of statement credits, with varying degrees of applicability for a Canada-based cardholder:

- The annual US$200 airline fee credit can be used towards incidental charges, like seat selection fees, checked baggage fees, and pet fees, on a certain US airline of your choice. Recent data points have shown that certain charges like loading a United Travel Bank may be able to trigger the credit; however, do note that Amex US has shown a mean streak in the past when it comes to “creative” attempts to use up this credit outside of its intended usage.

- There’s up to US$200 in Uber credits per year, split across 12 calendar months (US$15 per month, plus a US$20 bonus credit in December), although these can only be used on Uber rides and food deliveries in the US. I find this credit helpful for getting a free Uber ride the odd time I visit the US, but otherwise not very useful here in Canada.

- Then there’s two sets of US$50 Saks Fifth Avenue credits per year (one for January through June, and one for July through December), which is pretty straightforward to redeem.

- As of July 1, 2021, there’s a set of US$240 in digital entertainment credits per year (US$20 per month) on subscriptions with Peacock, Audible, SiriusXM, and The New York Times. For Canadians who subscribe to these platforms, it’s easy enough to set a US billing address and get your monthly subscription cost covered by the credit.

- As of July 1, 2021, there’s a set of US$300 in Equinox credits per year (US$25 per month) on an Equinox fitness subscription. With only three Equinox locations in Canada, I can’t imagine the uptake on this credit will be too high.

- As of July 1, 2021, there’s a US$200 prepaid hotel credit per year for hotel bookings made through Amex Fine Hotels & Resorts and The Hotel Collection. This should be fairly easy to use for a frequent traveller.

- As of July 1, 2021, there’s a US$179 CLEAR credit per year for an annual CLEAR membership, which provides expedited security queue at major US airports. CLEAR requires verifying US residency at an Enrollment Centre to sign up, so it wouldn’t be accessible to most Canadians; furthermore, you can already get expedited security with TSA PreCheck via the NEXUS program anyway.

In theory, if you were to maximize all the credits here, you’d unlock US$1,369 in value, almost doubling your return on the US$695 annual fee. In practice, you probably won’t be in a position to take advantage of all these credits, so you’ll need to think carefully about the credits you actually value and how they stack up against the annual fee.

For example, in my case, I’m confident of getting value out of the US$200 airline fee credit, the US$100 in Saks credits, and the US$200 prepaid hotel credit, which adds up to US$500 all on its own. Among the rest, I could probably take advantage of some Uber credits, and I’m fairly on the fence as to whether to continue my Audible subscription, so I guess you could say I’m getting some value out of the US$20 monthly digital entertainment credit too.

Ultimately, the annual credits on their own don’t completely justify the US$695 annual fee in my case. When you throw in the 5x earning rate on airfare, ongoing Amex Offers, and generous lounge access benefits, I could see the case for continuing to keep my US Platinum Card even at the higher US$695 fee, but I’m very much on the fence.

In fact, I’d venture to say that for most Canadian-based cardholders, the US Platinum Card might not be worth keeping beyond the first year at the US$695 annual fee. That’s because most of its core travel benefits overlap with what’s offered by the Canadian-issued Amex Platinum Card and Amex Business Platinum Card:

- Marriott Gold Elite status

- Unlimited Priority Pass, Plaza Premium, Centurion Lounge, and other lounge access

- Amex Fine Hotels & Resorts

- Platinum Concierge

If you can rely on the Canadian-issued equivalents or other high-end travel rewards cards in Canada for these types of benefits, then the US Platinum Card doesn’t necessarily make sense to keep in the long run, since the incremental value won’t quite justify the US$695 annual fee.

Even if you don’t see the US Platinum Card as a long-term keeper, though, it still absolutely makes sense to sign up now under the record-high bonus. Let’s imagine you signed up now, in July 2021. Before your renewal comes up in July 2022, you’d be able to unlock:

- Two sets of US$200 airline fee credits: one set by December 2020, and another set starting in January 2021

- Two sets of US$200 prepaid hotel credits: one set by December 2020, and another set starting in January 2021

- Three sets of US$50 Saks credits: one set by December 2020, another set between January–June 2021, and a third set starting in July 2021

Maximizing these credits alone would more than offset the US$695 annual fee you’ve paid upfront, allowing you to net the 125,000+ US MR points of pure gain in case you decide not to renew the card by the time the second year’s annual fee comes due.

Apply Now

Remember, the current signup bonuses are only available if you’ve never held the US Platinum Card before. As an existing cardholder who had previously signed up for only 75,000 US MR points, I’m definitely a little salty about that.

Apply via the Resy special offer for the best deal of 125,000 US MR points and 15x points on up to $5,000 spent at restaurants worldwide and US Shop Small.

Alternatively, if you’re earning points in two-player mode and already have a partner who’s in the US game, then signing up via their refer-a-friend link can yield a higher bonus as a household.

HI Ricky:

Does Fluz still counts as small business? thinking of buying GC although 25K seems like a lot!

How long do we expect this Resy offer to be available for? Thanks!

The credits for the US Platinum card are per calendar year and not based on membership anniversary date like the Canadian cards?

Thanks

Correct.

Signed up via Resy for 125k + 15x MR points offer. Now I just have to figure out how to spend $25k in dining over next 6 months lol

I just paid 3 sets of house taxes on 2 new amex gold business, 2 different card holders (2 player mode) thru plastiq, no problem, pretty much took care of minimum spend for sign up bonus on both cards

The Platinum Card 100k offer is in USD.

I have the card. Weird enough when I went through RESY link and signed in as if I was going to apply, it says I was pre approved and asked for income, but after entering the information, it says problem loading the page.

If I apply via Nova Credit, do I still need a US-based bank account to pay my outstanding balance each month?

Yes.

I just posted above about my offer. I logged out, opened a new Incognito window and went to the Amex US website and boom…100,000 MR offer. Coincidence for sure, but a nice one. I’d only seen 75k up until now.

I have the US Amex Gold and I checked for any upgrade offers for the Plat. They’re offering 25,000 MR for $2,000 in purchases within the first 3 months. Yeah, pass.

Hey Ricky, if I just got accepted to American Express Aeroplan Reserve Card. Should I cancel, call to change this one to go with the stunning Platinum Card in order to take advantage of the 100k points offer ?

Is it recommended to keep the card beyond the 1 year mark to avoid Amex shutdown or would it be safe to cancel without much other churning activity in the US?

Always recommended to only cancel past the 1 year mark – even if it’s during Month 13, when you’re still able to get the second year’s annual fee refunded.

I haven’t had a US$ credit card before, so I have a question on logistics. How would I arrange to make payments towards the outstanding balance? Would I need a US-based bank account that I can transfer funds to from Canada in order to pay the monthly statement balance?

Yes, a US-based bank account is one of the necessary steps in getting US credit cards. There are also some premium Canadian chequing accounts (like BMO’s top-tier banking package) that lets you pay US credit card bills directly; however, keep in mind that another reason for getting a US-based bank account is to verify your address with US issuers.

The one thing that’s held me back from using US cards to book flight or travel is that I would miss out on travel insurance/coverage from not being a US citizen. Anyone has any DP claiming credit card insurance as a non-US citizen?

The terms for Saks credit says “Not valid on online purchases shipped outside of the US”, anyone have data points on whether it worked for Canadian orders?

In my case, I ordered something to a US address and had it forwarded to be on the safe side.

I heard in store purchase won’t trigger. Anyone has DP for online orders?

OMG I’ve been waiting a long time for a 100K+ bonus on the US amex plat card, but I already opened a couple of other cards where I need to meet a MSR of $10K USD combined in the coming months.

Very torn whether to add this card to my portfolio, which will further increase the MSR by $5K USD.

Hi Ricky:

Is there a premium US card that’s worth keeping for an average Canadian?

(I think Amex Aspire, and maybe hotel cobranded cards that gives a free night, but not much else)

IMHO many US premium cards are worth keeping for Canadians.

For example:

1) Citi Prestige gives x5 points on dining worldwide. I’d argue the value proposition of the Citi Prestige card is better than the Amex gold card, which gives x4 points on dining worldwide.

2) Chase cards for their unique ability to earn Hyatt and IHG points.

3) Amex Hilton Aspire card, Chase/Amex Bonvoy cards, Chase IHG cards, Chase Hyatt card for the free nights and points.

I don’t know if the 5x bonus is worth the annual fee. you will have to spend $5K USD just to break even, if you value 1 TY- .02$. Same with other cards that requires annual fee.

Hotel cards may be worthwhile. But if you have only 1, it’s hard to plan. maybe with 2P, so you could book at least 2 nights.

For me, the Amex Bonvoy Brilliant, Amex Hilton Aspire, and perhaps the Amex Gold Card are worth keeping in the long run (Gold Card for the 4x on worldwide dining).

Sorry one more question. Plastique seems to limit using Amex now on certain things. Would I be able to pay my Canadian property taxes using this Amex Card thru plastiq? Thx

Hi Ricky. Good write up. So this card is also no foreign transaction fees?

Hey AI, that’s correct, the card comes with No Foreign Transactions fees.

Correct – as is the case with most of the good Amex US cards.