Each of the four Hilton Honors co-branded credit cards issued by American Express US have great limited-time welcome offers, which are available until April 29, 2025.

The Hilton Honors family of credit cards offered by American Express in the United States represent one of the best ways to diversify your hotel rewards game. With these juicy offers, you can unlock nights at some of the chain’s best properties at a very steep discount.

In This Post

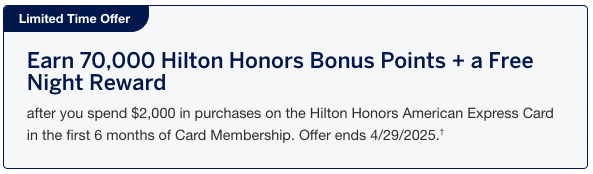

- Hilton Honors American Express Card: 70,000 Points + Free Night Reward!

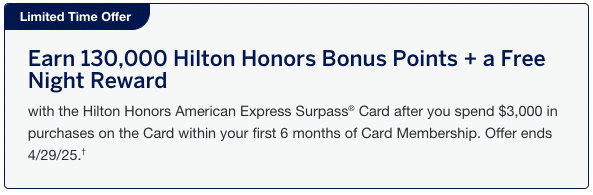

- Hilton Honors American Express Surpass Card: 130,000 Points + Free Night Reward!

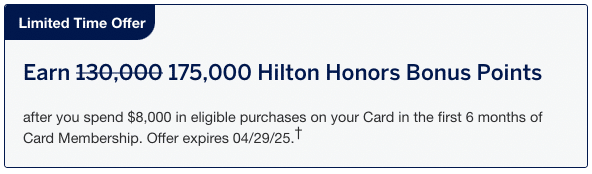

- Hilton Honors American Express Aspire Card: 175,000 Points!

- Hilton Honors Business Card: 175,000 Points!

- Strategies for the Hilton Honors American Express Credit Cards

- Conclusion

Hilton Honors American Express Card: 70,000 Points + Free Night Reward!

The Hilton Honors American Express Card is an entry-level product with no annual fee.

As part of the limited-time offer, you can earn 70,000 Hilton Honors points and a Free Night Reward upon spending $2,000 (all figures in USD) in the first six months. Offer ends April 29, 2025.

As a reminder, Free Night Rewards can be used for standard night redemptions worth up to 150,000 Hilton Honors points, including stays at Small Luxury Hotels of the World properties and high-end brands across the world.

This is in line with some of the best offers that we’ve seen on the card, so be sure to consider it if you’re eligible to apply.

The Hilton Honors American Express Card represents one of the best choices for your first credit card. Thanks to its $0 annual fee, you can easily hold onto it year after year and boost your credit history in the long run.

Hilton Honors American Express Surpass Card: 130,000 Points + Free Night Reward!

The Hilton Honors American Express Surpass Card is the mid-tier personal card in the Hilton lineup, and commands an annual fee of $150.

As part of the limited-time offer, you can earn 130,000 Hilton Honors points and a Free Night Reward upon spending $3,000 in the first six months. Offer ends April 29, 2025.

This offer is also on par with some of the best-ever offers we’ve seen.

In terms of ongoing value in exchange for the $150 annual fee, the Hilton Honors American Express Surpass® Card gives you instant Hilton Gold status for as long as you hold the card, a total of up to $200 in statement credits for Hilton stays each year ($50 every four months), as well as a Free Night Reward upon spending $15,000 each calendar year.

Hilton Honors American Express Aspire Card: 175,000 Points!

The Hilton Honors American Express Aspire Card is the top-tier personal card in the Hilton line-up, and commands an annual fee of $550.

As part of the limited-time offer, you can earn 175,000 Hilton Honors points upon spending $6,000 in the first six months.†

This offer is higher than the card’s standard welcome offer of 150,000 Hilton Honors points. However, it’s worth noting that we’ve also seen other, even more lucrative welcome offers last year that came with Free Night Rewards attached.

That said, the current welcome offer is indeed quite generous, and is most certainly worth the annual fee. We value Hilton Honors points at 0.5 cents per point, and using that metric, we’d peg a value of $875 on the welcome offer alone.

In terms of ongoing value in exchange for the $550 annual fee, the Hilton Honors American Express Aspire Card gives you instant top-tier Hilton Diamond status for as long as you hold the card, plus a total of up to $600 in statement credits each year.

You can also earn up to three Free Night Rewards each year: one on your cardholder anniversary, one upon spending $30,000 in a calendar year, and one upon spending $60,000 in a calendar year.

Each Free Night Reward is good for a stay worth up to 150,000 points, which can be used at some of the chain’s most prestigious properties that typically run hundreds of dollars per night or more.

This offer is available until April 29, 2025, so be sure to sign up before then if you’re eligible.

Hilton Honors Business Card: 175,000 Points!

As for the Hilton Honors Business Card, the card’s offering an elevated welcome offer that’s substantially higher than its baseline offer.

The welcome offer is for 175,000 Hilton Honors points upon spending $8,000 in the first six months, with an annual fee of $195.

As with the Hilton Honors American Express Surpass® Card, you’ll also have Hilton Gold status for as long as you hold the card.

Plus, you can earn a $60 statement credit for stays at eligible Hilton properties worldwide each quarter, for up to $240 in credits each year.

As a reminder, this card recently had an overhaul, and many of its benefits changed.

This offer on this card also expires on April 29, 2025.

Strategies for the Hilton Honors American Express Credit Cards

Let’s go over a few key points on the best strategy for maximizing these offers.

To begin, which of the three personal Hilton Honors credit cards should you apply for?

As mentioned above, if you’re just starting out on your travel rewards credit card journey, it may make sense to begin with the no-fee Hilton Honors American Express Card – which also happens to have the lowest minimum spending requirement.

However, it’s worth noting that the Hilton Honors American Express Surpass Card could be the right choice too.

That’s because you always have the option of downgrading the Hilton Honors American Express Surpass Card to the no-fee Hilton Card after 12 months if you don’t see the value in holding the card year after year. By approaching your strategy this way, you’d still keep your oldest account open to bolster your US credit history.

Overall, a newcomer to the Hilton Honors family of credit cards would do well to begin with either the Hilton Honors American Express Card or the Hilton Honors American Express Surpass Card.

If you’re in the market for a business card, then the natural choice is to go with the Hilton Honors Business Card.

Keep in mind that it doesn’t count towards the Chase 5/24 rule, which is something to consider if you have your eyes on any of Chase’s cards in the near future.

However, there’s always a strong argument to be made for the Hilton Honors American Express Aspire Card, which can easily be a keeper card if you stay at Hilton properties with any frequency.

Despite the $550 annual fee, the Hilton Honors American Express Aspire Card is one of the strongest rewards cards in all of North America once you factor in the ongoing benefits:

- An automatic Free Night Reward every year

- Instant Hilton Diamond status

- $200 airline incidental fee credits ($50 each quarter)

- $400 Hilton resort credits ($200 every six months)

- 14x points at Hilton hotels

Hilton’s best luxury properties generally cost 120,000 Hilton Honors points per night at most, with two properties – the Waldorf Astorias in Los Cabos and the Maldives – exceeding the cap at 150,000 Hilton Honors points per night.

If you can snag one or two of these limited-time bonuses, and earn Free Night Rewards through spending or by simply holding the Aspire card each year, you’ll have enough points for a couple of nights at some of Hilton’s best hotels, or even more nights if you book some of the more modest hotels in Hilton’s portfolio.

As it stands, there aren’t any “family language” restrictions on the Hilton Honors family of co-branded credit cards. That means that you’re still eligible for the welcome offer on any card that you haven’t held before.

However, American Express has been adding family language restrictions to most of the other families of cards in its lineup, and this could change at any time for the Hilton Honors family.

Therefore, the most prudent approach would be to work your way up the Hilton Honors lineup over time – starting with the Hilton Honors American Express Card, followed by the Hilton Honors American Express Surpass Card, and finally with the Hilton Honors American Express Aspire Card – to ensure you don’t miss out on any welcome offers should American Express add family language restrictions.

Conclusion

Once again, we’re seeing great welcome offers on the range of Hilton Honors cards.

The top-tier Hilton Honors American Express Aspire Card, which commands an annual fee of $550, offers 175,000 Hilton Honors points.

Meanwhile, the Hilton Honors American Express Card and the Hilton Honors American Express Surpass Card are offering 70,000 and 130,000 Hilton Honors points, respectively, plus a Free Night Reward. The lowest-tier Hilton Honors American Express Card comes with no annual fee year after year, while the mid-tier Hilton Honors American Express Surpass Card comes with an annual fee of $150.

As a reminder, the elevated offers for the personal cards and the business card are available through both public and refer-a-friend channels until April 29, 2025.

If I got the HH couple of months ago would it be OK to apply now for the Surpass or there is a minimum wait period.

Thanks

When you downgrade to a lower tier card, is the sign up bonus still available?

Not upon downgrading. You also won’t be eligible for future signup bonuses upon holding a card (even if you didn’t get the signup bonus then) so you’d ideally apply for the Hilton Card under a brand-new application before downgrading your Surpass.

Thanks for that! Trying to get my card order correct – this would be my first US card ever so the offers came at a opportune moment. Now just waiting for the 30 days before changing my US TD bank address.