One of the best features available on American Express cards is the referral program.

By sending a refer-a-friend link to a friend or family member, you can earn bonus points if they’re approved, and they also tend to get a better offer than what’s available publicly.

If you take advantage of the referral program, it’s an excellent way to boost your balance year after year, especially with higher-end cards in the American Express lineup.

In This Post

How Does the American Express Referral Program Work?

American Express offers cardholders the ability to refer friends and family members to various credit card products through the referral program.

As an existing cardholder, you can generate a referral link from your account, and then you can send it to friends and family members.

If they’re approved for a card, you’ll receive a referral bonus in the form of points or cash back, depending on which American Express card you’re referring from.

Your friend or family member will sometimes benefit from an offer that’s better than the best-available public offer, although they’re also sometimes the same.

Each card has a different referral bonus, and all cards have a cap on the amount of points you can earn through referrals each calendar year. We’ll summarize all of this information later on in this guide.

It’s important to note that you can’t use your own referral links to refer yourself to a card. Doing so is in violation of the program’s terms and conditions, and you risk having your account shut down.

One important aspect of the referral program is that the person using your referral link can apply for different cards other than the one to which they were referred. In some cases, you can leverage this to earn more points from your referral than you otherwise would be able to, which we’ll cover in the latter section of this guide.

Since American Express credit cards tend to offer the strongest overall value, with generous welcome bonuses, great earning rates, the most flexible points in Canada, and ongoing deals and offers, it’s certainly worthwhile to understand the referral program and how you can use it to your advantage.

Which American Express Cards Refer to Which Cards?

As we’ll discuss in detail, it’s important to understand which cards can refer to which cards in the American Express lineup. That’s because you may be able to earn more points by generating a referral from one card over another.

Generally speaking, each card within a family of credit cards can refer to most (if not all) cards in the family, but you can’t refer across families.

This means that you can refer from a card that earns Membership Rewards points to a card that earns Membership Rewards points, but you can’t refer from a card that earns Aeroplan points to a card that earns Membership Rewards points.

As a reminder, there are four families of American Express credit cards in Canada:

Membership Rewards

- American Express Green Card

- American Express Cobalt Card

- American Express Gold Rewards Card

- American Express Platinum Card

- American Express Business Gold Rewards Card

- Business Platinum Card from American Express

Aeroplan

- American Express Aeroplan Card

- American Express Aeroplan Reserve Card

- American Express Aeroplan Business Reserve Card

Marriott Bonvoy

SimplyCash

The following table summarizes which credit cards each American Express Canada product can refer to, as well as the number of points you’ll earn per referral and the cap on points earned through referrals each calendar year:

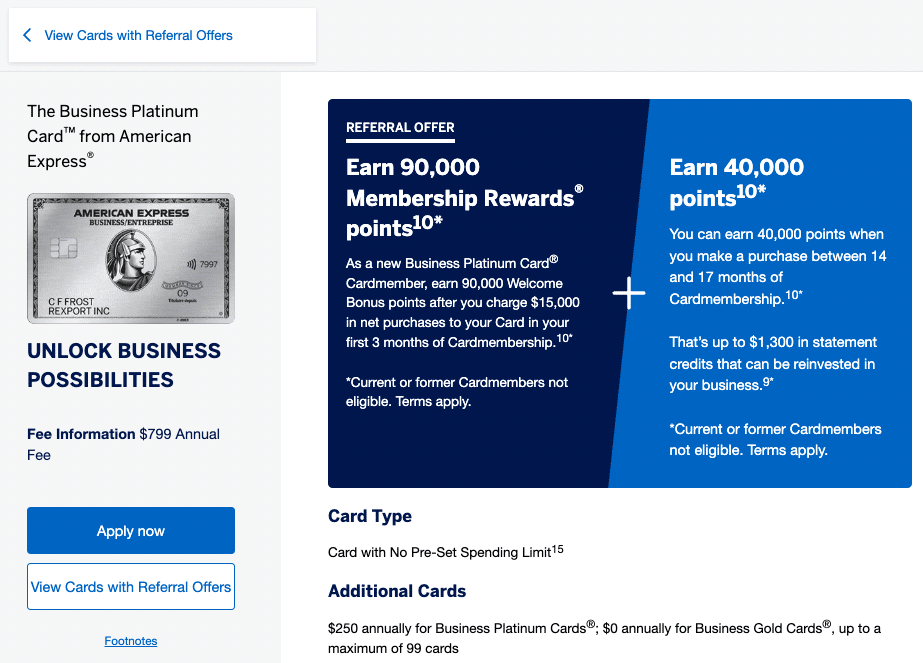

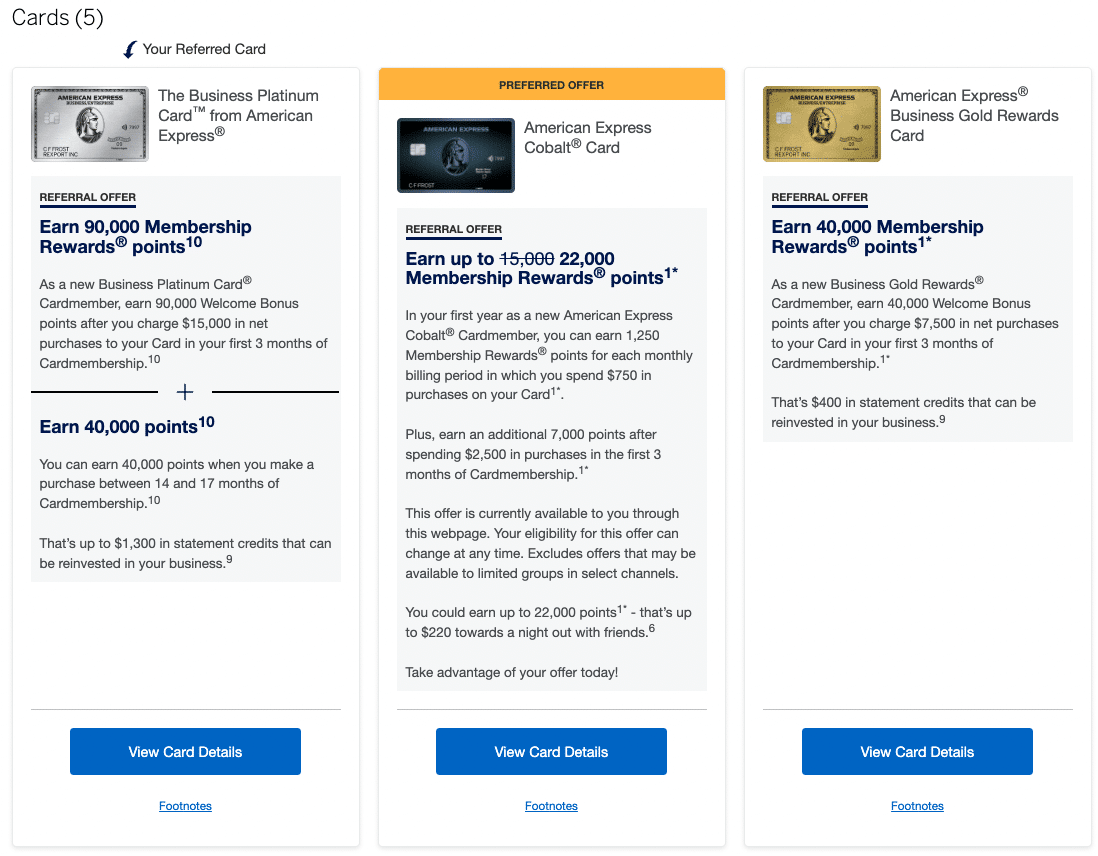

If you send a referral link to someone and they’d like to consider a different card, all they need to do is click “View our other Cards” on the left-hand side of the page (both below the “Apply now” button and at the top of the page).

Doing so will bring them to another page that shows all cards available from the referral.

The person who’s referring will receive the referral bonus depending on the card from which they refer, not the card to which they’re referring.

How to Send American Express Referral Links

There are three ways to generate referral links from your American Express card: from your online account, from the Refer A Friend dashboard, or through the Amex app.

Referring from your online account

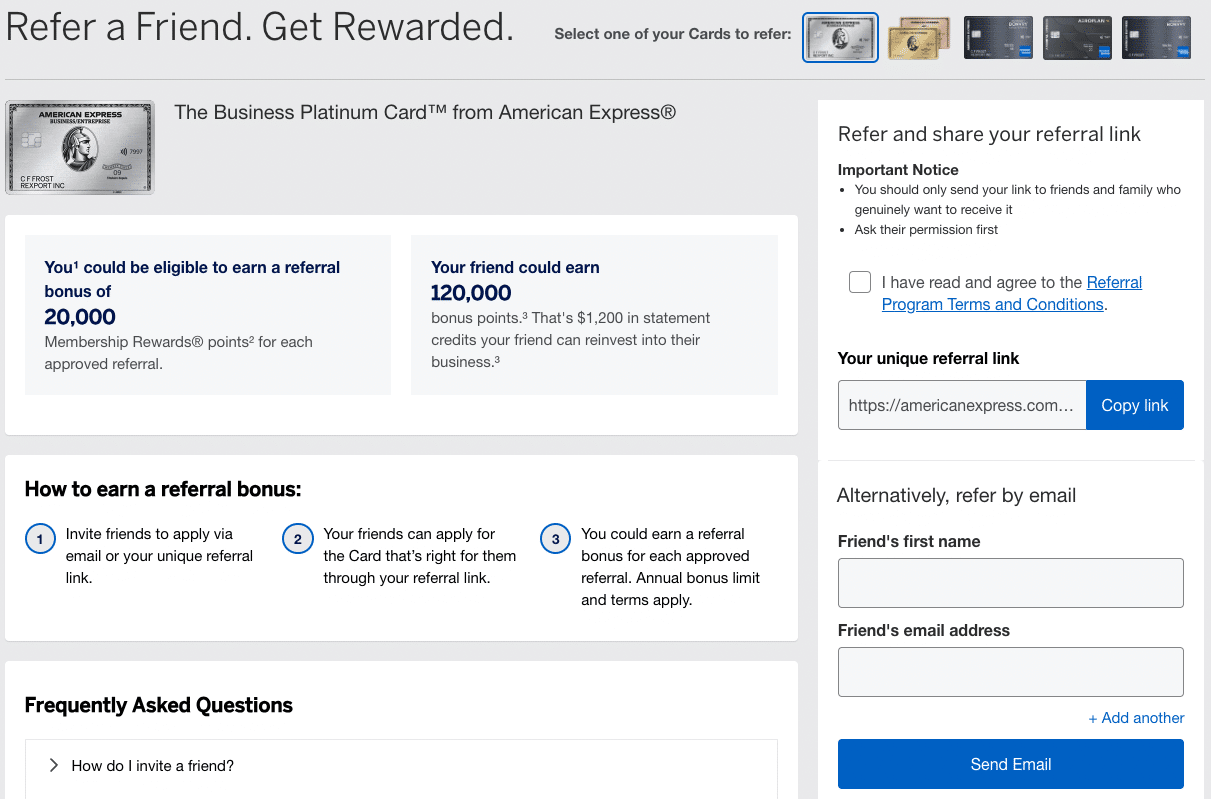

To generate a referral link from the Amex website, simply log in to your account, and select the card to which you’d like to refer a friend or family member.

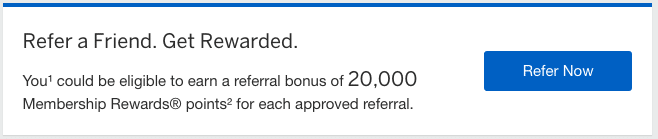

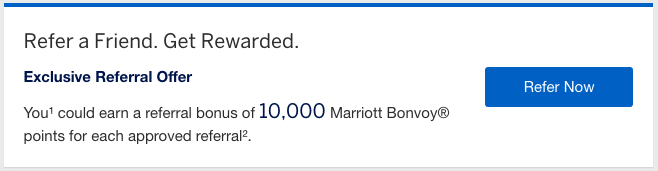

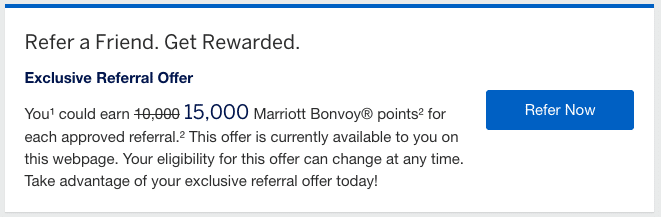

Then, scroll down the page, look for a box that says “Refer a Friend. Get Rewarded”, and click “Refer Now”.

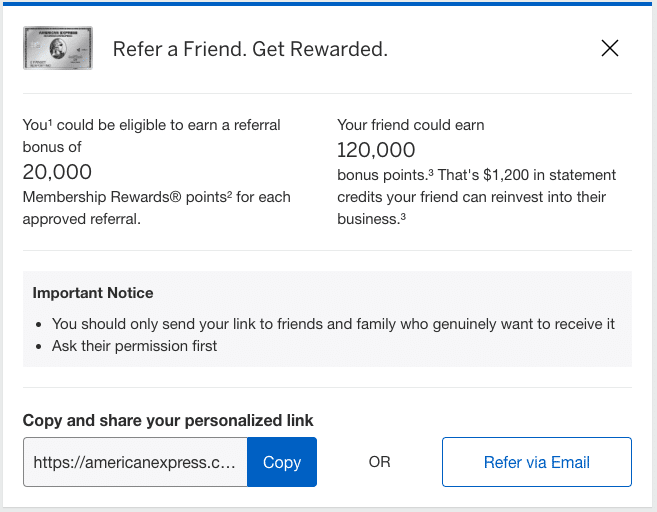

Then, agree to the terms and conditions, and you’ll be able to see you unique referral link (which you can copy and send to a friend or family member).

You can also choose to send the referral link by email, which simply opens up your computer’s email program and pre-populates the message with a referral link.

Referring from the Refer A Friend dashboard

Alternatively, you can just head to the Refer A Friend landing page, and sign in to your account from there.

On the next page, be sure that you’ve selected the right card once again by referencing the available cards that you hold at the top-right corner of the page.

On this page, you can generate a referral link, or you can refer by email by filling out the fields.

Referring from the American Express app

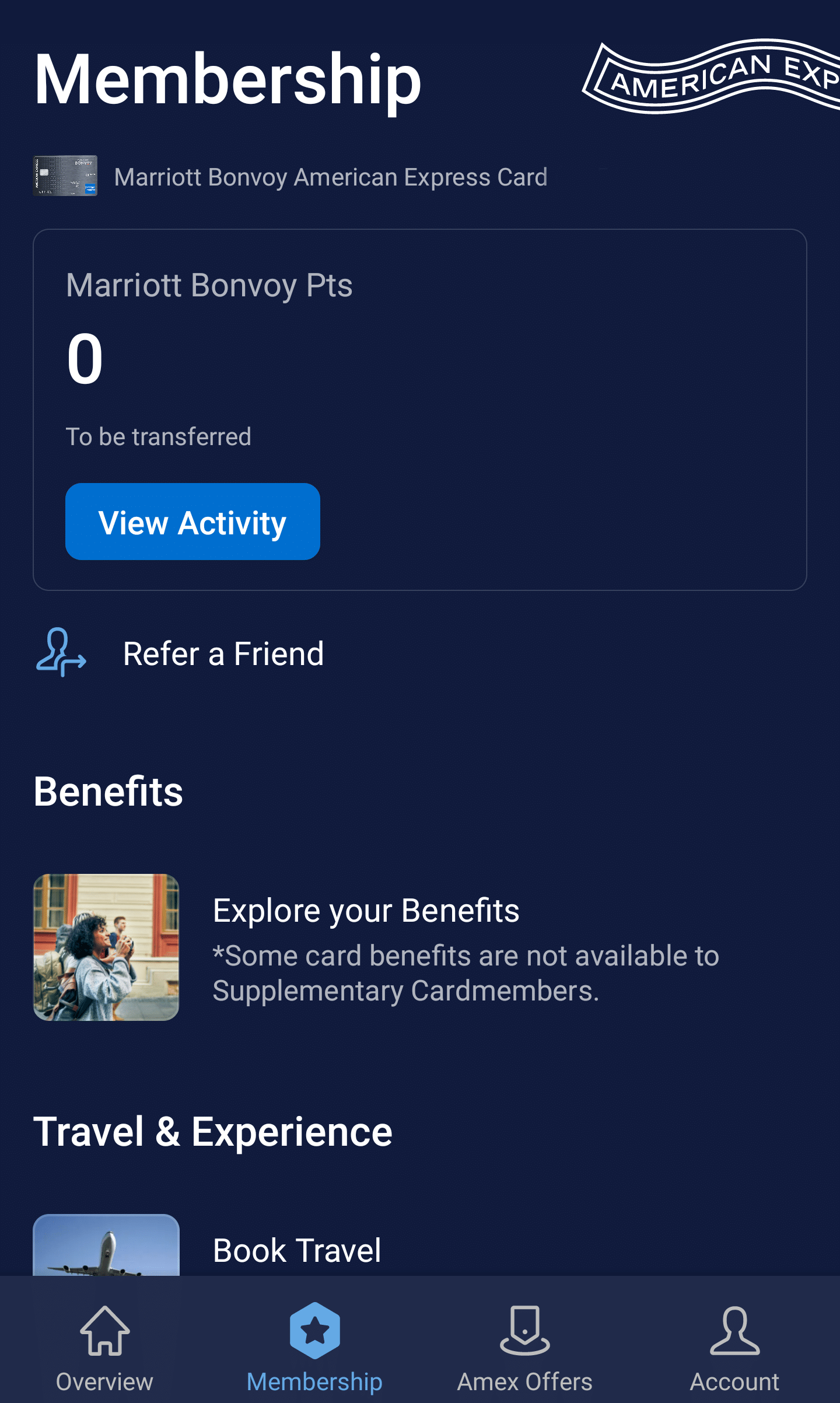

It’s also possible to generate a referral link from the American Express app.

Once you’ve signed in to your account, select the “Membership” tab at the bottom of the screen, and then select the “Refer a Friend” logo.

Select the card to which you’d like to refer a friend or family member, agree to the referral program terms, and press “Share”.

A unique referral link gets generated, and you can choose to share it with contacts through a number of apps on your phone, or you can just copy and paste it into a message yourself.

How to Keep Track of Referrals

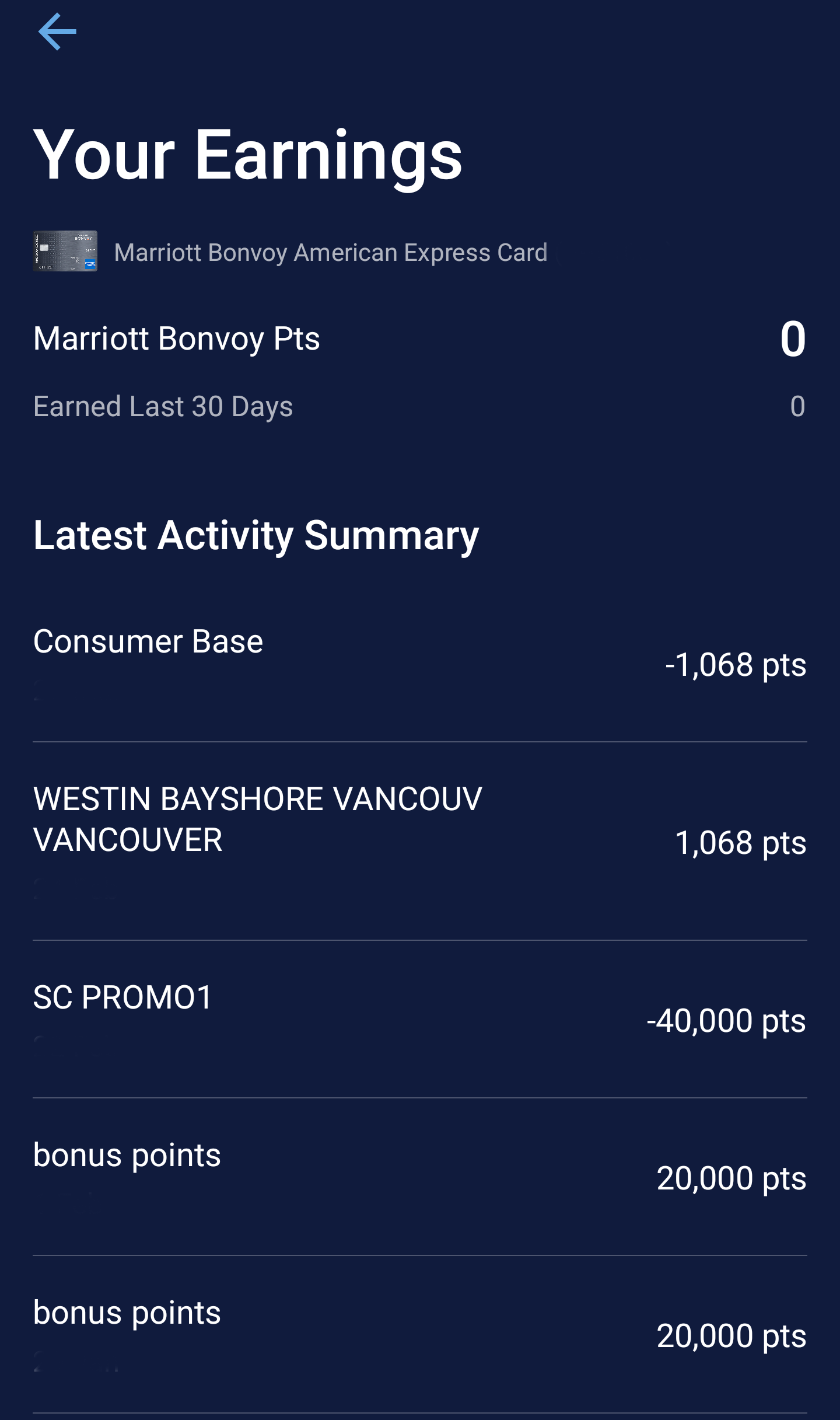

While you won’t know if anyone whom you’ve referred has been approved or denied on their application, you can easily keep track of your referrals for all American Express products on the Amex app.

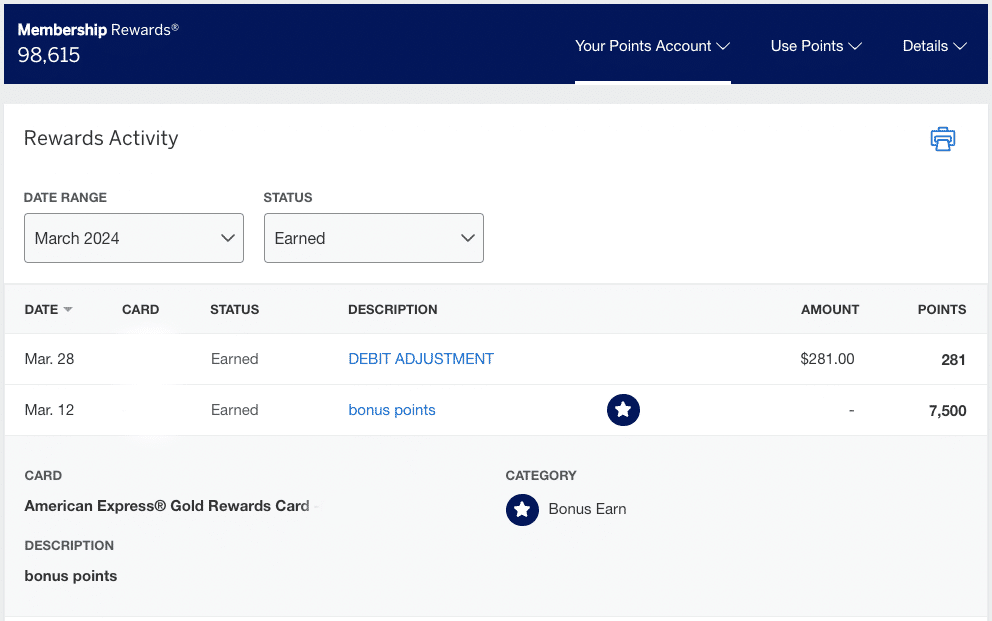

After signing in, select the “Membership” tab. After pressing on “View Activity”, any bonus points earned from referrals that have been approved will be listed as “bonus points” in your activity.

It’s also possible to view your approved referrals on the American Express website, but this is only for cards that earn Membership Rewards points. If you have a Marriott Bonvoy or Aeroplan co-branded credit card, you can only keep track of referrals through the app.

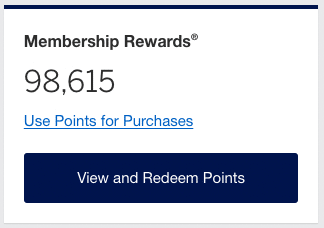

On the Amex website, click on “View and Redeem Points”, which is displayed under your current points balance, after signing into your account.

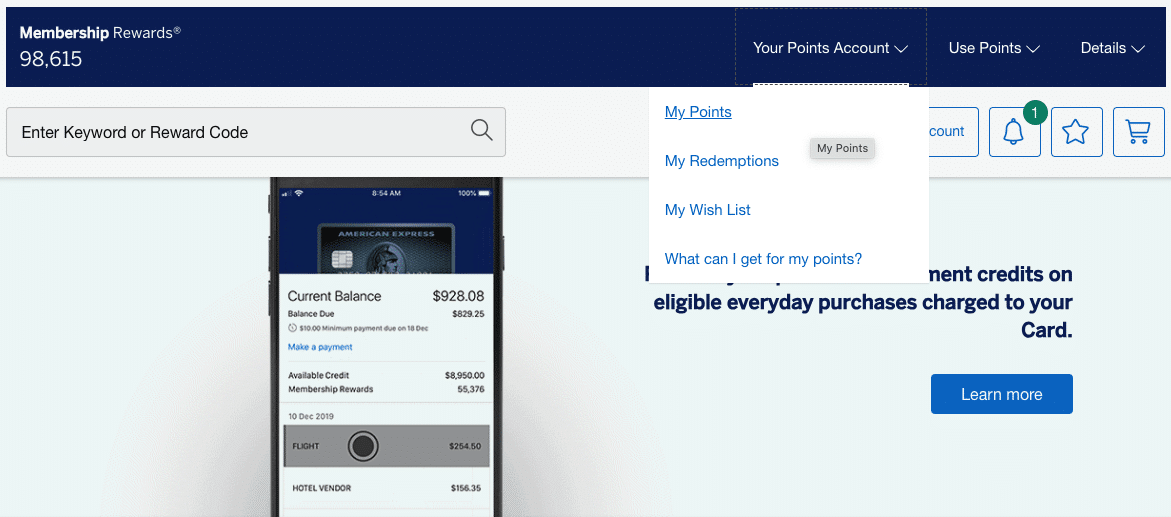

Then, choose “My Points” under the “Your Points Account” tab.

Any referral points you’ve earned on the card will show up as “bonus points” in this section.

How to Maximize the American Express Referral Program

With so many points on the line every year, it’s worth strategizing around the American Express referral program, since it’s one of the best ways to earn points on your card year after year.

Naturally, if your friends and family ask how you manage to travel so often and in style, the conversation will likely shift towards your Miles & Points strategy. This is a great opportunity to gauge interest for referrals, and to begin working your network.

Refer Down, Not Up

In the above chart, you can see that cards with higher annual fees earn more points per referral than cards with lower annual fees.

For example, if you refer from an American Express Cobalt Card to an American Express Cobalt Card, you’ll earn 5,000 points from the referral. However, if you refer from the Business Platinum Card from American Express to the American Express Cobalt Card, you’ll earn 20,000 points from the referral.

Therefore, before you initiate a referral, you should always check to see which card in your portfolio will offer you the greatest return in points.

Generally speaking, business credit cards have higher referral bonuses than their personal counterparts, which means it’s best to refer from a business card whenever possible.

The best credit cards for referrals are the Business Platinum Card from American Express (20,000 points per referral to most Membership Rewards cards), the American Express Aeroplan Business Reserve Card (20,000 points per referral to the American Express Aeroplan Reserve Card), and the Marriott Bonvoy Business American Express Card (15,000 points per referral to Marriott Bonvoy co-branded credit cards).

Generating referral bonuses from credit cards with higher annual fees is an easy way to help justify the cost on an ongoing basis. With a bit of time and effort, you should be able to refer at least a few friends and family members every year, and if you approach it strategically, you’ll benefit the most.

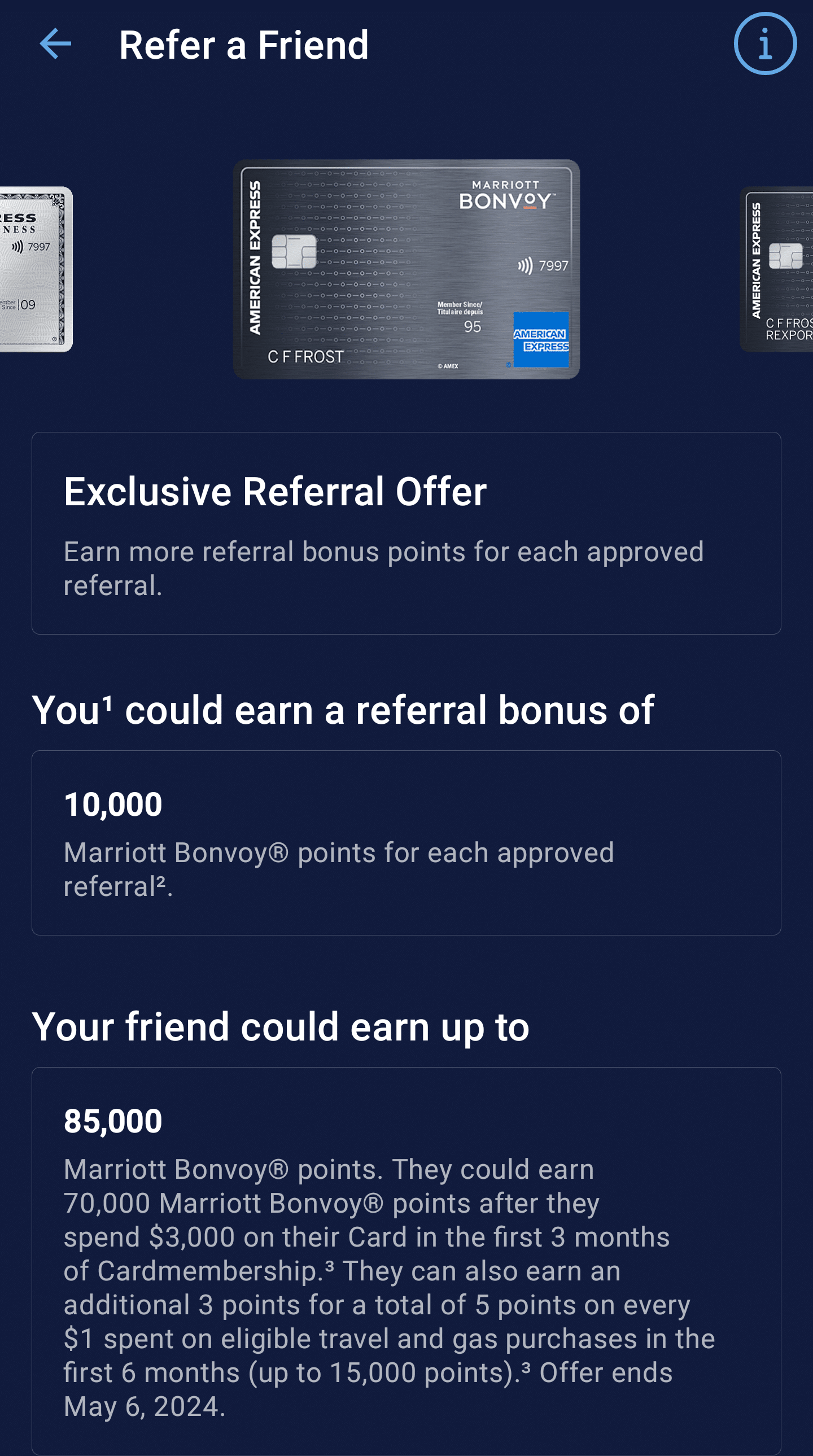

Exclusive & Preferred Offers

Every now and then, you may notice Exclusive Referral Offers and Preferred Offers available for referrals from your account.

Exclusive Offers give you a heightened referral bonus compared to what’s usually offered.

For example, the standard referral bonus on the Marriott Bonvoy American Express Card is 10,000 points per approved referral.

However, if you have an Exclusive Referral Offer available on your account, you’ll get 15,000 points per approved referral, which helps you pad your balance more efficiently.

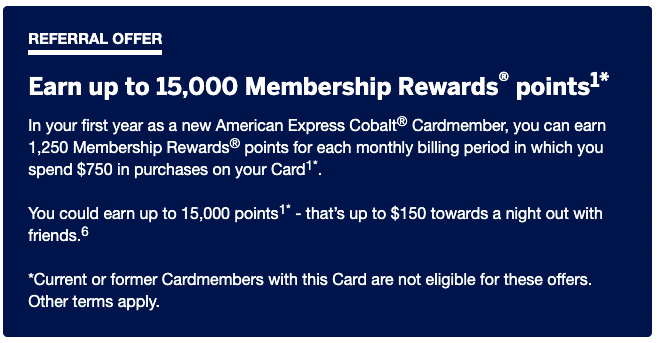

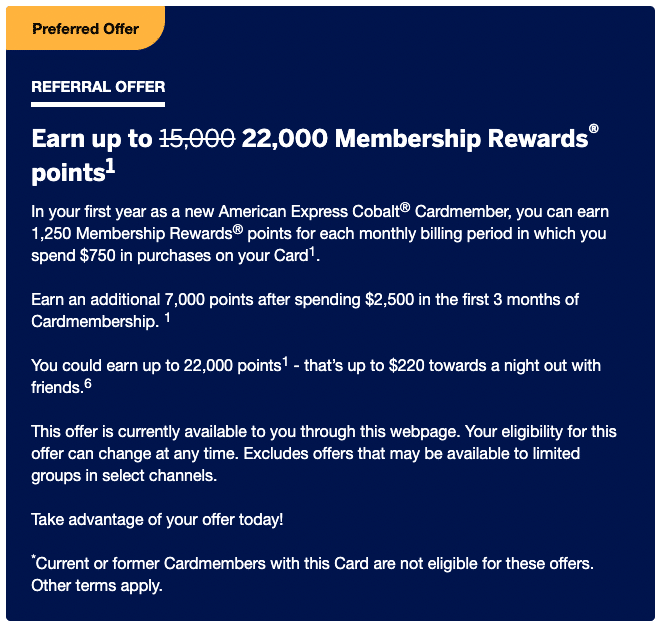

On the other hand, Preferred Offers give the person whom you’re referring a better welcome bonus that what’s available through public offers or the standard referral offer.

For example, suppose that the standard public and referral welcome bonus on the American Express Cobalt Card is for up to 15,000 points.

If you have a Preferred Offer available on your account, you may notice that the applicant will get up to 22,000 points instead of the standard 15,000 points.

Therefore, if you notice Exclusive Referral or Preferred Offers available through your account, it’s a good sign to reach out to your network of family and friends, as there’s an incentive for both parties.

Double or Triple Refer-a-Friend Bonus Events

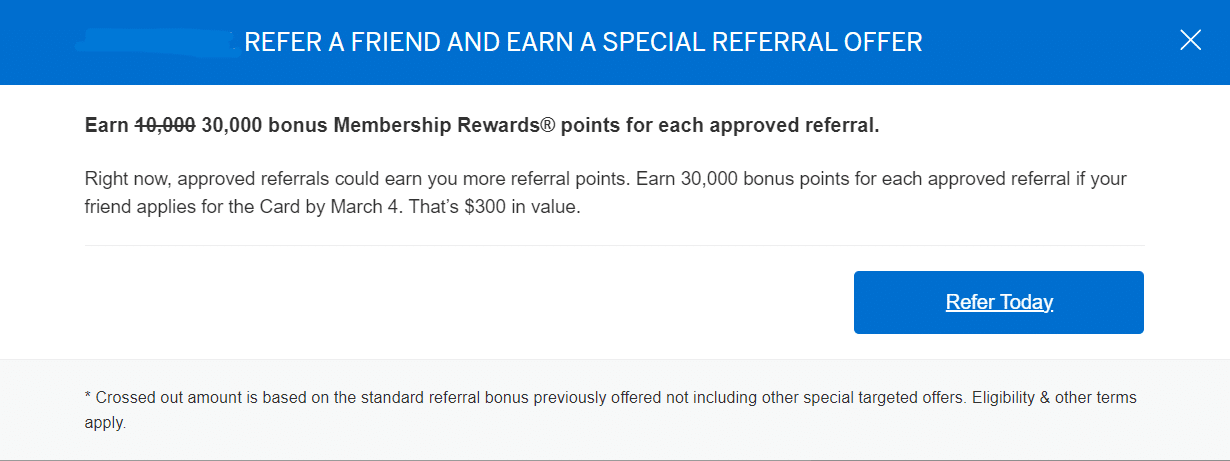

Every year, American Express tends to put on a bonus event, offering double or triple the standard amount of points per referral.

Whenever these offers happen, it’s an excellent opportunity to fast track your way to a boosted balance.

For example, the standard referral bonus on the American Express Platinum Card is 10,000 points per successful referral, for up to 225,000 points each calendar year. Through this method, you’d need to refer 23 people each year to max out your referrals.

During a triple referral bonus event, you’d only need to refer eight people at 30,000 points each to max out your referrals for the year, which you may be able to do over the course of a weekend or month.

If you want to be notified of deals like this as soon as they become available, be sure to subscribe to our newsletter and stay tuned to our various channels.

Two-Player Mode

If you engage in Miles & Points with a significant other, leveraging referrals within your household is a great strategy to keep in mind whenever you’re ready to add a new card to your combined inventory.

Ideally, one person in the relationship would have a card that can refer for the highest referral bonus each time, thereby maximizing each opportunity to generate points.

For example, both the Marriott Bonvoy American Express Card and the Marriott Bonvoy Business American Express Card are great long-term cards to have, since you get a Free Night Award each year in exchange for the reasonable annual fees.

The standard referral bonus for the Marriott Bonvoy Business American Express Card is 15,000 points, whereas it’s just 10,000 points for the Marriott Bonvoy American Express Card.

Therefore, the best approach would be for one family member to hold the Marriott Bonvoy Business American Express Card first, and then refer the other family member to earn an extra 5,000 points each time.

The same idea holds for other card families available from American Express Canada. If one member of the relationship holds the best card for referrals in each family, then referring other family members (and friends) will result in the best returns.

Conclusion

The American Express referral program offers cardholders the opportunity to earn points by referring friends and family members to American Express products.

Earning points through referrals is an excellent way to pad your points balance and fuel your travels on an ongoing basis, and it can easily justify paying high annual fees on cards if you’re able to spread the good word and earn referrals.

The next time someone asks you about how you manage to travel in style so often, be sure to see it as an opportunity to earn points through referrals.

It’s working now. Thanks!

The link to the Personal Gold card takes me to the Business Gold card

Hi,

I have just checked the link, it should bring you to the Personal Gold Card and not the Business Gold. Would you mind to retry again? Thank you