Last week, American Express announced stellar signup bonuses on its most premium products: the Platinum Card, and the personal and business variants of the Aeroplan Reserve Card.

Coming close to last summer’s outrageous highs, these new offers are extremely similar, with up to 115,000 points on each card when you apply via refer-a-friend links. Surely, you’ll want to get as many new cards as you can.

But with steep annual fees, hefty spending requirements, and only a few months to apply before the offers end on October 26, 2022, it might be more realistic for you to only get one. So which one of these offers is truly the best?

In today’s Head-to-Head, let’s have a showdown between the three cards, with an emphasis on how the welcome bonuses differ.

In This Post

- Bonus Structure

- Points Currency

- Annual Fee

- Referral Bonuses

- Earning Rates

- Lounge Access

- Other Travel Benefits

- Charge Card vs. Credit Card

- Conclusion

Bonus Structure

First and foremost, let’s take a look at the signup bonuses, often one of the most significant factors that compels you to get a new credit card.

To recap, each card is offering 115,000 points, which are very strong Canadian credit card offers any way you cut it.

Platinum | Aeroplan Reserve | Aeroplan Business Reserve | |

Spend Bonus | 95,000 MR points upon spending $6,000 in three months | 65,000 Aeroplan points upon spending $6,000 in six months | 95,000 Aeroplan points upon spending $7,000 in three months |

10x Bonus | Eats & drinks, up to 20,000 points or $2,000 spent in the first three months | Eats & drinks, up to 20,000 points or $2,000 spent in the first three months | Air Canada & travel, up to 20,000 points or $2,000 spent in the first six months |

Monthly Bonus | N/A | 5,000 points in each of the first six months in which you spend $1,000 | N/A |

Total Spend | $6,000 | $6,000 | $7,000 |

Total Points | 115,000 MR points | 115,000 Aeroplan points | 115,000 Aeroplan points |

The offers are quite similar, with two key differences.

First, the Aeroplan Business Reserve Card is featuring 10x points on travel categories more closely associated with business expenses, whereas the personal cards are offering the same bonus rate on more consumer-oriented eats and drinks, encompassing groceries and dining options alike.

Second, the Aeroplan Reserve Card is offering fewer points up-front for meeting the primary spending threshold, with monthly spending requirements making up the remainder.

To align with six months of monthly spending, the Aeroplan Reserve Card also has a longer six-month time horizon to meet the primary spending threshold.

On the other hand, the Platinum Card and the Aeroplan Business Reserve Card have no monthly spending thresholds, meaning you can capitalize on a gigantic up-front expense to meet the full bonus requirement. However, you’ll only have three months to do so.

Whether you’d rather earn 10x on eats and drinks or on travel, or whether you’d rather concentrate or spread out your spending, it’s all a matter of your own personal preference and situation.

I don’t see any of these welcome bonuses as being prohibitively hard to achieve for a motivated traveller. Despite a bit of structural variance, I don’t see a whole lot separating these offers, and any of them would be a compelling choice.

That being said, what’s caught my eye about this round of Summer 2022 offers is the simplicity of the Aeroplan Business Reserve Card’s spending incentives.

Usually, this card has monthly bonuses, but at double the required spending as the personal card. This time, however, it more closely resembles the Business Platinum Card, long a popular choice for “small business owners” with an affinity for travel rewards.

Verdict: Without much to separate these offers, I’d give a slight edge to the Aeroplan Business Reserve Card, simply because its offer is substantially more appealing than usual for casual cardholders.

I also have a preference for avoiding monthly requirements and earning the bulk of my points up-front, which makes it easier to book aspirational trips sooner.

Points Currency

The Aeroplan Reserve cards are co-branded Aeroplan cards, and naturally they earn Aeroplan points.

Aeroplan is the best travel rewards program for Canadians, with redemptions on any seat on Air Canada flights, outsized value for long-haul seats in premium partner cabins, and unparalleled interconnectivity linking Canadians across the country to the vast global Star Alliance airline network and beyond.

The Platinum Card uses Amex’s in-house travel rewards program, earning Membership Rewards points.

These can be used for the Fixed Points Travel chart for flights, redeemed for statement credit, but most importantly, they can be transferred to airline and hotel partners, including Aeroplan.

Simply put, because Membership Rewards can be transferred to Aeroplan, there’s nothing they can’t do that Aeroplan can. I often treat the two interchangeably.

However, there’s an inherent value in flexibility, which is reflected in our Points Valuations. We currently value Aeroplan points a 2.1 cents per point but Membership Rewards points a 2.2 cents per point, although your actual redemption values will always differ slightly.

With Membership Rewards, I can always choose to use them for a different airline partner, or even to cash them out for statement credit, if those uses present a better choice when I have a redemption lined up.

You can’t do that with Aeroplan – once the points are in, you’re more limited by what the program allows you to do with them. Even though it’s a great program with lots of redemption options for good value, it’s still a one-trick pony.

Verdict: The Platinum Card wins here, because with all other things being equal, flexibility is a virtue.

Annual Fee

The Aeroplan Reserve Cards both have an annual fee of $599. On the surface, it looks like they come out ahead of the Platinum Card’s annual fee of $699.

However, the Platinum Card offers a $200 annual travel credit, which can be easily redeemed for any type of travel booking through the Amex Travel portal.

I’d consider this credit as good as cash, since it’s so easy to redeem. Plus, you should have no trouble keeping the credit in case your travel plans change and you need to cancel a refundable booking.

Effectively, this brings down the net annual fee to $499, making the Platinum Card a less expensive choice.

Verdict: The Platinum Card has a slight edge here, saving you $100 each year. But I wouldn’t let that be a dealbreaker if you decide that an Aeroplan card is an overall better fit for you.

Instead, I’d use it as a tiebreaker if none of the other factors sway you strongly in one direction.

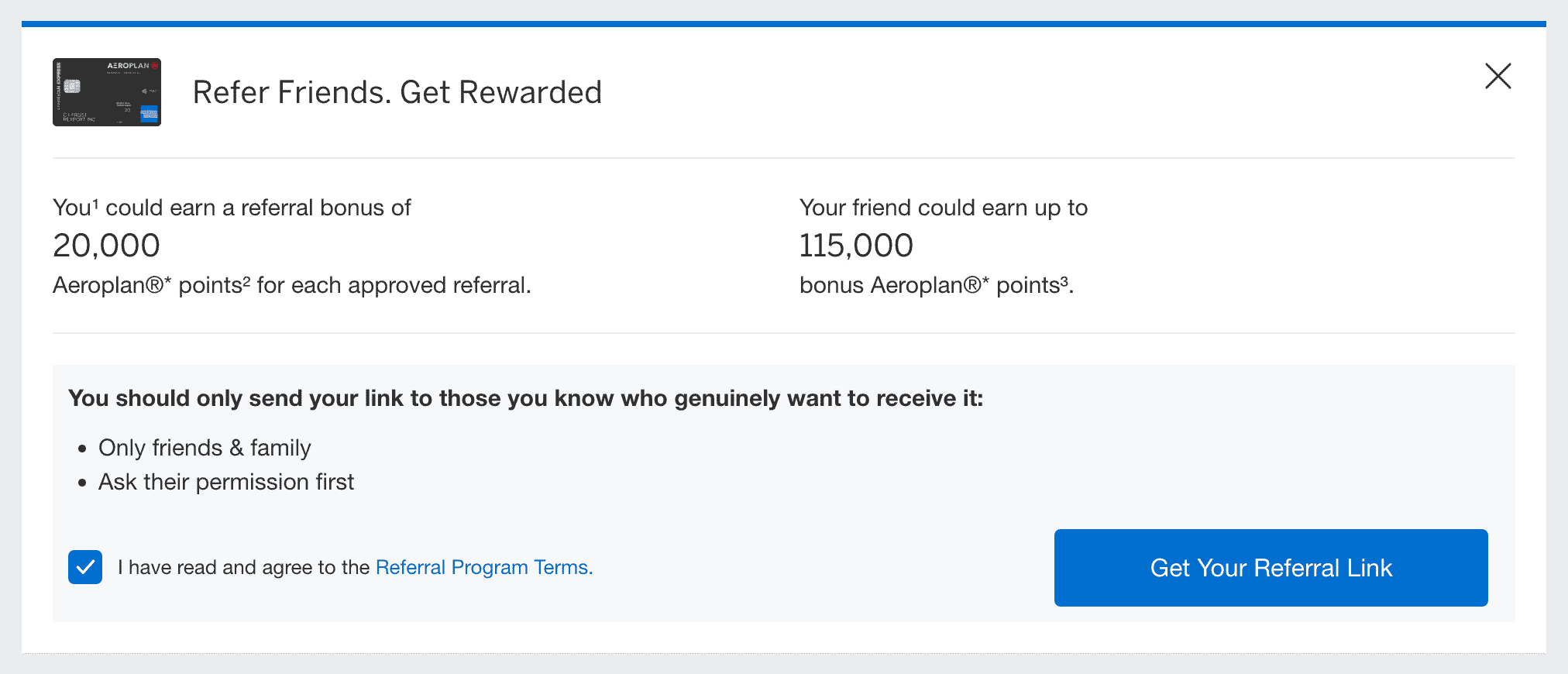

Referral Bonuses

The Platinum Card rewards the referrer with 10,000 MR points when family, friends, or colleagues use their referral link and are approved for a new Platinum Card or Business Platinum Card. You can earn up to 225,000 MR points per calendar year this way – it’ll take quite a few referrals to hit the limit.

The Aeroplan Reserve cards can refer to each other. The personal card rewards the referrer with 10,000 Aeroplan points per referral, while the business card awards 20,000 Aeroplan points per referral. Both cards have a referral limit of up to 150,000 points per year.

If you’re looking to apply for as many cards as you can this month in multi-player mode, you’d want to prioritize the Aeroplan Business Reserve Card. Once you start scaling with many referrals, the difference will compound dramatically.

Also, it’s important to consider your other referral options. For example, if you have a Business Platinum Card, you’d earn 20,000 MR points per successful referral, with more cards to refer to than the Platinum Card. Therefore, it wouldn’t make sense to open a Platinum Card just for referrals, as you’d always come out ahead using a Business Platinum card for that purpose instead.

Verdict: The Aeroplan Business Reserve Card is a clear winner here. Even though the annual referral limit is higher on the Platinum Card, most cardholders are unlikely to maximize it. With better referral options available for MR cards, it makes sense to grab the Aeroplan card with the best refer-a-friend incentive.

Earning Rates

Once you’ve finished with the 10x earn rate to kick off your new card, or for everything that doesn’t fall under the 10x categories, it’s important to consider the regular earning rates on the cards, especially if you have an eye on keeping the card long-term.

The Platinum Card uses a 3-2-1 structure:

- 3 MR points per dollar spent on dining in Canada

- 2 MR points per dollar spent on travel purchases

- 1 MR point per dollar spent on everything else

The Aeroplan Reserve Card uses a 3-2-1.25 structure, with slightly different categories:

- 3 Aeroplan points per dollar spent on Air Canada and Air Canada Vacations

- 2 Aeroplan points per dollar spent on dining in Canada

- 1.25 Aeroplan points per dollar spent on everything else

Finally, the Aeroplan Business Reserve Card mostly parallels the personal card:

- 3 Aeroplan points per dollar spent on Air Canada and Air Canada Vacations

- 2 Aeroplan points per dollar spent on hotels and car rentals

- 1.25 Aeroplan points per dollar spent on everything else

On these cards, dining includes restaurants, bars, cafes, and food delivery. Groceries are included in the 10x eats and drinks bonus on the personal cards, but once that’s finished, they’ll no longer earn extra points.

Basically, between the two personal cards, travel and dining are flipped, and the Aeroplan Reserve Card gets a minus for restrictions on which travel expenses earn bonus points, but a plus for a higher earning rate on other purchases.

Between the two Aeroplan cards, the 2x category reflects the same difference found in the 10x promotional rate: the personal card features dining, while the business card features hotels and car rentals.

There’s a unique advantage with the Air Canada category: no other cards will earn that many points. Even the TD and CIBC Aeroplan Visa Infinite Privilege cards only earn 2x points on those purchases. If you spend a lot of money with Air Canada, there’s no better card to make the most of those purchases on an ongoing basis.

On the other hand, 3x points on dining on the Platinum Card is certainly juicy, but it’s hardly exclusive – you can earn a superior 5 MR points on dining with the Cobalt Card instead.

Verdict: As usual, it depends on what you tend to spend the most money on, but I’ll give the edge to the Aeroplan Business Reserve Card for its comparative advantage on its bonus categories, with the personal card not far behind.

There are many cards with strong dining bonuses, but few with 2x on select travel expenses, and even fewer with 3x points on Air Canada cash fares. Also consider the higher rate on uncategorized spending, and these cards makes a compelling case whether or not you’re a big Air Canada spender.

Lounge Access

Nothing compares to the Platinum Card’s comprehensive suite of lounge benefits. You’ll get unlimited access to Priority Pass and Plaza Premium airport lounges for yourself plus one guest, as well as access to Centurion lounges and a plethora of other lounge affiliates around the world.

Most major airports have a Priority Pass or Plaza Premium lounge, so you and your travelling companion will always be able to find respite from the crowds in the terminal.

The Aeroplan Reserve cards are no slouch either, with unlimited access to Maple Leaf Lounges in North America when travelling on Air Canada or a Star Alliance partner.

That might be useful if you frequent the 14 airports with a Maple Leaf Lounge, but overall, the Platinum Card will elevate your travel experience in a wider variety of situations.

Also, now that Plaza Premium has ended its relationship with Priority Pass, it’s a lot harder to access Plaza Premium lounges with other credit cards. They have a strong presence in Canada and were always a good choice for the single-use passes found on many Visa cards.

The Platinum Card, however, has maintained access to Plaza Premium, since they are a direct partner with Amex, not just through Priority Pass. That comparative advantage makes the strong Platinum Card even stronger.

Verdict: No question, the Platinum Card comes out ahead.

Other Travel Benefits

Premium credit card perks aren’t just about lounge access – there are other travel benefits that you need to consider.

With the Platinum Card, you’ll get automatic Gold Elite status with Marriott Bonvoy, Hilton Honors, and Radisson. While you might not score top-tier treatment, it’s still useful for a baseline level of service, including things like late check-out and some amenities.

If you concentrate your efforts on one hotel loyalty program, such as Marriott Bonvoy Platinum Elite, then no-brainer Gold Elite status can be useful for the odd times when you stay at a different hotel.

Alternatively, you could also use the Amex Fine Hotels & Resorts program, a de facto elite status program for assorted luxury hotels, only available to Platinum cardholders.

Both cards offer a mixed bag of priority airport services. The Platinum Card will score you car rental discounts and priority security lanes at Toronto Pearson.

On the other hand, the Aeroplan Reserve cards give a very strong collection of benefits when travelling with Air Canada, including priority boarding, priority check-in, and a free checked bag.

Also, you’ll get preferred pricing discounts on Aeroplan award tickets, at the best rate available to premium credit card holders. Furthermore, you’ll be able to carry over up to 50 unused eUpgrade credits year after year, which you can parlay into business class flights for the price of economy.

You can also earn Status Qualifying Miles and Status Qualifying Segments by spending on your Aeroplan Reserve cards. If you’re an Aeroplan Elite Status member with lots of Status Qualifying Dollars from buying revenue fares, but need a boost on the other side, this card can help you climb the status ladder.

Finally, both cards have very strong insurance. The Platinum Card has some of the most generous payouts and coverage in the business, while the Aeroplan Reserve cards will cover your Aeroplan award bookings if you pay the taxes and fees with the card.

Verdict: It depends. The Aeroplan Reserve cards truly shine for Air Canada loyalists, whether you rack up lots of cash fares as a Super Elite, or redeem lots of Aeroplan points for flight rewards.

But if you’re not going to maximize those perks, the Platinum Card might be a better all-around fit for the breadth it offers.

Charge Card vs. Credit Card

Finally, you’ll need to make sure that you can actually get the card you’re applying for!

Amex is usually quite generous with who they’ll approve, and they have no income requirements. But there is one specific rule that might trip you up: you can only have four Amex credit cards at a time.

Amex is unique amongst Canadian credit issuers in that they are the only one that offers charge cards. They’re similar to credit cards, except they have no preset spending limit, and an obligation to pay in full every month (which you should be doing anyway).

Luckily, Amex doesn’t count charge cards against the four-card limit. You can have as many charge cards as you want, but only four credit cards.

The Platinum Card is a charge card, and it won’t impact your limit. Hooray!

The Aeroplan Reserve Card and the Aeroplan Business Reserve Card are credit cards, competing in your wallet with other useful keeper cards including both Marriott Bonvoy cards, the Cobalt Card, the Air Miles Reserve Card, and the SimplyCash cards. Boo!

Verdict: As a charge card, the Platinum Card wins, since it won’t fill one of four precious credit card slots.

Conclusion

One thing’s for sure: American Express continues to lead the pack with these three new premium credit card offers for Summer 2022.

There’s a compelling case for any of these cards, and it always depends on your own situation, but overall I’d give a slight edge to the Platinum Card over the Aeroplan Reserve personal and business cards.

Realistically, the answer is probably extremely simple: get whichever card you haven’t had before, to guarantee your eligibility for the welcome bonus. For many of us who got in on last year’s ridiculous 150,000-point offers on the Platinum Card and Aeroplan Reserve Card, that means it may be time to take the plunge with the Aeroplan Business Reserve Card.

Personally, as an existing cardholder of the Platinum Card and Aeroplan Reserve Card, this year the Aeroplan Business Reserve Card intrigues me, especially given the friendlier-than-usual spending requirement on its welcome bonus.

But if you’re new to American Express credit cards, then the world is your oyster – go forth and conquer as many 115,000-point signup bonuses as you can handle before these marvellous offers expire on October 26, 2022.

I have Aeroplan Reserve Card, but I may not be able to travel till all Covid restrictions are lifted due to family member’s special needs. Now tt’s time to renew, but I wonder what’s the impact to my Elite status in case my only Aeroplan card is cancelled. Do I have to keep at least on Aeroplan credit card to maintain the Elite status and eUpgrade credit? If I downgrade to the regular Amex Aeroplan card, will the Elite status and eUpgrade credits be kept? Thank you!

Hi there, if I apply for American Express Aeroplan Card through your referral, the end date, October 26, is different from the Amex website, is the October 26 guaranteed as a deadline?

I’m curious, is there any benefit to holding an Amex card for a long period? E.g., I’ve had a Gold card for 20+ years, outside of the “member since 2001” moniker, I can’t think of any good reason to care about switching cards?

Also, similar to the other posters question above. For the priority security, does one have to “check in” first at the Amex Kiosk at Pearson to get a QR code?

Amex has some of the best everyday earn rates, insurance, and rebate offers that you’ll find on any Canadian credit card. If you’re not satisfied with the value you get for your annual fees, for any product, it’s time to mix it up.

Other benefit of the Aeroplan cards is the current 12 month Uber Pass promotion. However the weekly AMEX offers seem to be better on the Platinum. Also both Platinum and Aeroplan Reserve provide a $100 Nexus credit every 4 years.

Just curious why did you not include the American Express Business Platinum in your analysis? To me, that one is the winner given the slightly higher bonus of 120k, higher referral, better points currency, no additional steps to get all of the bonus quickly. The downside is obviously the much higher $10k spend in 3 months. Just would have thought it’s good to include in the analysis

It’s hard to do a proper head-to-head with 4+ cards, so I stuck with the ones that have similar welcome bonuses. Stay tuned for a more comprehensive number crunch across all of this summer’s Amex welcome bonuses.

Looking forward to it!

If I hold one of the aeroplan reserve cards, do you know how the priority check in works with air Canada flights? Do I just flash them the Amex card?

You probably won’t even need to do that, as your cardholder status is attached to your booking. The priority check-in counter will have a list of who’s eligible (elite status, business class, cardholders).

I have Aeroplan Reserve card. Can I refer my husband for a Platinum card or only one of the Aeroplan cards?

No, Aeroplan cards can only refer to Aeroplan cards.

Tiny correction: “Furthermore, you’ll be able to carry over up to 20 unused eUpgrade credits year after year” – according to Amex it’s up to 50 eUpgrades (and up to 200,000 Status Qualifying Miles!).

“Basic Cardmembers who also hold Aeroplan Elite Status will be able to roll over up to a maximum of 50 eUpgrade credits received in the prior status year to the next status year”.