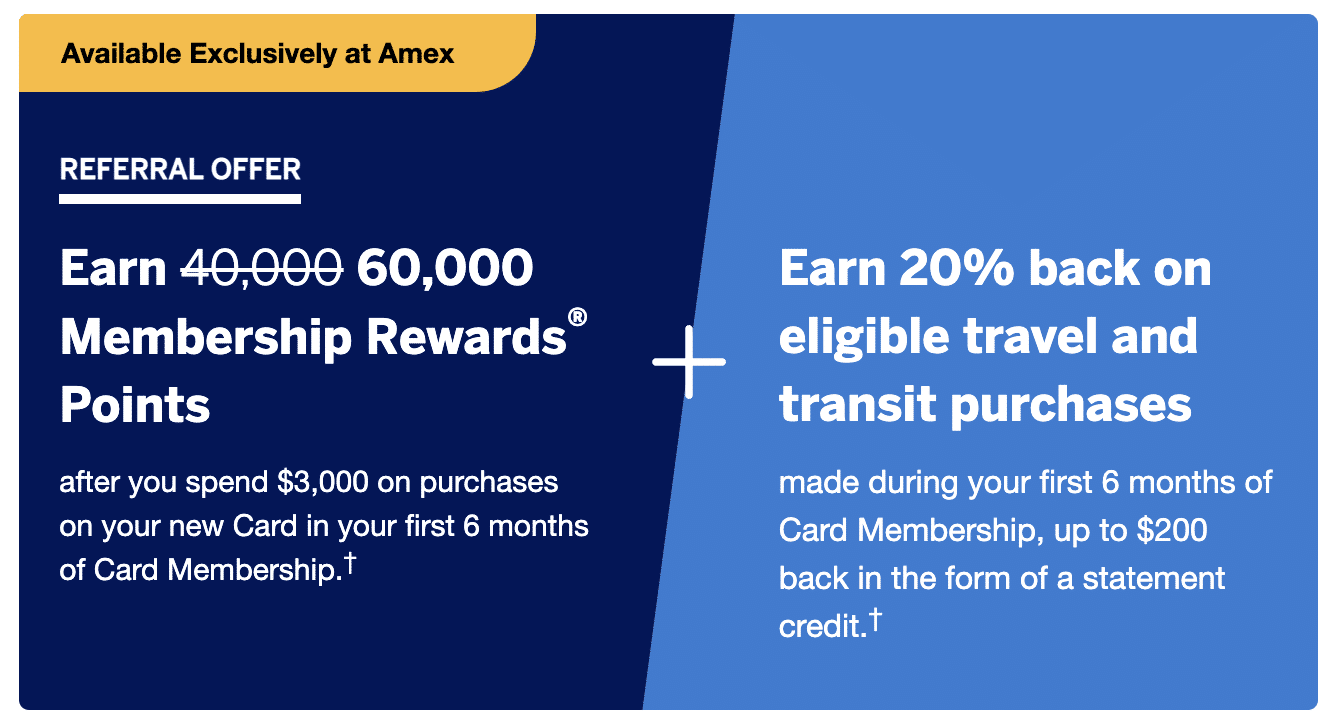

A best-ever welcome bonus has just appeared on the American Express US Green Card. There are up to 60,000 Amex US Membership Rewards points up for grabs, as well as up to $200 (USD) in statement credits available, too.

Now is a fantastic time to get the Green Card if you don’t have it already, so let’s take a look through the special welcome offer, and then weigh up the benefits of the card to see if it justifies the $150 (USD) annual fee in the long run.

60,000 US MR Points + Up to $200 Statement Credit

The current welcome offer on the American Express US Green Card is the best we’ve ever seen, and now is a great time to apply if you’re eligible to receive the bonus.

There are two parts to the signup bonus, which is structured as follows:

- Earn 60,000 Amex US Membership Rewards points upon spending $3,000 (USD) in the first six months

- Earn 20% back as a statement credit on eligible travel and transit purchases, up to $200 (USD)

The Green Card is a charge card, meaning that it has no preset spending limit and you need to pay the balance off in full every month. It comes with an annual fee of $150 (USD).

Perhaps the best part of this offer is that the bonus is indeed very high, and it comes with a relatively low minimum spending requirement that’s spread out over the course of six months. By charging $500 (USD) to the card in each of the first six months, you’ll have fulfilled the requirements, and can come out with 60,000 Amex US MR points at your disposal.

Another way to look at the welcome bonus is that you’re acquiring 60,000 points at the cost of the annual fee, which works out to be just 0.25 US cents per point. We value Amex US MR points at 1.8 US cents per point, so needless to say, this is an outstanding offer.

The second part of the welcome bonus gives you up to $200 (USD) back as a statement credit on travel and transit purchases. To maximize the offer, you’d have to spend $1,000 (USD) on the two categories in six months, which isn’t unreasonable by any means.

Furthermore, the statement credit more than makes up for the card’s annual fee. If you’ve never had this card before, now is an excellent opportunity to take advantage of the record-high welcome bonus.

Given that Amex US enforces a strict once-in-a-lifetime rule on welcome bonuses, it’s best to wait for historical high offers, such as this one, before applying for any product you haven’t held before.

As a reminder, some of the best uses of US MR points might include:

- Transferring to Virgin Atlantic Flying Club to book ANA First Class

- Transferring to ANA Mileage Club to book an ANA round-the-world award with eight stopovers and four open-jaws

- Transferring to Emirates Skywards to book Emirates First Class

- Transferring to Singapore Airlines KrisFlyer to book Singapore Airlines Suites Class

- Transferring to Cathay Pacific Asia Miles to book Cathay Pacific flights with much greater award space

- Transferring to Canadian MR points at the prevailing exchange rate

If you’ve already gotten started with US credit cards, then you can simply go ahead and apply to add the Green Card to your portfolio.

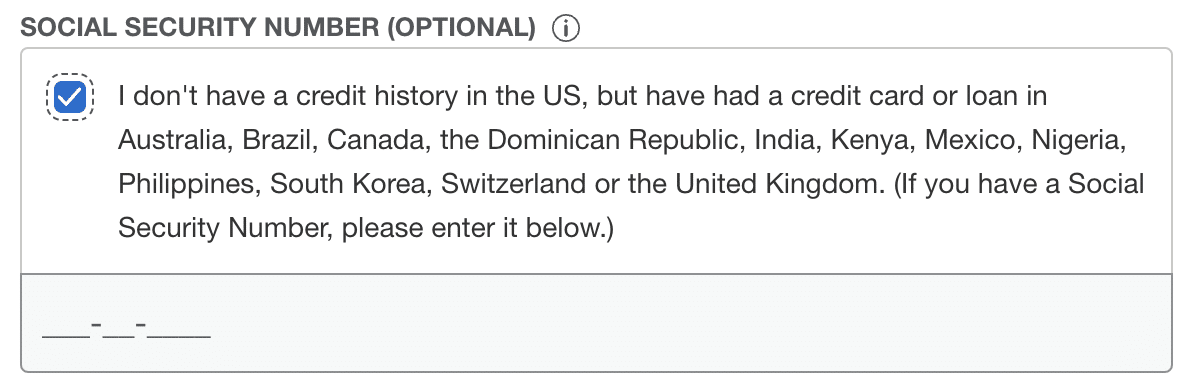

If not, you can quite easily apply for this card via the Nova Credit service. When filling in the application, simply check the box that says “I don’t have a credit history in the US, but have had a credit card or loan in Australia, Brazil, Canada, the Dominican Republic, India, Kenya, Mexico, Nigeria, Philippines, South Korea, Switzerland, or the United Kingdom” on the application form, where it asks you for a Social Security Number.

The Nova Credit service will then link to your Canadian credit file to assess your creditworthiness, although you may still be required to call or live-chat with Amex US for identity verification purposes (usually to submit a copy of your foreign passport).

Be sure to review the full guide to getting US credit cards for Canadians for more information.

Is the Amex US Green Card a Long Term Keeper?

If you apply for the Amex US Green Card, does it make sense to keep the card in the long run with its $150 (USD) annual fee?

Like many other Amex US products, the Green Card offers a few annual credits to offset the fee, but the utility of these credits can a bit limited.

First, there’s a $189 (USD) CLEAR credit per calendar year. CLEAR is a service that uses biometric scanning to get you through the security screening process faster at select US airports and event venues. The service is only open to US citizens and legal permanent residents, and the membership is $189 (USD) per year, so the annual credit effectively pays for the membership year-after-year.

It’s worth noting that many other credit cards come with a NEXUS credit, which is arguably much more beneficial.

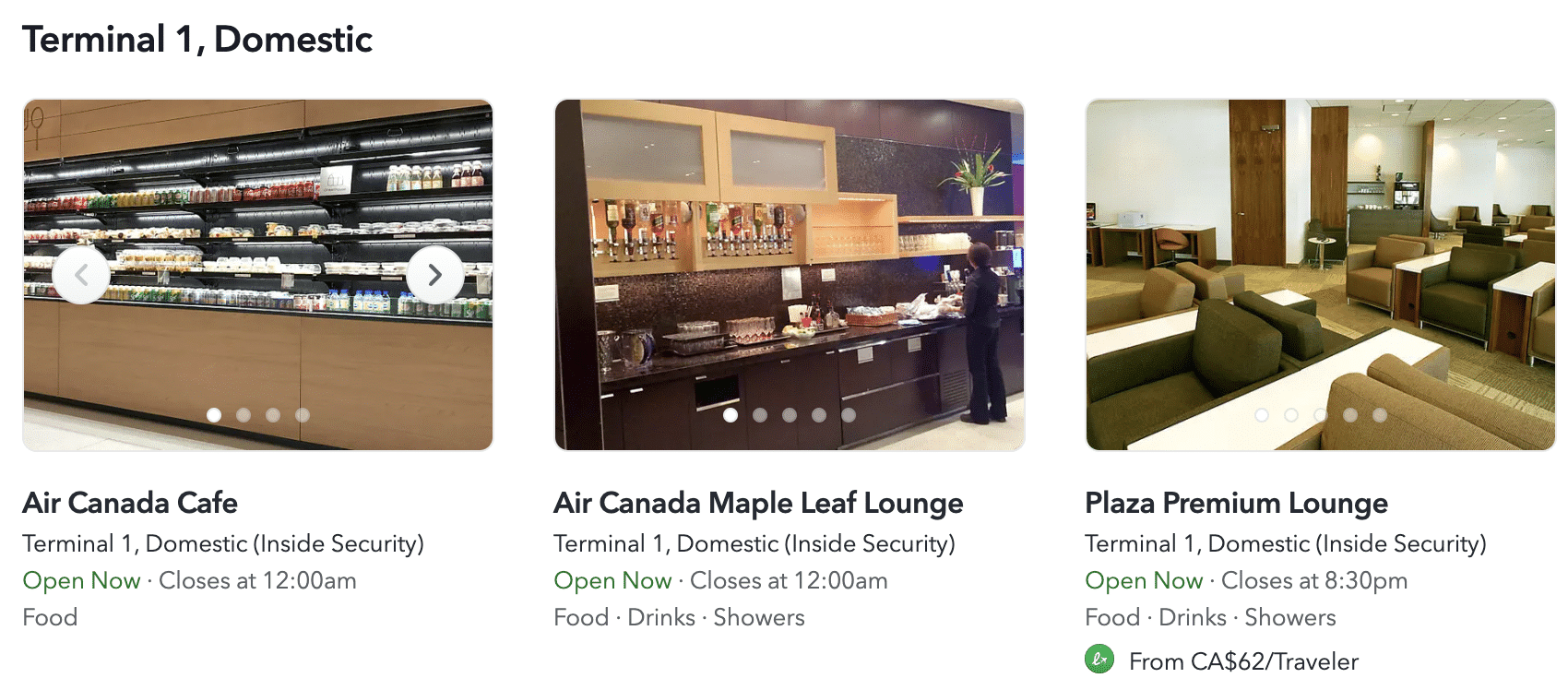

The Amex US Green Card also comes with a $100 (USD) LoungeBuddy credit per calendar year. LoungeBuddy started off as a service to inform airport visitors of their airport lounge options, and then moved to allow users to purchase lounge access and was eventually acquired by American Express in 2019.

On the surface, it seems like frequent travellers would certainly be able to make use of the $100 (USD) annual LoungeBuddy credit; however, most airport lounges worth their salt are either already part of the Priority Pass or DragonPass networks, or are operated by an airline themselves, in which case they’re unlikely to sell access via LoungeBuddy.

There may be some occasions when you could use the LoungeBuddy credit to access a lounge that you wouldn’t otherwise have access to, or perhaps bring in an extra guest over and above your guest allowance. But I get the feeling that, for those of us who usually have a Priority Pass membership on hand, using up this credit may require a fair bit of going out of our way to do so.

Still, the LoungeBuddy credit is the more practical one for Canadians to derive value from, thereby partially offsetting the $150 (USD) annual fee.

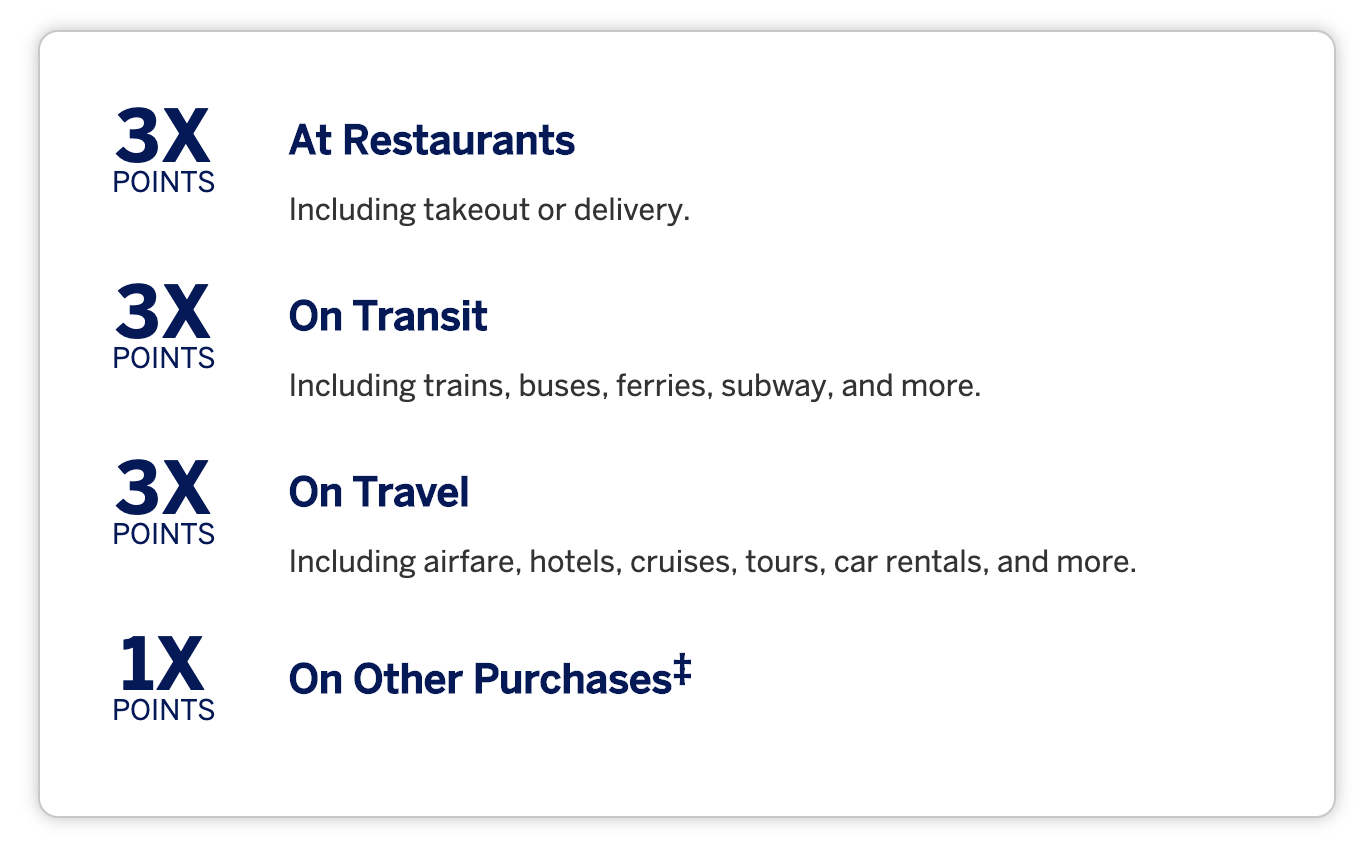

The remainder of the value of the Green Card will be from its ongoing category earning bonuses: 3 US MR points per US dollar spent on worldwide dining (including food delivery), transit, and travel.

These earning rates are very competitive compared to what we have in Canada. The 3x earning rate on transit and travel is virtually unparalleled, while the 3x earning rate on dining is arguably better than the Canadian-issued Platinum Card’s 3x rate (due to the stronger MR points south of the border) and slightly inferior to the Cobalt Card’s 5x MR earning rate.

With the above in mind, there’s definitely a case for keeping the Amex US Green Card around after the first year, but you’ll also want to think about other US-issued cards that the Green Card might compete with.

For example, the Gold Card and the Green Card are generally seen as competing rather than complementary products, so you’ll want to take a look at the respective fees, credits, earning rates, and benefits of both cards and think carefully about which one provides you with more value in the long run.

Conclusion

If you want to benefit from the record-high offer of 60,000 Amex US MR points and up to $200 (USD) in statement credits on the Amex US Green Card, you’ll want to apply before the offer expires.

As long as you’re eligible to receive the welcome bonus, now is a great time to take advantage of the sky-high welcome bonus that comes with a low annual fee, a statement credit, and a very reasonable minimum spending requirement spread out over six months.

Below is a direct link for referral to the Amex Green card. Apply via a regular tab to get the 50k offer. Or if the 20% statement credit is more appealing to you, open the link in incognito mode. Thanks in advance!

http://refer.amex.us/ZUBAIB9t4Z?xl=cp33

Amex US Gold

http://refer.amex.us/CLINTR3KAZ?XL=MIDCP

For the Amex US Green, Click ‘All Personal Cards’ to find referrals for other cards, including the Amex US Green.

Thanks Ricky for the love to the community!

Thanks in advance for using the referral link 🙂

Thanks for sharing the love with this one and the Gold card, Ricky. Much to my pleasure and surprise I got two referral bonuses bringing me close to the max. Thanks to whoever used my link before! I was very excited and am getting closer to an ANA round the world!

Amazing to hear!

Here’s a link for the 50K point Amex Green card offer! Just scroll down the referral page to see it. Thanks!

http://refer.amex.us/ZORANVllzI?XL=MITCP