The Government of Canada released its 2023 budget a short while ago, and part of the document committed to providing relief for small businesses by helping them save on credit card transaction fees.

On May 18, 2023, the government announced the formal agreement it has managed to draft with Visa and Mastercard to lower the aforementioned interchange fees, while also specifically vowing to protect Canadians’ credit card rewards such as Miles & Points.

Today, let’s look at the changes, what led to them occurring, and think about how they might affect your travel plans in the future.

Interchange Fees Lowered for Small Businesses

It’s always good to see a government live up to its promises, and the turnaround from the announcement of the budget to these changes has been quite rapid.

Of course, high credit card fees have been a contentious issue for years, with business interest groups such as the Canadian Federation of Independent Businesses (CFIB) making no secret of its desire to get the fees lower as soon as possible.

The new schedule of fees is available to all small businesses whose Visa transactions total $300,000 or less per year, as well as for businesses whose Mastercard transactions are less than $175,000 per year.

The new fees that small proprietors can expect to pay are a weighted average of 0.95% on in-store transactions. There has been a reduction of 10 basis points, or 0.1% of the gross transaction total (for a net savings of 7% of the total interchange fee), on online purchases.

Visa and Mastercard have also agreed to make anti-fraud and cyber-security resources available for free in order to prevent fraud and/or chargebacks (the latter being a consumer protection mechanism sadly abused by scammers).

Credit card fees were lowered by negotiations mandated by the elected government in Ottawa.

It’s important to note that the new settlement that’s been negotiated between Canada and its largest payment networks affects only Visa and Mastercard transactions. The agreement does not affect American Express, who presumably has different arrangements with merchants utilising their payment network.

Canada: A Haven for Miles & Points

What interests me about the text of the new lowered schedule of fees is that the federal government has committed in writing to “…protecting rewards points for Canadian consumers offered by Canada’s largest banks”.

For us Canucks, our home and native land is the second greatest jurisdiction in the world for accumulating Miles & Points for travel. I must admit that, in large part, this is due exactly to the fact that we have higher-than-average interchange fees permitted on credit card transactions.

Our strong rewards scene is also strengthened by the fact that the Big 5 Banks (Scotiabank, BMO, RBC, CIBC, and TD) hold approximately 80% of all consumer banking business in Canada, and therefore have a strong incentive to keep customers within their respective ecosystems.

Nothing sharpens a competitive edge like a strong adversary, and each of the Big 5 would love nothing more than to convert each other’s customers. Of course, this leads to excellent signup bonuses and strong rewards partnerships, such as between banks like CIBC and TD and my personal favourite program, Aeroplan.

To point towards a positive trend in innovation, the desire for companies to gain more consumer spending has led to many positive changes and the creation of much more competitive programs such as Scene+, which recently gobbled up almost the entirety of Air Miles‘s waning empire. The ultimate winners? Canadian shoppers, of course!

Will the New Legislation Benefit Consumers or Business Owners?

This new legislation makes me slightly apprehensive for the future of Miles & Points. For a counterpoint, I would like to direct folks to the United Kingdom, whose government since Brexit in 2019 have decreed that credit card fees shall not exceed 0.3% of the gross fees of a transaction.

I am concerned that this first reduction in fees, for what is now a limited number of businesses, could be part of a greater push to reduce all credit card fees at a much greater number of businesses. As has been established earlier in this article, industry pressure groups have made no secret of their desire to reduce credit card fees, and it is hard to believe that their appetite for interchange cuts has yet been sated.

In the short term, small cuts to interchange fees, as have been instituted by the government, could be positive. It certainly is nice that qualifying businesses can save while allowing customers the freedom to continue using credit payment products.

However, a gradual process of reducing interchange fees could be bad for many Canadians, especially regular consumers and even business owners, and I’d like to explain why.

It would be silly for me to pretend I am not worried about the ability to accumulate reward points. One of the major reasons Canadian banks are so generous with their welcome bonuses and credit card earn rates are our transaction fees.

What we must not forget, however, is that banks are businesses. They have a mandate to deliver profitability and returns to their shareholders, and in many cases, those shareholders aren’t tycoons, but are instead retail investors, employee pension funds, and the almighty Canada Pension Plan itself.

If interchange fees go down, where do you think the profits previously made off said fees will come from? On the one hand, reward payments will reduce, so this will make up for some of the losses.

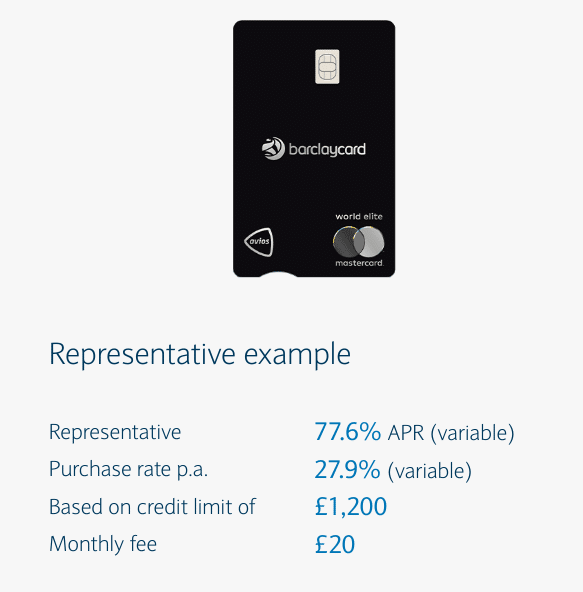

On the other hand, the banks are likely to hike interest rates, especially on premium credit card products. Don’t believe me? Just look at a high-end credit card from the UK:

77.6% variable interest rate on rewards credit cards. Yikes! While you could always opt for a lower-interest credit card that does not pay you back in the form of rewards, lower interchange fees across the board will lead to increased interest rates on all unsecured lending products.

This would punish every single person who forgets to pay their balance in full, including those who’ve never benefited from a rewards flight in their entire life.

Moreover, in an ironic twist, many of the biggest benefactors of earning Miles & Points on credit cards are, you guessed, it, small business owners. Because of the large amounts of spend required to maintain business operations, many proprietors are able to leverage their everyday operational expenses into vacations or cash back.

It would be very sad for such merchants to suddenly be unable to see their travel rewards or cashback cut in half because interchange fees dropped.

Further, as in love and war, in business one must do what one needs to in order to survive. On some occasions, this can mean running operations off a credit card, and thus carrying a balance and incurring interest. Lower interchange fees lead directly to higher interest rates.

Therefore, a business which is now pushing hard for a decrease in fees could see those savings be translated later into increased interest expenses.

Lastly, there is the question of impulse buying and basket sizes. Right now, we are seeing a potential 27% reduction in fees on the gross total of interchange for an in-store transaction, as well as a 7% reduction online, assuming that the customer is paying with Visa or Mastercard.

If the buck stops here, this could be a great win for both businesses and consumers. If another cut comes, as I suspect, it could have unintended consequences.

This is because one of the well documented effects on consumer behaviour for people who pay with credit products is that of impulse buying. The morality of this phenomenon can be debated ad nauseam; the net effect is that using credit cards tends to significantly increase the quantity of items (and thus final prices) customers pay for.

Reducing interchange fees from 1.25% to 0.95% of the gross transaction is utterly wiped out as a net benefit to a business if the average basket size drops a few percentage points. If credit card users tend to buy more items than those using cash or debit, the shortfall could lose businesses more in the long-run.

Conclusion

The Government of Canada has fulfilled its pledge to put more money back into the pockets of small businesses by reducing credit card fees for qualifying businesses. It has achieved this by negotiating a new deal with the juggernauts of Visa and Mastercard, and for now, business industry groups are celebrating.

Whilst it is good to see the government commit to protecting consumers’ reward points, I hope that this does not become the first step on the road to disappointing average customers by continuing to legislate fees down until reward points are accumulated slowly, and interest rates are high.

Time will tell what road lies ahead for Canada, but here’s hoping that Canadian business organisations don’t try to throw the baby out with the bathwater and reduce fees to the point that interest hikes and reduced basket sizes eat into the margins they so strongly desire to protect.

Until next time, don’t pay with debit.

Kirin, that UK card’s interest rate is not 77%.

It’s 27% the same as many Canadian cards.

It also has a £20 monthly fee, £240/year.

The silly 77% number comes from advertising regulations that require the inclusion of the AF in the APR calculation. Combine that with low example balance owing of £1200 and get a nonsense APR of 77%