After American Express US announced a few weeks ago that they would be extending the minimum spending windows on all recently and newly opened credit cards, all eyes have been on American Express Canada to see if they would follow suit.

At the time, I had expressed my belief that Canadian cardholders would be offered a similar extension, as it would be the right thing to do at a time when social distancing measures can make it tough to meet minimum spends.

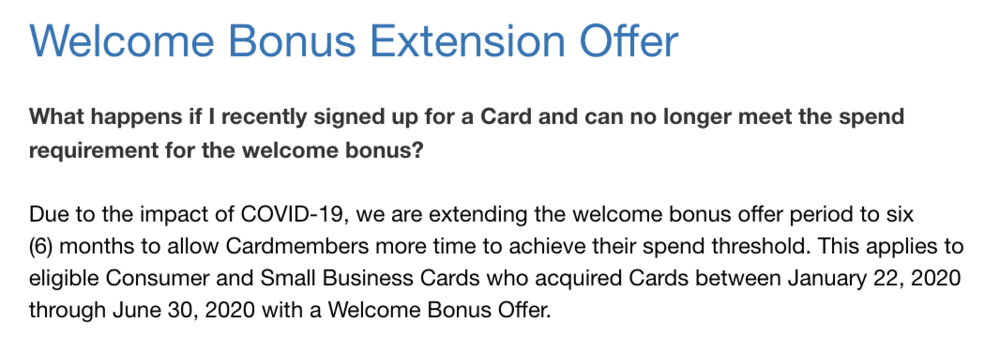

And while we’ve had to wait for a few weeks, American Express Canada has now officially extended the minimum spending window by an additional three months, for a total of six months, on all cards opened between January 22 and June 30, 2020.

Three-Month Minimum Spending Extension

Most of American Express’s products attach their welcome bonuses to a three-month minimum spending window, and cardholders are advised to plan their regular spending patterns and major purchases around this window when aiming to earn the signup bonus on a new card.

At this time, however, most cardholders aren’t spending very much money at all on a day-to-day basis, and potential new cardholders may also be put off by some of the higher minimum spending requirements on American Express’s products. That’s why an extension to the three-month window is a sensible move, and should give cardholders much more leeway for meeting their thresholds.

For most American Express cards, if you applied on or after January 22, or plan to apply before June 30, then you’ll have six months to meet the minimum spend instead of the usual three. There’s no action that needs to be taken on your part, as the extension will apply automatically.

I’m a little embarrassed to admit that this will be of great help to myself as well, since the extension will breathe new life into a Gold Rewards Card that I had recently opened, but had then accidentally forgotten about meeting the minimum spending amidst everything that was going on.

Which Cards Are Eligible?

The three-month extension has been announced for most products, but there are a few exclusions that are worth noting. You may consult the American Express website for the full details.

Most of the products that we in the Miles & Points community are interested in fall under the three-month extension, including the Gold Rewards Card, the Business Gold Card, the Platinum Card, the Business Platinum Card, the Business Edge Card, the Bonvoy Card, the Bonvoy Business Card, and the Air Miles Platinum Card.

Some noteworthy exclusions include the no-fee Amex AeroplanPlus Card and the high-end Amex AeroplanPlus Reserve Card, which have now been discontinued to new applicants.

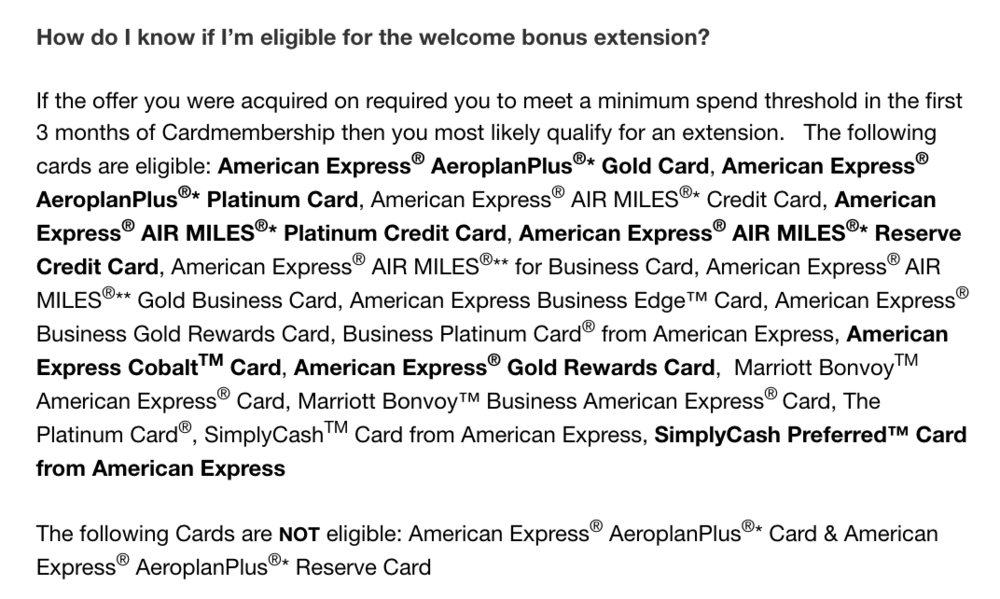

Meanwhile, select offers on other products are also excluded, even if the card itself is listed as eligible for the three-month extension. These exclusions mostly consist of offers where the bonus wasn’t attached to a three-month spending window in the first place, but was rather based on some other criteria.

The most significant example is probably the Cobalt Card, which operates on a monthly cycle in which you’ll earn 2,500 MR Select points during each of the first 12 months that you spend $500 on the card. This offer is listed as an exclusion, because it doesn’t make much sense to offer a three-month extension on a spending requirement that operated on a monthly basis in the first place.

Similarly, when applying via Perkopolis, the Gold Rewards Card has offered an extra bonus of 2,500 MR points during each of the first six months that you spend $1,000 on the card. This offer is likewise excluded from the three-month extension as well.

However, the Gold Rewards Card’s public (i.e., non-Perkopolis) base-level welcome bonus of 25,000 MR points upon spending $1,500 in the first three months would be eligible for the extension.

Is Now a Good Time to Apply for American Express Cards?

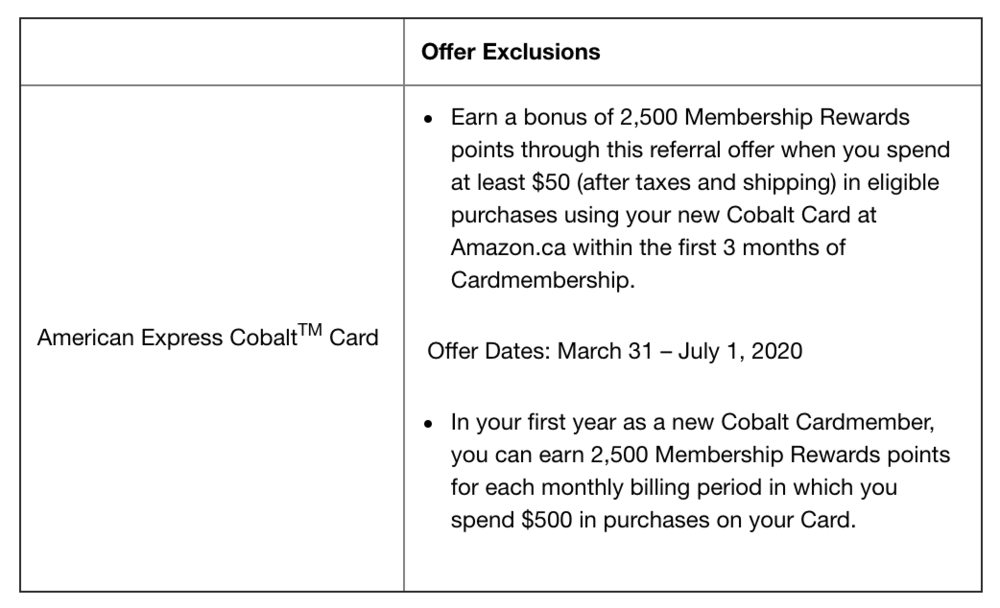

One could argue that there has never been a better time to apply for American Express cards, thanks to the Double Rewards promotion on the Platinum Card, which runs until July 20, 2020.

I’ve written about the many ways you can maximize this promotion, which allows you to earn and redeem points at double the usual rate, effectively transforming the Platinum Card into a no-limit 4% cash back card with 8% and 12% bonus categories in travel and dining.

Better yet, any MR points you earn from the Gold Rewards Card, Business Gold Card, and Business Platinum Card can be combined with your Platinum Card to avail of the Double Rewards promotion as well.

Having six months to meet the minimum spend should make the $3,000 or $5,000 spending threshold on the Platinum Card (depending on whether you sign up via the public offer or via a referral link) much more manageable. However, bear in mind that if you do want to take advantage of the doubled redemption value, then you’d still want to complete the minimum spend and earn the welcome bonus by the promotion’s end date of July 20.

Of course, you don’t have to redeem points at double value either – you can simply earn points at double the usual rate on your Platinum Card, and then keep them around and transfer them to frequent flyer programs to secure a higher than 2% return via flight bookings in the future. And in that case, a six-month timeframe should give you plenty of leeway to meet the spending at your own pace.

Conclusion

Better late than never, right? After a few weeks of playing the waiting game, it’s great to see American Express Canada finally offering a three-month grace period on minimum spending requirements for most of their cardholders. Hopefully this makes it easier for some of you to complete your minimum spends, while also assuaging the fears of those who might’ve been on the fence about getting an American Express card at this time.

It remains to be seen whether this is the last of the relief measures being offered to Canadian cardholders, or whether additional specific perks designed to justify the annual fee, similar to what was announced by Amex US last week, might be rolled out on this side of the border as well.

Ricky,

I know there is a Perkopolis/Travelzoo offer that gives you 40k points, with 10k points given out for the $3,000 spend for the first three months. Do you know if the minimum spending window is extended for the 10k bonus points offer? I think it should, but I couldn’t quite tell from the Amex website.

Oops, I realized I haven’t made it absolutely clear which card I was referring to — I meant Cobalt.

does the personal plat. card code the same when u use it with apple pay or google pay? u still get 2x same as normal right? thx

Yes, you do.

I never knew there’s an offer of additional 2500 pts for the first 6 months.

Sorry. After done little research, the offer is from the Perkopolis for Cobalt & Gold.

You’re right that the additional 2,500 MR points per month on the Gold is only via Perkopolis, I’ll clarify that.

The Cobalt Card’s 2,500 MR Select points per month is very much part of the public offer though.

Hi Ricky, we usually do our groceries in superstore, but they dont accept american express. Im planning on buying visa giftcards using my american express. Is this safe? Is this considered cash advance? Will i get double points on this too?

You can buy Superstore gift cards on Rakuten Gift Cards. They take American Express via PayPal.

I think Maxi, Loblaws and Provigo gift cards will work too.