Earlier today, we covered the upcoming changes to the American Express Cobalt Card, as well as the news that the Choice Card from American Express would also allow airline transfers on the same date of August 16.

In fact, not only will the Choice Card be adding this new feature, it will also be undergoing an identity transformation as well.

On August 16, 2021, the Choice Card will rebrand as the American Express Green Card and take up its place as the only member of the Membership Rewards card family that comes with no annual fee.

The New Amex Green Card: No Annual Fee, 1x Earning Rate

The new American Express Green Card will be a continuation of the current Choice Card from American Express.

It’s a pretty basic offering in every way, which is to be expected for a no-fee product.

The Green Card remains a credit card rather than a charge card, meaning that cardholders will be subject to a preset credit limit and will have the ability to make minimum payments on their monthly balances (although you should of course always pay off your bill in full).

Like the current Choice Card iteration, the Green Card will offer a flat earning rate of 1 MR point per dollar spent on all purchases.

(Note that we’re referring to the Green Card’s points currency as “MR points” rather than “MR Select points” because we know the future Green Card will earn points that can be transferred to airline partners, including Aeroplan and British Airways Avios at a 1:1 ratio.)

While the Choice Card was entirely devoid of insurance benefits, the new Green Card will actually be introducing two new types of basic insurance for cardholders, which is nice to see on a no-fee card:

- Buyer’s Assurance Protection Plan, which automatically doubles the manufacturer’s warranty on a new purchase, up to one year

- Purchase Protection Plan, which reimburses you for the cost of a purchase in the event of direct physical damage or theft within 90 days

Existing Choice Card holders will receive a new Green Card in the mail upon their existing card’s expiration – or they can presumably request a new replacement card at any time after August 16.

Finally, in terms of the welcome bonus, it remains to be seen whether the Green Card launches with a superior bonus on August 16 compared to the Choice Card’s current 10,000–15,000 MR (Select) points (with the offer for 15,000 points showing up via incognito mode only).

Points Will Be Transferable to Airline Partners

While the transition from the Choice Card to the Green Card is mostly cosmetic, the primary meaningful change is that the Green Card will earn points that are transferable to American Express’s airline partners as of August 16.

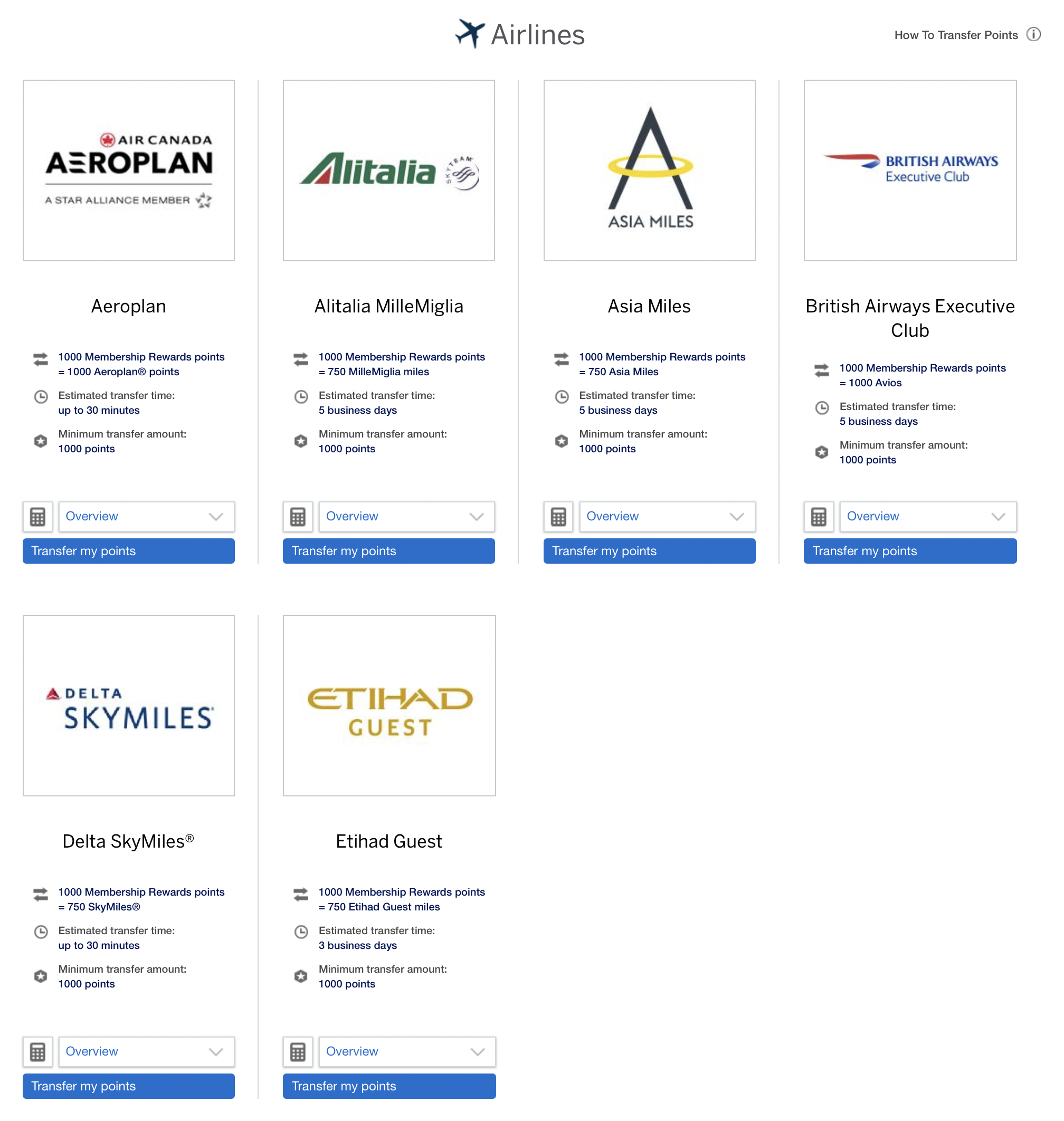

These include Aeroplan and British Airways Avios at a 1:1 ratio, as well as secondary airline programs like Cathay Pacific Asia Miles at a 1:0.75 ratio – in addition to the existing ability to transfer points to hotel partners like Marriott Bonvoy.

Somewhere to Park Your Membership Rewards Points

Even though the new Green Card may not be the most exciting product on its own, it still addresses the gap that there previously hadn’t been a no-fee product in the Membership Rewards family.

That was a point of frustration for those who might’ve held other MR products, but who no longer saw value in their card and wanted to cancel, and yet didn’t want to transfer out their points just yet.

In theory, the Green Card provides an option for “parking” your MR points that you might’ve earned from the Platinum Card or Business Platinum Card by combining the MR Select accounts if you no longer wished to keep one of those products going forward.

You’d still retain all of the options associated with your MR points indefinitely, since they’d be attached to your no-fee Green Card instead (where, as of August 16, points will be convertible to airline partners as well).

Conclusion

On August 16, 2021, the American Express Choice Card will rebrand as the new American Express Green Card, offering cardholders the ability to transfer points to airline partners (in keeping with the Cobalt Card‘s concurrent changes) and acting as a no-fee solution within the Membership Rewards family.

With a flat 1x earning rate, the Green Card isn’t too much to get excited about, but the current signup bonus of 10,000 soon-to-be-regular MR points still represents a decent chunk of value to unlock in exchange for a no-fee card that will support your credit history going forward.

If you prefer to avoid paying annual fees as you play the credit card game, then the new American Express Green Card could be the best option for making your entry into the Amex MR ecosystem.

What credit score do you need for this card? I’m a student that’s fairly new to credit. Would you recommend this card as a starting point?

Ricky, I was told finally today, Aug 16 (after waiting for the D day of Choice to Green card switch) that it’s not possible to transfer or combine the MR points from my Gold card to my Green card. If you’ve had a different result, please share.

This is my understanding as well, it looks like MR and MR Select were kept separate on the back-end for linking purposes, even though they’re effectively one and the same. The Green Card is therefore a good place to park the points from the Cobalt or Business Edge cards, but not from the remaining cards. I’ll update this article to reflect.

Ricky, my Gold card’s annual fee is up for July 23 this year, should I wait until the Green card comes out officially and switch and pay the annual fee in the in-between time? Or should I ask to switch to the Choice card first right away? Thanks for your insight.

Do you think that Amex is going to update the Gold card as now that the cobalt also earns regular MR points it is kind of lacking. I hope they up the earning rates and add a few Priority Pass access as that would create a larger difference between the two cards and make the Gold card more worthwhile.

I do think that’s fairly likely, yes.

Quite a contrast to US version of the Green card, which is my go-to card for travel and dining purchases.

love the option of using this to “park” MR points now 🙂

My parents have a grandfathered Green Card from way back. Would this means that it changes from a charge card to a credit card?

I wonder if this means the Platinum card will now have a downgrade path to a no annual fee card.