Miles & Points are a powerful tool that can unlock luxury travel at a fraction of the cost; however, there’s a lot to learn before you can begin flying business class all around the world.

Even though it may seem “too good to be true”, you can actually travel in luxury without having to spend thousands – it just takes some effort. After all, “free” business class flights don’t just fall out of the sky.

In this Miles & Points for Beginners series, our goal is to guide you through the world of Miles & Points and help you get over the steep learning curve.

With a bit of effort, in no time at all, you’ll be able to earn enough points to cover even the most aspirational trips.

To begin, let’s dive into the backbone of it all: What are Miles & Points, and why do they matter?

In This Post

What Are Miles & Points?

Miles and points are currencies made up by airlines, hotels, and banks. Similar to real currencies, you can use accumulated miles and points to make purchases.

The most common ways to earn miles and points are through spending on credit cards, and through engaging with loyalty programs.

You earn points through welcome bonuses and with each purchase you make with your credit card, and you also earn points on paid flights with airlines and through hotel stays, amongst other means.

Credit card rewards come in many forms. In fact, there are four different types of rewards:

- Cash back

- Fixed-value points

- Loyalty-program points

- Transferable points

Each of the four types of credit card rewards have their place, and can be useful as part of an overall travel strategy.

That said, if you want to earn credit card rewards to travel in luxury, there are certain types you’ll want to focus on more than others.

Different Kinds of Rewards: Cash Back

Every bank offers some form of cash back credit card. With a cash back card, you simply earn a set amount of money for every dollar you spend.

The cash back return on spending always has 1:1 value. This means that if you earn 1% in cash back rewards, you’ll get $1 (all figures in CAD) back for every $100 you charge to your credit card – no more, no less.

Some credit cards offer higher cash back rewards on specific categories. For example, the Scotiabank Momentum® Visa Infinite* Card comes with the following cash back earning rates:

- 4% cash back on groceries and recurring payments

- 2% cash back on gas and transit

- 1% cash back on all other purchases

If you have large grocery expenses and don’t care about travel, then the Scotiabank Momentum® Visa Infinite* Card is worth considering.

However, if you want to book a flight in a premium cabin, a holiday for your family, or a fancy hotel stay, the amount you’ll have to charge on a cash back card to get flights and hotels on the cheap is astronomical.

Throughout this series, we’ll use the example of flying in business class, as it’s one of the most common reasons for people to start engaging with Miles & Points

Let’s say you’ve got your eyes set on a business class flight that costs $5,000 to book directly with the airline.

With a cash back card that earns 1% cash back, you need to spend a staggering $500,000 to earn enough to cover the cost of that flight.

Even with a higher category earning rate, the amount required to spend is out of reach for most people.

Given this, if your goal is a business class flight (or two), instead of a cash back credit card, you should turn your attention to credit cards that earn various types of miles and points.

Different Kinds of Rewards: Fixed-Value Points

Fixed-value points differ from cash back rewards in that you can redeem them in a number of ways.

You aren’t limited to only receiving cash back as your reward; instead, you can redeem points for travel, as well as things like gift cards, merchandise, and statement credits.

Similar to cash back rewards, and true to the name, you can redeem fixed-value points at a fixed rate. Generally speaking, fixed-value points are worth (at most) 1 cent per point; however, there are also some exceptions.

In Canada, examples of programs with fixed-value points include the following:

With fixed-value points, you’re often able to earn them at a better rate and redeem them for a higher value compared to cash back rewards credit cards.

For example, you can redeem Scene+ points against travel purchases at a fixed rate of 1 cent per point, up to one year after you made the transaction. You can earn on a variety of Scotiabank-issued credit cards at rates of 1–6 Scene+ points per dollar spent, depending on the card.

On the other hand, you can redeem CIBC Aventura Points against any travel purchase at a rate of 1.25 cents per point; however, they can also be used to book flights through the CIBC Aventura Airline Rewards Chart. When redeemed this way, you can receive value of up to 2.29 cents per point if you book certain flights – but only in economy.

Going back to the example of a $5,000 business class flight, you’d still have to spend a lot of money to book that business class flight using fixed-value points.

At an average redemption value of 1 cent per point, you’d still have to spend anywhere from $100,000–500,000 to earn enough points for business class, depending on how many points you earn per dollar with your credit card.

As we’ll explore later in this series, fixed-value points are very useful to have at your disposal as part of your overall travel strategy; however, the real magic comes through loyalty programs and transferable points, which we’ll look at just below.

Different Kinds of Rewards: Loyalty Programs

As we’ll explore in this series, loyalty programs are the key to unlocking the true magic of Miles & Points.

Most airlines and hotel chains have loyalty programs that you can access by taking flights or staying at hotels.

What’s more, you can also earn airline and hotel points through credit card partnerships.

For example, Aeroplan points are awarded when you fly with Air Canada (or with one of Air Canada’s airline partners), or by spending money on an Aeroplan co-branded credit card.

With a co-branded credit card, you receive points directly in your loyalty program account through the card’s welcome bonus, as well as each month based on your credit card spending.

Loyalty program points can be redeemed for flights, hotel stays, gift cards, and merchandise; however, we strongly encourage you to redeem airline points for flights and hotel points for hotel stays, as the potential value you can get with these redemptions is much better than redeeming them for gift cards or merchandise.

As we’ll discuss in detail later in this series, each program has its own set of sweet spots and perks, and the more time you invest in learning about each program, the better equipped you’ll be to reach your travel goals.

Different Kinds of Rewards: Transferable Points

You can also access airline and hotel loyalty programs through transferable points currencies.

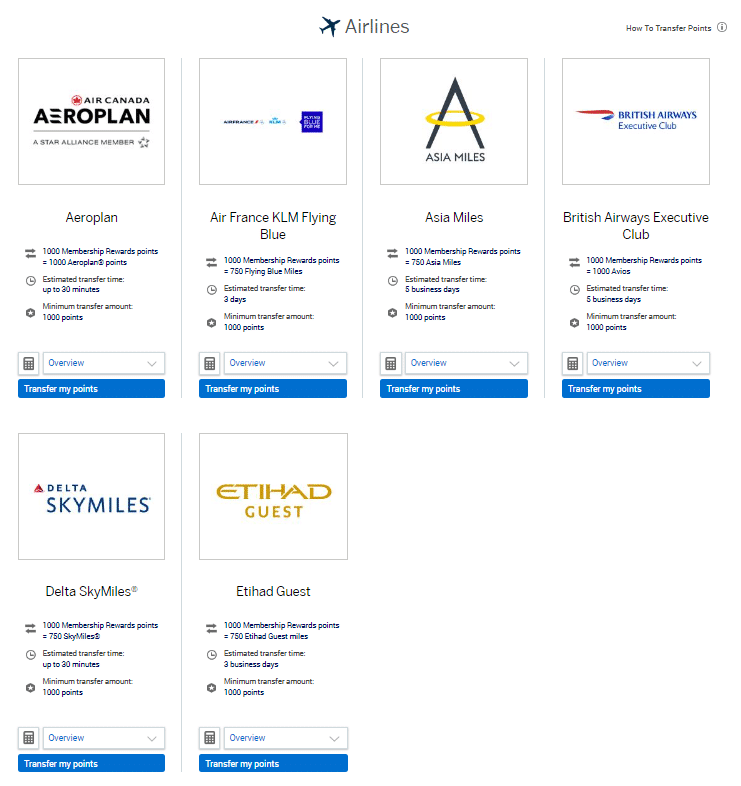

In Canada, there are only two transferable points currencies: American Express Membership Rewards (MR) and RBC Avion Rewards.

With transferable points, you first earn points by spending on a credit card that earns Amex Membership Rewards and/or RBC Avion Rewards. These points are then available in your online Amex MR or RBC Avion Rewards account.

Once you’ve earned points, you can choose to convert them into points with an airline or hotel loyalty program at various ratios. In our opinion, this is the best way to use your points if you want to travel more and travel better.

Plus, with transferable points, you have additional redemption options at your disposal.

You can redeem points for statement credits (similar to cash back and fixed-value points), book flights at a higher value with the RBC Air Travel Redemption Schedule and or the Amex Fixed Points Travel Program, or transfer them to external loyalty programs.

In other words, your Amex MR and RBC Avion points can do everything that cash back and fixed-value points can do, but they can also be converted into loyalty program points that offer access to flights and hotels.

Going back to our example of a business class flight, let’s use a popular option to illustrate why points are so magical.

You can book a one-way business class flight from North America to Doha in Qatar Airways Qsuites – widely considered to be the world’s best business class – for 70,000 British Airways Avios, plus around $165 in taxes and fees.

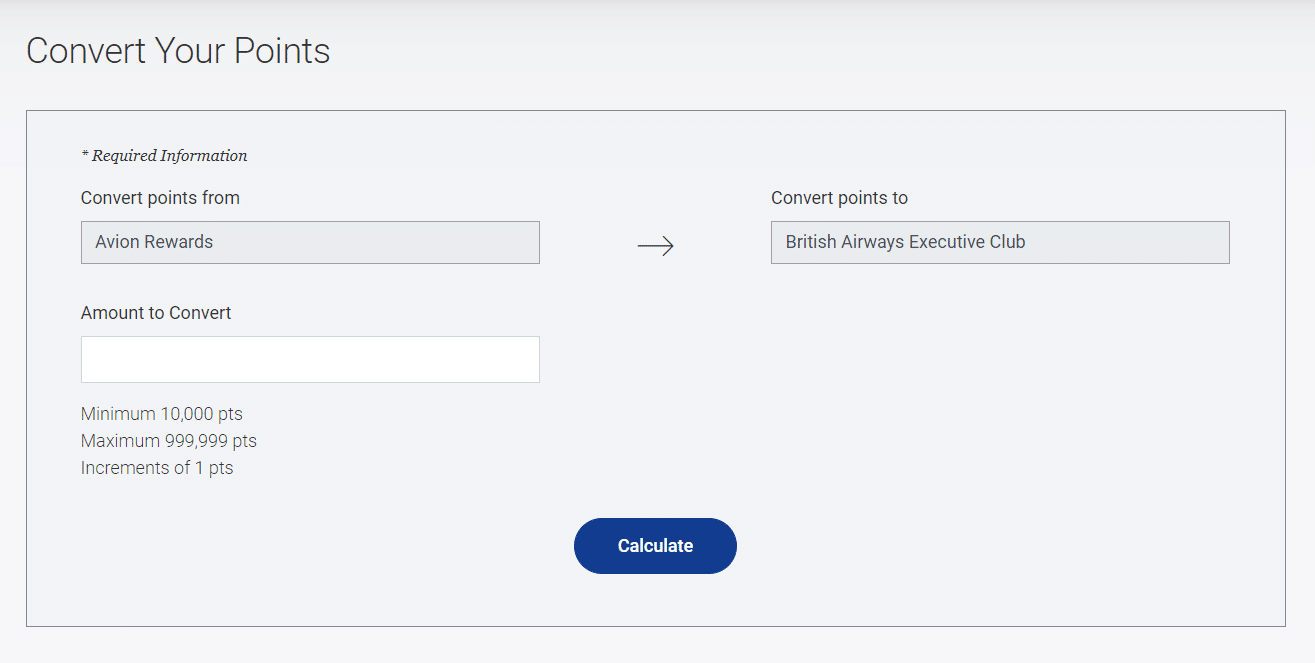

You earn British Airways Avios by spending on the RBC® British Airways Visa Infinite†, or by transferring your Amex Membership Rewards points or RBC Avion Rewards points to British Airways Executive Club (the name of the British Airways loyalty program), where they become Avios at a 1:1 ratio.

In other words, you’d need to transfer 70,000 Amex Membership Rewards points or RBC Avion Rewards points to your British Airways Executive Club account, at which point they’d become 70,000 British Airways Avios.

Once you convert your Amex MR or RBC Avion points into British Airways Avios, you could then go ahead and book the Qatar Airways Qsuites flight that would have otherwise cost you $5,000 (or more!) for only a fraction of the price.

Now, although the value opportunity here is exceptional, unfortunately it’s not usually as simple as our example suggests.

As we’ll discuss in this series, to book business class seats using miles and points, you’ll need to contend with finding award availability, knowing which loyalty program is best to use to book specific airlines, and a host of other considerations.

However, if you put in a bit of time and effort, you’ll enjoy luxury travel that costs a fraction of what it otherwise would if you paid for it out of pocket.

Conclusion

By putting in the effort to earn the right type of points, and by learning how to use transferable points and loyalty programs effectively, you’ll unlock a whole new world of travel.

For some, this could mean travelling more, and for others, this could mean travelling better.

Either way, Miles & Points will get you to where you want to be faster, and you’ll unlock experiences that might otherwise be out of reach.

There are many nuances that we’ll go over throughout this series, but remember this: the more you put in, the more you’ll get out.