Down south in the United States, American Express has been anything but shy with its offerings these past few months.

From the artistic reinventions of their signature Platinum Card, to their new-and-improved Hilton co-branded card welcome bonuses, the company is in full gear.

This week, another new and truly unique product joined the Amex US portfolio: a no-fee personal checking account, complete with a debit card, that earns Membership Rewards points on all purchases.

Let’s get right into dissecting the new Amex US Rewards Checking Account and Amex’s first foray into the world of direct-to-cardholder banking.

The First Consumer Bank Account from American Express US

Launching the new Rewards Checking Account represents another ambitious step for American Express US.

Not only have they been boosting their competitiveness recently with increased credit card signup bonuses, but this is actually the second checking account that Amex US has released in quick succession.

In October of last year, American Express launched their first banking product in the form of the Amex Business Checking Account, which also comes with a debit card.

This account offered many unique new features, such as strong wire transfer availability, for customers who wished to handle their business banking with American Express. However, it was confined to the business community alone, and unfortunately its debit card didn’t earn any Membership Rewards points.

The new personal American Express US Rewards Checking Account, though, will be loaded with great features for everyday use.

Amex US Rewards Checking Account Features

Let’s take a look at what the Rewards Checking Account is providing its inaugural batch of customers.

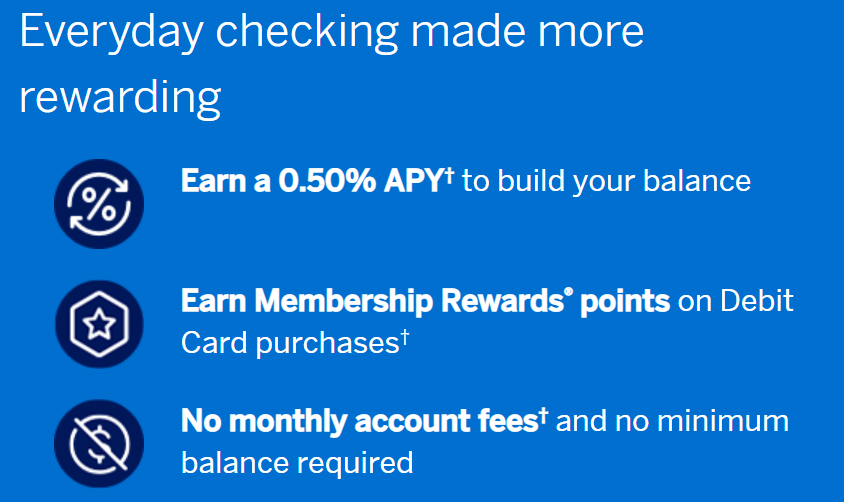

Unlike Amex’s consumer credit cards, which are famous for annual fees, the American Express Rewards Checking Account has no fees whatsoever.

The bullet point about earning 0.5% APY interest is a nice addition, but it won’t make a big difference unless you maintain a gargantuan deposit.

When it comes to account capabilities, the American Express Rewards Checking Account has full electronic funds transfer capabilities, so you can use it with any US bank that enables Automated Clearing House (ACH).

You can therefore fund your account via ACH from other US bank accounts, or via mobile check deposit.

When it comes to cash access, you may access up to US$1,000 per day at any ATM displaying the Amex logo, though withdrawals will only be fee-free at US-based MoneyPass ATMs.

There’s a big caveat to note, though: the American Express Rewards Checking does not offer online bill payments.

So while you could set up your Amex consumer cards to withdraw money from this checking account, you could not use it to initiate payments to third-party banks like Chase, Citi, or Capital One. Similarly, wire transfers are not supported.

One should also be wary of the US$5,000/day debit card transaction limit, as a very large purchase could require more spending power than this permits.

Next up, let’s talk about the rewards structure.

Earning MR Points with the Amex US Rewards Checking Account

I think some of the most exciting news to come out of the Amex US Rewards Checking Account is the fact that their associated debit card will earn 1 US MR point per US$2 spent.

Now, this isn’t the best earn rate out there, and you should definitely prioritize your rewards-earning Amex US credit cards for earning points based on spend.

However, an MR-earning debit product does fill a niche for making payments that can’t be made with a credit card (outside of bill payment services), or for individuals who are still building their credit history.

This earn rate is also much more competitive than our Canadian-issued debit cards, such as the Scotiabank Scene+ Debit Card, which only earn 1 point per $5 spent. If I had a large debit-only transaction coming up, I know which card in my wallet I’d reach for.

Aside from earning MR points, the Amex US Rewards Checking Account also comes with a suite of purchase protection coverage of up to US$1,000 on items paid outright with the debit card.

So if you purchased something for under US$1,000 and then lost said item within 90 days, you could file a claim and be reimbursed. This is a neat feature for a debit card, as most come with no such protection at all.

How to Get the Amex US Rewards Checking Account

To enroll in the American Express Rewards Checking Account, you must be a current Amex US cardholder with an account in good standing for the past 90 days. You’d then simply go to the Amex US Rewards Checking Account’s landing page and apply.

Current reports from across the US Miles & Points community indicate a fast approval time without a hard inquiry at any of the three major American credit bureaus.

This is a bit unfortunate for Canadians looking into joining the US credit card game, though, because it means that the Amex US Rewards Checking Account can’t be your initial bank account when making your first foray into the American market.

Still, you could definitely sign up for an Amex consumer credit card via Nova Credit or Global Transfer with a different bank, such as RBC, TD, CIBC, or BMO’s US subsidiaries, and then switch to Amex later.

Will I Be Getting the Amex US Rewards Checking Account?

As someone who’s enthusiastic about new banking products on both sides of the border, I’m going to be watching this checking account with interest. Before I run off to apply though, I need one nagging question answered.

My one unresolved query is: what will acceptance of the debit card be like in practice? Will it only work, as I suspect to be the case, at terminals that can process Amex credit card transactions?

Alternatively, will the Amex US Rewards Checking Account debit card work for transactions made up here in Canada?

Consider that many of our own Canadian-issued debit cards don’t run on a major credit card network’s system, and are instead powered by Canada’s proprietary Interac network.

Debit cards issued by Simplii Financial and most credit unions, for example, don’t have any co-branding with any of Visa, Mastercard, or Amex at all.

Of course, those unbranded debit cards do work at machines that only have debit purchases enabled, so here’s hoping that the American Express debit card does, too.

For now, my main interest in this product derives from the enormous amount of trust I place in the American Express brand, something that the company has earned through its customer-centric focus. It’s a level of confidence I simply don’t possess for any other financial services company.

Conclusion

With the new Amex US Rewards Checking Account, the opportunity to earn US Membership Rewards points on debit-only transactions is really enticing. I’m a bit wary of how universally accepted the account’s debit card will be, but I remain hopeful.

I’ll be watching this US-issued product closely, and I’d also love to see Amex Canada shaking up our domestic consumer banking landscape in a similar fashion.

It’s easy to feel suspicious of financial institutions, as their customer service is often sorely lacking. On the other hand, Amex is a brand in which we place great trust here at Prince of Travel, so if this account feels right for your unique needs, don’t hesitate to apply (and let us know about your experience).

Hi Kirin. Could I draw my rent, to my landlord for my canadian residence, from this checking account.

What’s the point of paying with this debit over any canadian debit card? Doesn’t FX fee kills the advantages?