I’m a sucker for innovation. The creativity of the human spirit knows no bounds, and I’m always amazed at new products and technologies emerging which aim to make our world work just a little bit better.

When a new fintech startup arises, naturally I’m all ears. I was excited to hear about the launch of Neo Financial and their Neo Card™ last year, and while I haven’t had a chance to get my hands on the card, I wanted to take a look at how it might disrupt the payments industry before I bite the bullet myself.

A Primer on Neo Financial

The Neo team is a who’s who of successful entrepreneurs and venture capitalists. They can count Peter Thiel of PayPal and Palantir, Tobi Lütke of Shopify, and Arlene Dickinson from Dragon’s Den among their early investors.

Neo is the brainchild of the founders of SkipTheDishes, who are now running Neo full-time as they oversee its growth. They’ve taken their success at connecting individual businesses more directly to consumers, and now they’re applying those same ideas to credit card rewards.

Based in Calgary, Neo launched in Alberta late last summer. When I was in Calgary in September 2020, I was already seeing their sticker in restaurant windows. They’ve since expanded across Canada to all provinces except Quebec, although there are some reports that Ontarians and others east of the Prairies are still having trouble signing up.

Neo currently offers two products: the Neo Card™ (which we’ll get to in a minute) and Neo Savings.

The latter is a fully-regulated and insured hybrid chequing/savings account. It has no monthly fees, free Interac e-Transfers and bill payments, and pays a high interest rate (currently 1.55% but always subject to change).

It’s aiming to be the reward-paying, no-fee, mobile-centric hub of all of your daily banking needs, competing with other startups and nontraditional banks like EQ Bank, Koho, Stack, and WealthSimple.

Neo Card™: Powered by Partner Rewards

The Neo Card™is a full-fledged cash back rewards credit card. You’ll have to consent to a hard credit inquiry to apply; early data points indicate that Neo checks TransUnion.

(It was initially speculated that Neo might be a prepaid reloadable card, similar to products offered by other Canadian fintech companies, but Neo ultimately chose to go with the standard model of a credit card with a revolving balance.)

Like many of its fintech competitors, the Neo Card™’s primary point of differentiation lies in its emphasis on individual partnerships with businesses, offering discounts and rewards at specific stores across Canada.

Traditional credit cards and big banks mostly give out rewards based on spending categories: for example, 3% cash back at all grocery stores, 2 points per dollar spent at all gas stations, and 1.5% cash back on all other purchases.

Some fintech startups, like Koho and Brim, have taken a hybrid approach, with a base earning rate for most purchases and extra bonuses at featured stores.

What about Neo? Well, Neo has fully leaned into the concept of partner rewards. In fact, they’ve done away with base rewards entirely for their free tier – you’ll earn rewards only when you spend at their partner stores.

A Closer Look at Neo’s Earning Rates

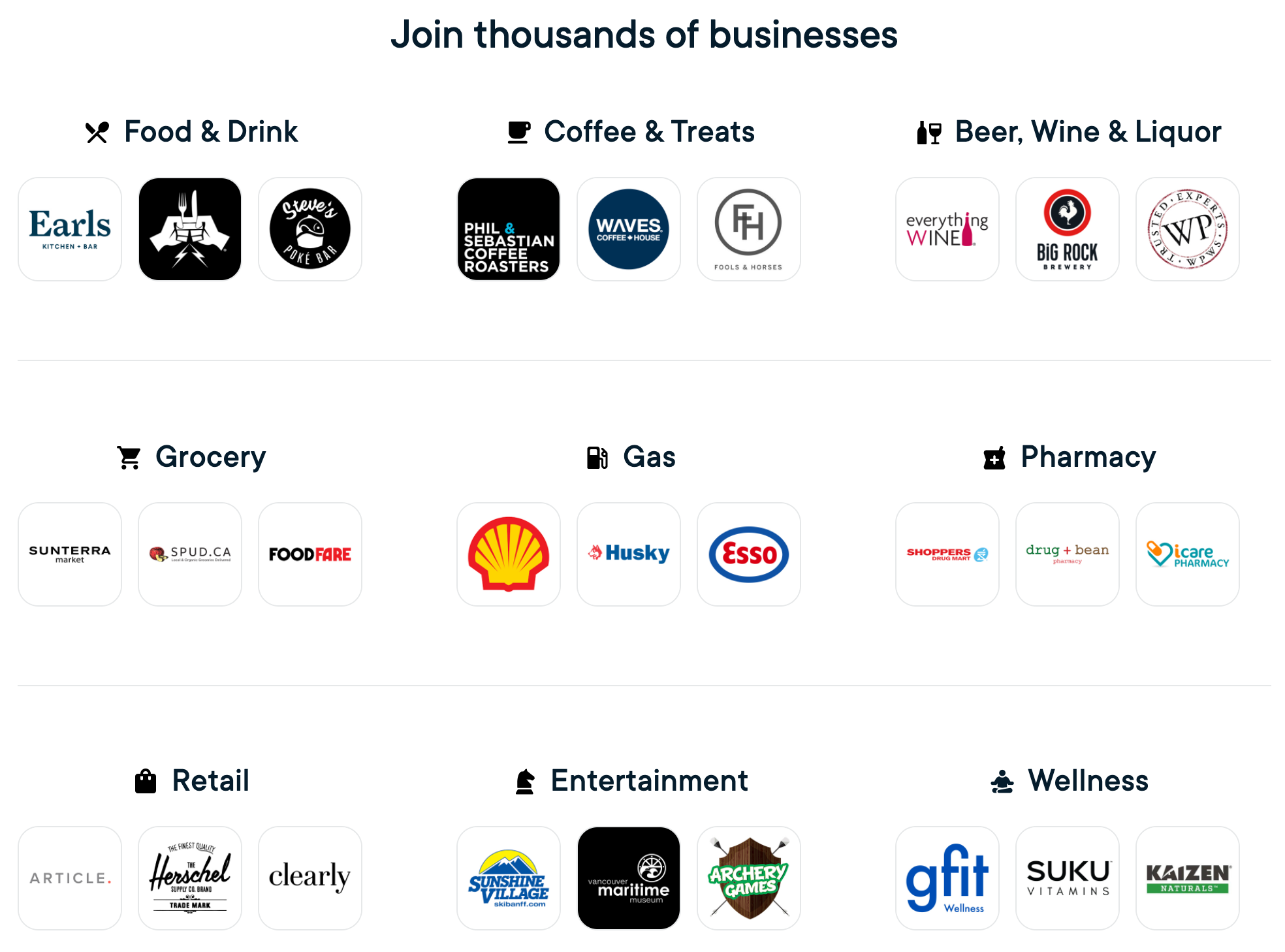

Since its inception, Neo has very aggressively and very effectively built thousands of retail partnerships across Canada.

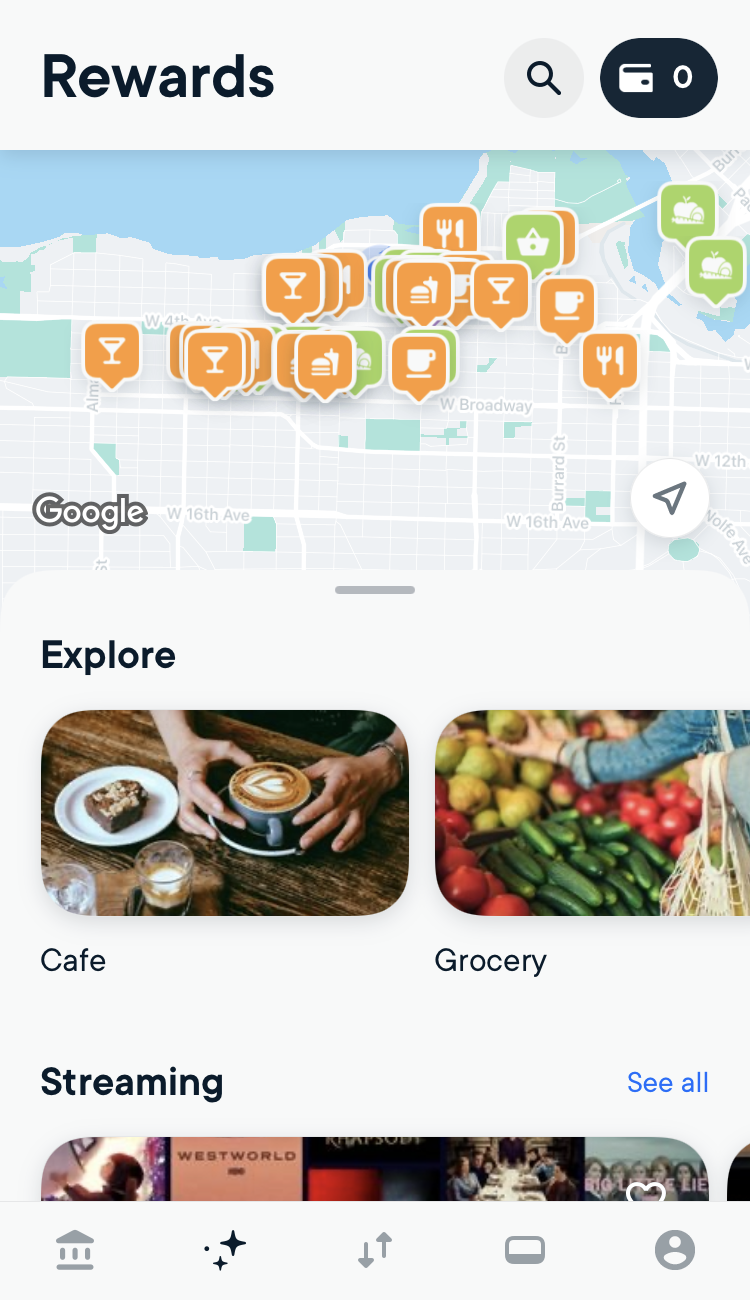

There’s no way to search partners on their website, but you can create an account and browse on the app before applying for the credit card. I’ve gone ahead and done that, in an attempt to piece together what sort of rewards you can expect as a Neo cardholder.

Unique Bonuses

So far, I’ve noticed three main types of rewards, all varying by store:

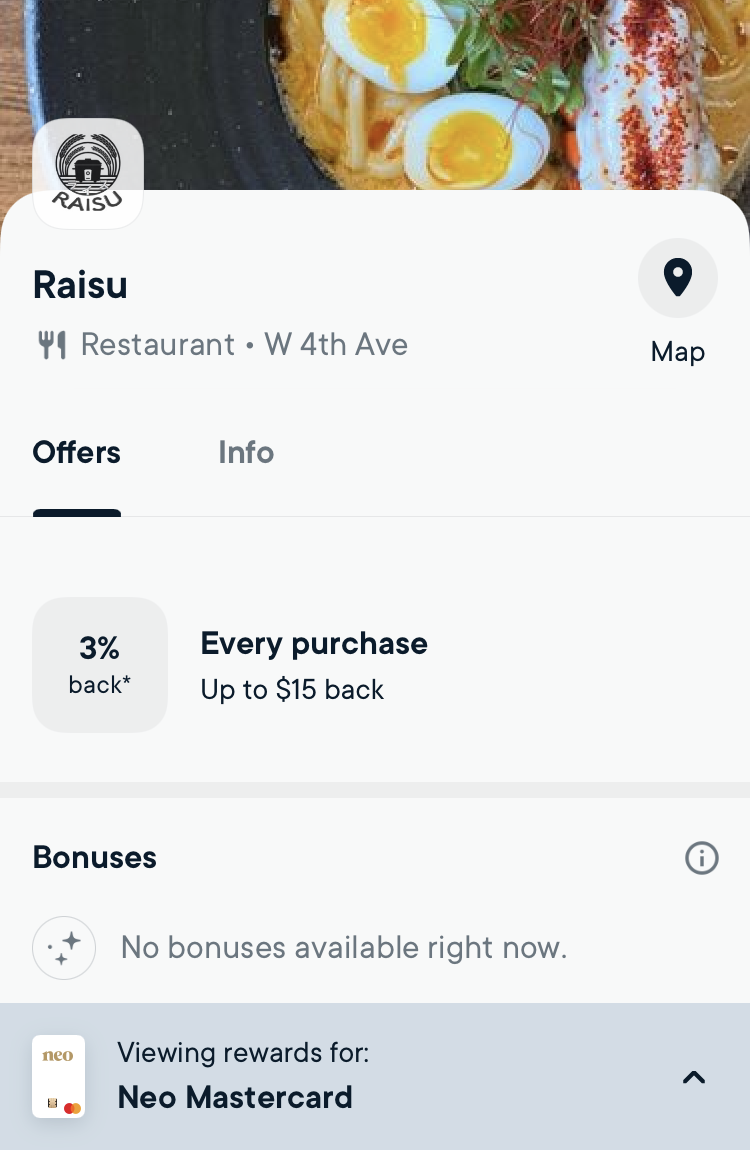

- Regular rewards: You’ll earn the same percentage cash back every time you visit. Each visit has a rewards cap, but most consumers likely won’t exceed it.

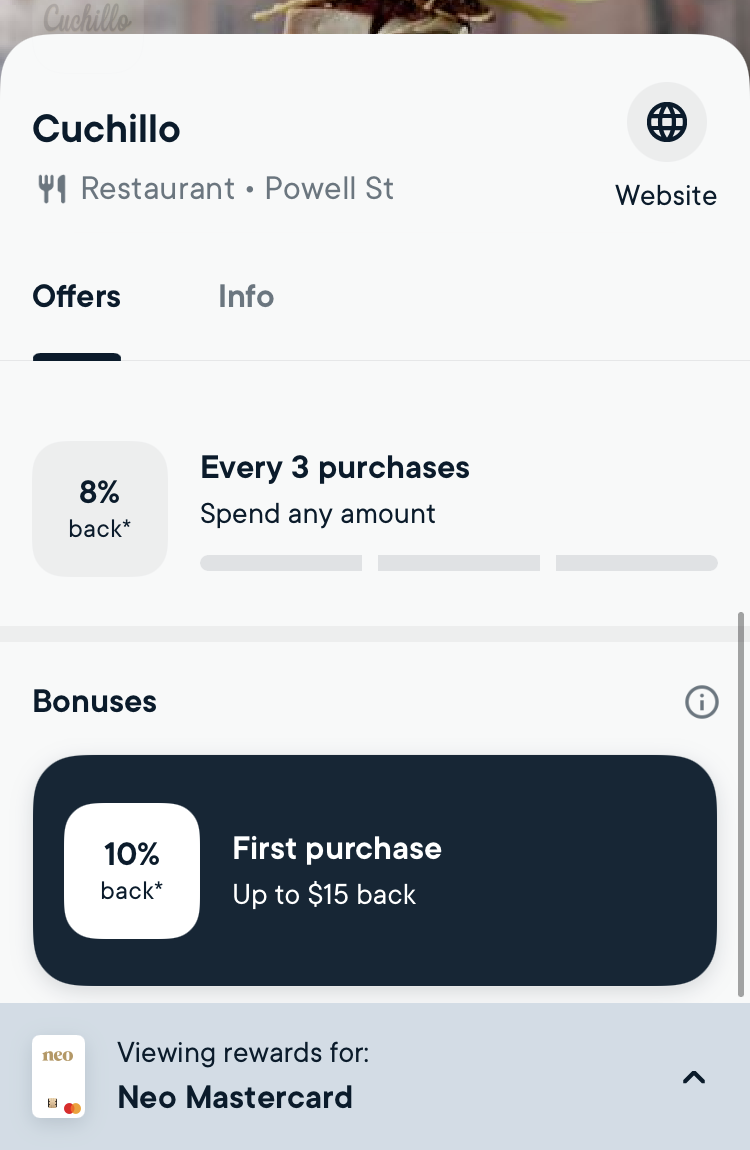

- First purchase bonus: Some stores have a one-time elevated bonus rate, up to a cap, the first time you visit. These rates can be as high as 10%.

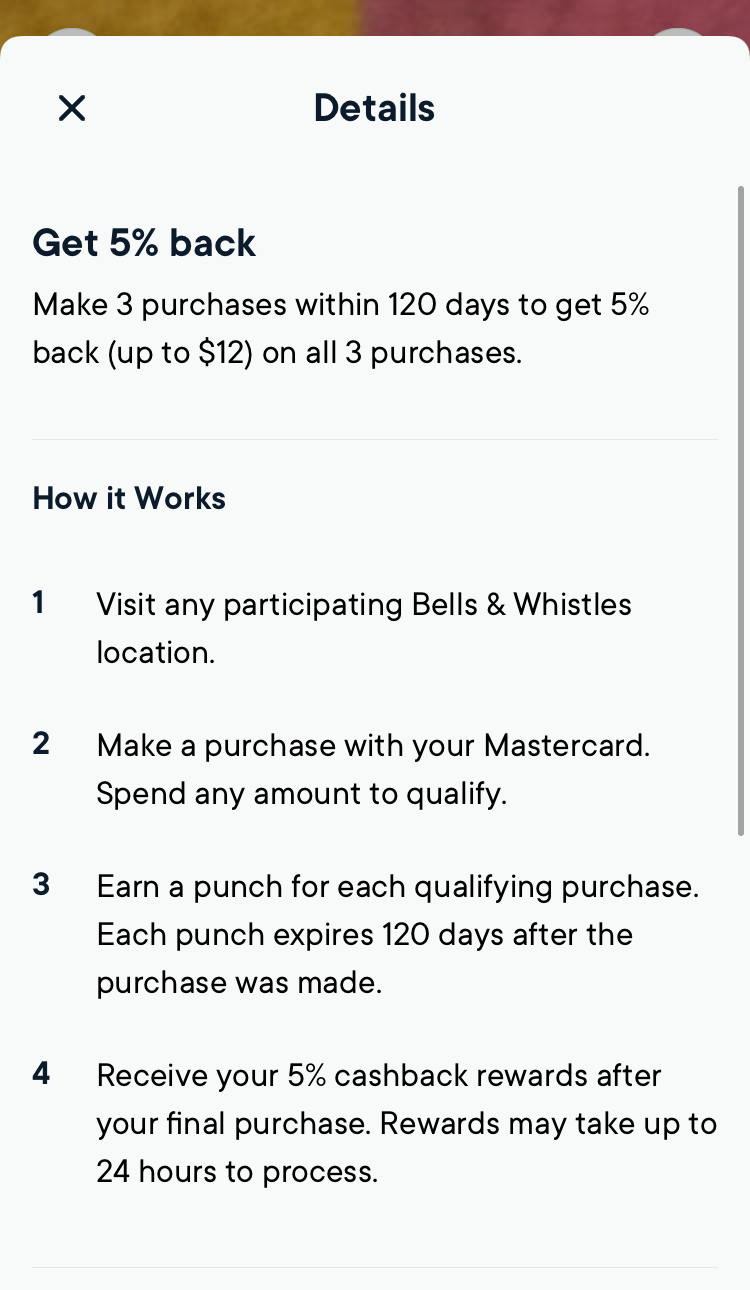

- Repeat purchase bonus: This is like the “buy 10 loaves of bread and the next one’s on us” punch cards that we’ve had since the dawn of commerce. You can earn a high cash back percentage, or a lump sum bonus, but its payout is only triggered after visiting the store multiple times in the span of a few months. Some of these offers are recurring; others are one time only.

It’s clear, especially from the last one, that Neo sets itself apart by emphasizing brand loyalty – not necessarily between the cardholder and Neo, but between the cardholder and Neo’s partner merchants.

In those cases, you have to make multiple visits to the store to unlock your rewards, and you’ll usually be compensated north of 5% for your trouble. It’s certainly a unique business model!

And those featured brands aren’t mega corporations – this isn’t an Aeroplan co-branded credit card, after all – but rather the most lucrative bonuses and repeat incentives are with select small local businesses who’ve chosen to enter into an enhanced partnership agreement with Neo. Very much in the spirit of SkipTheDishes, Neo is an intermediary that enables countless smaller players to run meaningful rewards programs without the overhead of building the loyalty infrastructure themselves.

(I should add that big brands, like Safeway and Shoppers Drug Mart, are indeed Neo partners as well; they just aren’t featured with the best rewards.)

Spending Categories

For the regular percentage-based rewards I mentioned above, the Neo Card™ doesn’t officially publish any category-based earning rates. Instead, they have separate arrangements with each merchant.

I’ve looked at a bunch of partners in Vancouver, and these are the closest approximations that I could discern:

- Earn 1% cash back on groceries, gas, drugstores, and Costco, up to $5 in rewards or $500 spent per purchase

- Earn 3% at restaurants

- Up to $5 in rewards or $166 spent per purchase at coffee shops and fast food

- Up to $15 in rewards or $500 spent per purchase for sit-down dining and take-out

- Earn 5% at bars

- Earn 3% at private liquor stores 👀

- Earn 3% at retail stores

- Up to $20 in rewards or $666 spent per purchase at clothing retailers (Lululemon, SportChek, Zara, etc.)

- Up to $50 in rewards or $1,666 spent per purchase at big box stores for home improvement and electronics (Home Hardware, HomeSense, Best Buy, Canadian Tire, etc.)

Neo is definitely targeting the young, plugged in, on-the-go demographic. You’ll earn the most rewards for boozing it up, getting your avocado toast three times a week, and a healthy dose of retail therapy. Bars and restaurants clearly make up the vast majority of partners with elevated or one-time offers.

If your hectic lifestyle has shifted away from nightlife and towards family life, however, you’ll probably earn less with Neo. You’ll earn far fewer rewards for driving your army of children to hockey practice and preparing a home-cooked meal for their ravenous appetites. In that case, stick with a cash back Visa card from one of the Big 5 banks with high grocery and gas rates, low restaurant rates, and a clunky smartphone app to tie the experience together.

Pay to Increase Your Rewards

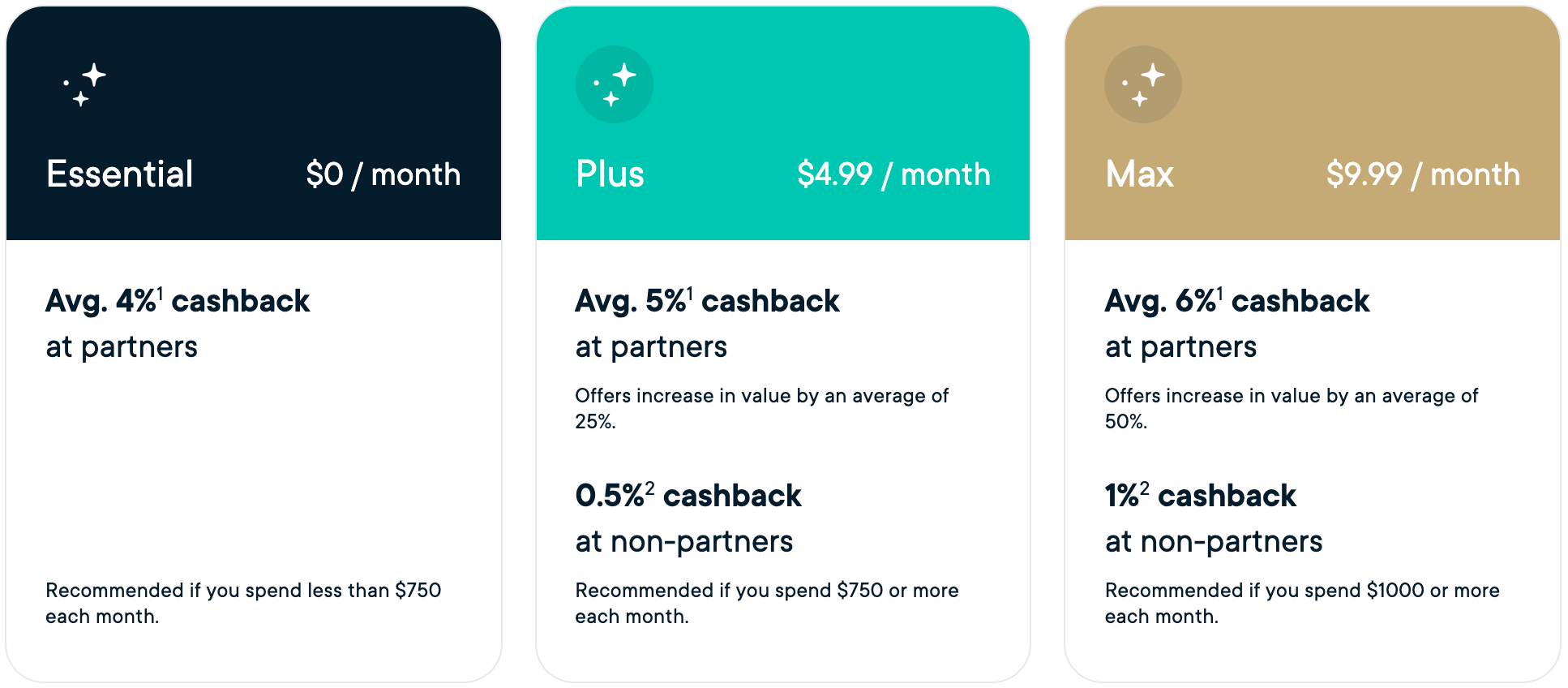

Neo has three rewards tiers: Neo Essential, Neo Plus, and Neo Max. While they only offer one credit card currently, with basic perks (i.e. no insurance coverage), you can pay a monthly fee to earn more rewards if you wish.

It’s unclear how the average rates are distributed amongst partners. In the absence of more granular information, I’d treat the tiers as blanket percentage increases. For Neo Max, for example, I’d take all of the estimated earn rates I’ve gathered above, and increase them by 50%.

With that in mind, I can see two possible profiles to describe a candidate for the Neo Card™.

First, see if you can anticipate that the card’s unique high-earning partners will match up with your lifestyle. If you’re a high spender at big box stores or liquor stores, or if you’ve got a few favourite neighbourhood restaurants and bars that frequently offer more than 5% rewards, you’d come out ahead with the Neo Card™ for those purchases.

Second, upon closer inspection, Neo Max is actually a decent lifestyle credit card for cash back rewards. It has similar costs and benefits as the American Express Cobalt Card, but with a twist.

Comparing Neo Max to the Amex Cobalt, both cards charge a $10 monthly fee, neither has an income requirement, and both earn 5–6% on restaurants and bars but with limitations (Amex only where it’s accepted, and Neo only where it’s partnered). Depending on your purchasing habits, it might be a good alternative.

One thing’s for sure, though: the lack of non-partner rewards at the free tier is a huge drawback, and it immediately takes the card out of the running for a one-sized-fits-all solution. Even Neo Max members will probably want to pair it with another high base earner rather than simply going with the 1% back at non-partners.

Will I Get the Neo Card™?

I won’t mince words – no, I will not. But before casting it off, I think it’s important to highlight a few reasons why.

Too Much Effort

First of all, the whole thing seems like such a chore. If I’m trying to maximize my rewards, every time I go to a store I’d have to check my app to see if they’re a Neo partner before selecting the best payment card.

It’s much easier just to use a card with a predictable rewards rate. Even if it’s a flat 1%, at least I know what I’m getting, and I know that I’m getting something.

The amount of mental gymnastics required to use Neo is astonishing. It’s not clean-cut like a welcome bonus and category rates. You’ve got to juggle first purchase per store bonus, minimum number of purchases per store, minimum spend per purchase, deadline for repeat visits, regular earn rates at each store, and which stores are even a Neo partner at all.

Neo claims to be simpler than other loyalty programs. That may be true for redemptions, but what good is cash back if you can’t figure out how to earn it?

Also, to fully optimize your return rates, you’d want to come in right at the maximum spend for every single purchase you make that has a bonus offer. That’s way less appealing than, say, the Amex Cobalt Card‘s blanket 5% return plus a Shop Small credit here and there.

In fact, I’d say that by overly “gamifying” the rewards equation, it actually has the potential to hurt small businesses by incentivizing consumers to only spend up to a certain level, which would be the opposite of Neo’s intention.

Maybe there’s more juice to squeeze by maximizing every single purchase, but I’m a firm believer in applying the Pareto principle to my rewards strategy. Put in 20% of the effort for 80% of the results, and call it a day. Optimizing takes time and energy, and neither are unlimited resources.

For a modern financial startup with an incredibly slick interface, I must say I expected more. As I try to visualize how I would benefit from Neo, I can’t see any way that it would simplify my decisions as a consumer. That’s a real shame, as that’s the whole point of innovation – to reduce our cognitive overload, not to add to it.

Lack of Transparency

I highly value transparency when it comes to the people and platforms managing my money and data. All this talk of “estimated average rewards rates” doesn’t inspire confidence in me as a consumer.

If I’m going to commit to building loyalty with your brand, it’s on you to clearly show me the value I can achieve. Neo not only doesn’t show it clearly, they barely show it at all.

Despite my best efforts to uncover a trend, there’s no indication that rewards rates are consistent. I can’t tell if I’ll see more, less, or a different distribution of offers over time, or by paying for a higher Neo tier. I have no idea if my one-time offers are targeted. All I can imagine is that I’d need to spend on the card and engage with the platform in order to find out.

As the saying goes, if you’re not paying, you are the product. If companies are going to aggregate my shopping habits and use that data for their benefit, I may as well earn something for my trouble. Instead, is Neo expecting me to give them my data for free as I shop at non-partner stores, on a hope and a prayer that rewards will improve down the line?

Preference for Bigger Bonuses and Travel Rewards

Simply put, travel rewards are worth much, much more than even the highest cash back rates imaginable.

The Neo Card™ doesn’t have a welcome bonus, which is disappointing, as spending towards a welcome bonus is always more efficient than everyday rewards. Take the Scotiabank Gold American Express Card, currently offering 30,000 points upon spending $1,000. Each dollar spent towards that initial $1,000 threshold represents a rate of 30% return on spending, plus an extra 1–5% for the underlying purchase.

Or with the MBNA Alaska Airlines World Elite Mastercard, even after the welcome bonus, the everyday earn rate of 1 Alaska mile per dollar spent can be worth upwards of 30 cents per mile with the best Alaska redemptions, for a rate of 30% return on spending. That’s double the highest that Neo claims to offer!

If I had a Neo Card™, I’d always consider the opportunity cost of not using a different card for a purchase, either to work towards a welcome bonus or to earn airline miles on everyday spending. And I can imagine I’d put it right back in my wallet just as fast as I’d pulled it out almost every time.

Even if you score some ultra-high bonuses with Neo, your rewards will be inherently limited by your spending. By paying big annual fees for bigger welcome bonuses, there’s theoretically no limit to the ways in which you can turn your money into travel value.

For that reason, I’ve stopped considering “Return on Spend” as a useful metric, and since return on spend is all that Neo offers, it doesn’t offer me much.

At best, the card might have some great discounts, but it won’t ever be a ticket to outsized rewards or aspirational experiences.

Doesn’t Benefit the Consumer

I’ll close with one of my core principles of Miles & Points: rewards should augment your life, not guide it. Don’t work for your rewards; make your rewards work for you.

If you’re changing your shopping habits to chase the highest rewards, is that really adding value for you? Are you spending more money than you need to by opting for a pricier store or a larger purchase? Are you spending more time than you need to by taking a detour? Are you neglecting your own tastes, principles, and desires because they don’t pop up on the Neo map, and instead indulging in things you don’t really want?

Fundamentally, that’s my biggest concern with a rewards program that so heavily relies on individual partnerships. Neo has done a stellar job at forging business-to-business relationships, but I worry that they’ve neglected the other side of the equation.

I’m sure Neo has data supporting the argument for this approach from a business perspective, but I find it hard to believe that most people would benefit by having more rewards at fewer stores.

And as eager as I am to dive in headfirst when it comes to fintech startups, I’m not here to get distracted by shiny new toys (I have enough of those already) – I’m here to get value for myself and for you!

Conclusion

The Neo Card™ is certainly an innovative model, but not one that fits my needs. I’m curious to see if it’ll take off, or if they’ll just burn through a bottomless bucket of venture capital. Perhaps they’ll turn more heads with other financial services in the future.

No matter how it all plays out, I’m intrigued by a partner-driven approach. I must admit, I’m torn – I think it could be great for small business loyalty, but I fear that it may be a harbinger of anti-consumerist patterns continuing to slowly spread throughout the rewards scene.

If you’re at all curious, I’d absolutely recommend taking a gander at the map in their app first. As Neo’s business model is heavily focused on local partnerships, and their rollout has been choppy at best, I’d hate to apply for the card only to discover that they actually don’t have great coverage in my area.

Thanks for the review. I have to agree with you that it’s too much work to keep track of which business to buy what. I like the KISS and know I get 2% off grocery and gas, etc., It was challenging to change my gas station from PetroCan to Chevron because of their alliance with a certain brand of credit card if I want a better discount.

I have to say I am very surprised at your review considering you haven’t tried the product. I can say first hand that I am loving NEO and it is now one of my favourite cards. To have a card encourage supporting small business and with great cash back too. I wasn’t sure what kind of cash back I would be receiving when I first signed up but it has been great. The signup was flawless and you instantly get access to a digital card so I didn’t have to wait for my card to arrive. I got to use it the same day.

Like I said really surprised by the negative review when I think it has a lot to offer. It has added some nice variety to my card choices now.

I say for those looking for a card with instant approval and use, and a card that helps the user support local with great rewards I am in. It is definitely my new favourite card by far.

Thanks for sharing – glad to hear the card is working for you! As it’s still in its early days, it’s been hard to find many anecdotes, let alone from satisfied users. Personally I find it really challenging to apply for a card that isn’t upfront about the value I can expect to get, and I have no shortage of reasons to support small businesses anyway (like, y’know, just shopping there because I want to). But I do think Neo has room to grow, and I’ll be keeping an eye on them.

Great review of the card, doesn’t really interest me after reading how it works. Thanks so much! The HISA does sound intriguing though, I may look more closely into that.

Doesn’t sound like this is a fit for the type of person that frequents this site. It’s an “easy” and less traditional reward card for the person who doesn’t know or care about maximum returns or optimisations.

Love the use of Pareto Principle for miles and points. I do a lot of life based on this including my credit card strategy but hadn’t considered it in this context.

Great review! Honest and through. I’m sticking with my KOHO card 🙂

*thorough

Great review, clear and concise. Disappointed in their decision to pivot to a full on credit card, was hoping for another fintech disrupting product that would have allowed for possibly unconventional usage.

Not every innovative product is truly revolutionary 😉

Thanks for teaching me a new term – Pareto principle. I’m a big fan of that idea when it comes to points and miles.

Excellent article! Josh’s contributions to POT are a welcome new addition.

Is there any word on whether the card will come with any Foreign Exchange fees?

There’s a 2.5% foreign transaction fee. Unless they advertise otherwise (and any card with no FX fees will scream it from the rooftops), it’s safe to assume this standard rate.

As an alternative, check out Brim. They have no FX + no annual fee + base rewards everywhere + bonus partner rewards.

Seconding Brim. I didn’t except much when I applied for it but it’s proven itself to be pretty useful.

Neo: Forget the fees!

Also Neo: $10/month fee for a card that is almost close to competitive.

Innovation is always good, but I can’t imagine who they believe this card will work for and how many people will actually bite on it. 1.55% HISA is decent enough though.

Nothing about the partnership with The Bay? (https://hudsonsbay.neofinancial.com/) Considering how many emails I’ve received advertising that, it’s a bit shocking that this article doesn’t make the slightest mention.

I would have expected at least a cursory dive into how the two programs integrate and what the sweet spots may be, if any.

Thanks for an amazing review of the NEO card.

I had some questions/concerns on the card but glad you answered them on the article. I’m with you on the same boat. My preference is for luxury or travel in general vs cash-back since sign up bonuses on credit cards can easily give you 10%-20% return on spend