US Credit Cards: The 2018 State of Play

I wrote Getting US Credit Cards for Canadians exactly one year ago, and since then it’s become one of the most popular articles on Prince of Travel. I figured we’re due for an update, so in this post I’ll round up all the latest developments in terms of the optimal strategies for getting, managing, and maximizing US credit cards.

I’ve also kicked off our new Knowledge Base feature with a dedicated US Credit Cards section for those of you looking to get into the game stateside, and I’ll be keeping an eye out for the most pressing questions that people have about the topic as I expand Knowledge Base.

Is It Worth Getting US Credit Cards?

People often ask me whether US credit cards are worth their time. As many of you know, it takes quite a bit of effort to get everything going at the beginning – there are mail forwarding services to book, bank accounts to set up, ITINs to procure, etc.

The way I see it, getting into US credit cards is a long-term investment in your future points earnings. Indeed, while Amex US can be quite easy to get approved for at the beginning, other issuers may require at least a year of credit history to approve you, so this isn’t a quick process by any means.

Instead, one must recognize that the credit card market in Canada will always be rather limited when compared to our neighbours down south, so setting up a US credit file is a way to access both a much larger volume of signup bonuses and a much wider range of points currencies and frequent flyer programs.

Once you’ve completed the initial few steps and you’ve started to build a credit history, there’s really not much more work involved – it’s simply a matter of banging out a few credit card applications every now and then, similar to what you’d do domestically in Canada.

The New US Credit Cards of 2018

In the Managing US Credit Cards for Canadians article, I highlighted a few US credit cards that I thought were particularly worthy of your attention. 2018 has seen plenty of shifts in the credit card landscape, so what’s changed since then?

The American Express Premier Rewards Gold Card has since rebranded as the American Express Gold Card. The Premier Rewards Gold used to be a great first card to choose thanks to its first-year fee waiver, but nowadays the Gold Card’s US$250 annual fee is levied on the first statement, making it less suitable as an intro card – it’s now essentially a mid-tier premium card, offering solid earning rates and perks such as 4x MR points on US supermarkets and dining.

On the plus side, there’s a limited-edition Rose Gold colour available until early 2019 – how cool is that?!

Meanwhile, we’ve seen Amex make changes to their SPG credit card offerings in light of the Marriott–SPG merger that took place this year. You’ll now earn 75,000 Marriott points on the personal and business SPG cards when you spend US$3,000 in the first three months. The annual fee of US$95 is also waived for the first year.

In my view, the first-year fee waiver and the strong signup bonus make these very good choices for your first Amex US credit card (you can get them through a Global Transfer – see below). Moreover, since Amex signup bonuses in the US have strict once-in-a-lifetime policies, you don’t have to ever cancel these cards – the annual free night certificates can easily outweigh the US$95 annual fee, so you can keep these cards around to build credit history.

There’s a new SPG Luxury Card as well, but given the hefty US$450 annual fee, I don’t see this card as being worthwhile unless you actually have a lot of paid stays at Marriott hotels and can take advantage of the 6x earnings, the US$300 hotel credit, etc.

Lastly, Amex US has also elevated their Hilton co-branded products. There are three cards you can choose from: the Hilton Honors Card, the Hilton Ascend, and the Hilton Aspire. Out of these three, the Hilton Honors Card might be a great choice as an introductory US credit card as well, given the lack of an annual fee and the signup offer of 75,000 Hilton Honors points upon spending US$1,000 in the first three months.

Mail Forwarding: Shipito OUT, MyMallBox IN

Unless you’re one of the lucky few to maintain a US address or can rely on family and friends to forward your US mail, you’ll need a mail forwarding service to use as your US residential address. Shipito had been the fashionable choice until early this year, when data points began filtering in that they were refusing to forward credit cards in the mail.

It’s unclear how they knew whether each package was a credit card or not – some people reported Shipito asking them about the contents of their mail, while others claimed that Shipito just knew on their own. In any case, Shipito’s policy seems to have changed sometime in 2018 that credit cards need to be picked-up in person and could not be forwarded.

Fear not, because MyMallBox has emerged as a new contender for all your mail-forwarding needs. The Delaware-based service is NOT listed as a “Commercial Mail Receiving Agency” on the USPS website, which is what we want, since credit card issuers might otherwise refuse to accept its address.

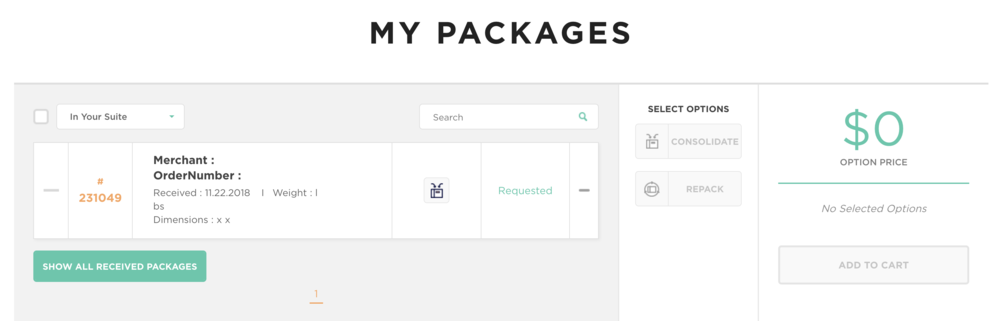

Moreover, there’s an easy online portal for you to track which items have arrived and which you want sent to you, and you can even consolidate multiple items into one in order to save on shipping fees. There’s also no ongoing fee to use the service – only a small fee per package forwarded.

I’ve signed up for a MyMallBox account, but so far I haven’t switched over my US address to it yet. I’m still using 24/7 Parcel based in Niagara Falls, NY, which has been very good to me so far. However, they do charge an annual fee of US$95, so I really should switch over when I get the chance.

ITIN: Smashwords OUT, Amazon IN

The best practices for obtaining ITINs has undergone a similar change (consult the original US Credit Cards article if you need a refresher on what an ITIN is and why it’s important).

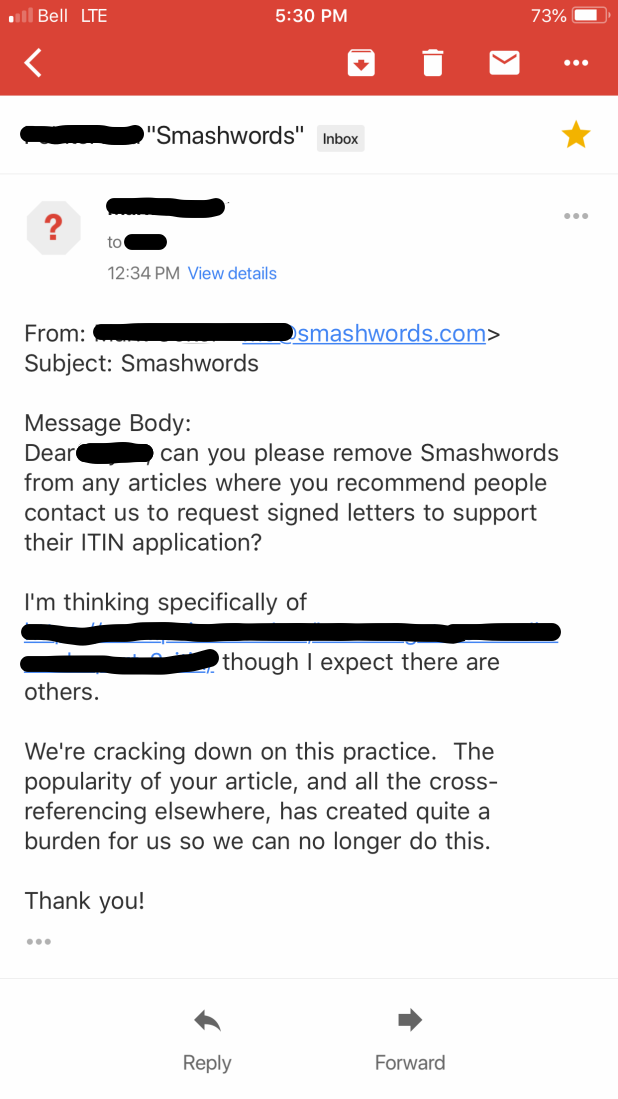

The prevailing method back in 2017 was to ask Smashwords, an eBook publishing company, for a signed letter to the IRS certifying that you were a foreign national using a US-based service and therefore required an ITIN to avoid withholding taxes. Nevertheless, Smashwords soon buckled under the pressure of so many Canadians asking them for ITIN letters:

Nowadays, the best method to obtain an ITIN support letter is through Amazon, who’ve made it super easy – almost too easy. They’ve made the ITIN document available as as download, so you just download the form and fill it in with your name and date. Once that’s done, you file it along with your completed W-7 form and your passport certified copy, toss it in the mail, and wait for the IRS’s response in 6-8 weeks.

As a reminder, you can either wait for your ITIN to arrive before you begin the entire US credit cards process, or you can get a head start through Amex Global Transfer (see below) and then “attach” your ITIN to your US credit file after you obtain it by including it on your next credit card application.

Can You Do Multiple Amex Global Transfers?

American Express prides themselves on being a global company, and one of the key perks they offer is the Global Transfer program, a seamless process that’s designed for individuals who are existing customers in one country maintain their Amex relationship when they relocate to a different country.

For Canadians looking to get in on the credit card action south of the border, Global Transfer represents a “shortcut” in the process. You don’t need an SSN or ITIN to initiate a Global Transfer; you just need a US address, a US bank account (to verify your US address), and a Canadian credit card account that’s been open and in good standing for three months.

In the past the strategy has always been to initiate a Global Transfer while you wait for your ITIN to arrive – this way you get a head start on the process of building your credit history. However, recent data points indicate that you can take this even further by initiating multiple Global Transfers from different Canadian Amex cards.

So for example, if you held a Platinum Card and an SPG Card here in Canada (both in good standing for at least three months), you could do one Global Transfer from each, thus obtaining, say, the Hilton Honors Card and the US-issued SPG Card. This way you’re now obtaining two (or more) juicy signup bonuses and building credit history with two (or more) accounts!

Note, however, that obtaining multiple Global Transfers isn’t completely necessary if you don’t want to go through the whole process another time. That’s because once you’ve gotten your first Global Transfer done and established a relationship with Amex US, you should be getting approved for more Amex US cards within a few months if you simply apply directly as a US resident using the online application.

Can You Get Approved by Chase?

Chase is the juggernaut of credit card bonuses in the US, so getting approved by them represents the ultimate goal. Unfortunately, they’re rather strict about how much credit history they require, so the road towards getting their approval is a bit of a slog.

I myself applied for the Chase Sapphire Preferred a few times before getting approved in November of last year, and even then it required multiple reconsiderations to get through. And now that I’ve been a Chase customer for a year (and my overall credit file is over two years old), I still can’t get approved for the Chase Ink Preferred or any of their business cards – I’ve applied and been denied thrice already, and I’ll be trying again soon and hoping for better luck.

I will say that having regular utilization on your credit cards is pretty important for building up credit history. Whereas in Canada you might apply for a credit card, meet the minimum spend, and then put it away in your drawer, it’s probably best to put a bit of spending on your US credit cards every month in order to demonstrate that you’re using your credit responsibly (instead of having no usage at all).

That’s been pointed out to me by the Chase reps as a reason why they don’t view my credit history favourably enough, so I’ll be looking to rectify that and hopefully get approved for more Chase cards in the near future.

Having an existing banking relationship with Chase also helps. If you ever find yourself down in the US, it may be worthwhile to visit a Chase branch and open a checking account – you can use your foreign passport and your US residential address. Word on the street is that Chase plays much more nicely with those who apply for their credit cards while also having other banking products with them, since it paints an overall picture of someone who’s recently “moved” to the US and looking to establish a long-term relationship with Chase.

Conclusion

The strategies for collecting points via credit cards changes rapidly here in Canada, and that’s even more the case if you’re looking to expand your operations down into the US as well. This stuff isn’t an exact science, so we rely on data points throughout the community in order to put together the latest picture.

I’ve brought you up to speed on the many changes we’ve witnessed in 2018 to mail forwarding, ITINs, Global Transfers, and which US credit cards to get, so now all that’s left to do is to go out and get them 😉

First-year value

$336

Monthly fee: $15.99

• Earn 1,250 points per month upon spending $750 per month for 12 months

Earning rates

Key perks

- Transfer to airline and hotel partners

Monthly fee: $15.99

• Earn 1,250 points per month upon spending $750 per month for 12 months

Earning rates

Key perks

- Transfer to airline and hotel partners