Managing US Credit Cards for Canadians

So you’ve successfully navigated your way through the process of obtaining your first US credit card. You’ve established an address, a bank account, and most importantly, a credit file in the United States. Your ITIN is up and running, and your brand-new piece of foreign plastic has made its way into your hands. What’s next?

Well, the American marketplace is lucrative and far-reaching, but first, there’s a few significant differences between the credit card landscapes in Canada and the US. Understanding these nuances will be critical in maximizing your opportunities and avoiding missteps as you dabble with US credit cards.

In this article, I’ll lay out these nuances so that you’re well-equipped with the knowledge, which will prepare you for next week’s final installment of the series, in which we’ll talk about the best US credit cards to get and how you can use those points towards some unbelievably sweet redemptions.

Meeting Minimum Spend

If you started off with an introductory American Express card like the Blue Card, this might not be an issue for you at first. However, most of the premium travel credit cards in the US demand that you meet a minimum spending requirement in order to earn the signup bonus. And since the signup bonuses down south are relatively supersized as compared to Canada, the same can generally be said for the minimum spending requirements as well.

For example, the American Express Business Platinum Card in the US requires a minimum spending of US$10,000 within the first three months. In Canada, the equivalent card only requires $5,000 of spending within the same period.

The good news is that unlike in Canada, most of the good American credit cards have no foreign transaction fees, which means you can use the card for everyday spending here in Canada without being dinged 2.5% for every transaction. That also means that when it comes to meeting the spending requirements, you can follow the same general advice for meeting minimum spends in Canada – prepaying bills, timing around large expenses, etc.

The bad news is that American Express – in the US, not in Canada – has recently introduced the following verbiage in their terms and conditions:

If we in our sole discretion determine that you have engaged in abuse, misuse, or gaming in connection with the welcome bonus offer in any way or that you intend to do so (for example, if you applied for one or more cards to obtain a welcome bonus offer (s) that we did not intend for you; if you cancel or downgrade your account within 12 months after acquiring it; or if you cancel or return purchases you made to meet the Threshold Amount), we may not credit Membership Rewards® to, we may freeze Membership Rewards® credited to, or we may take away Membership Rewards® from, your account. We may also cancel this Card account and other Card accounts you may have with us.

No one knows what exactly constitutes “abuse, misuse, or gaming”, but one of the examples is if you “cancel or return purchases you made to meet the Threshold Amount”.

The same goes for Chase, which has recently adopted a more hardline stance being used to meet minimum spending requirements. Account shutdowns, without any hint of a warning, are not unheard of.

What does this mean for you as you tackle the minimum spending on your US credit cards? Of course, organic spending is the best – use the card for your regular purchases on food, groceries, shopping, etc. Using a service like Plastiq or Paytm to pay hefty bills that wouldn’t normally take credit cards is probably okay as well.

Paying Off Your US Credit Card

Once you’ve spent money on your credit card, you need a way to pay it off (although as a sidenote, if you live in Canada, there might be no real consequence to “ruining” your US credit either).

You already have a US bank account, so all we need is a way to transfer Canadian dollars to your US bank account at a favourable exchange rate.

Finding an FX solution is a big part of the puzzle…

You want to avoid the banks for this one. Even though TD, BMO, RBC, etc. do a great job of helping you with your crossborder banking by providing chequing products in both countries, the exchange rates that they offer customers tends to be rather uncompetitive. You can typically do a lot better by using dedicated FX services.

VBCE and Knightsbridge are two such services that I’ve heard lots of good things about. Their exchange rates are typically around 1% above spot. That beats out the 2.5% spread that the big banks will offer you, which will save you hundreds of dollars over the long run.

Another service I’ve used in the past is TransferWise. Unlike traditional FX services, TransferWise works on a peer-to-peer system, matching your FX order with equal offsetting orders in the opposite direction. So if you wanted to exchange CAD for USD, they’d find one or more of their customers in the US who wanted to exchange USD for CAD, and just swap your money around, so there’s no money crossing borders at the end of the day.

Of course, TransferWise charges a nominal fee for this service, which works out to make your overall exchange rate about 1% above spot as well. Keep in mind that with all these services, if you’re transferring large sums of money on a regular basis, you’ll eventually be asked to submit documents to prove your identity. TransferWise even goes so far as to ask for notarized copies of your documents (certified copies of a passport – those you obtained from Passport Canada when getting an ITIN – will not work).

Lastly, while the big banks like to fleece their customers on FX, they treat their employees much better, and most bank employees are eligible to exchange Canadian and US funds at the mid-market rate. If you’re friends with someone who enjoys this benefit, see if you can pull some favours! 😉

Nurturing Your US Credit

A credit file is just like a house plant, or a pet, or even a child – it needs to be monitored and nurtured regularly in order to fulfill its maximum potential. When you get your first US credit card, your credit file is considered “young and thin”, and most issuers of premium travel credit cards won’t approve you just yet.

In general, you should follow the same advice as I gave for keeping your Canadian credit file in tip-top shape. In particular, keeping your utilization in the 5–10% range is a big factor, as it illustrates responsible credit usage. This means that even after you meet the minimum spending (if any) on your first credit card, you shouldn’t just forget about it – instead, continue to spend a small amount on the card every month in order to maintain a 5–10% utilization.

There’s only one way to make your credit file less “young” – by maintaining responsible credit usage over time. To improve the “thin” assessment, though, the solution is to get more credit cards. Fortunately, even though Chase or Citi might not approve you just yet, Amex are generally very lenient and should have no issues approving you for a second or even a third credit card.

An important difference between the US and Canada is that in the US, business credit cards don’t get reported on your personal credit file. This is a huge distinction! While your personal credit file is still used to assess approval, and you can still get a business credit card even if you don’t have a business (although it can be a bit tougher in some cases), the credit account itself goes unreported on your credit file!

My advice for what to do after getting your first US credit card (and what has worked for me) is to get two more Amex cards: one business and one personal. In particular, the US-issued American Express SPG Card and American Express Business SPG Card are great choices at this moment, because they may be discontinued relatively soon given the SPG–Marriott merger. Both cards have a signup bonus of 25,000 Starpoints and have their first year annual fee waived.

This way, you’ll have two accounts showing up on your credit file (your first credit card, plus the second personal card you obtained), helping to improve your credit. Why is it important to limit the amount of cards you get for now? Well, you may have heard of a certain party-pooper known as “5/24”…

5/24, Issuer Restrictions, and the US Credit Card Timeline

5/24 is the infamous, unwritten rule that Chase implemented a few years back to combat “churners”, or people who would repeatedly sign up for a credit card and obtain the bonus multiple times. For certain Chase cards, your application will be automatically denied if you’ve opened five credit cards over the past 24 months.

That’s not just five Chase credit cards – that’s ANY credit cards. If you’ve opened five credit cards within the past two years, you’re automatically ineligible for a host of Chase’s best credit cards.

Meanwhile, some of Chase’s other excellent products are NOT subject to 5/24 (yet), meaning that you can be approved for them even if you’ve opened six or more cards over the past two years. Check out this excellent post by Doctor of Credit for which cards are and aren’t under 5/24.

There’s a few things to say about this. Since Chase issues some of the best cards in the US, it’s worth doing some planning so that you don’t run afoul of the 5/24 rule.

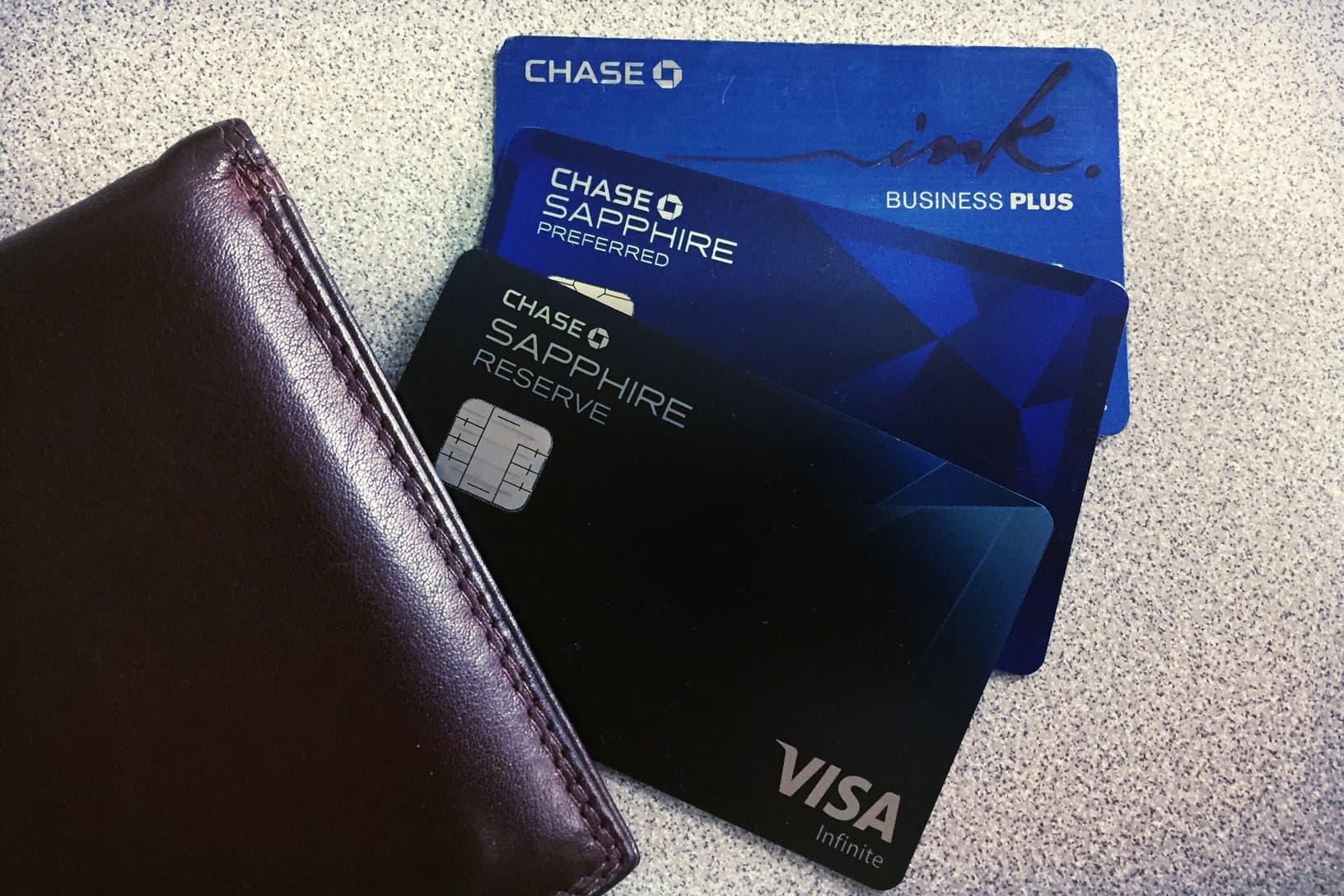

In particular, you’ll ideally want your 3rd, 4th, and 5th US credit cards to be Chase cards that ARE subject to 5/24, since otherwise you wouldn’t be able to get them at all (or at least until two years later). Based on the current offers, I’d pick the Sapphire Preferred, the Ink Preferred, and the Marriott Rewards Premier Card.

Once you’ve gotten your 5th credit card, you’re now considered “over 5/24”, so you can happily apply for any of the other credit cards out there without worrying about this anymore.

Unfortunately, Chase likes to see at least one year of credit history before they’ll approve you for any of their cards, which means you might spend a fair bit of time just waiting for your credit file to age before you can enjoy some of the best signup bonuses. There is a silver lining though. Remember how business cards don’t appear on the credit file? That means they also won’t count as one of the five cards under the 5/24 rule.

So, while you’re waiting for your credit file to age enough to be approved by Chase, you can get as many business cards from Amex as you’d like, enjoying the benefits and bonuses of those cards.

Let’s summarize with a timeline of how your journey in US credit cards should ideally go:

Get started

Follow the steps to getting your first credit card: Get your US mailbox, bank account, ITIN, and your first American Express credit card via Global Transfer.

3 months

Get second American Express personal credit card

Recommended: American Express SPG Card

3 months – 1 year

Get as many business credit cards as you wish

Recommended: American Express Business SPG Card, American Express Business Platinum Card, American Express Business Gold Card

1 year – 1.5 years

Get 3rd, 4th, and 5th personal credit cards from among Chase’s cards that are subject to the 5/24 rule

Recommended: Chase Sapphire Preferred, Chase Ink Preferred, Chase Marriott Rewards Premier Card, Chase United MileagePlus Explorer Card

After 1.5 years

Start applying for whatever cards you want!

Note that, in addition to Chase’s 5/24 rule, other issuers have also implemented rules to combat repeat applicants. Most notably, American Express maintains a once-in-a-lifetime rule for the bonuses on all their cards, and unlike in Canada, that rule is strictly enforced. Thankfully, they have a very wide selection of credit cards to keep you busy!

Conclusion

If you thought playing the credit cards game in Canada was complex, wait till you get involved in the US. With so many more consumers down there, it’s no surprise that the rules have changed a bit in order to discourage those who like to squeeze every cent of value out of the credit card issuers.

For those of us with young credit profiles, then, it means we have to be a bit careful in planning out which cards to get next. That’s exactly what’s on the agenda for next week’s article.

First-year value

$336

Monthly fee: $15.99

• Earn 1,250 points per month upon spending $750 per month for 12 months

Earning rates

Key perks

- Transfer to airline and hotel partners

Monthly fee: $15.99

• Earn 1,250 points per month upon spending $750 per month for 12 months

Earning rates

Key perks

- Transfer to airline and hotel partners