Last year, American Express US had rolled out a series of monthly recurring statement credits on a few major credit cards, and that initiative has now resumed for 2021.

For 11 months from February through December, the Amex US Marriott, Hilton, and Delta co-branded credit cards will all enjoy monthly statement credits on US restaurants (for personal cards) or US wireless services (for business cards) of US$5–20 per month, which can add up to as much as US$220 per card throughout the year.

Since many of us hold one or more of these products, I wanted to summarize the details of these generous monthly credits and highlight some of the easiest ways to maximize these credits from up here in Canada.

Register via Amex Offers

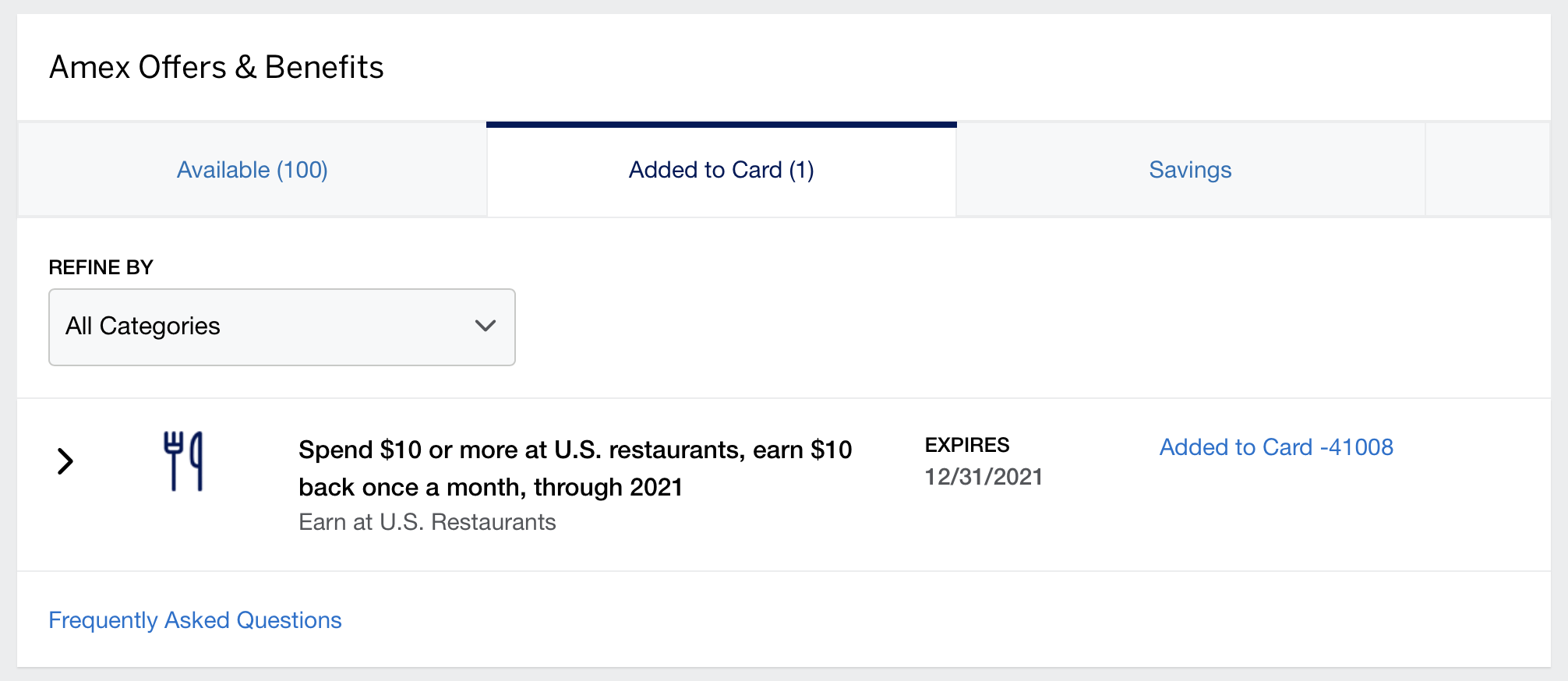

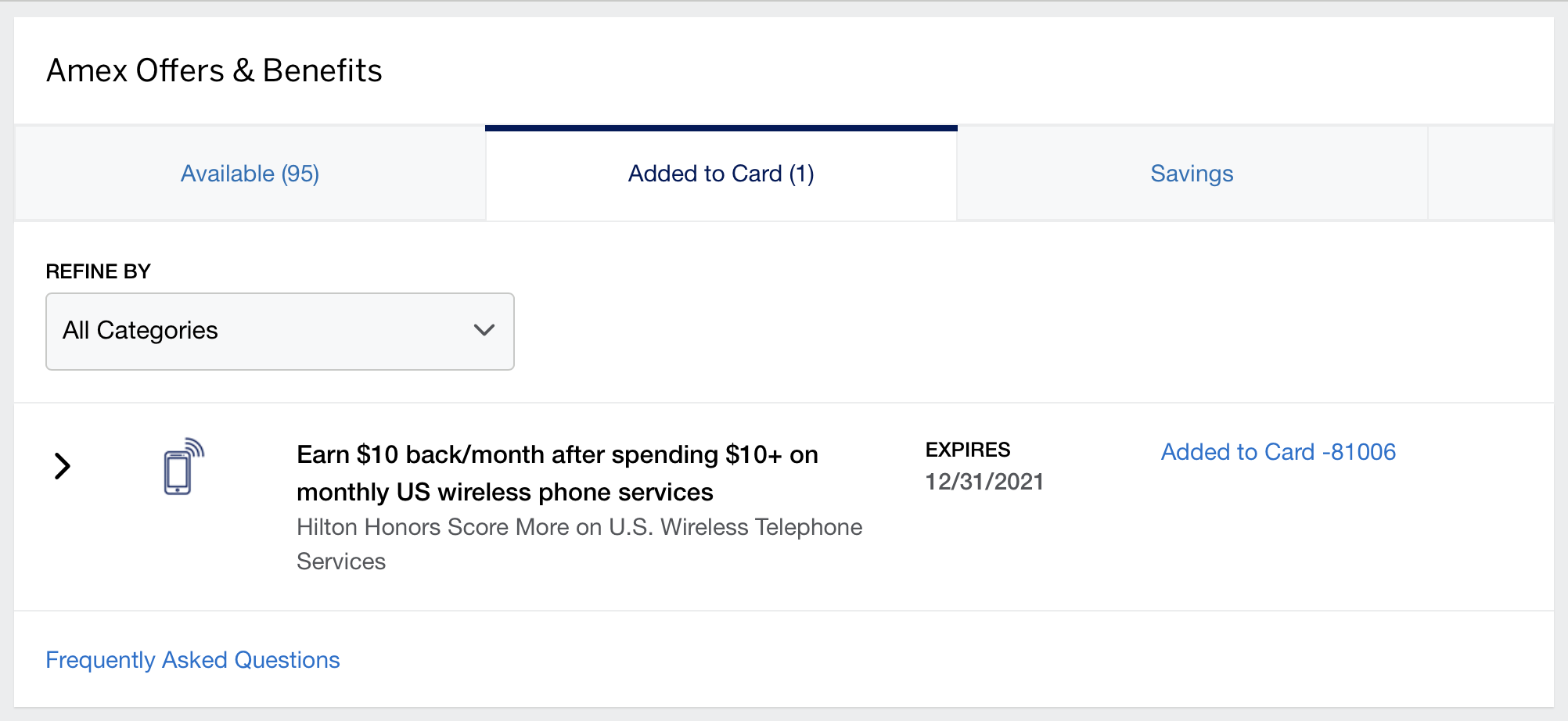

Unlike the 2020 statement credits, which were automatically enabled and did not require manual registration, these new offers require you to visit your Amex Offers dashboard and add the offer to your card.

You may not see the offer immediately, because each card can only display 100 unregistered Amex Offers at a time. If this happens, try adding a few other Amex Offers to your card first, or choosing the “Featured” category of Amex Offers to get the monthly restaurant or wireless credit to show up.

The monthly US restaurant credit on personal Amex US Marriott, Hilton, and Delta cards looks as follows:

And the monthly US wireless credit on business Amex US Marriott, Hilton, and Delta cards looks as follows:

US$5–20 Monthly Credit for US Restaurants on Personal Cards

The following cards will earn a US$20 monthly credit on US restaurants through 2021:

- Amex US Marriott Bonvoy Brilliant Card

- Amex US Hilton Honors Aspire Card

- Amex US Delta SkyMiles Reserve Card

The following card will earn a US$15 monthly credit on US restaurants through 2021:

- Amex US Delta SkyMiles Platinum Card

The following cards will earn a US$10 monthly credit on US restaurants through 2021:

- Amex US Marriott Bonvoy Card (no longer open to new applications)

- Amex US Hilton Honors Surpass Card

- Amex US Delta SkyMiles Gold Card

And the following card will earn a US$5 monthly credit on US restaurants through 2021:

- Amex US Hilton Honors Card

You’ll earn the US$5–20 statement credit every month from February through December, for a total of 11 statement credits.

To be eligible for these offers, you must have opened your card prior to January 1, 2021. Therefore, you won’t get these offers if you’re just signing up for the cards now (such as under the new elevated offers on the Amex US Hilton cards).

While US-based cardholders would find it pretty effortless to score the credit each month with a simple restaurant or food delivery purchase, cardholders based in Canada will need to get a little more creative.

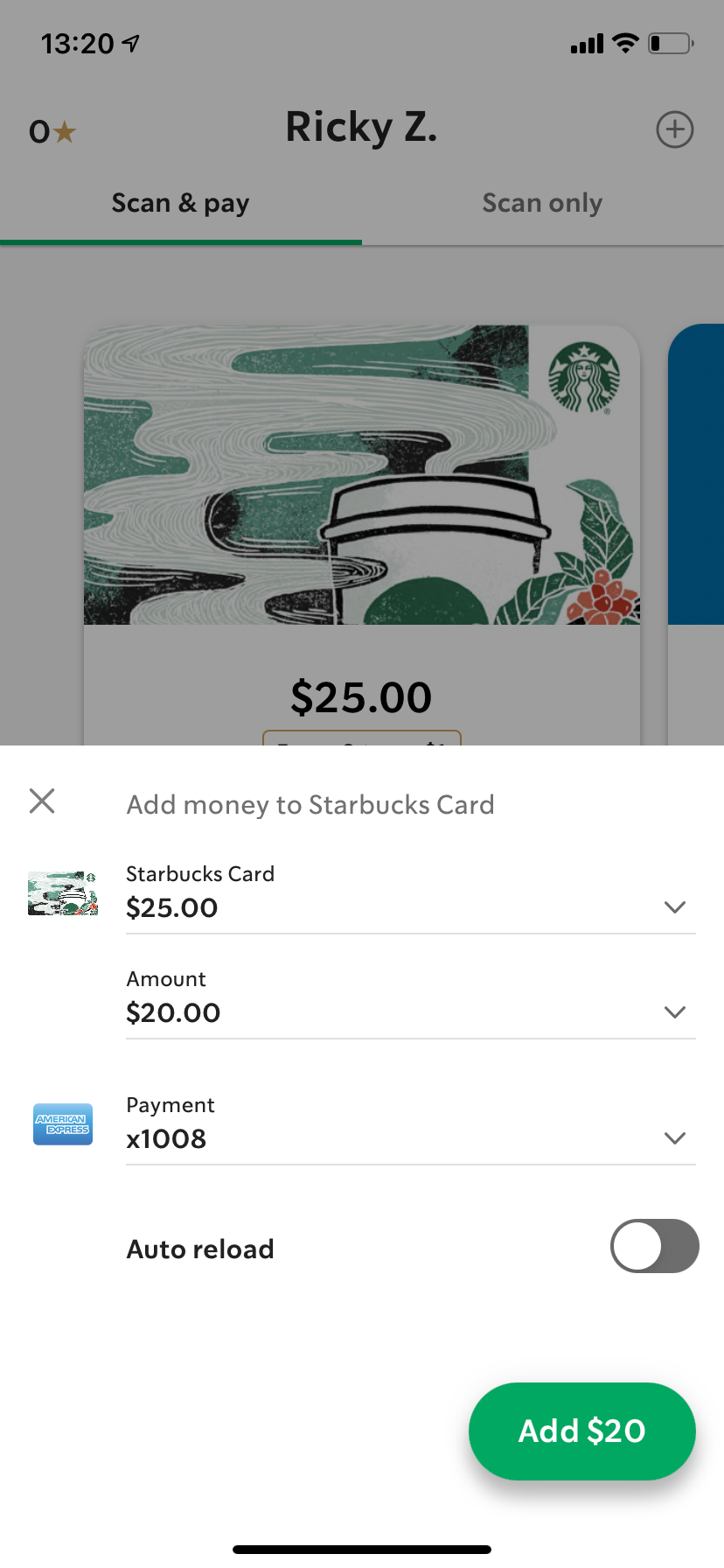

According to data points from last year’s temporary measure on the Hilton Aspire Card, in which the US$250 resort credit was expanded to US restaurants as well, the easiest way to cash out this credit every month will be to load a Starbucks US mobile account and spend the funds in Canada.

To do this, head to the Starbucks.com desktop site (not Starbucks.ca) and create a new US account separate from your Canadian account. Then, log into this US account on your Starbucks mobile app, and you’ll be able to load USD funds with your US credit card.

Based on last year’s data points, this should count as a US restaurant purchase and therefore trigger the US$5–20 monthly credit.

You’d then be able to spend the USD funds in Canada – the exchange rate may not be ideal, but hey, it’s free coffee. Or you could save them for future purchases at Starbucks locations in the US.

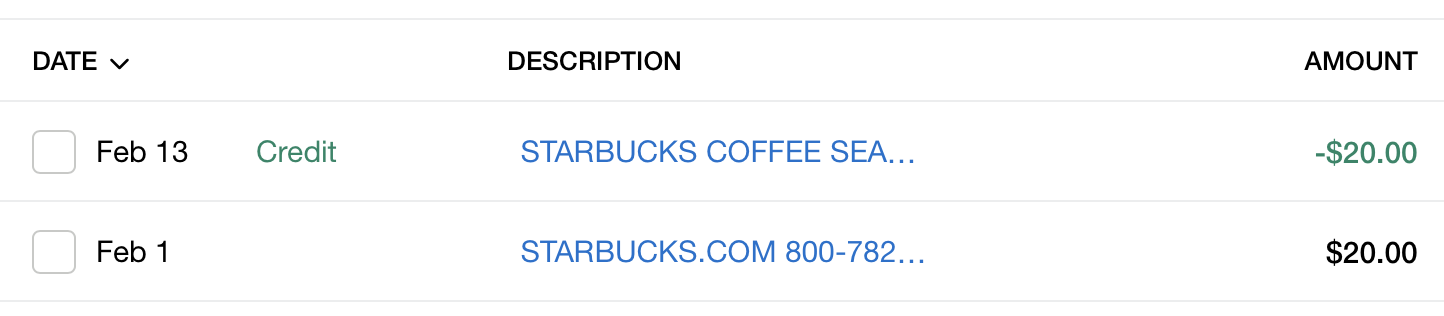

I made my first US$20 load on February 1, and received the credit a few weeks later on February 14:

US$5–20 Monthly Credit for US Wireless Services on Business Cards

The following card will earn a US$20 monthly credit on US wireless services through 2021:

- Amex US Delta SkyMiles Reserve Business Card

The following card will earn a US$15 monthly credit on US wireless services through 2021:

- Amex US Marriott Bonvoy Business Card

- Amex US Delta SkyMiles Platinum Business Card

And the following cards will earn a US$10 monthly credit on US wireless services through 2021:

- Amex US Hilton Honors Business Card

- Amex US Delta SkyMiles Gold Business Card

You’ll earn the US$10–20 statement credit every month from February through December, for a total of 11 statement credits.

As before, to be eligible for these offers, you must have opened your card prior to January 1, 2021. Therefore, you won’t get these offers if you’re just signing up for the cards now.

Canada-based cardholders will find it relatively tougher to redeem these credits on US wireless services compared to the US restaurants credits.

One solution would be to offer to pay off the phone bill for a US-based friend of yours and split the credit with them. You could also try using the credit to pay off a Google Fi phone plan if you have access to one.

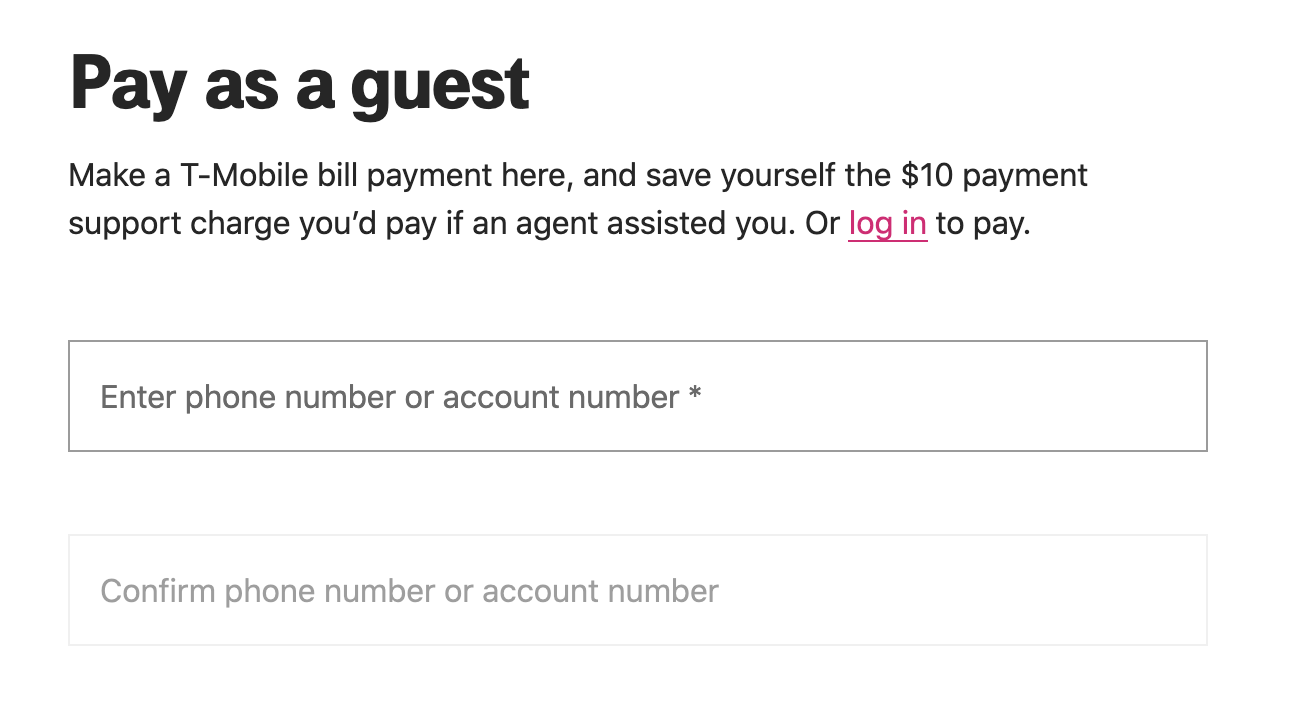

(As a last resort, it’s possible to use the quick-payment option for, say, T-Mobile to pay off the phone bill of a complete stranger – that’s always better than leaving credits on the table!)

Personally, I’ll be trying to set up a Google Fi at some point, as I’ve heard that it’s a pretty good long-term roaming solution when travelling abroad too, and will try to apply my wireless credits there.

I’ll also update this section if I come about any other good ways to cash out these monthly wireless credits.

How Much Value Do These Credits Offer?

If you’ve gotten started on your US credit card journey and hold one or more of these eligible co-branded credit cards, then the monthly statement credits can really add up through the rest of the year.

Many of these cards are worth keeping in the long run anyway, but just in case you were thinking about cancelling or downgrading, these credits could be a good incentive to keep the card for another year.

In my case, I’ll earn the following credits:

- US$220 in restaurant credits on the Bonvoy Brilliant

- US$220 in restaurant credits on Jessy’s Bonvoy Brilliant

- US$220 in restaurant credits on the Hilton Aspire

- US$165 in wireless credits on the Bonvoy Business

- US$110 in restaurant credits on the Bonvoy Card

- US$110 in wireless credits on the Hilton Business

- US$55 in restaurant credits on the Hilton Card

That’s a total of US$1,100 of value throughout the year, which is just delightful!

Granted, I may not place full value on the wireless credits, but it’s still an impressive chunk of value that will help to offset the annual fees – and that’s in addition to the anniversary free night certificates on the Bonvoy cards and the free weekend nights on the Hilton cards.

Conclusion

American Express US has set its cardholders up for success in 2021 on the co-branded credit cards by Marriott, Hilton, and Delta. If you’ve held one of these cards since prior to January 1, make sure to check your Amex Offers dashboard and add the corresponding offer to your card.

The US restaurant credits on the personal cards are easier to redeem in Canada, whereas the US wireless credits will be more of a mixed bag. I’ll update this article as we learn more about maximizing both of these sets of statement credits.

Now that the co-branded Amex US cards have rolled out their temporary perks for 2021, I’m now waiting to see what kind of benefits or credits we see on the Membership Rewards family of cards, like the Platinum Card, Gold Card, Green Card and their respective business versions.

Worked for me on all 3 of my US Amex’s since the start of the promo but no credits have posted for September and I put through the transactions 8 days ago. Credit usually posts 1-2 days after. Anyone else?

Same here Jason, wonder if they changed the merchant category for the online reload.

Anyone got any other paths to use the $20 benefit?

Good news! I used the Chat function with Amex. They confirmed Starbucks is still eligible and there is a delay with the rebates. 🤞 hopefully it posts soon!

The “Dining” category in Fluz works, and is an especially good option if you don’t go to Starbucks. You could sell the gift cards on somewhere like CardCash. They even often have virtual Visa gift cards that count as dining.

Its Mar 1 and getting ready for another month of credits. Just tl confirm the credits are based on calendar month or card holder monthly cycle? Thanks

Calendar month. So thanks for the reminder, I’ve just gone ahead and loaded another round of Starbucks.

Google Fi doesn’t trigger the credit, I made a payment to my account and called Amex 10 days later. They said it wasn’t a qualified purchase. Anyone have other ideas for the wireless credits?

I haven’t had a chance to look into Google Fi yet, so thanks for letting me know. I think I’m gonna go ahead with paying my US friends’ phone bills and cashing in some beers later.

This is not working. Amex is using level 3 data and it codes as a gift card.

it took me about 2 weeks after the transaction but it was posted. be patient and DO NOT contact Amex about this

The credit just posted for me, so it works pretty well.

My $20 posted today!~ Thanks, Ricky.

Anyone get their crediy yet? Its been several days and i got the email notification that that i have redeemed for for promo but still no credit. Remembrr last year it was relatively quick depsite t&cs.

Got my credit as of the 13th.

I’m still waiting too. Seems like Amex US credits are uncharacteristically slow to post this month.

I am in the same boat as you are. Waiting with fingers crossed

Update – Credit posted yesterday. Thanks, Ricky!

anyone actually got their 20 dollars back? I assume it is because of L3 data, Amex US doesn’t give this one out easily cuz it is in-app reloads.

When reloading using your US Starbucks account on the app, do you have to add the US Amex as a form of payment or would paying for it using Applepay work if it’s saved?

I didn’t get the monthly restaurant offer in neither of my brilliant nor aspire. Tried to chat and was told it is “targeted”. I guess it is targeted to the universe. What should I do…

Very timely suggestion! I really appreciate it. Just wonder if there is also some creative way to redeem the $10 monthly dinning credit and the $10 Uber credit of the Amex Gold card if I am stuck in the Canada?

Would like to know the same as well

Were you able to redeem the credit for all 4 cards?

They’re showing on all four of my cards currently, yes.

I have a USA based Platinum card and would like to know how to access the Paypal monthly statement credit offer which implies the need for a Paypal USA based account

that I cannot qualify for with a Canadaian based cell phone number. How would you navigate this challenge?

Harry

I was able to use my Canadian based number. Try using different browsers. Edge ended up working for me

I reloaded $5 on the desktop website and did not get any confirmation from Amex for the offer. The transaction posted as “STARBUCKS CARD EGIFT877-850-1977 ME”. I’ll give it a few more days but I doubt I’ll see a credit, so I’ll have to use the app.

Also confirmed, loaded $20 onto my USA Starbucks account with the app and received a confirmation the offer has been redeemed email from Amex. Thanks for the heads up on this. And also to register for offers so that more new offers appear as there seems to be a limit of 100.

true both.. desktop and app shows the minimum is $10

That’s what I meant to say lol. Guess we can’t take full advantage. Only BOGO

Thanks for the update Ricky. I had asked my brother to use up the restaurant credits until I saw this post. I immediately added US$10 to my U Starbucks account and Amex sent me email confirming that I had redeemed my restaurant credit for Feb – success!

Also, looking at your credits, looks like you have got your caffeine fix for the whole year! Now would have been a good time to go for coffee chats (I’m sure you remember this from your Bay Street days!)

Ah, coffee chats. The good old days when we could just reach out to people and ask them to hang out! 😭

Looks like minimum amount you can add to Starbucks is $5

You can buy $5 gift card from Starbucks desktop but I don’t think that will trigger credit. I bought one last night and never received confirmation email, so I don’t think it’s coded as restaurants. So appears only reloads directly in app work and minimum reload is $10.

Looks like the minimum is 10$ on the app. At least that’s what i see.

Yes, so i have to load $10 when my offer is only for $5