The US credit card landscape tends to be far more nuanced than the Canadian side, mostly because of the various rules and restrictions that the card issuers have put in place to make the game trickier to play and protect their profits from points-hungry travellers.

One of the more draconian measures that American Express US in particular has implemented in recent years is known as the “dreaded pop-up”, which can deny you a signup bonus on a brand-new credit card even if you’ve never held that product before (and would therefore otherwise be eligible for the bonus under Amex US’s once-in-a-lifetime rules).

What Is the Dreaded Pop-Up?

The dreaded pop-up is intended to weed out grossly unprofitable behaviour from Amex US’s customer base.

When an individual signs up for a credit card, spends just enough money to meet the minimum spending and claim the signup bonus, puts the card away without spending another cent on it, and cancels or downgrades the card immediately after the second year’s annual fee hits to get a refund, the issuer obviously loses out.

(By the way, another important difference from the Canadian side is that you should never cancel your US credit cards before the first year is up, since that’s an easy way to get into the issuers’ bad books. Instead, a more advisable approach is to wait until the second year’s annual fee posts and then cancel or downgrade during Month 13 of card membership to get a refund on the annual fee.)

Even with Amex US’s once-in-a-lifetime policy on signup bonus in place, the sheer variety of products that they offer means that an individual can repeat such unprofitable behaviour over a dozen times across all of Amex US’s products, and that’s what the dreaded pop-up was designed to address.

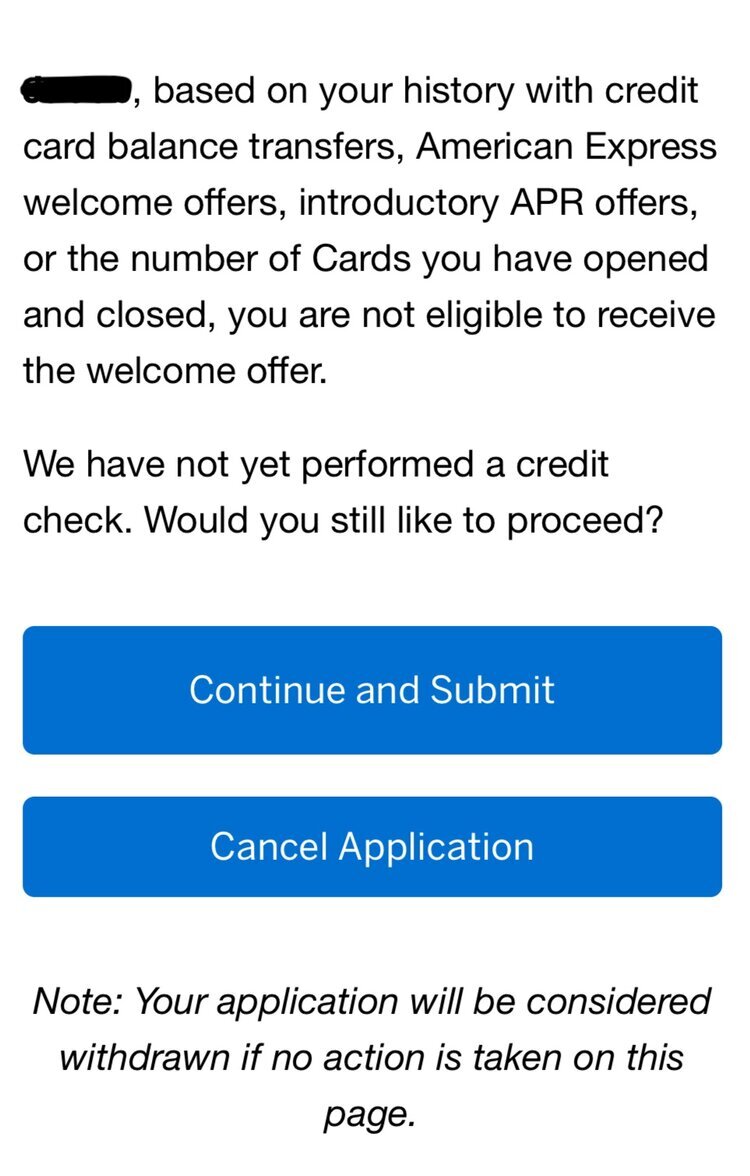

When you apply for a new Amex US credit card, right after you click the “Submit” button, an algorithm on the backend checks for your current and past Amex US credit card activity. If the algorithm determines that your card behaviour has been sufficiently unprofitable, you’ll receive the following pop-up message:

You’ll be told that you aren’t eligible for the welcome offer on the card “based on your history with American Express welcome offers, introductory APR offers, or the number of cards you have opened and closed”. You’ll be given the choice of proceeding with the application or not, and are informed that the application is considered withdrawn if you take no action at this point.

(And this isn’t like in Canada, where the issuers might say you’re ineligible for a bonus but will still give it to you anyway. Amex US can and will deny the signup bonus on your new card if you press “Continue and Submit”.)

Now, you might be thinking that if a certain credit card is worth getting for its perks and benefits alone (like the Hilton Aspire Card, for example), then you might want to continue this stage and proceed to get the card anyway, even if you won’t be getting the signup bonus.

That, however, is usually a bad idea, because as soon as you’ve held the product in question even once, you won’t ever be eligible for the signup bonus on that card ever again.

You’ll definitely want to bypass the dreaded pop-up somehow and claim the bonus on your first time holding an Amex US card, and for that, the solution is relatively simple…

Avoiding the Dreaded Pop-Up: Spend Regularly on Your Cards

A savvy points collector’s relationship with any credit card issuer should be one of give and take. You give the credit issuer a bit of profit by spending on the card, and in exchange, you’re rewarded with the signup bonus, points earned on the spending, and the card’s benefits.

Sure, the goal should always be to take more than you give, but there ought to be a little bit of giving nonetheless to keep the relationship good-natured on both sides.

The Amex US dreaded pop-up is designed to curtail unprofitable behaviour, and most data points indicate that putting some regular spending on all your Amex US credit cards is a good way to cause the pop-up to disappear in a couple of months’ time.

There’s no exact guidance to how much you should be spending, or how the spending should be distributed across the products you currently hold, or even how long of a spending history you should be aiming to establish. The best practice, therefore, is to simply spend regularly on your Amex US cards as soon as you receive them, even after meeting the minimum spending requirement for earning the bonus.

The amount of spending seems to matter less than the regularity, so it can be a good idea to go with something simple and distribute some of your recurring charges, like your cell phone bill or utility bill, across your Amex US card portfolio.

Of course, for Canadians who obtain US credit cards, there could be an FX impact when converting your Canadian dollars to US dollars to pay off your credit card bill every month (unless you have access to USD organically or at the mid-market rate).

Combine that with the fact that there are always minimum spends to complete up in Canada, and you don’t want to be putting too many charges on your Amex cards south of the border. If I had to estimate, I’d say roughly US$50–100 per month on each of your Amex US cards should give you ample protection from the dreaded pop-up.

My Experience with the Dreaded Pop-Up

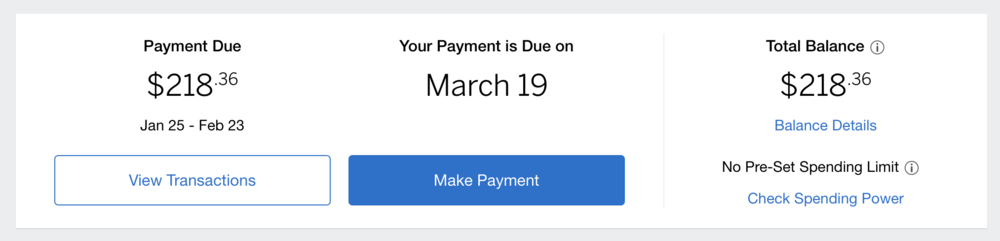

I personally encountered the dreaded pop-up late last year when I was hoping to bang out two applications for the Amex US Hilton Aspire Card (for its signup bonus of 150,000 Hilton Honors points, annual free night certificate, and instant Diamond status) and the Amex US Platinum Card (for its signup bonus of 60,000 US MR points and the ability to earn 5x points on airfare purchases).

I was pretty disappointed to receive the pop-up on both applications, but after some research on the nature of it, I put a few hundred dollars of spending on each of my existing Amex US cards, many of which had been lying dormant for several months at the time.

This was pretty much just a matter of paying off a few outstanding cell phone and internet bills, as well as carrying my Amex US cards around in my wallet and using them to pay for meals and groceries here and there.

A little over one month later, I was able to attempt the application once again; this time, upon hitting the “Submit” button, the little circle went round and round and those 60 seconds crawled by… but there was no pop-up, instead only the message that I was approved!

Conclusion

The “dreaded pop-up” is an inconvenient but understandable measure by Amex US to deter unprofitable behaviour among its customers, and denies the welcome bonus to those who simply complete the minimum spending on a card, claim the bonus, and then stop using it.

While a few months of renewed regular spending can cause the pop-up to go away, the best practice is to get in the habit of spending small amounts on your Amex US credit cards as soon as you receive them to ensure that you remain in Amex US’s good books.

Note that, as you’d expect, Amex US has never publicly disclosed the criteria that’s taken into consideration for the dreaded pop-up; instead, it’s anecdotal evidence from cardholders that has established that regular spending is the best way to sidestep it.

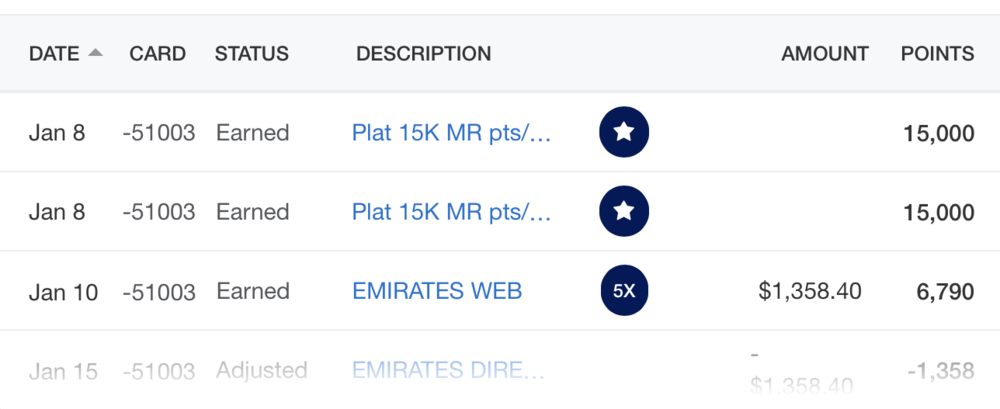

Is it just me or is there a hidden message in the screenshot of your transaction history? Particularly regarding the EK purchase…

You didn’t get to where you are today without being keenly observant. 😉

My wife has 2 Amex cards. One she puts 200-500 spend on every month. The other card is older has no annual fee and has been in the sock drawer for almost 2 years.

I have 2 Amex cards, Gold and Blue Business Plus, which I use regularly for 200-1000 each month. Both my wife and I got the pop up. After my wife got it we read that not spending regularly on all Amex cards can be the cause. So today I applied thinking I have consistent history of regular spending. I got the pop up. We are both 800+. I’m looking for the reason why spending history didn’t protect me from the pop up. I and my wife have had a couple of Amex cards in past years which we canceled at the 13 month mark without any regular spending after we got the welcome bonus. I thought not canceling until month 13 was what was required to stay in good graces. If those cards we canceled 2 or 3 years ago are the cause how can we change that since they are closed.

hi – my husband who is an Amex holder referred me to a card and i got this dreaded message. If I accept and move forward foregoing a chance for a welcome bonus [I need an free Amex card to park my existing points because i want to cancel my green], will my husband also not get the referral bonus? Do you know?

The referral bonus shouldn’t be affected. He should still get the referral bonus for your approval.

Hey Ricky,

With your recommendation to put spending on all cards you hold would this include Authorized User cards as well? My wife currently only has only card in her name but a couple Authorized user cards. She got the pop up.

This isn’t an exact science, but I would imagine that primary cards matter more. If she spends a fair bit on the card in her name but still gets the pop up after a few months, then I’d recommend spreading it out to the authorized cards as well.

Let us know how it goes, it’ll be nice to have a data point.

We put a few charges on her her only card over a couple months (none of the authorized user cards) and was able to get rid of the pop-up. Approved for a Hilton card today with no pop-up. No pre-approved offers were showing up under her account, so I thought the pop-up had not been removed yet.

That’s awesome to hear! Approximately how much were the amounts you put on?

Probably about 15 charges; all less than $100 charges – totaling less than $500. These charges were over the course of about two months.

Hey RIcky, I know you’ve been pretty pre-occupied with the changes to the aeroplan program so i’m not sure if you’ll be reading this comment. But I’ve got this pop-up as I was applying for the 60k Amex Gold offer in the states. I’ve put some spend on one of two cards that I have of around ~$100. Should I put some spend on the other card to get this dreaded popup to go away? And I know your dp was around 1 month after but how long after this spend do you think I should be able to get approved for the gold card? (I really want to take advantage of the 60K offer!)

Yes, try to put at least ~$100 of spend on all the cards you currently hold. I really can’t say for sure, it seems like at least 1 month though. Also, be sure to use “Check My Pre-Qualified Offers” in your account dashboard, which in theory should only show you offers that you’re qualified for. At least that’s where I had accessed my offers when I eventually cleared the dreaded pop-up.