Many financial institutions monitor activities from cardholders to ensure they’re adhering to the bank’s rules and cardholder agreements. Any activities on your account that appear to be questionable can result in it being frozen and investigated.

American Express uses financial reviews (FRs) to look at unusual activities on accounts, and then implements corrective actions (if any) after the process is complete. Financial reviews certainly aren’t nearly as exciting as signup bonuses or elevated earning rates, but they’re a relatively rare occurrence along most Miles & Points journeys.

This article aims to provide an overview of the American Express financial review and the various outcomes that can result from undergoing one.

What Is an American Express Financial Review?

A financial review is a process used by American Express to verify information pertaining to your account. As an unsecured lender, Amex uses financial reviews to ensure that the information provided on your application(s) is indeed true and that you have the ability to pay back the debts owed to them.

Your entire account will be under scrutiny during the review, including your spending patterns, account(s) history, purchases, applications, and business credentials, and you may be asked to provide some detailed answers and explanations about any of the above. You won’t be able to use any of your Membership Rewards points during the financial review, too.

At the onset of an financial review, there are several ways that you will know that something is amiss with your Amex card(s). You won’t be able to avoid the financial review once it has been initiated, and it will be immediately obvious that there’s something going on with your account.

If you go to make a purchase with your American Express card and it’s declined, it’s a pretty good indication that something’s amiss with your account, which could very well be a financial review.

If you have the Amex app on your smartphone, you may receive a notification that Apple Pay has been deactivated on one or more cards (even if you don’t have an Apple device). This is usually the first indication that something has changed with your account.

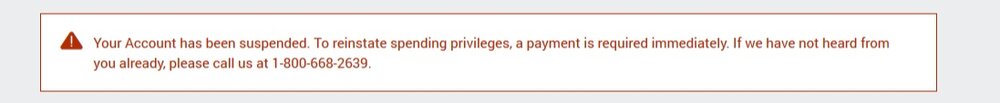

On your online account, you’ll notice a message stating that your spending privileges are suspended due to the status of another account, and asking you to call in if they haven’t spoken with you already. Since your accounts are frozen during the financial review, be sure to change any automatic payments to ensure you don’t fall behind on your bills in the interim.

A member of the American Express team will call to inform you that they are conducting a financial review of your account. Typically, the agents prefer to discuss the details of the review immediately, so if you answer the call, be prepared to dive right in.

You will also receive a letter in the mail advising you to speak with one of their representatives, especially if you haven’t already contacted the financial review team.

When you call in to any Amex number, you will be redirected to the financial review call centre after entering your account number. In Canada, they’re only open from Monday to Friday, from 9am to 5pm Eastern Time, so if you call outside of those hours, you’ll have to call back when their office is open.

In the meantime, you won’t be able to speak with any other call centre representatives, who will simply direct you to call back to speak with the financial review team.

What Happens During an American Express Financial Review?

When you first speak with a member of the American Express financial review team, you’ll likely be asked a variety of questions pertaining to your account.

The nature of the questions should give you an indication of why you are having a financial review. Therefore, you should always be prepared to offer a clear explanation for anything relating to your account.

In most cases, the financial review team will request several documents from you.

You’ll need to provide the Notice of Assessment from the previous year’s tax return. This is likely to verify that the income reported on your card applications matches the income reported to the Canada Revenue Agency, which is why it’s important to always be truthful in this regard.

Amex will also ask to see your bank statements for the preceding three months, which is likely looking to see regular income deposits from reputable sources to ensure that you can pay back your debts to them.

If you have any business cards, the financial review team may ask for information about the nature of your business, which could include business numbers, a master business license, and/or separate bank accounts for your business.

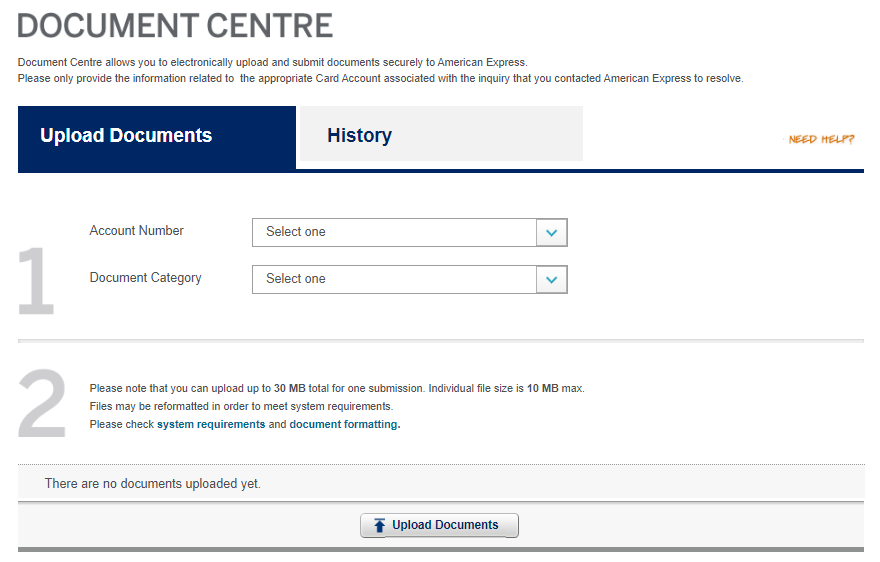

Documentation may be sent in via the Form and Document Centre on the American Express website or by fax. If you submit the documents via the Form and Document Centre, it is a good idea to call the financial review team to verify that they have received everything.

Once Amex has received the documentation, the actual review takes a few days to be completed. After they have combed through the documents you provided, the statements you made on the phone, and your account data, you will receive a phone call advising you of the outcome of the financial review.

What Are the Outcomes from an American Express Financial Review?

In the vast majority of cases, if the information you have provided matches what the financial review team is expecting to see, most people have their accounts reopened within 30 minutes of the phone call and everything returns back to normal. So, if you have been forthright from the onset, you should emerge from the financial review unscathed, albeit possibly with a lowered credit limit or cap on your charge cards as a risk-management measure.

In some cases, you may be asked to voluntarily close one or more of your accounts. You may be eligible for an annual fee refund or rebate, which can be discussed when you are transferred to a call centre representative to close the account.

In rare cases, the result of the financial review could be that all of your accounts are closed and you are required to settle the balances in a timely manner. If this happens, you also lose any of the Membership Rewards points that remain in your account.

If you’ve had a financial review before and were asked to refrain from any spending behaviour, and then you have continued to engage in these behaviours, you are very likely to be asked about the activity again under a second financial review, which may very well have harsher consequences than the first. Therefore, be sure to adhere to any suggestions the financial review team gives you if you’d like to avoid further scrutiny on your account.

It isn’t possible to dictate the outcome of a financial review, so while having your accounts closed is indeed a rare occurrence, your best defence is to avoid one in the first place.

How to Avoid an American Express Financial Review

When it comes to exactly what triggers a financial review in the first place, without being an employee on the financial review team, it is impossible to know what gets an account flagged.

Applying for a large number of cards within a short time-frame could increase your odds of having a financial review, which is why you’ll want to develop a long-term plan to reach your Miles & Points goals and take spaced-out, incremental steps to get there.

If you have a partner, two-player mode is also a great way to rake in the points strategically as a team.

If there have been any sudden changes to your established spending patterns, you are likely at a greater risk of having a financial review on your account. This could include any unusually large purchases made shortly after opening an account (especially a charge card, which has no preset spending limit) or any transactions or pattern of transactions that appear suspicious.

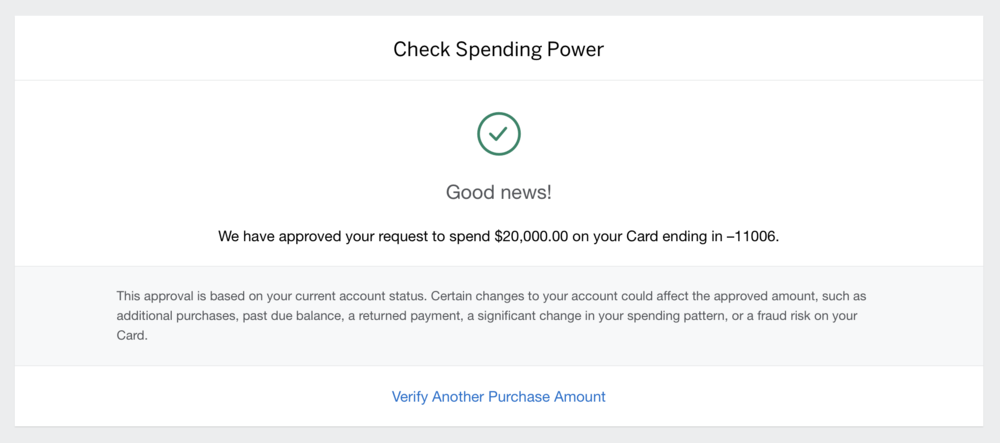

One way to check whether a purchase on a charge card would be deemed “safe” is through the “Check Spending Power” tool on your Amex dashboard. However, excessive use of this tool has also been known to raise flags.

While planning your large purchases in advance can be a great way to meet some of the higher minimum spending requirements on Amex cards, there’s a small chance you may end up having to explain the expenses to a member of the financial review team if those large purchases happen to trigger a review.

Of course, spending more on your card than your stated annual income is probably one of the most likely ways to be flagged.

For example, if your reported annual income is $60,000 and you have already put through $50,000 on your account by June, you may be asked some questions about why you managed to do that.

Some people are required to charge work expenses to their personal credit card and then are reimbursed after the fact, which could be a situation in which you’re spending a lot more than what your annual income might otherwise suggest.

The practice of “cycling through” your credit limit within a single billing cycle may raise some eyebrows from the American Express financial review team, as well.

For example, suppose you are doing some renovations on your house and plan to spend around $20,000. But, since your credit limit is $5,000 on the card that you’d like to use, you’d have to do four rounds of maxing out your card and paying it off in a short amount of time.

Of course, you want to maximize your earning potential as often as possible, just be mindful that if this involves cycling through your credit limit, you could be flagged for a financial review.

Conclusion

While undergoing a American Express financial review can be a bit nerve-wracking, it’s something from which most emerge with little or no impact.

If you give the financial review team what they ask for, and if it lines up with what they were looking for, the worst part will be the inconvenience of having your accounts temporarily frozen for a few days’ time.

It’s important to understand that your financial institution has the power to close your accounts if they don’t like what they see, and the best way to avoid scrutiny is to play by the rules.