As I elucidated in my post on credit card strategies a few weeks ago, my mindset on US credit cards tends to be quite different from how I approach the credit card offers here in Canada.

Whereas I tend to apply for Canadian credit cards on a regular basis, the stricter eligibility policies on US credit cards means that I generally only act upon them when highly compelling offers come around. And if any of these highly compelling offers also happen to be time-sensitive, I’ll be especially diligent in taking action.

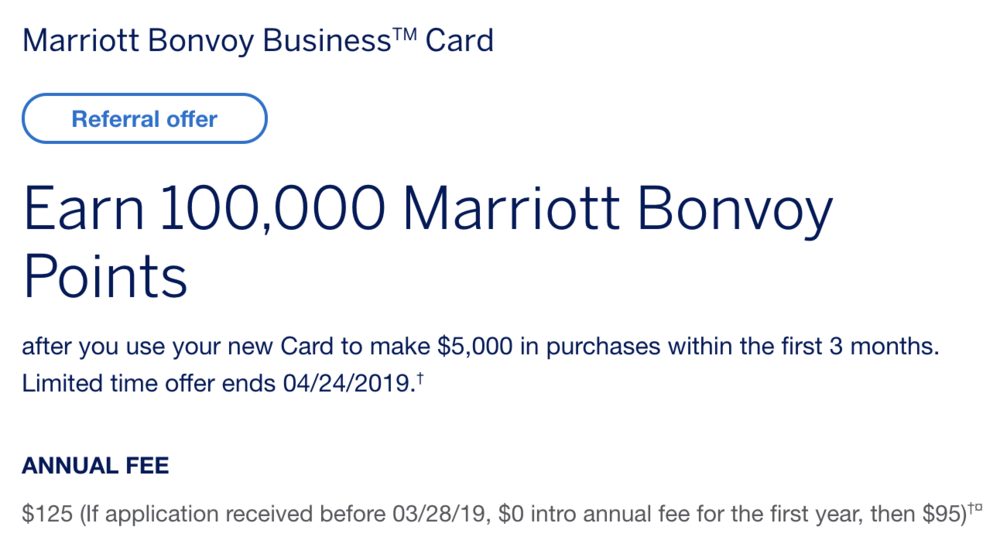

There’s one such offer at the moment that I would certainly be jumping on if I didn’t have the card already, so I figure it’s worth giving you a heads-up in case it’s applicable to your situation. I’m talking about the American Express US Marriott Bonvoy Business Card, which is offering 100,000 Marriott Bonvoy points after spending US$5,000 in the first three months. The signup bonus is valid until April 24, 2019, but the first-year annual fee waiver is only valid on applications received before March 28, 2019.

That gives you just over a week to grab this card (if you don’t have it already) to take advantage of the first-year annual fee waiver and a reduced US$95 annual fee for every year thereafter. After March 28, the annual fee will be rising to US$125, and the first year will no longer be waived. While that’d still be a good deal for the 100,000 bonus Bonvoy points, it certainly pales in comparison to US$95 + First Year Free.

A Great Card to Keep Forever

In the US, American Express enforces the once-in-a-lifetime rule on signup bonuses rather strictly. This means that if you’ve previously signed up for this card (even if it was known as the Amex Business SPG Card back then, which I wrote about last year), you will not be eligible for the bonus points of 100,000 Bonvoy points.

Rather, if you’ve recently established your US credit history but haven’t applied for this card yet, then there’s no better time to do so than prior to March 28.

A side effect of the strict once-in-a-lifetime rule on Amex signup bonuses is that there’s no incentive for cardholders to cancel their cards in the hopes of reapplying and getting the bonus in the future. Therefore, whether or not to keep the card in the long run boils down to a very simple calculation of whether the card is worth keeping for every year’s annual fee.

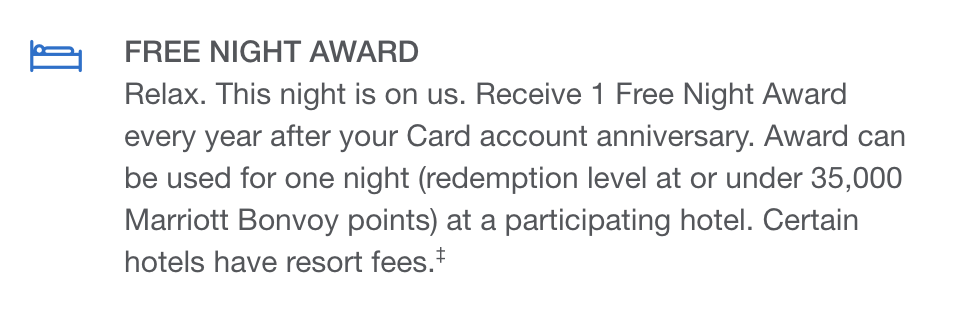

In the case of the Bonvoy Business Card with its annual fee of $0 for the first year, then US$95, the answer is a resounding yes. That’s because one of the benefits of this card is an anniversary free-night certificate valid at Marriott hotels costing up to 35,000 Bonvoy points per night (i.e., a Category 5 hotel or lower).

Generally speaking, I’d say the average retail price of a Category 5 hotel is around $200 per night, meaning you’re already getting great value out of your US$95 annual fee from this anniversary free night certificate alone.

Moreover, if you time your redemption around popular travel periods, it’s not uncommon to see Category 5 hotels retailing for much higher nightly rates. For example, rooms at the Category 5 Le Méridien Munich were going for $900+/night when I stayed during Oktoberfest.

(Having said that, this sweet spot might be somewhat neutralized when Marriott Bonvoy introduces peak/off-peak pricing later in 2019, when the Category 5 peak pricing of 40,000 Bonvoy points per night would render those hotels ineligible for the free night certificate during peak periods.)

Redeem your Category 5 certificate for a free night at the Hotel Bristol Warsaw

Overall, you’d almost struggle not to get your money’s worth if you’re paying US$95 every year in exchange for a free night certificate worth 35,000 Bonvoy points. If you apply after March 28, you must pay US$125 every year instead (including the first year), and while that’s still a good deal, it’s certainly not nearly as compelling. It’s therefore a highly lucrative opportunity to grab the US Bonvoy Business Card before March 28 and hold onto it in perpetuity.

In the US, Business Cards Do Not Build Credit History

As always with US credit cards, there are a few nuances to talk about when applying as a Canadian resident – the most significant one being that unlike in Canada, US business credit cards don’t report to personal credit bureaus.

When you apply for a business credit card, your personal credit file does receive a credit inquiry to assess whether or not you’re creditworthy enough to be approved. However, once you get approved, the tradeline doesn’t actually get reported to the credit bureaus on a monthly basis. It’s something about the separation of personal and business liability, I’m not exactly sure.

From the perspective of nabbing US credit card bonuses, there are both pros and cons to this. On one hand, applying for Amex business credit cards won’t count towards your 5/24 status when applying for Chase credit cards, so you can power through multiple Amex business signup bonuses while waiting for your credit file to mature long enough to be approved for Chase.

On the other hand, business credit cards also don’t really help you build a US credit history for this very reason! When issuers look up your US credit files, they don’t see the spending and payment activity on your business credit cards, so they can’t use those accounts to judge the robustness of your credit history.

For that reason, I don’t recommend going for this Amex US Bonvoy Business Card as your first US credit card, because it’s not going to help you build your credit history in the long run.

Instead, for those of you who’ve already obtained a US Amex card by way of either Global Transfer or NovaCredit, you should be able to apply for this card on the basis of your existing relationship with Amex US (the longer that relationship has been in place, the better your odds of approval). This may require calling in, since the online application does have a mandatory SSN/ITIN field.

And if you have an SSN or have obtained an ITIN, then you can go ahead and use that to apply directly on the Amex US website. If that’s the case, I’d be grateful if you considered applying via my referral link, which would go a long way towards supporting the website.

Conclusion

While Canadians looking to dabble with US credit cards should be focused on building credit history for the long term, it remains in your best interest to watch out for time-sensitive deals and jump on them if it looks like there won’t be a better opportunity with that particular card in the future.

That’s exactly what’s happening to the Amex US Bonvoy Business Card, which currently offers a fast-closing window to pick up a sweet 100,000 Bonvoy points and lock in the annual fee structure of $0 for the first year followed by US$95. If you’re eligible, make sure to get those applications in before March 28!

Are there any similar offers now? I was skeptical about applying for this card until I saw this!

Unfortunately it looks like Marriott Bonvoy Business Card is down to 75,000 Marriott Bonvoy Points with no annual fee waiver right now (either through a referral or the general link). I’d keep an eye out on referral offers, American Express has offered increases bonuses through referrals before (ie. you may see 100,000 Marriott Bonvoy Points again).

Is it possible to apply for this card using Nova Credit? I don’t see the option on the page.

I tried applying the traditional route, but I’ve only had my personal PSG card for a month and they declined based on lack of credit history.

Hey Whygee, mind if I ask if you applied with an ITIN?

I think NovaCredit may only be available on personal cards. Business cards will likely require a call to the Global Transfer team.

Thank you, I like you have made US American Express Marriott Bonvoy yourself for travel. I even asked for it to be delivered to an Australian address, which they also confirmed. Great!

Do you need to sign up for a US address forwarding service if you are getting this deal through AMEX Global Transfer (for the first time)? Or will they be okay to mail to your Canadian address?

Do you get any points if you don’t hit the minimum spend?

In the way most of our cards here work where you get x number of points on approval/first spend, then x number of points after 90 days + spend

Just wondering as I would likely never hit a US spend amount, but fyf and if the initial points are decent….

So.. how does one actually get this card, as a Canadian?

I know you said you don’t recommend for your first US card, but the offer is only available for a week, so.. time sensitive!

If you haven’t gotten started with US credit cards yet, there’s a case to be made that you should get this time-sensitive deal (likely via Global Transfer) and then use it to build up a relationship with Amex, before applying for your first personal Amex credit card on the basis of that relationship to jump-start your credit history.

Of course, the more urgently you need those 100k Bonvoy points, the more this makes sense.

Just want to make sure, if I have the Canadian SPG Business card, will I get the 100k bonus with the US card?

Yes!

Hey Ricky – thanks for the notice. I do a some credit history with Amex US, so this is a good bet for me. However, that $5000 USD spend to get that 100k bonus, yikes! Any tips on MS for USD from up in Canada? It obviously not easy doing the gift card thing up here. And front $5k USD for some of the other MS tricks that buy you time to complete natural spend is still a big one from a USD perspective.

Thanks for the heads, I would like to get this card for my SO but she recently got the 1st personal SPG via GT and they declined the Hilton Honors due one GT per person.

As her personal SPG opened on Feb 12th and received our first bill 14th march and in the process of paying on April 8th. So i highly doubt they would approve in non-GT route as the free credit report on the account does not generate any thing.

Any advise for my SO with this young credit file can give it a try?

Note: we have SSn/ITIN but no credit history seems to be existed so far despite our first bills generated.

I am in the same time frame as your SO, I was just approved this morning with my ITIN, even though I just received a few weeks ago. I had to call after submitting my application and they 3 wayed with my bank in the States. I was approved right away. Worth a shot! I didn’t think I would be approved but the person over the phone just wanted to verify my address and ITIN.

Hey miles, just to clarify: was your previous application your first US card? Or did you already have an ongoing credit file?

So it was basically a GT for this biz card then right?

The problem is my SO does not have US bank (TD-USA) account yet. We have to go down south to get the Joint account application to be done.

The first GT for my SO was not asked for address verification, hence i am hesitant to try again the GT route which was declined already once for 2nd card. I wish the Novacredit route is possible for 2nd try…

I’m in the exact same scenario, got declined two weeks ago attempting a 2nd GT as well. I’d just received my ITIN however, so I’ll give it one more try before I miss out on this killer offer.

please post your attempt result. I might try my luck at the end of the month

Hi Ricky, I tried to click on your referral link but some odd reason its not working…

My bad – it should be working now.

yup working now!

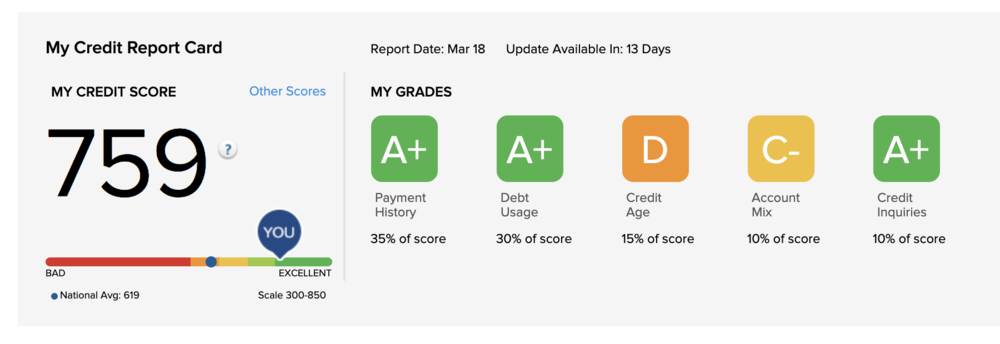

May I ask what service you use to track your US credit score?

Credit.com gives you a nice high-level overview. I have trouble accessing my actual credit file with any of the three credit bureaus though – I suspect it’s the ITIN in place of SSN that’s causing the issue.

Yup, their T&Cs state this: "Welcome offer not available to applicants who have or have had this product or The Starwood Preferred Guest® Business Credit Card from American Express. We may also consider the number of American Express Cards you have opened and closed as well as other factors in making a decision on your welcome offer eligibility."

It’s always good to apply over the phone while recording the call and make sure they state the welcome offer as they’re legally obligated to. Obviously, if you were to apply for additional cards after getting approved then that changes everything.

T&Cs here: https://www.americanexpress.com/us/credit-cards/card-application/apply/prospect/terms/marriott-bonvoy-business-american-express-card/45094-9-0?key=tncBody&rwdFlag=rwd#offer-terms

AMEX US recently added a feature that auto-checks for bonus eligibility during online applications. If you do not qualify for a bonus, the site will generate a pop-up saying that you are ineligible and asking if you want to continue with the application. This occurs before they do a hard pull. Early on there were reports of some people not getting the bonus despite never getting the pop-up, but it appears as if Amex went back and credited those applicants with their bonuses.

Hi Ricky, if I have both the personal and business Marriort Bonvoy card, does that mean I will get 2 free night (1 from each card)

Yes!

Thanks Ricky. Don’t forget that for anyone who has had Marriott/Starwood US cards in the past, the rules for whether you are eligible for the sign up are much more byzantine than the normal Amex "once per lifetime" restriction. You might also be restricted if you currently have or have had various previous Chase/Amex Marriott (US) cards. Frequent Miler made a good chart explaining eligibility: https://frequentmiler.boardingarea.com/marriott-bonvoy-complete-guide/#creditcards

Yeah, thanks for pointing this out. I’d imagine most Canadians getting started with a US credit file won’t have much trouble with this. Having said that, you almost need a PhD to understand some of these eligibility criteria…