CIBC’s in-house points currency is known as CIBC Aventura points, and many consumers who bank with CIBC end up collecting sizeable balances of Aventura points via the personal and business CIBC Aventura credit cards.

The reality, unfortunately, is that CIBC Aventura points do not hold nearly as much value as some of the other points programs available to Canadians, like Aeroplan, Amex MR, or RBC Avion. No matter what your travel goals are, you’d almost always be better off earning one of those points currencies instead of Aventura, if given the choice, because of their additional flexibility and value.

Having said that, the CIBC Aventura credit cards do put on some very strong signup bonuses on a regular basis, which make them a good choice as secondary credit cards after you’ve already applied for the most valuable cards out there.

In this post, we’ll cover the various ways that you can use your CIBC Aventura points to meet your travel goals, even though the overall upside to the program can be relatively limited in the end.

In This Post

- Redeem Aventura Points for Travel via CIBC

- CIBC Aventura Airline Rewards Chart

- Seasonal Flight Promotions

- Transferring to Aeroplan Miles (for pre-2013 Cardholders)

- …Merchandise?!

- Conclusion

Redeem Aventura Points for Travel via CIBC

The baseline use-case for CIBC Aventura points would be to redeem them at a value of 1 cent per point (cpp) against travel that’s booked through the CIBC Rewards Travel Centre. For example, the current signup bonus of 35,000 Aventura points on the CIBC Aventura Visa Infinite would be redeemed against $350 worth of travel booked via CIBC.

It’s important to note that Aventura points redemptions can only be made directly through CIBC’s in-house travel agency (either online or over the phone). Unlike similar products and programs like the Amex Cobalt or the Scotia Passport, you cannot make travel purchases directly on your CIBC Aventura credit card and then choose to offset the purchase using Aventura points later on, and I’d consider that to be a major limitation of the Aventura program.

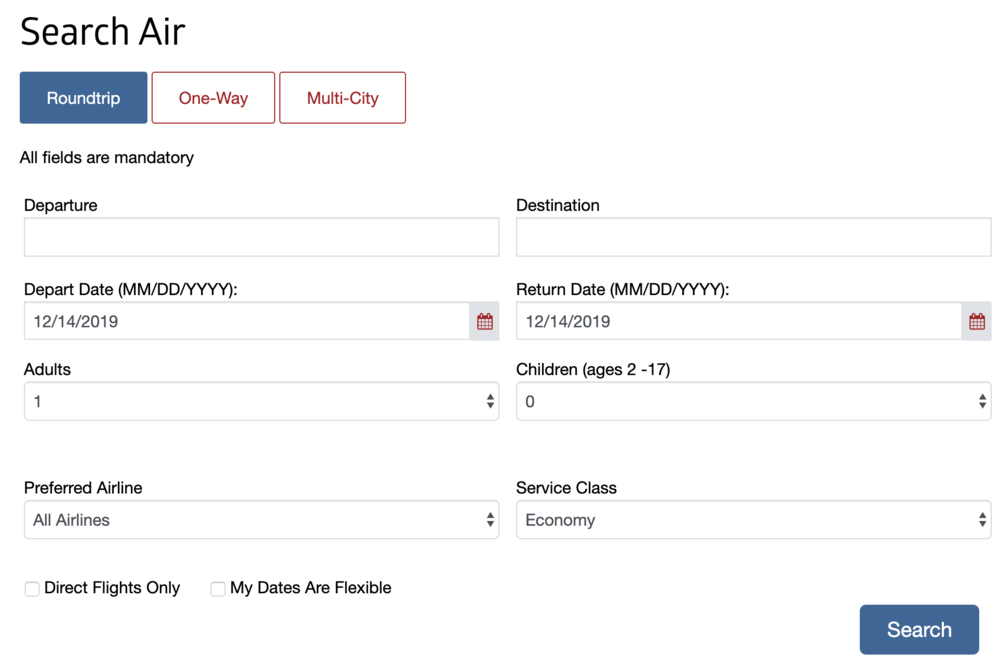

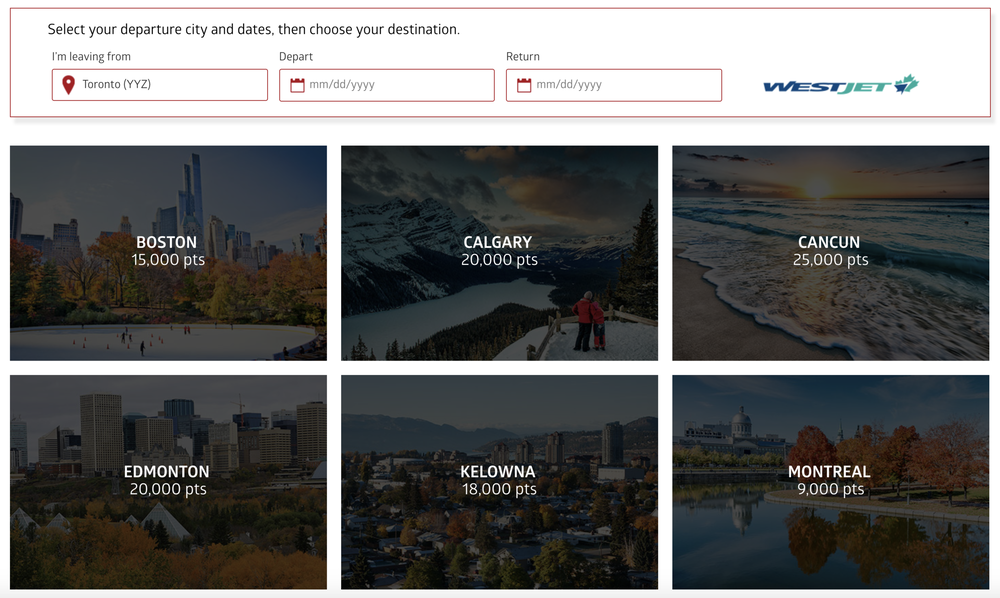

The CIBC Rewards website allows you to search for “simple” flights, hotels, and car rentals and book directly using your Aventura points.

Unless you’re booking a flight that falls under the Airline Rewards Chart (which we’ll describe below), the payment page will automatically apply your points towards the value of the booking at 1cpp.

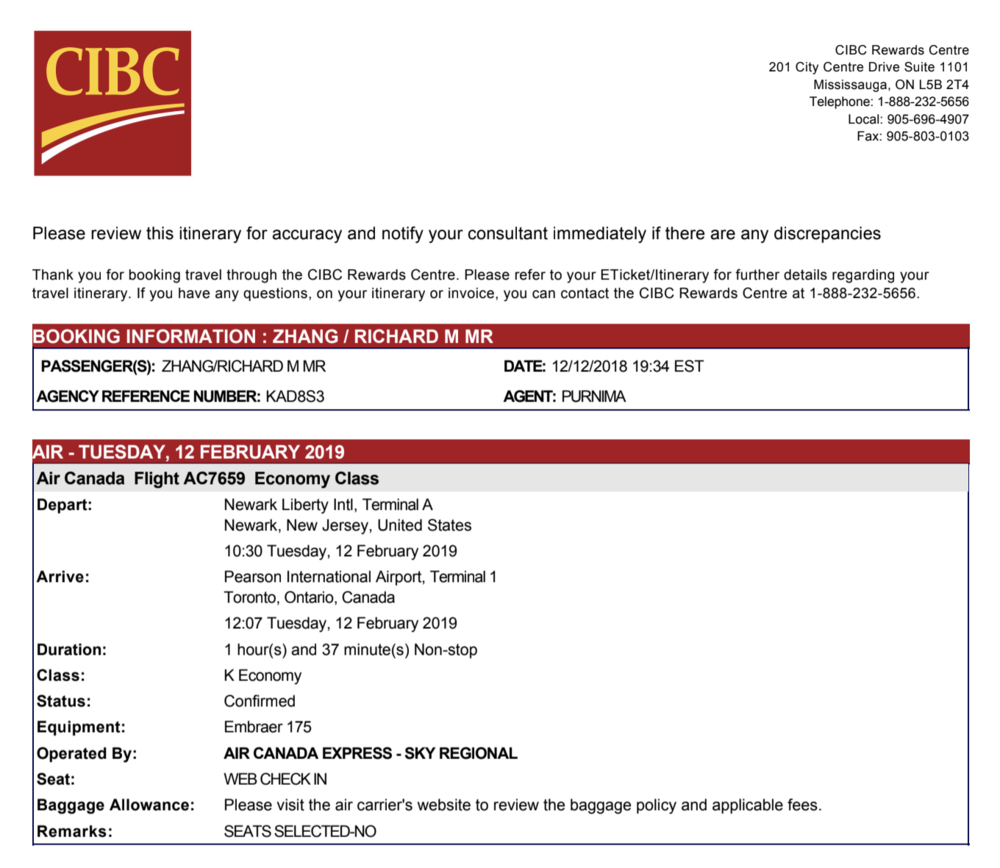

You may also book travel via the CIBC Rewards Travel Centre over the phone, where you’ll be connected with a dedicated travel agent who will assist you with the booking.

The CIBC travel agency seems to be able to book most major flights, hotels, car rentals, and other travel products that you can find on the major online travel agencies like Expedia; however, I have found in the past that there are a few gaps in what CIBC is able to book (and therefore what you’re able to redeem Aventura points for).

For example, the CIBC travel agency cannot book flights on low-cost airlines in Europe or Asia, nor are they able to book “less mainstream” airlines such as the AirBaltic or Air Astana – flag carriers of Latvia and Kazakhstan, respectively. My attempts redeeming Aventura points for cash fares on both of these airlines resulted in the agent attempting to issue me a ticket within their backend systems, but to no avail.

(I’ve heard a few data points of CIBC travel agents allowing the customer to book whatever they want on Expedia.ca on their own and then applying the Aventura points manually, but these were few and far between, and I haven’t personally had any success doing this.)

Overall, the 1cpp redemption option should be treated as a baseline; you should never redeem your Aventura points for anything less than 1cpp. However, I must admit that it’s quite rare that I find myself needing to redeem Aventura points in this fashion.

After all, most of my flights are booked using award tickets, and the cash flights that I do buy are usually on the less mainstream airlines of the world, which Aventura agents are unable to book. And on the hotel side, I’m always booking hotels either directly with the program or through a third-party booking service in order to maximize my elite benefits.

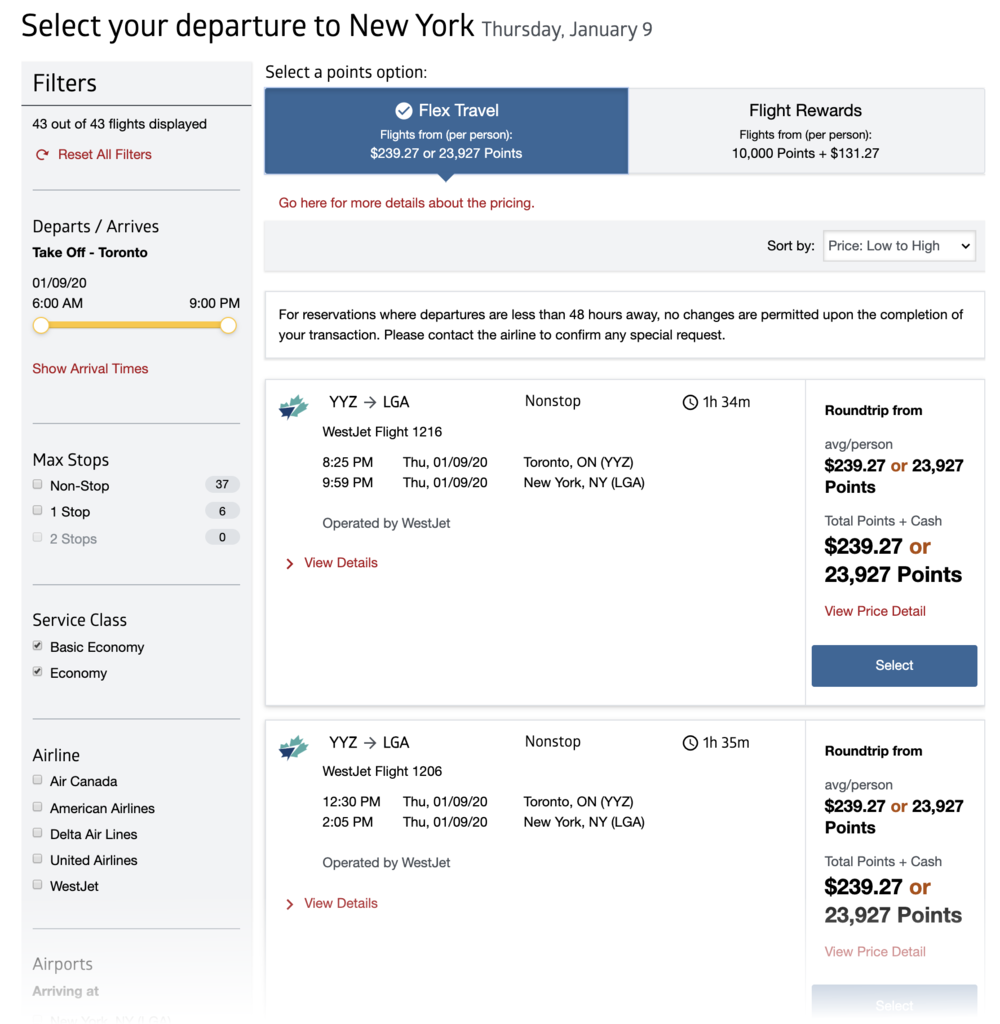

Most often, I find myself redeeming my Aventura points for short-haul flights on Air Canada or WestJet, such as Toronto–Montreal or Montreal–New York, when the price isn’t high enough to justify redeeming Aeroplan miles. These flights also happen to be easily searched on the CIBC Rewards website, saving me a time-consuming phone call with a travel agent.

CIBC Aventura Airline Rewards Chart

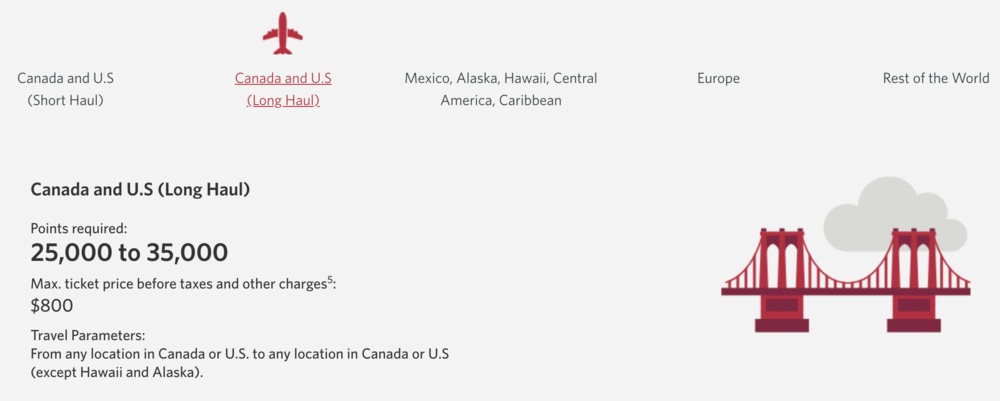

Another way to redeem Aventura points for flights is via the Aventura Airline Rewards Chart, which allows you to exchange a certain quantity of points for a cash ticket in economy class from Canada to a certain geographic region, up to a certain maximum ticket price. It’s a similar arrangement as the Fixed Points Travel program with Amex MR, or the Travel Redemption Schedule with RBC Avion.

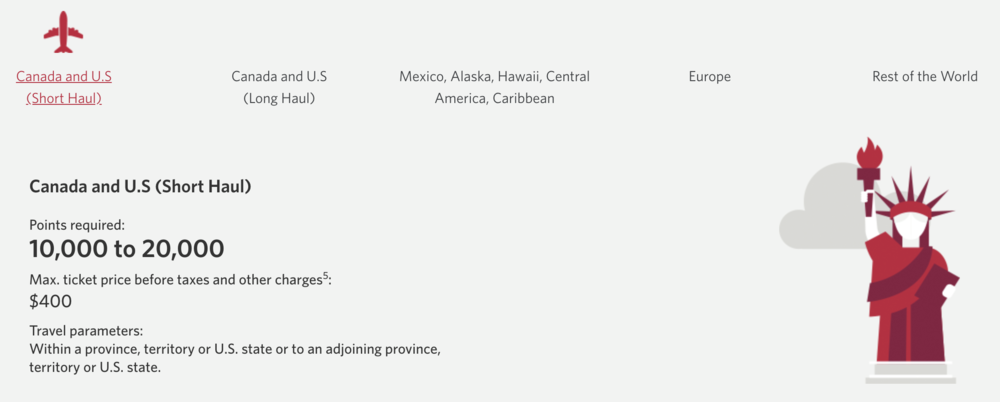

The chart is found on the CIBC Rewards website, and can be summarized as follows:

As you can see, if you were booking a round-trip flight designated as Canada and U.S. (Short Haul), then you’d pay between 10,000 and 20,000 Aventura points for a ticket whose base fare (i.e., the price before taxes and fees) is up to a maximum of $400. If the base fare were higher than $400, then you’d also pay the difference at the standard 1cpp valuation of Aventura points.

It’s my understanding that the exact price within the range of prices (10,000 to 20,000 points, in this case) is determined by your base fare – if you’re “using up” the full maximum amount of $400, then you can expect to pay 20,000 Aventura points; meanwhile, if your base fare is only, say, $200, then you might only be charged 10,000 Aventura points for this redemption.

Note that Aventura points can be only be used to cover the base fare portion of a flight under this chart, not any of the associated taxes and fees. You may still redeem your Aventura points against the taxes and fees, but only at the base-level rate of 1cpp.

If you do the math, you’ll see that you can achieve much higher value than the standard 1cpp redemption by using the Aventura Airline Rewards Chart. Indeed, the maximum value arises when you redeem 35,000 Aventura points for a flight designated as Canada and U.S. (Long Haul) with a maximum ticket price of $800 – using up that full amount would give you a value of 2.29cpp, which is pretty amazing value for the Aventura program.

The value on maximizing the Canada and U.S. (Short Haul) region is pretty outstanding as well at 2cpp, whereas Europe, Mexico/Alaska/Hawaii/Central America/Caribbean, and Rest of the World clock in at maximum values of 1.85cpp, 1.67cpp, and 1.6cpp respectively.

(Note that the definitions of short-haul and long-haul are based on whether the respective provinces or states of the origin and destination cities share an adjoining border, and this results in a few oddities, like Toronto–Chicago being classified as long-haul even though it’s a shorter distance than Toronto–Minneapolis, which is classified as short-haul.)

If your travel patterns regularly involve paying for economy class flights within Canada and the US, then the CIBC Aventura Airline Rewards Chart could be a very suitable fit for your needs while allowing you to extract higher than normal value out of your Aventura points.

Seasonal Flight Promotions

In addition to the above flight redemption options, you can also watch out for CIBC’s seasonal redemption offers, which usually partner with a specific airline like Porter, WestJet, or Air Transat to offer discounted redemptions on certain routes during a certain travel period.

For example, we’ve seen promotions where you could redeem as few as 8,000 or 9,000 Aventura points for a round-trip flight on popular routes like Toronto–New York, Montreal–Boston, Toronto–Ottawa, or Vancouver–Calgary. Overall, these promotions have largely been more favourable for Canadians living in the Eastern provinces (especially since Porter, for example, only operates on this side of the continent).

While these promotions do offer up some very low redemption price points, it’s still important to compare against the cash fare to figure out the value you’re getting, since they could still tread the fine line against the base-level 1cpp redemption in many cases.

Remember that you still have to pay about $100–150 in taxes and fees on these low-priced redemptions, so even a points rate of 8,000 Aventura points might not present stellar value when the cash tickets on the Toronto–New York route are often as low as $220 round-trip.

Always do the math against the cash price to figure out the value you’re getting for your Aventura points, and if it’s below 1cpp, then it’s best to offset the cost directly at par instead.

Finally, one important question that arises from all of the above types of Aventura flight bookings is whether you’ll earn miles when crediting these flights to a frequent flyer program. It’s my understanding that you do indeed earn miles when you offset the cost of a flight at 1cpp, since the flight is counted as a regular revenue fare that’s simply being offset using your Aventura points.

However, when you redeem via the Aventura Airline Rewards Chart or through one of the seasonal airline-specific promotions, you do not earn miles since the flight is marked as a mileage redemption – even if the flight is booked into the same fare class in all three cases.

Transferring to Aeroplan Miles (for pre-2013 Cardholders)

If you’ve been an Aventura cardholder since at least 2013, then you enjoy the grandfathered ability to transfer your Aventura points into Aeroplan miles at a 1:1 ratio.

Aventura points were once freely transferrable to Aeroplan when CIBC held the main Aeroplan credit card contract in Canada; however, that ability was phased out when TD won over the contract in 2014, so only the legacy cardholders of CIBC Aventura products can still make use of this opportunity.

If you’re one of these cardholders, then transferring your Aventura points to Aeroplan will likely be the best-value usage of your points in general, especially if you’re looking to maximize your miles by booking business class or First Class flights.

If you’re content with economy class, then you can compare the price points between Aventura and Aeroplan (as well as the availability situation, since the former can book any available seat on any flight, whereas the latter is constrained by award space), and only transfer your points over if it makes sense.

…Merchandise?!

Finally, we all know that redeeming points for merchandise is usually seen as a major faux-pas due to the poor value it provides; however, I’m not ashamed to say that CIBC Aventura points are the only currency that I’ve ever redeemed in exchange for a retail good.

Indeed, when the Aventura program was offering a Cyber Monday special on merchandise redemptions last year, there was a wide range of products, from iPhones to coffee makers, that were available at 50% off their usual points price, offering a value of around 1.8cpp.

Since I had no immediate plans to redeem my balance of around 35,000 Aventura points at the time (and in fact wanted to cancel the card soon), and I was in the market for a medium-sized luggage anyway, I decided to trade in 21,950 Aventura points at that 1.8cpp level for a new Heys suitcase.

21,950 Aventura points well spent!

I’d only recommend redeeming for merchandise in these situations when all three criteria are met: there’s a special offer on these types of redemptions, you’re certain you would be purchasing the product anyway, and you don’t see yourself getting higher value (such as the 1.6cpp+ redemptions through the Airline Reward Chart).

While I don’t think the Cyber Monday special offer returned in 2019, I recall there was a similar limited-time offer on Boxing Day last year as well, so hopefully that will be back this year in case you have some spare Aventura points lying around that you’re happy to exchange for some new “stuff”.

Conclusion

While Aventura doesn’t really have a place among the most valuable points programs in Canada, they’re still very easy to collect via the CIBC Aventura credit cards, and are good for reducing the cost of your flights and hotels here and there to supplement the more valuable redemptions you make with other currencies.

You can get the highest value (up to 2.29cpp) via the Aventura Airline Rewards Chart, while their frequent redemption promotions also represent good value. The baseline scenario – and indeed the option that I resort to the most often – would be using Aventura points at 1cpp against the cost of travel, although the fact that you must book through CIBC’s travel agency can be a major limitation.

Can you use Aventura points to book a flight for a family member, without travelling with them? I have heard some programs are fussy about that, but didn’t see anything about that in CIBC’s FAQs.

Yes.

Much appreciated. Too many rumours out there.

I’ve been a aventura mastercard holder for a very long time and have always had the ability to transfer my aventura points into my aeroplan account even as recently as July 2019. But recently, no one seems to know how to do this at CIBC. saying that it’s not possible. I was passed around from the main agent to rewards agents and back. No one seems to have an answer for me. At this point, I just want the rest of my points and then to cancel this card. Any thoughts?

Why can I not book my seat selection on the flight that I am using Aventura points for. I have been sitting on the phone for 2 hours trying to reach an agent to choose my seats for my trip. I have completed the online application with all of my info but when i go to book seats the Seat Map is not available. So frustrating.

Time to update the article now that shopping with points is 1.25cpp and fixed point redemption is >2cpp

Aventura Privilege card opens up business class rewards charts. I don’t know what the redemption rates are but it might be something worth looking into.

I am also waiting to see this. Aeroplan business rewards have to be booked WAY in advance so I can seldom use them. Hoping the Aventura Privilege will be more useful.

Do you know if the four Priority Pass visits loaded to a PP account are removed if you cancel the card (similar to Amex Plat, although that is unlimited visits)?

it depends on the card. Amex is removed pretty much instantly but CIBC seems to be active for another year. eg. get the CIBC VI, let the annual fee renew, call in and cancel and get the AF refunded.

free 2 years of PP (8 free passes).

I think I saw a data point somewhere indicating that the PP passes weren’t removed, but someone should correct me if they have experience to the contrary.