If you live in Ontario and have been considering a staycation or a weekend getaway nearby, the new Ontario Staycation Tax Credit for 2022 may be your sign to take action.

This 20% tax credit will help Ontarians save money, explore the province, and contribute to the financial recovery of the tourism industry.

With up to $200 back per individual and $400 for families, the new tax credit is estimated to provide $270 million in support to around 1.85 million Ontario families, and may be a great incentive for Ontarians to travel and stay locally.

What Is the Ontario Staycation Tax Credit?

The Ontario government will allow Ontarians to claim 20% of their accommodation expenses for leisure stays between January 1 and December 31, 2022.

Residents can claim up to $1,000 in expenses as an individual (for a $200 tax credit) and up to $2,000 in expenses with a spouse, common-law partner, or eligible children (for a $400 tax credit). However, only one individual per household may claim the staycation credit for the year.

Eligible accommodation expenses only include leisure stays at short-term accommodations, and these stays must be less than a month long. Additionally, boats, trains, and timeshares are not considered eligible for the tax credit.

The following accommodation types are eligible for the tax credit:

- Hotel

- Motel

- Resort

- Lodge

- Bed-and-breakfast establishment

- Cottage

- Campground

Keep in mind, non-accommodation expenses such as hotel dining and incidentals are not included, nor are business-related travel expenses.

Finally, to ensure you qualify for the tax credit when filing in 2022, you must submit a detailed receipt showing payment from you or your family member.

The receipt must include the following:

- Accommodation location

- The accommodation portion of your stay

- The tax paid

- Date

- Name of the individual who paid

The tax credit will be claimed when filing your personal Income Tax and Benefit Return for 2022. If eligible, you will receive the tax credit amount regardless of whether you pay income tax for 2022, since this is a refundable personal income tax credit.

Optimize the Ontario Staycation Tax Credit with Ongoing Promotions

To help you get the most out of your staycation, let’s think about a few ways you can combine your tax credit with current promotions.

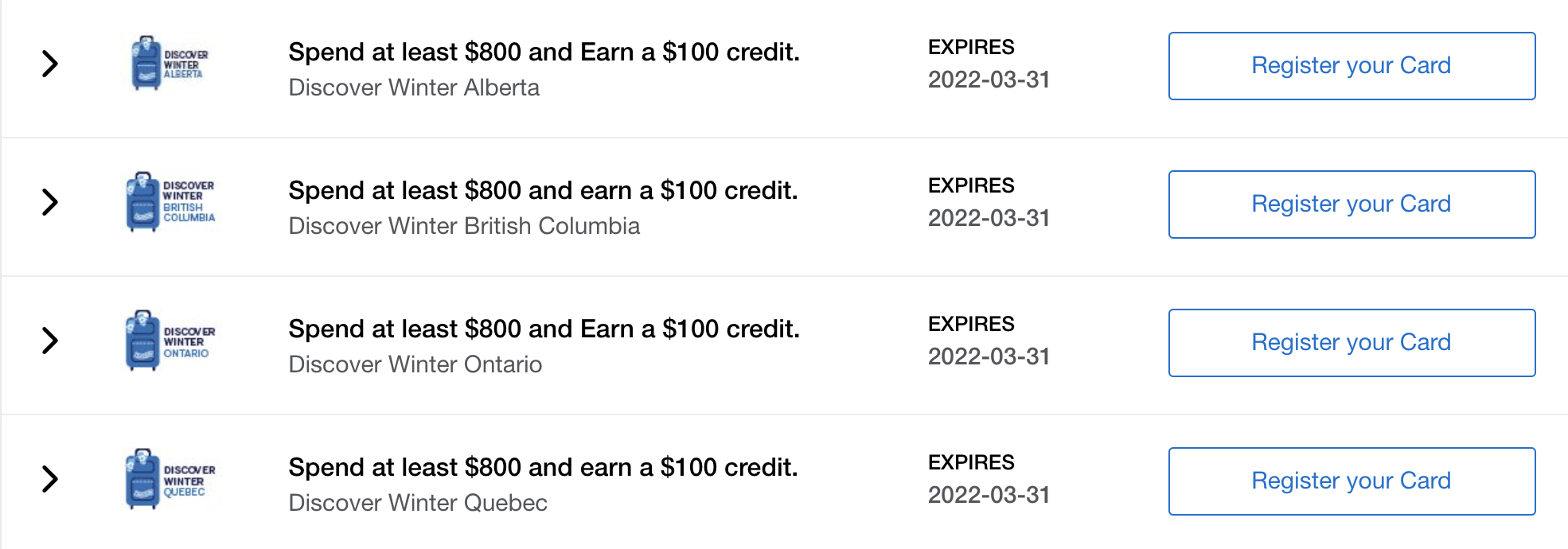

With the ongoing Discover Ontario Amex Offer, you’ll receive a $100 statement credit when you spend $800 or more at eligible hotels in the province. Since the $100 rebate goes directly on your credit card statement, the original hotel expense will contribute towards the tax credit allowance in full.

The Discover Ontario offer is redeemable at any hotel(s) in the province, as long as you book directly with the hotel. With this offer, Airbnb bookings, short-term rentals, and hotels booked through third-party websites will not qualify for the statement credit.

Furthermore, the Discover Ontario Amex Offer is cumulative across multiple transactions, so you can choose between a luxurious one-night stay at the JW Marriott The Rosseau Muskoka, a few nights at the Park Hyatt Toronto exploring downtown, or both if you wish.

Meanwhile, if you’re interested in exploring our national capital of Ottawa, then you can also take advantage of Ottawa Tourism’s ongoing promotion for a $100 gift card when booking two nights or more at eligible hotel.

The offer must be booked via Ottawa Tourism website, or directly with the hotel using a promotional code provided by Ottawa Tourism.

Hotels participating in this promotion include the Delta Ottawa and the Fairmont Ottawa Chateau Laurier. You can view the full list on the Ottawa Tourism website.

Although the 20% tax credit can be used until the end of the year, both the Discover Ontario Amex Offer and Ottawa Tourism promotion are only valid until March 31, 2022, so you may wish to front-load your staycation plans this year in order to maximize your savings.

How I’ll Use the Ontario Staycation Tax Credit

I’ve maintained my ties in Ontario despite currently spending most of my time in British Columbia. Therefore, I’m looking forward to using the Ontario staycation tax credit towards an effective 20% discount on a nice hotel stay the next time I’m passing through Toronto in the coming months.

Personally, I’d use this tax credit to save 20% on some of the luxury hotels in Toronto that I haven’t had a chance to try yet, such as the Shangri-La or the Four Seasons.

To maximize my savings, I’d combine it with the Discover Ontario deal. An $800 expense at either hotel would save me $100 via Discover Ontario, plus $200 via the tax credit, for a total 37.5% discount.

Furthermore, I’d book via Amex FHR, Virtuoso, or Four Seasons Preferred Partner to unlock extra perks on my stay, like space-available upgrades, breakfast, and late checkout. Booking through these platforms won’t affect the tax credit, since you still get billed by the hotel at the end.

Conclusion

If you live in Ontario and have your sights set on a staycation or intra-province getaway this year, the new Ontario Staycation Tax Credit can go a long way to help you explore all the province has to offer while simultaneously saving 20% on up to $1,000 spent.

Layering on current offers such as the Discover Ontario Amex Offer and Ottawa Tourism’s $100 gift card on a two-night stay will optimize these savings even further. However, keep in mind that these two special offers end on March 31, 2022, so don’t wait too long to start planning.

Can we still claim the expenses if part or all the hotel fees are paid with gift cards or points, such as Marriott Bonvoy?

In your $800 example, 20% tax credit is only $160 not $200. Therefore 32.5% saving not 37.5%

Hi Ricky, you should check the tax rules regarding residence for provincial individual income taxes. I believe it is based on where you physically reside on Dec 31 and you moved to BC last year. You may not be eligible for the Ontario tax credit.

We think alike! That was my first thought!