Maximize Your Earn, Part 1: American Express Credit Card Multipliers

We’ve all been there before: you’re in a rush to pay for something, and suddenly, you wonder if you’ve used the right credit card.

By using the right card, you’d be maximizing your earning potential on each and every expense. Many credit cards offer multipliers, or more points, on specific categories of spending, which means that one credit card may offer more points depending on what you’re buying.

In Part 1, we’ll focus on cards issued by American Express, while in Part 2, we’ll take a look at cards issued by other banks.

(For simplicity’s sake, we’ll only focus on Canadian cards that earn airline points currencies or their equivalent, as opposed to cash back cards or other types of points currencies).

Start with Your Goal

Before tackling spend multipliers, one has to consider what kind of points currency or currencies you want to accumulate. If you’re not sure, start by asking yourself these few questions:

- Where do I want to travel?

- Which airline do I wish to travel with?

- Which points currencies can I use to make my redemption happen?

If you don’t know where to begin, then a website like FlightConnections is a great place to start.

First, choose your destination or origin to see which airlines fly in and out of each. Next, figure out which alliances they are a part of, or which points currencies can be used to redeem for that particular airline.

Once you’ve figured that out, the next questions to ask are:

- Which credit cards earn the point currencies I want?

- Where do I spend my money?

- Is there a card that earns the point currency I want that offers a multiplier for my spend?

Demystifying Spending Categories

Below is a list of the most common categories that credit cards offer multipliers on:

- Dining, drinks, food delivery. This category includes restaurants, coffee shops, Uber Eats, and DoorDash.

- Groceries. Who doesn’t spend money on groceries? Take note that some cards include grocery stores as a part of eats and drinks, while others do not.

- Travel. This category includes flights, hotels, car rentals, cruises, and even tours.

- Transportation and gas. Some cards offer multipliers on gas only, while others offer multipliers for use of rideshare services, buses, taxis, and public transportation.

- Office supplies and electronics. These include spend on stores such as, but not limited to, Apple, Best Buy, and Staples.

- Drug stores. These generally include standalone drug stores like Shoppers Drug Mart and Rexall. It typically does not include pharmacies nestled within a bigger establishment, like a pharmacy located inside a grocery store or within Costco.

- Streaming subscriptions. These are increasingly popular, and include Netflix, Disney+, and other such services.

- Entertainment. This category generally includes movies, theatrical performances, and sales by ticket agencies. Unfortunately, theme parks don’t typically fall under this category.

As you can see, many of the things we spend money every day on can be earning you extra points – if you have and use the right card.

Which American Express Credit Card Should You Use?

One important factor in all this is which credit cards are accepted by your merchant. In the Canadian card game, it often boils down to whether they take American Express or not.

If they do, it’s great news, because there are a lot of earning opportunities here. If they don’t, you’ll have to look at your backup options issued by Visa or Mastercard.

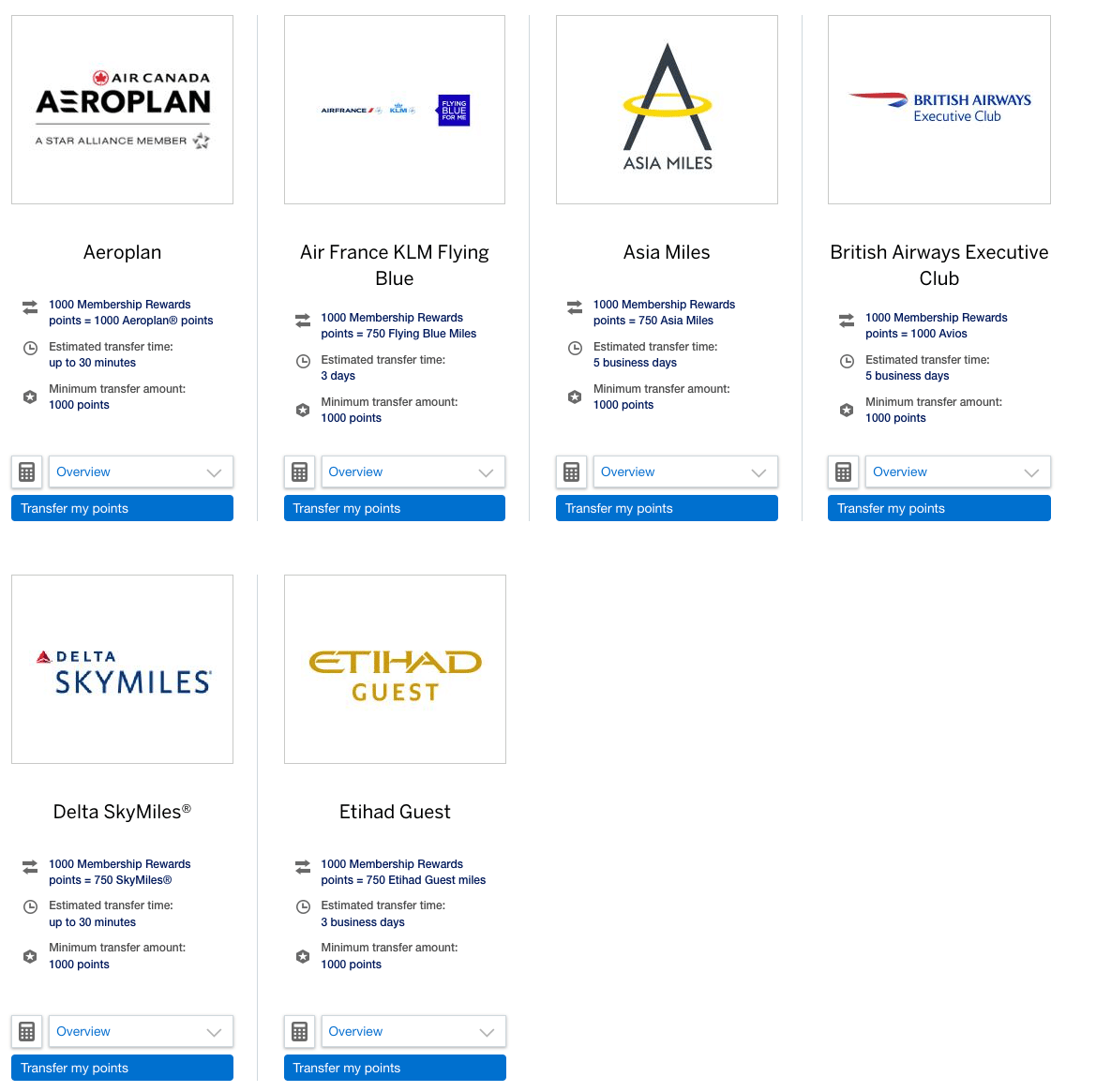

Amex cards earn their own points currency, known as Membership Rewards (MR) points. Canadian-issued Amex MR points can thus be transferred to six different airline loyalty programs, making it among the most valuable points currencies here in Canada.

Meanwhile, co-branded Amex cards will earn their affiliated partner’s currency. In Canada, there is only one airline with an Amex co-branded card: Air Canada.

Let’s take a look now at which Amex cards provide multipliers on specific categories of spend. Unless indicated, spend in all other categories can be otherwise assumed to earn one point per dollar.

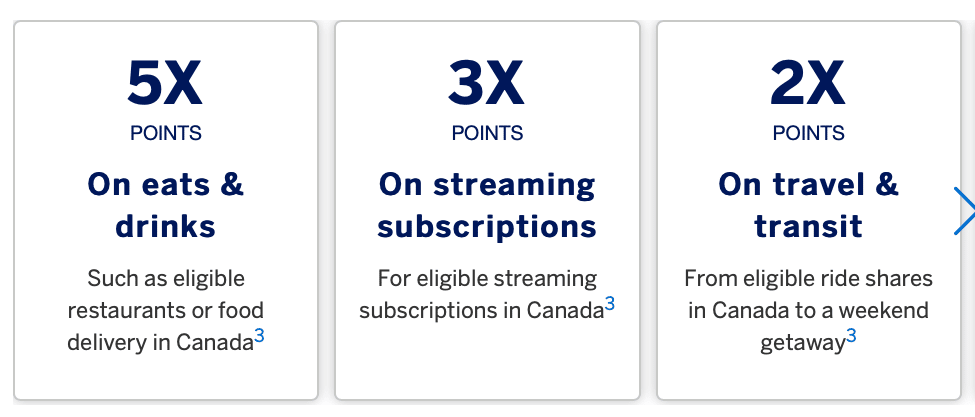

The Cobalt Card is a solid card when it comes to dining, drinks, and groceries. No other Amex card earns you 5x points in this category within Canada.

Depending on how much you spend in this category (up to a monthly maximum of $2,500), it could easily offset the low monthly fee of $12.99. In addition, it is the only Membership Rewards card to provide a multiplier for streaming subscriptions.

The Business Platinum Card is great for everyday spend as it earns 1.25x on everything.

However, if your business can spend exactly $20,000 each quarter per year, the Business Gold Card is a solid option as well thanks to its quarterly bonus of 10,000 MR points for reaching that spend threshold, especially given that it has a lower annual fee than the Business Platinum.

If you’re solely looking to collect Aeroplan points and fly primarily with Air Canada, then the Aeroplan Reserve Card will give you a minimum of 1.25x points per dollar on all non-category spending, in addition to its other multipliers. On the business side, the Aeroplan Business Reserve Card also shares the same 1.25x non-category spend multiplier.

If you have a lot of electronic or office supplies expenses with your business, then hopefully you hold the , which is the only card to provide multipliers on these categories, and for the low annual fee of $99. Unfortunately, this card is .

If travel for work or leisure makes up a big proportion of your spend, then the Gold Rewards Card used to be a solid card for travel with its 2x multiplier.

However, since the Platinum Card earns 2x on travel, but comes with better travel insurance and an annual $200 travel rebate, it’s a bit of a toss up – which brings us to the next point.

Other Considerations

The assumption in the above chart is that you hold all the Amex cards and simply need to choose between them based on the multipliers. The reality, however, is that you may only have or want to hold one, two, or a few Amex cards.

Before jumping to the conclusion of which card is the better one to have based solely on its earning rates, you should consider the sign up bonus with a new card, its annual fee, and any additional benefits with the card that add to its value.

For example, the earning rate for dining on the Platinum Card is only 3x compared to the Cobalt Card’s 5x. However, the Platinum Card includes superior insurance policies, Priority Pass lounge access, elite status with several hotel chains, and a $200 annual travel credit, whereas the Cobalt does not.

For all those additional perks, you’ll be paying an annual fee of $699 for the Platinum Card, whereas you’ll only pay $155.88 annually ($12.99 each month) for the Cobalt Card. Which one you invest in will depend on your personal spend and travel habits.

Many people find it valuable to hold both, but ultimately, each individual will have to weigh the cost of each card with the benefit of its multipliers to decide which card they should have, keep, and use.

Merchant Category Codes

To wrap things up, it’s important to understand Merchant Category Codes (MCCs) and why they matter.

Once in a while, you may expect to get a multiplier on a purchase because you feel a merchant falls under one of the above categories, but the multiplier doesn’t come through. This could be because the merchant has registered themselves under a different type of business than you expected.

All merchants are required to register their business under an MCC. An MCC is a number that identifies the type of business a merchant is engaged in and it is what credit card companies use when awarding multipliers.

For example, the MCC for a restaurant is “5812”. If you dine at a merchant that mainly does catering but also serves food on the side, and don’t get the multiplier, it could be that the merchant has classified themselves as a caterer, which has the MCC “5811”, rather than a restaurant.

In this case, you won’t get the restaurant multiplier.

Conclusion

Hopefully after reading this, you’ll grab the right Amex card to pay for your next purchase. You’ll still have to do a bit of leg work to see which card has the best cost-benefit ratio, despite knowing which has the best categorical multiplier.

If you still can’t keep track of it all, feel free to bookmark this article for future reference.

However, we know that American Express is not always accepted by certain merchants, so it’s important to be aware of multipliers on non-Amex cards and how they may play a role in this decision-making process.

Amy is an avid traveller and having three kids has not slowed her down. Through leveraging travel rewards, she continues to explore the world with her family in a fun and memorable, yet affordable way.

First-year value

$1,581

Annual fee: $799

• Earn 80,000 points upon spending $10,000 in the first 3 months

• Plus, earn 30,000 points upon spending in month 13

Earning rates

Key perks

- $200 annual travel credit

- $200 annual dining credit

- $100 NEXUS credit

- Unlimited Priority Pass lounge access

- Marriott Bonvoy Gold Elite status

- Platinum Concierge

Annual fee: $799

• Earn 80,000 points upon spending $10,000 in the first 3 months

• Plus, earn 30,000 points upon spending in month 13

Earning rates

Key perks

- $200 annual travel credit

- $200 annual dining credit

- $100 NEXUS credit

- Unlimited Priority Pass lounge access

- Marriott Bonvoy Gold Elite status

- Platinum Concierge

Comments

Create a free account or become a member to comment.