When it comes to understanding the ins and outs of personal finance, there can often be a steep learning curve. Between budgeting, debt management, and planning for the future, the whole subject can be quite overwhelming.

Credit scores are often a source of financial concern, and it’s not uncommon to be unsure about what your credit score means and why it changes, or even what your score is.

To help you improve your knowledge around this aspect of your finances, this article will go over the basics about credit scores in Canada, including what they are, how they’re used, how to check yours, and how you might improve your credit score over time.

In This Post

Credit Score Basics

In Canada, a credit score is a three-digit number that is designed to represent how likely it is that you’ll pay your bills on time (i.e., your credit risk). Your credit score is calculated based on information in your credit report, which we’ll talk about below.

Building a good credit score is important as it helps lenders determine your capacity to acquire and maintain credit, and this, in turn, helps you get approved for personal loans, mortgages, and of course, credit cards.

The better your credit score, the more lending options will be available to you and the more access you’ll have to competitive interest rates.

Canada has two main credit bureaus, Equifax and TransUnion, that calculate and provide credit scores. These two companies assess information from banks, credit card issuers, collection agencies, and more to track how you use your credit and to determine your overall credit score.

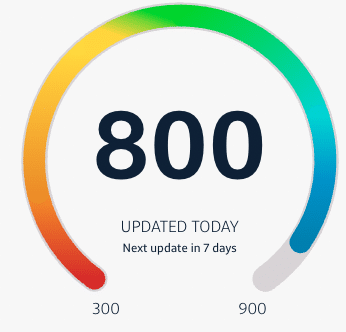

A credit score typically ranges from 300 to 900 and is categorized as Poor, Fair, Good, Very Good, and Excellent.

The ranges used to determine which of these categories you fall within change depending on which credit bureau’s model you use, but according to Equifax, the category ranges break down as follows:

- Excellent: 760–900

- Very Good: 725–759

- Good: 660–724

- Fair: 560–659

- Poor: 300–559

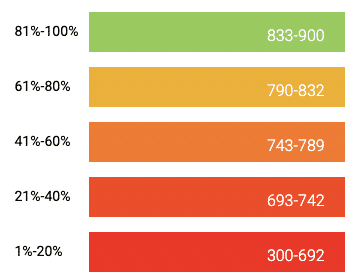

TransUnion uses a bit of a different approach, in that the scores are broken down into 20% bands, each representing the proportion of Canadians with a score in that range.

- 81–100%: 833–900 (Excellent)

- 61–80%: 790–832 (Very Good)

- 41–60%: 743–789 (Good)

- 21–40%: 693–742 (Fair)

- 1–20%: 300–692 (Poor)

You can think of each 20% block as Excellent, Very Good, Good, Fair, and Poor, although it’s not the terminology used by Transunion.

Additionally, according to Equifax, with most credit models, typically the best score you can hope to get is around an 850, towards the top end of Excellent.

You may also find that your score differs slightly depending on which credit bureau it comes from, how you access it, and when the data was last updated.

How Are Credit Scores Calculated?

As we mentioned above, your credit score is calculated based on information taken from your credit report. So, what exactly is a credit report?

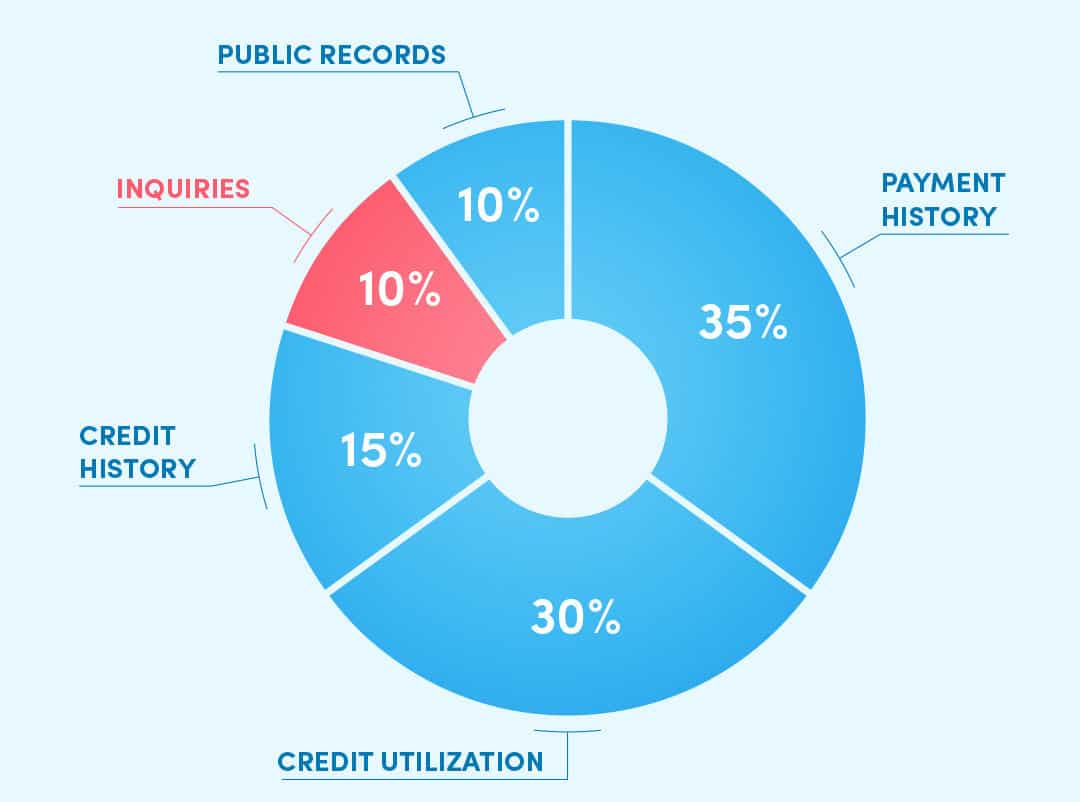

Your credit report is a summary of your credit history and is made up of five categories:

- 1. Payment history, accounting for 35% of your credit score. This category looks at whether you pay your bills on time, the number and type of credit accounts, delinquent accounts, collections information, and more.

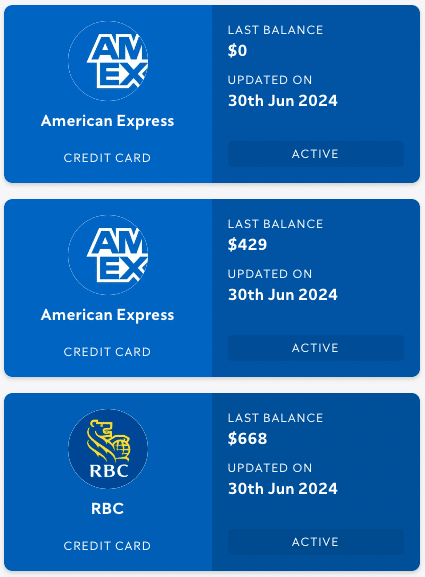

- 2. Amounts owed and credit utilization, accounting for 30% of your credit score. This category looks at what percentage of your available credit is being used.

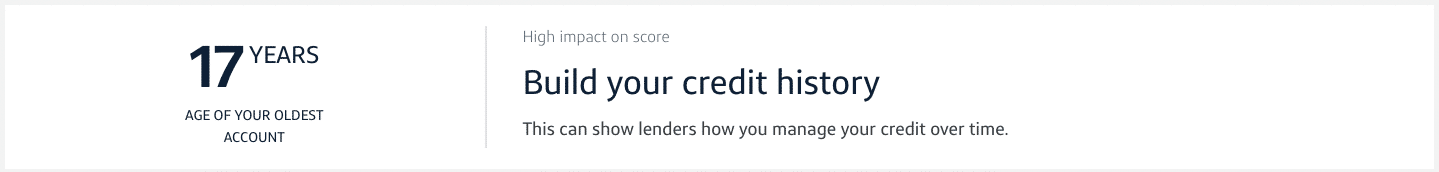

It is generally accepted that using only up to around 30% of your available credit at any given time demonstrates good credit utilization. Lenders may see the use of more than 30% of your available credit as a sign of financial distress. - 3. Length of credit history, accounting for 15% of your credit score. This category looks at the age of your credit accounts. In general, lenders like to see that you can manage an account over a long period of time, so it’s to your advantage to keep older accounts open even if you aren’t using them.

- 4. New credit applications, accounting for 10% of your credit score. This part of your credit report is affected when you seek new credit (like a credit card or loan), and the application requires an inquiry (known as a “hard inquiry” or “hard pull”) into your credit history.

- 5. Public Records, accounting for 10% of your credit score. This category refers to records of bankruptcies and/or consumer proposals, which can have a negative impact on your credit health.

When you look at your credit report, the information will likely not be spelled out so neatly into categories, but this should give you an idea of what might be causing your score to go up or down.

It’s also important to remember that these factors are weighted. This means that your payment history and credit utilization have much more influence over your credit score than the hard inquiries done when applying for a new credit card or two.

That said, it’s in your best interest to be aware of all the factors that go into your credit score, so that you can understand any changes that occur as you pay down debt, apply for new credit, or work to rebuild your score after a period of financial hardship.

How Do I Check My Credit Score?

You can check your credit score a few different ways.

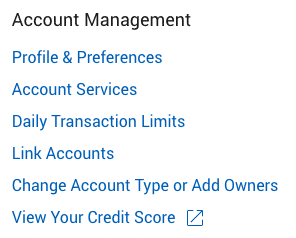

Many Canadian banks offer their clients the ability to check their credit score for free through their websites or apps. In these cases, you simply need to click on the provided link (often listed under Bank/Other Services or on a side menu), and the bank will show you your score.

The score you see through your bank is generated by one of the two credit bureaus in Canada (Equifax and TransUnion), and you can find details with your credit score and credit report to confirm which bureau has provided the information.

You can also access your credit score and credit report through Equifax and TransUnion directly on their websites; however, both companies do charge a fee if you go this route.

Additionally, there are other financial websites such as Borrowell, Credit Karma, and ClearScore that pull your credit score information from Equifax and TransUnion and then package it with financial tips and product offers.

How Do I Improve My Credit Score?

If you’re looking to improve your credit score, the first thing you’ll want to do is to find out your score and learn about what factors are affecting it.

As mentioned earlier, there are five factors that affect your credit score: credit history, credit utilization, length of credit history, new applications/inquiries, and public records (bankruptcies and consumer proposals).

To improve your credit score, it’s a good idea to first review your credit report to make sure everything is accurate and that there are no unpaid balances that you’ve forgotten about (e.g., that $4 left unpaid on a credit card you threw in a kitchen drawer and forgot about a year ago).

You also want to make sure that you pay all of your bills on time and in full whenever possible. Since payment history makes up a considerable chunk of your score, it’s important to not have late payments.

As we mentioned earlier, it’s a good idea to keep your credit utilization rate below 30% of your available credit. If you’re not there already, this can be done by either paying down balances or asking your credit lenders for a credit limit increase.

When you’re trying to improve your credit score, it’s a good idea to limit the number of new credit applications you submit.

Now, this doesn’t mean that you shouldn’t apply for a new credit card; it just means that you should be thoughtful and strategic about which cards you apply for so that you limit the number of hard inquiries to your account.

A final thing that’s recommended in order to improve your credit score and maintain it in good standing is to keep your oldest accounts open, even if you’re no longer using them. These old accounts help with the length of credit history category by demonstrating your ability to manage a credit account over a long period of time.

In terms of how long it takes to improve your credit score and when you can expect to see the number tick upwards – this will depend on the negative factors that affected your score in the first place.

It will take less time to improve a score after a single late payment or a few hard inquiries from credit card applications than it will to improve your score after a bankruptcy or consumer proposal.

Although the process will take effort and patience, having a good credit score is helpful in so many ways, not least of which, the fact that it improves your ability to get your choice of credit cards to use in your Miles & Points journey.

Conclusion

Credit scores can be confusing, but it’s really important to know what yours is and how they work.

By building your knowledge and your credit score, you are well positioned to borrow money for big purchases like a home, and you’re able to enjoy fun hobbies using Miles & Points to fund your travel dreams.

Hopefully this article has helped you grow your financial confidence, and if you’d like to learn how to use your credit score to power amazing travel experiences, sign up for our newsletter to get a weekly snapshot of what’s happening in the Miles & Point world.