It’s a piece of personal finance wisdom that has become ingrained as gospel: avoid hurting your credit score at all costs. Without a strong credit history, it’s harder to get approved for credit cards and other types of loans.

Credit cards present an excellent opportunity to earn rewards, and each new card comes with a new bonus. But the act of applying for credit momentarily hurts your credit history, which hurts your ability to apply for the next card.

Fortunately, there are a few ways to avoid credit inquiries when applying for a new card, and to minimize the impact of credit inquiries when you do have to incur them.

What Is a Credit Inquiry?

There are two credit bureaus in Canada: Equifax and TransUnion. Whenever you open a credit account (such as a credit card, mortgage, or loan), the lender reports your credit activity to the credit bureaus. The bureaus keep track of your personal credit history, including payment history, credit limits, and credit-seeking events, among other things.

When you apply for new credit, the lender pings one or both of the credit bureaus for this information. They use your existing credit file to assess your creditworthiness at that time. This is called a credit inquiry.

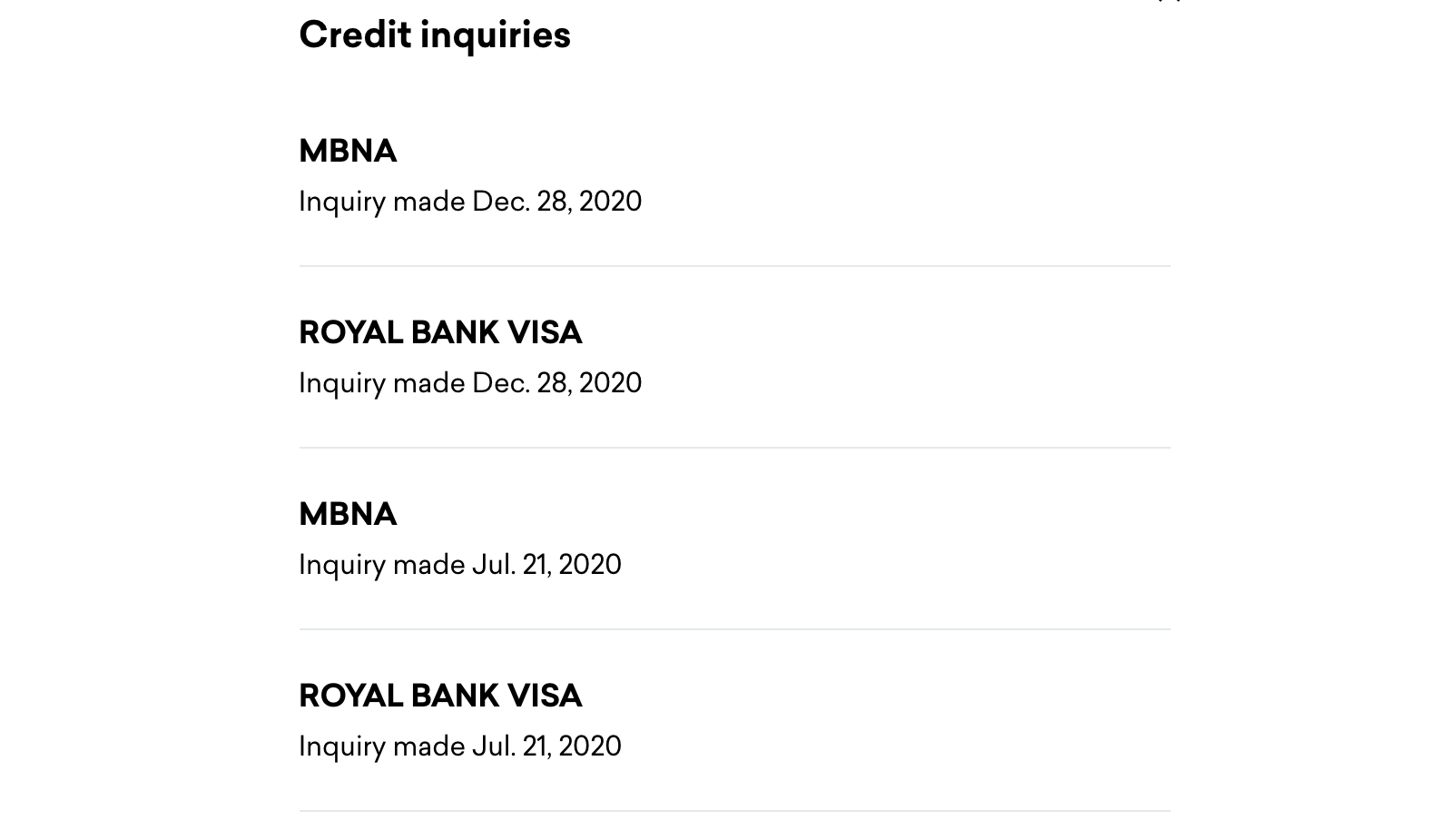

Inquiries are tracked on your credit history as credit-seeking events. When a lender performs an inquiry, they’ll see all past inquiries on file. And when you apply for another card in the future, that issuer will see an inquiry from today.

You can view your credit report for free, to track what the bureaus track and see what the banks see. You can access your TransUnion report at CreditKarma and your Equifax report at Borrowell.

How Do Inquiries Affect Your Credit Score?

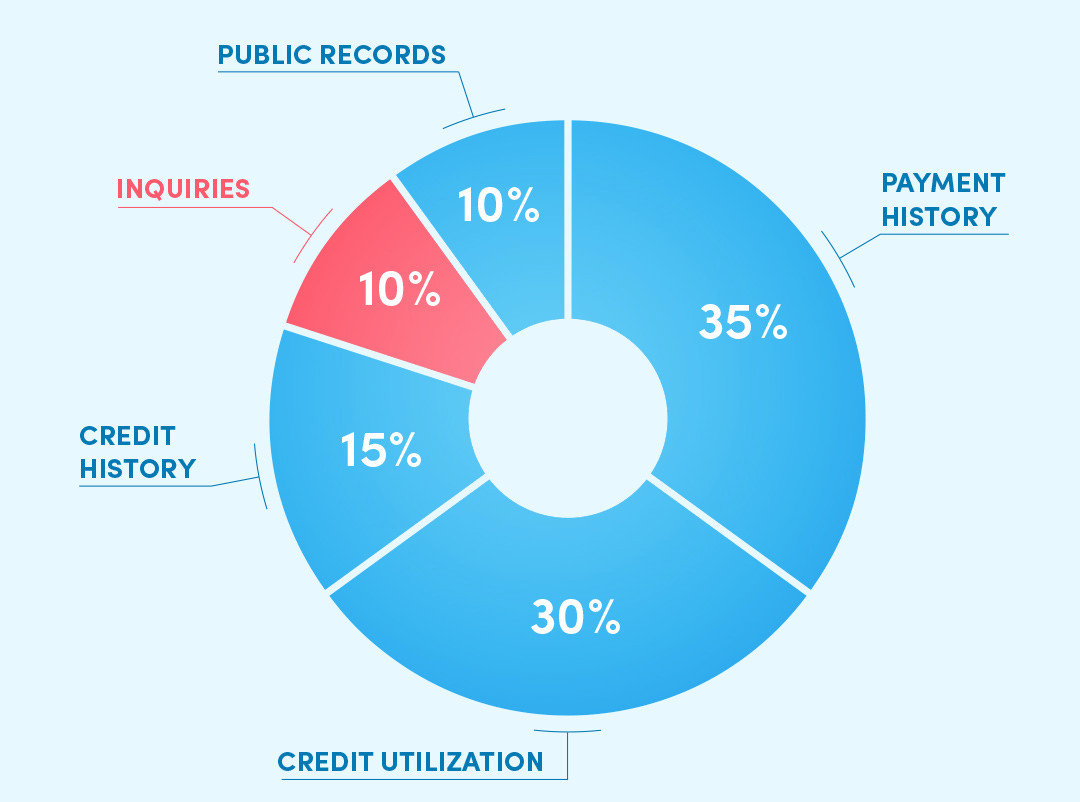

Equifax and TransUnion use proprietary formulas to calculate your credit score. Your score is a number between 300 and 900, based on a handful of factors that represent your creditworthiness. New credit applications make up 10% of the calculation.

However, banks also have their own criteria to evaluate whether to lend to you. It’s better to think of your credit score as more of a guideline that’s visible to you, and not as a perfect representation of how the bank sees you or which cards you’ll be approved for.

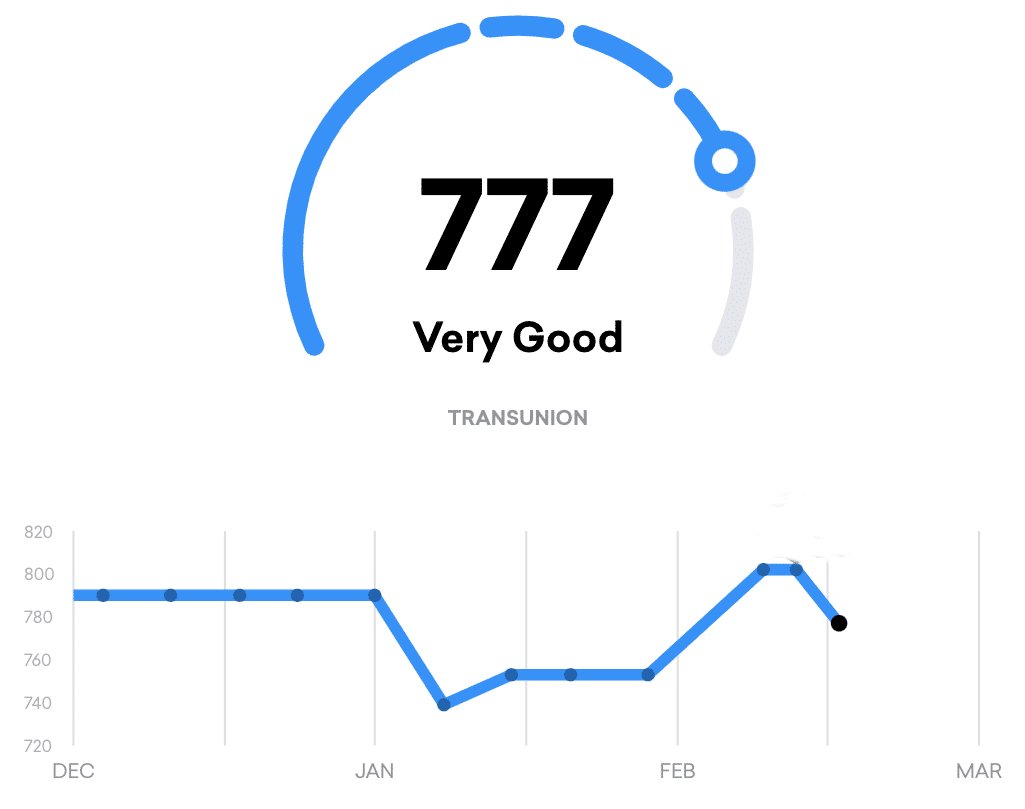

Generally speaking, it’s good to keep your scores above 700, preferably higher. I personally target 750, and haven’t seen a significant difference in terms of credit approval at higher levels than that.

The amount your score drops for each inquiry will vary due to other credit factors, but it’s typically about 10 points per inquiry, before recovering over the next six months. In any event, the underlying factors matter more than the number itself.

Why Is It Important to Minimize Credit Inquiries?

Since the “inquiries” criterion accounts for 10% of your overall credit score, each new inquiry leaves a small and temporary ding on your file. Therefore, if you apply for too many cards in a short span of time, lenders will be less likely to approve you.

After all, excessive credit-seeking behaviour implies a risk that you might not repay your debts, even if you have a spotless record of decades of on-time payments.

For that reason, there’s an opportunity cost for every credit inquiry. You can’t recklessly apply for every credit card. If you’ve been pursuing too many low-value offers or cards that don’t align with your goals, you might later get rejected for offers that are truly worth it.

As hard as we try to plan our credit inquiries and new cards in advance, flexibility is essential. It’s good to have wiggle room in case you do get a rejection, or if an offer that’s too good to pass up unexpectedly appears.

Of course, no matter how long or strong your credit history is, you really won’t know what the limit is until you start getting rejections – so feel free to push the boundaries! Just be sure to monitor your score and take breaks if your score gets below a certain point.

What Is a Soft Inquiry?

Credit inquiries are also known as “hard inquiries”, or informally, “hard pulls”.

Every time a potential issuer does a hard pull, it appears on your credit report as a credit-seeking event. When you apply for another credit card in the future, the bank will see these past inquiries and consider them as they see fit.

Credit issuers should only do a hard pull when they are determining whether to extend additional credit to you, and only with your consent.

Sometimes, companies check-in with your credit file when you are not requesting additional credit. For example, many services partner with credit bureaus for identity verification or to show you your credit report. Also, banks occasionally update their internal scores for their clients, to refresh your risk profile and to pre-approve you for future offers at their own discretion.

These checks are called “soft inquiries” because they aren’t a credit-seeking event initiated by the consumer. They won’t ever affect your ability to be approved by any lender.

You don’t need to worry about them at all – in fact, we’re completely unaware of soft pulls unless we request to see our full report directly from the credit bureau.

As you can see, fascinating stuff.

How to Minimize the Impact of Credit Inquiries

Because credit inquiries are a limited resource, it’s important to get as much value out of them as possible.

Apply for Several Cards Together

Affectionately known as the “app-o-rama”, you can apply for cards at different banks on the same day. That way, the negative impact of the inquiries will fade at the same time, at which point you can reload for another round of applications with higher chances of approval.

Inquiries appear on your file immediately. If you click “apply” for two cards at literally the same time, one lender might not see the other’s inquiry, but I wouldn’t rely on a race condition. If you’re worried about approval, always apply for the card you want more first.

If you open several cards on the same day, the minimum spend periods will overlap. This strategy is only useful if you can hit all of those thresholds at the same time, and stay organized. If not, it’s better to tackle them one at a time and spread out your applications to fit your spending power.

Whether you stack or spread out your inquiries, you can successfully be approved for many credit cards. This trick isn’t necessary to maintain a fast pace, but it can help with long-term planning. The prospect of a clean file down the line is always appealing, especially when you intend to apply with a stingy lender.

Juggle Between Two Credit Bureaus

Both credit bureaus generally hold the same information, with one key exception.

When a lender does a credit inquiry with one of the bureaus, that inquiry won’t show up on the other bureau. As a result, the bank will only see past inquiries against the same bureau, not against the other one.

As banks pretty reliably always pull from the same bureau, you can plan your applications in advance with this in mind.

If you’ve had heavy action on your TransUnion file recently, consider applying for cards offered by banks that pull from Equifax, and vice versa. Or, if you’re planning an important application with a bank that pulls from TransUnion, you can cool off your TransUnion inquiries in preparation, while maintaining a steady stream of new cards by focusing on Equifax banks.

While this won’t reduce the number of inquiries, it will reduce the number of inquiries that a lender will see – and that’s really what matters anyway.

Also, while inquiries only report to one bureau, credit accounts always report to both. So while you can juggle the impact that inquiries have on your file, you can’t do the same with other components of your credit report like average age of accounts or utilization.

Here’s a guide to which credit card issuer pulls from each bureau, as per the most recent data we’ve gathered. The bureaus are split pretty evenly amongst Canada’s financial institutions, so it’s easy to spread out your credit inquiries between them.

Equifax | TransUnion | |

American Express | ✓ | |

BMO | ✓ | |

Brim | ✓ | |

Canadian Tire | * | ✓ |

Capital One** | ✓ | ✓ |

CIBC | ✓ | |

Desjardins | ✓ | |

HSBC | ✓ | |

Home Trust | ✓ | |

MBNA | * | ✓ |

Meridian | ✓ | |

National Bank | ✓ | |

PC Financial | ✓ | |

RBC | ✓ | |

Rogers Bank | ✓ | |

Scotiabank | ✓ | |

Tangerine | ✓ | |

TD Bank USA | ✓ | |

TD Canada Trust | ✓ | |

Vancity | ✓ | |

Most credit unions | ✓ |

* Some banks may pull from the other bureau if they need more information or are unable to find your file.

** Capital One is known for pulling from both bureaus for all new applications.

Open a Credit Card Without an Inquiry

I particularly like this strategy, because I can keep earning bonuses while saving my inquiries for other applications where these methods don’t work.

As a card reaches the end of its life cycle, you can do a product switch to a different card. Closing the card and applying for a new one would trigger a new inquiry. This way, you avoid the inquiry but still get a new card. Note that not all banks allow product switches, and not all product switches will be eligible for the same welcome bonus that you’d get with a new application.

If you have a credit card from an issuer and want to open another one with them, see if they’d be willing to split credit off of your existing account. The bank shouldn’t do an inquiry, because you’re not requesting new credit, you’re just reallocating credit that they’ve already extended to you.

Some banks also let you reuse a recent credit inquiry. For example, CIBC will keep an inquiry on file for up to three months when you apply for products in-branch, and can reuse the inquiry within that three-month period. Issuers like American Express may even skip the inquiry for an existing longstanding client.

This trifecta of tactics isn’t strictly about minimizing the impact of an inquiry. Instead, it’s about maximizing the value of an inquiry, which is really just the other side of the same coin. Either way, you’re looking to add as much value as you can with a limited number of credit inquiries available.

Don’t Waste Inquiries

While we can never predict for sure if we’ll be approved or rejected, we still want to set ourselves up for success with every inquiry, as best we can. We can try to piece together trends and expectations based on word-of-mouth anecdotes.

If you have good reason to believe that you might not be approved, it might be prudent to skip the application altogether. Here are a few situations where that could be the right choice:

- Any cards that require a strong credit history, if yours is short or poor

- Any banks that are sensitive to credit-seeking behaviour, if you have a high number of recent inquiries

- Any banks that have tightened their lending standards for any reason

- Any banks that are more likely to ask for income verification or a branch visit to finish the application, if you aren’t able or willing to do so

That said – no risk, no reward! If you’re willing to risk burning a credit inquiry, consider the value of the offer you want, and the strength of other offers with better odds of approval.

And in the unfortunate event that you do get rejected, don’t be afraid to call for reconsideration. Sometimes there’s an error on your application, perhaps you can push your application forward as a secured credit card, etc. If possible, it’s always good to salvage some value for the credit inquiry. Check with the issuer to see what your options are.

Conclusion

A strong credit score is undoubtedly useful, but it isn’t much more than a vanity unless you plan to benefit from it. Credit card rewards are a great way for anyone to use their healthy credit history for something worthwhile.

It’s always a balancing act between applying for new cards now, and gearing up for future applications. Thankfully, it’s not one or the other, and there are a number of ways to pursue both goals at the same time. These include applying for several cards at once on three-month or six-month cycles, juggling across the two bureaus, and maximizing the value of each credit inquiry.

A little bit of planning goes a long way, and you can try any combination of these strategies to manage your credit inquiries while maintaining a steady influx of new credit cards.