American Express offers a handful of products for business owners who want to earn travel rewards. Two of the most popular cards in the lineup are the Business Platinum Card from American Express and the American Express Aeroplan Business Reserve Card.

Both cards command higher-than-average annual fees, but offer a commensurate amount of perks to help justify the costs on an ongoing basis.

In this edition of Head-to-Head, we’ll compare and contrast these two cards to help guide your decision as to which one suits you best.

Card Basics

When deciding between two credit cards, the most important comparisons will always be made on a few key factors.

1. Welcome Bonus

As premium cards, both the Business Platinum Card from American Express and the American Express Aeroplan Business Reserve Card are known to offer generous welcome bonuses.

As it stands, the welcome bonus on the Business Platinum Card is for up 120,000 Membership Rewards (MR) points, structured as follows:

- 80,000 MR points upon spending $15,000 (all figures in CAD) in the first three months

- 40,000 MR points upon making a purchase in months 14–17 as a cardholder

It’s worth noting that you’ll have to pay the annual fee twice before you receive the full allotment of points from the welcome bonus, and that the minimum spending requirement is quite high. However, 120,000 MR points is currently the most generous welcome bonus available in Canada, and is well worth the pursuit.

Meanwhile, the current welcome bonus on the American Express Aeroplan Business Reserve Card is for up to 95,000 Aeroplan points, structured as follows:

- 70,000 Aeroplan points upon spending $10,500 in the first three months

- 25,000 Aeroplan points upon spending $3,500 in month 13

The total welcome bonus is less than what’s offered on the Business Platinum, and you’ll also have to keep track of and spend $3,500 in month 13 as a cardholder. On the other hand, the minimum spending requirement in year one is lower than the Business Platinum Card, while offering a comparable (albeit lower) amount of points.

Verdict: Both cards offer generous welcome bonuses with similar structures that award points in each of the first two years. However, the total amount offered through the Business Platinum is greater than the Amex Aeroplan Business Reserve, and it comes without a minimum spending requirement in year two.

Therefore, we’ll side with the Business Platinum in this measure, keeping in mind that both offers are subject to change at any time.

2. Annual Fee

The Business Platinum Card comes with an annual fee of $799, while the Aeroplan Business Reserve comes with an annual fee of $599. However, the Business Platinum Card comes with a $200 annual travel credit, which could arguably offset the annual fee to be equal to the Amex Aeroplan Business Reserve.

Verdict: We’ll side with the Amex Aeroplan Business Reserve this time, since its annual fee is $200 lower than the Business Platinum’s.

3. Points Currencies

Another very important consideration to keep in mind is the type of points earned on both cards.

With the American Express Aeroplan Business Reserve Card, you’ll earn Aeroplan points that get deposited directly into your Aeroplan account after your statement posts each month. The most valuable way to redeem Aeroplan points is for flights, and you can also redeem them for hotel bookings and merchandise at a lower value.

Meanwhile, you’ll earn American Express Membership Rewards points with the Business Platinum Card from American Express, which accumulate in your account on an ongoing basis.

MR points can be transferred to Aeroplan at a 1:1 ratio, and they can also be transferred to a number of other popular airline and hotel loyalty programs, including British Airways Executive Club, Air France KLM Flying Blue, Marriott Bonvoy, and more.

Plus, you can also redeem MR points for a statement credit on any purchase, or you can redeem them through Amex Fixed Points Travel.

Verdict: Since Membership Rewards points can be transferred to Aeroplan and a number of other programs, in addition to being used for a statement credit or booking through Amex Fixed Points Travel, they’re more flexible than Aeroplan points. Therefore, we’ll once again side with the Business Platinum.

4. Earning Rates

The Business Platinum Card has one of the most straightforward earning structures out there: 1.25 MR points per dollar spent on all purchases.

Meanwhile, the Aeroplan Business Reserve grants cardholders the following:

- 3 Aeroplan points per dollar spent on Air Canada and Air Canada Vacations purchases

- 2 Aeroplan points per dollar spent on hotels and car rentals

- 1.25 Aeroplan points per dollar spent on everything else

Both cards have the same baseline earning rate of 1.25 points per dollar spent. The extra 0.25 points per dollar spent can certainly add up over the course of a year if you spend in high volumes, and it’s a nice perk available on most premium credit cards.

However, only the Amex Aeroplan Business Reserve Card offers other category multipliers, which are notably geared towards travel-related purchases rather than other common business expenses.

Verdict: If you’re a frequent flyer with Air Canada, the Amex Aeroplan Business Reserve Card offers an excellent earning rate for flights and vacations. The bonus points for hotels and car rentals is also competitive; however, it’d be great to see other common business spending categories added here as well.

If you have high volumes of spending in these categories, then the American Express Aeroplan Business Reserve Card would offer a stronger return. Otherwise, consider the Business Platinum Card for the same baseline earning rate, and more flexible points.

5. Foreign Exchange Fees

Both products continue to levy the industry-standard 2.5% foreign transaction fee on purchases in a foreign currency. There certainly doesn’t seem to be much appetite among Canadian card issuers besides Scotiabank in removing this fee anytime soon; however, a change to the status quo would be great to see.

Verdict: A dull draw.

Perks & Benefits

At annual fees of $799 and $599, these products aim to justify their hefty price tags via bundles ongoing cardholder benefits.

1. Lounge Access

The Business Platinum’s lounge benefits are among the best in Canada. It provides unlimited access for the cardholder and one guest to thousands of lounges worldwide through the American Express Global Lounge Collection.

Meanwhile, the American Express Aeroplan Business Reserve Card provides the cardholder and one guest unlimited access to Maple Leaf Lounges and Air Canada Cafés within North America. However, keep in mind that you need to be travelling on an Air Canada or Star Alliance flight (as opposed to any airline) to enjoy lounge access.

Verdict: On the whole, the Business Platinum Card’s lounge benefits will elevate your pre-flight experience on a broader basis than the Aeroplan Business Reserve.

2. Priority Airport Services

Like the other premium Aeroplan credit cards, the Aeroplan Business Reserve offers cardholders a considerable number of perks when flying with Air Canada: a free first checked bag, priority check-in, Zone 2 priority boarding, priority standby, and priority baggage handling, as well as a higher priority on the upgrade list.

The Business Platinum Card’s airport services are comparatively more limited, and only include valet services, parking discounts, and express security lane at Toronto Pearson – which are matched by the Aeroplan Business Reserve.

Verdict: The Amex Aeroplan Business Reserve is victorious in this category, since its priority airport services are much stronger, as long as you’re flying with Air Canada.

3. Elite Status Benefits

With the Business Platinum Card from American Express, you’ll enjoy Marriott Bonvoy Gold Elite status and Hilton Honors Gold status upon enrollment.

On the other hand, the Aeroplan Business Reserve makes the path of achieving and maintaining Aeroplan Elite Status easier, but doesn’t actually instantly earn you any status on its own.

Instead, you’ll earn 1,000 Status Qualifying Miles (SQM) or 1 Status Qualifying Segment (SQS) per $5,000 in eligible spending, and can rollover up to 200,000 SQM and up to 50 eUpgrades to the following year.

Keep in mind that the SQM you earn count towards Threshold Rewards, which can become very meaningful with high amounts of spending.

Verdict: The Business Platinum grants instant mid-tier status with Marriott Bonvoy and Hilton Honors, while the Aeroplan Business Reserve opens more doors towards achieving a higher Aeroplan Elite Status level, although you’ll still have to meet the Status Qualifying Dollar (SQD) requirements.

It’s a pretty close comparison here, but there’s more to gain with the American Express Aeroplan Business Reserve Card, especially for high-volume spenders.

4. Threshold Benefits

Like the personal side, the Aeroplan Business Reserve allows cardholders to earn an Annual Worldwide Companion Pass for travel on Air Canada, starting at $99 as the companion fare, with $25,000 in annual spending.

If used strategically, the pass can result in hundreds of dollars in savings, and sometimes even more.

There are no threshold-based benefits on the Business Platinum Card from American Express.

Verdict: The singular benefit on the Amex Aeroplan Business Reserve is better than the absence of any published threshold benefit on the Business Platinum Card, where heavy spending will only earn you a chance of a nice retention offer at the end of the year, at best.

5. Other Benefits

Here, the comparison lies between the Business Platinum’s “Platinum family” benefits like the Amex Concierge, access to the Fine Hotels & Resorts program and International Airlines Program, additional statement credits for Dell, Indeed, and wireless accounts, and the $200 annual travel credit.

Meanwhile, the Aeroplan Business Reserve offers preferred pricing on Air Canada flights under the dynamic pricing model, and no expiration of Aeroplan points for as long as you’re a cardholder.

Both cards have access to Amex Offers, and typically get the most attractive ones, since they’re both premium cards.

Verdict: While extra card benefits are only meaningful if you engage with them, those offered on the Business Platinum Card outweigh the extra benefits offered on the Aeroplan Business Reserve.

Other Factors

Finally, let’s take stock of the cards’ remaining benefits and any other considerations that might sway your choice in either of their favour.

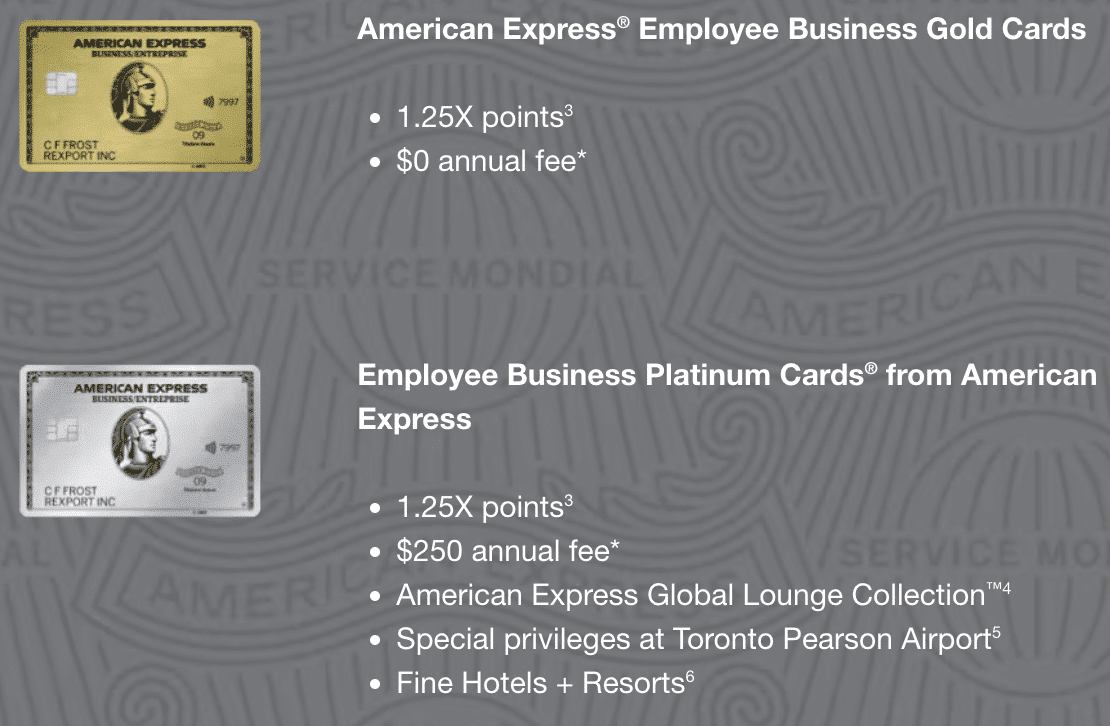

1. Supplementary Cards

Adding supplementary cards on the Aeroplan Business Reserve Card costs $199, and cardholders will enjoy some of the same perks as the primary cardholder, including unlimited lounge access, priority airport services, and preferred pricing.

There’s also the option to add no-fee supplementary cards; however, those come without any additional perks for the cardholder.

On the other hand, adding a supplementary cardholder to your Business Platinum Card will cost $250 per person. They’ll also enjoy unlimited lounge access through the Amex Global Lounge Collection, access to Fine Hotels & Resorts, and priority services at Toronto Pearson.

You can also add additional Business Gold Cards for free, but the cardholders won’t enjoy any of the Business Platinum Card’s features.

Verdict: There’s no clear winner here, as both products are pretty generous about treating authorized users to many of the same key benefits, while the pricing is fairly evenly matched. Let’s call this one a draw, since the Aeroplan Business Reserve’s benefits are tied to Air Canada, while the Business Platinum Card’s benefits are universal.

2. Travel Insurance

Interestingly, the insurance benefits offered on the cards are exactly the same, right down to the very letter of the terms and conditions.

Among the key insurance provisions are emergency medical travel insurance covers the first 15 days of your out-of-province trip for anyone aged under 65 for up to $5,000,000 (although coverage for those aged 65+ is not provided), trip cancellation and trip interruption insurance for up to $1,500 per person, and aggregated flight and baggage delay insurance for up to $1,000 in essential purchases.

Verdict: With the same suite of insurance coverage, we have ourselves a clear draw. However, it’s worth noting that Aeroplan bookings charged to the Aeroplan Business Reserve Card will be covered, while those charged to the Business Platinum Card won’t.

3. Ease of Getting Approved

Neither card has a minimum income requirement, although traditionally charge cards (without a preset spending limit, but a requirement to pay off the balance in full every month) like the Business Platinum have been easier to get approved for than credit cards (with a preset credit limit) like the Aeroplan Business Reserve.

Verdict: American Express is generally quite lenient with approval criteria compared to the Big 5 banks, so in theory, neither is particularly difficult to get approved for. Nevertheless, since the Amex Aeroplan Business Reserve Card is a credit card rather than a charge card like the Business Platinum, the latter retains a slight edge in this category.

4. Visual Appearance

Both cards are made of metal, and carry the premium swagger that comes with the material.

The Business Platinum Card from American Express has a classic design for Platinum cards, with the Centurion prominently featured in the middle of the card. It’s largely similar to its personal counterpart, save for the word “business” displayed on the front.

Likewise, the Amex Aeroplan Business Reserve Card is a near identical copy of its personal counterpart, with Aeroplan’s logo emblazoned on a textured background.

Verdict: It’ll be up to personal taste as to which card looks better; however, the Business Platinum Card’s classic design presents as more upscale than the Amex Aeroplan Business Reserve.

Plus, just like the personal cards, the Business Platinum’s 18 grams of precision-cut engraved metal will clang a bit louder than the 13 grams of the Aeroplan Business Reserve.

Conclusion

With the various points of comparison swaying from one card to the other, there’s no landslide victory here.

For business owners who are heavily entrenched in the Air Canada ecosystem, the Amex Aeroplan Business Reserve Card offers a slew of perks, such as an enhanced earning rate for Air Canada flights and vacations, priority services with Air Canada, strong rollover benefits, and the ability to earn an Annual Worldwide Companion Pass.

Meanwhile, the earning rate on the Business Platinum Card from American Express is locked at 1.25 points per dollar spent; however, you’ll get access to a greater number of lounges worldwide, and can find extra value through Amex Fine Hotels & Resorts, more flexible points, and the $200 annual travel credit.

Plus, with a more generous welcome bonus, there’s a strong argument to be made that the Business Platinum Card from American Express is your best choice for a business card in Canada, regardless of issuer and despite the high cost.

Last year Amex Aeroplan Reserve has an incredible sign up offer that included 20,000 SQM and e upgrade credits plus 80k Aeroplan points if spend met. This incredible offer allow me to jettison up to 35k status this year and now perched to get 50k status next year. It is hard to achieve the 50k SQM for me and so this offer last summer did it. TJ helped advise me on a few of the points. And I quite like the card for the air Canada perks…

Have you done a comparison between the AMEX Platinum and the AMEX Business Platinum?

Yes sir: https://princeoftravel.com/blog/head-to-head-amex-platinum-vs-amex-business-platinum/

Thanks, Ricky!

Please do one with the Amex Aeroplan vs GoldRewards. Im waiting so much for that one !

That’ll be a good comparison vs. the new “core” cards for sure. Stay tuned!