I’ve added a new page to our Resources section on Credit Cards: the CIBC Aventura Visa Infinite. Just in time for these new benefits kicking in!

Today, CIBC introduced a new set of benefits and improved insurance policies to their Aventura-branded cards, which represents their main portfolio of personal premium travel credit cards. You can read all about the improvements on the CIBC Aventura website. The changes apply to new and existing clients on the following cards:

-

CIBC Aventura Gold Visa Card

-

CIBC Aventura World MasterCard

-

CIBC Aventura World Elite MasterCard

Note that the changes don’t apply to business cards, such as the CIBC Aventura Visa Card for Business.

If you think about it, it’s pretty rare that we see Canadian credit card issuers introduce new benefits without demanding a corresponding increase in annual fee, so I’d consider this a pretty exciting development. The new benefits aren’t groundbreaking, but they’re quite unique and certainly make the relatively run-of-the-mill Aventura products a little more interesting.

Complimentary Priority Pass Membership + 4 Lounge Visits

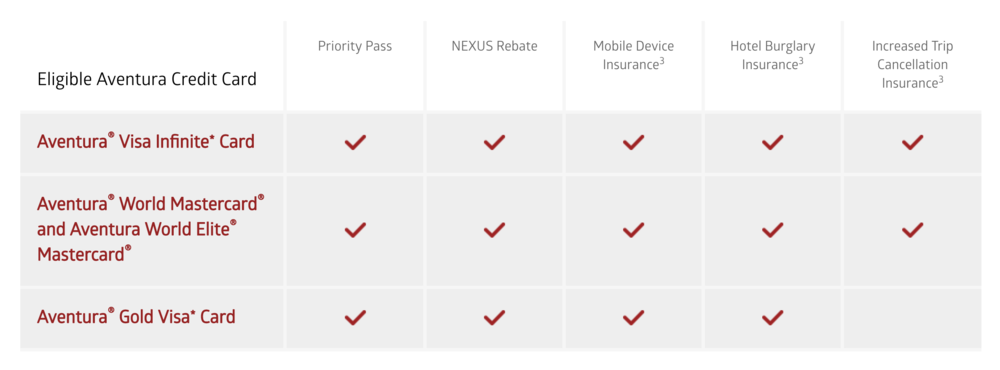

Beginning today, eligible CIBC Aventura cardholders will be able to enroll in a Priority Pass membership and receive four complimentary visits per membership year.

Normally, a Priority Pass membership itself costs a certain amount of money, with each visit to a lounge also incurring a fee. By holding a CIBC Aventura credit card, you’ll get the membership for free in addition to four lounge visits, with additional visits costing you US$32 apiece.

A “visit” counts for the primary cardholder and any guests. Therefore, you could use your complimentary allowance on, say, a single lounge visit while bringing three guests, or two separate lounge visits each with one guest, or four separate visits on your own, etc.

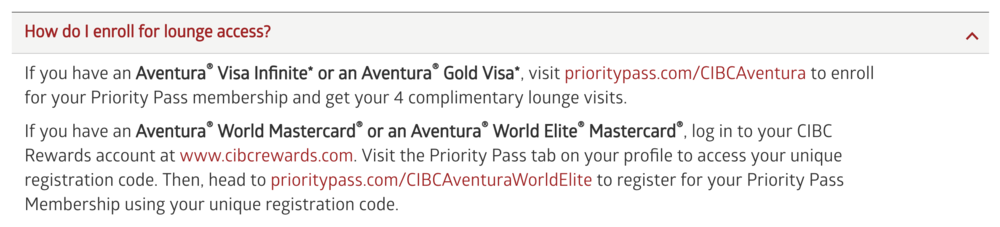

To begin taking advantage of lounge access, you first must enroll in the Priority Pass program. The CIBC Rewards page details the exact procedure for enrolling:

Upon enrollment, the physical card will be mailed out to you, while you can begin using your digital card on the mobile app immediately (although keep in mind that not all Priority Pass locations accept the digital card).

Tyrol Lounge Innsbruck, an excellent Priority Pass lounge I recently visited

How useful is this new benefit? The way I see it, many of you will already be receiving unlimited complimentary Priority Pass visits via the Amex Platinum or the Amex Business Platinum – those credit cards have excellent signup bonuses, with Priority Pass access as an added perk on the side. If that describes you, then this benefit will be of limited use.

However, if you’re in the habit of cancelling and reapplying for those top-tier credit cards in order to attain the bonus multiple times, then the CIBC Aventura cards would come in handy for ensuring you still have lounge access in-between holding those premium Amex cards.

In my view, having access to Priority Pass lounges is essential for any frequent traveller, since it makes the economy class experience a lot more palatable by giving you some nice surroundings to rest and relax before your flights and during your layovers.

NEXUS Rebate

With the new NEXUS rebate on the CIBC Aventura cards, you’ll earn a rebate on your NEXUS application fee once every four years simply by charging the application fee to your Aventura credit card.

NEXUS is a trusted traveller program designed to allow for smoother and faster travel between Canada and the United States. Many frequent travellers consider it an absolute necessity; indeed, I myself have been planning to apply for NEXUS for the longest time, but simply haven’t gotten around to it, so I’m delighted to see this new benefit kick in.

Given how often Canadians travel down to the US, and how travelling onwards to other countries often involves connecting in the US (this is especially the case when redeeming points for travel), NEXUS can save you a lot of time and stress at the border.

I can’t tell you how many times I’ve been stuck in the jam-packed US immigration queue with my departure time fast approaching, and I had to awkwardly ask people in front of me if I could squeeze past them. Clearly, I need NEXUS quite badly, and will be taking advantage of this perk in the near future.

Applications for NEXUS go through the Canadian Border Services Agency website, and you simply pay for the application using your Aventura card in order to receive the rebate.

Many of you might already have NEXUS, in which case this benefit won’t be of much use until the next time your NEXUS is up for renewal. Nevertheless, I commend CIBC for thinking outside of the box in introducing this benefit –no other travel credit card on the market offers a NEXUS rebate, and it’s a relatively simple new benefit that I can see attracting plenty of new business to CIBC.

Mobile Device Insurance

The third significant improvement to the Aventura cards takes the form of a new type of insurance coverage: Mobile Device Insurance of up to $1,000. Essentially, by paying for your new mobile device (smartphone, tablet, or smartwatch) using the CIBC Aventura credit card, you’ll be covered for up to $1,000 in the event that your device is lost, stolen, or accidentally damaged within two years of purchase.

The coverage takes effect no matter how you finance your new device – whether you purchase it outright or take advantage of one of the $0-upfront offers out there – as long as all the charges related to the purchase (i.e., the upfront payment and any monthly payments) are posted to your Aventura credit card.

This is a pretty amazing insurance benefit, and I can definitely see it enticing cardholders to purchase their new mobile devices using their Aventura cards. I’ve had an iPad stolen before, and I also remember dropping my spanking-new iPhone 5S in my bowl of noodles within a week of purchasing it (although fortunately it emerged from the soup unscathed).

This insurance would’ve certainly come in useful in those situations, and would also give me considerable peace of mind at the time of purchase itself. I’m genuinely very happy to see this new insurance item being introduced, and the next time I’m in the market for a new mobile device, I’ll definitely be looking to take advantage of it.

Besides the new Mobile Device Insurance, CIBC has also taken this opportunity to add Hotel Burglary Insurance of up to $2,500, as well as improving their Trip Cancellation Insurance to a per-person maximum of $1,500 (previously $1,000). That last one doesn’t apply to the CIBC Aventura Gold Visa Card, whose lower income requirements have historically meant that its insurance coverage is slightly weaker than the other Aventura cards.

Should You Apply for CIBC Aventura Cards?

CIBC’s Aventura line of products aren’t really the most compelling travel credit cards on the market, particularly if you’re looking to rack up valuable points to redeem for travel. However, they can definitely be appealing in the right circumstances, such as if you’ve already gotten the better cards out there and are looking to earn even more points.

The CIBC Aventura Visa Infinite currently offers 15,000 Aventura points upon first purchase. The annual fee of $120 is waived for the first year, and you’ll also get a $100 travel credit, redeemable towards travel expenses booked via the CIBC Travel Rewards Centre.

That’s at least $250 in value right there – $300 if you intend to take advantage of the NEXUS rebate. And if you were to redeem your 15,000 Aventura points at a higher value through CIBC’s airline rewards chart, the value would shoot up even further. In my view, this makes the CIBC Aventura Visa Infinite well worth your time.

Keep in mind that CIBC also offers regular promotions that allow you to redeem fewer Aventura points for travel on given routes and airlines. Their latest promotion for Fall 2018 is in partnership with WestJet, allowing you to book round-trip travel from major Canadian cities for as low as 9,000 Aventura points. If you play your cards right, the value from using your Aventura points through these promotions can be quite spectacular.

Meanwhile, the CIBC Aventura Gold Visa Card – essentially a carbon-copy of the Visa Infinite with a lower income requirement and slightly weaker insurance – has the exact same offer as well. Some people have even tried getting both credit cards at once, with mixed reports of success.

CIBC only does one credit check every 90 days if you apply over the phone or in-branch. This means that with only one credit inquiry, you can get one of the Aventura Visas, plus any other great CIBC offers out there like the Aerogold for Business (30,000 Aeroplan miles) and the Aventura for Business (30,000 Aventura points), as long as you apply within 90 days of each other.

Online applications always incur a new credit hit, but if you apply over the phone or in-branch, the representative should be able to see the existing credit report that was pulled within the past 90 days and put it to use.

Conclusion

It’s great to see CIBC sprucing up their Aventura line of credit cards with some exciting new benefits. Four Priority Pass visits and a NEXUS rebate can certainly come in handy in the right circumstances, while the new insurance coverage on mobile devices is an inspired move – everyone needs a smartphone these days, and I can certainly see lots of people giving the Aventura cards their business given the generous two-year coverage.

While I’m very happy with these changes, I’d also love to see CIBC build upon this in the future by adding more ways to redeem Aventura points at a good value, in order to make the overall program more competitive.

Hey Ricky,

May I know that will CIBC refund annual fee pro-rated if I switch to another credit card after let’s say 5 months? Many thanks

I don’t believe they pro-rate it by default, but they are pretty generous about fee waivers and the like, so you could always ask.

Hi Ricky,

Do you know if I can enter First Class Lounges if I’m flying Economy class?

Only if you have some kind of top-tier status within an airline alliance. For example, Oneworld Emerald members can access Oneworld First Class lounges no matter what class of service they’re flying.

Sounds like a good plan to me!

Hi Ricky,

I tried to apply for the Aventura Infinite, and I was refused , even though I meet the minimum requirement for income.

CIBC proposed me another card, the Classic Visa card !

The only things that come in my mind of the refusal, is that I applied for MBNA Alaska World Elite

and Amex Gold .

Do you have an idea why CIBC does not allowed me to the Aventura Infinite ?

Thanks

It could be any number of reasons. Try calling CIBC and asking them for the reason for the denial and see if they’ll reconsider.

Anyone having problems applying online? I go through the application and get to the end and it comes back saying I am not eligible for the product. I have gotten the cibc aerosols business and cibc business Aventura earlier in the year. Had to apply for both of those through someone in the branch to get fyf so haven’t had an experience with CIBC applying online. Thanks in advance.

Perhaps it’s the income requirement? That’s the only reason I can think of for getting a message saying you aren’t eligible.

Get the lead out Ricky. You NEED a NEXUS card. More time in the lounge, and less angst about missing a tight connection. On my last redemption to Australia, Air Canada (!!) operated the only one of 9 business class flights that wasn’t on schedule. It was my first segment out of Halifax and all the way to YYZ I had visions of how Air Canada was messing up an Aeroplan itinerary that took hours to assemble. I swear, without NEXUS there’s no way I would have made it through screening and U.S. Pre-Clearance. I’m a huge NEXUS fan: https://packinglighttravel.com/travel-tips/nexus-card-worth/

Thanks for the post. Good stuff, as usual.

Just applied this week! Thanks for the reminder 🙂

Ricky, I cancelled my CIBC Aerogold Aeroplan in early September. Can I already apply for a new CIBC card?

If yes, can I do the Aventura business online and then go apply for the Aventura infinite in the branch for one credit check?

Yes and yes!

I just made a product switch with CIBC from the Aerogold to the Aventura Infinite and was told on the phone that I would receive fyf, the publicly available bonus points, as well as the travel credit. Im quite eager for the Phone insurance available!

Ricky,

As someone who has a NEXUS card I can tell you it is a MUST HAVE if you travel often. Arriving in canada or the states, from the plane to the sidewalk in under 10mins usually.

So I’ve heard – just need to get off my ass and get apply! The $50 rebate should certainly be motivation enough 🙂

Hey Ricky

Great post. Looks like CIBC is really tightening the wire on applications for business gold cards. Recently a friend and I tried applying (at different times) for the Aeroplan Gold Business Card and were asked for our CRA business filing reference’s and a business licence number even though we explained differently through the phone and in-person at the branch that we were sole proprietors – we dont actually own/operate a business.

Shut down at both the branch and in person….

Any ideas?

In case your persistence (as the other commenter suggested) still doesn’t bear fruit, it’s worth noting that CRA business numbers can be easily and freely obtained online.

Hey Axel,

I can tell you that don’t give up and try calling in again or visiting a different branch.

Yesterday morning I walked into my local CIBC branch and applied and got approved for the CIBC aerogold visa infinite and the CIBC aerogold business card. A pretty simple process, wish I had read your post and applied for the aventura aswell.

Muhammad, were you able to get your personal CIBC Aerogold Visa Infinite FYF too?

Ricky, I think you mentioned this may be possible in branch … however, not sure if this is the discretion of Financial Advisor?

Yes, as I understand it the personal Aerogold routinely has FYF offers as well and it’s pretty easy to get it if you ask.

That’s right Anna, both cards came with no FYF.

sorry, they both came with FYF.

It’s not too late! Go back and apply for the Aventura using the same credit inquiry 🙂

Min spend is getting tight with juggling so many new cards lol

Just realized its upon first purchase! Awesome, Dentyne Mint 🙂

Hi Ricky,

The priority pass fee has increased to $32 per visit

Hi Ricky,

The priority pass fee has increased to $32 per visit

Has it? I still see US$27 on the CIBC Rewards website.

Priority pass website says US$32. I think this is a recent increase.

I think you’re right – I received an email about this awhile ago as well. Article updated.