Recently, we’ve taken a lot of pot-shots at annual fees because, let’s face it, nobody likes paying ’em.

It’s often a huge drag to decide if we want to pay the second-year annual fee for a credit card we might really like. Alternatively, a new signup bonus can look daunting if we have to explain to our Player 2 about forking out another $120… for the third time in a month.

I’d like to share a few scripts I’ve used successfully in the past to get annual fee reductions or waivers. By convincing banks to waive your fees, you can continue to get value out of your cards without paying out of pocket.

Public Service Announcements

Please consider the following before using a script:

Remember that you are working with call centre agents. They’re people, too, and don’t like or deserve to be abused. That being said, if you feel you need to make your position felt firmly as a loyal customer, don’t be afraid to politely reiterate your case.

The key is to be persuasive but non-confrontational. You’ll catch more flies with honey than with vinegar. A little human touch can go a long way.

A healthy dose of assertiveness should help because call centres are designed to get you off the phone ASAP. Escalating to a manager or standing firm in your position will often help you get what you want.

Even so, as with anything involving calling, your mileage may vary. You may very well need to hang up and call again.

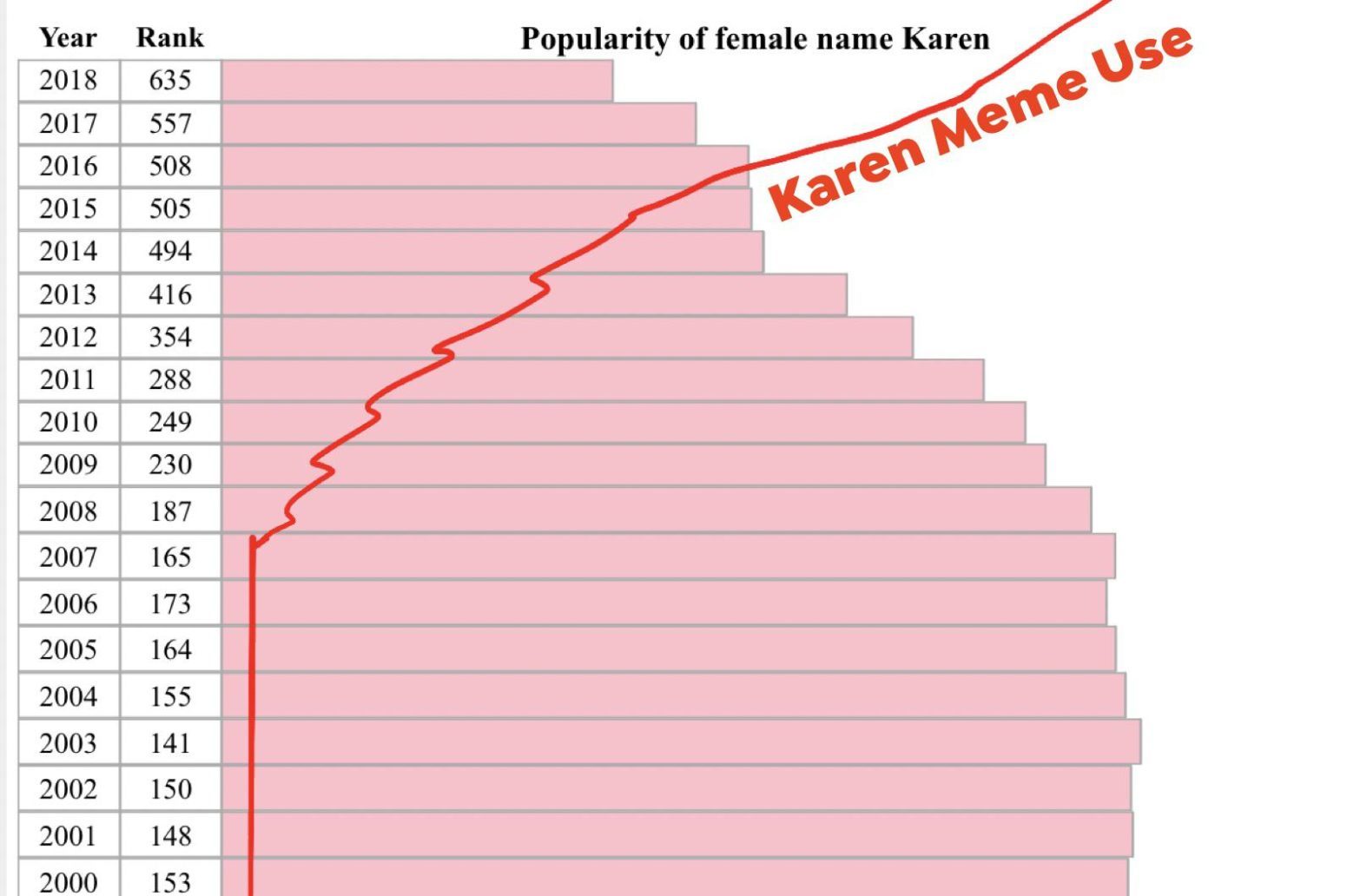

Whatever you do, just never go full Karen. The results could be disastrous.

Don’t employ these tactics if you aren’t comfortable calling on the phone. To paraphrase Keats, the truth is beauty, and beauty, truth – so don’t be telling crazy lies.

If you use a script, make it seem natural. Feel free to mix and match, and do be sure to put your own twist on what I’ve written! If Player 2 needs to call, once you’ve convinced them to do so, it’s probably best not to shackle them to my meandering wordplay.

Lastly, these will never, ever, ever, under any circumstances work against American Express. Every year there’s at least one genius posting somewhere about trying to get the annual fee waived for their American Express Platinum Card. They are invariably unsuccessful.

(If you insist on calling Amex, you might have better luck getting a retention offer in the form of points.)

Script #1: Appeal to Quantity of Spend

Where this worked: RBC (WestJet RBC World Elite Mastercard)

When this worked: October 2019

This first script works best if you have a large amount of legitimate transactions on the credit card in question.

What we are attempting to do here is take advantage of the fact that we are a profitable customer of the bank: even though we pay our bills on time and in full, we are still generating a large amount of interchange fees. Therefore, our business is more valuable than an annual fee.

“Hello. I’m currently having a great time using my WestJet World Elite. As part of my daily spend and small business activities, I’ve found that the WestJet Dollars have been very valuable for my needs. However, I have realized the $119 fee for the coming year could put quite a dent in my financial planning. As I spend in excess of $1,100 per billing cycle on this card, do you think you could rebate the annual fee for me?”

I got a little resistance from the agent (who offered a downgrade as an alternative), so I stated the following:

“Hey, I love the WestJet World Elite card and its benefits. I understand RBC doesn’t wish to lose revenue. However, I think I’m a valuable customer and I need the insurance coverage that comes with this card as well as the companion fare – do you think you could make an exception for me this year? If not, I’d rather cancel than downgrade.”

This seemed to do the trick. The fact that I empathized with the agent, looked at it from their perspective, but was ultimately willing to cancel the card seem to have been decisive in getting me my waiver.

Script #2: Leverage Length of Relationship

Where this worked: BMO (BMO World Elite Mastercard)

When this worked: January 2020

When we leverage our length of relationship, we are using the principles from Script #1 of showing we are a valuable customer. More than just value, though, we are trying to show that we are loyal and that the loss of our business would be an avoidable negative outcome for the bank.

For obvious reasons, use this script on the bank you’ve had the longest history of dealing with.

Note: this required a LOT of extra negotiating back and forth. What follows is an abridged version.

“Good day, I’m calling because I’ve been a BMO customer since I was 17. You really had my back during my time in the military and I’ve been using your Defence Banking plan ever since. I’ve noticed there’s a $40 rebate credit for credit card fees but I was wondering if you could waive the entire membership expense for me?”

The agent told me in no uncertain terms that I could downgrade or get stuffed. Neither appealed to me so I continued to press some version of the following for ten minutes:

“I really find the BMO World Elite to be useful for my car rental needs when I travel, but I can’t justify holding this premium card another year if you charge me the $150 fee. I’m in my rights to ask for a $40 rebate, but given my history with the bank and long record of loyalty, it makes sense you rebate my annual fee for this year.”

The agent didn’t like this line of reasoning but I was able to escalate to a manager at this point.

I then used a variation of these arguments for another ten minutes. I re-stated them multiple times in slightly differing order, and eventually, it got me the result I wanted: a full waiver.

Script #3: Disclosure of Financial Hardship

Where this worked: CIBC (the credit card formerly known as “Aerogold”: CIBC Aeroplan Visa Infinite)

When this worked: March 2020

This section is a straightforward one and was sponsored by Tax Season – like the Season of the Witch, but for modern peasants.

“Hey, folks. I’m calling because it’s that time of year when the CRA balances their books and looks at my debits and credits. My present for tax year 2019 was a nice fat bill! Worse yet, it was much heftier than I’d expected – I really should have claimed some of that income earlier!

“That being said, my CIBC Aerogold card is up for renewal. That extra $120 fee would be a big kick to the shins this tax season. I don’t want to have to cancel the card, but I really can’t afford the extra $120 this season, can we work anything out?”

Maybe the call centre agent had enjoyed too acutely one of the only two certainties of life (the other being death), but they waived my annual fee on the spot without question. Of course, your financial issue doesn’t have to be tax-related when you call in; any legitimate monetary concern is fair game.

Script #4: Request for Student Benefits

Where this worked: Scotiabank (Scotiabank Gold American Express)

When this worked: February 2021

This is also a fairly simple one. Have you enrolled in school recently, or are you in part-time education?

If you do claim this, make sure the personal or household income you claim doesn’t fall beneath the parameters to hold the card. I’m not saying your account will be cancelled if it dips, but it’s better to not risk it. You’ve already been approved, so you shouldn’t be considered ineligible.

“Hello. I’m calling right now about my Scotia Gold Amex, a card I’m really enjoying for the grocery store benefits. It’s going to be even more important now because I think I’ll be buying many more ramen noodles – I’ve re-enrolled in my Master’s program and was wondering if you could give me a hand with affording the student life? I’m still working so I earn income, but I really want to cut expenses.”

I like to hook the agent in situations like this where my income may appear lower. A little personality, a little humour, lighten the mood with a human connection so I don’t come off as a grubby discount-chaser. Then I continue. I got a little bit of a fight back but persisted.

“School is really expensive but I also want to keep this card for the groceries and no foreign transaction fees. At the same time, my books cost easily $120 a pop which is the same cost as the card. Could you do a fella a favour and waive the fee? Books are a need for me, even though I still want your card.”

This did the trick. Not much more convincing was needed, just a picture of my student ID via a form they emailed me and it was good to go!

Script #5: Argumentum ad Covidium

Where this worked: Scotiabank (Scotiabank Gold American Express)

When this worked: August 2020

This one comes from a friend who got a full waiver. Feel free to give it a try, I just don’t recommend using it with every issuer, and definitely don’t think you should try it for multiples of the same card from the same bank. By now they’re all sick of hearing about the plague and the myriad issues for their bottom lines it’s caused.

“Hey, I’m really liking my Scotia Gold Amex card. The 5x on dining and 3x on gas have been awesome for my small business. Sadly, with the pandemic, my company isn’t getting the kind of revenue I desire.

“On top of that, the lunch meetings and mileage on my truck for work have both gone down a lot, as have my tax write-offs. I really like this card and want to use it when things get back to normal, but right now that annual fee would hurt bigly. Think I could get it waived this year?”

This prompted a bit of pushback despite the customer indicating he was a decently valuable account for Scotiabank to retain. My friend remembered to stand his ground and carried on by pointing out that many of the benefits touted as coming with the card could not be used.

“You see, this is a travel card and I wanted to use the travel benefits such as the 0% foreign transaction fees, maybe charge a lounge visit to the card, or use some of the Amex Front of the Line deals. Sadly, those aren’t available right now because everything is shut down. Think you could at least rebate my fee for the coming year?”

This worked with minimal further contest.

Conclusion

I hope that these scripts help you sidestep those pesky annual fees. While we do have to swallow them once in a while, I always want you to get maximum value out of the cards in your wallet that you do pay for.

If you feel that this has been helpful and want more of my candour when it comes to haranguing banks on the telephone, I’d invite you to the Prince of Travel Discord chat. I’m on there quite often and so would love to answer any questions you might have about how to get what you need from a banking phone call.

It’s freezing in Alberta right now so until next time, stay warm!

Re “Argumentum ad Covidium” I’m planning to use this argument with travel cards. My argument is that pandemic-related travel restrictions have reduced my travel expenses to zero for the past year (when my card was FYF) and thus I never got an opportunity to benefit from the travel-related features that make this a premium card.

Amex gave me a retention offer on the AP Platinum which I think is pretty standard atm. The 100.00 credit which is automatic on renewal but also the choice of 15k AP or 150.00 credit. I think that’s only available if you call in. A friend of mine was given the same offer when he phoned as well. I decided that this would be the only premium amex card I will hold for this year as I have flights booked on it and I’m guessing domestic travel will open up before international–MLL access will be useful in that case.

Has anyone in recorded history ever gotten Amex Plat fee waiver?

Not necessarily a fee waiver, but the AF equivalent in MR as a rentention offer.

Re: Script 1. The bank (RBC) doesn’t make money on the interchange fees. MasterCard does. The bank only makes money on the interest on the balance, which doesn’t apply to us.