Bloggers in the Miles & Points space have a tendency to “sell the dream” of travelling on points. “Simply grab this card, meet the minimum spending, rack up those points right away, and redeem them for a free flight!”

We make it look easy and effortless. We focus on the wow factor of amazing First Class flights and free beach vacations, instead of the gruelling planning and organization that goes on behind-the-scenes. And we promote behaviour that, in reality, might not make sense for everyone.

I don’t need to go back and read my previous posts to know that I’ve been guilty of this as well. Everything I write about is of course achievable for everyone, but if you were to read a handful of my articles in quick succession, you might get the impression that earning and redeeming points is the easiest thing in the world, and that’s a dangerous mindset to have. There are complex webs of rules and restrictions to navigate, countless teeth-gnashing moments of frustration, and some real risks that you should carefully consider before getting involved.

That’s why I’ll share with you some hard truths about Miles & Points that you’ll want to absorb before you dive in. I’m playing Devil’s Advocate and giving you a host of reasons why you might not want to get involved with Miles & Points.

If any resonate, it may be wise to reconsider whether this is right for you. And if, after reading this article, you do indeed feel at ease with the game and how it’s played, then it’s time to go forth and conquer.

In This Post

- 1. You Need Strong Financial Literacy

- 2. You Need to Be Organized

- 3. You Need to Put in the Work

- 4. You Need to Think Critically About “Value”

- 5. You Need Flexibility

- 6. You Need to Maintain Perspective

- Conclusion

1. You Need Strong Financial Literacy

This should go without saying, but I still hear people asking me “What credit card should I get?” followed by “Oh, what’s the APR on that one?”

Learning how to maximize rewards points to your advantage should always be treated as the “cherry on top” of having your personal finances in order. That means things like paying your bills on time, ensuring that you’re earning, renting or buying, spending, and investing optimally, and most importantly, being free of credit card debt, carrying no balances on your credit cards, and paying no monthly interest.

If you aren’t doing those things, your time and energy is better spent focusing on achieving those goals first, before learning how to earn points cheaply and redeem them optimally. Otherwise, the purpose of maximizing rewards is completely defeated, since your earnings in terms of points will be more than offset by losses (or forgone gains) elsewhere.

More importantly, if you don’t have your financial house in order, you’re very unlikely to succeed at Miles & Points in the first place. You probably won’t get approved for credit cards if your credit score isn’t in great shape, and even if you do get approved, the extra available credit is likely to tempt you into extra spending and deepen your financial troubles.

The flip side of that is that once you have steadied your ship and developed good financial habits, those same skills that you’ve gained along the way will serve you well in the process of earning and redeeming points and reaching your travel goals. So above all else, make sure you possess strong financial literacy before getting in the game. Don’t worry, we’ll still be here when you’re ready.

2. You Need to Be Organized

This one goes hand-in-hand with the above. Organizational skills are essential to staying on top of your credit cards, points balances, and upcoming trips. If you let things fall into disarray, you will miss out on potential value at best, and set yourself on the path to financial ruin at worst.

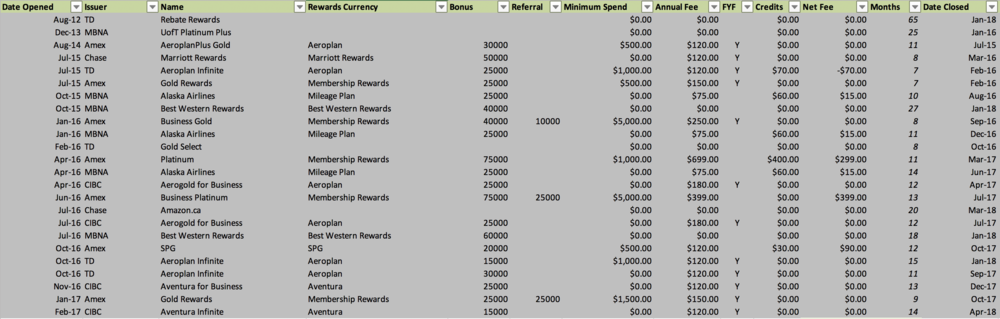

Everyone does it differently, so you should try out a few methods and see what works for you. Some people make elaborate spreadsheets to track their credit card signups and activity; others set Google Calendar reminders to pay off their bills and cancel their cards before the first year is up (I do both). Some use AwardWallet to track their points balances (I rely on memory for this). Many prefer to use pen and paper when planning out a complex award redemption (I typically use the Notes app).

My credit card tracker from a while back…

People who have strong financial literacy typically possess good organizational skills as well, so ensure that you’re well-equipped in both regards before we talk any further. Otherwise, instead of First Class champagnes, you’ll be sipping on the tears you cry after forgetting to cancel your card and being charged a second year annual fee.

3. You Need to Put in the Work

This is something I routinely emphasize on the blog. Travelling on points is, like any worthwhile pursuit, quite a significant undertaking.

If you were to ask any non-participant why they’re a non-participant, I bet you that one of their first responses will be “it’s so much work”. And they’re 100% correct, because Miles & Points does in fact require you to put in a considerable number of hours along the way.

There’s the learning: reading blogs, participating on forums, and attending in-person meetups to learn about the best ways to earn and redeem points.

There’s the keeping track: you have points balances across multiple airlines, hotels, and credit cards, and you need to monitor your balances in each program while figuring out what to do with those points eventually.

And then there’s the doing, which is by far the most important part: executing on your plans and making your dream destinations a reality. This is also the area where you run into the most difficulties – for example, a single flight without award availability can scupper your plans for the entire trip, forcing you to go back to the drawing board.

All of this requires significant time and effort on your part, and it’s reasonable for outsiders, looking in, to feel put off by the workload that lies ahead.

But allow me to be blunt for a second – those outsiders only feel that way because they don’t clearly see the massive rewards that await those who do put in the work. After all, the implied continuation to “it’s so much work” is “…for very little reward”, and when you consider that the payoff is a lifestyle of travel that most people could only dream of, then that couldn’t be further from the truth.

Nothing says you have to blaze through the entire body of knowledge at once and start redeeming First Class tickets on Day 1. Everyone is encouraged to go at their own pace, but ultimately, this game does require you to put in the work to reap the rewards. Considering the spectacular return that you get, though, the workload isn’t something that should stop you.

4. You Need to Think Critically About “Value”

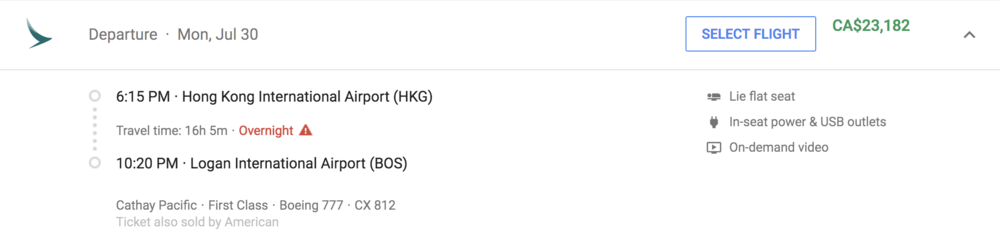

“Value” is one of the most elementary concepts around these parts – earn points at a low cost, redeem them for expensive flights and hotels, and thereby capture the value in-between. But it’s also one of the more controversial topics among Miles & Points practitioners, because no one knows exactly how to measure it.

Sure, you can use the $23,000 retail price of a First Class trip and calculate your value to be well over 30 cents per mile, but one could argue (rather compellingly) that you never would’ve paid that price in cash, so you can’t reasonably say that you attained such a mind-blowing value from your points.

Of course, the (also compelling) counter-argument is that the First Class trip clearly retails for $23,000 on the free market, which is the best determinant of its price, so it’d be unreasonable to use anything but that figure in calculating value.

Ultimately, value is something that is subjective to each individual, so you’ll need to decide what maximizes value for yourself at an entirely subjective level.

For example, say you have the choice between spending your 110,000 Aeroplan miles on a round-trip to either Europe or South America in business class. You figure out the retail prices of both redemptions, and the South America trip is much more expensive if booked with cash than the Europe one, thereby presenting a much better value on paper. However, while you’d be happy going to either destination, your heart wants to go to Europe more than South America. What do you do?

Do you go with what your heart desires and jet off to Europe, forgoing the extra value that the South America trip presented? Do you instead capture that extra value by heading to South America, since after all you’re happy with this trip anyway? Or do you work out the difference in value between both trips and weigh that against the incremental satisfaction you’d get in Europe compared to South America?

All of the above approaches have their merits – the important thing is that how you redeem your points is a decision that shouldn’t be taken lightly. Remember that every single point has a certain minimum value – both in terms of what it originally cost you to earn and what it can be sold for on the secondary market (although that’s a topic for another day) – and to redeem them for less than that value is akin to lighting money on fire.

Therefore, each redemption should be backed by careful thought to ensure that it carries a sufficient value, both monetarily and in terms of personal satisfaction. Otherwise, you’d be better off swiping your Air Miles card at the grocery store and calling it a day.

5. You Need Flexibility

There’s no way around it: flexibility is king in Miles & Points.

When I say flexibility, I mean it in many ways. For example, you can be flexible in terms of destinations. After all, those with a thirst to travel to every part of the world will have many more uses for their points than those who only want to visit a select few places.

You can be flexible in terms of travel dates. Conventional wisdom tells us that award flights are much easier to find in the middle of the week than over weekends, so if you’re looking to fly out on Friday night and get in on Monday evening on a long weekend, you’re going to face a lot more competition from others who want to use their points on the same flights.

You can be flexible in terms of travel planning. Airlines typically release lots of award seats either very far in advance or very close to the date of departure, especially in premium class cabins. So if your workplace allows you to schedule your vacations along either of those timeframes, you’re going to have an easier time redeeming your points than someone with a more unpredictable work pattern.

And you can be flexible in terms of the number of travellers. It’s easiest to find an award seat for one passenger. Two passengers is pretty easy as well. Three passengers is doable, but starts to require a few tweaks here and there – there might only be one flight out of many that has three seats available, or you may have to split up the party. Once you get to four passengers or more, it can be genuinely quite tough to get everyone on the same flight, but still possible with enough flexibility in the other regards. And so on and so forth.

In general, the more flexible you are along the above axes, the more you’ll be able to get out of your points, because you’ll always be able to find alternatives if your original plans don’t work out.

A couple or a small family with ambitions to see the world extensively and decently flexible work schedules? This is your game.

A workaholic who only wants to bring the spouse and three kids to Europe every summer? Consider a cashback card or a fixed-value travel currency – ultimately, earning hundreds of thousands of points is no good if you can’t put them to use in a way that fits your needs.

6. You Need to Maintain Perspective

For me, this one is the most important, especially if you have aspirations to take your game to a very advanced level. Miles & Points has the potential to change your lifestyle – if you get good at this stuff, you can get to a point where business class flights and fancy hotel suites are the norm for you. It’s important not to let this stuff get to your head.

Some people are content with using their points to fund modest trips here and there, but no doubt a significant chunk of participants are attracted by the glitz and glam of luxury travel. As I mentioned previously, if you put in the work and stay organized, then those rewards will come, and they will come in spades.

And when one starts to grow accustomed to poolside cocktails and bottomless caviar, there comes the temptation to buy into the belief that one is somehow worthy of these luxuries or somehow better than others for having access to them.

After all, Miles & Points can give you access to experiences otherwise enjoyed only by the fabulously wealthy, and as a result, people might assume that you are fabulously wealthy based on your lifestyle. If that happens, will you remember that travelling luxuriously on points is something whose mere existence is downright crazy, something to be savoured before it’s gone, something to be grateful for? Or will you start to believe your own hype?

The ostentatious side of the game can be quite dazzling indeed, but it’s far from the be all, end all. It’s always the extensive travel possibilities that are unlocked by points and the personal growth derived from those travels that are ultimately the most meaningful. If redemptions for premium class travel and hotel stays were to disappear tomorrow, I’d continue using points for economy class and go back to staying in hostels, and I’d hope that all you feel the same way.

Conclusion

The game of Miles & Points is often portrayed as straightforward and effortless. Bloggers have every incentive it make it seem like you can start travelling the world in the throes of luxury “in just a few easy steps!”

Don’t be fooled by this. Ultimately, travelling on points is an exciting journey that rewards those who put in the effort to understand it with amazing and unforgettable trips, but it’s not without a considerable learning curve and potential pitfalls at many turns. In this article, I’ve highlighted some of the hard truths that newcomers and veterans often run into. If you think you’re cut out for it, then it’s time to get into the action now, since big rewards lie in store.

Such a great article. So many of the bloggers are all rainbows and unicorns, I think many of them forget what its like to start out and like to make out how easy it all is so they can get the referral bonuses rolling in.

This "game" is not for everyone and it can be hard work, you have to be prepared to invest some time, sometimes some money and definitely be willing to do some work to get the most out of it.

I totally agree with "BG", you are by far the best Canadian blogger on the subject and one of the best anywhere on the net.

Great post. Linda

Hi Ricky:

My understanding is that you need to have good bonuses and signup and cancel. However, I don’t see that many good cards in the market. Maybe Alaska but Amex has really downgraded their benefits. Are there cards you would recommend and am I missing something?

At this moment I’d recommend the RBC Avion (25K Avion, $0 first year), the CIBC Aerogold for Business (30K Aeroplan, $0 first year), the Amex Gold via Perkopolis (25K MR, $0 first year), the Amex Platinum (60K MR, $299 effective first year), plus the MBNA Alaska like you said.

You’re right that the Amex offers aren’t as good as they were earlier in the year, but even the Amex Biz Gold still presents good value at its $250 fee (it’s easy to get $800+ of value out of the 40K bonus points). Things are also cyclical in this game, and with the impending changes to SPG/Marriott and Air Canada/Aeroplan, we’re in a bit of transition period. I’ve been around the block a few times to know that better offers are coming our way soon.

And this is all not mentioning stuff like US credit cards and MS, which are great ways to boost your points balances. There’s lots to keep you busy.

Cheers

Ricky

Hi Ricky:

thanks for the suggestions. BTW, do you know if there are rebate sites for US credit cards (like GCR)?

Not that I know of, although I haven’t looked into this too much. Perhaps some of the US sites may be of help.

Very, very good post, Ricky! This is the first post I have seen in such an objective way to describe points game! Nowadays, an increasing number of bloggers tend to exaggerate the reward of this game but ignore the negative side, perhaps due to some "reasons". Meanwhile, mariad new practitioners tend to follow those bloggers without further consideration.

Yep, it’s the way this blogging niche works (including this website), after all. There just needs to be a recognition that every First Class flight or amazing hotel suite is the result of meticulous planning and strategizing. Don’t get me wrong – it’s worth every minute of the behind-the-scenes work – but nevertheless it needs to be done.

WoW. First post I’ve read about the « behind the scene » and you are so right. YES effort has to be done and Lots of reading either from Anglophone or Francophone bloggers. Thank you very much for your blog

Great article! I agree that lifestyle is much harder to achieve than simply collect/cancel/repeat/luxury. Really enjoy your articles. In my opinion, you are the best Canadian blogger on miles/points. Hope you will keep us updated and let me know how to support your blog.

Thanks BG! If you want to support the blog – keep reading, spreading the word, and come to meetups! 🙂

Great points about organization. I use excel to track cards and I list them in order of due date so I have some semblance of order. One trick I might start implementing is having every card pre-auth pay out of a single chequing account. This would take away a lot of the tedious excel tracking.

Great shout Ben. I’m personally averse to pre-authorized payments because I tend to obsessively look over every transaction, but it has led to cutting it a bit close a few times when paying the bill.