We’ve been working hard on a few new features for the Prince of Travel website over the past little while, which I’m excited to finally launch and be able to share with you today.

A Brand-New Credit Card Comparison Tool

Previously, our Credit Cards page allowed users to filter among Canada’s top credit cards by a limited handful of categories.

We’ve now revamped the page and introduced a new Compare Credit Cards tool to take things to the next level, allowing you to sort and filter our entire database of credit cards by a series of customized criteria.

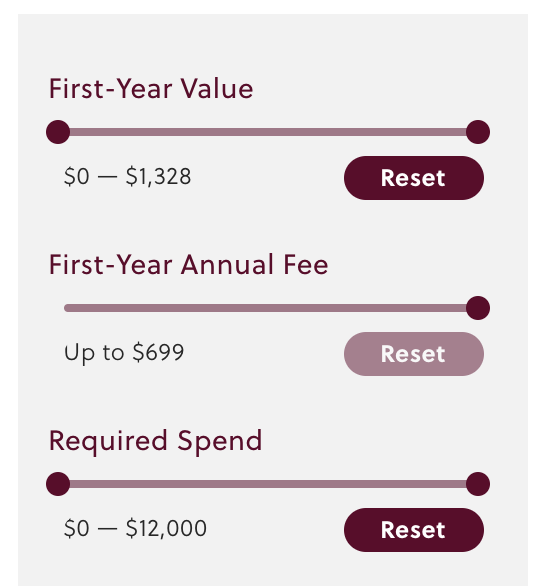

In particular, you can use the filtering tools (on the left-hand side on desktop and via an expandable menu on mobile) to filter the credit card database by the following criteria:

- First-year welcome bonus value

- First-year annual fee

- Required spending

- Issuing bank

- Rewards program

- Payment network

- Personal and household income

The sliders for the value, fees, and spend criteria bear a little bit of further explanation.

First and foremost, we look at the net value you can expect to earn when you apply for the card. After all, the cards with the most valuable bonuses will help you earn rewards fastest.

Our calculation includes the welcome bonus points, their value (based on our Points Valuations), the regular points you’ll earn on spending as you satisfy the conditions to meet the welcome bonus, and any annual fees or credits.

For example, considering the American Express Business Platinum Card, you’d come out with at least 83,750 Amex MR points upon completing the minimum spend of $7,000 in the first three months.

Based on our valuation of 2.1 cents/point, those points are worth $1,759, and subtracting the $499 annual fee, we arrive at a first-year welcome bonus value of $1,260.

The first-year annual fee is self-explanatory: $0 if the card has no annual fee or a First Year Free promotion, or simply the card’s annual fee otherwise.

What about the required spend? In most cases, this is simply the usual minimum spending requirement associated with earning a credit card welcome bonus.

However, some credit cards have a welcome bonus that comes in two or more parts upon meeting different conditions, but we consider part of it to be unrealistic or inadvisable for most people to try to earn.

(An example of this might be the Scotiabank Passport Visa Infinite Card, which technically offers 40,000 Scotia Rewards points as a welcome bonus, but 10,000 of those points are only granted upon completing a gargantuan $40,000 spend in the first year.)

The spend slider, as well as all the sorting and filtering options, only measure what you’d earn by reaching our recommended spend threshold, which may be lower than the advertised but inadvisable spending thresholds. You can read more details on each credit card’s information page.

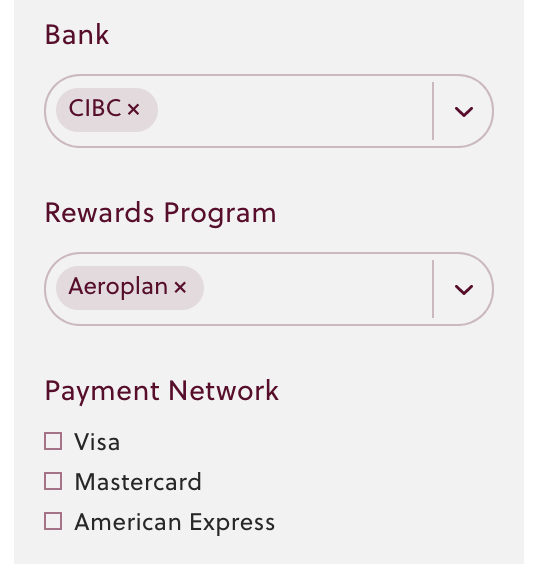

You can also filter the credit card database by bank, network, and associated points currency. Looking for a new CIBC credit card that earns Aeroplan points? Pop them into the selectors, and you’ll see the results.

(Currently, these selectors don’t account for transferable points currencies, but we’ll be adding this functionality very shortly too.)

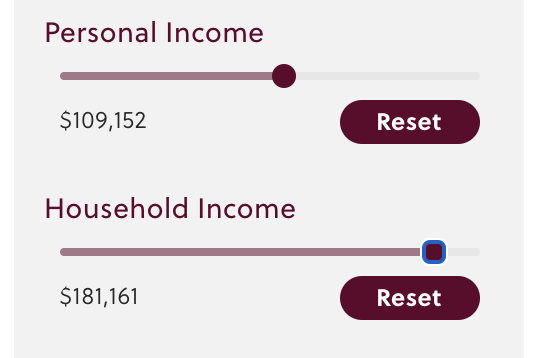

Finally, you can input your own personal and household income levels to view only the credit cards that you’d be eligible for.

In addition to filtering, you also have a few sorting options:

- Sort by first-year value (high to low)

- Sort by first-year annual fee (low to high)

- Sort by recommended spend (low to high)

These three sorting options align with the three predominant ways to measure your Miles & Points earnings: Net Gain, Return on Fees, and Return on Spend.

As you’d expect, the list is sorted by first-year welcome bonus value as a default. However, if you’re looking to pay minimal annual fees, or you’re operating on a limited spending capacity, you might choose to sort the list by fee and spend, respectively, to view the credit cards that are a best fit for your situation.

In both cases, the secondary sorting criteria is the welcome bonus value, so that you’re always seeing the most valuable offers first.

Whether you’re looking for travel points or cash back, flights or hotels, domestic economy or round-the-world in First Class, I hope the new Compare Credit Cards tool allows you to more easily find the exact credit card that you’re looking for.

New Credit Card Pages + Best Credit Cards Features

In fact, the Compare Credit Cards tool had better be more effective in helping you find the right credit card, because we’ve also simultaneously launched new information pages for 50+ credit cards that we didn’t cover in-depth before.

That’s right, our collection is now more than twice as comprehensive as it was before, encompassing a much wider range of credit card products from major and minor issuers alike.

As of now, we’re confident that our coverage includes all of the Canadian credit cards that any savvy credit card user might be interested in learning more about. And if there’s any that you still think we’ve missed, pipe up in the comments below and we’ll add it to the collection.

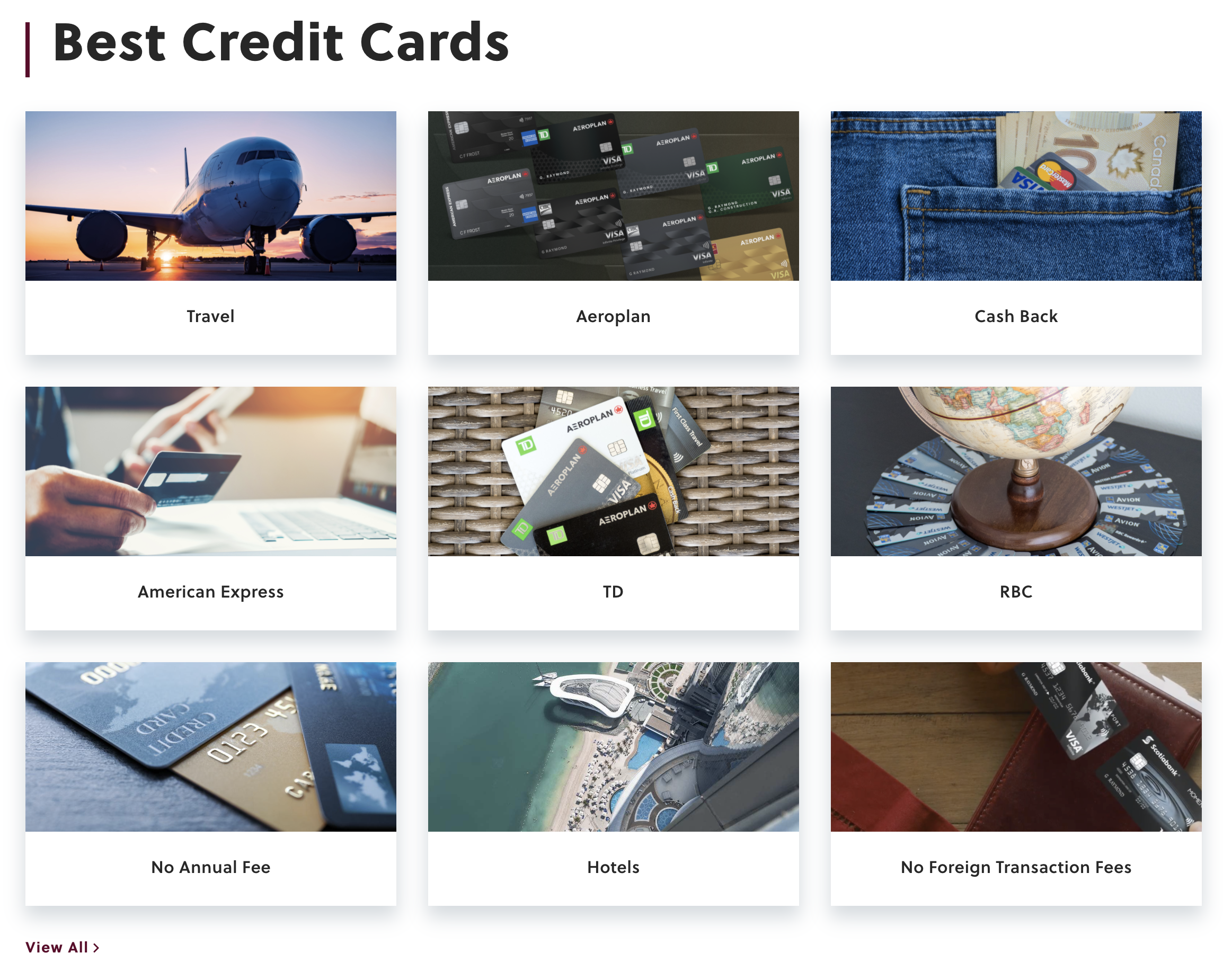

At the same time, we’ve also launched a new series of feature pages on the website to cover the Best Credit Cards in Canada, with the goal of helping newcomers to our space decide on the best option among specific credit card categories, like travel credit cards, Aeroplan credit cards, or no-fee credit cards.

These lists aren’t necessarily definitive rankings – rather, a broad collection of ideas as you consider the finer details that separate one card from another.

Feel free to browse these new features over at the Best Credit Cards page, and we’ll also be adding more comprehensive lists for new credit card categories over time.

New Home Page Layout

Finally, we’ve introduced a new layout for the What’s New section on the Prince of Travel home page.

As we produce content more frequently over time, the previous layout struggled to keep up with the pace of new articles and videos, making it harder for visitors to find stuff even if it was published relatively recently.

With more articles being surfaced and a series of navigational tabs to filter by category, we’re confident the new home page layout will make for a more enjoyable and effective browsing experience here at Prince of Travel.

Conclusion

We’ll be fine-tuning many parts of the new features over the next few days. If you notice any bugs, issues, or things that don’t seem to be working as they should, feel free to let me know in the comments below and we’ll get them sorted out.

When we launched the new-look Prince of Travel website last summer, I had promised that we’d be continually introducing new features to the website over time to give you an even better experience.

I’m delighted to launch our newest-generation Compare Credit Cards tool to help readers maximize their credit cards better than ever before, and I’m looking forward to bringing you even more new website features in the coming months.

Yousef, if you use Costco.ca you can use American Express why I do not know but it works great for me! Plus they deliver so you do not have to go into that hellhole that is a Costco store.

Hi Ricky! Thank you for this. Could you make a Costco video? I spend a lot of money there annually for both my household and my business! Since payments are limited to Mastercard, I’m sure there must be a better way to maximize the possible returns on $20,000 annual spend than the Capitol One Costco Mastercard. Would love a comprehensive video on the possibilities, especially since the travel deals through Costco Travel are sometimes great.

Yousef I purchase cash card’s on Costco web site Ex: I get 1000.00 card for me and 1 for my wife and paid with visa and I get all the points on my CIBC for exemple and when I shop at Costco I use the cash card when the card is down to a few hundred dollars I order new one so last year I got about 15k in cash card’s and got all my points

Very nice work!

Compare Credit Card is broken in Safari

Try clearing your cache – that’s fixed a lot of the issues for many visitors who might be seeing a mid-migration version of the page.

Could you add a feature for like Students/International Student Friendly like?

Slick