The Scotiabank Passport® Visa Infinite* Card has emerged as the best travel credit card with no foreign transaction fees in the Canadian market.

As its rewards program, Scene+, continues to take hold in the loyalty landscape, it’s easier than ever before to maximize this card.

With heightened category multipliers and a time-sensitive elevated welcome bonus, let’s look at 10 reasons why the Scotiabank Passport® Visa Infinite* Card should be in your wallet.

In This Post

- 1. Earn Up to 40,000 Scene+ Points

- 2. 2x Points on Groceries & Dining + 3x Points at Sobeys

- 3. 2x Points on Entertainment

- 4. 2x Points on Transit

- 5. No Foreign Transaction Fees

- 6. Airport Lounge Access

- 7. Reasonable Annual Fee

- 8. Versatility of Scene+ Points

- 9. Savings on Car Rentals

- 10. Strong Insurance Coverage

- Conclusion

1. Earn Up to 40,000 Scene+ Points

If you apply for the card before July 1, 2025, you’re eligible to receive a total welcome bonus of up to 40,000 Scene+ points, split into two chunks:

- Earn 30,000 Scene+ points upon spending $2,000 in the first three months†

- Earn another 10,000 Scene+ points upon spending at least $40,000 in your first year†

As is often the case with Scotiabank’s welcome offers, the first batch of points is very easy to earn, with a low spending requirement. At a value of 1 cent per point, 30,000 Scene+ points is equivalent to $300 towards travel expenses, and it’s hard to pass up such an attractive offer.

Meanwhile, earning the additional 10,000 Scene+ points requires significant spending, which may be less compelling or out of reach for many.

However, this extra bonus of 10,000 points is available every year, and it will reward loyal cardholders who maximize ongoing everyday spending on their Scotiabank Passport® Visa Infinite* Card .

- Earn 35,000 Scene+ points upon spending $2,000 in the first three months

- Earn an additional 10,000 Scene+ points upon spending $40,000 annually

- Earn 2x Scene+ points on groceries, dining, entertainment, and transit

- Plus, earn 3x Scene+ points on grocery purchases at Sobeys, IGA, Safeway, and FreshCo

- Visa Airport Companion membership with six free lounge visits per year

- Redeem points for a statement credit against any travel expense

- Minimum income: $60,000 personal or $100,000 household

- Annual fee: $150

2. 2x Points on Groceries & Dining + 3x Points at Sobeys

The Scotiabank Passport® Visa Infinite* Card has always offered 2 Scene+ points per dollar spent at grocery stores and on dining purchases, including restaurants, bars, cafés, and take-out.

Since kicking off the close partnership between Scene+ and Sobeys a few years ago, the card has boosted its rewards to 3 points per dollar spent at all Sobeys-affiliated grocery stores.

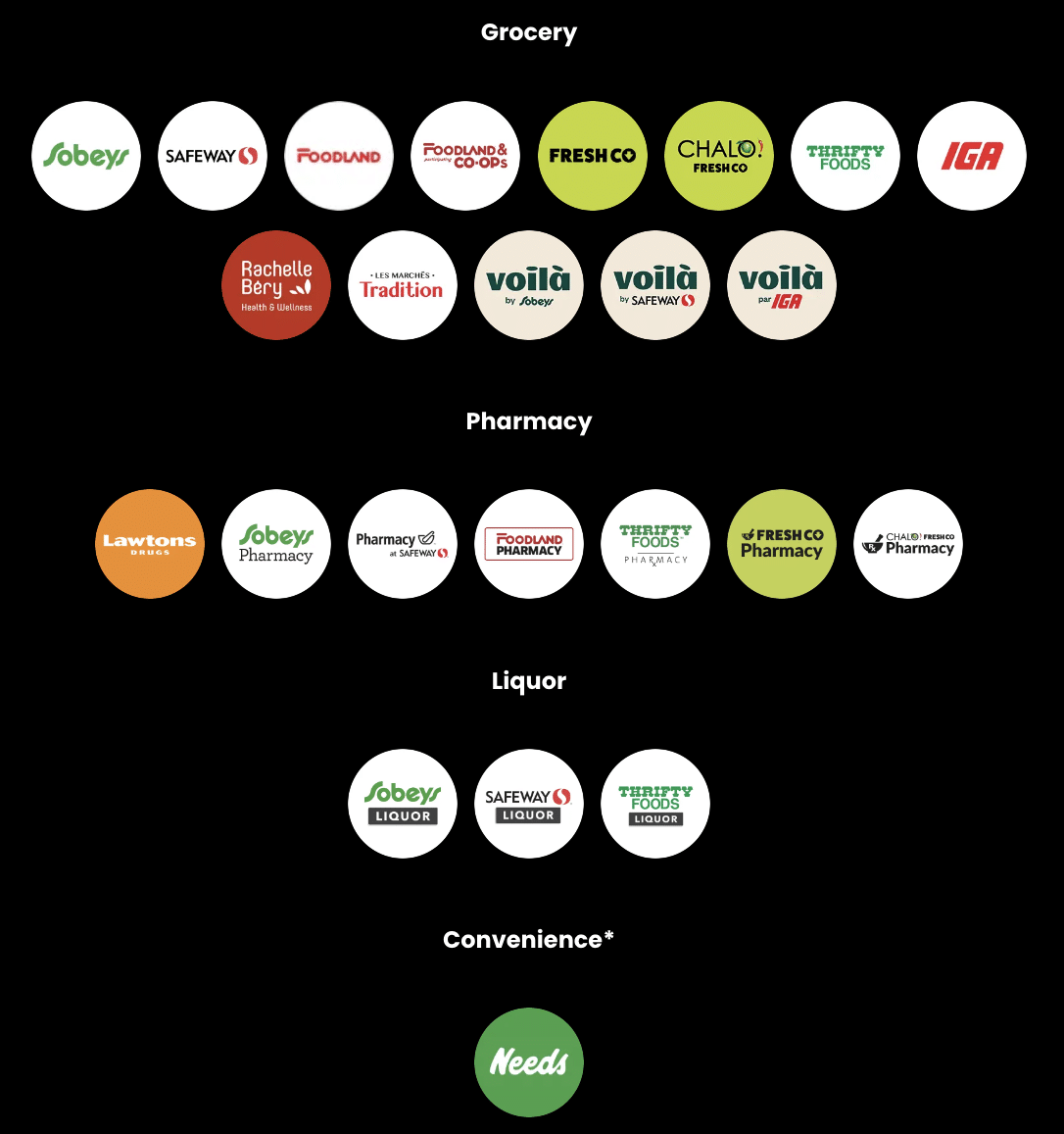

Brands that are eligible for the 3x earning rate include Sobeys, IGA, Safeway, Foodland, FreshCo, Voilà by Sobeys, Voilà by IGA, Voilà by Safeway, Chalo! FreshCo, Thrifty Foods, IGA West, Les Marchés Tradition, Rachelle Béry, and Co-Op.

Since Scene+ points can easily be redeemed at 1 cent per point against travel purchases, this means that you’ll essentially receive a healthy 3% back on all purchases at eligible Sobeys-affiliated locations.

The increase to a 3x multiplier is exceptionally strong amongst Canadian Visa cards. Indeed, a 50% increase in rewards at Sobeys versus other grocery stores is a significant margin, enough to potentially influence where you choose to shop.

Curious how many points you could earn with your monthly spending habits?

Use the calculator below to estimate how many Scene+ points you could rack up with the Scotiabank Passport® Visa Infinite* Card.

3. 2x Points on Entertainment

In addition to the elevated category bonuses on groceries, food, and dining, you’ll also earn 2x Scene+ points on select entertainment expenses with the Scotiabank Passport® Visa Infinite* Card .

Eligible entertainment expenses for bonus Scene+ points include theatres, ticket agencies, and, of course, movies.

This is a strong multiplier among Canadian credit cards. While many cards that target millennials tend to feature other lifestyle categories such as dining, most exclude entertainment from their bonus multipliers.

4. 2x Points on Transit

Continuing with the category bonus dominance, the Scotiabank Passport® Visa Infinite* Card further offers 2x Scene+ points on transit expenses.

Eligible transportation expenses include gas, rideshare services, buses, taxis, subways, and anything else that has a Merchant Category Code of “transit”.

2x points represents a nice 2% return on transit – not necessarily an industry-leading rate, but no slouch either.

For an all-in-one solution towards many of life’s common expenses, the Scotiabank Passport® Visa Infinite* Card packs quite a punch.

5. No Foreign Transaction Fees

Almost all Canadian credit cards impose a hefty 2.5% foreign transaction fee on purchases made in currencies other than the Canadian dollar. You won’t encounter this cash grab with the Scotiabank Passport® Visa Infinite* Card .

In fact, Scotiabank is the only bank out of Canada’s Big 5 to offer credit cards with no foreign transaction fees. If you often travel outside of Canada, or if you make many purchases in other currencies, this perk can translate into huge savings.

As a nice bonus, the card earns 2x Scene+ points on its bonus categories even in foreign currencies. This sets it apart from the Scotiabank Gold American Express Card, which also has no foreign transaction fee but uniformly earns 1x Scene+ points on such transactions.

Along with widespread worldwide Visa acceptance, those factors could count for this card if you expect to primarily use it for foreign spending.

6. Airport Lounge Access

Any traveller looking for a seamless airport experience will come to appreciate the value of lounge access, which can be easily obtained with the Scotiabank Passport® Visa Infinite* Card.

Cardholders receive a complimentary membership to the Visa Airport Companion Program, which is partnered with DragonPass. Through these programs, you’ll have access to over 1,200 lounges worldwide, including Plaza Premium lounges which have a large footprint at Canadian airports.

Each year, you’ll receive six free lounge visits included in your membership. You can use these vouchers for yourself or any travelling companion, and you can always buy additional visits for $32 (USD).

The Scotiabank Passport® Visa Infinite* Card has long been a leader on the Canadian credit card scene when it comes to lounge access.

In particular, all Visa Infinite Privilege cards offer a membership with six annual visits, but this card is the only Visa Infinite card to provide the same allowance as its more premium alternatives – which come at a more premium price point.

7. Reasonable Annual Fee

The Scotiabank Passport® Visa Infinite* Card charges a reasonable annual fee of $150.

While the current offer doesn’t include a first-year annual fee rebate (which we’ve seen in the past), this is a card that we recommend for all Canadian travellers since it provides outsized value year after year.

In fact, if you spend a lot of money outside of Canada, the card might even pay for itself. That’s because if you spend $6,000, you’d have saved $150 worth of foreign transaction fees that the vast majority of other Canadian travel credit cards would have charged.

Note that if you have an Ultimate Package banking bundle with Scotiabank, you’ll enjoy continued annual fee waivers every year on this card.

8. Versatility of Scene+ Points

Scene+ points are some of the most flexible travel rewards points when compared to other Big 5 banks’ loyalty programs. You can redeem them at 1 cent per point for any travel expense charged to your Scotiabank Passport® Visa Infinite* Card.

The most attractive aspect of Scene+ points is the ease of redeeming them for travel purchases.

After paying with your Scotiabank Passport® Visa Infinite* Card , you simply apply your Scene+ points at 1 cent per point against travel expenses once they’ve posted to your account. Other rewards programs require you to redeem points through dedicated portals, which are often clunky and cumbersome.

If you don’t have enough Scene+ points to cover the whole travel expense right away, don’t fret, as you can still use points you earn in the future. You’ll have up to one year from the date of purchase to redeem points for an eligible travel expense.

The flexibility of Scene+ points makes the program a great option for minimizing out-of-pocket expenses on cruises, independent hotels, or any other travel purchases that can’t be otherwise booked with points.

9. Savings on Car Rentals

Scotiabank Passport® Visa Infinite* cardholders receive a complimentary Avis Preferred Plus membership.

Avis Preferred Plus members receive complimentary upgrades whenever available, a members-only customer support phone line, and 5–25% discounts in Canada and the United States.

It’s often hard to use points to offset your costs on car rentals, much harder than it is with flights, hotels, or other travel arrangements.

As the prices of car rentals have been steadily increasing in recent years, it’s becoming more and more compelling to look for savings like those offered via the Scotiabank Passport® Visa Infinite* Card.

10. Strong Insurance Coverage

As you’d expect for a travel credit card, Scotiabank Passport® Visa Infinite* Card comes with a strong suite of travel insurance.

By charging expenses to the card, you’ll be eligible for the following types of insurance coverage:

- Emergency medical insurance

- Trip cancellation/interruption

- Flight delays

- Delayed and lost baggage

- Travel accidents

- Rental car collision/damage

- Hotel/motel burglary

- Purchase security

- Extended warranty

While the above inclusions are more or less standard these days, the Scotiabank Passport® Visa Infinite* Card ups the ante by offering a generous 25 days for emergency medical insurance for eligible persons under the age of 65.

Most emergency medical insurance offered on similar credit card products is capped at 15 or 21 days. Having an extra period of coverage can come in handy if you tend to travel for more than two or three weeks at a time.

Travel insurance of up to $2,000,000 per person is available for cardholders, their spouse, and dependent children. As with all types of emergency medical insurance on travel credit cards, the insurance applies even if the card wasn’t used to book any portion of the trip.

Conclusion

The Scotiabank Passport® Visa Infinite* Card is an excellent, well-rounded credit card with some of the best features available in Canada.

With a flexible rewards program, complimentary airport lounge access, no foreign transaction fees, and competitive travel insurance, it’s a highly compelling all-around solution, and arguably a must-have for Canadian travellers.

As Scene+ continues to emerge as a major player in the Canadian loyalty landscape, you’ll definitely want to pick up this card and start earning flexible Scene+ points before its current welcome bonus ends on July 1, 2025.

†Terms and conditions apply. See Card Provider’s website and Card Application for complete card details, terms and current offers. Reasonable efforts are made to maintain accuracy of information.

I’ve always been underwhelmed by what seems to me be poor redemption rate for the points accrued. I’m not sure the no FX fees are enought to justify this card. I don’t go to enought movies to justify that avenue.

This was my travel card until the HSBC card came on the scene. 21 days for anyone over 65 for emergency health insurance cannot be beat! A few years ago the credit unions had a similar plan. Soon as I joined they both went away.

Security is an issue. Had my $350 scene+ points removed at a Freshco while I am in Thailand. Security prevents me from reporting the problem because of 2-factor (a problem with Scotia).

But definitely this is my card of choice if they fix the security problem.

This card gives 2 points per dollar at Quail’s Gate Winery. The Scotia Gold gives squat.

In Seattle this is the only card that has any value.

I sure wish someone would pick up on the over 65 21 day health care.

cheers

Is a partner of the card holder admitted to premium lounges for free when they travel together?

This card provides you with six lounge passes per year. If you and your spouse both attend a lounge together, it will use two of your six passes. They don’t have to be a cardholder to attend with you.

this card might be a nice backup for a visa card but the hsbc world elite trumps it in all depts other than the lounge visits. so i dont know why you make a big fuss about it unless you get renumerated from visa

Does this product download into financial software such as Quicken etc? I just got rid of a Scotiabank Gold card after being instructed to ‘do it myself’ by printing out each statement and then manually entering each line of data (!). Apparently Scotiabank thinks it’s 1986.